MORE DOOM & GLOOM AS CORN BREAKS BELOW $4.00

WEEKLY WRAP

Prefer to Listen? Audio Version

Futures Prices Close

Overview

The sell off continues, as we saw corn closed below $4.00 for the first time since 2020 while soybeans post a new contract low.

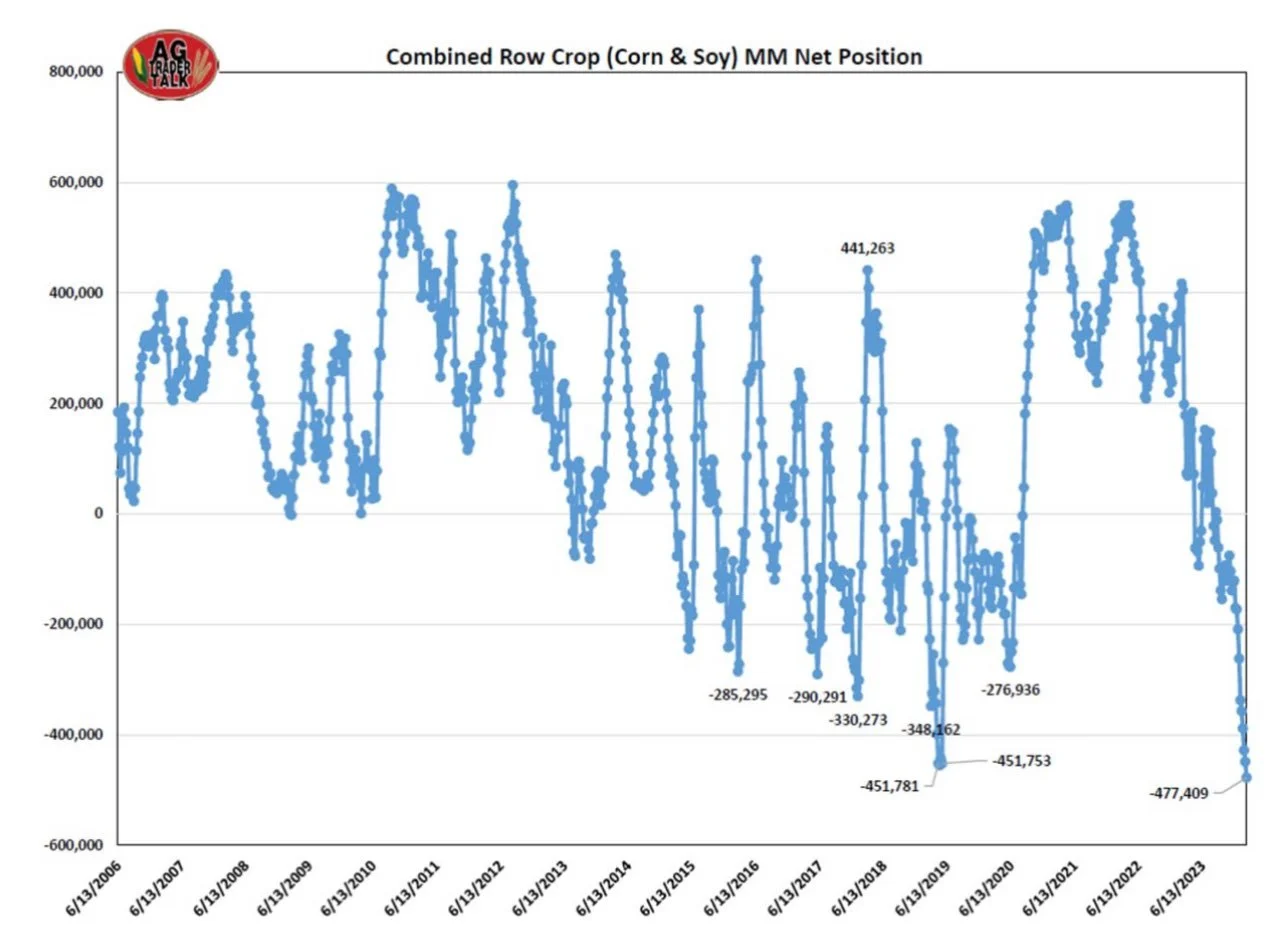

There isn’t any good news to help prices, which more so than often leads to more technical and fund selling. With the funds continuing to pile on to their record shorts.

Funds are now short around -340k corn, -130k soybeans, and -70k Chicago wheat.

Combined corn and soybeans shorts are the shortest ever. Surpassing 2019.

