RECORD SHORT FUNDS, SOUTH AMERICA, & MANAGING RISK

WEEKLY WRAP

Futures Prices Close

Overview

Grains mixed to end the week following yesterdays USDA report.

Corn made yet another new low, while both soybeans and wheat have traded completely sideways the entire week.

Overall, the USDA report was bearish. Prices didn’t reflect that however because the CONAB numbers that came out before the USDA report were very friendly.

Today corn and beans were pressured from the rains in Argentina as well some possible after effects of the report.

Soybeans had the most bearish report, yet we were able to close higher yesterday. Even with the USDA barely lowering Brazil beans and with both the US and world carry out numbers coming in higher. This was a good sign, but for now we are still stuck in a complete sideways range as we gave back those gains today.

Click Here for Yesterday’s Report Breakdown if you missed it.

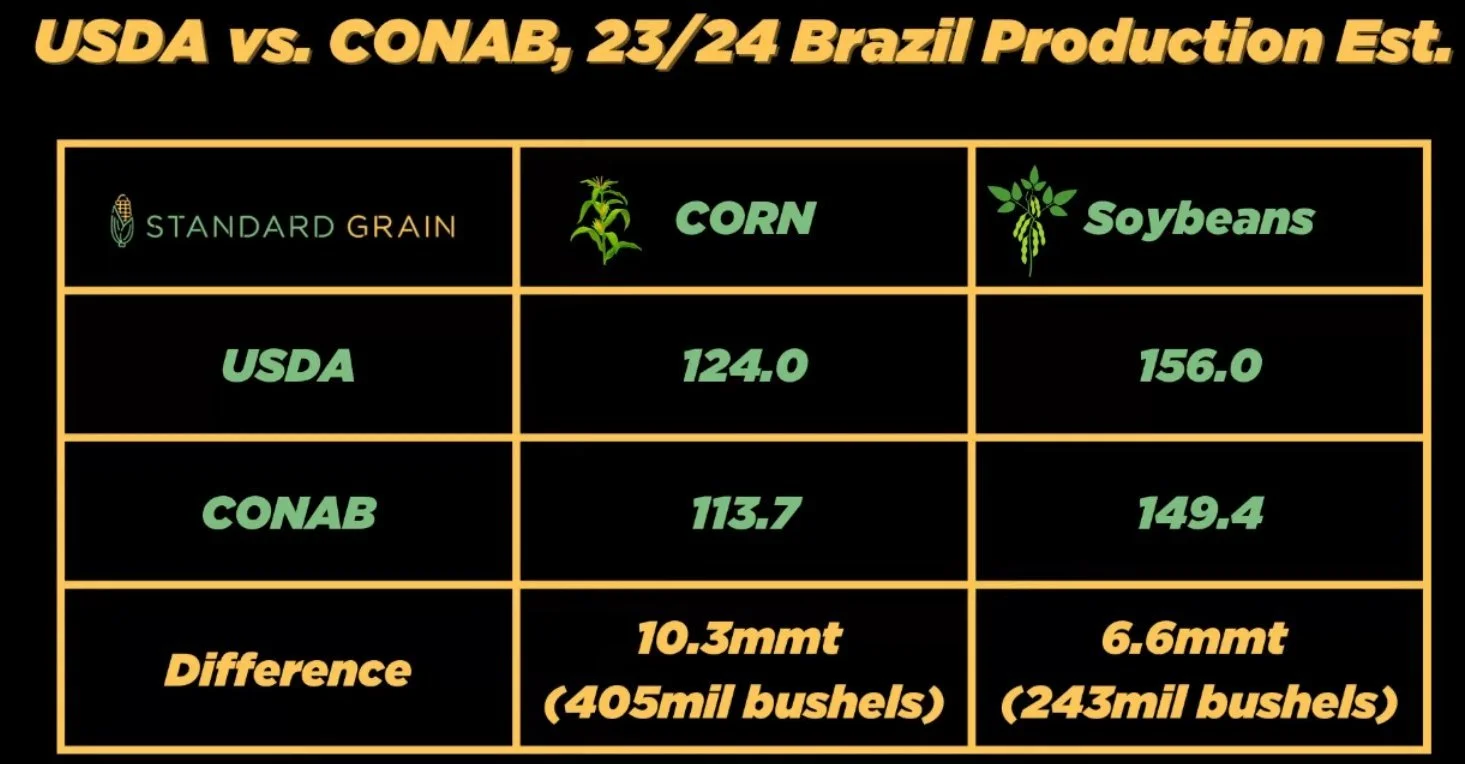

Here were the numbers again in case you missed them:

Now the real kicker here and what the traders are trying to wrap their heads around is the massive difference between the USDA and the CONAB numbers for Brazil.

