OPTIMISTIC PRICE ACTION IN GRAINS

MARKET UPDATE

Since your trial ended.. you usually do NOT share full updates or signals on social media.

Want future updates, signals & 1 on 1 market plans?

TRY 30 DAYS FREE: CLICK HERE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Futures Prices Close

Overview

Amazing closes in the grains.

Off their lows today:

Corn: +7 3/4

Beans: +20 1/2

Wheat: +13 1/4

Corn tested the $4.00 heavy psychological support level for the 3rd straight day in a row.

Today corn posted a bullish key reversal. (bullish indicator).

We took out yesterdays lows, then closed above yesterdays highs. In a downtrend after posting new lows.

One day isn’t a trend, but today's price action definitely gives bulls some hope.

I will go over all of the charts later in the update, but here is corn.

We bounced right where we needed to.

Why did we rally so hard off the lows today?

More than anything, I think it was simply technical driven. All the grains were approaching support after this brutal sell off.

Up until today, the markets had continued to be pressured by a speedy harvest that is going to show record numbers.

Then we have the funds, we were record short at one point earlier this year, have now covered essentially their entire short. Now taking a more balanced approach but recently selling into that technical weakness.

When the funds stopped covering their shorts, there was no buying to offset the harvest pressure selling.

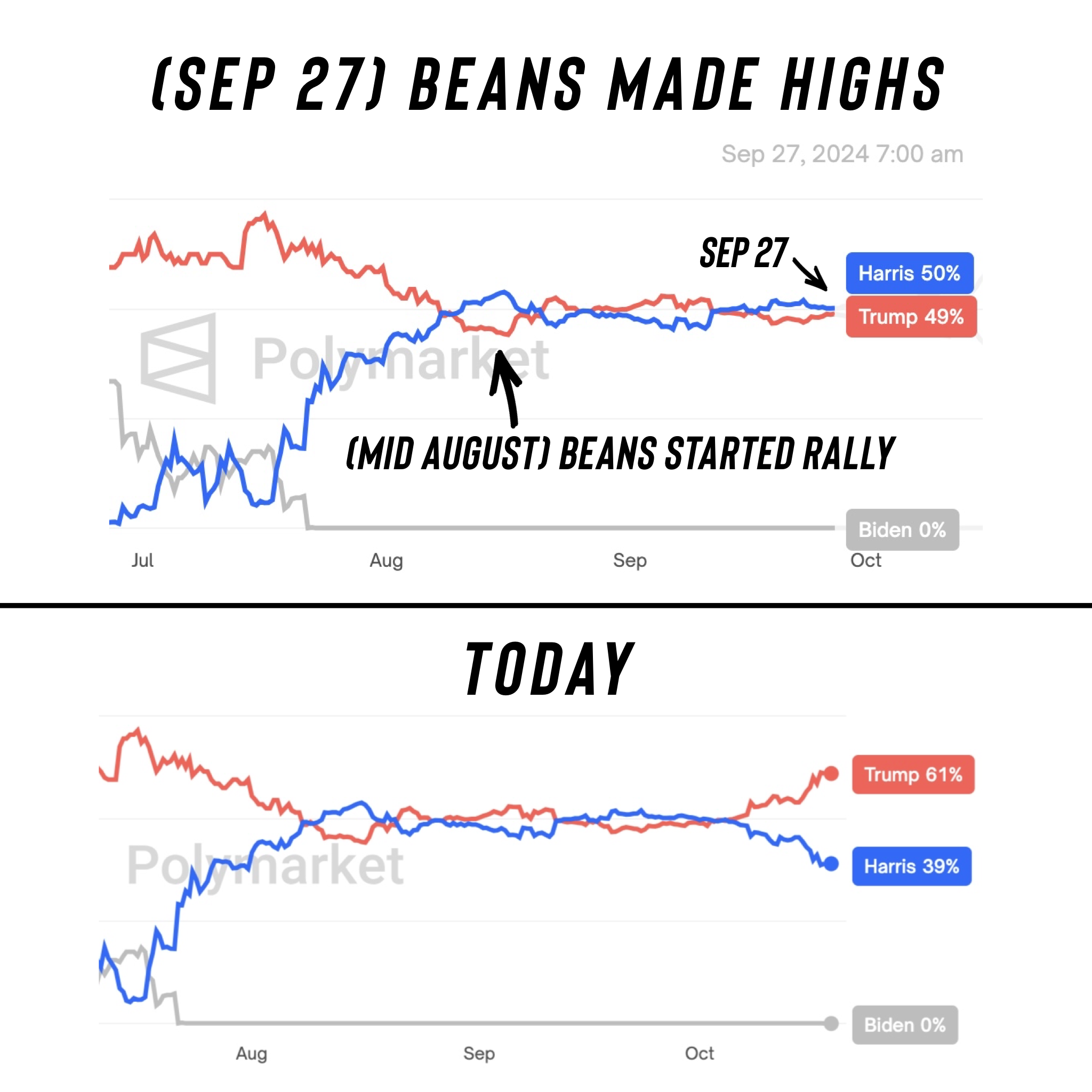

Some say think that the recent betting polls favoring Trump has pressured beans.

