AFTERNOON MARKET UPDATE

Futures Prices Close

Overview

Risk off day today for the grains, as its red across the board, with grains, stocks, and equities all sharply lower. The U.S. dollar surges again, hitting new highs after just recently doing so. S&P 500 is down over 2%, Dow Jones down 2%, and crude oil down nearly 6%, breaking below $80. Lowest price we've seen from crude since February.

Today's Main Takeaways

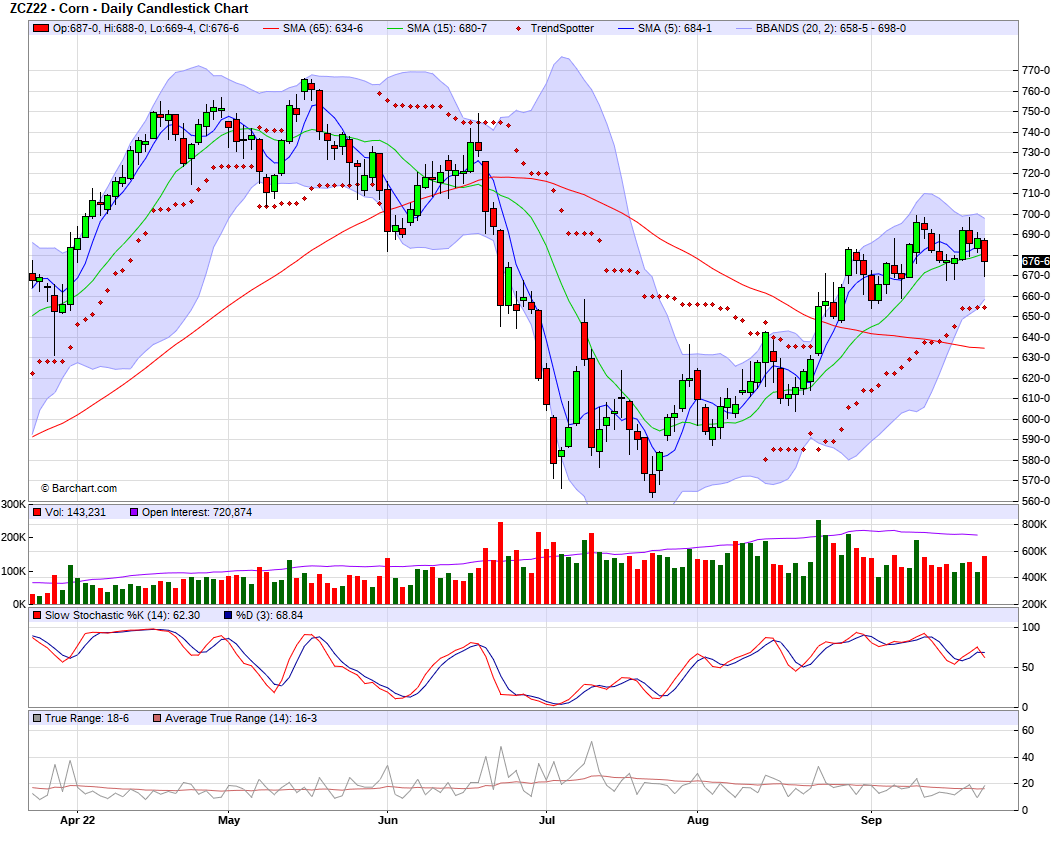

Corn

Corn down -11 1/2 cents this afternoon, holding up the best of the grains, and soybeans and wheat closed significantly lower than corn did. Grains being pressured by the outside markets, and nearly every thing is sharply lower today. Crude oil being down -$5 for the majority of the day isn't helping prices.

On one hand, we have uncertainty with Putin and the Black Sea adding support. As well as Argentinas planting running slightly behind. Many believe we will still need to see the USDA lower its yield.

On the other hand, demand still remains a bearish factor. As the weekly exports came in extremely subpar and further confirmed the lack in demand we've discussed the past few weeks. The outside markets also continue to drag the grains along with them, as recession and inflation are more evident than ever. With the U.S. dollar hitting another new high today.

France harvest was reported at 26% finished through 9/19 compared to last weeks 14%.

