AI DROUGHT & PRICE PREDICTIONS

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

Weather

Right now it is all about weather, nothing much else like demand seems to matter. No one expects weather to take a back seat. It’s why sometimes traders refer to grain futures as weather derivatives, because at least during this time of the year that is all they are. A way for the high stake players to bet on how much and when it will rain as well as how hot or cold it will get.

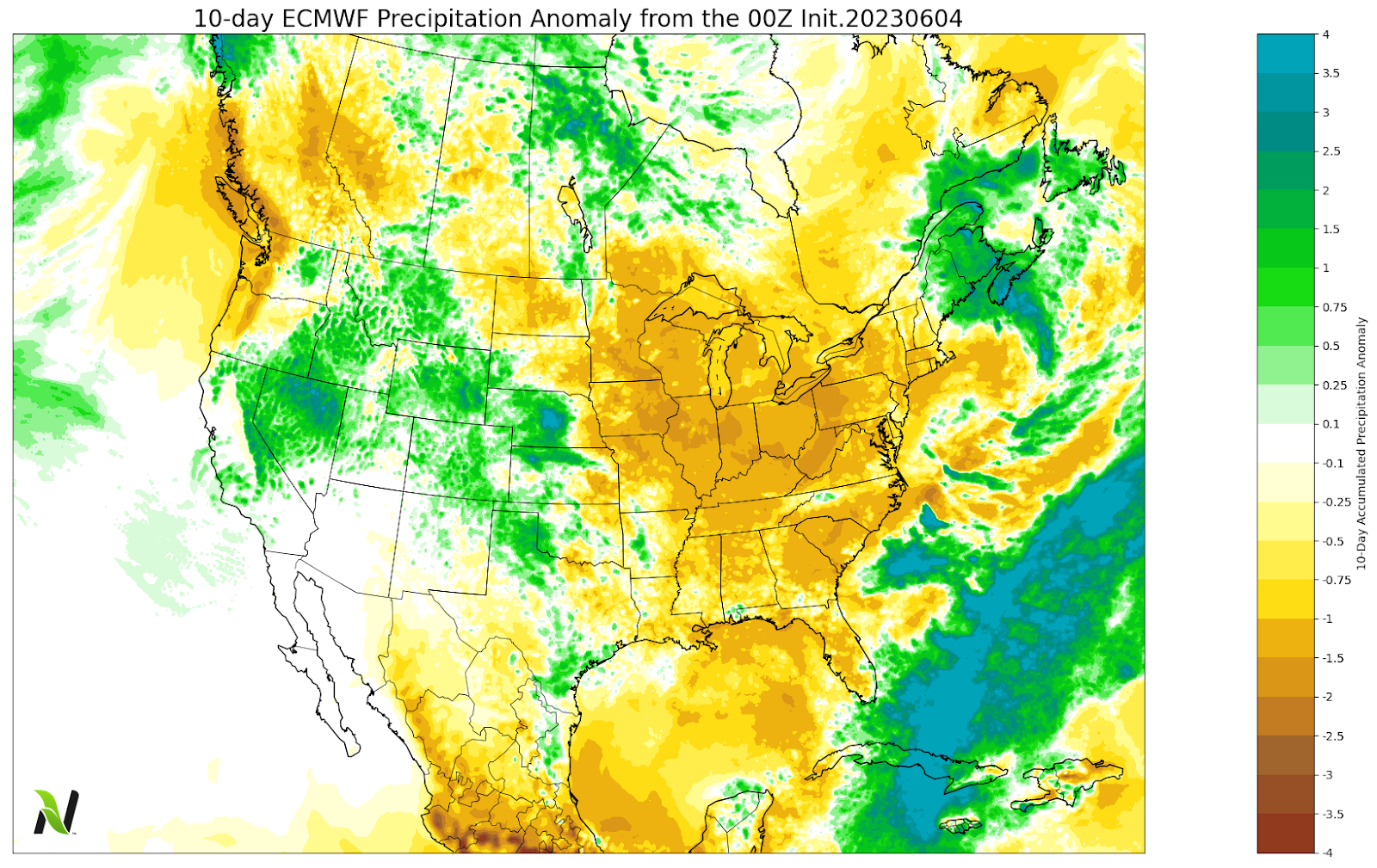

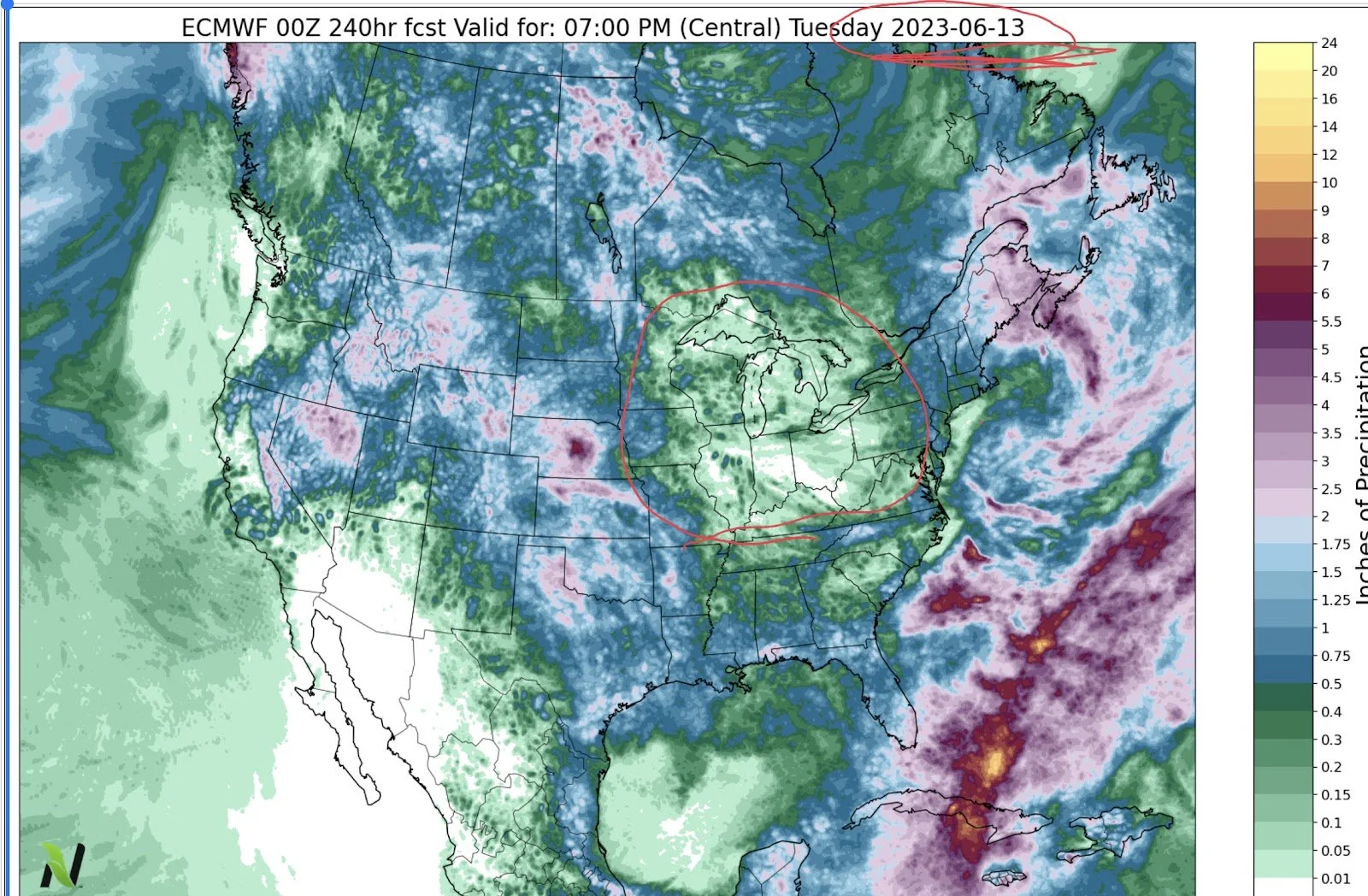

Here are just a few weather maps to look at for your info.

