RALLY TAKES A PAUSE

Overview

Grains mostly lower but we rebounded well off our lows.

Corn was down a few cents but closed just 1/2 a cent lower. Soybeans were down -10 cents but managed to close a penny higher to the highest level in a month. Chicago wheat was down -13 cents but rallied back to close just -3 cents lower.

Since the first notice day lows the markets have been grinding higher. Corn is now +33 cents off it's lows while soybeans are +68 cents off their low. Wheat is currently +20 cents off the lows made this Monday from the China cancellations.

Overall the past few days including today have been good price action. The markets are just pausing the recent rally. The charts are still looking pretty friendly.

We have had a lack of demand news for the markets with no sale announcements, but we also haven’t gotten anymore cancellations out of China.

The funds still remain heavily short. Short roughly 260k corn, 110k beans, and 60k wheat. Still plenty of room to cover those shorts.

It would make sense for the funds to start lightening up those heavy short ahead of that huge report at the end of the month, upcoming planting here in the US, and the uncertainty in Brazil.

Yesterday the Brazil CONAB numbers came out lower than the market expected. Here is a comparison for the CONAB vs USDA numbers.

CONAB

Corn: 112.7

Beans: 146.9

USDA

Corn: 124

Beans: 155

Difference

Corn: 11.3

Beans: 8.1

Today's Main Takeaways

Corn

Corn slightly lower today, but the price action wasn’t negative at all.

This is the 4th day in a row where corn has traded lower but rallied back.

It just looks like this market is taking a breather, we just had the biggest weekly gain in 5 months. A pause is healthy.

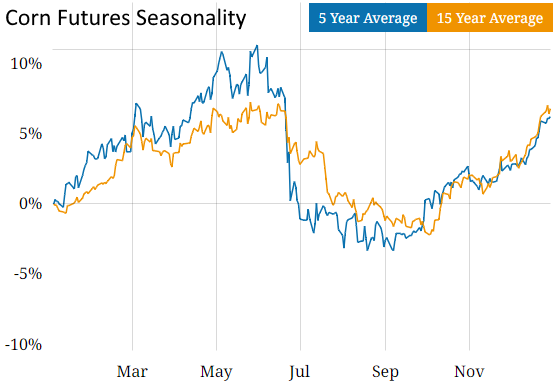

This week is seasonally the week that corn tends to make it's highs for the month of March. As seasonally we trend lower for a few weeks but turn higher into late spring.

Despite this, corn has never once made it's top in March.

Here is the seasonal chart:

Despite what the seasonals say, I still think we likely grind higher from here short term. At least for the next few weeks.

Then if it stays warm and dry, we have been talking about early planting a lot lately. But that is a risk this market faces. Early planting leads to more acres which in turn is negative for prices. So be prepared if this happens.

