BEANS CONTINUE THEIR RALLY

Overview

Grains mixed as beans continue their rally and wheat continues to fall lower. With little fundamental change or news over the weekend, as everyone prepares for Wednesday's USDA report, we also have the CONAB numbers out Thursday.

Just a heads up, there will be no update or audio tomorrow as we will be attending the funeral of Jeremey's father and my grandfather Tom Frost.

Yesterday's Weekly Grain Newsletter

What To Do If You Panic Sold - Read

Enjoy Our Stuff?

Get 50% off yearly & monthly or try 30-days for $1. All updates and audio sent via text message and email.

Today's Main Takeaways

Corn

To end the week last week, we saw corn rally amid declining crop conditions in Argentina, but the trade is somewhat ignoring the Argentina drought here today in the corn market. As corn was stuck in the middle of higher beans and lower wheat, closing down a few cents.

Crude oil added support today, up over $2 off its lows, trading back over $80.

We had two flash sales this morning. With 110k metric tons to Japan, and 182k metric tons to unknown. The last flash sale reported was February 17th, so its been a while. Was this the first of many to come the next few weeks?

Will have to see what the funds do tomorrow ahead of the USDA report, but I wouldn’t be surprised to see prices firm tomorrow due to expectations of large production cuts. The same goes for beans.

The trade estimates for Wednesday;

U.S. Carryout:

1.308 Billion Bushels

An increase from 1.267 in February.

World Carryout:

293.17 MMT

Smaller than 295.30 in February.

Brazil Production:

124.86 MMT

Tad lower than 125 in February.

Argentina Production:

43.40 MMT

Far lower than 47 in February.

So looking at the report, we will probably see the USDA reduce our U.S. corn exports again. The biggest question is just how big of a reduction to Argentina production are they willing to make?

It's obvious this number needs to be a lot lower than what they currently have. Even though a vast majority of other analysts think the Argentina numbers should be even lower than what the estimates have, we probably won’t see the USDA make any super major changes and push the number below 40 just yet, as they typically like to slow-play these things.

Brazil estimates on the other hand aren’t expecting to see much change come Wednesday. Nonetheless, the production is still being debated. With the ongoing delays, some are saying the second crop acres that are going in late could put a dent in yield. While some are saying the crop is going to be bigger. Either way we won’t see any major changes in the report.

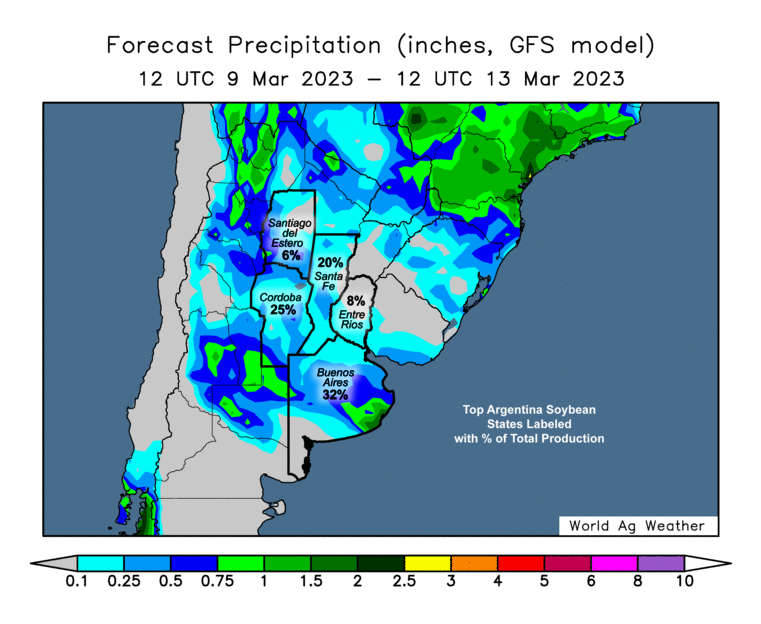

Argentina weather forecasts for this week look like they are going to be heating up again, with hotter temps and drier conditions through Wednesday, but there is the chance for some scattered rains later in the week.