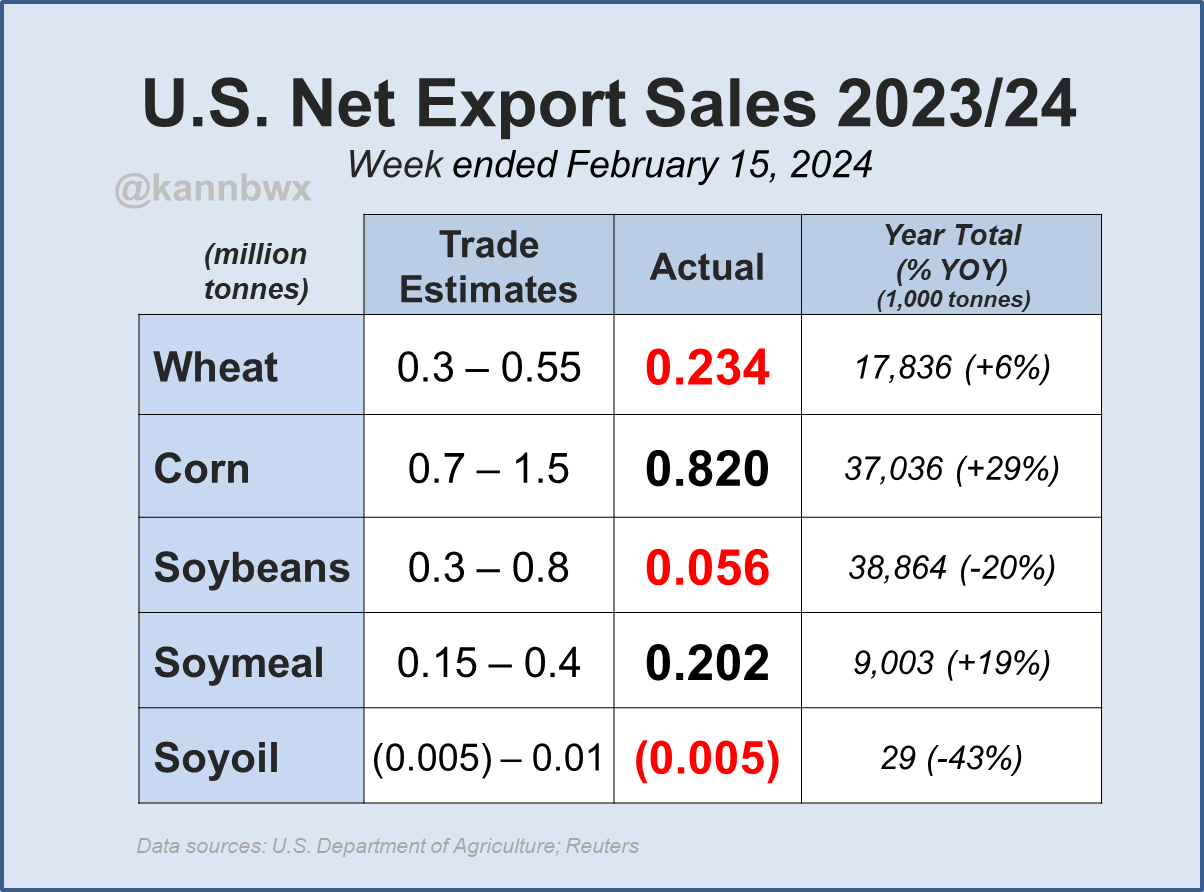

We had terrible soybean exports. Some of the worst in recent memory. They came in at 56k while the estimates were 300k to 800k. Exports were light all around. Chart is from Karen Braun.

We have mostly favorable weather in South America for the next two weeks. With their crops stabilizing and Argentina being far better off than last year.

We have the sanctions in Russia, but this isn’t having much of an effect as the market doesn’t seem to concerned.

Biden approved the sale of ethanol year round, but just like everything else that news disappointed as it will not start until 2025. Most were hoping it would start this year.

Then today we also had March options expiration, which added even more selling pressure.

From Heartland Farm Partners:

"First notice day for March futures is next week. This could signal the end of forced liquidation we have seen recently and could be the beginning of fund short-covering next week."

Do we have anything at all to provide a glimmer of hope?

Well, there is only 2 things that are remotely friendly in our markets..

The first is the funds. Holding record shorts. They will "eventually" have to cover.

