4TH DAY OF GAINS IN CORN

Overview

Grains close the day mixed following a day full of choppy price action. As corn posts it's 4th straight day of gains while beans end the day lower but managed to close 20 cents off their lows.

Export sales this morning were poor, as the Chinese cancellations showed up.

The debt crisis is a potential problem. But you would think if everyone was concerned about this, we would've seen the stock market hammered and gold and silver would’ve been higher as people would’ve rushed to alternative investments. Nothing today pointed to the US not solving this before June 1st.

Mark Gold from Top Third said,

"It is weather vs debt crisis, if we get that solved I think the grains rally significantly. If we don’t and we go into default, it will be a mess."

The funds remains short across the board outside of meal.

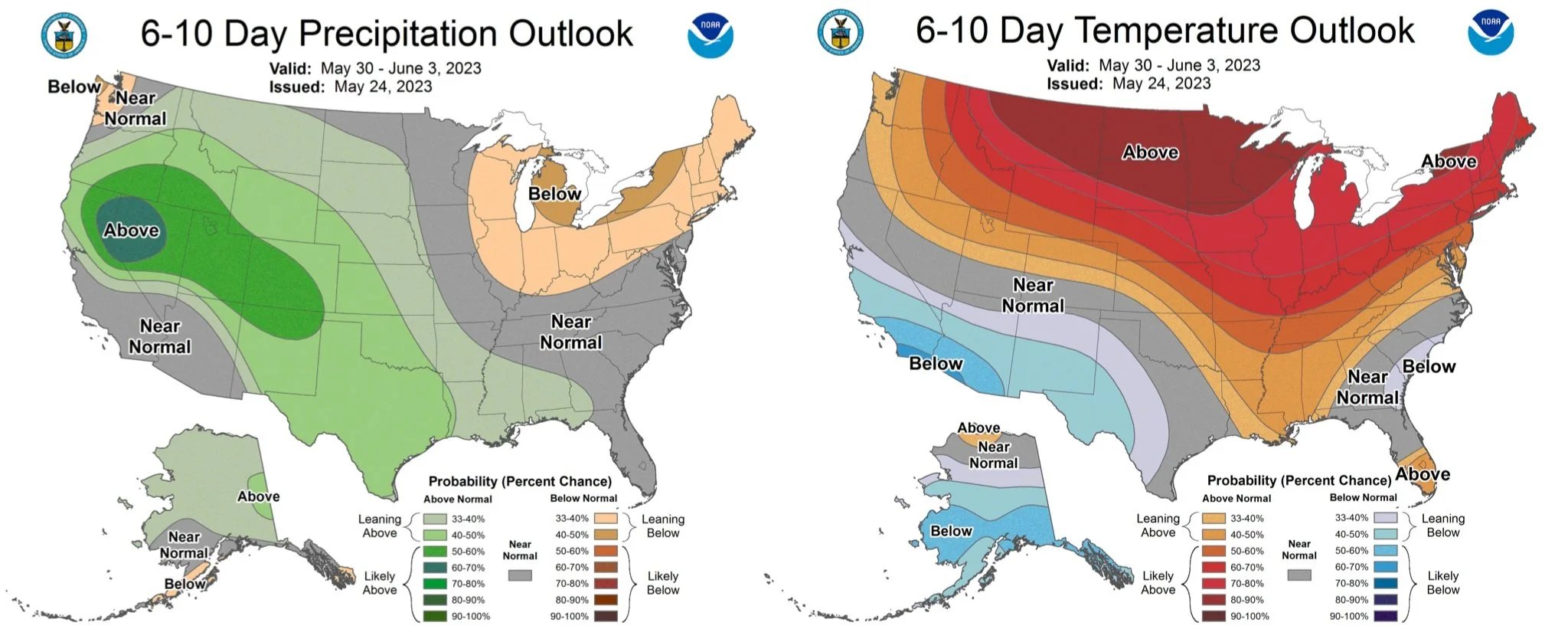

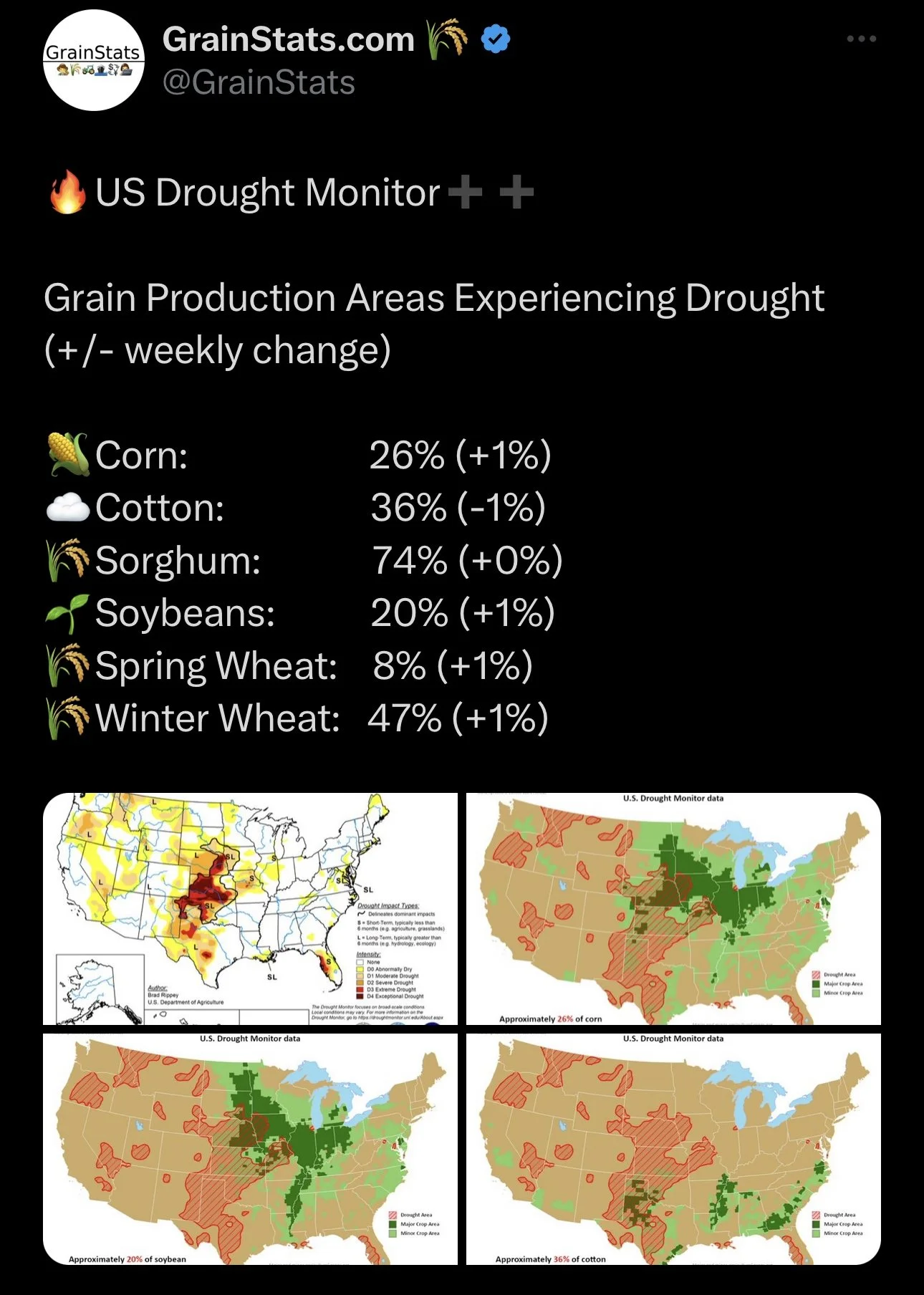

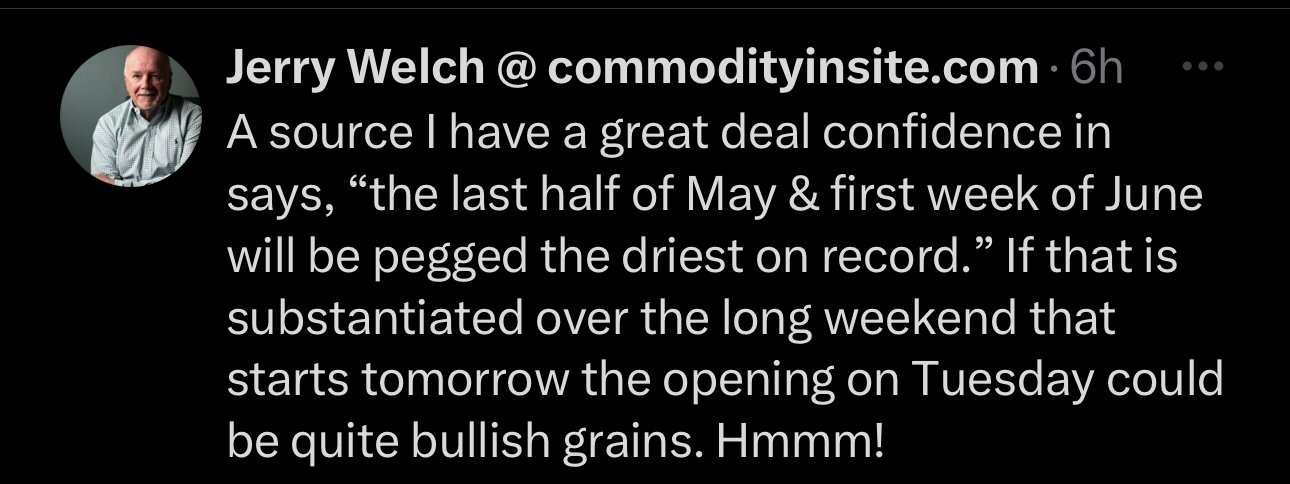

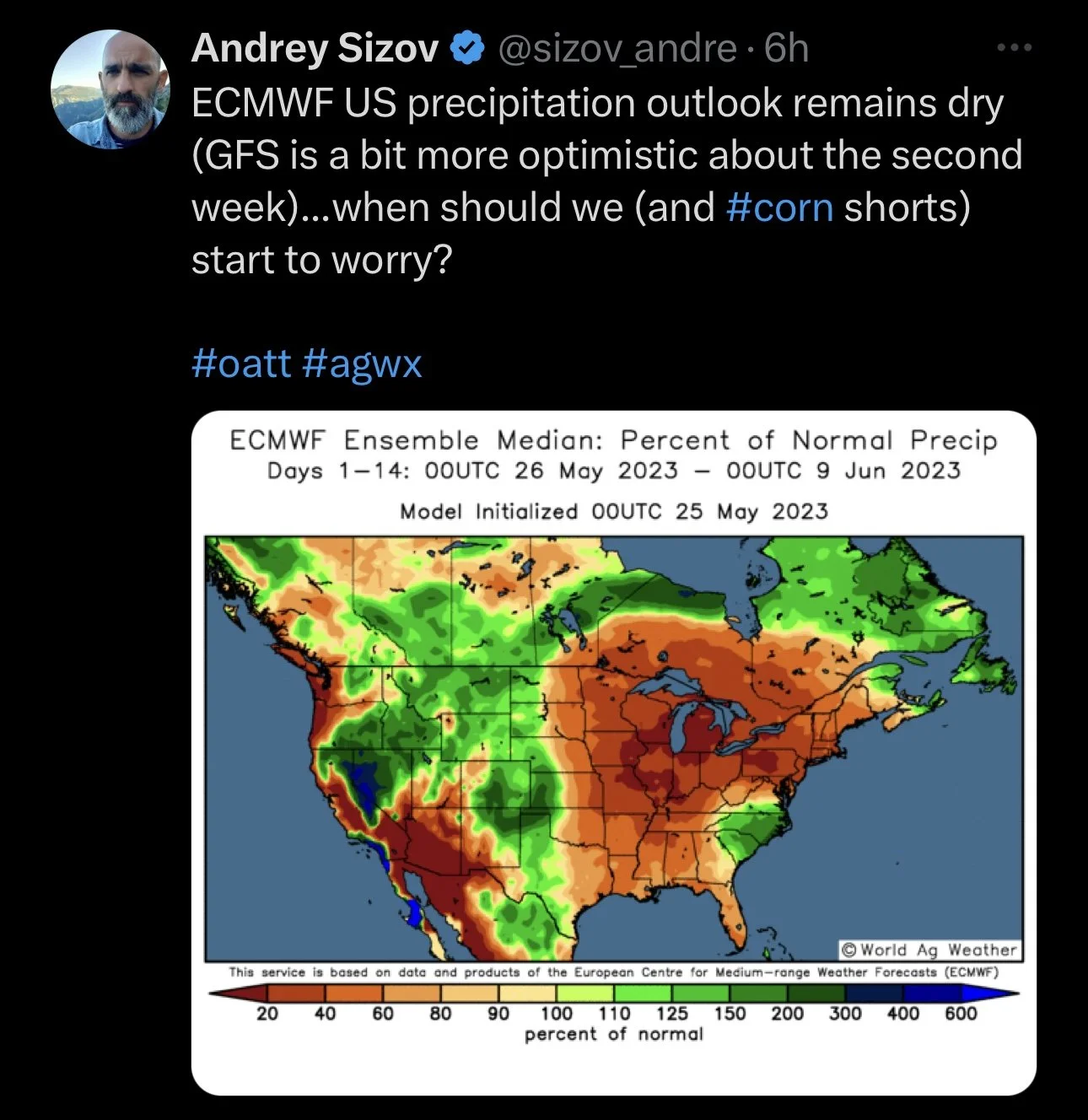

Forecasts are showing essentially no precipitation for the next two weeks. If forecasts stay that dry over the long weekend we could be in for a fun day come Tuesday.

