BEING COMFORTABLE NO MATTER HOW THIS SHAKES OUT

AUDIO COMMENTARY

Heavy volatility continues

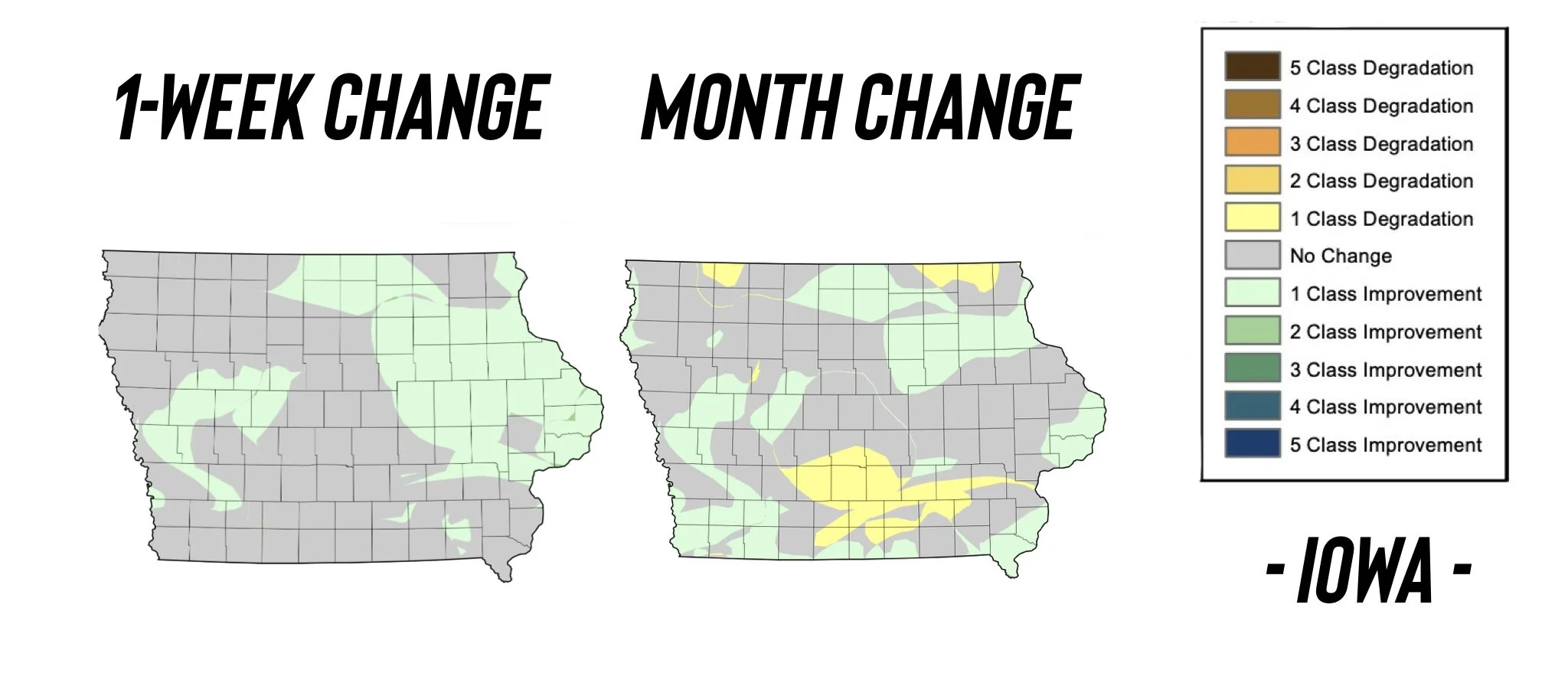

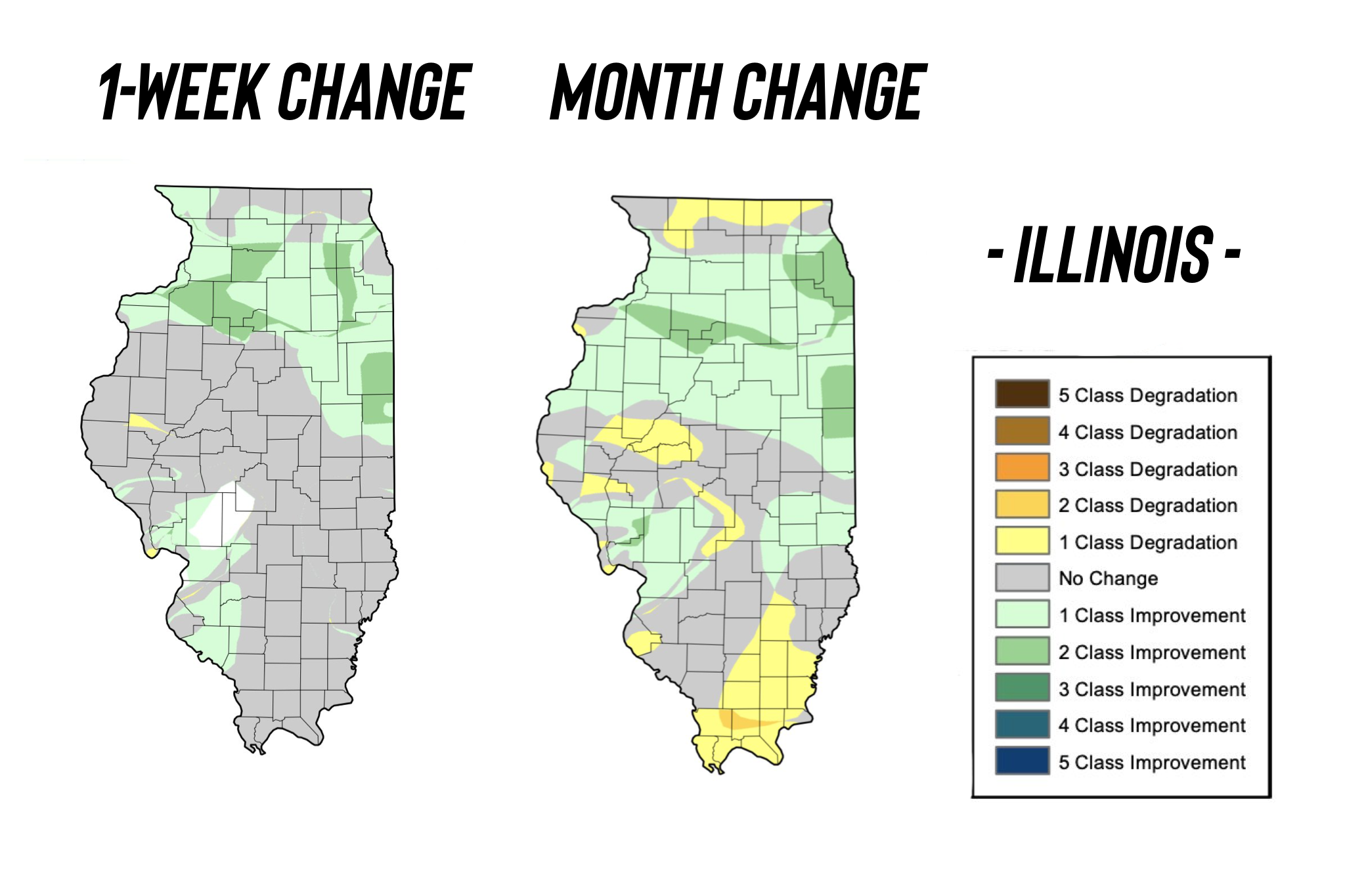

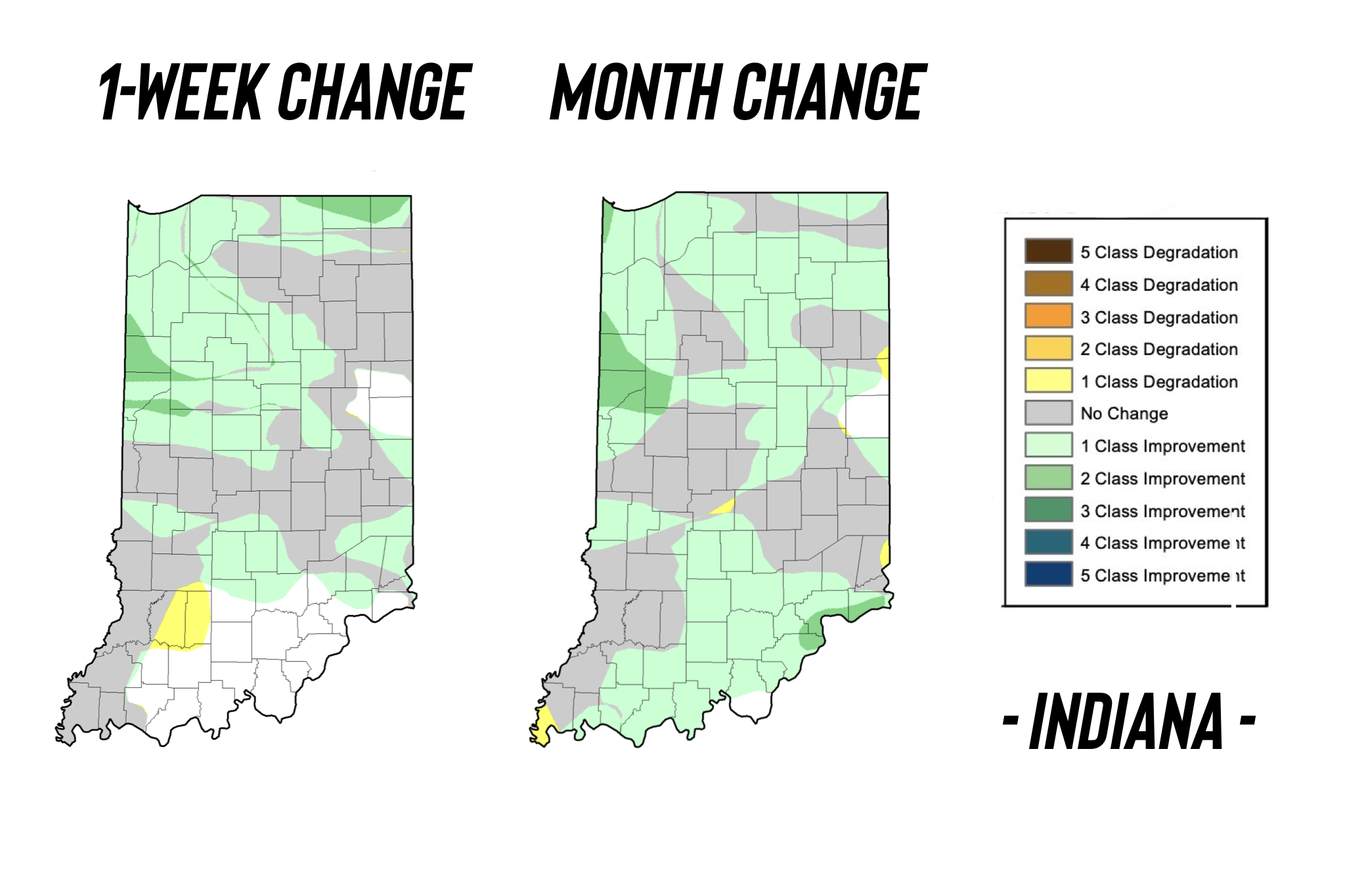

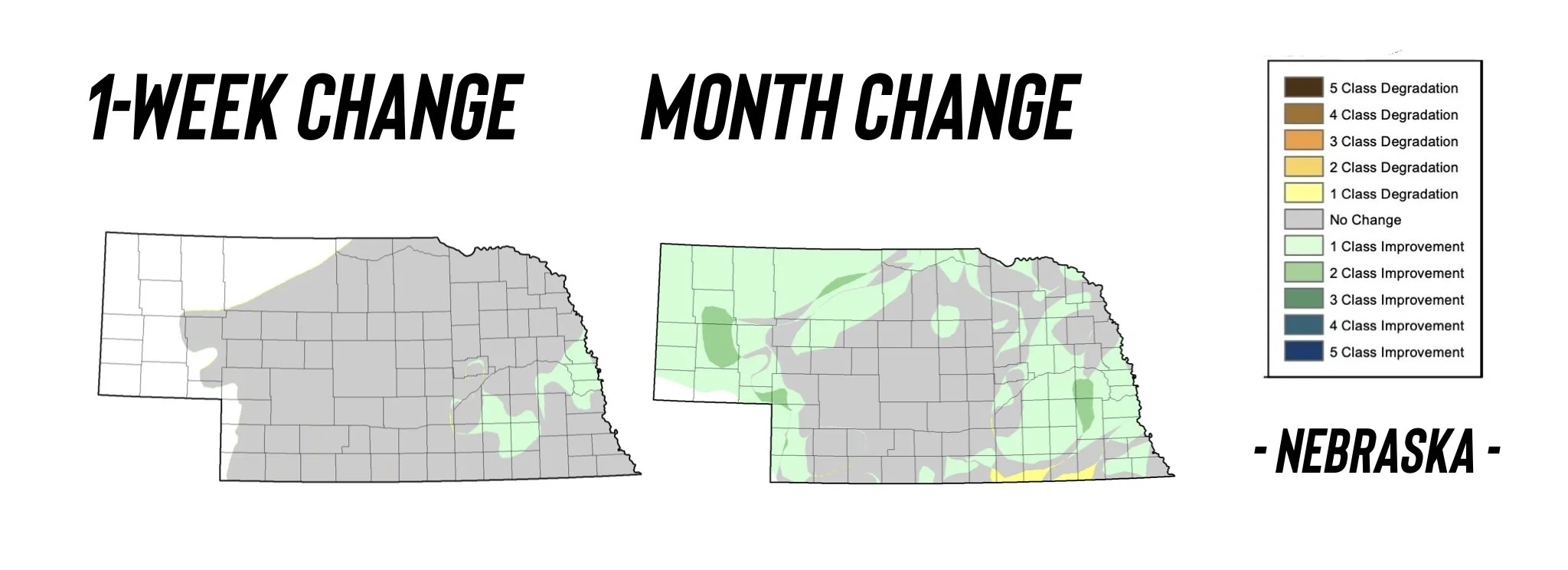

Drought improves (Scroll for maps)

Will the war lead to US business

Extreme World & US weather

Is Brazil crop as good as they say?

Should we reward the rally

Will we get a smaller sunflower crop?

Could war cause wheat rally like last year?

What to do if you are undersold or oversold

What makes the most sense for your operation?

Finding a way without trying to outguess the market

(Scroll for drought update & technicals)

Listen to today’s audio below

WANT TO KEEP LISTENING?

You only got to listen to 5min of the 14min today. You can keep listening with a free trial, or take advantage of our huge discount and get over 50% off. Discount is limited time only. $350/yr vs $800.

Not sure? Try a 30 day free trial HERE

(Scroll to very end to see updates you missed)