With the thought process being that he is going to raise tariffs on China. Which would lead to less business for the US, and have China rely more heavily on Brazil instead.

Coincidence?

If you take a look at the polls, beans did start falling right when Trump started pulling away. They also began their initial mid-August rally right when Harris took the lead.

In my opinion, Trump leading polls had very little to do with this sell off.

Perhaps it slightly made a difference, but the trade is more concerned about the global balance situation for beans projected to be the most bearish all-time with 160+ MMT crop coming from Brazil in a few months.

We also have the fact that Harris is also considering a tariff approach on China to go against their unfair trade practices.

Brazil is getting rain which is going to allow that bean planting to catch up fast. So no threat to the Brazil bean crop. But if a good majority of the beans are not planted by the end of October, that 2nd corn crop in Brazil could be negatively impacted. As it'll push those into a bad growing window. But no concern just yet.

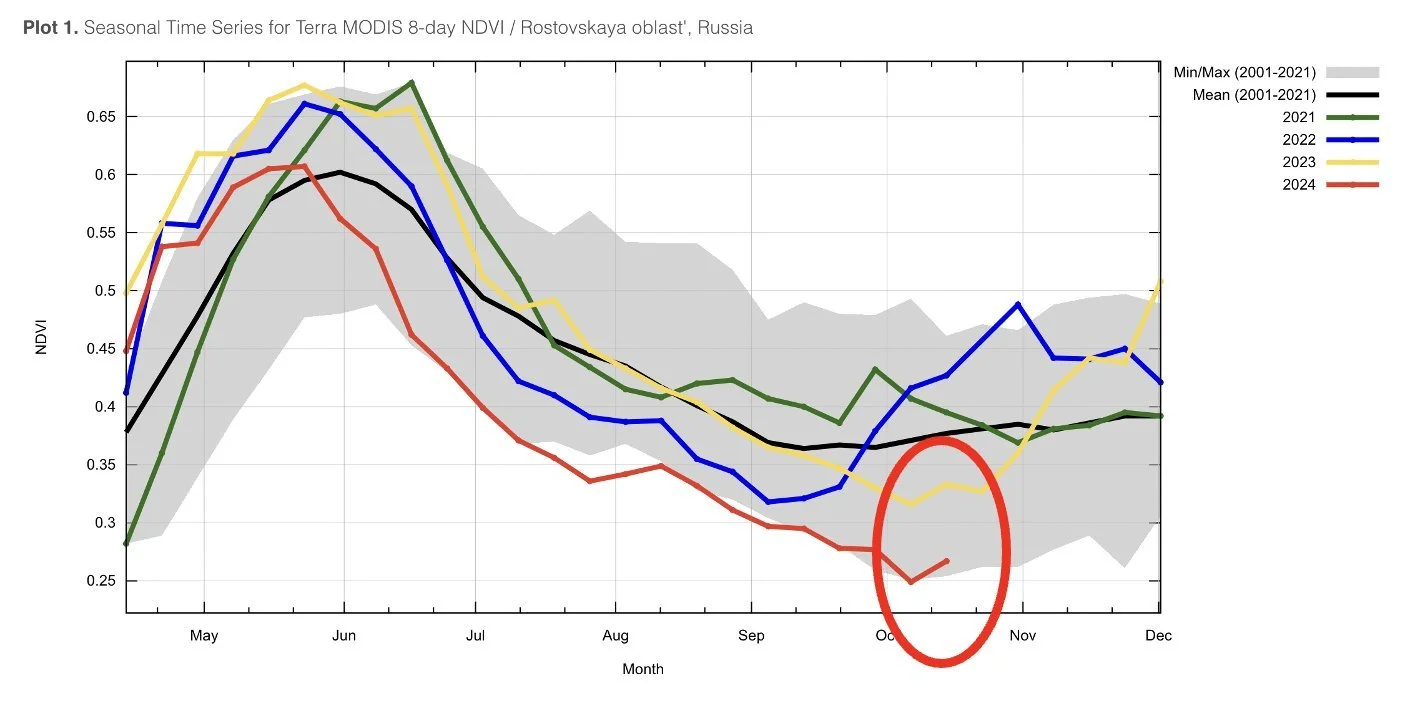

Wheat has a decent potential story going for it. As the global balance sheet is fairly bullish. We have a drought in the US. Russia, EU, & Australia are all facing issues of their own. However, rain in Russia is expected. So that could bring a little pressure and ease the concerns over there.

