DO THESE BRAZIL RAINS MATTER?

Overview

Grains lower again here to close out the up and down week.

Off the back of hot & dry Brazil forecasts, Sunday night we saw soybeans gap open higher as they rallied 35 cents higher on Monday. We also saw corn rally double digits.

This rally came to a halt Wednesday when they added some rain to the forecasts. As today was the third day in a row where soybeans have taken it on the chin due to some rains in Brazil.

Despite being up 42 cents on the week on Tuesday, these past 3 days gave back that entire rally as soybeans actually closed lower on the week.

Corn is slightly higher on the week, but stuck in that same range we've been in since August.

The wheat market continues to struggle to find any momentum to the upside, as the wheat market traded lower nearly the entire week.

Weekly Price Changes:

Brazil weather worries give, and they take. This was the reason for the early week rally and the late week sell off.

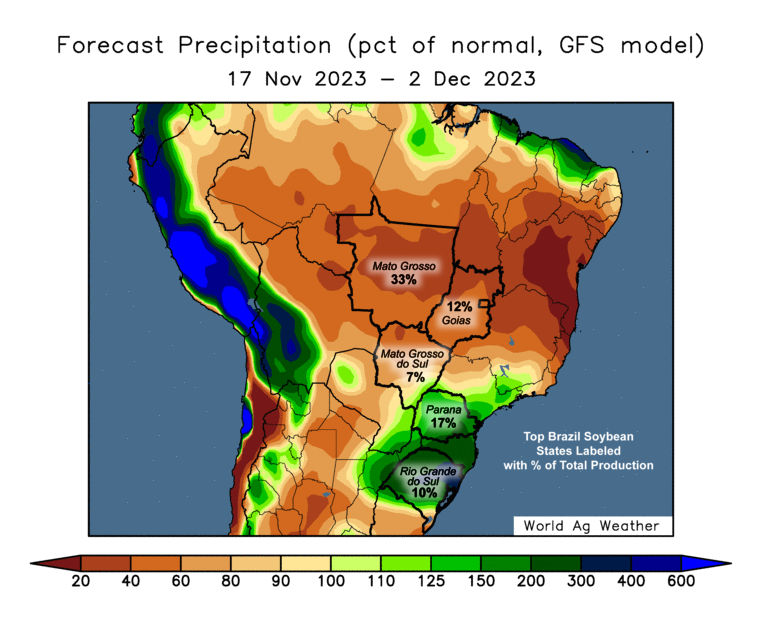

The dry areas in Brazil are forecasted to receive some rain over the next week or two. However, after these rains it looks like it will quickly return to hot and dry once again.

We have had forecasts like this in the past, only for the rain to disappear. Guess we will have to see how this round shakes out. If these rains do not materialize over the next 10 days, these weather concerns will pick right back up.

Either way, we could be in for a big move come Sunday night. How Brazil's weather shakes out will determine the direction of that move.

As we mentioned the past few days, rain in November for Brazil will not make or break this crop.

How much it rains over the next 10 days will not even be as remotely close to important as how much it rains in December.

Yes, short term the market is going to trade these forecasts and it is and will be the most dominant factor. But if we are talking about the real damage or liveliness of the crop, right now is not going to determine how this crop pans out. This heat and dryness has certainly not helped, but one rain is not going to magically make a crop. Where the crop is made will be in December and January.

