ARGENTINA RAINS LEAD TO LOWER OPEN

Overview

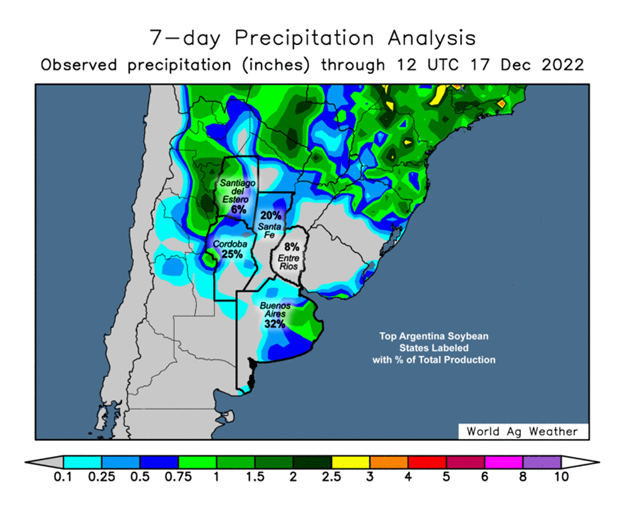

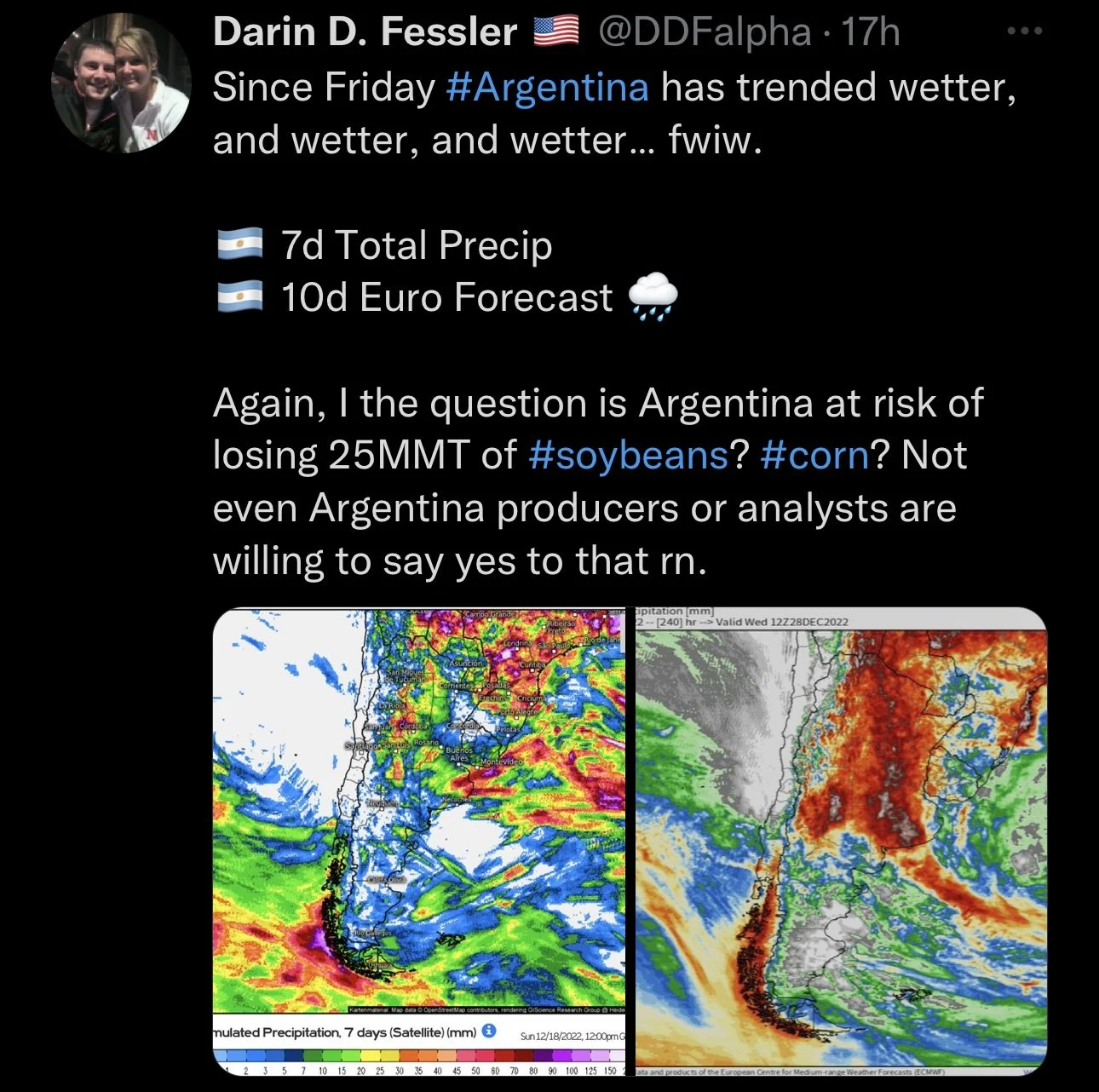

Grains start off the week with a mixed overnight session, that has grains all lower at open this morning. With soybeans being pressured from some unexpected rain in Argentina while corn and wheat are following behind both being in the red as well. China covid uncertainties also adding some pressure. Soymeal is down sharply this morning, down over -2%.

With the holiday weekend approaching we can expect decreased trading volume with possibility for some more volatility.

We saw two sales this morning. 132,000 tons of soybeans to unknown and 141,000 tons of corn to Mexico.

Today's Main Takeaways

Corn

Corn is slightly lower here to begin the week, with no real fundamental news to get prices moving strongly in either direction. Often a lack of news leads to a risk off day with lower prices. Prices continue to chop around.

It seems like corn is comfortable trading in the $6.35 and $6.60 range for now. We haven’t seen March corn trade over $6.80 since November. Taking a look at our highs and lows. Our lows were made in July with a low of $5.68 and we saw prices peak at $7.11 in October. Since we hit our high we have seen choppy sideways trading for the most part with no real catalysts.

War is still evident but hasn’t made much of any change in moving the markets. Nonetheless this will be something to watch out for both the corn and wheat markets.

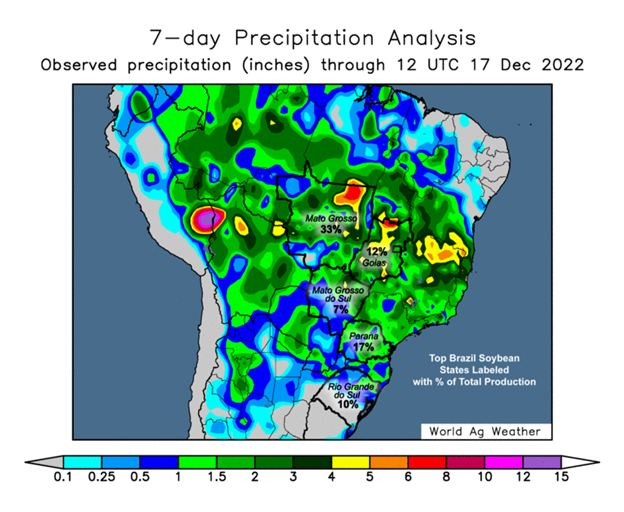

We all know South America is a risk in the markets if we want higher prices and bulls want to see a weather scare to give prices that bullish catalyst we need for higher prices. Current outlook for Brazil is still cooperative but its still very early and there is plenty of time for things to change. We are now entering a very crucial window for South America for the next month or two.