Weather continues to be the dominant factor especially in corn. There are various sources calling for this last half of May and first week of June to be pegged as the driest on record.

***

In case you missed it, Sunday's Weekly Grain Newsletter

Will We Replicate 2012 or 2013? Read Here

Today's Main Takeaways

Corn

Corn posts it’s 4th straight day of gains, as we are now 40 cents off our lows from exactly a week ago.

Private Brazil Crop Analyst, Agroconsult, raised their projection for the second corn crop in Brazil to 102.4 million metric tons. This was a whopping 11% higher than their last projection and well above both that of the USDA and CONAB. If you take a look at the forecasts for Brazil, it is looking awfully dry. Dr. Cordonnier recently said that it is indeed dry, with very little precipitation in the expected forecasts. If it stays that way we could see some problems down the road.

The main focus for corn is going to be weather and war, and I think weather will ultimately trump nearly every other factor in our markets when it is all said and done. Currently, the weather here in the US has been fairly cooperative. Planting is taking off at an amazing pace.

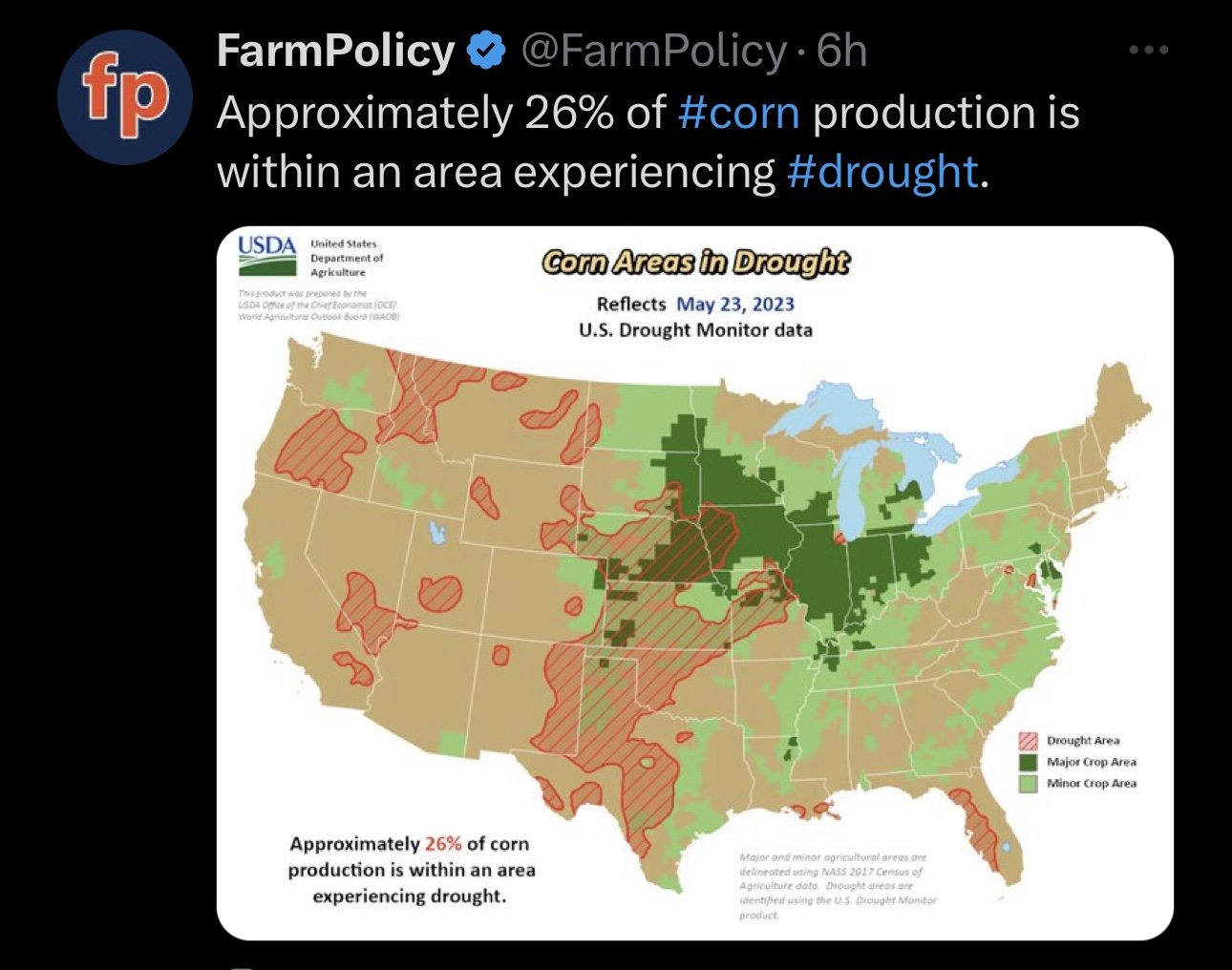

However, there is some underlying concerns with the fast planting. That being the looming drought concerns, which the trade has mostly ignored until recently.

