BEANS SELL OFF WHILE WHEAT RALLIES

Overview

Soybeans get pressured heavily with the favorable weather and forecasts while the wheat market rallies off the back of war headlines over the weekend. Corn was stuck in the middle of both headlines.

We had good rains over the weekend. We got good rains in Iowa, Missouri, South Dakota, Minnestoa, Iowa, Illinois, and Indiana. With more rain in the forecasts to go along with cooler temperatures.

Friday we will get the USDA report. Supply and demand as well as crop production. One thing to keep in mind for the report is that the crop production numbers are going to be as of August 1st. We have got some good rains since then.

The trade's focus by mid-week will start to shift to pre report positioning ahead of Friday's USDA report.

Saw some more export business this morning. These lower prices may offer a better opportunity to see some purchases from China.

As for the war, Saturday night the talk was we were going to see limit up action as Ukraine attacked Russian ships, which had some worried they would disrupt Russian exports. Wheat still rallied, but was slightly disappointing for bulls.

Crop conditions came out after close today. We saw both corn and beans come in 1% better than the trade was estimating and 2% better than last week. While spring wheat on the other hand went down a point while the trade was expecting no change to be made.

Crop Progress & Conditions

Corn 🌽

Rated G/E: 57%

Trade: 56%

Last Week: 55%

Last Year: 58%

Soybeans 🌱

Rated G/E: 54%

Trade: 53%

Last Week: 52%

Last Year: 59%

Spring Wheat 🌾

Rated G/E: 41%

Trade: 42%

Last Week: 42%

Last Year: 64%

Winter Wheat 🌾

Harvested: 87%

Trade: 89%

Last Week: 80%

Last Year: 85%

Average: 88%

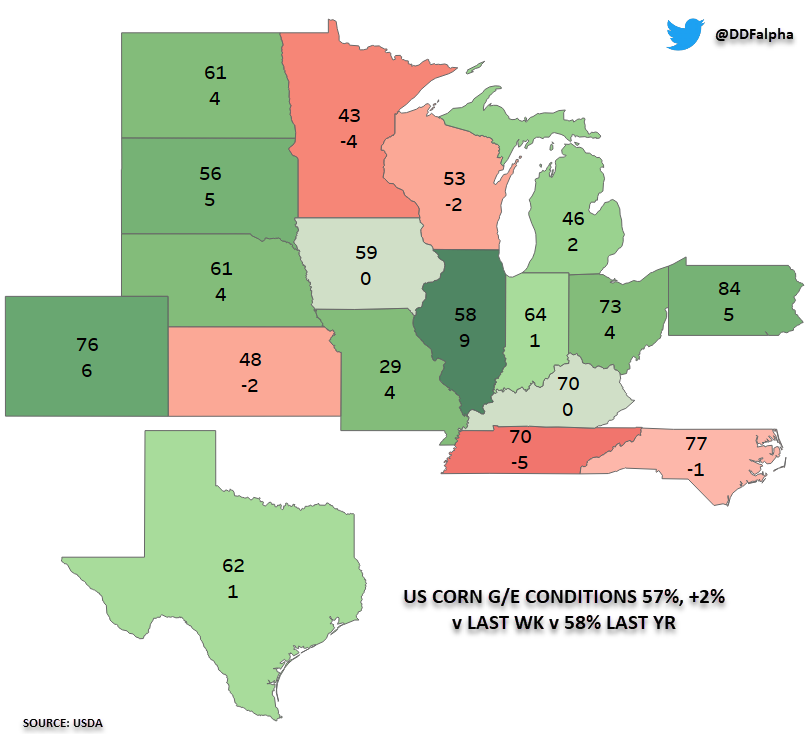

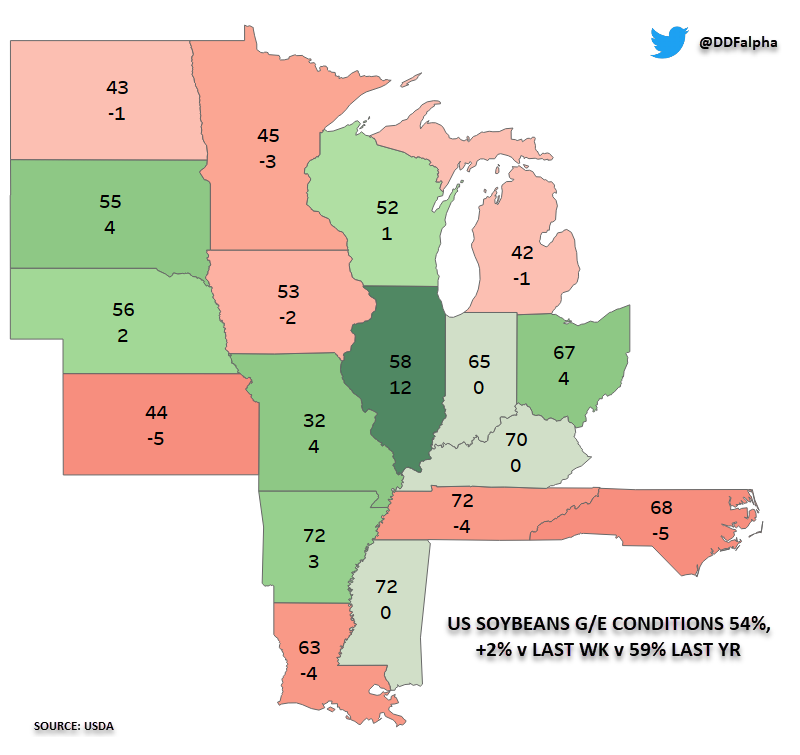

State By State Map (% Change)

- From Darrin Fessler -

Corn 🌽

Beans 🌱