In the U.S. the big discussion points are demand and new crop planted acres. We won't know a whole lot more until we get the Quarterly Grain Stocks & Prospective Plantings Report at the end of March. Early reports had a little over 15 billion bushels compared to 13.73 billion harvest last year for total new crop production.

Outside of the report, we could just see more choppy trade here short term until we get a clearer picture around things such as U.S. new crop production. The war headlines are also something we always have to watch out for. Remaining factors short term here will be Chinese demand and South American weather.

Corn May-23

Crude Oil

Crude oil over $2 off its lows today. Did we finally break out of our 9-month downtrend?

Crude April-23

Soybeans

Beans higher again today, posting their 4th day of gains on this rally. As traders prepare for production cuts to Argentina in the USDA report.

Trade Estimates for Wednesday;

U.S. Carryout:

0.220 Billion Bushels

Slightly lower than 0.225 in February.

World Carryout:

100.28 MMT

Lower than 102.03 in February.

Brazil Production

152.90 MMT

A hair lower than 153 in February.

Argentina Production

36.55 MMT

Well below 41 in February.

Argentina production is the number everyone is watching Wednesday. The USDA currently has 45.5 million metric tons. The estimates are down to 41 million, but there is a ton of talk that this number needs to be below 35 with some throwing out sub-30 numbers. Will we see the USDA take that big of cut down to the 30-32 range, probably not, even though I ultimately think we could get there eventually. Being realistic, we probably see the USDA take another -5 million or so off their estimate, which was be around 40. Bulls would be happy with a number closer to 35.

Similar to corn, Brazil estimates aren’t expected to see much change even though there is some debate there that we will need to see the USDA walk back those numbers a bit as well. But, even if we did see a large cut to their current 153 estimate, that is still well above last years 129 million.

With China assisting Russia in war, there is some debate surrounding Chinese demand and the overall relationship between us and China. China is our number one buyer of soybeans so sure there is some reason for bulls to be a tad nervous, but don’t think this will hurt demand nor our relationship as they will have to continue to buy at some point.

Looking at the U.S., new crop production isn't as hot of a debating point as it is corn. Most think we see U.S. export demand increase with crush numbers being a mixed bag. The current acre forecast is at 87.5 million, which is on par with last years 87.45.

Going forward this week, the USDA report will give us a good look at where they stand on South American numbers. How big of a cut do we see to Argentina, and do we get any surprises. I don’t see us getting an overly bearish report, but if numbers aren’t trimmed as much as bulls would like we could see some selling due to lack of bullish news, as we have to wonder just know much of Argentina's cuts are factored in already.

Beans continue to push higher, looking to test our recent highs. The $15.50 level still remains very stiff resistance. As mentioned in a few updates the last couple weeks, if we get a break past that level there is a huge gap to the upside.

Soybeans May-23

Soymeal

Meal continues to climb, breaking well past resistance making new highs. Where is our ceiling?