Now let's jump into the good stuff....

Today's Main Takeaways

Corn

As mentioned, great action in corn today. It gives bulls a little hope here.

The other big thing out there was the exports we have saw recently.

We saw nearly 2 MMT of corn sales announced yesterday, and another 300k MT today.

(Most of this went to Mexico. The other portion went to unknown. Some do not think unknown was China, solely based on the thinking that corn might’ve popped a little more if China was buying heavy)

Subscribe to @GrainStats on X

But what these sales do mean is that the big buyers see value here. So they are taking advantage of these prices. Perhaps they do not expect prices to move much lower. If end users see a value here it could definitely provide us a floor.

If you are looking for a reason to have hope, corn demand has got to be the #1 thing you are looking at.

As I have mentioned in the past, corn demand is great. We could very easily see a 1.80 billion bushel carryout this year. No, that is not a bullish number.

But not long ago many were afraid we would see a 2.5 billion bushel carryout.

If carryout falls to 1.80 it also means that despite yield jumping +7 bushels from last year's record crop, our carryout could still be lower than last year's 1.81 billion.

Now that would be fairly bullish in my opinion, and a reason to believe demand can lead us higher.

Now despite corn having a really real demand story behind it looking longer term, the biggest concern has to be soybeans. Will soybeans weigh down corn?

Corn fundamentals are bullish. Bean fundamentals are bearish. With the global balance sheet looking awful for beans.

Either way, I think corn has a story moving forward that could carry us higher.

Interest & storage costs are expensive. So how should you play the market? There are a few ways.

One would be to simply sell the corn off the combine, then buy a longer dated call. Yes basis is awful. But the cost of a call is cheaper than the cost of storage.

Another option you have if you are storing your corn is to hedge some of by selling calls. Selling calls is one way to offset those storage costs.

If you are going to be forced to move corn off the combine, it probably makes the most sense to lock in a floor with a put until you make a cash sale.

Looking at the chart once again. Like I said, friendly day. But we can’t get too excited until we break above $4.13. Still need to hold $4.00. As there is very little support below.

*Our $4.23-26 protection signal: (CLICK HERE TO VIEW)

Soybeans

We also had a phenomenal day in soybeans. We rallied back well off our lows after posting a new low for the move.

In all honestly, it is hard to paint a bullish story for beans.

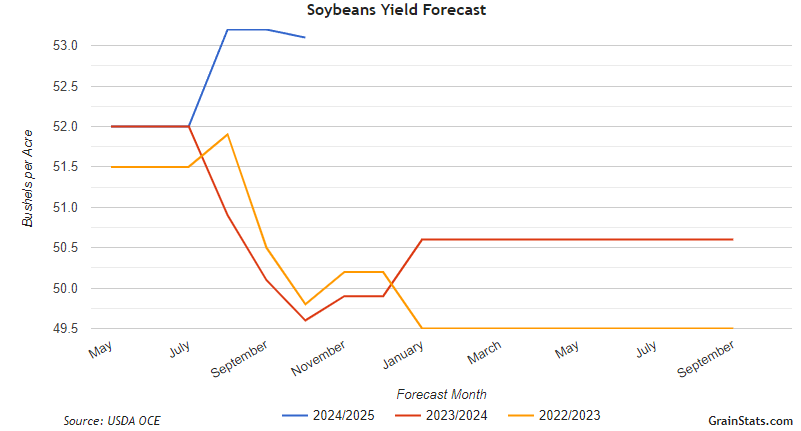

Well what if yield comes down?

