GRAINS CONTINUE TO BOUNCE

Overview

Beans lead the way up +15 as grains continue their slight rebound. Beans post their highest daily gain since December 11th and have now actually taken back all of the losses since the day of the brutal USDA report.

Although they haven't amounted to much, corn is green for the 4th day in a row, the longest streak since the end of November into early December.

Wheat closed a dime off of it's highs, ending unchanged and breaking it's 4 day rally.

Why have the markets found some footing? Mainly it's just the funds. The sharp 3 week downtrend was mainly due to fund selling, and it seems like they view this area as a decent spot to stop the selling and reevaluate.

However, we haven't seen a big wave of buying either which is slightly depressing and creates choppy trade. But it's better than the blood bath we have seen recently.

South America weather remains mostly cooperative, the weather Brazil sees over the next month and a half will likely dictate their crop size.

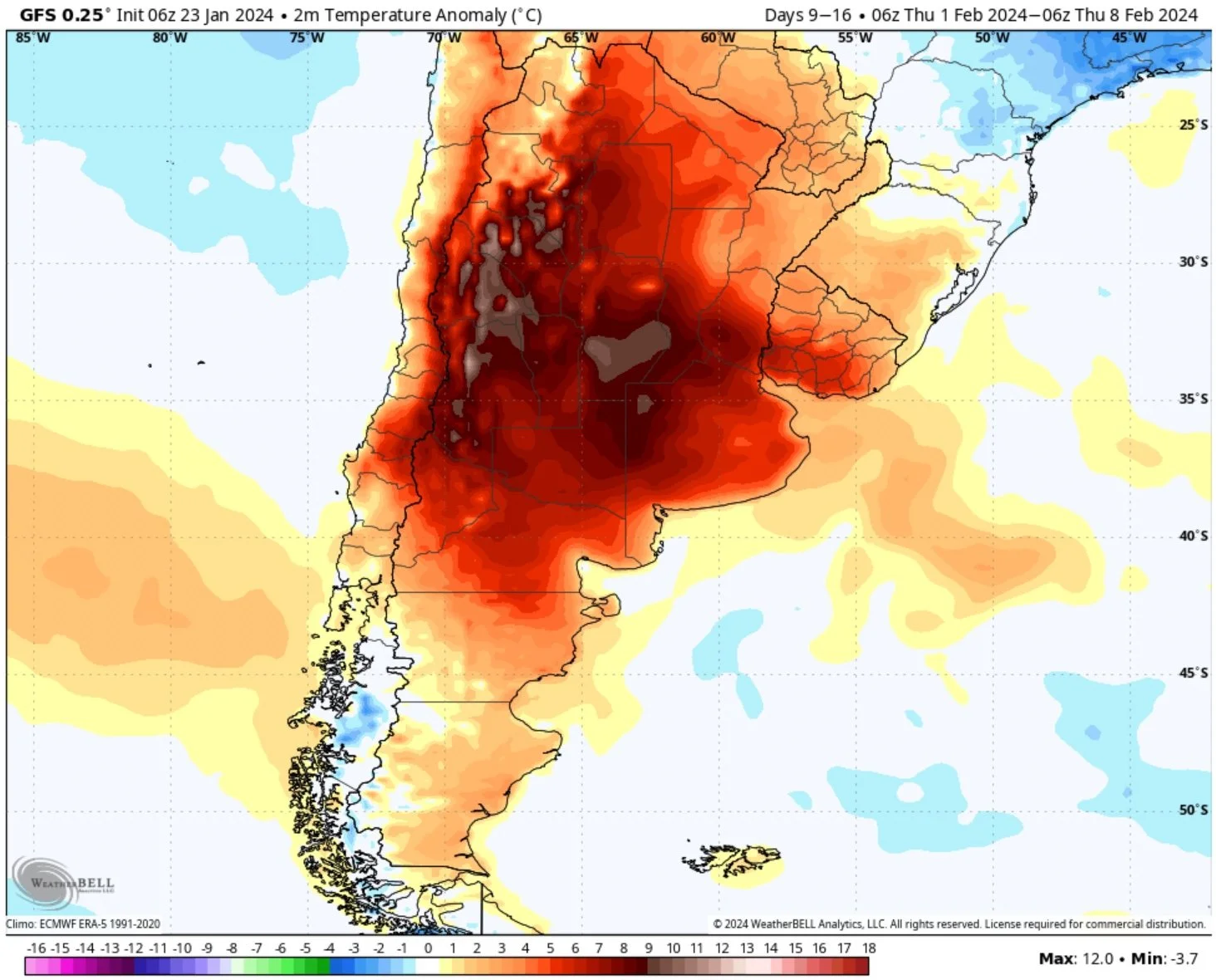

Part of the reason for the beans rally today was Argentina. Argentina is having an amazing crop, but they are expected to see some really hot and dry weather the next two weeks. If rain doesn’t come, we could certainly be looking at some stress in their crops that are mostly in great shape.

For context, right now is their version of July in the US for their growing season. So a lot of those recent rains are evaporating with the heat.

Here is the next 7 days.

Election Year vs Non Election Year History

Friday we took a look at how election years are typically great years for the grain markets. You can read Friday's full update HERE.

