FUNDS DON’T WANT TO BE SHORT GRAINS

Overview

Grains higher, led by yet another massive rally in wheat. As both corn and wheat make new highs for the move.

Wheat traded to it's highest levels since last August, now up +$1.50 from the $5.38 March lows. Closing at $6.87.

Corn traded to it's highest levels since the first week or two in January. +50 cents off those $4.22 February lows. Closing at $4.72 1/2.

Soybeans are still down about -30 cents from last week's high close of $12.49 closing at $12.19 1/2 today. But still +75 cents off the April lows of $11.45.

The big news has been the funds.

They were holding massive record shorts this year, but they have covered a record amount the past few weeks.

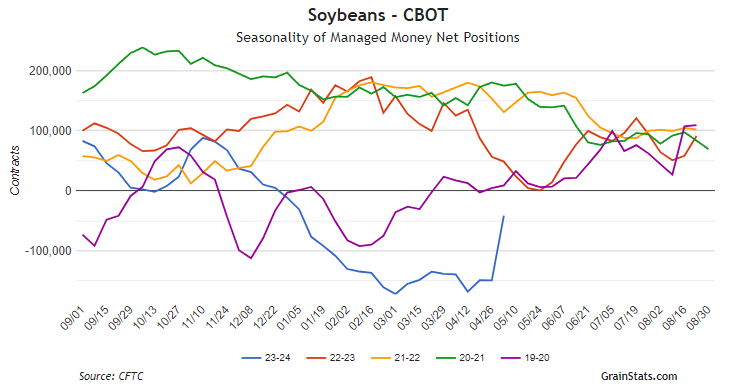

For the week that ended May 7th, it was the largest fund buying since July 2017 for the ag complex.

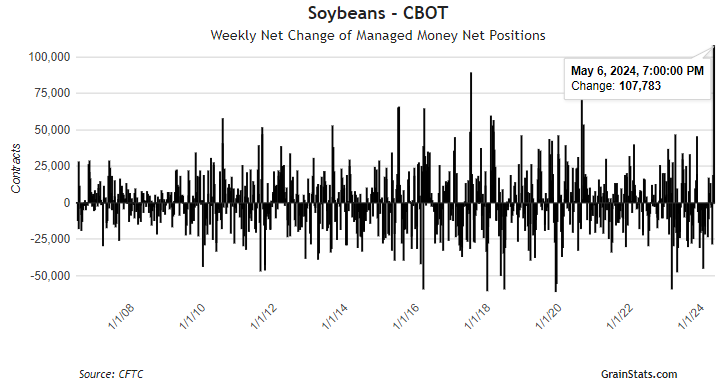

They covered a one week RECORD in soybeans. Covering +107k contracts in just 5 days.

They are now short just 40k contracts.

Chart Credit: GrainStats

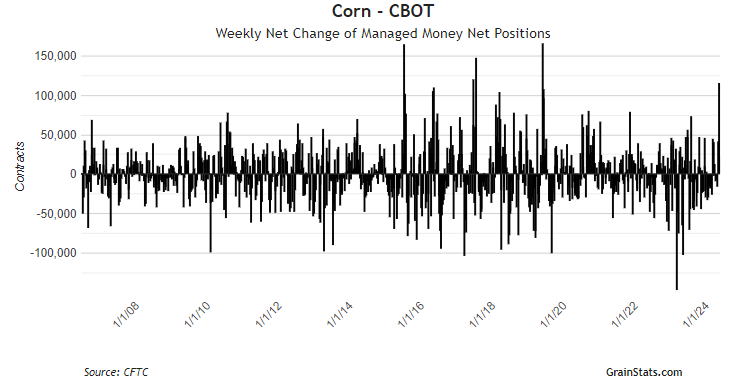

For corn, they covered a massive +100k contracts. Not quiet a record, but close.

Since February, the funds have covered +200k contracts.