Here is a chart from Standard Grain that shows the differences.

CONAB sees the soybean crop nearly -7 million smaller and the corn crop is a whopping -10.3 million smaller.

The CONAB numbers if true, are a big deal. Because if you take the USDA or CONAB numbers from where they started months ago vs now, the amount they have cut the bean crop by is nearly the size of our entire US carryout.

At that same time, Brazil has gotten smaller and smaller yet our exports have decreased. That doesn’t line up.

Now yes, the USDA almost always has bigger numbers than CONAB. But 10 million metric tons?? That is such a wide discrepancy. You would think Brazil's USDA would have a far better understanding for their crop than the US's does.

Last year, the USDA was +5 million higher when it was all said and done compared to CONAB.

CONAB had 132 for corn, and 155 for beans. The USDA had 137 and 160.

So will the USDA come to game? Hard to say. They always come to the game late. But no we can’t rely on that. They are the one who dictates these things whether we like it or not.

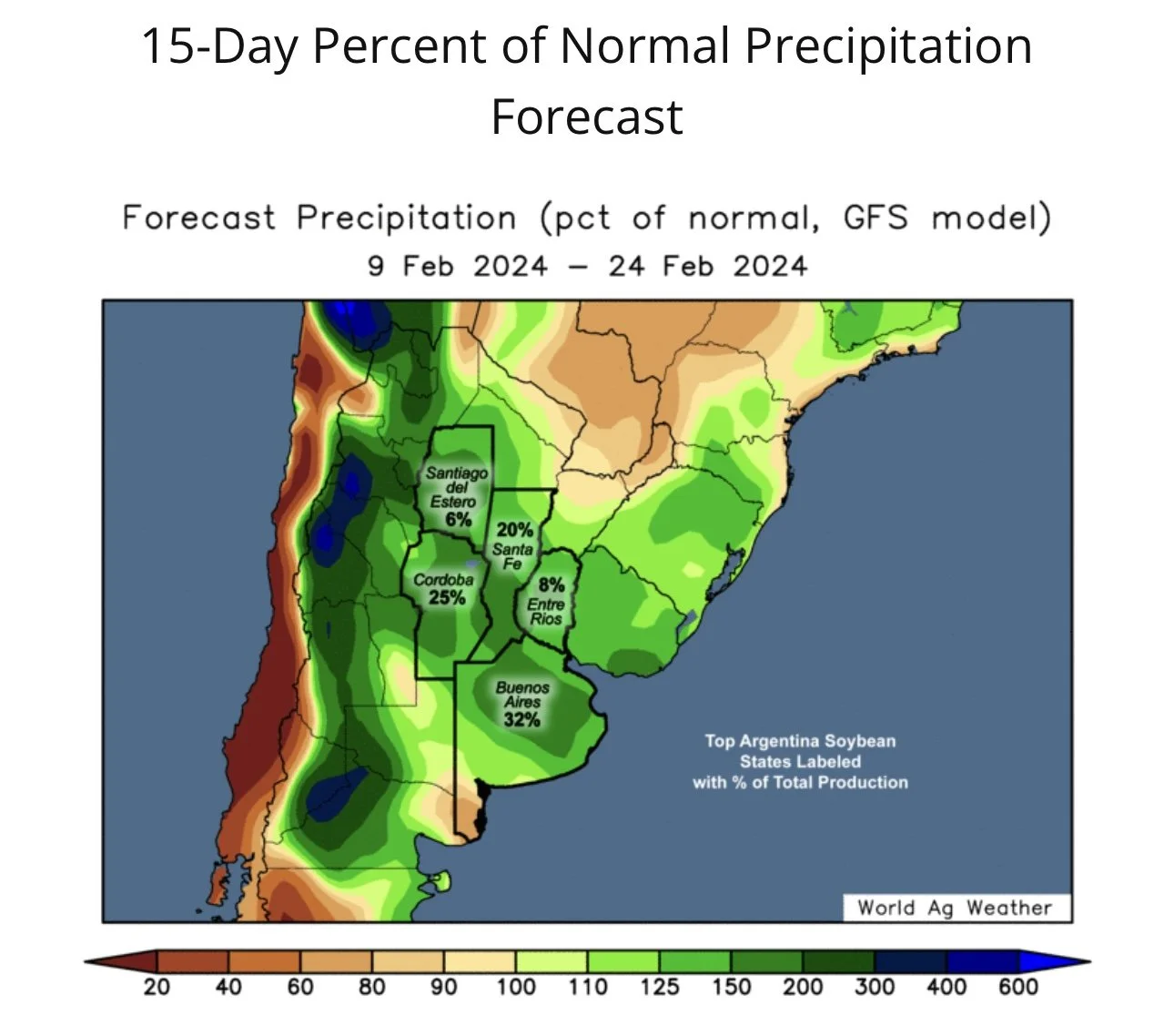

Then we had Argentina, nearly all the numbers came in line with the estimates. But these numbers could very well be taking a step back rather than forward.

They are suppose to get some good rains. But keep in mind, this is a critical key time frame in their growing season.