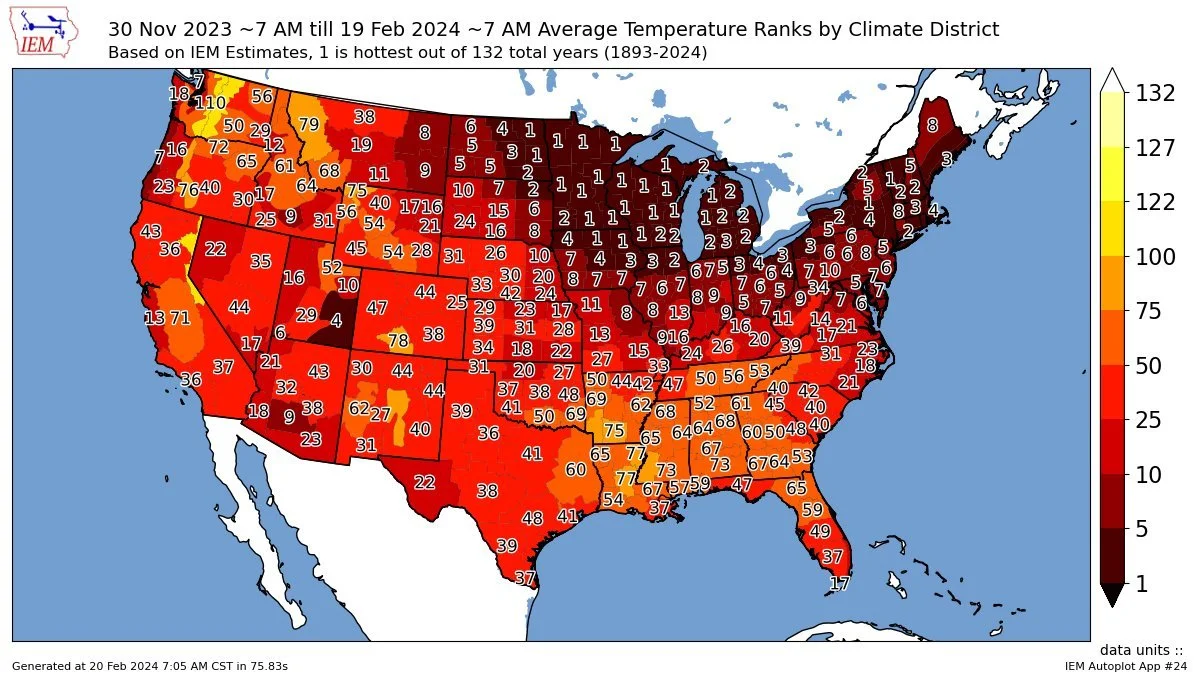

The second is US weather. We have had an abmorally warm winter with little snowfall.

Does this matter right now? No. Will this send prices higher right now? No.

It is far too early to be making any bold predictions, but looking long term, it has the "potential" to be a very positive factor.

So what does this look short term?

We will probably early planting due to the lack of frozen ground and rain will absorb better.

My opinion there is to get started early on your planting, as a few week head start could help add to your bushels if we do get a drought.

So what does this "potential" drought look like?