Soymeal May-23

Wheat

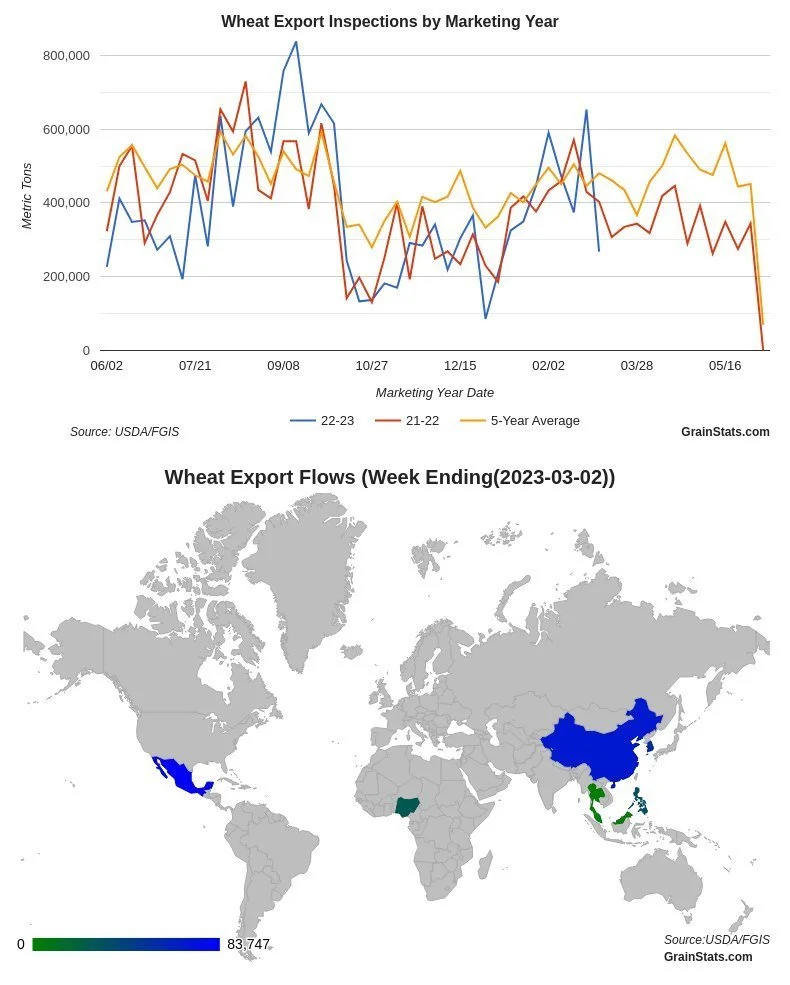

Wheat continues to make new lows, as May-23 makes its lowest low since September 2021. Perhaps we could see some support from the WASDE report Wednesday.

Cheap Russian wheat offers pressuring the global market including the EU and U.S. market, additional pressure coming from optimism that the Black Sea agreement will be extended.

The war is now over a year old and continues to lurk but hasn’t made much noise as of late. The Black Sea deal expires in less than 2-weeks. Russia stated they are trying to fund an end to sanctions against their country in exchange for renewing the deal. At the same time, Turkey and others are really pushing for a deal to be made. Ultimately I think we do see an agreement made, but there is also that far chance one doesn’t. We also still have the chance over the next week or two for Putin to cause some headlines, but we just haven’t seen that yet.

Along with the war and lurking agreement extension, traders continue to debate the actual damage that has been done in Ukraine and what changes its made to production.

