WHEAT LEADS THE GRAINS REBOUND

MARKET UPDATE

Below is todays full update. Make sure you subscribe if you’d like future ones.

Try 30 Days FREE: CLICK HERE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Great price action in grains today.

Soybeans put up a heck of a fight today. After being down -13 cents, they rallied back and ended the day +11 cents higher. A +24 cent swing.

Wheat was the leader today, now +20 cents off the lows from last Thursday.

Wheat was severely oversold and due for a technical bounce. As I mentioned Thursday the indicators were very overcooked.

To add on to this, the dollar finally saw some weakness today. After recently trading to +1 year highs last week. A stronger dollar is negative for grain prices, especially wheat. As it makes it harder to compete for business globally.

Russia & Ukraine News

Over the weekend, we also saw some fresh Russia & Ukraine news.

Biden gave Ukraine the greenlight to use US-provided missiles to attack Russia.

Up until this recent headline, it seemed like most including the trade had pretty much forgotten about the war. With most coming to the idea that the war would end with Trump coming into office. So all of that war premium in the markets vanished. This headline gave a little bit of that premium back.

Keep in mind.. war premium tends to not last. But this might not be the last we see. As we still have 2 months until Trump takes office. Looks like Biden is trying to help them before Trump is in.

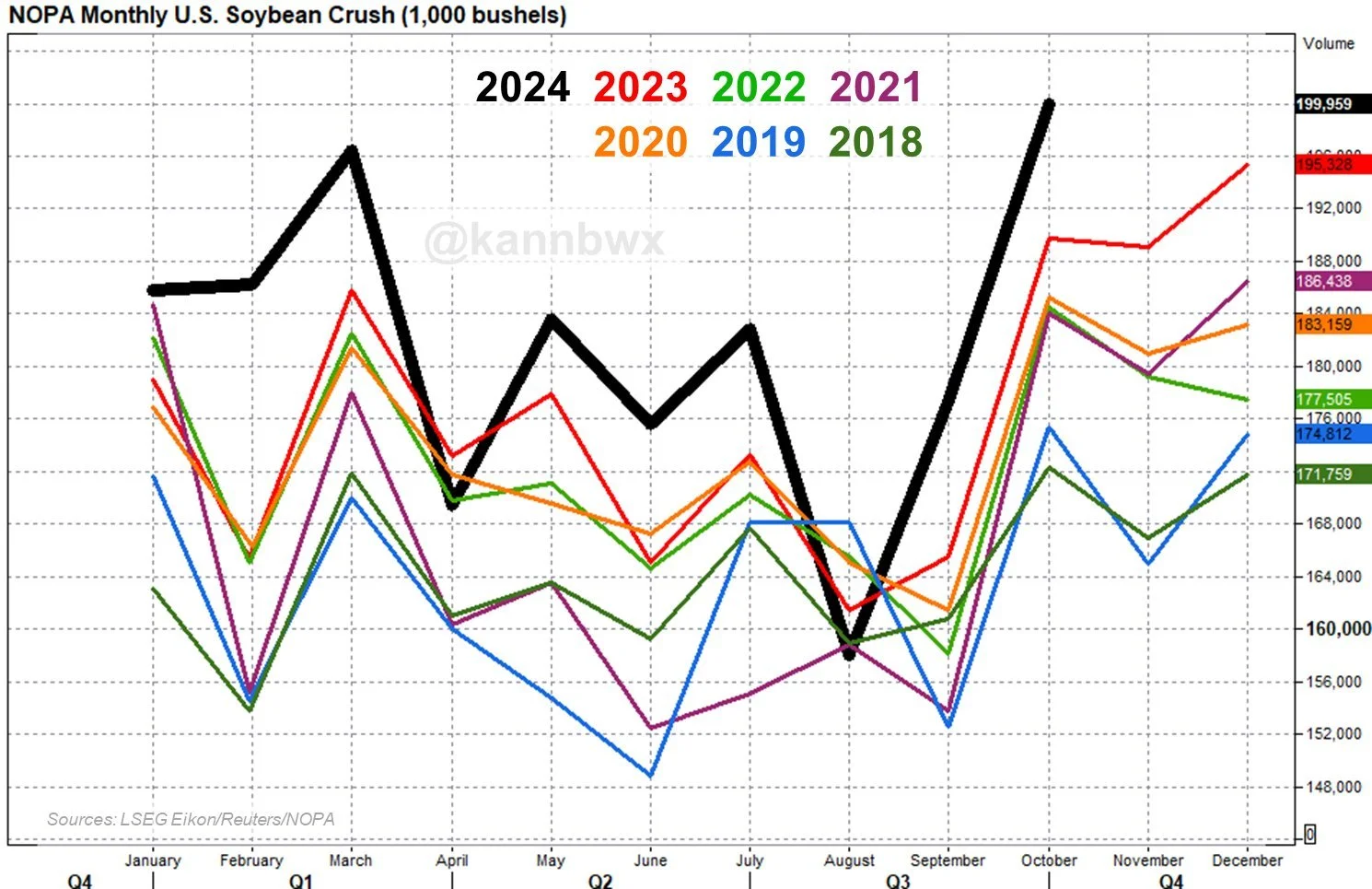

Record Ethanol & Crush

Despite some of the recent bearishness, we recently had two reports show records.

As both corn ethanol and bean crush set all-time records.

Ethanol production is one of the friendliest things corn has going for it.

We are well ahead of USDA expectations. Outperforming last year while the USDA projects us to be worse than last year. Could add quiet a bit of demand to the balance sheet.

Crush accounts for 55% of all bean demand, so this is good to see.