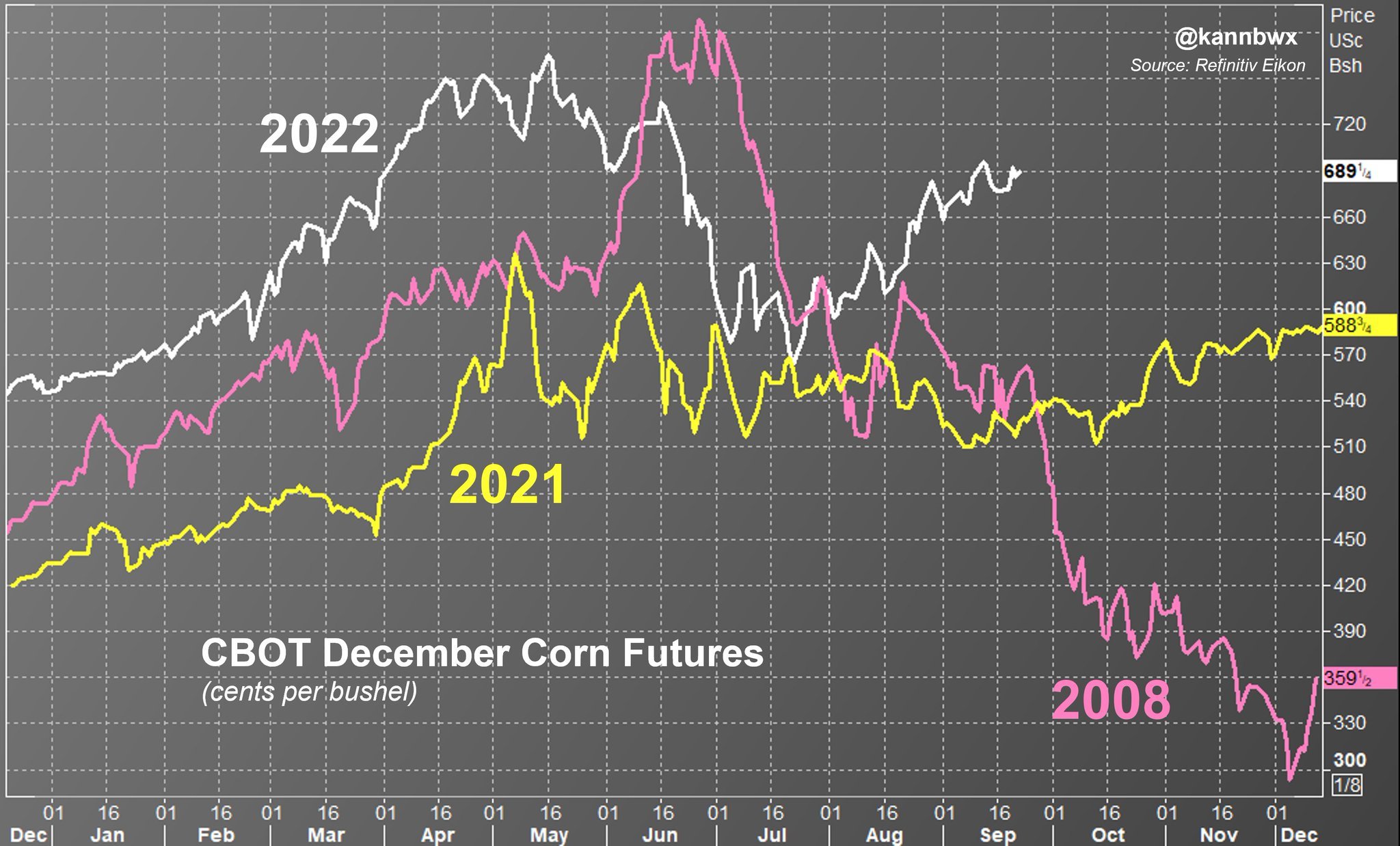

One would love to think that we see Chinese and overall demand sky rocket here and carry the markets, but that's a tough ask. We have to keep in mind that we are currently at historically high levels comparatively to today's date. As yesterday we settled at our second highest levels for the date, following only 2012.

Corn actually held up remarkably well compared to the rest of the markets and outside pressure. That $7 range still remains a tough resistance to break past.

Below is a chart comparing corn prices by year. Credit to Karen Braun on Twitter for the chart.

Dec-22 (6 Month)

