ARE THE HIGHS IN?

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

Are the highs in?

This is a question that we get all the time. Are the highs in, should I have sold my grain last week, etc. All the questions that come with any time the market sets back a little bit.

I usually try to side step the question about straight market direction, because without adding components such as time to the question you can answer correctly but still look like you are wrong.

For example without the time portion it is easy to say that grains will make new all time highs in the future. But that’s not much of a statement unless I make it more specific and say that we will see soybeans make new all time highs by X date.

So back to the question are the highs in? Let's reverse the question and provide some statements that are expanded a little bit and add a little time component to it and let's dive into some real answers.

CBOT Wheat will take out the highs it had in the past 12 months if one of a couple things happens overseas:

If Ukraine attacks in a way that disrupts the shipment of Russian wheat. Russia has nearly 50 MMT of wheat to ship

Attacks on the Danube.

Bottom line is that wheat could take off behind further escalations. The above two likely cause prices to soar in a hurry. Possibility exists that we would take out the 2022 highs. Meaning new all time highs in CBOT wheat.

Wheat will provide a huge opportunity to sell calls and buy puts. The combination of which will allow one to get much higher than the highs that we put in. No date as to when, but when I see the opportunity I will let our subscribers know.

Take at some of the option closes. Keep in mind that this is after selling off 30 cents or so on Friday.

September wheat closed at 6.971/2. Yet a 6.45 Sept put and a 8.00 Sept call are about the same price. The put is within 53 cents of the close, while the 8.00 call is over 1.02 above the close.

When you look at Courage Calls CBOT September wheat provides the perfect example of why we want to own the calls before things get excited. 9.00 calls that expire in a little over a month are a little over 5 cents, 10.00 calls are 3 cents, 12.00 calls are a little over a penny.

If wheat takes off look for bull spreads to work like magic. The shorts are too heavy in the front month and that’s where all of the action will go.

Take a look at the carry that CBOT presently has.