But exports account for over 40% of bean demand. Exports for beans have been relatively weak, along with the trade war fear and thoughts of a monster crop in Brazil.

Ethanol Chart from GrainStats

NOPA Chart from Karen Braun

Brazil & China Agreement

After market close we saw a trade agreement between China & Brazil.

This might be something that isn’t the most friendly, as it would take some China business away from the US.

Will have to see if the trade has any reaction to it tomorrow.

Today's Main Takeaways

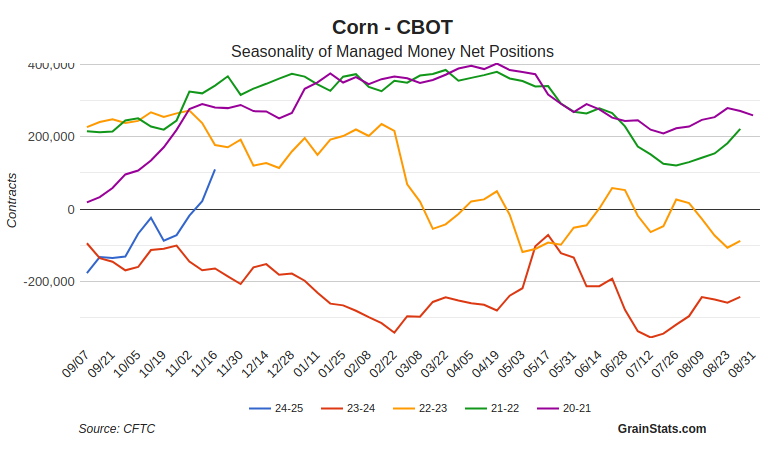

Corn

Corn was more of a follower today, but great price action.

The biggest recent headline is the funds. They are long for the first time in over a year.

They are now LONG 100k contracts. The largest long position since February 2023.

Chart from GrainStats

Last week it was reported they bought 97k contracts. Despite this.. we only rallied a dime or so..

Why?

This buying was met with farmer selling.

Short term, there is a lot of bushels still on commercial storage. So producers will have to roll to March or price them.

If they decide to sell, this could pressure us and perhaps keep a lid on a rally.

But long term, corn still has a very positive story going for it.

We have exports well ahead of pace. We have record ethanol production. We have a technical uptrend in place on the charts. The funds have now switched from record shorts to net long, meaning they are no longer betting against corn.

100k long position isn’t massively large by anymeans, but it's a much better headline than "Funds Record Short". So this could help to change the poor sentiment corn has faced all year long.

The fundamental story for corn has continued to get better and better. Keep in mind, back in February we had the largest carryout estimate ever, and it has been shrinking since.

We are building all of this demand to the point where if yield comes in at 177 next year, we would have to add acres.

