SOLD RALLIES & HISTORICAL HIGHS

Overview

Markets disappoint following our mini rally. As wheat gives up half of it's recent gains and soybeans continue their weakness from yesterday.

Despite the weakness, all of the grains have held their recent lows and are only slightly lower or even higher on the week. Here was the changes:

March Corn: +3/4 cents

March Beans: -4 cents

March Wheat: +7 cents

The grains are mostly lower due to weaker demand, some rains thrown in the forecast for Argentina.

South America weather is going to remain the hot topic of the grains for a little while with the wide range of estimates being thrown out for both crops.

The weather looks somewhat cooperative, but Argnetina is still seeing some brutal heat and dryness which is suppose to continue for the next week. However they are suppose to see more rains in the 10 to 15 day window.

If they get rain in the next week or so, there won’t be much damage and the talk is that the subsoil moisture levels can handle this heat and dry spell as long as it does not extend much farther than next week or two. If they do not get rain, keep in mind this is Argentina's July. They are in a very key pollination time. So we will have to see how it shakes out and how much rain they get or don’t get.

Buenos Aires Grain Exchange rated the Argentina soybean and corn crop conditions down slightly from last week, but far better than last year's disaster of course.

Beans:

44% G/E vs 55% last week vs 7% last year

8% poor/very poor vs 2% last week vs 53% last year

Corn

41% G/E vs 46% last week vs 12% last year

6% poor/very poor vs 3% last week vs 38% last year

Another thing that is pressuring the bean market is the continuation of weaker basis on Brazil. Some say that perhaps this is an indication of a large crop. Nobody knows yet, but this could also just simply be harvest pressure. Seeing basis drop at harvest is nothing unusual.

Wheat saw additional pressure from China approving imports of wheat from Argentina. Creating more global competition for business from China.

Being in the top 5% of the market

We mentioned this recently in one of our audio updates. A guy asked why do you seem to always be bullish?

There is 252 trading days a year.

If you wanted to be in the top 5% of the market, do you know how many days you had to do so?

Corn in 2023: 15 days

Corn in 2022: 5 days

Beans in 2023: 4 days

Beans in 2024: 1 day

So to be in the top 5% of the market, prices are going higher 95% of the time eventually. After we have made our highs, you can lock in puts to make money on the way down and might actually outperform the market.

Now let's dive into today's update..

Today's Main Takeaways

Corn

Corn gives up a portion of it's recent mini bounce. Closing red for the first time in a week and a half.

We mainly traded lower because of Argentina seeing rains in the forecasts, as well as the current Brazil outlook appearing more favorable, which helps the second corn crop.

As mentioned, it's July in Argentina, so we will have to see what unfolds.

When should you typically be selling corn? Usually spring and summer time. Because we will typically get a weather scare rally when supply is at it's lowest vs during harvest time when we have the most supply.

So when is historically the best month to sell corn?

