BEANS RALLY DESPITE SOUTH AMERICA CONCERNS

Overview

Grains higher across the board with soybeans leading the way despite the recent rains in Argentina and concerns over massive Brazilian crop. Bulls will be looking for increased Chinese demand for U.S. exports as they come back from their holiday.

In case you missed it, read yesterday's Weekly Grain Newsletter:

What Does ADM Think About Chinese Demand - Read Here

Today's Main Takeaways

Corn

Corn slightly higher today challenging it’s recent highs

Corn found some support from optimism that we see some Chinese export demand as they come off their holiday and easing of covid restrictions. But bulls were slightly disappointed that we didn’t see any sales, as most thought we would as they come back from their new year holiday.

The bigger question however is when they do come back into the market for corn, are they going to be buyers of U.S. corn or will they look to Ukraine and Brazil. As there have been some recent headlines of China looking to import corn from Brazil. Overall Chinese demand is really just a wild card at this point.

Another thing bears are looking at is the possibility that we see more corn acres planted here in the U.S. if the weather allows to do so.

Buenos Aries Grain Exchange reported corn planting at 94% complete, and have Argentina products at 44.5 million metric tons. Which is lower than last year's 52 million.

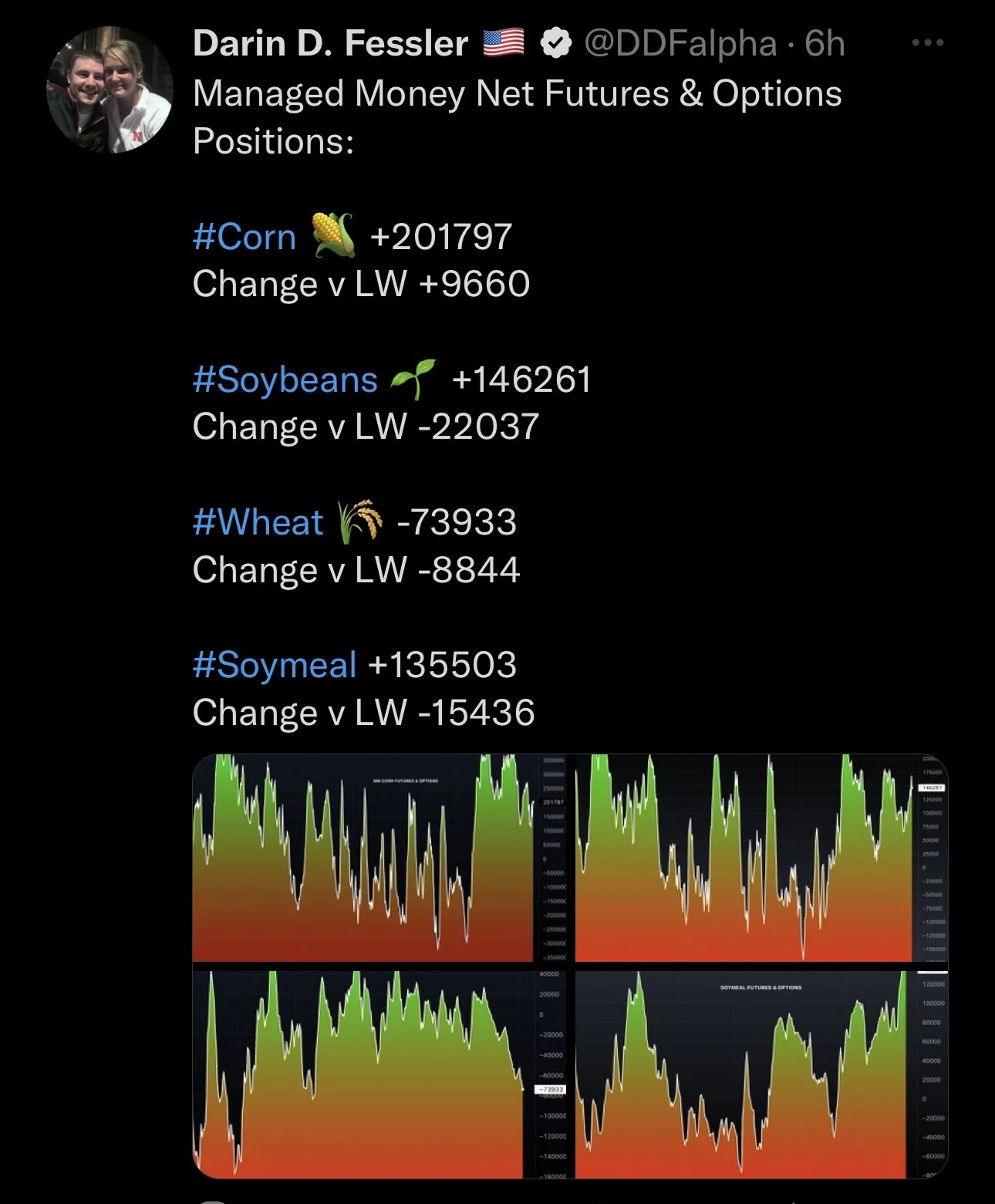

Funds are still heavily long corn, as they added onto the position last week. Being the only of the grains that saw an increase in fund buying last week.

South American weather & Brazil's second crop corn, Chinese appetite, and funds remain the largest factors in the corn market.

Corn retested its recent highs and rejecteds off the trendline. Will have to wait and see if we can get a break to the upside and test $7.

Corn March-23

Soybeans

Soybeans opened the morning very strong and continued higher into this afternoon's close, rallying despite the recent rains in Argentina and concerns with Brazil's large crop. March beans rallied almost +26 cents.

One thing that may have contributed to the higher prices today is that it might be too too dry in southern Brazil and too wet in northern Brazil.

Bulls are also looking at the harvest delays as Brazil is a week or so behind pace. Currently 5% of Brazil's harvest is complete vs 10% last year due to the wet weather. If they continue to fall behind this would be support prices.

We also have Argentina who has gotten some pretty decent rains, but the next ten days or so are are actually pretty dry which has added support to the bean and meal market today on this rally.

Even with the problems Argentina has faced, the largest concern is still the massive crop Brazil is expected to have. I'm just not sure we can continue to sustain these rallies with the monster crop and improved conditions in Argentina, so I’m slightly nervous there. But despite the recent rains in Argentina, soybeans continue to push higher and remain in an uptrend.