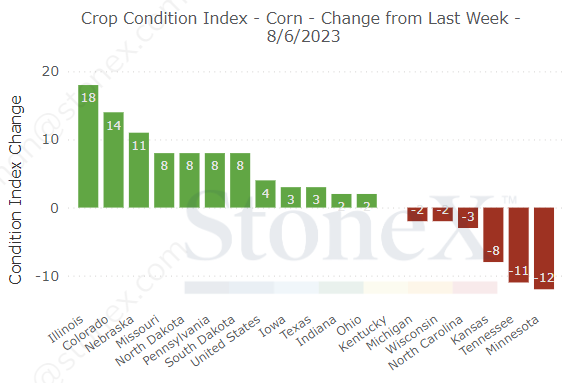

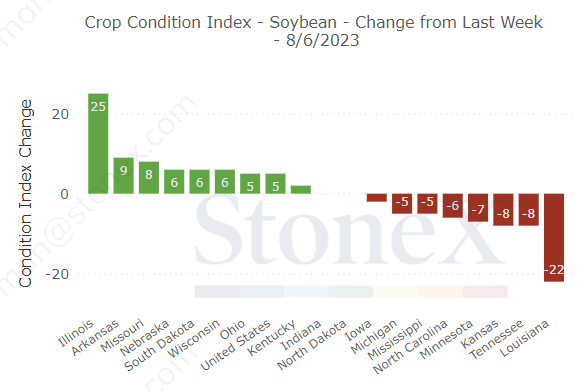

State By State Index Score Change

- From StoneX -

Corn 🌽

Beans 🌱

Today's Main Takeaways

Corn

Corn tried to follow wheat higher on the war tension, but ultimately the sell off in soybeans was enough to keep a lid on corn futures. As corn closed slightly lower.

Corn gave back 30 cents last week. The main factors are still war and weather. As corn is stuck between bearish weather headlines pressuring beans, and bullish war headlines supporting wheat.

Over the weekend, the war news was that Ukraine attacked a Russian oil tanker. The number one thing bulls are watching amongst all of this chas is whether or not we will see these attacks negatively effect Russia's ability to export. If this happened, it would be a huge deal as we have mentioned over the past few weeks.

On the other hand, there is talk that these attacks could pressure Putin into more negations about getting this thing resolved. Still looks far from over.

This afternoon crop conditions came in 2% better than last week and 1% above the estimates. So wouldn’t be too surprising to see some additional pressure tomorrow.

Weather still remains bearish. But this major improvement in weather is just simply too late for this corn crop. It's not the same situation as beans. Beans are made in August, the corn crop is made in July. So although this recent shift in favorable weather might help a little bit, it is not going to make that much if any of a difference.

As mentioned, as we get into the middle of the week, the trade's focus is going to shift away from weather and start to position themselves ahead of the big report on Friday. There is a lot in the air for the report. Do we see new crop production stay above 15 billion bushels. Do we see any major adjustments made to demand, or do we see them continue to kick the can down the road.