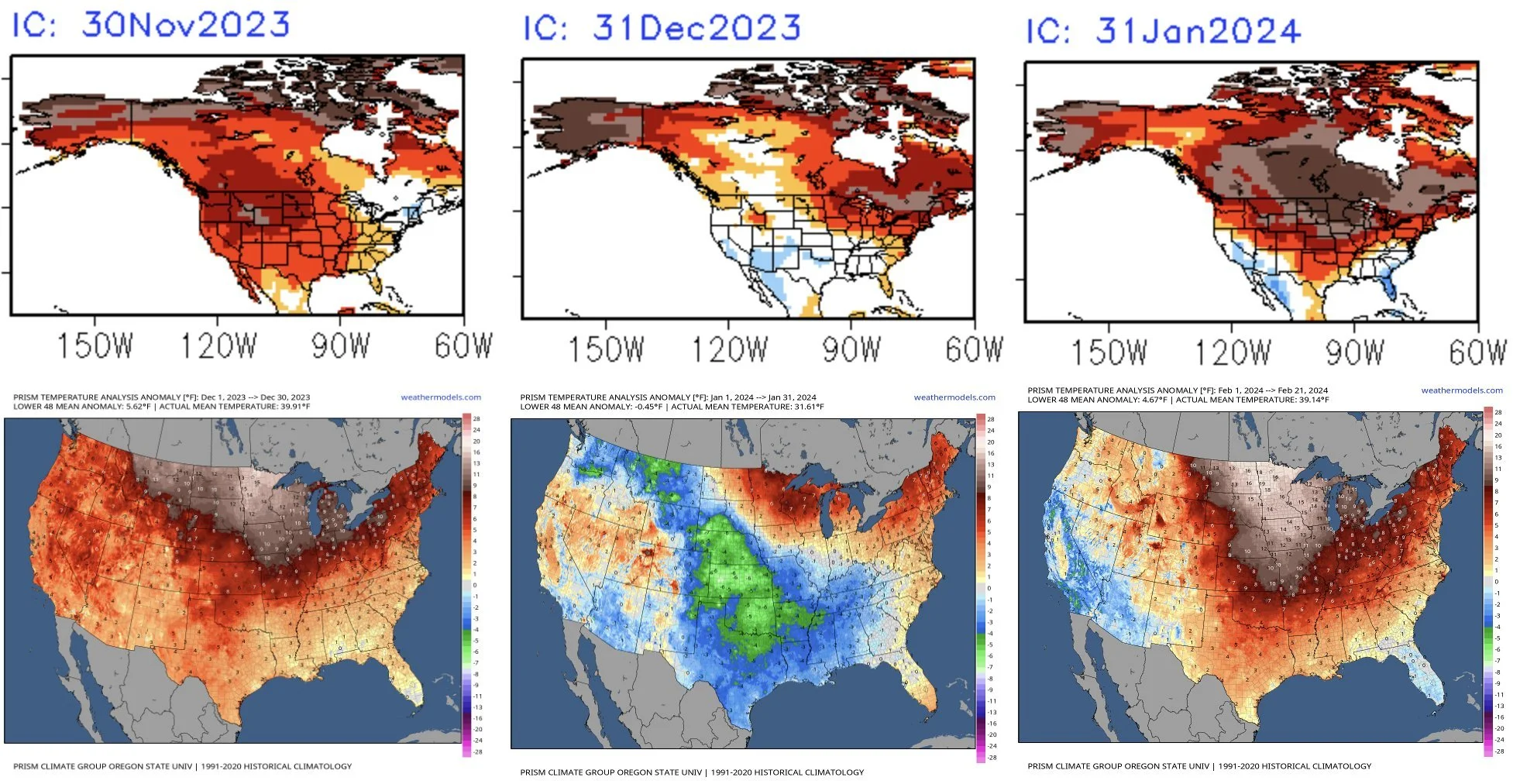

Here is a breakdown of the warmest winter on record.