Here are some good thoughts from GrainStats (GrainStats.com) when asked if a continued yield reduction in the US will play much of a roll:

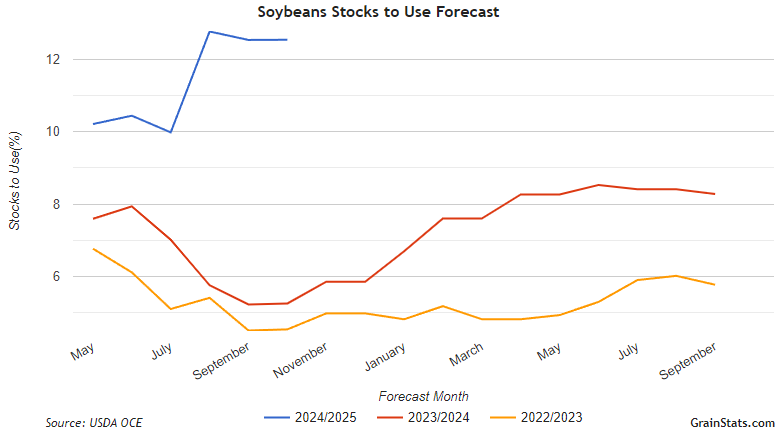

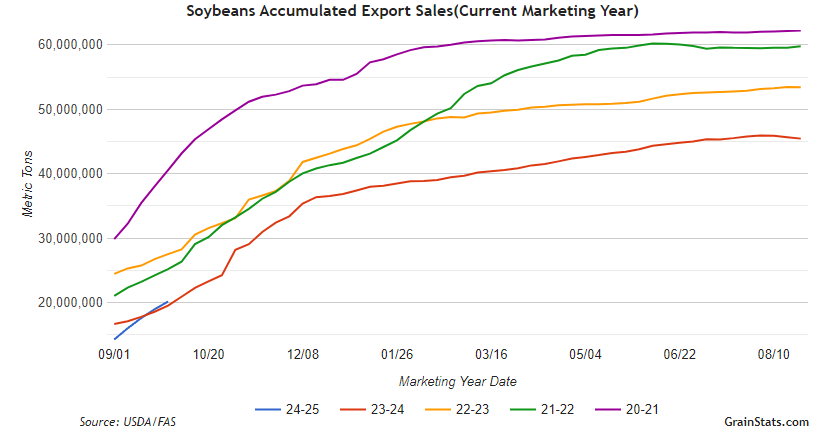

Charts from GrainStats

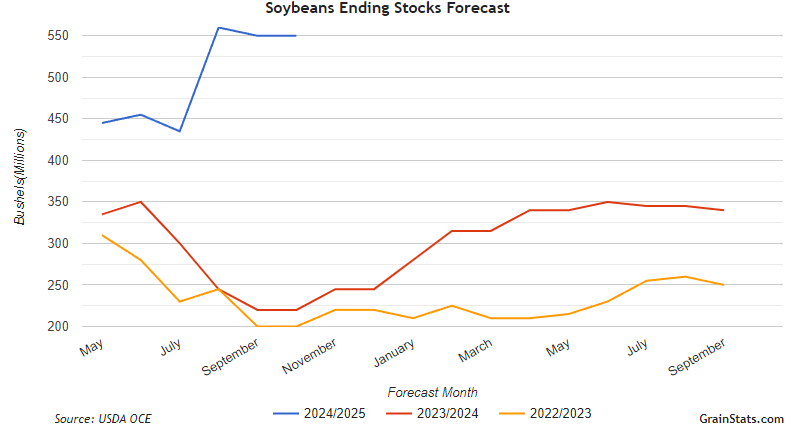

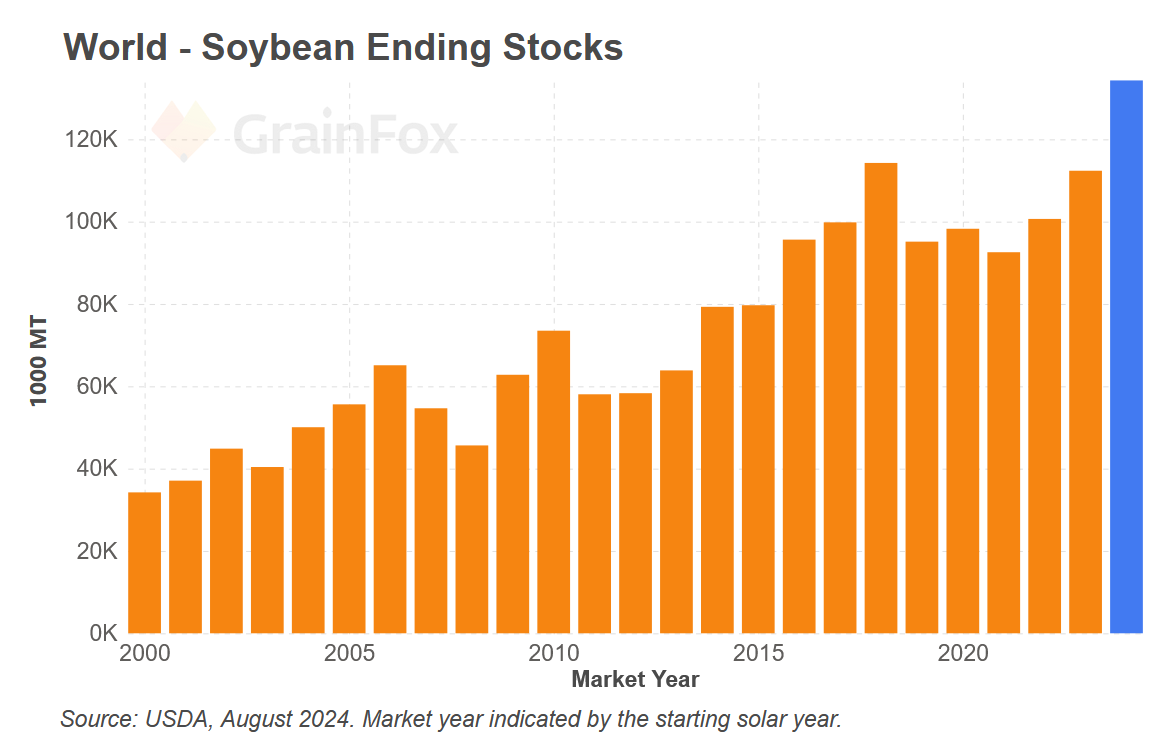