They are still short 100k contracts, and corn has already rallied +50 cents. Which is great, because they have more room to cover.

If we were to see a week like this happen again, the funds would actually be long. After holding a record short not long ago.

Remember, the funds have never not got long at least one point during the year for corn.

Chart Credit: GrainStats

Funds exiting their shorts in grains is not bearish.

Where we go from here will come down to weather, but if Big Money does not want to be short anymore there is a reason.

They see the potential for prices to go higher. They do not want that upside risk anymore.

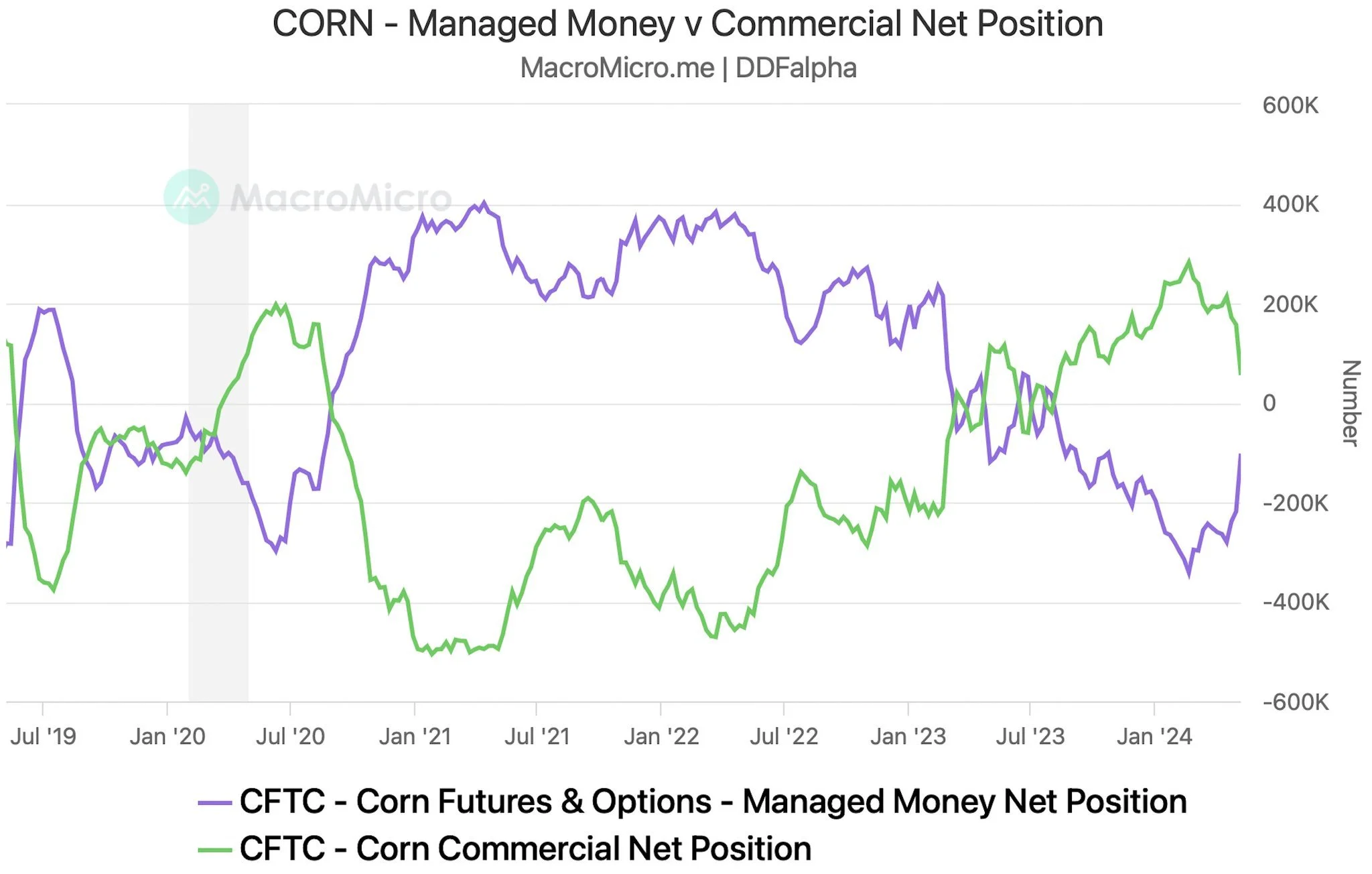

We have seen a ton of farmer selling recently. If you look at the CFTC data, producers added 100k shorts while the funds bought 100k longs. So the funds are literally buying the farmer selling.

The market is finding an equilibrium as it should. Heading into a growing season where there is an equal amount of upside and downside risk.

