BEANS LOWER DESPITE DROUGHT TALK

Overview

Poor day for the grains. Despite corn & wheat ending the day higher, all close well off their highs for the 2nd day in a row.

The big talk today is the potential "flash drought" talk for the western corn belt.

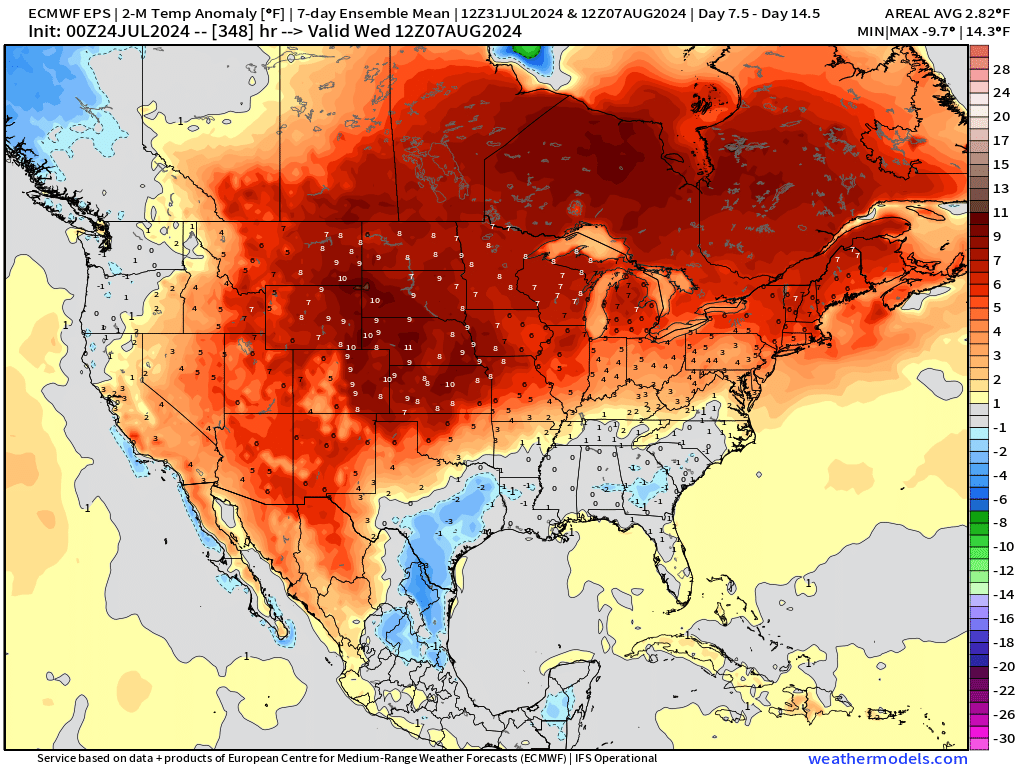

Overall the western corn belt will remain dry with very hot temps. Many areas +10 degrees hotter than normal.