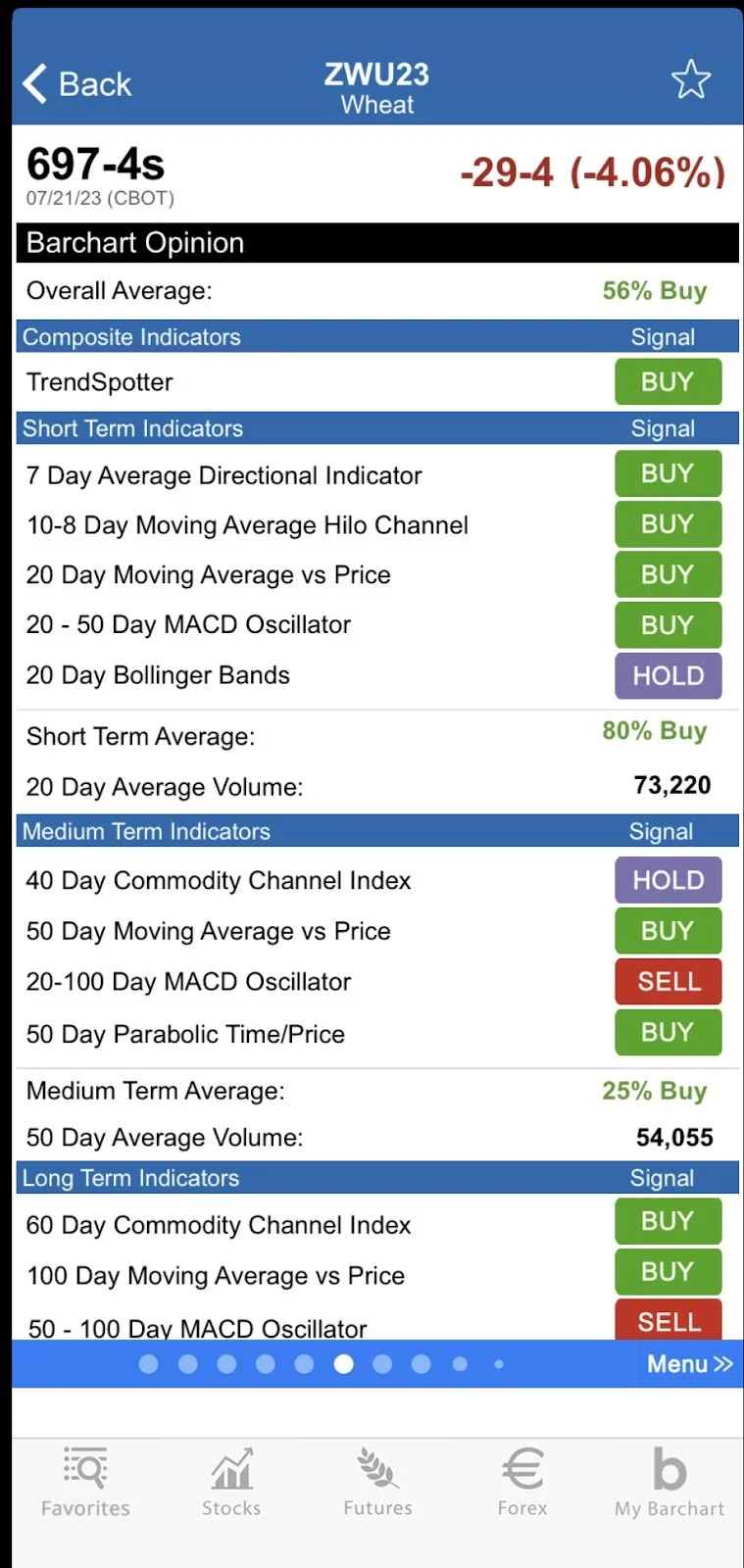

Here is a snippet showing some of the technical indicators that Barchart.com has.

If #1 or # 2 from above happen, look for CBOT to lead the wheat markets higher in the short term.

Historically, every major wheat rally has always started with CBOT wheat leading, via inverting and gaining on MGEX and KCBT. Do not be surprised if CBOT wheat goes to a premium against the hard wheat’s of KCBT and MGEX. Don’t look for it to stay and right now as we sit at a major discount it doesn’t seem possible. But the funds are not holding a big short in KCBT or MGEX, it is in CBOT wheat. So when they exit don’t look for a wheat rally to shake out any differently than it historically has. CBOT will lead and then the quality wheat’s will take over

We are not competitive in exports, we don’t have excess wheat to export and the bottom line is that any major rally will be very tough to sell because we will be getting reminded of the 2008 as well as last year’s rally.

Options will get stupid expensive which will provide the opportunity to sell calls above the market to buy puts. The timing will make pulling the trigger very tough. But this will be a huge opportunity. Make sure you have hedge accounts open. For more info on opening an account you can give me a call at 605-295-3100.

Soybeans will make new all time highs, IF…..

The rest of this post is subscriber-only content. Please subscribe to keep reading and to receive every one of our exclusive updates via text & email.

DON’T MISS OUR HUGE DISCOUNT

Make sure you lock in this offer before it’s gone. It is available for a limited time only. Become a price maker. Not a price taker. (Scroll to check out past updates you might’ve missed)

RIGHT NOW: $350/yr

WILL BE: $800/yr

Not Sure? Try a 30-Day Free Trial HERE

INCLUDED IN TODAY’S UPDATE

What would have to happen for soybeans to make new all-time highs

How to make money no matter which direction the market moves

Different methodologies for making sales

Corn price outlook & history

Being comfortable in your operation

Could we see some limit up moves soon?

CHECK OUT PAST UPDATES

7/21/23 - Market Update

RALLY TAKES A BREATHER

7/20/23 - Audio

BEING COMFORTABLE NO MATTER HOW THIS SHAKES OUT

7/19/23 - Market Update & Audio

THE RALLY CONTINUES

7/18/23 - Audio

WEATHER & WAR

7/17/23 - Market Update

RUSSIA EXITS GRAIN DEAL. BUY THE RUMOR SELL THE FACT

7/16/23 - Weekly Grain Newsletter

MANAGING THESE VOLATILE MARKETS

7/14/23 - Market Update

WHEAT RALLIES & CORN MAKES KEY REVERSAL

7/13/23 - Market Update

GRAINS BOUNCE BACK AFTER BEARISH REPORT

7/13/23 - Audio

DROUGHT & DOLLAR ERASE YESTERDAY’S LOSSES

7/12/23 - Audio & Report Recap

FULL USDA REPORT BREAKDOWN

7/11/23 - Audio

WHAT TO EXPECT IN TOMORROW’S REPORT

7/10/23 - Market Update

CORN & BEANS STRONG AHEAD OF REPORT

7/9/23 - Weekly Grain Newsletter