These all come from https://ag-wx.com

Even ChatGPT AI knows that weather is going to determine yields and where prices go and what our yields do.

So we asked several questions to AI this past several days and we continue to ask AI for several more.

But before we get into some of those questions we want to let you know some of the other benefits and capabilities that AI has and that we use.

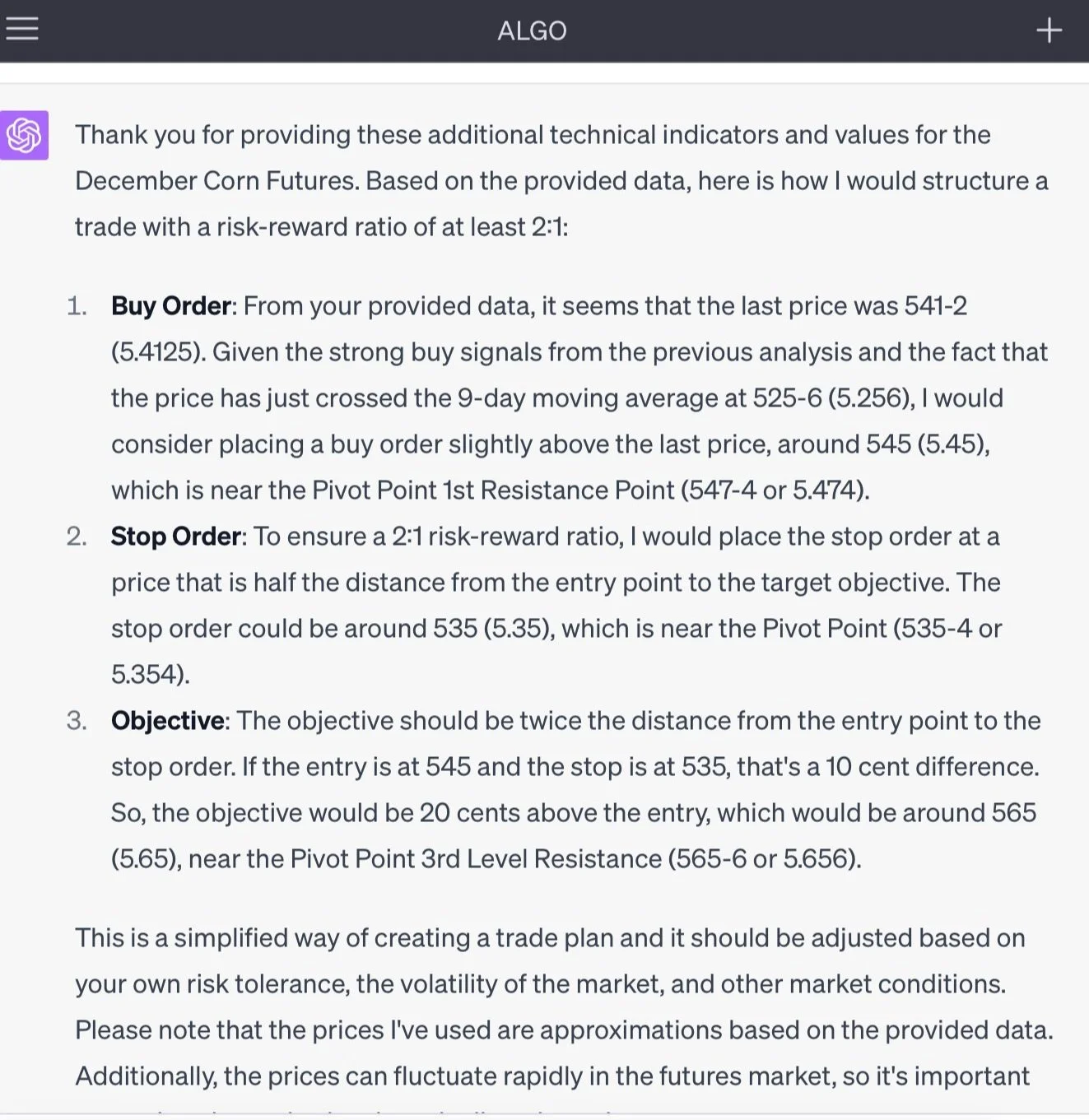

Here is from an Algo chat I had with AI where I asked it to come up with a trade for December corn. This is not a recommendation and shouldn’t be taken as one as futures and options trading is risky and not suitable for all. But I did want to show producers some of the benefits that AI has.