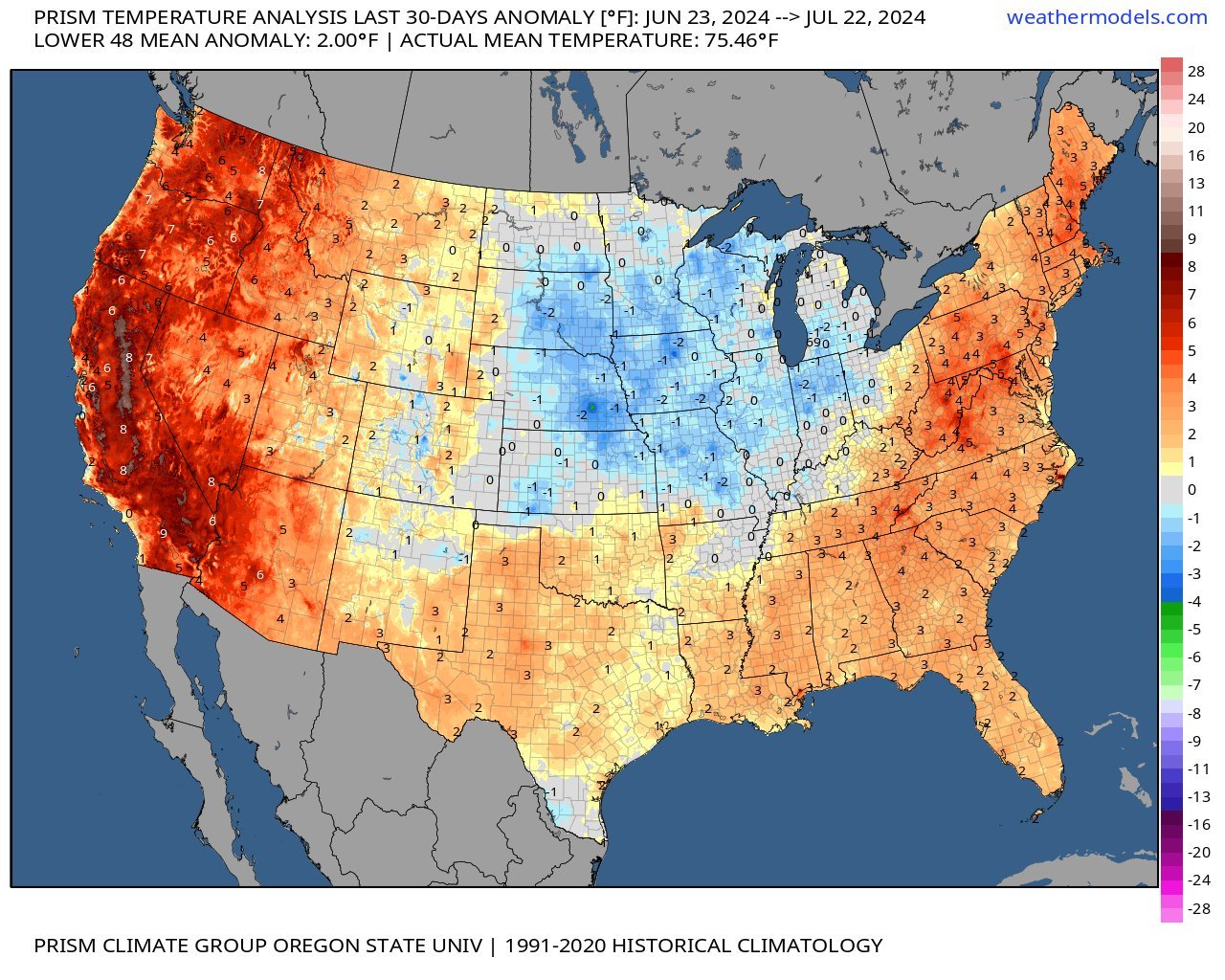

Take a look at the temp differences from the next 2 weeks vs the past 30 days. Huge heat swing.