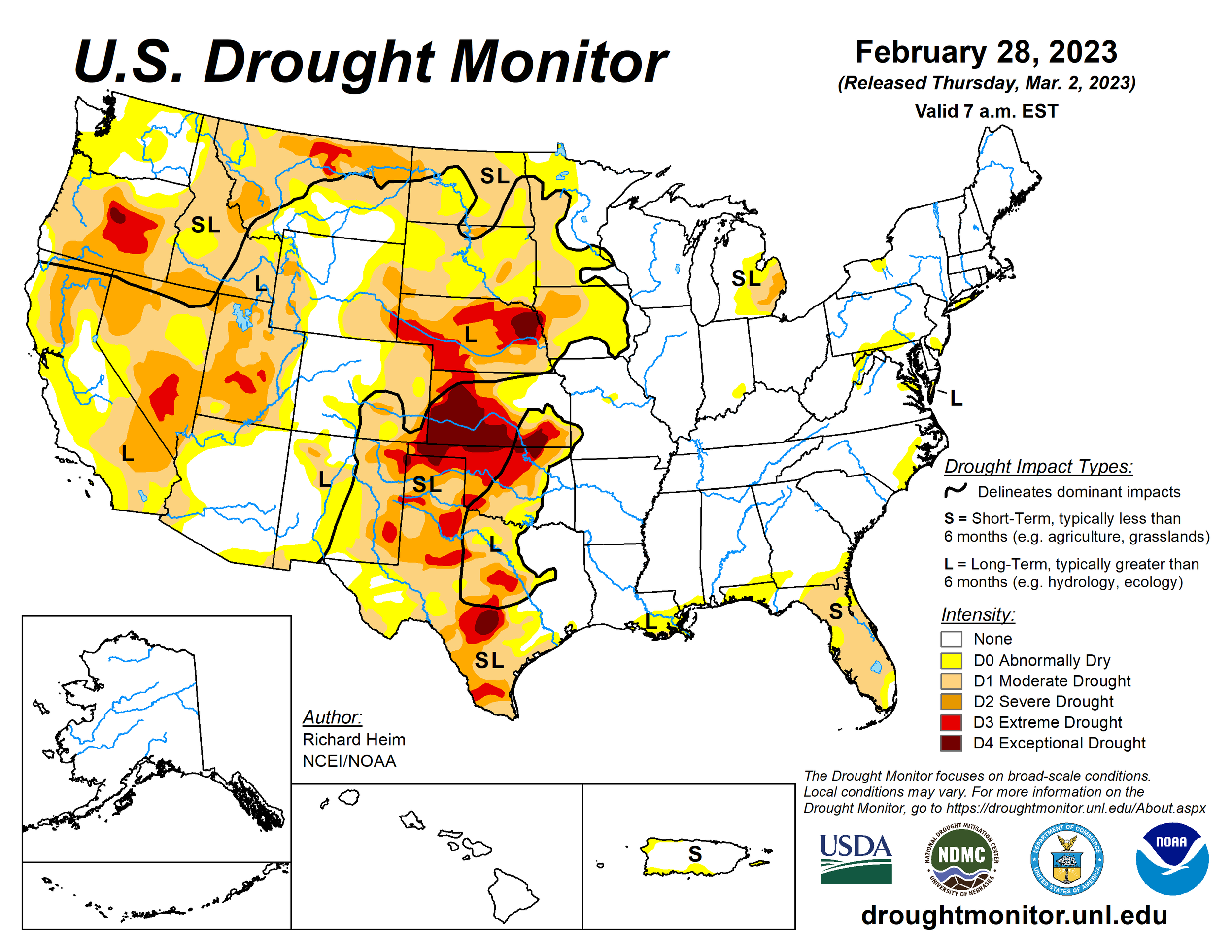

As of recent, the weather in the U.S. has added pressure to wheat, as we've seen improved moisture across the plains. But there is still a ton of areas that have continue to struggle and suffer from drought. States like Texas, Nebraska, and Kansas all saw their crop conditions last week come in at just 19% rated good to excellent. With Kansas showing a whopping 51% rated poor to very poor.

Going forward, bulls would like to see the funds pick up some interest in buying wheat. War is a big wild card and U.S. production will continue to be debated. We also have looming recession fears.

Short term we might see some more downside as we just don’t have many bullish catalysts to drive us higher at the moment. But I ultimately think we see another bull run into spring. We have plenty of time for additional U.S. and global weather concerns and the war doesn’t look like it's going anywhere. War, weather, and wealth will continue to be the main factors.

As for the USDA report, there isn't expected to be any huge changes in the wheat market with carryout expected to come in slightly larger. But taking a look at the April report, we will once again be reminded just how poor the U.S. winter wheat crop is. As 50% of U.S. winter wheat area is still in a drought.

USDA Estimates

World Carryout:

269.44 million metric tons

Tad higher than 269.34 in February.

U.S. Carryout:

0.573 billion bushels

Slight increase from 0.568 in February.

Chicago March-23

KC March-23

MPLS March-23

Hedging fuel and fertilizer with crude oil and natural gas call options.

From Wright on the Market;

A commodity can be hedged by using futures or options. A hedge in the futures will take more cash and could take a lot more cash to maintain the position whereas the option cash flow exposure is determined before an option is purchased. Generally, a futures hedge will make more or lose more than an option hedge. If you do not understand why that is so, you need to stick to options.

The futures market provides opportunities to trade Brent crude oil, West Texas Intermediate crude oil (WTI), ULSD, heating oil, natural gas, ethanol and gasoline. ULSD and ethanol have light volume (not many contracts traded), Brent crude is European economics, and we are not familiar with the ins-and-outs of heating oil and gasoline. Since Roger thinks cash diesel fuel prices and fertilizer will generally be steady to lower in the coming months, he does not recommend forward pricing either one and delaying purchase as long as possible.