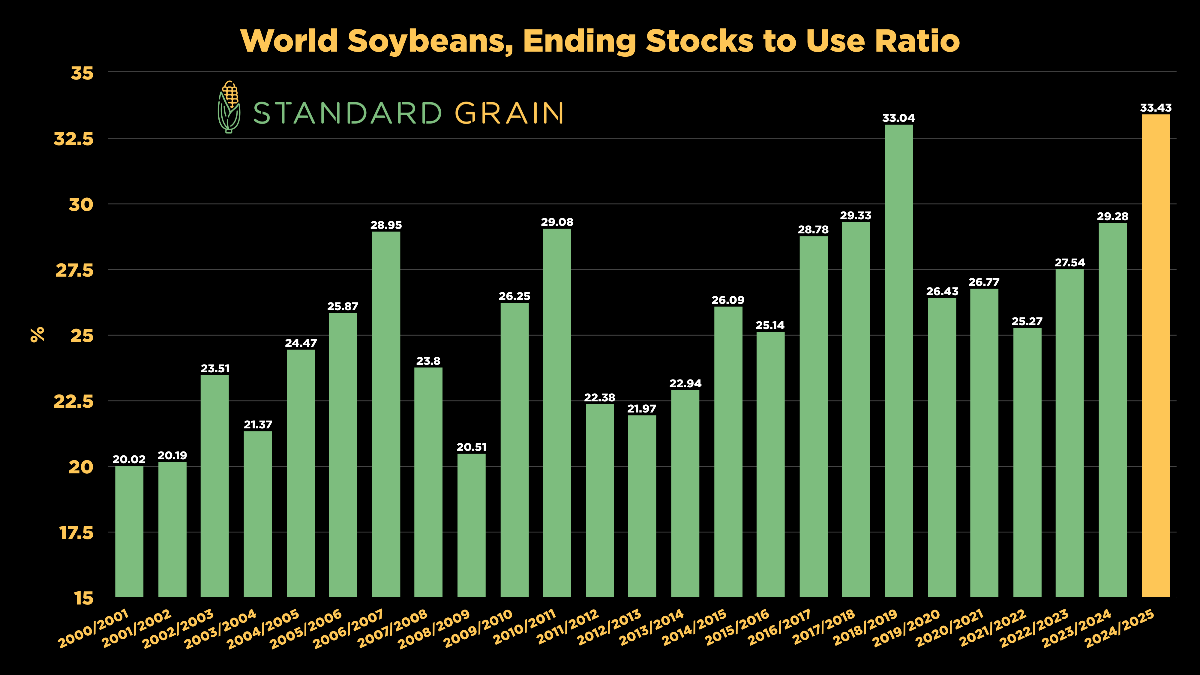

So altough yes, it will help a little. The global outlook is simply too bearish given the monster crop expected from Brazil.

I added this in a recent update, but here is a refresher of the global balance sheet.

A Brazil production scare would be the #1 potential thing that could save the bean market.