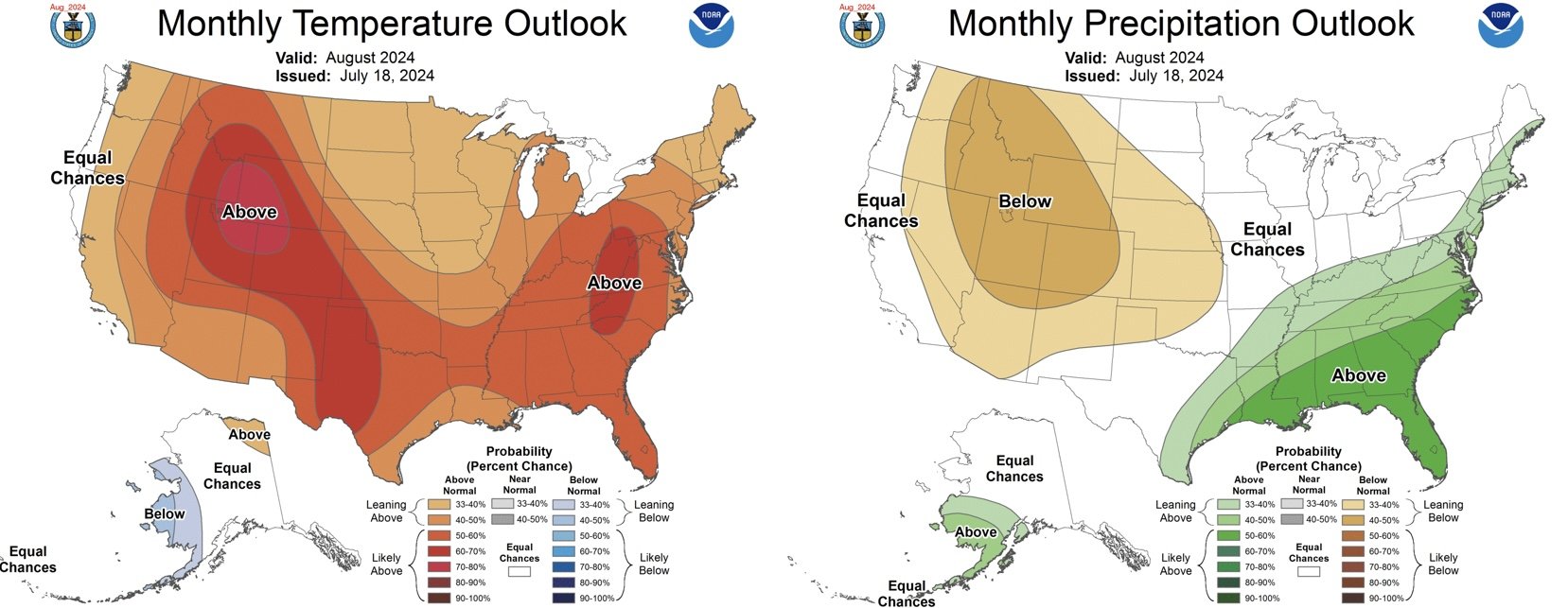

This heat is expected to continue throughout the month of August.

Next 2 Weeks

Past 30 Days

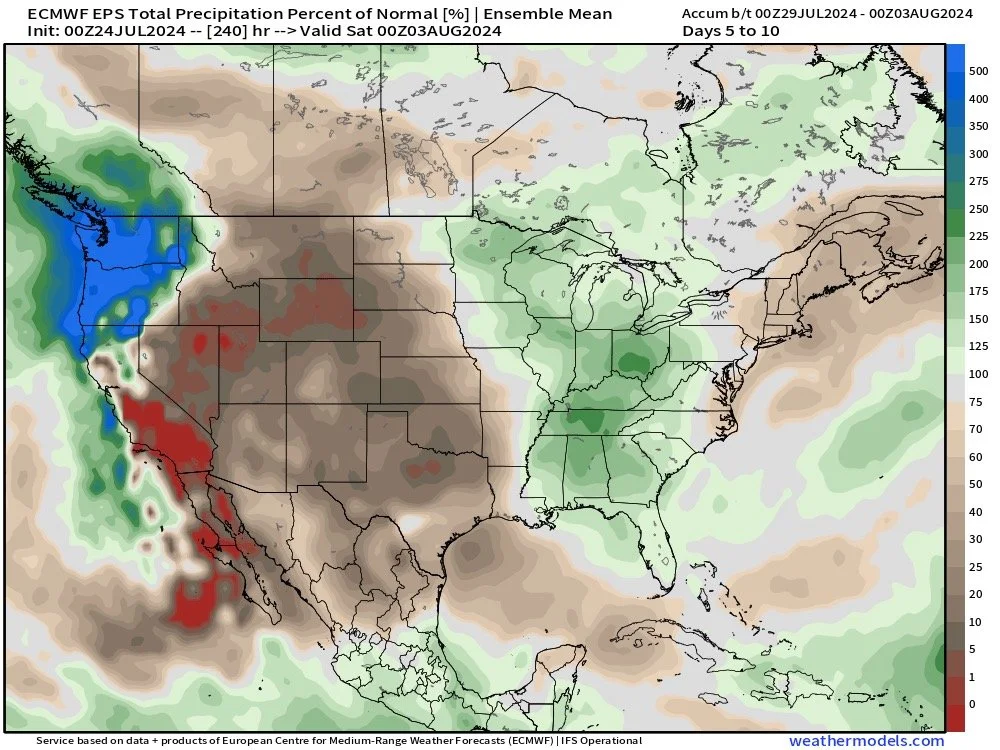

However, despite the western corn belt remaining dry. The eastern corn belt will likely get some timely rains again the next week.