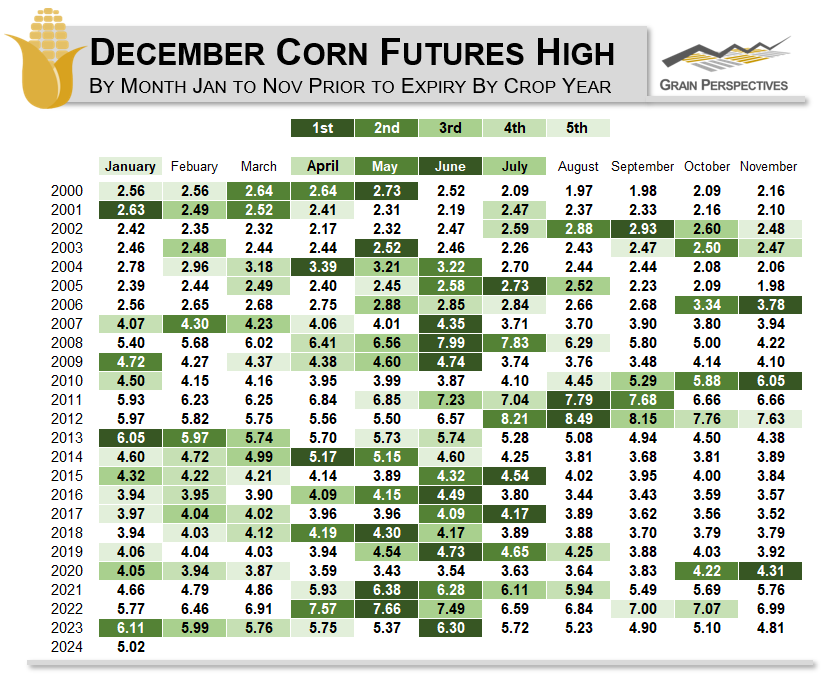

If we take a look at this chart from Matthew Pot of Grain Perspectives, they outline what months December futures have made their highs each year.

Here is a breakdown of how many times we have made our highs in each month since 2000.

January: 2 (2001, 2013)

February: 0

March: 0

April: 2 (2004, 2014)

May: 4 (2000, 2003, 2018, 2021)

June: 6 (2007, 2008, 2009, 2016, 2019, 2023)

July: 3 (2005, 2015, 2017)

August: 2 (2011, 2012)

September: 1 (2002)

October: 0

November: 3 (2006, 2010, 2020)

As you can see from this data, there have only been 2 years where the December contract did not make it's high after January.

June led with 6 of the 23 years.

If you add up April, May, June, and July (spring & summer time) it's 15 of the 23 years.

