PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

Overview

Grains pressured heavily with a risk-off day across all markets. This included a broad sell-off from everything from stocks to energy futures, spilling over into the grains. As the US dollar rallied, crude oil and the US stock market sold off.

To add on to this, the delayed planting story is gone.

Yesterday's crop progress showed no concerns as corn was 83% planted vs the 82% 5-year average. (Keep in mind if you remove 2019 from this, the average jumps to 90%.)

Soybeans came in at 68% planted, ahead of the 64% average and faster than the estimates of 67%. Last year were at 78%.

The corn and soybean market are now going to lose interest in planting progress and will very soon start paying attention to the actual crop developments and crop conditions. As we get the USDA's first conditions next Monday. Most expect strong initial ratings.

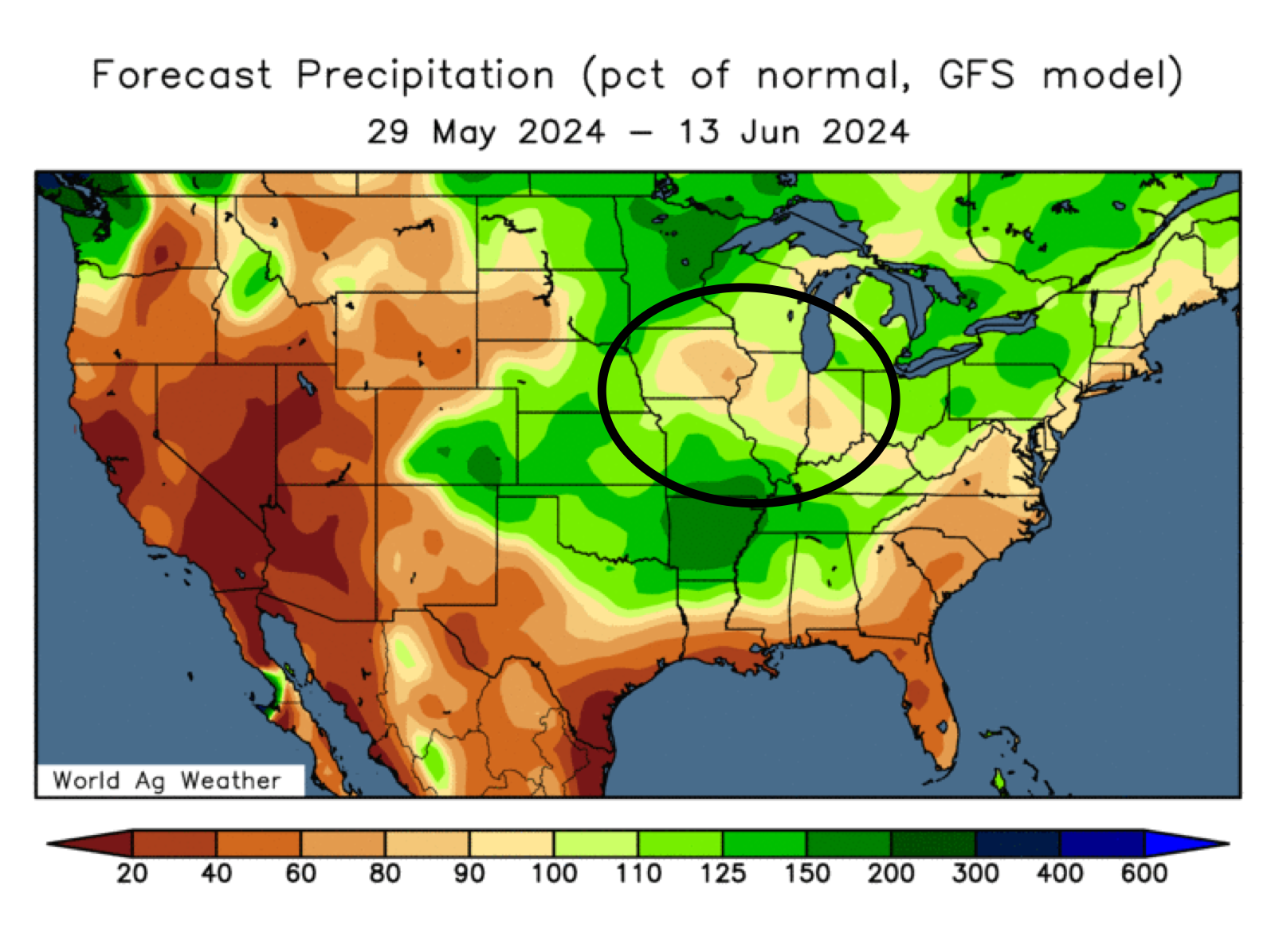

With planting delays gone, the market is looking for something to chew and without a bullish story to get behind for now as the US will be looking at it's driest outlook of spring this week and help finish planting those crops.

Overall just a lack of bullish news leading to the path of least resistance being lower.

Yesterday's action in grains was awful as we failed to break out on the charts. In yesterdays audio we said this would likely result in some more follow up selling before finding support.

Russia and Ukraine wheat areas are still suffering from dryness and the global wheat concerns have not gone anywhere, but the market has priced this in for now.

India is going to start importing wheat for the first time in 6 years, but this wasn’t a major factor as no one knows if it will be anything major or not. India also announced they are taking off their wheat import tax, but it looks like Russia will get most of the business. However, with Russias smaller crop some are asking how much they will be able to supply.

Argentina announced they are going to start exporting corn to China in July as they settled their trade disputes, so this doesn’t help the US corn market.

There just is not a clear story in these markets to make the funds have a risk on mentality like they had the past month. We initially had the possibility for major delayed planting, so they covered their shorts due to that possibility. That possibility is now gone, so they are pausing as we head into the time of year where these crops will be made or broken in the actual growing season. We do still however have the seasonal trend and technical trend in favor...

Today's Main Takeaways

Corn

Corn posts it's second big red day in a row, down nearly a dime to start the week.

As I mentioned, the planting delay story is no longer a thing.

But what if I said that was never the big story to begin with?

We all knew this year wasn’t going to be a repeat of 2019. Not even close.

But what we do know is that………

The rest of this is subscriber-only. Subscribe to keep reading and get every full update along with 1 on 1 tailored market plans.

IN TODAYS UPDATE

The real concern with a wet spring

Is the rally over?

Supply vs demand driven rallies

You can’t control the market, just your plan

Selling wheat vs corn?

Defending downside risk?

What you should be doing

TRY 30 DAYS FREE

Try all of our daily updates, audio, and recommendations completely free. Comes with 1 on 1 tailored market plans.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24

WILL FUNDS BE FORCED TO COVER?

4/24/24

WHEAT CONTINUES BULL RUN & CORN FAILS BREAK OUT

4/23/24

FUNDS CONTINUE TO COVER & RALLY GRAINS

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24