You cannot count this out, but you can also not count on it.

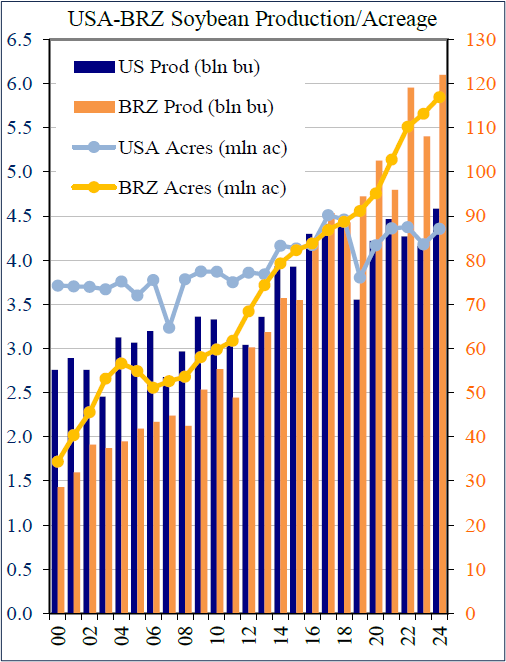

Here is a chart from StoneX that shows the historical acres & production for both Brazil and the US.

As you can see, Brazil bean acres are expected to increase for a whopping 18th year in a row (orange line).

This is why Brazil's production is so important. They are the #1 player in the world for beans. Unlike corn who's #1 player is the US, and wheat's whos #1 is Russia.