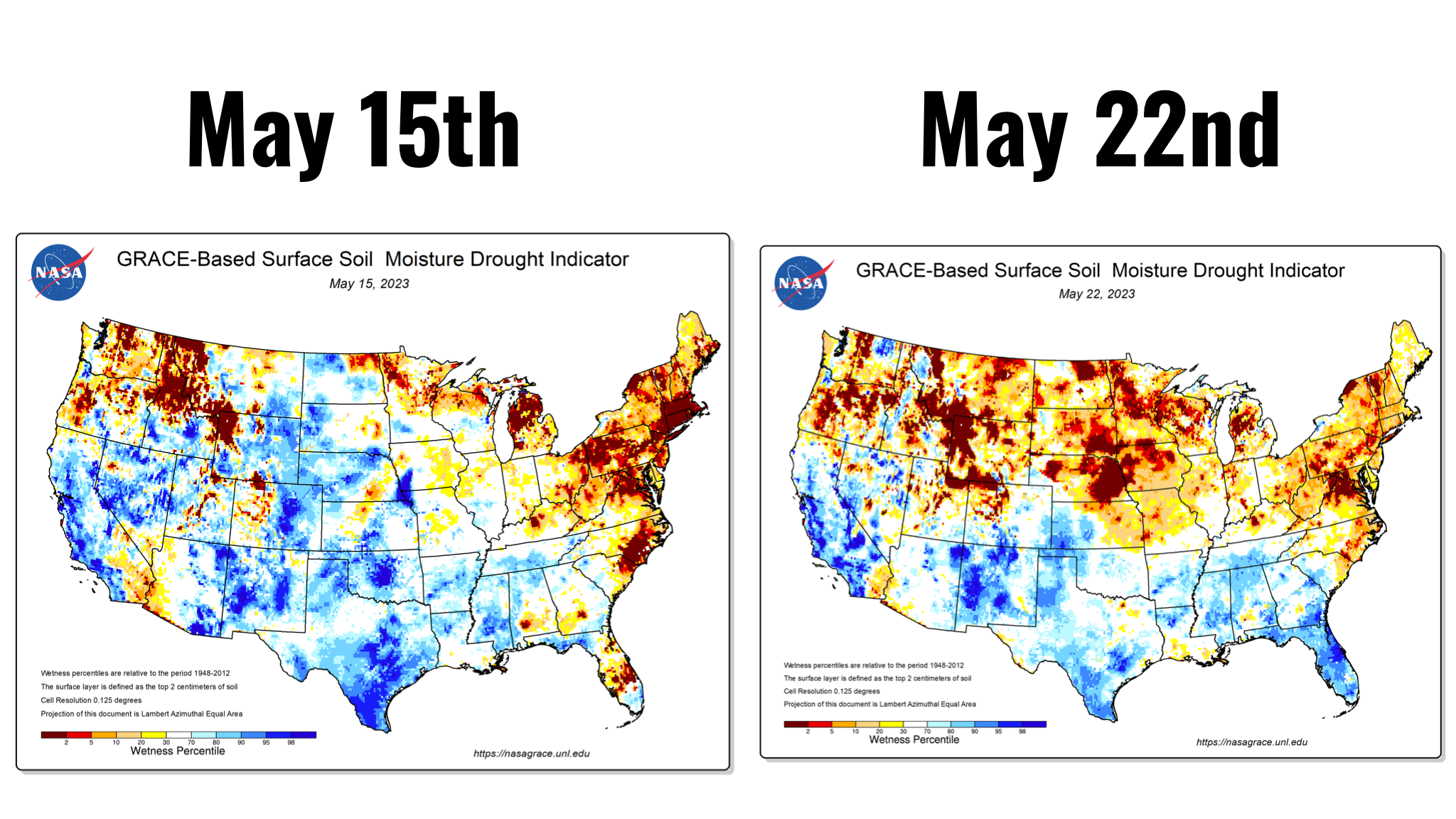

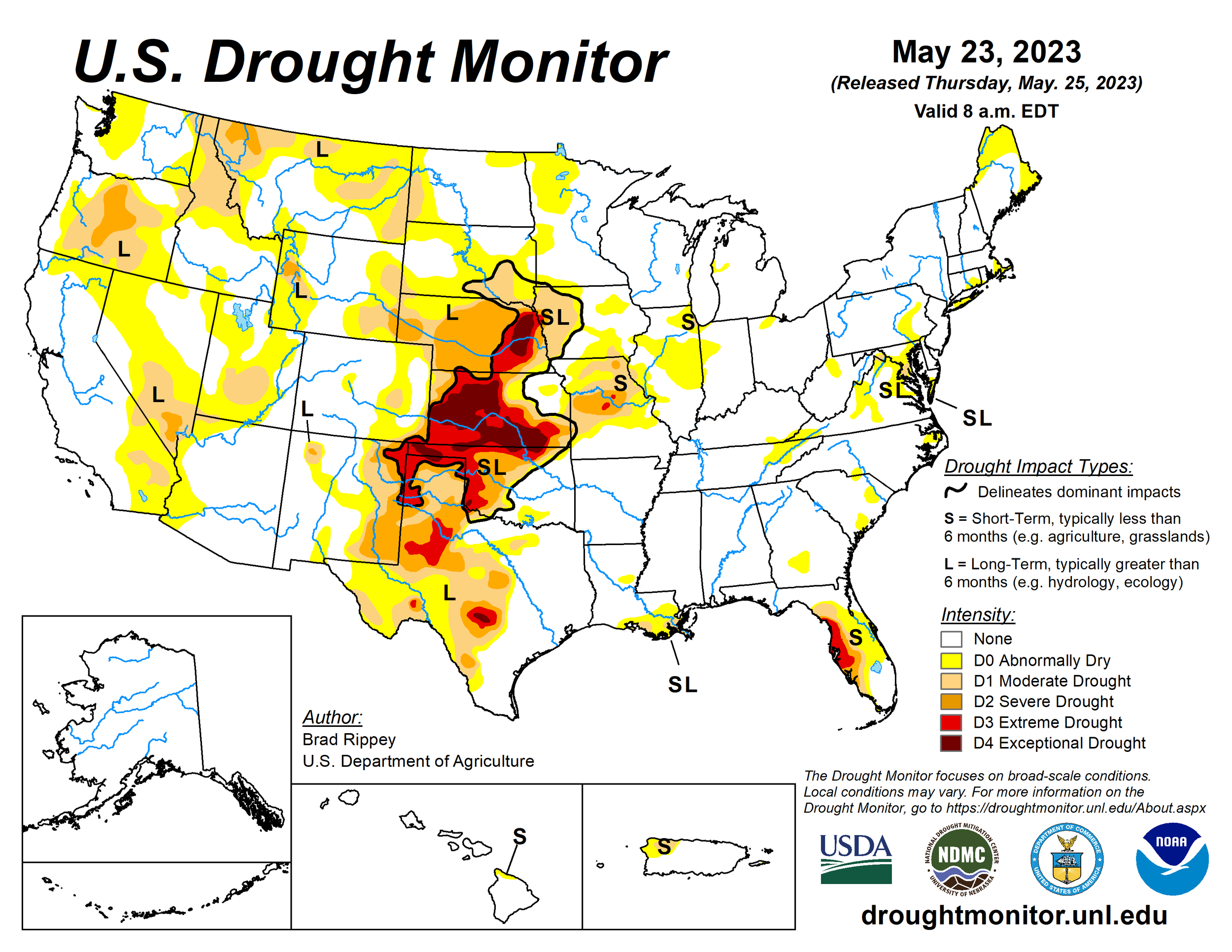

Forecasts are still looking dry for next week to 10 days. If you take a look at our surface soil moisture drought monitor, a lot has changed in just 7 days.

While drought has eased in some of hard red winter wheat country, the dryness has begun to spread east, including parts of Illinois and Missouri. Currently, no drought isn’t this massive problem across the entire corn belt just yet. But with almost no moisture in the forecasts, it is pretty clear the future drought concerns could far from over in the corn belt if we don’t start getting rain.

Here is the current temperature and precipitation outlook for the next 10 days. Notice how the heat has begun to spread south. If it stays mostly dry, we could be looking at topsoil levels becoming their driest since 2004. There is also a very real possibility that this April and May might be the driest on record since 1992 across the 7-state corn belt.

I’m not saying this El Nino event is going to happen, because I’m no expert when it comes to weather. But I wanted to again include it. The comparisons with the maps above speak for themselves. The map below shows what one forecaster says the effects the El Nino will have if it happens. The current forecasts and this chart look nearly identical.

All in all, weather is going to the driving factor that pushes us to $7 corn or $4 corn. There are various sources saying this summer will be one of the driest in history, while others say it won’t be. We will just have to see what Mother Nature decides to do here. But with the current forecasts looking the way they are, the fact that we are actually already a lot drier than most people realize, I am in the camp that we could begin to see a serious drought problem and ultimately see corn get a significantly rally soon like we have been talking about the past few weeks as we inch closer to the end of May.