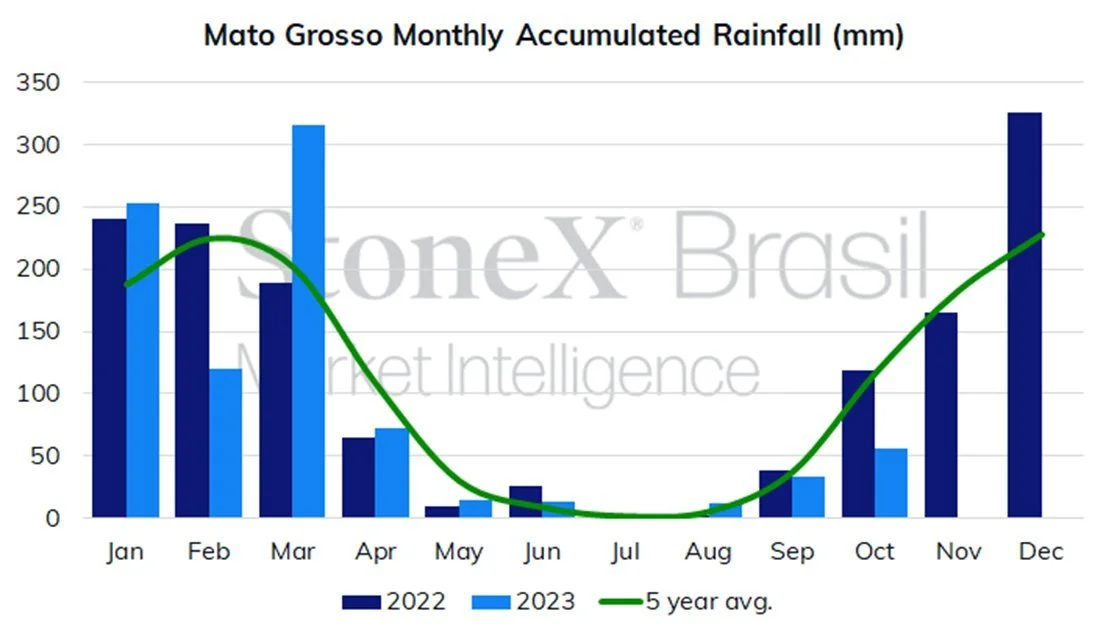

Look at this chart (from October). It shows how much rain Brazil gets each month. As you can see, December will be the key month that determines if their crop is a monster one or one that fails.

My entire point here is that these rains don’t necessarily make a huge difference here. What the weather looks like a month from now from will be huge for the markets.

And from what I've seen so far, the long term outlook does not look favorable.

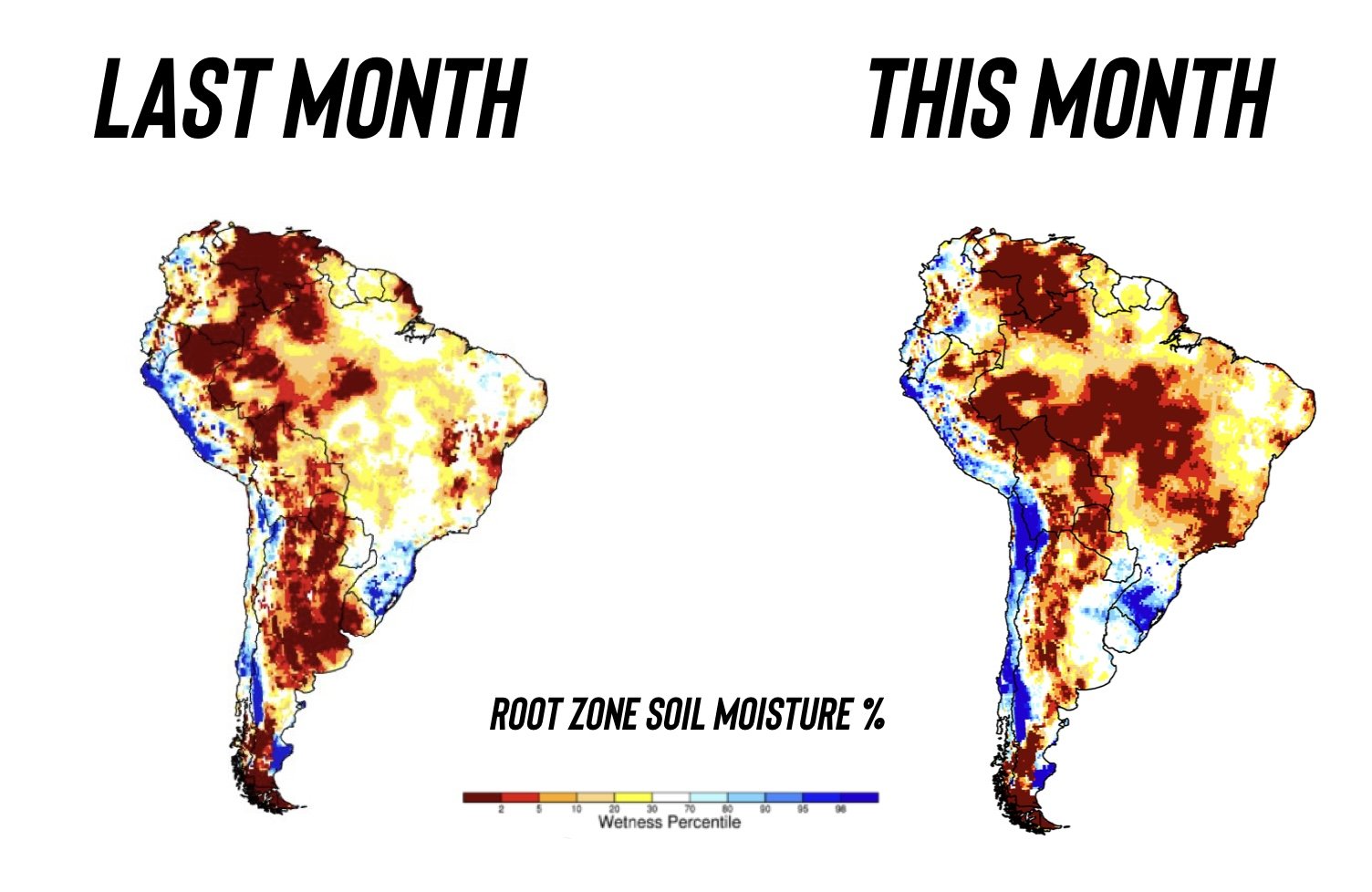

The forecasts ahead are calling for hot and dry over the next month. This root moisture chart will be one to monitor closely if it stays that way.