Chart Credit: Darrin Fessler

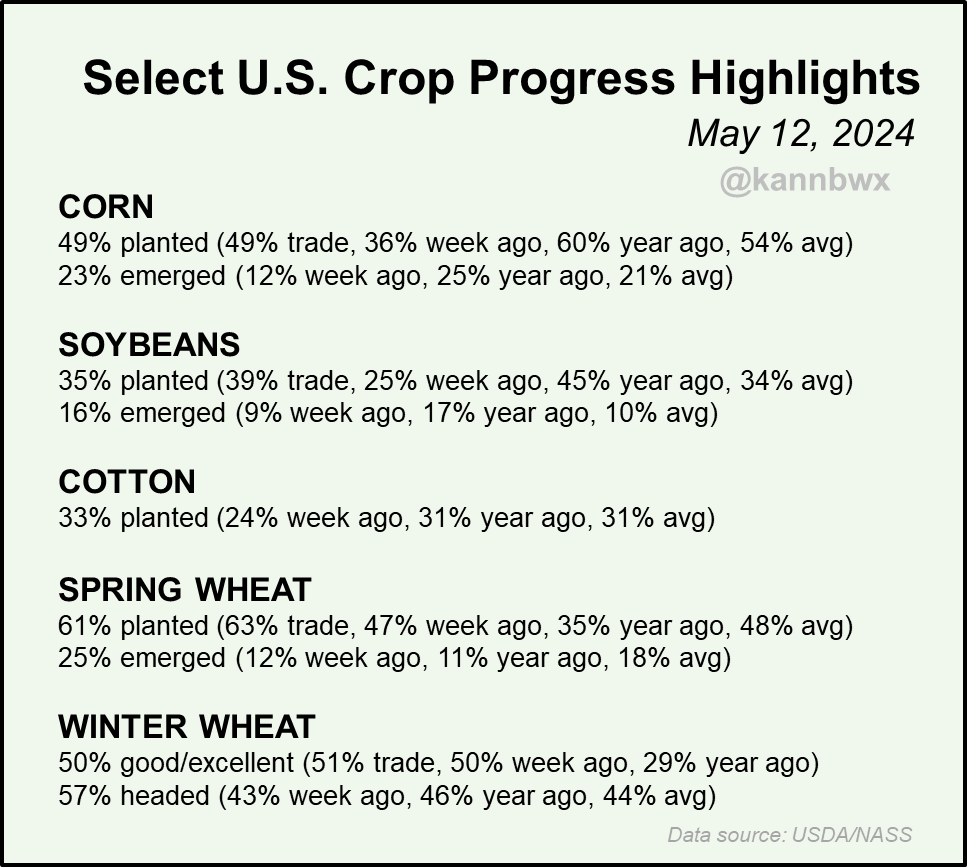

Planting

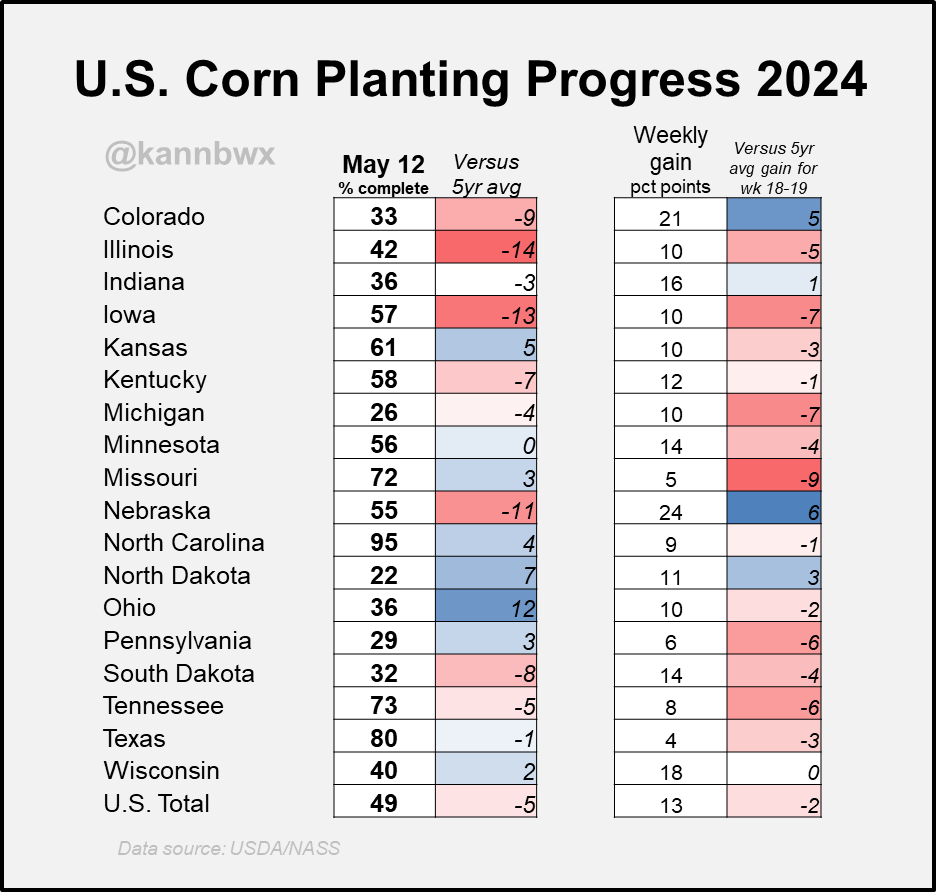

Planting is the 4th slowest in the past 25 years.

The worry right now is that we are pushing the crops into a less favorable window. The concern is not "if" we will get the crop in the ground.

Corn right on the estimates, but now 5% behind average.

Soybeans right on average pace, but a lot slower than expectations.

Spring wheat slightly slower than estimates, well ahead of average.

Winter wheat ratings unchanged, despite estimates thinking we'd see improvement.

The biggest concern is those leading corn growers of Iowa and Illinois. Both are 13-14% behind.