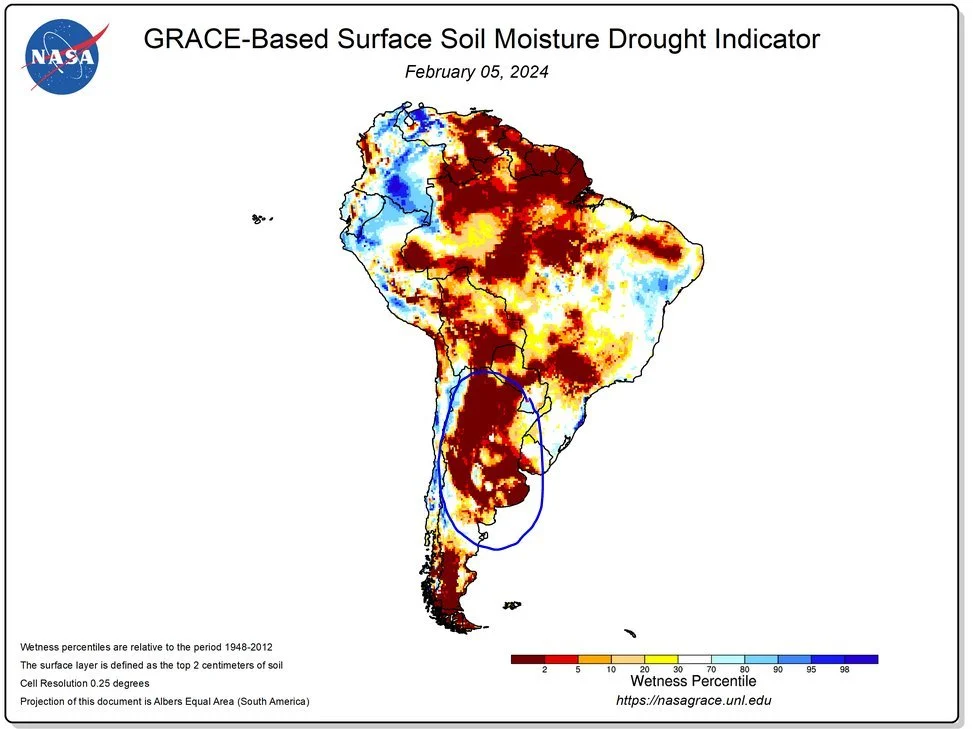

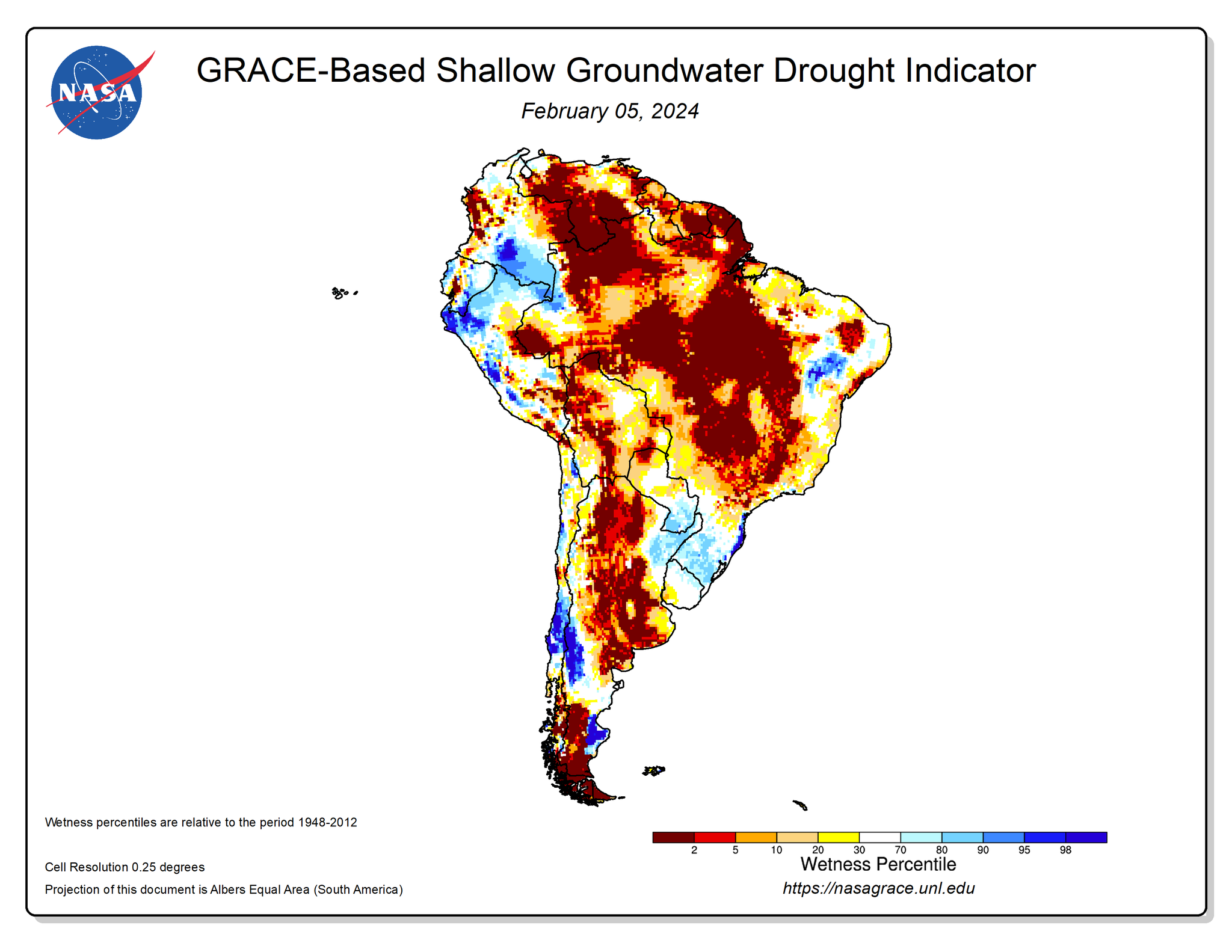

Take a look at how their soil moisture is holding up, despite seeing plentiful rain up until mid-January.

Gro Intelligence said:

"Our machine learning based Argentina yield forecast models show corn yield projections have dropped by more than -10%, and soybean yields are down about -8% since mid-January."

But.. they are suppose to get rain. Below are the forecasts.

How much of this is too late?

I guess we will find out over the next few months.