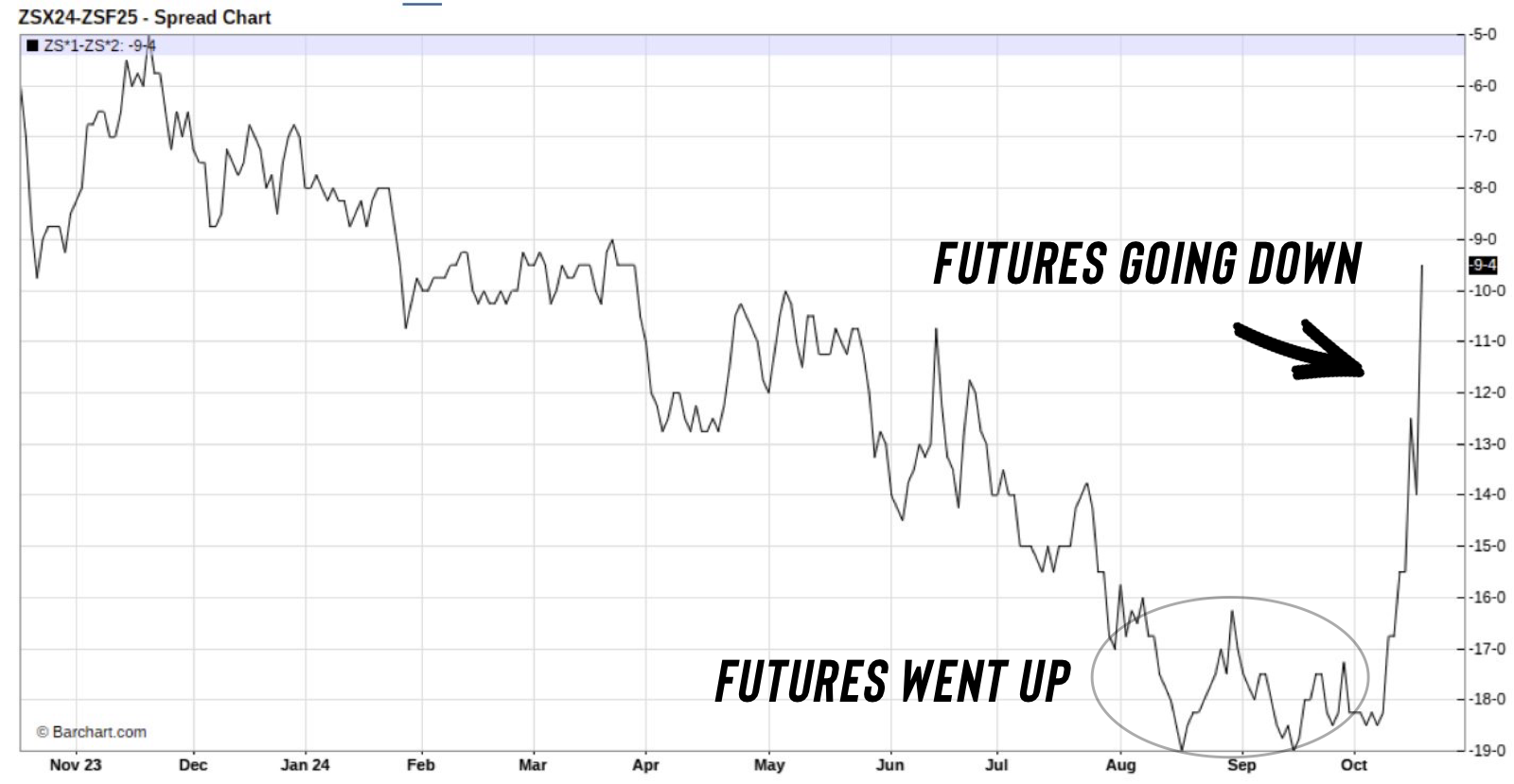

Spreads

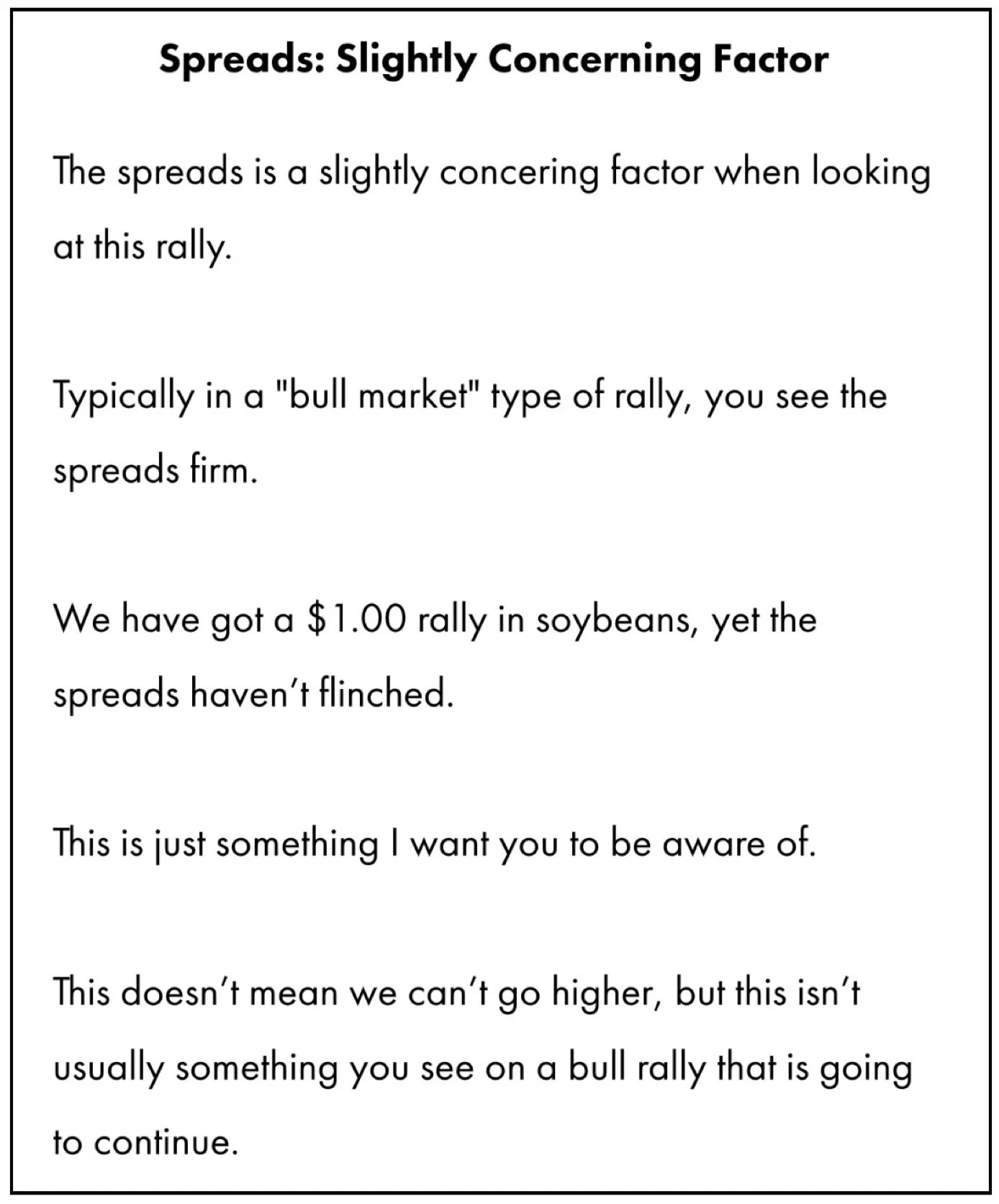

The spread action has not added up on this sell off.