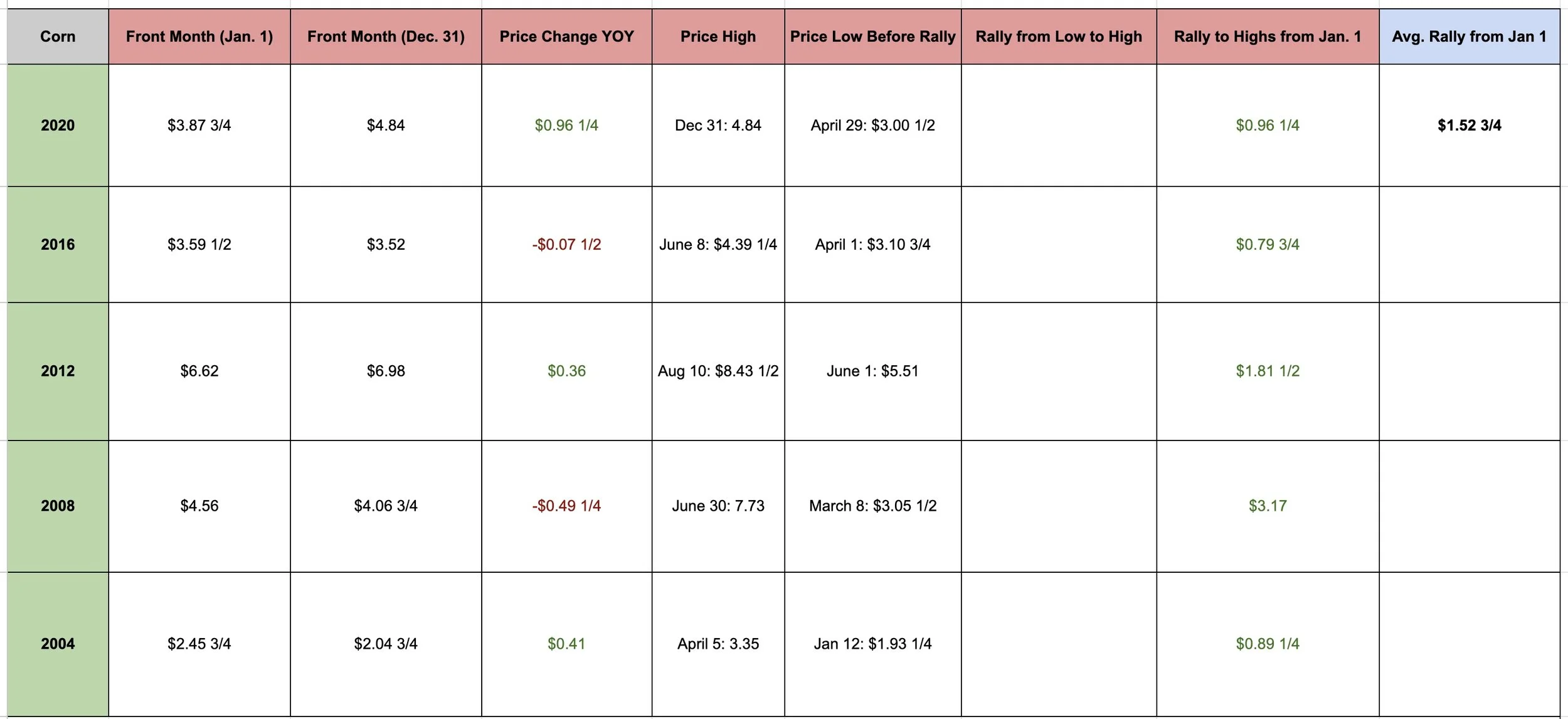

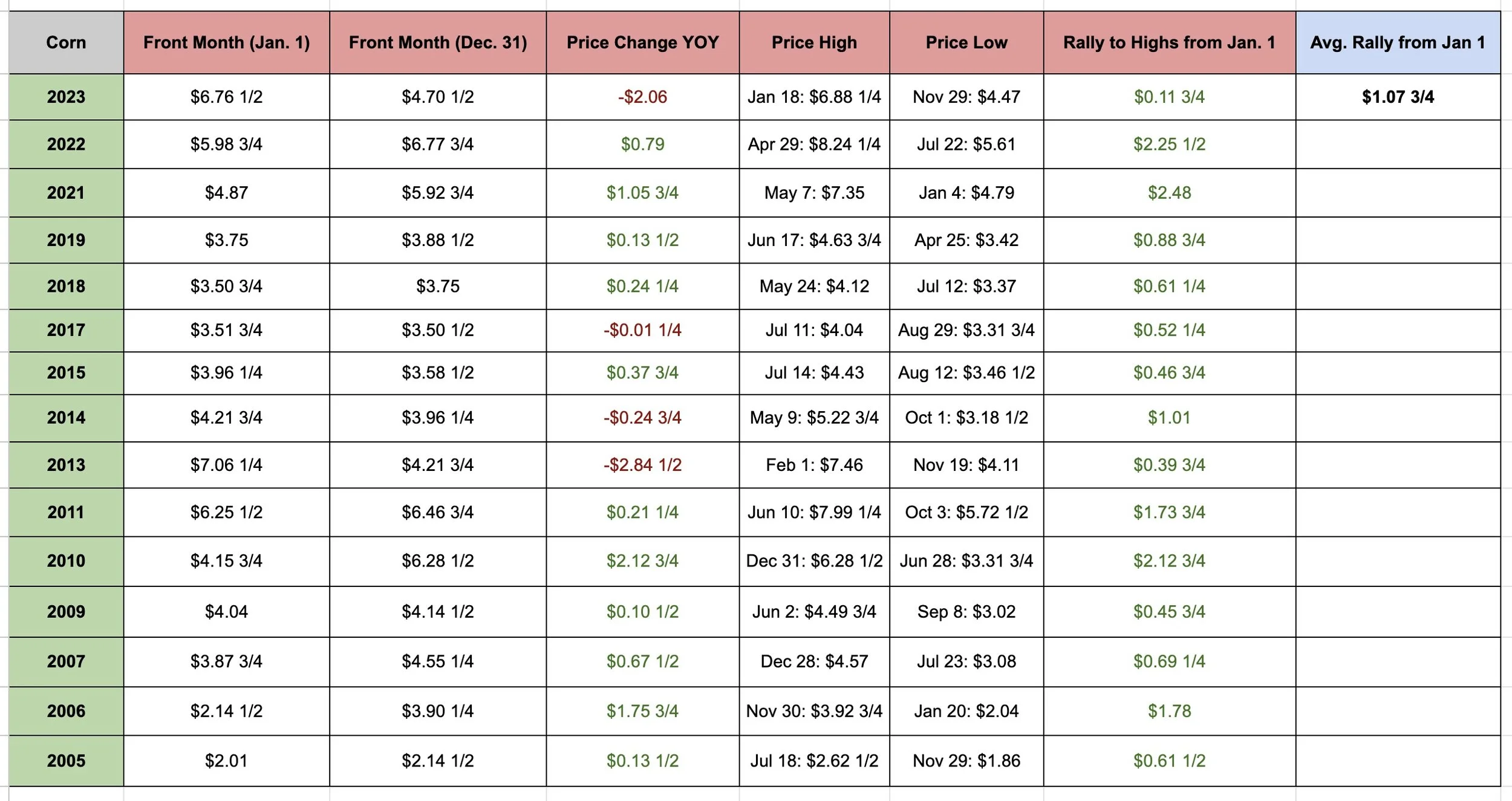

Now remember these next two charts? I shared them over the course of the past week. This chart shows the front month highs. So for example, right now our front month is March corn.

Only 1 time did we have the front month make it's highs in January. Which was last year, even though December corn made it's highs in June.

Election & Non-Election Year Data

My point is that there is a good chance prices will be higher towards spring and summer. We "almost" always get a seasonal rally. Typically the size of this seasonal rally comes down to South America production and if we get a weather scare for our crops here in the US.

I still believe that Brazil's second crop corn could very well be a lot smaller simply due to the late planting of beans potentially leading to less acres and pushing the crop into a non favorable time frame. But of course I could be completely wrong.

My biggest concern with the corn market that is a real possibility is……..

The rest of this is subscriber-only. Please subscribe to keep reading & get every exclusive update as well as 24/7 tailored recommendations and marketing plans.