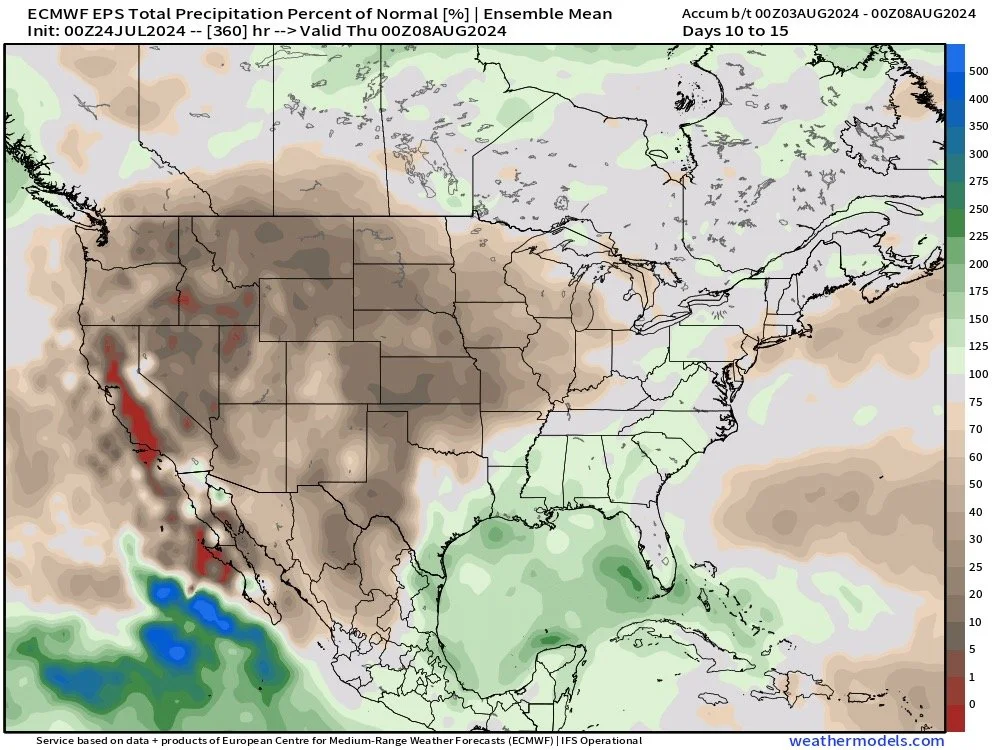

Towards the end of this 2 week period, the dryness out west could start spreading east. But for now they should be getting rain.

Here is how the rain should shake out the next week or two. East will start wet, but trend drier into August.

Days 5-10

Days 10-15

August Outlook

From BAM Weather: Key Notes to Watch

Trending hotter & drier across the western ag belt as we head into August

Timely rains, but still warmer for the eastern ag belt

Need to keep an eye on severe storm cluster risks in Midwest next week. Which could post more damaging wind threats.

End of growing season and early harvest looks hotter than normal for the ag belt overall, and could end on a drier not especially for the plains.

BAM had a great full weather breakdown this morning. If you want to watch it: Click Here

For BAM's direct weather updates: Click Here

Overall, there is some obvious concerns out west, but the rains to the east are enough for the market to "shrug off" the problems west.

As I have mentioned, the real weather market is behind us. If this happened in June rather than nearly August, it would be a completely different story.

These forecasts will not directly impact the corn market drastically.

For soybeans, dry & hot weather could still add support as beans are made in August, but it will not be this major market mover like weather in June/July is for corn. Weather in August matters to the actual outcome of the crop, but every little change in the forecast isn’t the only thing the market looks at here.

Right now the next week doesn’t look too threatening overall with the east getting rain, but if it does stay hot and dry throughout August and with the funds holding a record short, it could be a reason to see a small rally.

A lot of this heat and dryness is in spring wheat country, so it should provide some support. But some say it might be too late, as our spring wheat crop looks great. As the crop is rated 77% G/E vs the 5yr avg of 54%.