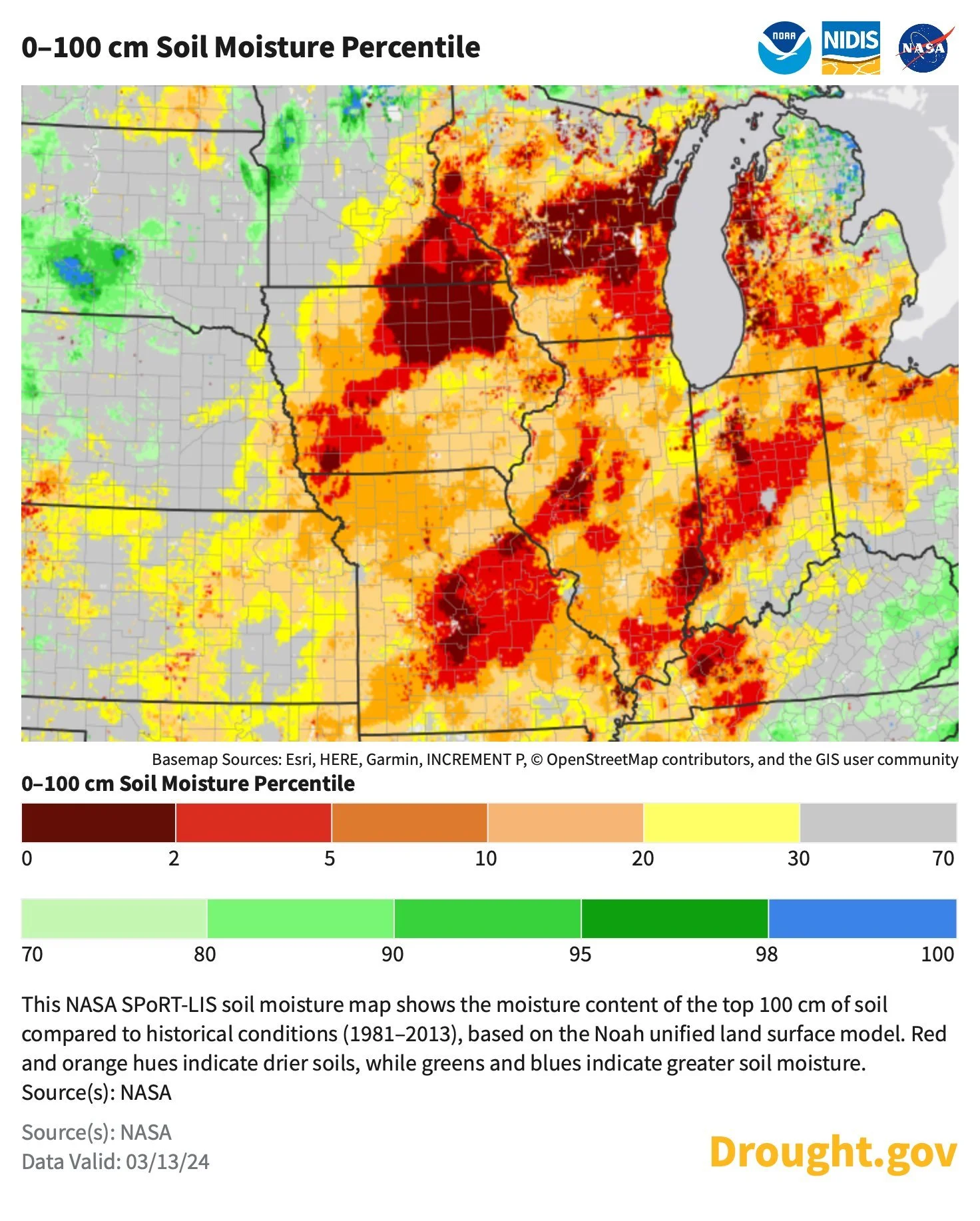

We had a dry harvest and dry winter. So why would it start to rain after we get this crop in the ground?

Check out how the moisture situation in the I-states looks right now. Not good if we don’t get rain.

This brings the possibility for that summer drought scare rally we have been talking about.

Some say this "warmest winter on record" doesn’t mean much.

Well it kind of does… Here is why…

The rest of this is subscriber-only. Please subscribe to keep reading & get every exclusive update along with 1 on 1 marketing planning for your operation.

IN TODAYS UPDATE

Why a warm February might matter

Price scenarios for corn

Brazil situation

Bullish technicals

Trump trade war matter?

KEEP READING FOR FREE

Try our daily updates, audio, and 1 on 1 marketing planning for free. Completely free for 30 days.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

3/12/24

CONAB A LOT SMARTER & SMALLER THAN USDA

3/11/24

CORN 4TH DAY HIGHER & KEY REVERSAL IN WHEAT

3/8/24

USDA RECAP: POOR REPORT, GREAT REACTION

3/7/24

CORN TECHNICALS TURNING BULLISH. PREPARING FOR USDA REPORT

3/6/24

CHINA CANCELS WHEAT? RUSSIA SELLING WHEAT TO FUND WAR

3/5/24

NEW LOWS IN WHEAT & USDA BRAZIL ESTIMATES

3/4/24

IS CHINA HUNGRY FOR CHEAP GRAIN?

3/1/24

FIRST HIGHER WEEK IN MONTHS

2/29/24

HOW TO USE TARGETS VS TRIGGERS

2/28/24

BIGGEST 3 DAYS IN CORN SINCE AUGUST

2/27/24

DID CHINA BUY CORN YESTERDAY?

2/26/24