GOVERNMENT CONCERNS & PREPARING FOR USDA REPORT

Overview

Grains end the up and down day mixed. At one point, all the grains were trading higher with both beans and Chicago wheat up a dime. However, we gave back most of those gains as beans still finished 5 cents higher, while corn and wheat see minor losses of 1 to 4 cents.

The biggest concern right now is the looming potential government shut down this weekend. If congress cannot come to a budget agreement, the government will be shutting down Sunday. This also means the USDA reports and data collections will also stop. Which means if the government shuts down we will not be getting our October WASDE report. This is certainly something to aware of. Markets do not like uncertainty. So we need to see a budget deal to prevent this, if they come to an agreement it will make it a lot easier for the grains to rally and put in harvest lows.

The dollar also put in a new contract high as it trades higher for the 10th week in a row, trading at it's highest levels since last year. This is making our exports even harder.

Friday is likely going to be an event filled day. Not only do we have the USDA report, but it is also the end of the week, the end of the month, and end of the 3rd quarter. With Monday being the start of the 4th quarter.

So with all of this doom and gloom in the outside markets, don’t be surprised if some of this concern leaks over into the grains. This could cause a lot of choppy trade the rest of the week. I’m not expecting much to happen until Friday's report.

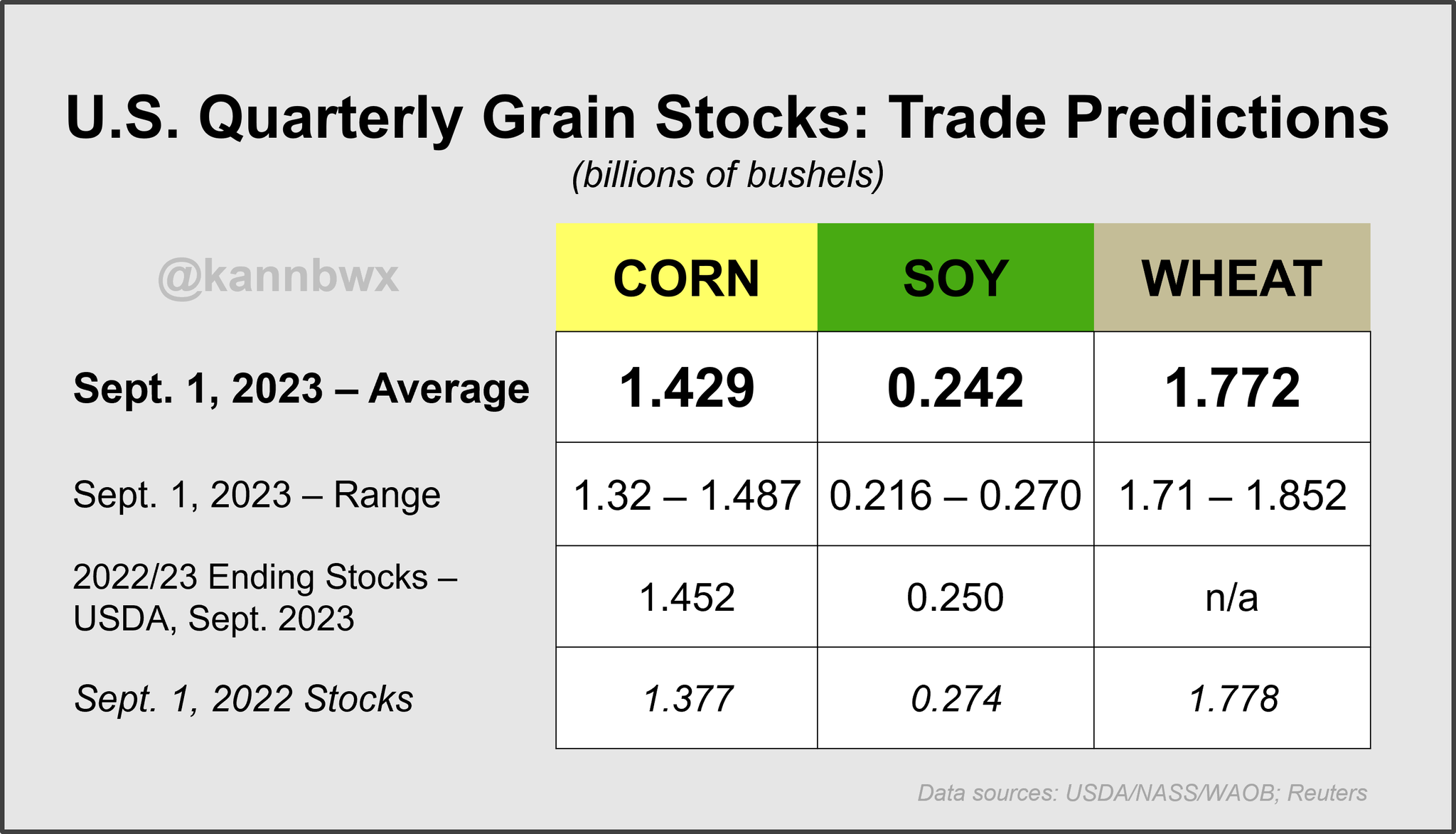

For Friday's report, the trade is looking for some slightly lower stocks. However, corn would be a 3 year high, but beans would be a 7 year lows. Wheat is looking for 16 year lows but almost identical to that of the past 2 years.

Chart Credit: Karen Braun

The funds still remain heavily short corn and wheat. So if the report is friendly corn or wheat, the funds could have some problems and be forced to cover those shorts.

In yesterday's crop progress and conditions report, we saw harvest moving along faster than normal. But slightly slower than the trade was expecting. We also saw corn conditions improve by 2% while soybeans deteriorated by 2%.

Overall, I'm expecting some…..

The rest of this is subscriber-only. Please subscribe to continue reading and to receive every one of our daily updates via text and email. Scroll to check out past updates you would have received.

HARVEST SALE SPECIAL

For a limited time lock in our stuff for a huge discount.

OFFER: $299/YR $800/YR

Become a Price Maker. Not a Price Taker.

NOT SURE? TRY 30 DAYS FREE

Check Out Past Updates

9/25/23

HAVING A PLAN OF ATTACK

9/22/23

WEEKLY WRAP

9/21/23

HARVEST BASIS THOUGHTS

9/20/23

BUYING OPPORTUNITIES

9/19/23

CAN WE FIND DEMAND?

9/18/23

HARVEST PRESSURE

9/15/23

BECOMING COMFORTABLE IN THE MARKETS

9/14/23

YIELDS, DROUGHT, & CHINESE APPETITE

9/13/23