Take from John Scheve:

I wanted to include an interesting take from John Scheve. He basically said:

If corn carryout was 1 billion bushels, prices would have to be $8 to ration demand.

If corn carryout is 2 billion the value of corn is around $4.

Every 100 million bushels in-between equates to around 40 cents of value.

With a current carryout of just over 1.9 billion, we are fairly valued here around $4.30-$4.40.

If carryout dropped to 1.8 billion, we would add roughly 40 cents. If carryout dropped to 1.7 we would add 80 cents and so on. Just an interesting way to see what value we are at.

From Zaner Hedge:

"Corn has double top action at $4.35. If we get a solid close above that, I think we see an upside extension back to $4.75 to $4.80 territory. That could happen before the end of the life of the December contract. But we are running low on time, so you might have to look out to March." "On the other hand, we need to $4.10 otherwise it would look like we might test those lows."

Unlike beans & wheat, corn has a nice uptrend from those August lows.

We bounced perfectly off that golden retracement zone I mentioned ($4.19-$4.22).

My first target to re-hedge or make a few sales for those that need to is still $4.39 to $4.46.

I also agree with Zaner Hedge that +$4.60 is very possible. As $4.60 is my 2nd target.

Soybeans

Soybeans bouncing nicely off the recent lows.

One thing we saw today was a key reversal in Nov-25 beans.

We posted contract lows but reversed and closed above the previous days highs.

A key reversal is often a very positive sign. But we will have to see if it matters or not.

Overall though, it is still hard to get "super" bulled up about soybeans.

Yes we just got a nice yield cut from the USDA, but the trade is still concerned about the potential monster crop out of Brazil.

Then we also have the unknowns from the trade war talk.

Something to keep in mind with all of this trade war talk is that the trade war never actually went away, as Biden kept all of the tariffs Trump had added. Biden actually added even more. But it seems like Trump wants to pick up where he left off.

Trade war or not, the globally situation is still bearish unless something changes.

We have record high world carryout numbers. Brazil weather is in good shape for now. Soybean exports have improved from the historically awful start but are still behind USDA pace.

Could we see $11-$12 beans? Very possible. IF the right cards fall.

But we could just as easily see another $1.00 downside if the cards do not fall.

Short term, we likely won't be seeing any farmer selling at these levels so soon after harvest. So that should help support us here at these levels. If corn is strong to close out the year, perhaps beans will follow.

But if Brazil does come out with a monster crop, this could cause a ton of pressure when their crop comes online in January.

Overall, I am just looking to spread out my risk on pricing opportunities. As no one knows how Brazil or the trade war will turn out.

Looking at the chart, optimistic price action today. We climbed back above $10. Really want to see us break that blue downward trend.

I do not have a current target at the moment, I am just waiting to see what unfolds as the last 2 targets were hit.

Wheat

Wheat now +20 cents off their recent lows.

I am still in the camp that wheat has plenty of "potential" moving forward looking towards 2025.

Why?

Well short term, yes wheat faces some headwind. Such as the dollar rallying. We also just saw winter wheat conditions come out this afternoon at 5 year highs. As they jumped to 49% G/E, an +11% improvement in 3 weeks.

So do not be surprised if either of these continues to weigh on us short term.

Long term, there are several reasons why wheat might be undervalued here.

Trump is going to cut off aid to Ukraine. We have funded billions to help their agricultural and they have relied on the US. Once this stops, you'd have to imagine their ags take a step back.

Secondly we have Russia. They have faced some serious issues with drought.

SovEcon (aka Andrey Sizov the Black Sea Guru) thinks that Russia's winter wheat crop is going to be smaller next year than it was this year due to the reduced planted acres and poor start.

France has one of their worst crops in years due to too much rain. This will become more relevant in the world balance sheets next year.

The global balance sheet is actually friendly for wheat. World carryout continues to fall year after year.

Global major exporters stocks to use ratio is the lowest since 2008.

Overall, I am remaining patient here. Short term wouldn’t be surprised to see us trade lower, but long term I think we have a story.

Looking at the chart, it looks awful. But nice two day bounce. Really want to see us break this downward channel.

To say perhaps we are done going down, we would need to close back above $5.70 or so.

Same story for KC.

Need to crawl back over that support (orange line) and break this downward channel.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24