Ultimately the main factor that will continue to determine the bean market is South American weather. Will we continue to see harvest delays in Brazil? Will Argentina continue to get rain, and if so how much of an impact does this make to the already damaged crop?

One thing giving bulls some hope in the bean market is Chinese buying, as there is concerns with late harvest in Brazil and of course the problems in Argentina, which could lead to them looking to the U.S.. China also made announcements that they are trying to fuel a rebound in their economy with a flood of spending by Chinese consumers and boosting consumption. Which is ultimately positive for demand.

So the big question is whether we see them increase their their appetite for U.S. exports, or if they hold off until Brazil’s crop is ready.

Funds were sellers across the soybean complex last week, being sellers of soybeans, meal, and soy oil.

Main factors are more of the same. South American weather being the biggest, followed by Chinese appetite and demand, and funds.

Taking a look at the charts, soybeans remain in a clear uptrend from October. On last week's sell off we saw a bounce right at support where we needed to. Will have to see if we continue to trade in this uptrend and can test our highs.

Soybeans March-23

Soymeal

The meal market has also added a ton of strength on today’s rally. As meal bounced off its 20-day moving average last week and started off this week strong hitting a fresh 10-month high. If meal continues to see strength this would be supportive in seeing higher bean prices, but again I'm slightly hesitant to think meal continues this bull run but has a chance if Argentina continues to struggle.

Wheat

Wheat slightly higher again today, looking to break out of its down trend from October.

One thing adding support was Ukraine wheat exports coming in down -44%.

Everyone will be keeping an eye out for the monthly crop conditions updates for here in the U.S. as we will get to see how much of an impact the rains and snow made on the winter wheat crop.

Funds are still short all classes of wheat and added onto those short positions last week. I think its only a matter of time before we see this narrative shift and see funds start to exit these shorts.

Prices are just now beginning to move off their recent lows, and I don’t think anyone is looking to sell wheat here with all the factors at play. The war headlines are still evident, there is long-term weather concerns in the U.S., and the funds are already extremely short wheat. I think we are just getting started and continue to see wheat move higher in the coming weeks.

From a technical standpoint we might have broke our downtrend from October. But most would like to see $8 to fully say this downtrend is completely over, which I think we see happen.

Chicago March-23

KC March-23

MPLS March-23

Ukraine Corn Acres & Trading in a Sideways Market

This is a write up from Jon Scheve over at Wright on the Market, where he discusses the impact of fewer corn acres in Ukraine who is the 4th largest exporter in the world. Later in the write up he also goes over a great trading strategy to capitalize on a sideways market.