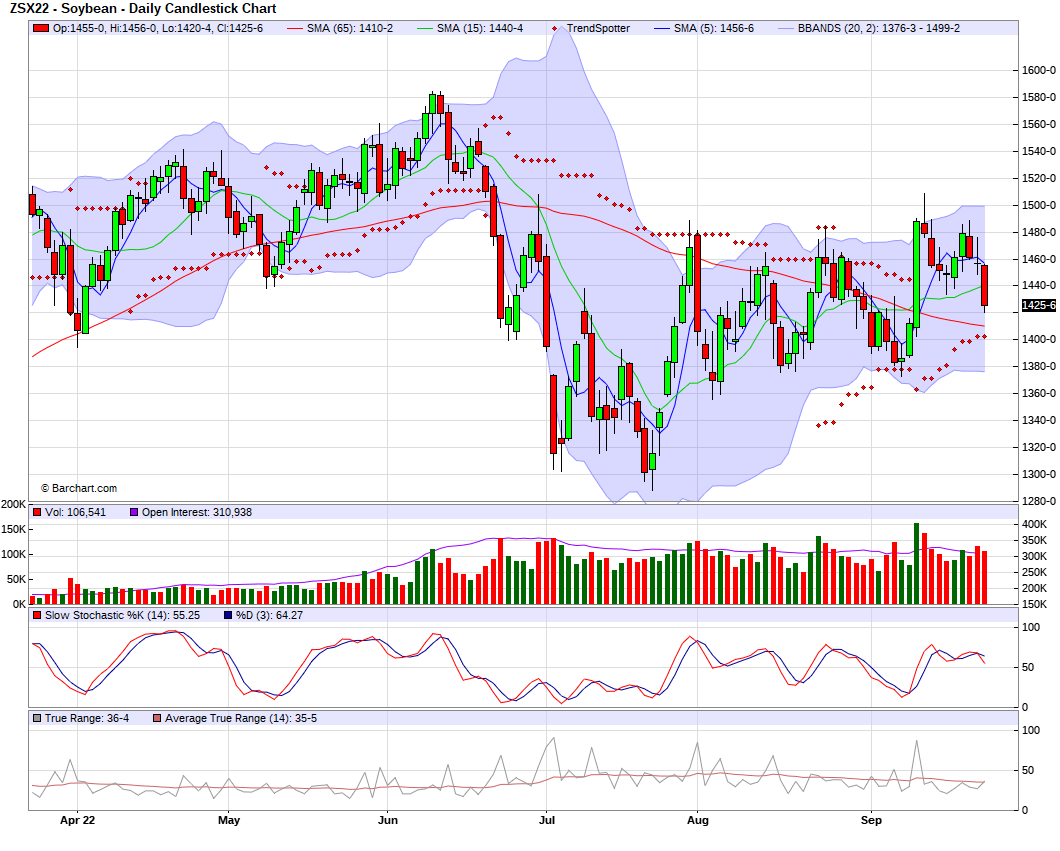

Soybeans

Soybeans sharply lower today, with no real reason to push prices higher today as there aren't any bullish headlines. Outside markets are getting crushed and putting pressure on all the grains.

Similarly to corn, demand as has been for the past few weeks remains poor. As we saw the weekly export sales for soybeans coming in at half of what they were the week prior, and far below all expectations. The outside markets aren’t helping the demand story either, with recession fears growing day by day, crude oil sharply lower once again, and the dollar continuing to hit new highs every other day it seems. Will have to wait and see if we can see Chinese demand pick up sooner rather than later if we want to see demand support prices.

Its a little to early to be debating the South America headlines, but one could argue that the recent drought could cause problems later down the road. As South America planting gets underway.

We broke below a key support level I touched on yesterday. That being the $14.50 area, we saw more movement to the downside once we broke below. We now have nearby support in the $14.20 range, we currently sit a few cents higher than that range.

Argentina has until the end of the month for their farmers to take advantage of their peso deal, where they are getting 200 pesos to the dollar. Causing a ton of strong selling from Argentina as China looks to scoop up as much as they can from them. Makes us wonder where we will see exports in the following few months.

Soymeal & Soyoil

Soymeal down -5.6 to 423.3

Soyoil down -2.78 to 63.68

Soybeans Nov-22 (6 Month)

Wheat

All wheat sells off after its three-day rally. As the recent Russia/Ukraine news helped push prices higher for the majority of the week. I think some profit taking and a correction was likely expected as every bull run comes to a roadblock.

We also have Russia looking at a record crop that hasn't been beneficial to prices. According to SovEcon, Russia's wheat harvest could reach 94.7 MMT from 90.9 MMT, which is a historic number. markets continue to work against the grains, with the dollar hitting another high, as people appear to be more concerned about recession than they have been recent. Exports also remain fairly poor which hasn't helped.

When markets are driven by headlines it is tough to sustain a rally for an extended period of time before running out of momentum. Now I’m not saying this rally is necessarily over. Of course, we could definitely see some more headlines spark another rally, but nobody ever knows what Putin will do next.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil down -4.87 (-5.83%) to 78.65

Dow Jones down -739.04 (-2.46%)

Dollar Index up +1.824 (+1.64%)

S&P 500 down -2.63%

News

Argentina farmers switch to soybeans rather than corn due to drought.

Indias rice export price hits 1 1/2 year highs

Russian wheat export tax drops again

China is continuing to experience a severe drought in south and central regions

Indias palm imports could jump 23% in 2022-23, reaching an 8-year high of 9.5 MMT

No railroad news

Is the Recession Here?

It seems like the entire world is panicking, with the U.S. dollar hitting fresh highs again. Crude oil broke below $80 for the first time since February. The S&P 500 is down nearly -25% year to date.

Today

S&P 500 -2.63% (-23.6% YTD)

NASDAQ -2.45% (-32% YTD)

Dow Jones -2.46% (-19.7% YTD)

Below is a chart comparing the S&P 500 from 2008 vs 2022. The comparisons are eerily similar.

Chart credit to Michael J. Kramer on Twitter

Bullish or Bearish Survey

We are conducting a survey on whether people are bullish or bearish on the grains. You can submit your answers here - This will be the last day for the survey as we will be adding the results in Sunday's newsletter

This Week's Weekly Newsletter - Read Here

Social Media

Credit: All credit to users of posts

Precipitation Forecast 2-Day

Weather

Source: National Weather Service