Other factors outside of drought are of course war, and if we get any wild cards there. But North Dakota is another large factor to keep an eye out on. As the planting delays and problems continue to arise. Keep in mind, farmers in North Dakota planned to plant 3.75 million more acres of corn this year. A 27% increase from last year. The largest increase of any state this year.

With the recent rally and the July contract nearing $6, there is nothing wrong with taking some risk off the table. I did notice some other advisors were making some sales for new-crop 23 and some 24 cash sales with the recent rally. Every operation is different, so even though we think corn has a lot of upside from here, do what makes you comfortable.

Taking a look at the chart, we closed above the $5.90 resistance level in July corn. The next target is that physiological $6 mark, past that is $6.20 or so. We have made an amazing rally from our recent lows. Could we see some more downside? Of course, that is always a possibility, but I think this reversal could have very well been our lows.

Corn July-23

MEMORIAL DAY SALE

ENDS IN 4 DAYS

Take advantage of this offer before it’s gone. Lock in our yearly option to save $500. Get all of our exclusive updates & insights on the grains

*Every update sent via text & email

Offer: $299/yr

Orginally: $800/yr

Soybeans

Soybeans continue to chop around at their recent low levels. As today July closed down just half a penny, while the later contracts were down double digits. July beans closed nearly 20 cents off their early lows, and 9 cents off their highs in a wide near 30 cent trading range day.

Bears have continued to look at weak US export demand as well as the weather allowing beans to get off to a fast start to planting. As planting progress continues to be strong, the markets begins to debate the faster than expected planting progress vs the fear of staying too dry in June with potential reductions to crop conditions.

The recent weather worries and drought concerns seen in the corn market have yet to materialize in the bean market, as dryness in June doesn’t post quite as big of a threat for beans as it does corn. But will still ultimately be a supportive factor if it remains dry.

The fact that corn is more directly correlated to the drought and weather concerns had led to some traders buying corn and selling beans as of lately, which hasn’t helped us at these recent low levels. To add on to this, the trade has taken note that planting deadlines are approaching very fast for corn, which could force some producers to plant beans instead. How big of effect will this actually have? Probably not a ton, but the trade seems to think so.

Beans do however remain under pressure from a massive crop out of Brazil and some lack in Chinese demand. The big crop is Brazil has been one of the biggest fears surrounding beans, and will likely continue to be.

Outside of weather, there just hasn’t been much for bulls to chew on. Looking longer term, I definitely see a greater demand story, nearby it is still tough to call a bottom, but think we see a reversal sometime in the coming few weeks.

Taking a look at our chart, a double bottom is still possibly in play, but we have continued to chop around this recent range near our lows. Bulls want to hold that heavy $13 support level.

Soybeans July-23

Wheat

Wheat futures closed mixed, as futures have struggled to string together multiple strong days following the recent correction in KC wheat off its highs.

Forecasts are showing some good chances for improved rains in many winter wheat areas, which could add pressure to the market. Just how much of an impact these rains make is a discussion for a different day.

At the same time, we also got some pretty wild numbers from the Illinois wheat crop tours. As they came up with a record 97 bushel per acre yield, while the USDA has their number at 78.

Additionally, there are some rumors that China could be sitting on a very large surplus of wheat. Which could mean we don’t see much business from China.

Bulls are trying to hang on to the global weather worries. As it is dry in many areas of the globe such as Canada and Russia. But it just hasn't been enough to spark any major concern.

War and the Black Sea is also still something bulls continue to look at and be optimistic that we ultimately see a wild card. As there were rumors that very few ships are moving in or out of Ukraine despite the extension of the grain corridor deal.

The debt crisis is definitely a potential concern. As the debt ceiling negotiations continued yesterday without a deal being struck. Both sides are reporting that progress has been made, but we do have a long weekend and the June 1st deadline is just a week away. I would like to imagine they come up with a resolution.

Going forward, it is going to continue to be weather and war but really comes down to the funds. Do they stand their ground on their massive short position or look to liquidate? I still like the thought of being bullish, especially with the funds so short creating a create opportunity to see a massive short-covering rally if we were to get a weather or war wild card. But I still can't say for certain if I think we have necessarily put in a bottom, as it’s impossible to catch a falling knife in these markets, especially wheat. Bottom line, I do think there are plenty of factors that could push us higher down the line, but just how much downside we see until we get that catalyst is the question.

Taking a look at the charts, Chicago is still nearing the end of that apex where support meets the downward trendline. So we could be in for a bigger move one direction or another. KC found support right on that $8.03 level before bouncing higher. Bulls would like to hold that level and get a break out of the downtrend rather than get a break below and test our recent lows. Similar story for Minneapolis.