But Roger could be wrong, so he does recommend you do some hedging. Roger does expect natural gas to be in an uptrend all year so contract the cash price with your supplier if you use natural gas. WTI crude is expected to be in a very mild uptrend into June at the least.

Alan Bonifas, a very successful technical long-term analyst, said (and we reported to you at the time) the low in the energy complex was two weeks ago. Therefore, if you want to lock-in diesel or fertilizer, use either WTI or natural gas futures or call options.

_____

For those of you who have already bought diesel or fertilizer, here is your opportunity to get some of that money back.

The general concept is this: You grow the crops you grow because you expect they will be the most profitable. When you want to trade options or futures as a speculator or as a hedger, you should also trade the one or two commodities that you expect will make you the most money.

Energy costs are a very high percentage of the cost of all fertilizers and (obviously) refined fuels. We recommend you consider hedging both with WTI and natural gas. Hedging energy, even with options, takes a lot of money, but then buying 10,000 gallons of diesel fuel or 100 tons of fertilizer takes a lot of money.

Two weeks ago, a full service client bought a $76.50 (its strike price) April WTI crude call option for $3010 (its premium) to hedge diesel fuel. He uses 10,000 gallons of diesel a year. A WTI crude option is 1000 barrels and a barrel of crude is 42 gallons.

This past Friday, he sold that April $76.50 (its strike price) WTI call option for $3,950 (its premium) because crude oil futures were near the top of the sideways trading range and April options expire March 16th. The goal was to make $1000 to $1500. He made about $900 and now will wait for crude oil to return to the bottom of the trading range and buy a May or June WTI crude call option for about $3000 and plan to make $1000 to $1500 with that option.

What did he accomplish? $900 spread over 10,000 gallons of diesel = 9¢ a gallon (or $9 a ton on 100 tons of fertilizer). It is reasonable to expect he can do that 5 to 8 more times this year and he will earn 60 to 80¢ selective (on and off) hedge profit to offset his cash diesel cost (or $60 to $80 per ton on fertilizer). Even if crude oil does not go high this year, the sideways trading pattern will earn him a hedge profit. If he loses his option premium, it will be because crude oil price dropped and did not come back. In that case, he should be able to buy his diesel and fertilizer at a price lower than it is now. That is the way a hedge works. You make (or lose) $ in the cash market while you lose (or make) $ in the futures market.

Here is the link for the May WTI Crude futures daily chart:

https://www.barchart.com/futures/quotes/CLk23/interactive-chart

Another full service client bought an October 2023 $2.60 natural gas call option. She was looking for the low stress, long uptrend to hedge diesel and fertilizer. She paid $7,460 for that call option, which will expire in September. She is going to do her best to sell that call when the futures are near the top over the next six months. On Friday (March 3rd), that $2.60 October call was worth (its premium) $11,869.

Here is the link for the October NG futures daily chart:

https://www.barchart.com/futures/quotes/NGv23/interactive-chart

Both of these clients could have bought a less costly (higher strike price) call option, but they would have less profit right now. They both could have bought a more expensive call option (lower strike price) and had more profit right now. One has to weigh the profit potential of a call versus the risk of losing its premium. Of course, your cash flow plays a role in that decision.

Thanks to Lynn for asking us to be more specific on the natural gas call option strategy.

Here is the link for our education about options:

https://www.wrightonthemarket.com/post/all-about-options-on-futures-contracts-part-1