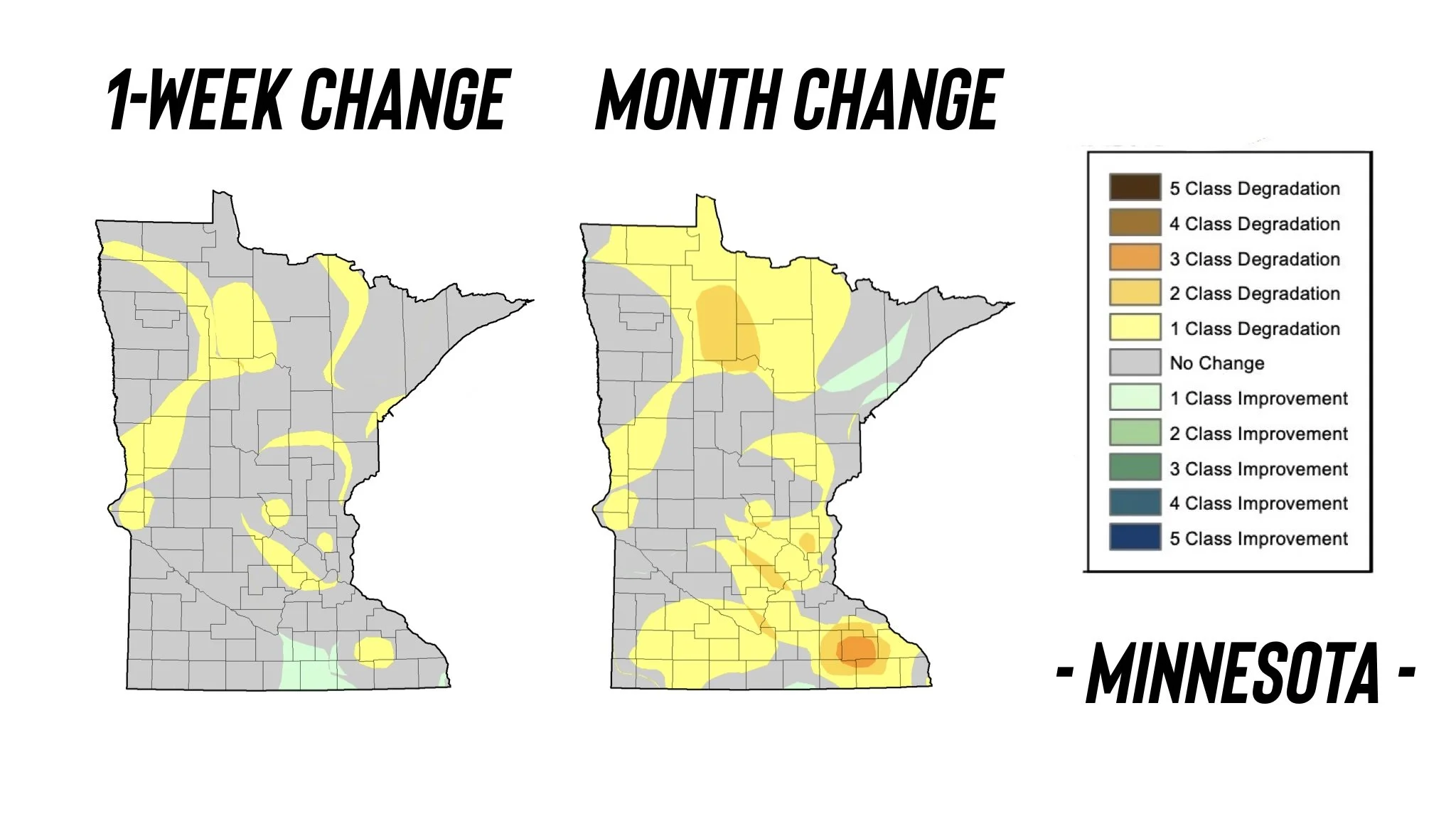

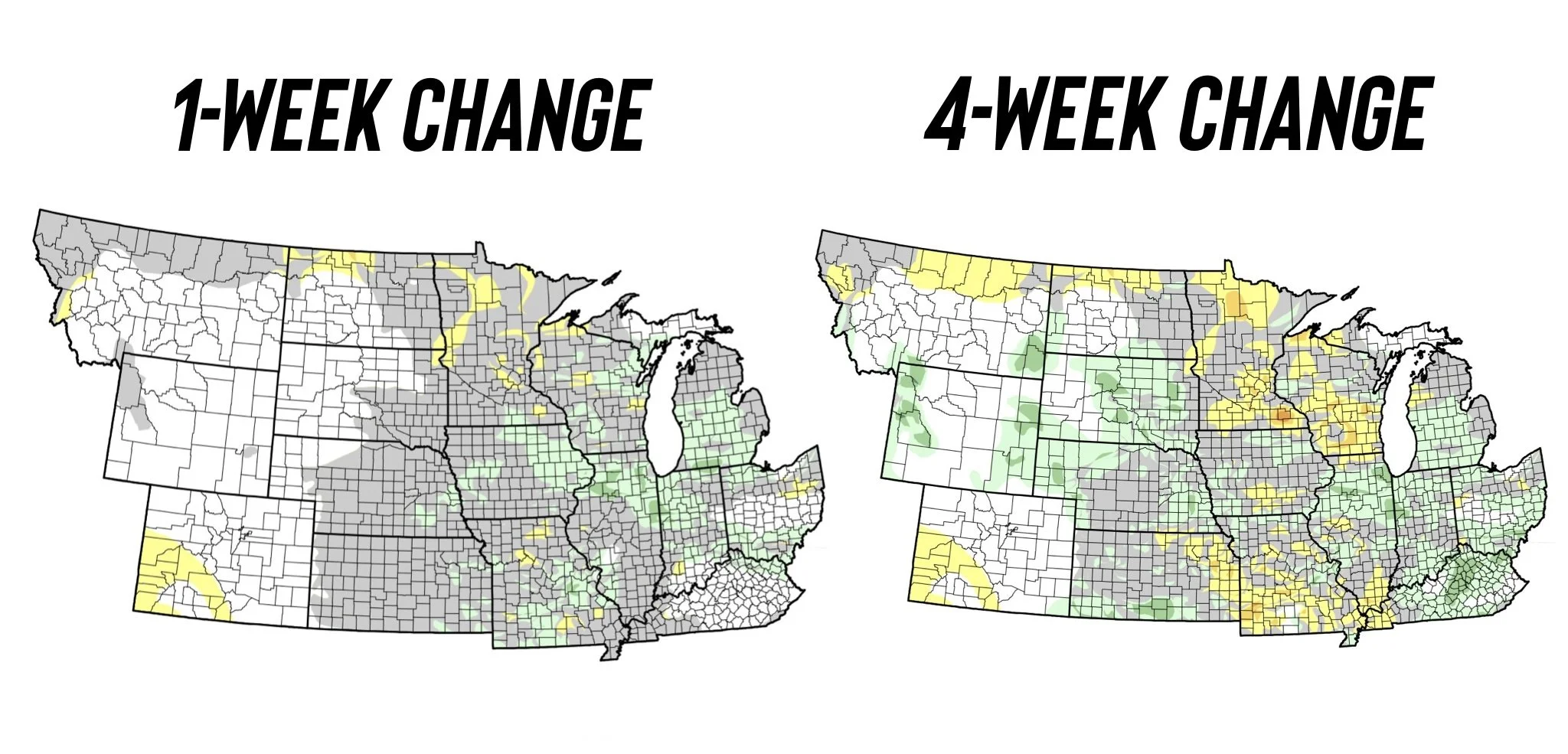

DROUGHT UPDATE

Below are a few drought comparisons for some states across the corn belt.