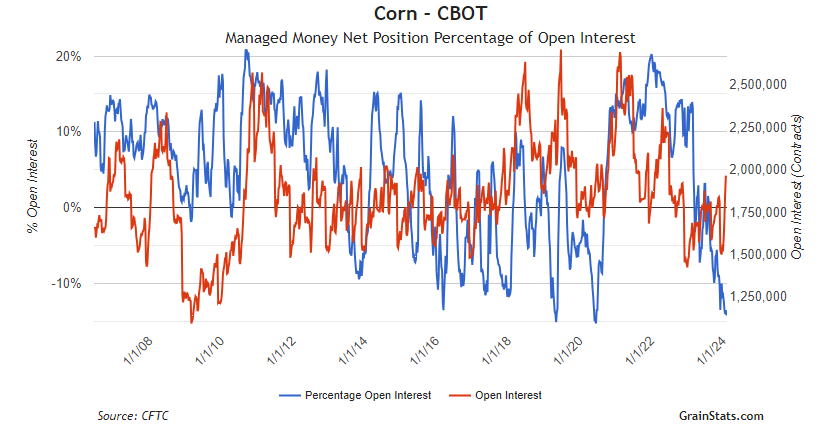

Now let's take a look at the short positions in the funds along with open interest.

Positoning for shorts by the funds is very low as a percentage of open interest. It is rare for the funds to hold such a massive position for an extended period of time.

(Meaning the difference between the red line, and the blue line. They do not stay that far apart for very long usually).