Visit Wright on the Markets Website Here

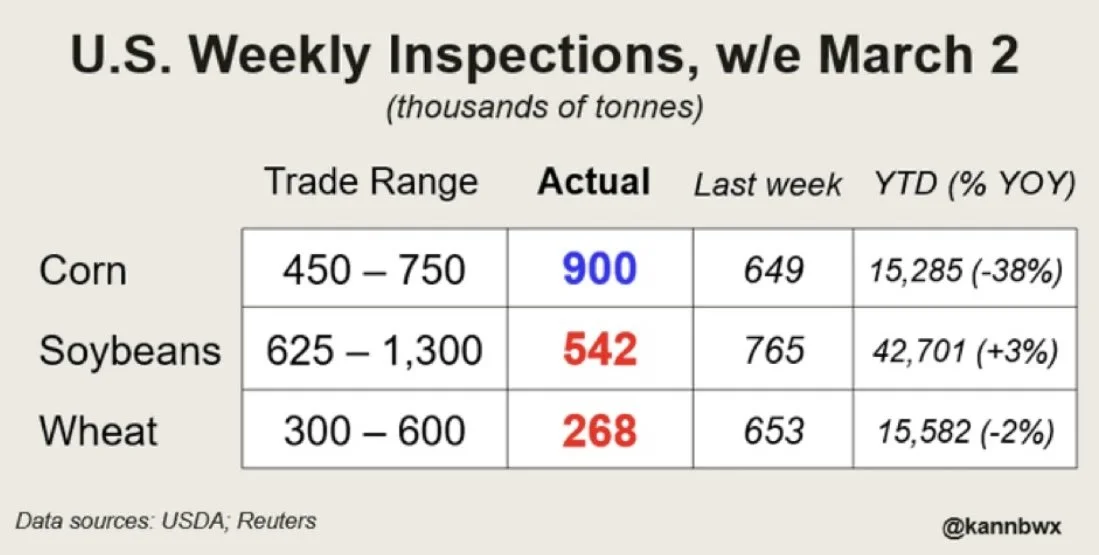

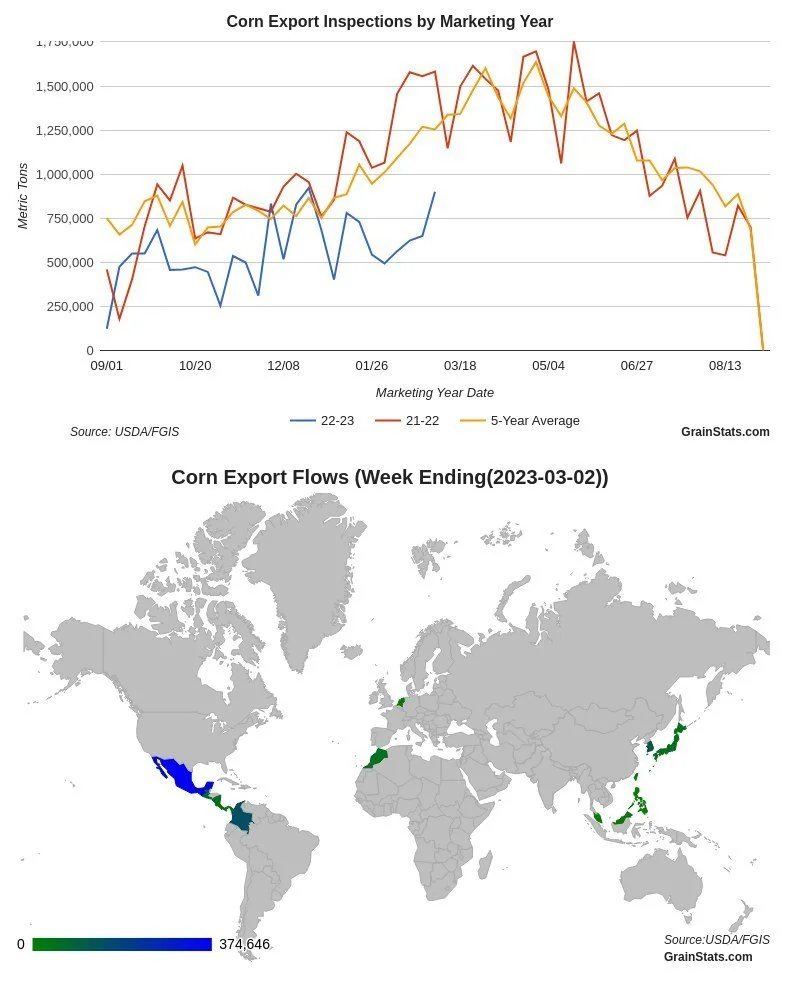

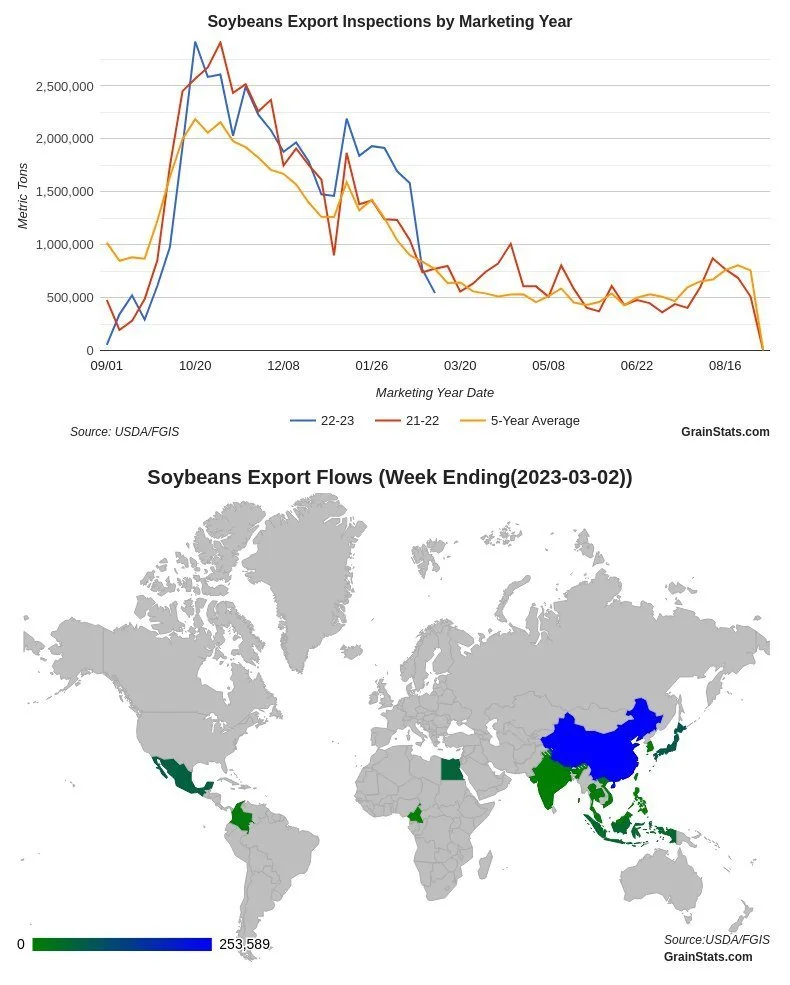

Export Inspections

U.S. corn export inspections have a great week, one of the best volumes of the year and well above expectations. Soybeans and wheat coming in below expectations. Second straight week of weaker bean inspections.

Chart Credit to Karen Braun

Thanks to GrainStats for charts

Highlights & News

Commitment of traders continues to be delayed, latest update from February 7th had funds still holding a sizeable large position in both corn and beans, while being very short wheat. One could assume they have exited a fairly decent amount of their corn position since.

World food prices fall for the 11th months straight.

Brazil's bean harvest is 43% complete.

India's wheat output is being harmed due to their heatwave.

The U.S. is preparing military aid for Ukraine worth $400.

Livestock

Live Cattle up +0.675 to 166.100

Feeder Cattle up +2.575 to 198.600

Feeder Cattle

Live Cattle

Check Out Past Updates & Audio

Here are a few of our past updates in case you missed them

3/5/23 - Weekly Grain Newsletter

What To Do If You Panic Sold Last Week

3/3/23 - Market Update

Corn & Beans Rally Off Lows

3/2/23 - Audio Commentary

Are The Lows In?

3/1/23 - Audio Commentary

Is The Panic Selling Over?

2/28/23 - Audio Commentary

Now Is Not The Time To Panic Sell

2/26/23 - Weekly Grain Newsletter

Is China Trying to Steal Grain Again?

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service