Crop conditions are still slightly worse than they were last year at this time. This comes after plenty of rains and good weather. For the majority of the year, this crop was far worse than last years. Yet the USDA still thinks we are so much better than last year. I just don’t think that is a reality. It will take some time, but eventually the USDA and trade will realize the extend of problems we have seen.

Unlike soybeans, demand just isn’t there yet, and is the number one thing bears continue to point at. We did see a sale this morning, so that was good news. But for corn to make a meaningful rally, we will need to see an increase in demand.

I expect prices to probably be lower tomorrow with the improvements in crop conditions. But, I think we getting near our lows. I think there is a chance we go and test $4.81 which was our previous low before we reverse higher. I noticed other advisors such as Roach Ag have placed buy signals across all of the grains.

We like the idea of re owning with cheap calls here depending on your situation. If you made sales north of $6 and north of $5.55 to $5.72 on the recent rally, take a look at cheap calls. The reason is if we rally after the USDA report, we want to catch the move before it's made. This is why it is called hedging. If we wait to buy calls after the move, that is chasing. However, this doesn’t make sense for everyone. So if you have any questions or what specific advise shoot us a text or call at (605)295-3100.

First upside targets are $5.16, a gap fill to $5.30, then $5.38, while downside support is $4.81.

StoneX Estimates

StoneX's official corn yield estimate based off their customer survey is 177 bpa. They also rose their yield model to 175 bpa up from last week's 172.5. They said this was due to the improved weather in August. I question whether or not the weather in August actually improved the crop as it is typically made in July.

From Wright on the Market's Tech Guy:

"There are several different formats of the Commitment of Traders report published every week.

The disaggregated report separates the large traders into two categories: managed money and large trading funds. Corn sold off every during day this past reporting period.

As expected, the managed money category added a net 12,000 more short contracts. What caught my eye, however, was that the large proprietary trading funds positions added 7,192 long positions and covered 14,785 short positions. This means that, overall, they are already net long position added +22,000 net long.

This is a rare occurrence for corn to sell off about 60 cents while the funds are adding any net long, let alone +22,000 positions. This is something for us to consider."

Corn Dec-23

Soybeans

Beans take it on the chin once again. The pressure was solely due to the rains over the weekend as well as favorable forecasts showing good chances for rain and cooler temps for the majority of August. As beans close over 30 cents lower at $13.02 and now well over $1 off their highs after hitting a 1 year high just 10 trading days ago.

Crop conditions this afternoon came in better than the trade was expecting. Coming in at 54% rated good to excellent vs the estimates of 53% and last week's 52%. This isn’t that much of a surprise given how weather has been, but nonetheless better than the trade had priced in. So don’t be surprised to see soybeans continued to be pressured tomorrow.

The cornbelt is expected to get above normal rain and below normal temps for the next two weeks. Unless we get a shift in weather or some other major surprise, some argue there isn't much of a reason for beans to be much higher two weeks from now. However, forecasts can shift on a dime and I do think we are very oversold here………

The rest of this post is subscriber-only content. Please subscribe to continue reading and to receive every exclusive update via text & email. (Scroll to check out past updates you missed)

USDA REPORT SALE

Lock in this huge discount. Save $500 a year. Don’t miss all our future updates & insights.

NOW: $299/yr or $29/mo

NORMAL: $800/yr or $80/mo

Become a Price Maker. Not a Price Taker.

Not Sure? Try 30 Day Free Trial HERE

Check Out Past Updates

8/7/23 - Audio

NAVIGATING WEATHER & WAR YOYO

8/6/23 - Weekly Grain Newsletter

ARE YOU READY FOR THE NEXT BIG MOVE?

8/4/23 - Audio

CAN OUR MARKETS BOUNCE ONE MORE TIME?

8/3/23 - Market Update

YIELD, DROUGHT UPDATE, TIME FOR CALLS?

8/3/23 - Audio

BUYING RECOMMENDATIONS

8/2/23 - Audio

WEATHER & WAR VOLATILITY CONTINUES

8/1/23 - Weekly Grain Newsletter

WHEN WILL THE BLEEDING STOP?

7/31/23 - Market Update

WEATHER HAMMERS THE GRAINS

7/30/23 - Weekly Grain Newsletter