Argentina is still facing problems which has been a supportive factor in the markets. Below this write up I will include a picture of the corn crop in Cordoba, Argentina so one can see how serious their drought has been and the damage it has caused. Image courtesy of Wright on the Markets. It makes one question that it doesn’t really matter if they get rain or not now, the damage might already be done.

Demand is also a big uncertainty here. But there are plenty of wild cards left in the deck that all have the possibility to see higher prices. But without a solid catalyst in place, it makes it tough to be wildly bullish here at least short term even though I still have a slight bullish tilt but more so long term rather than that of short. If we could get a bigger demand story that would be a good step in the right direction for higher prices.

March-22 (6 Month)

Soybeans

Soybeans saw some pressure overnight with reports of some unexpected rain over in Argentina yesterday and forecasts showing some potential rain in the future. Soybeans sharply lower at open this morning.

There is also a ton of uncertainty surrounding China and covid which also has the markets under pressure this morning. As I have been saying for a while now, this is one of the biggest factors going forward in the soybean market and one of the factors that has the potential to continue to pressure prices. I talk more about China and their lockdowns later in today’s post.

I still think if you want to take some risk off the table, prices are still so strong it wouldn’t make a ton of sense to not take some advantage and better manage your risk as there are plenty of factors that could result in lower soybean prices. But there are also factors that could send prices soaring, and that is the beauty of the markets.

Roach Ag currently has a sell signal in for soybeans for 20% of expected 2023 bean production. But also said prices are just hovering over their threshold to remain in a sell signal.

Obviously the biggest concern for the bean market is Brazil. As they are still expecting a record crop which CONAB currently has at 153.5 million metric tons.