Chart Credit: Grain Stats

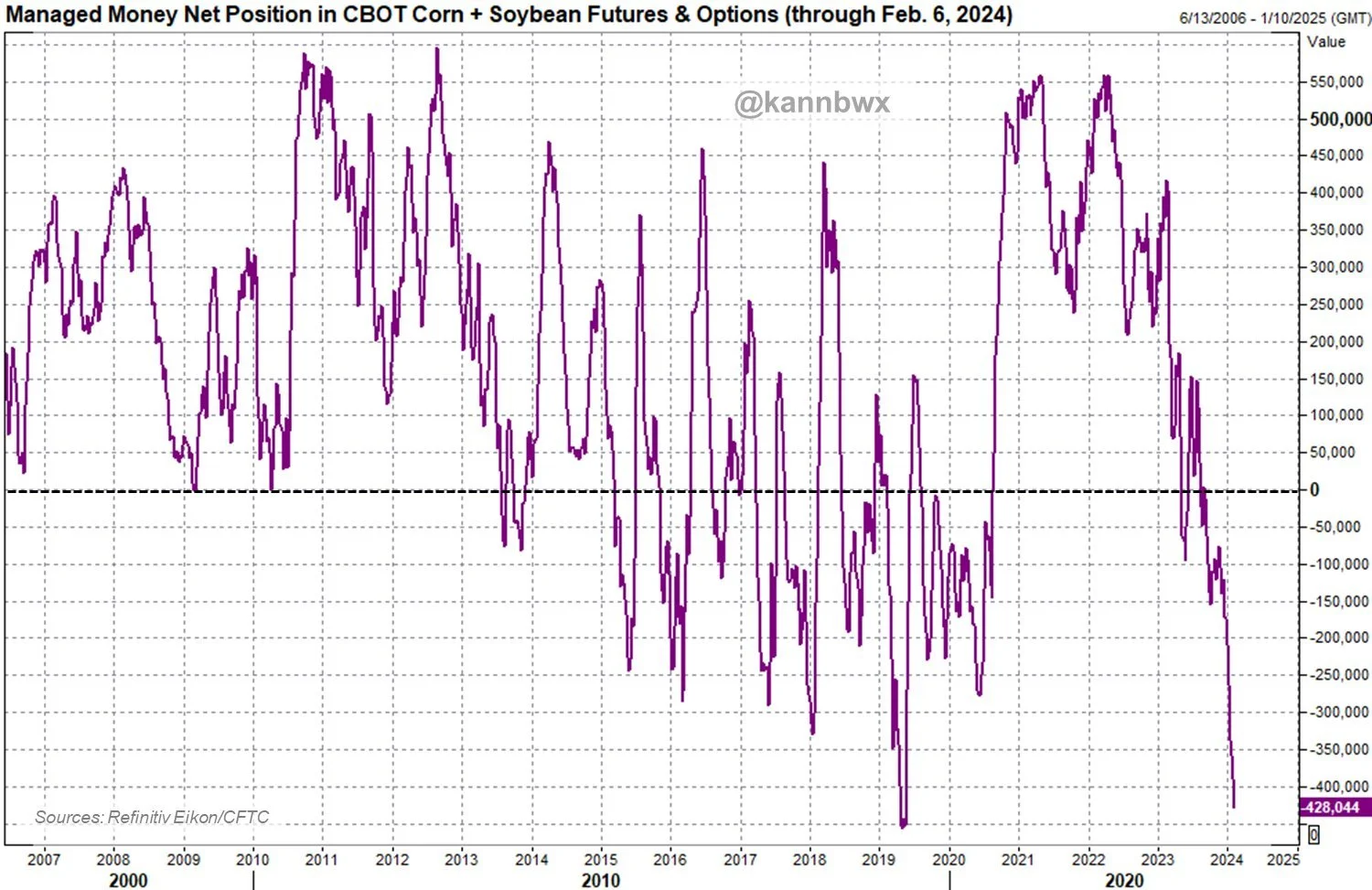

The funds are short a combined -428k corn and beans.

Very close to approaching the all time record from May of 2019..

Chart Credit: Karen Braun

Now what will it take for the funds to cover?

Well of course they could continue to pound the shorts for a while. But eventually they will have to cover.

When and how fast they decide to do so is what we don’t know.

A catalyst for them to cover could be a few things. We will need one, because without one they have no reason to cover. Here are the main ones that could cause them to do so:

South America weather scare

Planting season in US

Chinese buying

However keep in mind we do have the Ag Forum Outlook next week. This is almost always bearish and I can’t imagine they will have anything bullish to show. There could very well be talks about trend line yields, more acres, and bigger carryouts.

The funds will at least wait for that report to cover. Because they do not have a reason to cover yet, and the Outlook Forum will probably not be their reason. So they will wait for that report before doing any major short covering.

Let's jump into the rest of today's update..

Today's Main Takeaways

Corn

Corn makes another contract low closing at $4.29. For the week we are down -13 3/4 cents.

How has the recent heat and dryness in Argentina effected this crop? Some say yields have dropped -10% the past two weeks alone but……