He wrote;

This week’s announcement that NATO forces will be supplying Ukraine with tanks indicates hostilities may be heating up. This should give the market some additional risk to evaluate as it is now uncertain how many corn acres Ukraine will get planted this upcoming spring.

The Ukraine Grain Association recently suggested that a reduction in plantings was likely due to the war. If Ukraine’s weather conditions are normal, they estimate only 18 million metric tons (MMT) would be produced, and if weather is poor, it would be closer to 12 MMT. These numbers are much lower than the 22 MMT produced last year and the 40 MMT produced the year before the war started. With Ukraine needing about 6 MMT for domestic feed use each year, the fourth largest corn exporter in the world may have extremely limited supply next year.

With this massive corn production decrease, Brazil’s second corn crop being planted next month will need to hit current estimates. Otherwise, rationing will be needed throughout the rest of the world.

Another concern is that Brazil is expected to have a record bean crop. If they have a large corn crop too, it will put a lot of pressure on Brazil’s export supply chain. Therefore, any logistics issue could mean the world will be searching for anywhere between 160 million to 400 million bushels of corn. Most of that would likely need to be supplied by the US later in the year. And with tight stocks already, it may be a challenge for the US to cover all of Ukraine and any potential Brazil supply shortages.

Market Action:

On November 21st when March corn was trading at $6.63, I suspected corn prices would likely be range bound or slightly higher after the new year. Therefore, I placed a trade to maximize some profit potential if that happened. On 10% of my 2022 production, I sold a $6.90 February straddle (i.e., sold both the $6.90 February put and the $6.90 February call which are based upon March futures). This allowed me to collect a net positive value of 50 cents.

What Does This Mean? If the value of March corn on January 27th is:

Above $7.40 – I will sell futures at $6.90, but I keep all the 50 cents collected on the trade, so it would be like selling $7.40 futures.

Below $6.50 – I give back all the 50 cents collected from the trade, and I start to lose on this trade penny for penny below this value.

Between $6.50 and $7.40 – I keep some of the 50-cent profit I collected when I placed the trade. The closer the price is to $6.90, the more I keep.

Why Did You Make This Trade? I was comfortable with all potential outcomes.

Prices go up - I would be happy selling 10% of my crop at $7.40.

Prices go down - Based on the previous several months, it seemed unlikely corn would trade to the lower end of this range. Plus, since it was only 10% of my production and I had already collected profit on this type of trade previously, the downside risk seemed limited.

Prices stay sideways - I would collect additional profits to add to later sales, which seemed the most likely scenario.

What Happened?

On January 18th, over a week before the options expired, corn was $6.80. I bought back the $6.90 puts and calls for nearly 15 cents, because I was worried that corn could drop further as we approached the expiration date. After commissions, I made about 35 cents of profit that I can apply to my final prices (i.e., the 50 cents originally collected less the 15 cents to buy back both options).

Bottomline:

This is the third straddle I collected a profit on in three months. Combined I have made a $1.25 per bushel profit on 10% of my production, while the market has stayed relatively sideways. These trade examples illustrate how selling straddles in sideways markets can be a great way to increase profits. However, they need to be done carefully. Farmers need to fully understand and be willing to accept all potential final outcomes if prices go up, down or sideways before placing these types of trades.