On the other hand it looks like Argentina is still facing problems despite some rain over the weekend. With some analysts predicting we see production come in below 40 million metric tons. Keep in mind the USDA forecast is 49.5 million. So I think there is a good chance we see Argentina estimates further lowered. But it looks like many think the record crop in Brazil may far outweigh the reductions we are undoubtedly going to see in Argentina.

Overall, there are plenty of factors to swing the markets either way. But the largest going forward will be obviously South America weather as we are in that critical window for their crops. But also China and their lockdown situation and where they go from here.

Soymeal & Soyoil

Soymeal down -15.2 (-3.4%)

Soyoil up +0.90 to 63.40

Soybeans March-23 (6 Month)

Wheat

Wheat following the rest of the markets lower here to start off the week, with lack of any fresh news to drive markets.

With the funds still being incredibly short wheat, there is a possibility we see them sell corn and soybeans and perhaps buy some wheat.

Recently we’ve seen the Russia and Ukraine headlines escalate a little more than they had in the week prior. These headlines haven’t provided as much movement in prices and bulls would have hoped for. But this is going to be a big wild card for the markets mainly wheat, and I think there is a good chance we see Putin do something stupid and cause prices to go higher.

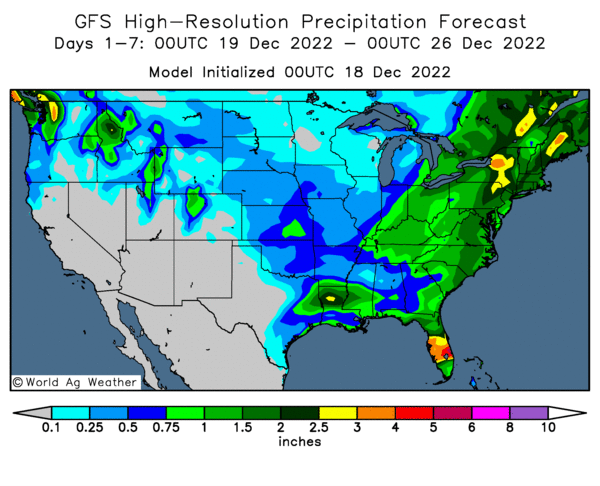

On the other side of things, we have improved moisture here in the U.S. but the crop is still in pretty poor condition all things considered. We also have demand uncertainties weighing on the markets.

Outside of the war, there are plenty of factors will the potential to support the wheat market going forward. For starters here in the U.S. one could look at the drier forecasts and brutally cold temps in areas not covered with snow. We have obvious concerns globally with wheat crops, and it is also looking like we are seeing improved exports.

Overall, I think we have many factors here that could lead us to higher prices. Now I'm not saying that is going happen tomorrow, the next, or even next week. But I think all these factors will combine to help support prices going into the new year.

Chicago March-22 (6 month)

KC March-22 (6 month)

MPLS March-22 (6 month)

Fertilizer Prices & Outlook

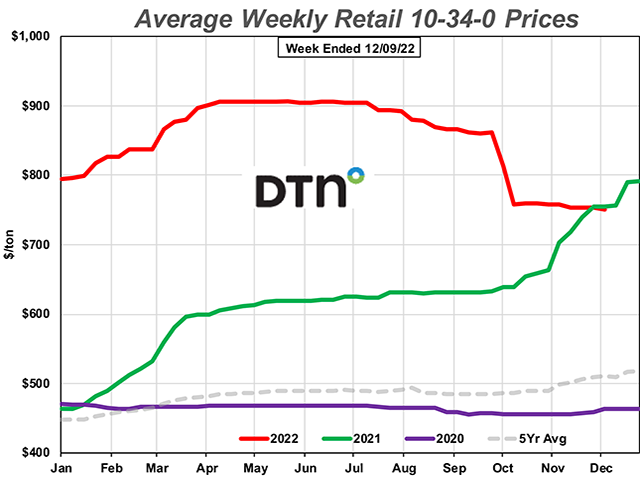

December of 2022 has seen 7 of the 8 major fertilizers see slightly lower prices this month compared to last.

Urea and 10-34-0 fertilizer prices fall below last year's levels for the first time this year. As you can observe from the graph below (via DTN) you can see prices are still far higher than that of 2020 and the 5 year average with all the inflation and economy concerns. But comparatively we have seen a good correction downwards in prices the last few months.

