DID BEANS CONFIRM REVERSAL?

Overview

Mixed day as soybeans lead us to the upside flirting with that $13 resistance and target we mentioned yesterday.

Beans saw some strength from the crush report yesterday. We saw a record large crush for September while soy oil stocks came in at their lowest level in 9 years. A pretty bullish report for beans.

Crop consultant Dr. Cordonnier raised his yield estimates for both corn and beans. He raised his corn by 1 bushel to 172.5 which is still 0.5 below the USDA's 173. He raised his bean yield by 0.3 bushels to 49.3 which is compared to the USDA's 49.6. His estimates are still slightly below the USDA's, but not something bulls wanted to see.

Harvest is 62% complete for beans, well above the 52% average. Beans good to excellent rating rose 1% to 52%.

Corn harvest is 45% complete, right around our 45% average. Corn's good to excellent rating remained unchanged at 53%.

As we have mentioned several times the past few weeks, row crops typically start to gain momentum and see less harvest pressure when harvest reaches 50 to 60% complete. Which means we have likely seen the last of harvest pressure from beans and harvest pressure should stop pressuring corn within the next week or two.

We still have conflicts and escalations in the middle east, but the market is ignoring the problems for now. It could definitely lead to a bigger issue down the road but it's anyone's guess.

Today's Main Takeaways

Corn

Corn takes another slight loss for the 3rd day in a row. Now a dime off of last week's highs where we failed that $5 resistance twice.

It has been nearly a full month since corn posted it's $4.68 lows. Since then we have chopped sideways and slowly grinded higher as bulls have their eyes set on $5.

Yesterday we saw awful export inspections which has continued to feed the bears argument that demand is still a concern and could ultimately limit our upside.

We still have +2 billion US ending stocks, which yes is a lot. With that big of carry out, the road to the top will very likely be a bumpy one.

As mentioned, corn ratings remained unchanged at 53%. Ohio impressed with 91% rated good to excellent. Taking a look at states to the west, Iowa and Nebraska were both around 50%, while Minnesota was 40%.

Overall, there hasn’t been a ton for bulls to chew on. Hence the choppy action. One thing bulls do have their eyes on is Brazil.

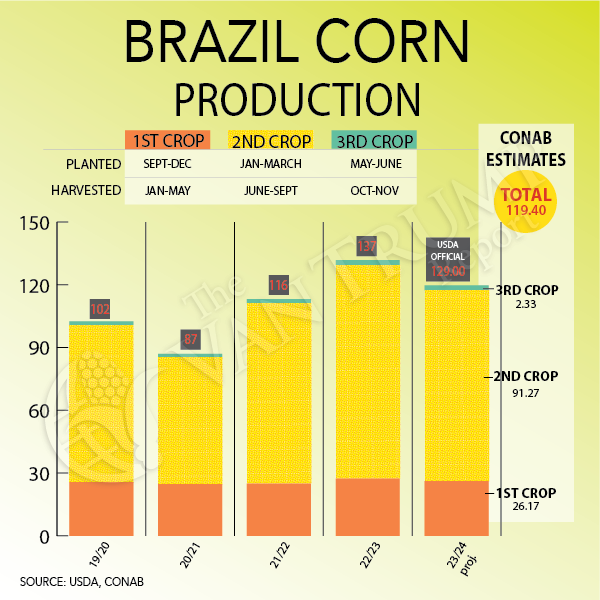

After back to back years of record corn crops, CONAB expects Brazil farmers to harvest a whopping -9.5% less corn this year. CONAB has their 2023 to 2024 corn crop at 119.40 million metric tons. Well below the USDA's current 129 and last year's 137. Still early, but this will be a dominant factor later in the year.

Chart Credit: Kevin Van Trump

Overall, I still believe our lows are in. Does this mean we are going to see a straight shot upwards? No. I expect corn to slowly grind higher like it has done over the past month.

If we can get a close above $5, I think it will lead to the funds hitting the buy button. Keep in mind, they have over 100k short contracts to unwind when they decide to get long.

Another thing to note that I have mentioned over the past several weeks is that corn typically sees harvest pressure until harvest reaches 50 to 60% complete. Currently we are at 45%. So we should see less harvest pressure in a week or two.

Targets are $5, then the 100-day moving average of $5.11, then $5.30, and lastly our 50% retracement of $5.50.

Corn Dec-23

Soybeans

Beans lead the way again. Now nearly +50 cents off of last week's lows.

From Brazil Ag Consultant Kory Melby:

"Today was the confirmation of Thursday's reversal."

Last week we had the bullish USDA report. Yesterday we got a bullish NOPA crush report. As mentioned, we saw a record large crush for September. While soy oil stocks dropped to 9 year lows.

At the same time, export inspections came in double what the trade was expecting.

I believe that today's price action was…….

The rest of this is subscriber-only. Subscribe to continue reading and gain access to our daily updates sent via text & email.

Scroll to check out updates you would have received.

USE CODE “HARVEST” FOR 50% OFF

Get 50% off using this special discount code. Click the link below for the pre-applied discount link.

Become a Price Maker.

NOT SURE? TRY 30 DAYS FOR $1

Try all of our exclusive stuff for just $1.

Check Out Past Updates

10/16/23

CHOPPY BORING TRADE

10/13/23

POST USDA REPORT CORRECTION

10/12/23

BULLISH REACTION TO USDA REPORT

10/11/23

CAN THE USDA GIVE US A BULLISH SURPRISE?

10/10/23

BEANS BREAK THEN BOUNCE - USDA PREVIEW

10/9/23

WILL YOU BE FORCED TO SELL ANYTHING AT HARVEST?

10/6/23

CORN & WHEAT HOLD LAST WEEK’S LOWS

10/5/23

UPSIDE BREAKOUT IN CORN

10/4/23

ARE YOU A PRICE MAKER OR PRICE TAKER THIS HARVEST?

10/3/23

CHINA IS BUYING, ARE YOU?

10/2/23

WHY YOU SHOULD BE EXCITED ABOUT TODAY’S RALLY

10/1/23