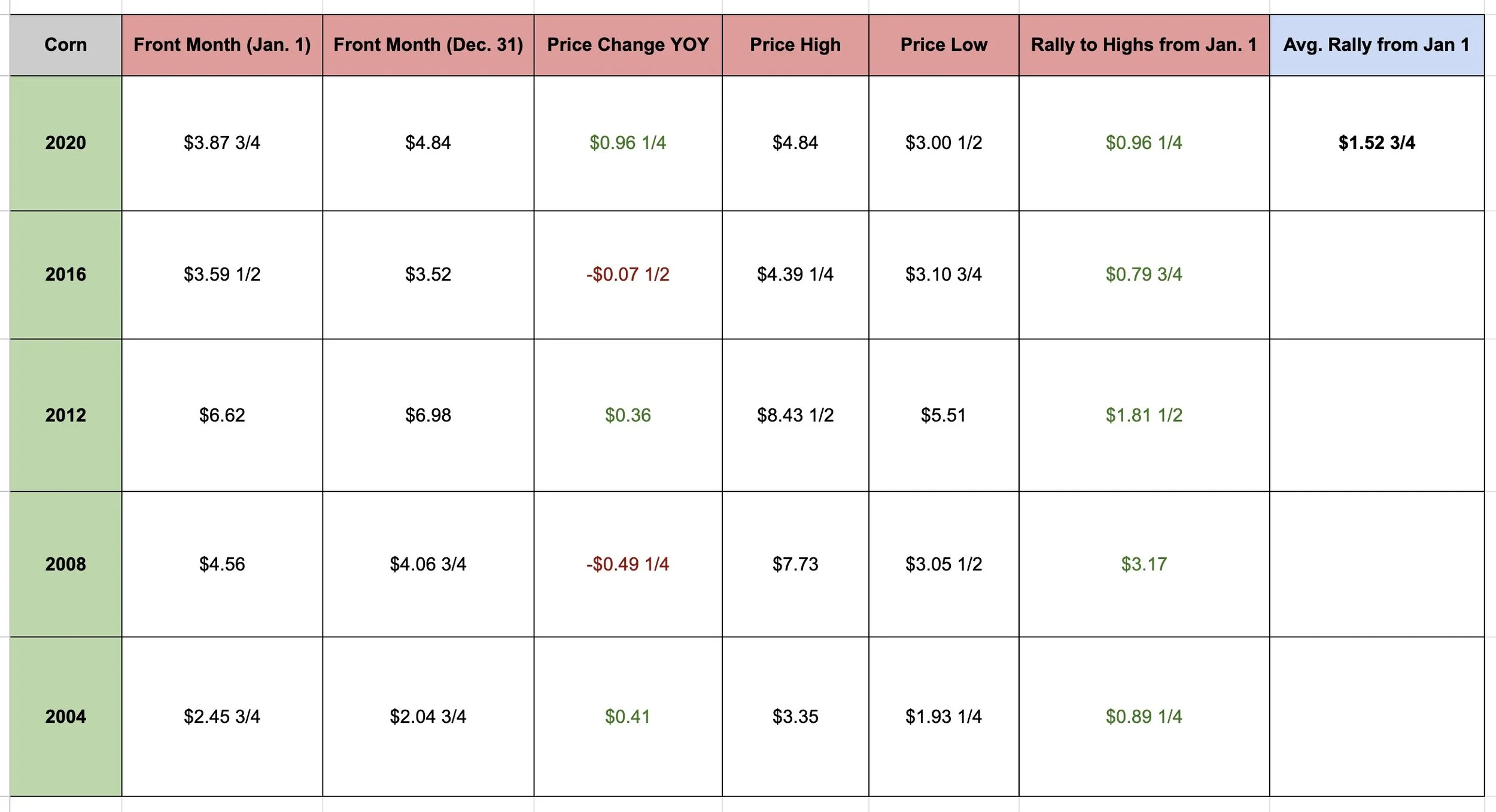

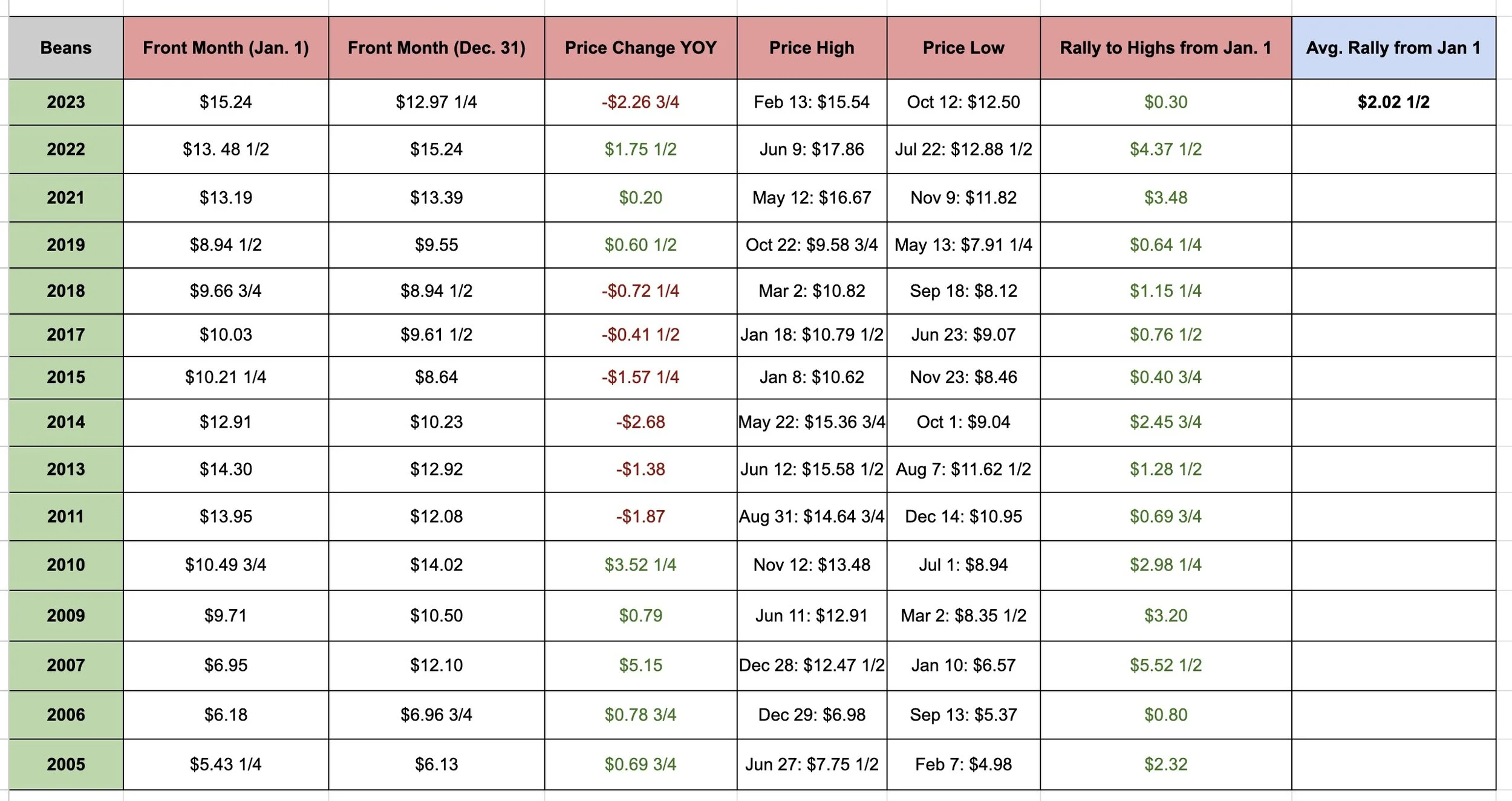

Our average rallies from January 1st to our highs for the year during election years are as follows:

Corn: +$1.52 3/4

Beans: +$3.89 1/2

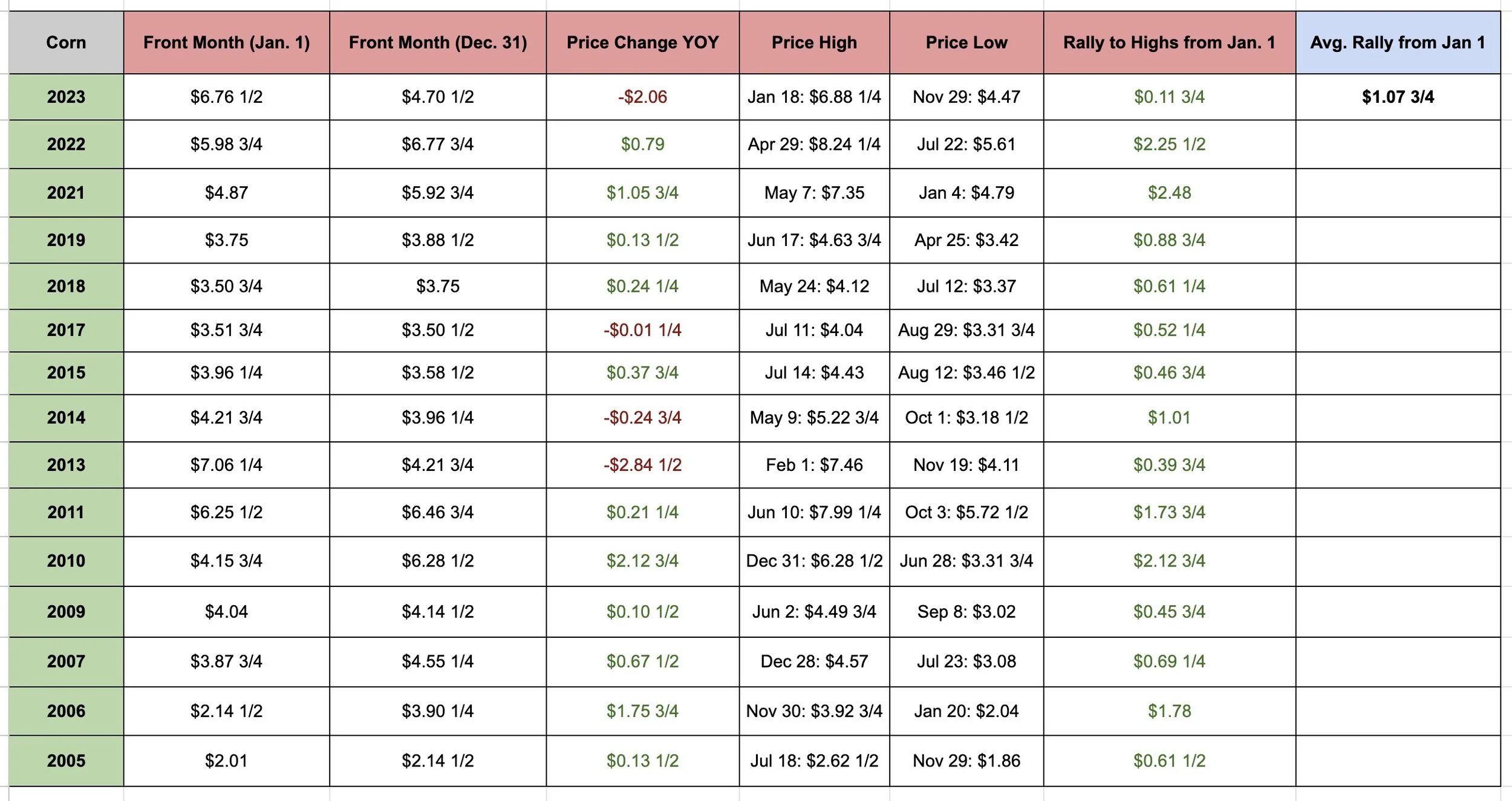

So what about "non-election years"?

Well, the difference may surprise you.

Corn: +$1.07 3/4

Beans: +$2.02 1/2

The difference? For corn that's $0.45 cents. For beans it's a big $1.87

Here is the data:

Election Years:

Non-Election Years:

Now of course this doesn’t mean grains "have" to rally like the average election year or rally at all. A lot of people would be extremely happy with even HALF of our typical rally which would be $0.76 cents in corn and $1.45 in beans.

How much we rally will depend on a few things. South America and what that crop looks like. Demand from China. And what kind of crop we produce here at home and how much weather cooperates or if we get a big weather scare.

But historically, yes election years outperform non election years. Since it's an election year, expect something out of the ordinary to happen. Typically these surprises wind up being friendly for our markets.

Some may say "2008 and 2012" don’t count. Which yes is a valid argument because 2008 was the ethanol boom and 2012 was the drought year.

If you take out 2008 and 2012, our average rally for corn is still $0.88 cents and beans is still $3.25. If we added those to today's prices we would be looking at $5.35 corn and $15.65 beans.

Of course this is all hypothetical and food for thought. But I do believe this election year will bring higher prices. How high is to be determined.

Near Record Fund Shorts