In other news, China dropped their interest rates from 1.8% to 1.7% Monday to boost their economy. Cutting rates for the first time this year. Some think this was part of the rally we have seen in corn & beans as rate cuts should result in more demand.

Today's Main Takeaways

Corn

Poor close in corn again, well off the highs for the 2nd day in a row. However, this is our 3rd day higher in a row. The first time we have seen that since May.

This potential drought scare will not have a major impact on corn itself.

Yes, if this provides a spark to soybeans, soybeans could help carry corn higher.

Until we get into harvest, the two biggest things to watch for are demand & technicals.

If we want to see higher prices we will need demand. These lower prices should be helping create more demand. We just had a flash sale of corn to China yesterday.

The USDA just added 250 million bushels of demand on our last WASDE report. So even though our production was higher, our carryout decreased. That is why demand alone can lead you higher.

At the end of the day, we will more than likely have a pretty good crop here in US despite all the problems we had. I am hesitant to say it'll be a record simply given the fact we had the wet start which alone can cause problems that do not pop up until later in the year.

The market is penicling in a 182 yield and I just don’t know if that’ll happen. If it does, we will of course struggle for a while and go lower. But I'd take the under.

Next the charts. Take a look at this hourly chart.

As you can see, we have been stuck in this 23 cent range since the June 28th USDA meltdown.

More recently, we have been stuck in a 13 cent range the past 2 weeks.

Yesterday, we finally broke out of the 13 cent range ($4.16) . A great sign, but not enough.

If we can break out of the 23 cent range (Above $4.26, our July 2nd highs) the chart would look promising. That would make me feel a lot more confident saying we have found a bottom. But until then, I am not confident we the bottom is in.

That $4.03 level is still a must hold level. We are now +15 cents off those lows, but if we were to break down below, the next implied downside target would be $3.80

$4.03 and $4.26 are the two levels to watch that decide where we are going next.