Here is the change from just a month ago vs today.

Imagine the impact this will have if they don't receive good rains in the months that matter the most.

From Reuters:

Some farmers in Matto Grosso, Brazil are abandoning soybeans for cotton due to the extended dry conditions in the state.

From Water Street Solutions:

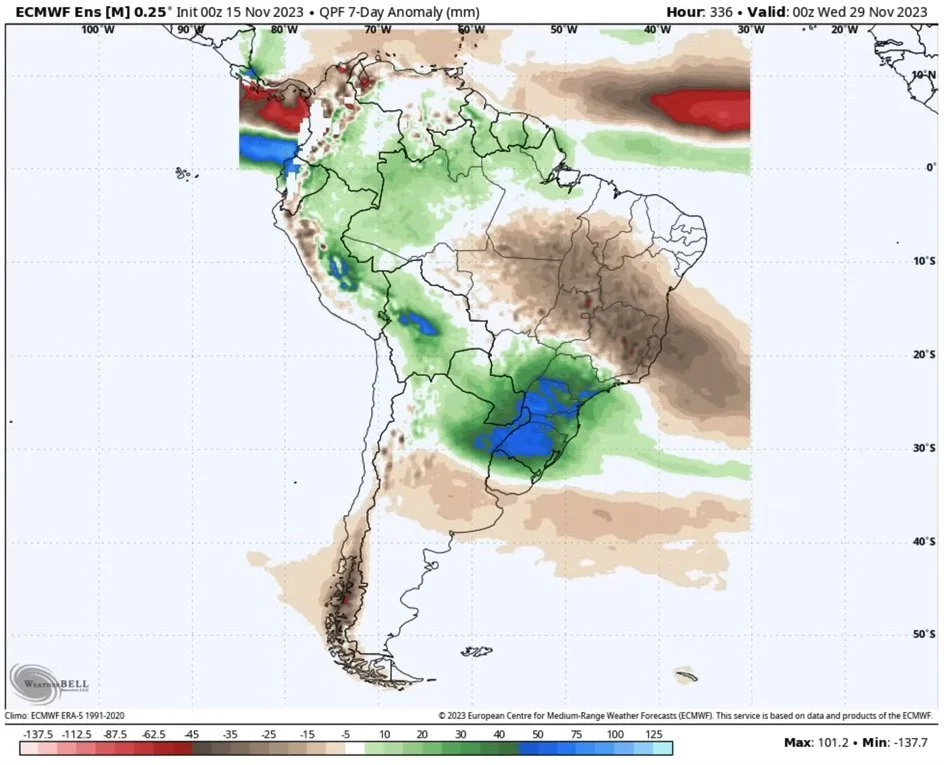

"The Euro (model) has taken large amounts of moisture out in the last 12 hours. Some of the biggest changes I have ever seen. Remember, after next Friday it is back into the oven!" (Talking about Brazil)

Jason Britt - President of Central State Commodities:

"China is praying for rain in South America. They are under bought if their crop falters at all"

Today's Main Takeaways

Corn

Corn lower for the second day this week. Despite the heavy losses in beans yesterday, corn was able to hold strong.

We have been stuck in the same range since essentially August outside of the one time we peeped our head above $5 back in October.

We had some strong export sales yesterday so bulls were happy about that. Even though the recent rain forecasts in Brazil have pressured the market, there is still some obvious concerns.

We could eventually get more South America worries due to the late second crop corn planting in Brazil, but that crop is still a few months out.

Thw two possible catalysts bulls need for corn to go higher are….

The rest of this is subscriber-only content. Subscribe to keep reading & receive every exclusive update. We will be going over our outlook for all of the grains, what to do with Dec. corn basis contracts & more

BECOME A PRICE MAKER

Try 30-days completely free. Get every update sent via text & email. Scroll to check out past ones you would have received.

Check Out Past Updates

11/16/23

WAYS TO OUTPERFORM THE MARKET

Read More

11/15/23

FINDING THE RIGHT GAME PLAN

11/14/23

DEMAND & SOUTH AMERICA

11/13/23

CORN & BEANS RALLY. WHY THERE IS MORE UPSIDE

11/10/23

WHY BRAZIL COULD PUSH THE GRAINS HIGHER

11/9/23

USDA REPORT RECAP

Read More

11/8/23

GRAINS FIRM AHEAD OF USDA REPORT

11/7/23

GRAINS LOWER AS TRADE PREPARES FOR USDA

11/6/23

BEANS CONTINUE BULL RUN AS HARVEST WRAPS UP

11/3/23

BEANS RALLY & CORN HOLDS OFF NEW LOWS

11/2/23

EVENING THE PLAYING FIELD

Read More

11/1/23

CORN CONTINUES LOWER & BRAZIL CONCERNS

10/30/23