Check out Wright on the Market Here

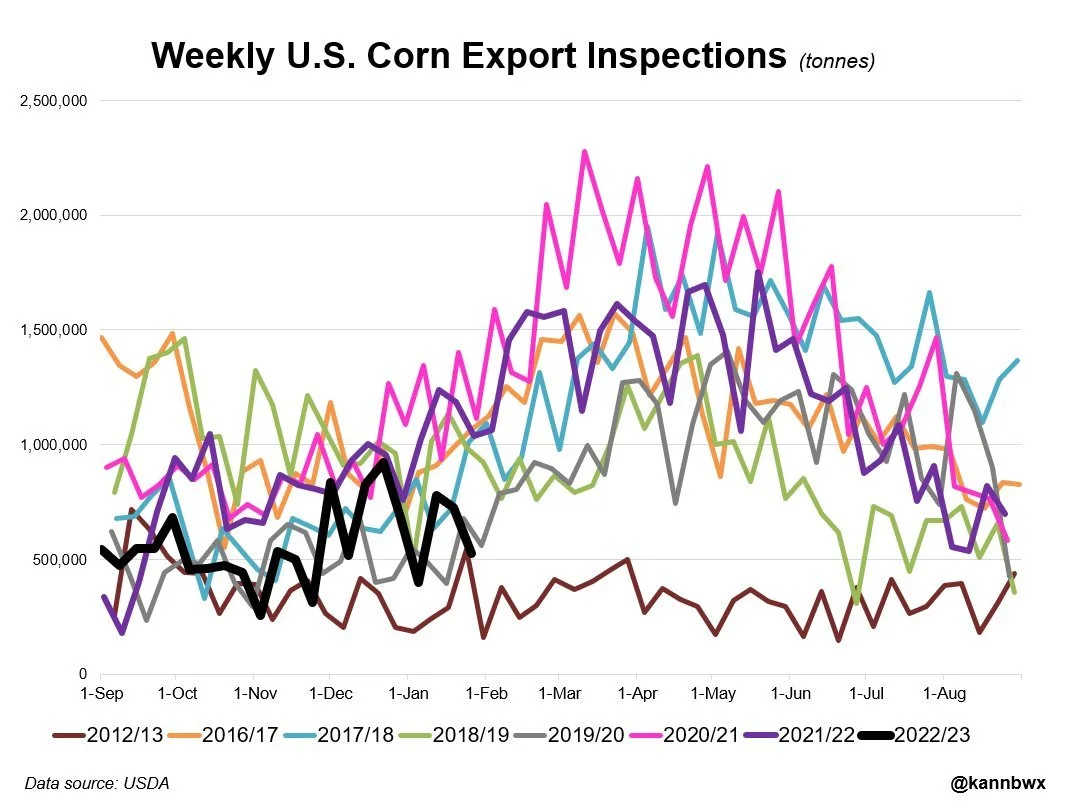

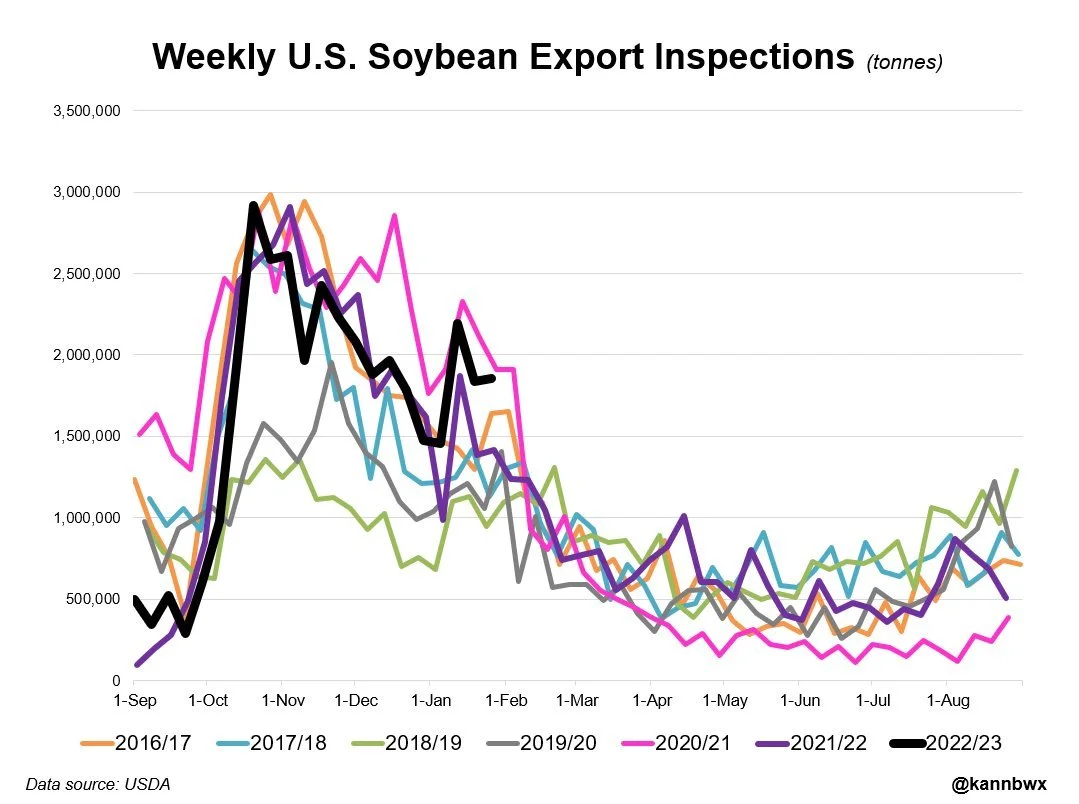

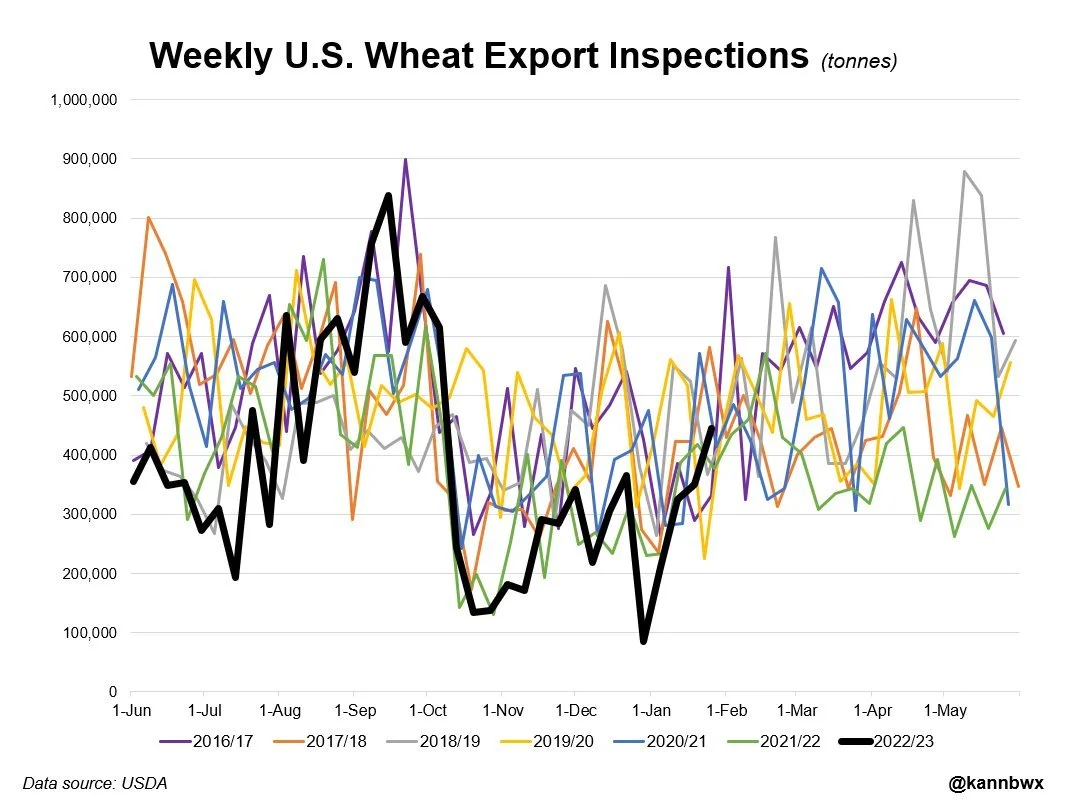

Export Inspections

Export inspections came in at the high end of the range for wheat and very strong for soybeans. Corn on the other hand had some pretty disappointing numbers falling below expectations.

Numbers (Thousand of Tons)

Corn

Actual: 528

Estimates: 600 - 950

Soybeans

Actual: 1,855

Estimates: 900 - 1,900

Wheat

Actual: 445

Estimates: 275 - 475

Chart Credit: Karen Braun @kannbwx on Twitter

Highlights & News

India sunoil imports rise to a record 473k tons.

Didn’t see any China purchases even though most expected we would.

Argentina weather is starting to look dry again.

The area sown to corn in Ukraine could fall by 35% in 2023.

Other Markets

Crude oil down -1.93 to 77.75

Dow Jonesdown -250

Dollar Index up +0.344 to 102.065

Cotton down -1.79 to 85.10

In Case You Missed It..

Here are a few of our past updates in case you missed them

What Does ADM Think About Chinese Demand

Read Here

What to Expect Going into This Week

Listen Here

Jan. 26 - Will History Repeat Itself?

Listen/Read Here

Jan. 25 - When to Make Sales

Listen Here

Jan. 25 - Market Update

Read Here

Livestock

Live Cattle up +2.525 to 163.350

Feeder Cattle up +0.450 to 183.925

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service