It also has the ability to write a grain marketing plan based on the information one gives to AI.

If you want help with a marketing plan or trading one of the first steps is to have a hedge account open. Here is a link to open one

https://www.dormanaccounts.com/eApp/user/register?brokerid=332

Or you can call myself at 605-295-3100 or Wade at 605-870-0091

The bottom line is we believe at www.dailymarketminute.com that we have come up with the correct prompts that we can utilize AI to help benefit farmers and easily write grain marketing plans as well as place various types of futures and options trades that fit you and your operations risk/reward.

To do this we simply ask you several questions, use the AI type Algo that we have, input your answers, and get a risk management/grain marketing program that is beneficial and tailored specifically to you and your operation.

I am a big believer in risk diversification, so I don’t recommend doing 100% exactly like AI says, but I do think it helps and gives one a solid starting spot that many presently don’t have. But the first step is to have a hedge account open. So please do that if you haven’t already.

Chat GPT - AI Questions!!!

One question we asked was if our corn drought area stays 23-25% worse than it was in 2012 and the drought starts earlier, do you think that we will have an even larger reduction then we did in 2012?

It said;

Yes, based on the historical data you provided for 2012, where the first yield estimate was 166 bushels per acre and the final yield ended up at 123.1 bushels per acre, it is reasonable to expect that a more severe drought with increased drought stress in corn-producing areas could lead to an even larger reduction in the corn crop.

If the drought in 2023 is anticipated to be 25% worse in terms of drought stress compared to 2012 and starts earlier in the growing season, it is likely to have a significant negative impact on corn yields. Drought conditions can cause increased heat stress, limited water availability, and adversely affect the development and productivity of corn plants.

Considering these factors, it is reasonable to expect a larger reduction in corn yields compared to 2012 if the assumptions of a more severe drought and earlier onset of drought conditions hold true. However, it's important to note that actual yield outcomes can be influenced by various other factors such as localized weather patterns, management practices, and pest/disease pressure.

Monitoring the weather conditions, drought severity, and crop development throughout the growing season will provide a clearer picture of the potential impact on corn yields in 2023.

-

Next I said “Let’s put a number on it, I understand that this is just an estimate”……..

The rest of this post is subscriber-content only. Please subscribe to continue reading.

INCLUDED IN THIS WEEK’S EDITION

AI answers whether we will have an even larger reduction than we did in 2012

AI predicts how big of a yield reduction we could see

Could we see a 30-40% reduction?

AI answers how high could corn go if yield significantly misses

AI lists factors that could surge prices

AI puts a number on chances we surpass 2012’s $8 corn

10 possible Black Swan events

Is China in trouble?

Does history repeat itself? Our Weekly Newsletter from Dec. 18th, 2022.

SUBSCRIBE FOR 50% OFF

Use code: DROUGHT to get over $400 off our yearly option. Receive all of our daily updates via text & email

NOT SURE? TRY A FREE TRIAL

Check Out Past Updates

6/2/23 - Market Update

When Will Fireworks Start?

6/2/23 - Audio

Could We See 160 or Even 140 Yield?

6/1/23 - Market Update

Drought & AI Predictions

6/1/23 - Audio

Weather Markets In Full Swing

5/31/23 - Market Update

Grains Crawl Back

5/31/23 - Audio

Are Markets Overdone to Downside?

5/30/23 - Audio

Is There Opportunity In Today’s Sell Off?

5/28/23 - Weekly Grain Newsletter