All of this info comes from DTN, you can read the full article here

These 7 fertilizers have seen prices declines

DAP had an average price of $920/ton

MAP average price was $950/ton

Potash $819/ton

Urea $784/ton

10-34-0 was $751/ton

Anhydrous $1,415/ton

UAN28 $581 a ton

Now the outlier fertilizer that was actually more expensive was;

UAN32 which came in slightly more expensive at $681/ton

In the article, it touched on a CoBank report that goes over the the forces that will shape the U.S. rural economy in 2023, which analyzes outlook for agriculture going into the new year.

CoBank said that their top challenge was the lower forecasted farm income. This forecast is likely due to farm income hitting a new record the past two years. CoBank thinks we may see a change in this solely due to rising production costs and the higher interest rates.

In the CoBank report they also touched over fertilizer outlook for next year. They expect prices to remain relatively high at least through out the first part of the year, as cooperatives will not only be absorbing high barge and rail cost, but will also be competing with the export markets for limited supply of nutrients.

The majority of fertilizers are still more expensive than that of last year, but two are now actually cheaper. Those being 10-34-0 which is now 1% cheaper than that of last year, while urea is 12% less expensive.

China & Lockdowns

China has been battling covid since the pandemic ever emerged. While countries such as the U.S. has almost forgotten the virus was the talk of the world not too long ago, China is still being majorly impacted.

We know we saw China ease off their covid restrictions which has given optimism for demand int he markets. But recent reports are saying that even though they eased restrictions, the streets of many cities are completely empty as people do not want to come in contact with the virus.

According to Financial Times, China is also reporting massive shortages in their medicine. This doesn't just include medicine for covid but medicine for the common cold.

Wright on the Markets made a good point of this whole situation and this situation brings risk to the bean and crude markets.

Wright on the Markets said; "Whether China has a formal lockdown or not, widespread sickness could scare the bean and crude oil markets lower as a loss of economic activity could reduce demand for beanss to crush and oil to refine"

I would have to agree. This is a major risk for both the soybean market as well as crude oil. Even though their might not be "lockdowns", China is still seeing covid run rampant and this alone could cause some panic in the country and could lead to weaker demand and ultimately we could see soybeans and crude oil take a hit due to this. But we will have to see where China goes from here.

You can visit Wright on the Market here

Wish List for the Grains

Here were 10 bullish factors listed in yesterday’s Weekly Grain Newsletter. These are recaps, you can read the full list and entire newsletter here

Demand. As demand markets last longer than that of fear supply markets. Bulls would like to see Chinese demand increase.

U.S. Dollar to continue to trade lower. As this helps with demand and helps create a story for big money to get behind.

Weather scare in South America

Bullish USDA report

Funds or Big Money to buy grains and oil seeds

Farmers to become price makers. We need farmers to supply less at times in the market, while being balanced with killing demand.

EPA hearings in January to be supportive for renewable diesel

Earnings calls from major companies in the renewable diesel game to stay intact with expansion of soybean crushing plants

Feds to say something that drives the markets

A Pink Swan Event

Bull Bullets

These were also included in yesterday’s Weekly Grain Newsletter

US Soybeans sales for export to China since September 1st the start of the marketing year are up 5% from a year ago. As are soybeans sales to all destinations = STRONG SOYBEAN DEMAND

World Wheat Production is pegged to lag World Wheat Demand for the 4th year in a row.

Fund wheat short position is largest since 2019

Hard Red Spring wheat carryout is projected at a 15 year low in the US.

Nearly 700 million bushels of US Soybean Crush Capacity is expected to come online in the next 2-3 years. If our exports and yield stay the same we could need an additional 14-15 million acres of beans.

Russia has over two times the whole USA Sunflower crop left in the field. Likely to stay in the field until Spring.

Make sure to give me a call at 605-295-3100 if you have sunflower offers or call Wade at 605-870-0091

China and Canada are having “girl” issues that could lead to more USA demand.

Other Markets

Crude oil up +1.26 to 75.70

Dow Jones essentially unchanged

Dollar Index down -0.088 to 104.245

Cotton down slightly -0.19 to 81.73

News

Despite easing covid restrictions in China, reports are that the city streets are empty with people trying to avoid contact and infection.

The Financial Times reported that is a shortage of almost all medicine in China. Not just for covid but for even the common cold.

Indian farmers increase wheat planting by 3%

Indonesia in making it mandatory for bio diesel blending to 35% starting the first of the year. This is in attempts to reduce fuel imports and high global energy prices.

Livestock

Live Cattle up +0.175 to 155.950

Feeder Cattle up +0.200 to 184.900

Live Cattle (6 Month)

Feeder Cattle (6 month)

In Case You Missed It..

Sunday's Weekly Newsletter - Full Version

Audio - Will Elevators Go Broke in 2023?

South America Weather

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service