On the recent rally, spreads were getting bigger. Which made me hesitant the rally would last. (I went over this in Oct 3rd's Update)

From Oct 3rd Update

Same thing kind of applies here, but opposite.

Look at the spreads. They have firming up while prices have been falling.

Ususally in a downward market, the later dated contracts gain on the nearby contracts. But that hasn’t been the case.

Today's price action for example:

Nov24-Jan25 Spread

Spread action is by no means a perfect indicator. But it means there is more buyers that want the product now rather than later.

Are we out of soybeans? Of course not. But maybe the end user is.

So this is a potential friendly sign here.

Todays price action was great and gives bulls some hope that we have possibly put in a short term bottom. So let's see if we can get some follow through to help make decisions moving forward.

But long term we still have some issues to face. Global production being number one.

For the bean market to gain some real steam we need a flop in Brazil, China to pump more stimulus money into the market, or China to buy a buttload of beans.

Until then, the outlook remains bearish and your risk remains lower.

*Our $10.65 signal: (CLICK HERE TO VIEW)

Wheat

Solid action the past two days for the wheat market.

There has not been a lot of news surrounding the wheat market, so I am going to keep today's update briefer.

Wheat definitely has a potential story going for it longer term.

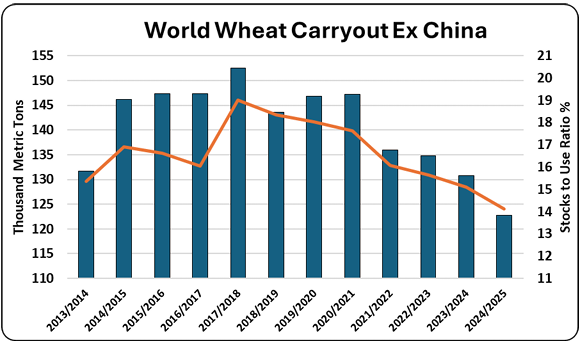

I mean just take a look at the global wheat carryout excluding China.

They are the lowest in over a decade and continue to fall year after year.

The biggest direct market mover is going to be Russia.

Russia has been facing drought. But now they are expected to get some rain.

Here is what Black Sea Guru Andrey Sizov said:

"The Russian South has received some rain, but it's likely too little, too late to fully reverse the worst crop conditions seen in many years."

Russia Seasonal Rain

We saw yet another Russia region declare a state of emergency for their wheat areas to help compensate farmers amid the drought that killed winter grain crops. This time the 7th largest growing region in Russia, Kursk.

So we have plenty of issues globally with a friendly world balance sheet. We have drought conditions in the US. Just feels like there could be a story down the road.

But I am not sure when all of these factors will take play, hence our recent sell signals in wheat we alerted over the course of the past month. Just because I think we can go higher, doesn’t mean it has to happen in a timely manner.

Personally, I am remaining patient.

Looking at the chart, we are bouncing right where we needed to at the bottom this channel and that heavy $5.80 support. So the chart also looks solid. The most friendly looking chart of all the grains.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24

BULLISH USDA FOR CORN: RECOMMENDATION

9/27/24

UP-TOBER? SELL SIGNAL, TARGETS, & FACTORS

9/27/24

BEAN SELL SIGNAL

9/26/24

NEW HIGHS BUT CONCERNING CLOSE

9/25/24

HIGHEST CLOSES SINCE JULY. UPSIDE & SALES CONSIDERATION

9/24/24

GREAT START TO THE DAY, AWFUL FINISH

9/23/24

MASSIVE DAY FOR THE GRAINS

9/22/24

EARLY YIELD TALK, DROUGHT, BRAZIL, SEASONAL LOWS & MORE

9/19/24

GRAINS SEE TECHNICAL SELLING

9/18/24

FED DROPS RATES, BRAZIL STORY, 2025 SALES?

9/17/24

TARGETS & WHAT TO DO IF YOU BOUGHT PROTECTION

9/16/24

WAS TODAY HEALTHY CORRECTION BEFORE GRAIN RALLY RESUMES?

9/13/24

CORN & WHEAT BREAK OUT: EVERYTHING YOU NEED TO KNOW

9/12/24