Chicago July-23

KC July-23

MPLS July-23

Price Expectations

From Wright on the Market,

Question from a client:

"Are you just copying and pasting your recommendation or do you really believe 10.00 spring wheat is attainable 15.50 to 16.00 soybeans is attainable and 7.00 corn is attainable? Still have tons of old crop spring wheat in elevator. Corn wheat and beans in the bin and a new crop half planted. Been slow planting up here getting rain on what has been planted is good though"

Yes, Mark, Roger believes those selling prices are reasonable expectations.

Last year's highs were all much higher than our current predictions for 2023.

Old crop carryouts for corn, wheat and beans are smaller (tighter) this year than last year.

The war in the Bread Basket of the World is in its second year as Ukraine's and Russia's corn and wheat production declines from 2022.

Interest rates in 2023 are higher (bearish grains), but the US economy contracted for two consecutive quarters… the very first two quarters of calendar 2022 (not 2023!). Every quarter since then, the US economy has expanded.

This year will be the fourth consecutive year that world wheat production will be less than world consumption.

Is Soymeal Near A Bottom?

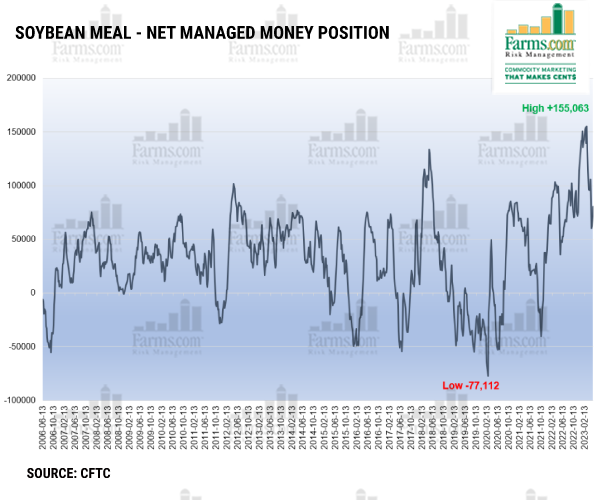

From Farms.com Risk Management,

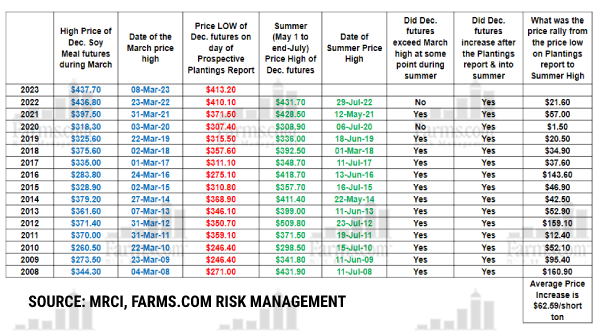

The seasonal rally tendency for new crop 2023 Dec soy meal futures (looking at the prior 15 years) is to have a summer peak during mid-June to mid-July. The 30-year trend also has been similar, with a summer peak during mid-June to mid-July. Last year though, the summer peak was towards end-July.

The 15-year average price rally from the low of the USDA March intentions report day, to the summer high is $62.59/short ton and works 15 out of 15 years. (Please see chart below)

As we have spoken about in the past, post-COVID seasonality has not always held true to pre-COVID seasonality, but Dec soymeal is near its bottom?

Managed money funds net long position hit a new record high in March 2023 & have since then eased off & halved the net length. Current US weather will help the wet spots dry down for fieldwork, allowing them to catch-up with an overall above-average pace. This also makes the market dependent upon good June weather to replenish moisture reserves. The market is accordingly building in some weather premium. From oversold technical conditions, this should provide the fundamental boost for funds to resume buying & take net length back higher.

Livestock producers should have 100% of feed needs booked through the end of 2024 where you can. Book ahead of the 2023 weather scare before it’s too late as it “smells, tastes and looks” like 2012 all over again? (Please see chart below)

ENJOY OUR STUFF? TRY A TRIAL

Get all of our exclusive updates and insights 30 days for just $1. Every single update is sent via text message & email

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

5/24/23 - Audio

Are You Prepared If We Tank or Rally?

5/23/23 - Market Update

Did Corn Confirm Bottom?

5/22/23 - Market Update

Drought Concerns Rally Corn & Beans

Read More

5/21/23 - Weekly Grain Newsletter

Will We Get Repeat of 2012 or 2013?

5/19/23 - Market Update

Grains Fail to Gain Momentum

5/18/23 - Market Update

KC Joins Sell Off

5/17/23 - Audio