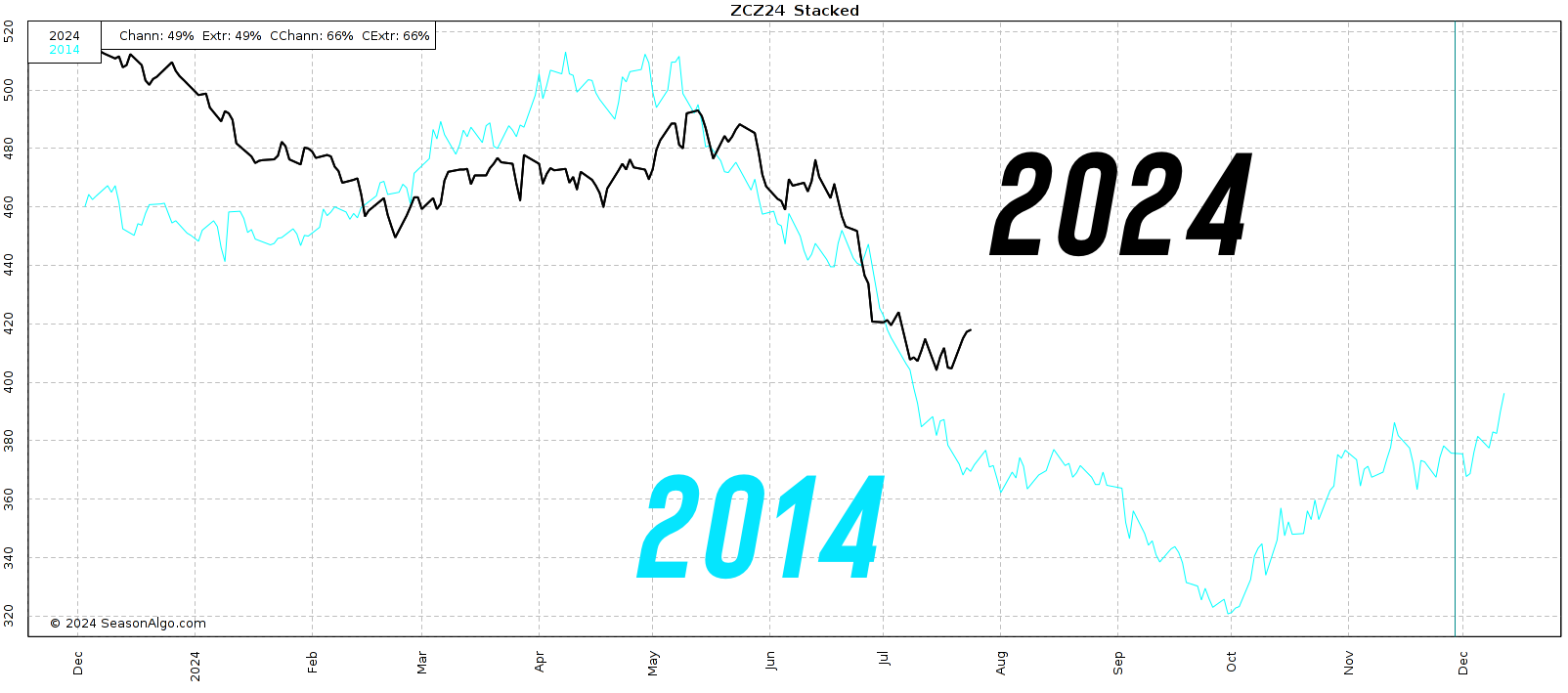

2014 vs 2024 Update

It looks like we may have finally broken the 2014 comparison. Still a little early to be certain, but good sign.

Keep in mind, the funds still hold record shorts. If the charts start moving against them, it would be one reason for them to look to start covering.

Seasonally we are suppose to go lower. But seasonally we were also suppose to get a big weather rally opportunity that we didn’t get. I still think we will see a rally led by demand. But it may take months to develop into something bigger.

If you are still sitting on some old crop, there is nothing wrong with cleaning up a few sales on this bounce. I do not like selling new crop here especially below the cost of production.

What this bounce did offer, is the chance to put your floors (puts) up a little higher for cheaper.

Rallies make puts cheaper, Giving you an even better opportunity to protect your downside risk. So if you do not have downside protection on new crop, I like adding some here. Use this little rally to your advantage.

So if you have unpriced grain, I still like protecting the downside until that $4.26 level is broken.

Dec Corn

Soybeans

Poor day for soybeans, at one point we were +15 cents off our lows but ultimately caved in and ended down double digits.

How big of an impact will…………

The rest of this is subscriber only. Subscribe to keep reading & get every update along with our signals & 1 on 1 market plans.

WHAT YOU MISSED IN TODAYS UPDATE

Is this drought a market mover?

What should you do with beans?

Using old crop bean inverse

Levels needed to confirm bottoms

Full breakdowns of beans & wheat

TRY 30 DAYS FREE

Get our daily updates, signals, & 1 on 1 plans free

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

7/23/24

BACK TO BACK GREEN DAYS FOR CORN & BEANS: MARKETING DECISIONS

7/22/24

BEST DAY FOR GRAINS IN A LONG TIME

7/19/24

DULL MARKETS: STRATEGIES TO USE IN GRAIN MARKETING

7/18/24

DEMAND, CHINA, POLITICAL PRESSURE, & TECHNICALS

7/17/24

DIFFERENT GRAIN MARKETING SCENARIOS YOU MIGHT BE IN

7/16/24

RELIEF BOUNCE FOR GRAINS

7/15/24

GRAINS HAMMERED. TRADE WAR FEAR

7/12/24

USDA REPORT: LOW PRICES CREATING DEMAND

7/11/24

USDA TOMORROW

7/10/24

GRAINS CONTINUE TO GET HAMMERED

7/9/24

RAINS, RECORD FUND SELLING & 2014 COMPS

7/8/24

PUKE SELLING, RAIN MAKES GRAIN & FUNDS RECORD SHORT

7/3/24

THIN HOLIDAY TRADE FOR GRAINS

7/2/24

BEARISH WEATHER, RECORD SHORTS, & CHINA

7/1/24

SUPPLY WILL BE THERE, BUT CAN DEMAND LEAD US HIGHER?

6/28/24

GARBAGE USDA REPORT

6/27/24

BIGGEST USDA REPORT OF YEAR TOMORROW

6/26/24

USDA PREVIEW & COUNTER SEASONAL RALLIES?

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24