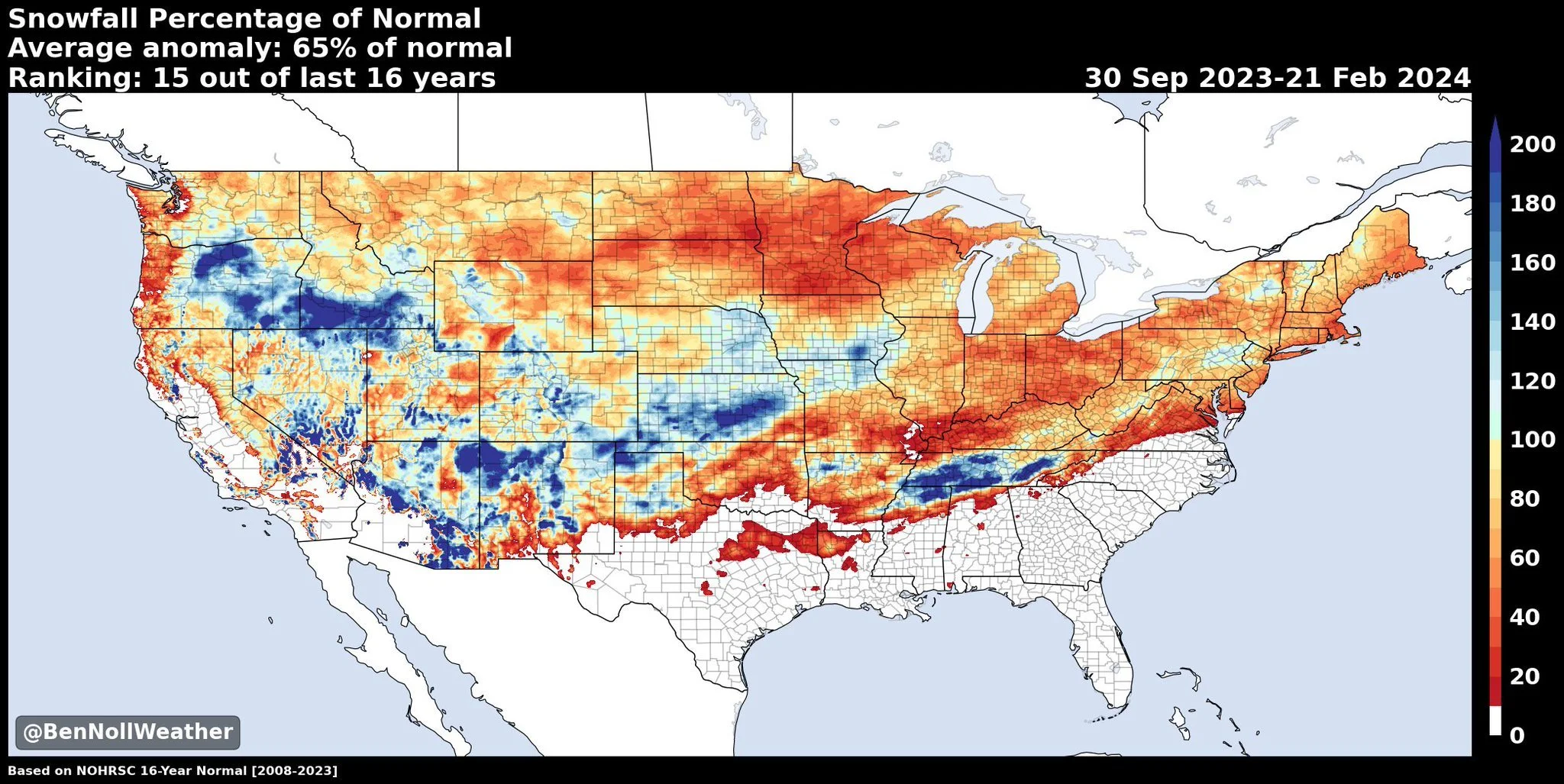

But that is not the biggest concern. The biggest concern is the lack of snow.

We are having the least snowiest winter since 2011-12.

This is even more concerning given that we already went into winter fairly dry.

The extended forecasts are also calling for "drought-like" expectations.

How you can never fully trust the weather man. But what if these forecasts hold true?

Take a look at the CFS monthly forecast from BAM Weather.

It completely nailed spot on the entire winter.

This could be the catalyst we need to finally give these markets some pain relief.

It will not happen very soon if this is the catalyst, but could very well cause our markets to rally come spring.

We "almost always" get a weather scare rally even if the scare doesn’t come to fruition at all. The scare is usually enough to provide at the very least a pricing opportunity in spring or summer.

The only question is, how low can we go before this happens?………

The rest of this is subscriber only. Subscribe to keep reading & get every exclusive update. Comes with 1 on 1 marketing planning & tailored recommendations.

IN REST OF TODAYS UPDATE

What is our risk in to seeing corn closer to $3?

What are the ways we could see $5 corn again?

How similar is Brazil 2016 to 2024?

If you need to grain here what to do

Corn is the most oversold since 2014

Soybeans don’t spend much time in $11

Canada drought

Cattle recommendation

KEEP READING FOR FREE

Try our daily updates completely free

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

2/22/24

HAVING A PLAN & DEFINING RISK

2/21/24

LOWER LOWS & DROUGHT TALK

2/20/24

HOPE ISN’T A MARKETING PLAN BUT HISTORY REPEATS ITSELF

2/16/24

HAVE ENOUGH OF YOUR NEIGHBORS THROWN IN THE TOWEL SO WE CAN BOTTOM?

2/15/24

BASIS CONTRACTS & USDA OUTLOOK

Read More

2/14/24

SELL OFF AHEAD OF USDA OUTLOOK: STRATEGIES TO CONSIDER

2/13/24

LA NINA, FUNDS, & USDA OUTLOOK FORUM

2/12/24

WHAT TYPE OF GARBAGE USDA OUTLOOK REPORT IS ALREADY PRICED IN?

2/9/24

RECORD SHORT FUNDS, SOUTH AMERICA, & MANAGING RISK

2/8/24

CONAB VERY FRIENDLY. USDA NOT. FULL BREAKDOWN

2/7/24

NEW LOWS IN CORN & USDA PREVIEW

2/6/24

WHAT IS EXPECTED FROM USDA & WAYS TO GET COMFORTABLE

2/5/24

STILL NO CLEAR DIRECTIONS IN THE MARKETS

2/2/24

NEW BEAN LOWS.. HOW LOW CAN CORN GO?

2/1/24

NO CONFIRMATION OF HIGHER OR LOWER PRICES IN GRAINS

1/31/24

HOW SHOULD YOU BE SETTING YOUR TARGETS?

1/30/24

OUTSIDE UP DAY IN ALL THE GRAINS

1/29/24