The funds hold some of the shortest positions on record. They hold a net short position across all 7 major grain and oilseed futures for the first time since September of 2019.

They hold a RECORD short for corn at this time during the year. Short over -260k contracts.

What happened the last time the funds were this short?

This is what happened……

The rest of this is subscriber only. Please subscribe to keep reading & get every update.

In the rest of today’s update we look at:

Exactly what happened the last time the funds were this short corn

-50% less 2nd crop corn acres in Brazil?

Why there will be less corn acres

Who should be getting courage calls? Puts?

Specific risks is there in corn

Is trend is turning higher for beans?

Bulls argument in wheat

KEEP READING FOR FREE

Get our daily updates & audio free. Don’t hesitate to reach out with questions. (605)295-3100

Scroll to check out past updates you would’ve received.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

1/22/24

HAVE MARKETS FOUND A BOTTOM?

1/19/24

FAILED REVERSALS & ELECTION YEAR RALLIES?

1/18/24

UTILIZING TRENDS & TECHNICALS IN YOUR GRAIN MARKETING PLANS

Read More

1/17/24

FUNDS & CHINA

1/16/24

BEANS TRY TO BOUNCE FOLLOWING BEARISH USDA

1/12/24

FULL USDA REPORT BREAKDOWN

1/11/24

USDA REPORT TOMORROW. ARE YOU PREPARED?

1/10/24

PREPARING FOR THE USDA

1/9/24

TURNAROUND TUESDAY & USDA PREVIEW

1/8/24

HOW TO GET COMFORTABLE AHEAD OF USDA REPORT

1/5/24

FIRST WEEK OF NEW YEAR FLOPS

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23