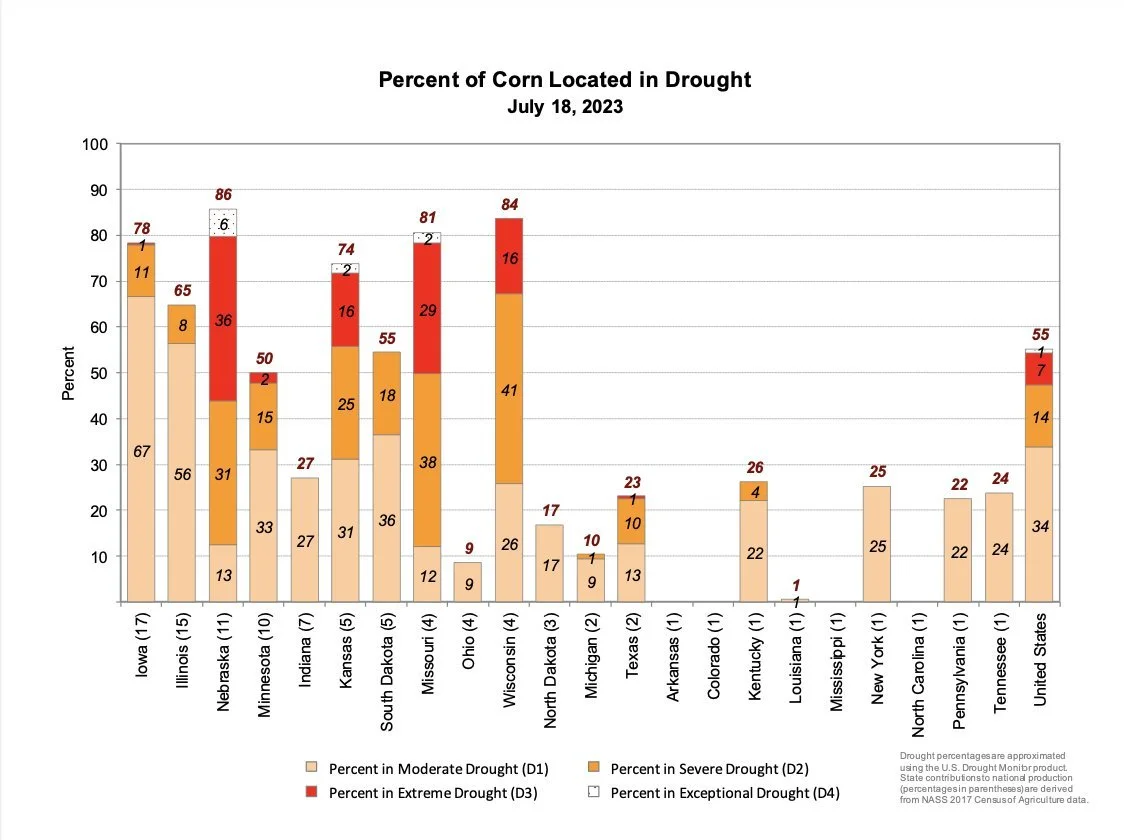

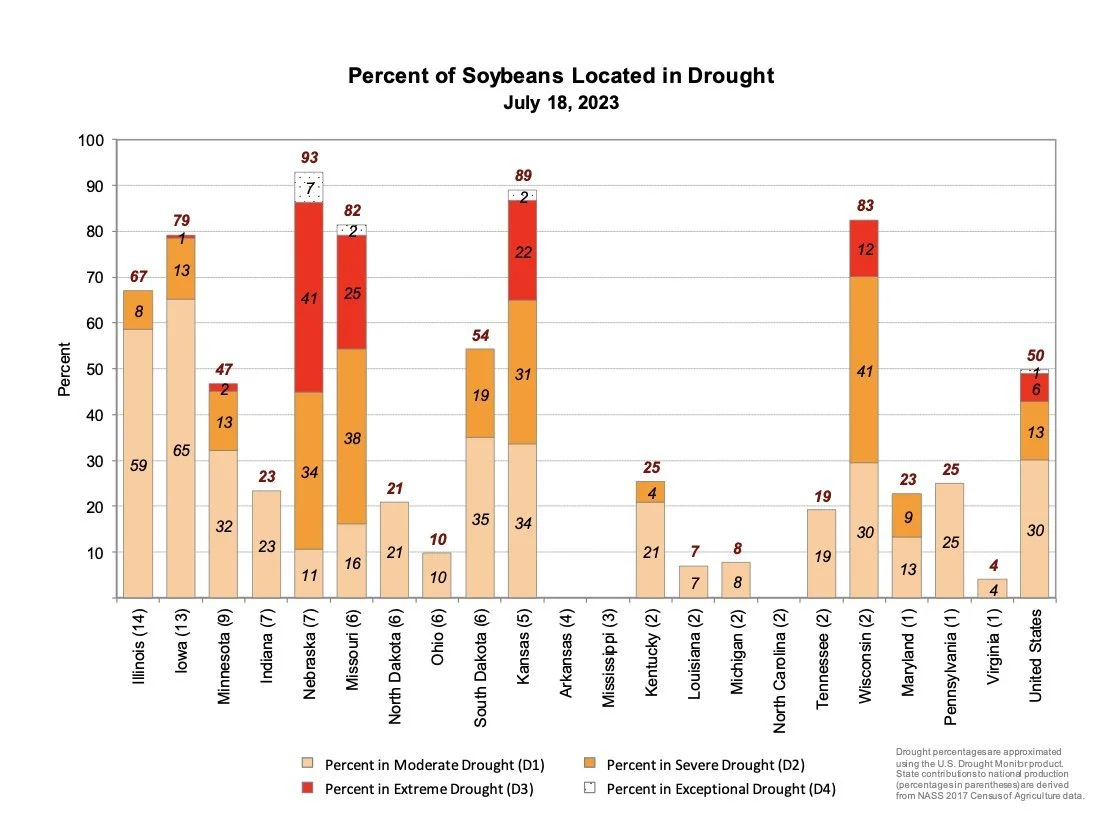

STATE BREAKDOWN

🌽 Corn:

8/10 top states located in at least 50% drought

🌱 Beans:

7/10 top states located in at least 47% drought

CHARTS

Corn 🌽

Yesterday we got that retracement to $5.50 we had been talking about for weeks. Today we rejected off of $5.63. Bulls would like to hold the $5.40 to $5.38 level. If we can reclimb back past $5.55, the next upside target would be the $5.75 range.

As mentioned in the audio, there is nothing wrong with rewarding an 80 cent rally. It all comes down to your situation. War and weather could push this thing either way.

Beans 🌱

We again failed to break out of that brutal downward trendline after testing above it, but we still sit above $14. On the daily, we did create a somewhat bearish doji candle. They can happen in uptrends, but typically it leads to lower prices the day after. But anything can happen in these markets.

Beans are still $2.70 off of their lows. We recommend the past 2 days for some of you that this would be a great area to take off some risk depending on where you are at in your operation. You have to ask yourself, would you be more upset if you sold here and we rallied to $15, or if you didn’t sell and we fell back to $12. It all comes down to your situation.

We do still believe there is a chance we see $15 in early August.

Chicago Wheat 🌾