The rest of this is subscriber-only. Please subscribe to keep reading & get every update. Comes with 1 on 1 grain marketing planning & tailored recommendations.

IN TODAYS UPDATE

What could push corn higher and where is our next stop to the downside?

How hot & dry is summer going to be for the US?

Should you be getting puts or courage calls?

Utilizing spreads in your options

Managing your risk

Will old resistance turn to new support?

Cattle recommendation

GIVE US A TRY FOR FREE

Keep reading and try our daily updates completely free. Become a price maker.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

2/8/24

CONAB VERY FRIENDLY. USDA NOT. FULL BREAKDOWN

2/7/24

NEW LOWS IN CORN & USDA PREVIEW

2/6/24

WHAT IS EXPECTED FROM USDA & WAYS TO GET COMFORTABLE

2/5/24

STILL NO CLEAR DIRECTIONS IN THE MARKETS

2/2/24

NEW BEAN LOWS.. HOW LOW CAN CORN GO?

2/1/24

NO CONFIRMATION OF HIGHER OR LOWER PRICES IN GRAINS

1/31/24

HOW SHOULD YOU BE SETTING YOUR TARGETS?

1/30/24

OUTSIDE UP DAY IN ALL THE GRAINS

1/29/24

GEO POLITICS, CHINESE, BRAZIL, ALGOS, & BIG MONEY

1/26/24

SOLD RALLIES & HISTORICAL HIGHS

1/25/24

DEVELOPING A GRAIN MARKETING PLAN WITH TECHNICALS

1/24/24

5TH GREEN DAY IN A ROW: WAYS TO OUTPERFORM THE MARKET

1/23/24

GRAINS CONTINUE TO BOUNCE

1/22/24

HAVE MARKETS FOUND A BOTTOM?

1/19/24

FAILED REVERSALS & ELECTION YEAR RALLIES?

1/18/24