In this rest of today’s update we will be talking about:

Concerns with the corn market

Who should be using puts vs calls vs nothing

History of soybean rallies and highs

Will we go below $12 or see a head fake?

Negative key reversal in wheat

Which crop will the funds cover first

Risk management & more

Cattle overview

MPLS spot floor

KEEP READING FOR FREE

Try all of our daily updates & recommendations completely free for 30 days.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

1/25/24

DEVELOPING A GRAIN MARKETING PLAN WITH TECHNICALS

1/24/24

5TH GREEN DAY IN A ROW: WAYS TO OUTPERFORM THE MARKET

1/23/24

GRAINS CONTINUE TO BOUNCE

1/22/24

HAVE MARKETS FOUND A BOTTOM?

1/19/24

FAILED REVERSALS & ELECTION YEAR RALLIES?

1/18/24

UTILIZING TRENDS & TECHNICALS IN YOUR GRAIN MARKETING PLANS

Read More

1/17/24

FUNDS & CHINA

1/16/24

BEANS TRY TO BOUNCE FOLLOWING BEARISH USDA

1/12/24

FULL USDA REPORT BREAKDOWN

1/11/24

USDA REPORT TOMORROW. ARE YOU PREPARED?

1/10/24

PREPARING FOR THE USDA

1/9/24

TURNAROUND TUESDAY & USDA PREVIEW

1/8/24

HOW TO GET COMFORTABLE AHEAD OF USDA REPORT

1/5/24

FIRST WEEK OF NEW YEAR FLOPS

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23