This is now the second time Chicago has rallied over $1 in the past two months. Similar to beans, we also made a doji candle on the daily chart.

KC Wheat 🌾

KC just had it’s highest close since May. Bulls are trying to break out this pendant.

Minneapolis Wheat 🌾

Minneapolis manages to barley close over that heavy $9 resistance that has kept a lid on prices for over a year. Can we finally break out? It is definitely a possibility. But for those of you that are nervous about the downside risk, keep in mind that this is only the 3rd time this year we have traded this high.

FORECAST OUTLOOK

CHECK OUT PAST UPDATES

7/19/23 - Market Update & Audio

THE RALLY CONTINUES

7/18/23 - Audio

WEATHER & WAR

7/17/23 - Market Update

RUSSIA EXITS GRAIN DEAL. BUY THE RUMOR SELL THE FACT

7/16/23 - Weekly Grain Newsletter

MANAGING THESE VOLATILE MARKETS

7/14/23 - Market Update

WHEAT RALLIES & CORN MAKES KEY REVERSAL

7/13/23 - Market Update

GRAINS BOUNCE BACK AFTER BEARISH REPORT

Read More

7/13/23 - Audio

DROUGHT & DOLLAR ERASE YESTERDAY’S LOSSES

Read More

7/12/23 - Audio & Report Recap

FULL USDA REPORT BREAKDOWN

7/11/23 - Audio

WHAT TO EXPECT IN TOMORROW’S REPORT

7/10/23 - Market Update

CORN & BEANS STRONG AHEAD OF REPORT

7/9/23 - Weekly Grain Newsletter

ARE YOU COMFORTABLE WITH WHAT’S ABOUT TO HAPPEN?

7/7/23 - Market Update

GRAINS SLIDE WITH FAVORABLE FORECASTS

7/6/23 - Audio