Chart Credit: Karen Braun

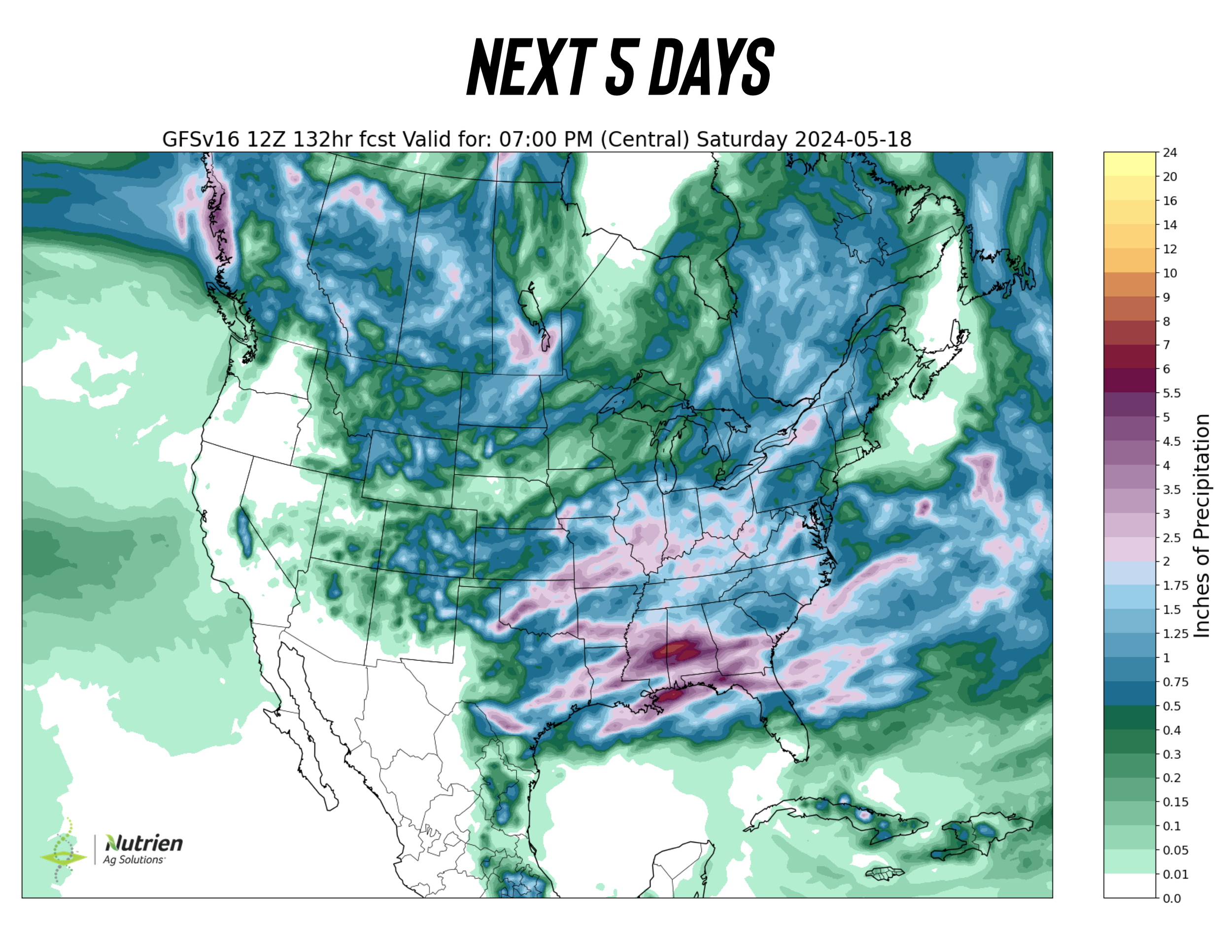

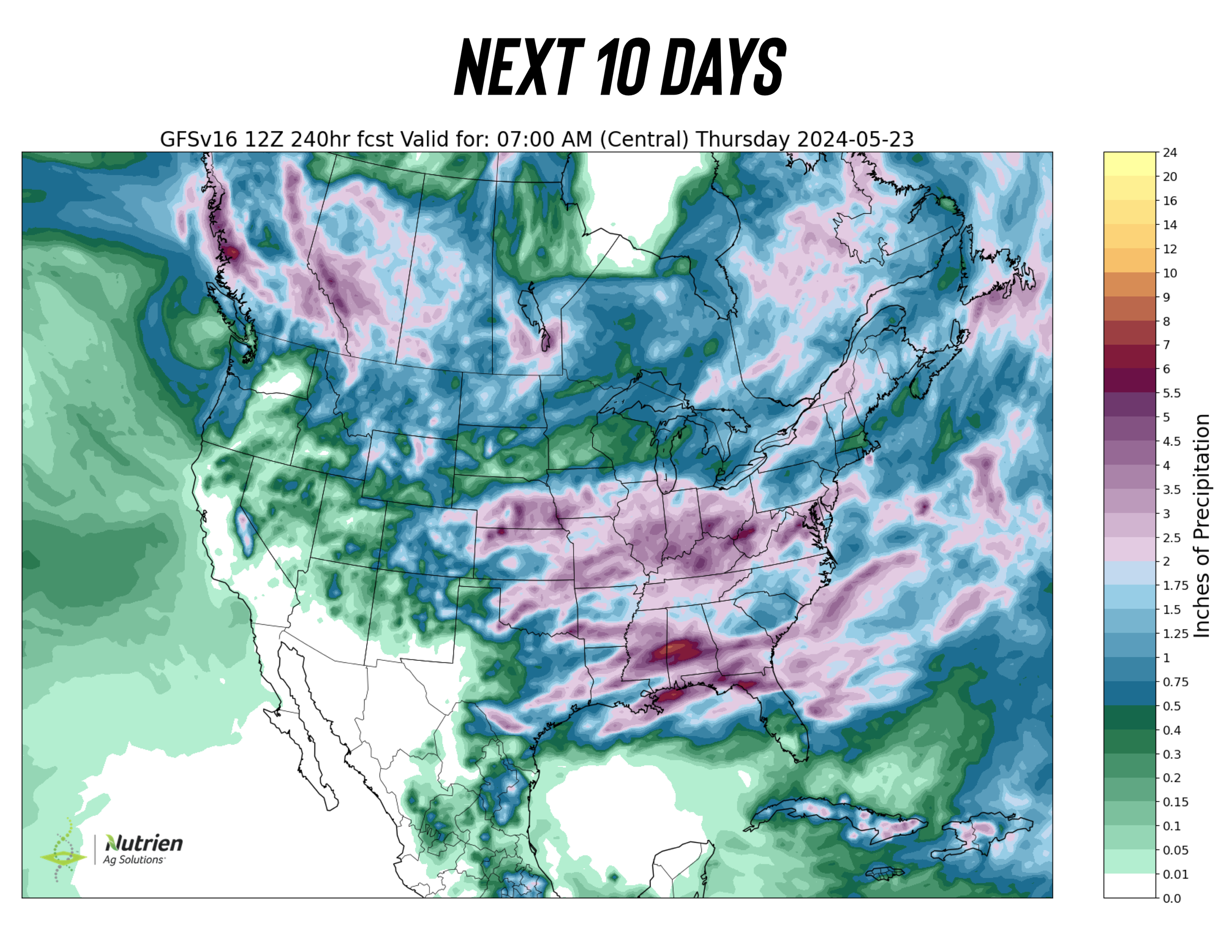

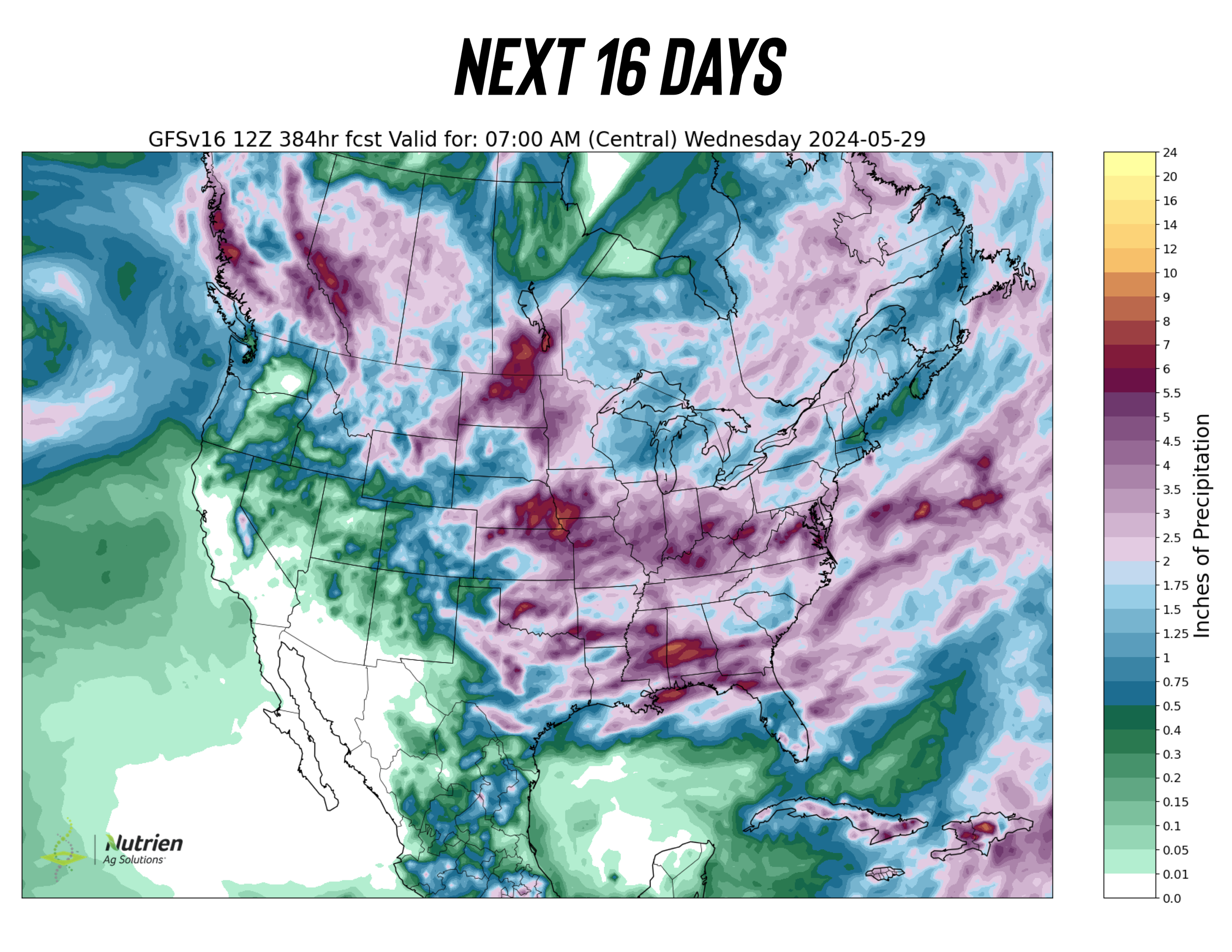

Right now it doesn’t look like the rain is going away. As the next two weeks suggest more rain. Two weeks from now is June.

There is the potential for some areas looking at June before they see any real major progress.

This is far from 2019, but is still a concern.

Along with that, we have farmer sentiment sitting at multiple year lows. Which means it could take higher prices to convince some growers in the wettest areas to continue.

To add on top, we just saw near record short covering from big money. It is very rare for the funds to hold an even position. Which makes me think we have plenty of more buying ahead...

Today's Main Takeaways

Corn

New highs in the corn market.

The USDA report was not crazy bullish but………

The rest of this is subscriber-only. Subscribe to keep reading & get every update along with 1 on 1 plans.

IN TODAYS UPDATE

Why I see corn going higher

Potential weather scares

Targets for all the grains

Spots to make sales

Risk management strategies

Concerns in soybeans

2008 type wheat?

TRY OUR DAILY UPDATES FREE

Get our daily updates & 1 on 1 market plans completely free for 30 days.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24

WILL FUNDS BE FORCED TO COVER?

4/24/24

WHEAT CONTINUES BULL RUN & CORN FAILS BREAK OUT

4/23/24

FUNDS CONTINUE TO COVER & RALLY GRAINS

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24