NEW BEAN LOWS.. HOW LOW CAN CORN GO?

Overview

New lows in soybeans, as we again break below $12 and this time take out the previous lows. Down -43 cents the past two days.

Corn and wheat held in there but corn had an outside down day which is typically a negative indicator as we took out yesterdays highs and closed below yesterdays lows.

Disappointing week following what looked to be potential reversals earlier in the week as from a technical standpoint we made key reversals. Corn and wheat are both still holding their key reversals thus far despite the lower action today.

Here were the price changes for the week:

The grains were actually stronger overnight, however they went under immediate pressure following the release of the non-farm payroll numbers this morning. This led to a surge in the US dollar. With our export demand already being weak, the rally in the dollar didn’t help things.

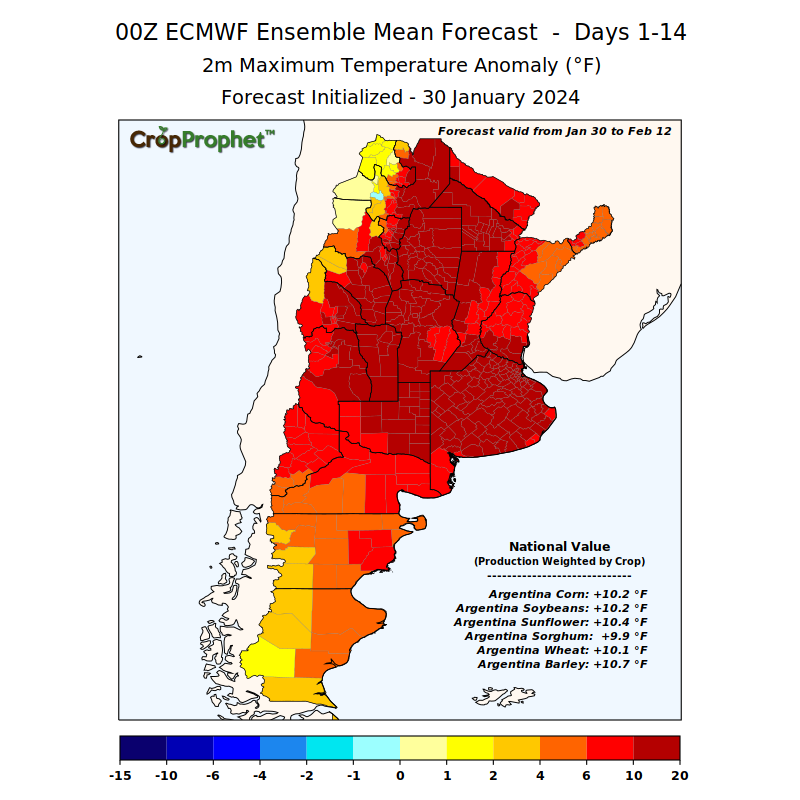

Then we have Argentina. They are looking hot and dry through early next week, but are expected to get rains late next week. If they do not get these rains, we will probably see another decline to the Argentina crop conditions. The past week alone we saw their good to excellent crop ratings drop -6% in soybeans and -5% in corn. Their crop is still obviously in better shape than last year, but the bears main argument has been that Argentina is supposed to make up for the losses in Brazil.

Despite the recent drought concerns, we actually saw USDA attache to Argentina RAISE their corn production estimates to 57 million metric tons. Which is 2 million higher than the USDA has. The reason was because of "higher planted area and beneficial weather ahead".

Here are the forecasts:

Here is what a few in the industry had to say:

Brian Wilson, Options Trader:

"When the funds are short they are eager to sell on 'forecast' of rain during drought. When they are long they buy on 'forecast' of rain until rain actually falls. This is a recipe for disaster when wrong."

Jason Britt, President of Central States Commodities:

"The BAGE report shows that corn is 46% pollinating and 34% sinking while soybeans are 59% flowering and 23% setting pods in Argentina.... Not really the best times to be the driest and hottest it's been all year I wouldn’t think. Oh yeah there is rain coming... I forgot."

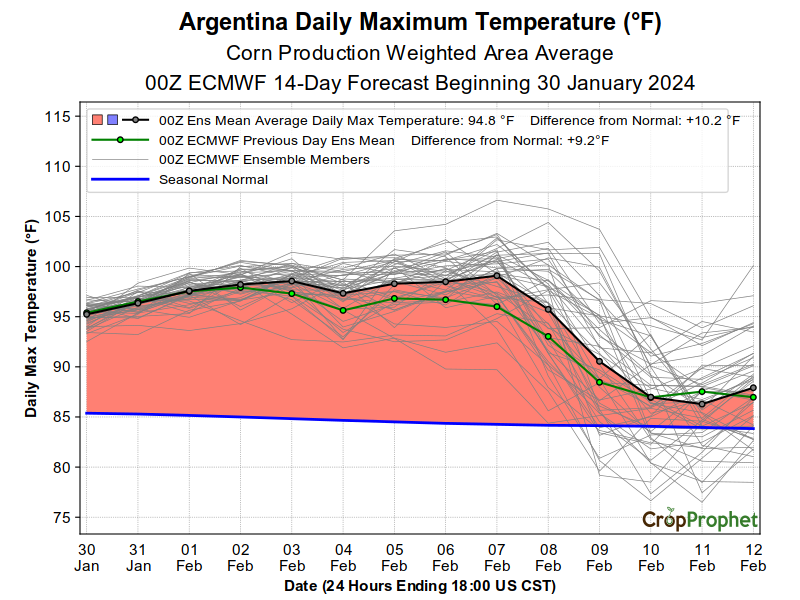

Crop Prophet (2 Days Ago):

"The ECMWF forecasts a long stretch of near 100 degree for corn production weighted daily maximum temps. Our yield model indicates significant yield declines."

Gro Intelligence SA Yield Forecasts

This next data is from Gro Intelligence. You can read their full article here.

Since they launched in 2020 they say they have accurately predicted the final Argentina yield forecast models within 92% for corn and 94% in soybeans five to six months in advance of the official government estimates.

They went on to say that their forecast models show corn yields in Argentina have dropped more than -10% and soybeans have dropped -8%... since mid-January.

Then they essentially went on to say that Argentina estimates will see a major setback and that the USDA Brazil estimates might actually be somewhat in line due to the recent rain. Afterall, the talk for the past few months has been that the losses in Brazil will be more than offset with the gains in Argentina.

Keep in mind, Argentina is the worlds #3 exporter for corn after Brazil and the US and they are the #1 world exporter for soybean meal and soybean oil.

Guess we will see how accurate they are. But could be very friendly for bulls if it realizes to be true.

There is some talk that the USDA is going to shave their Argentina crop estimates, with others saying that this could lead to the funds wanted to cover some of their massive shorts head of the report. The report is February 8th.

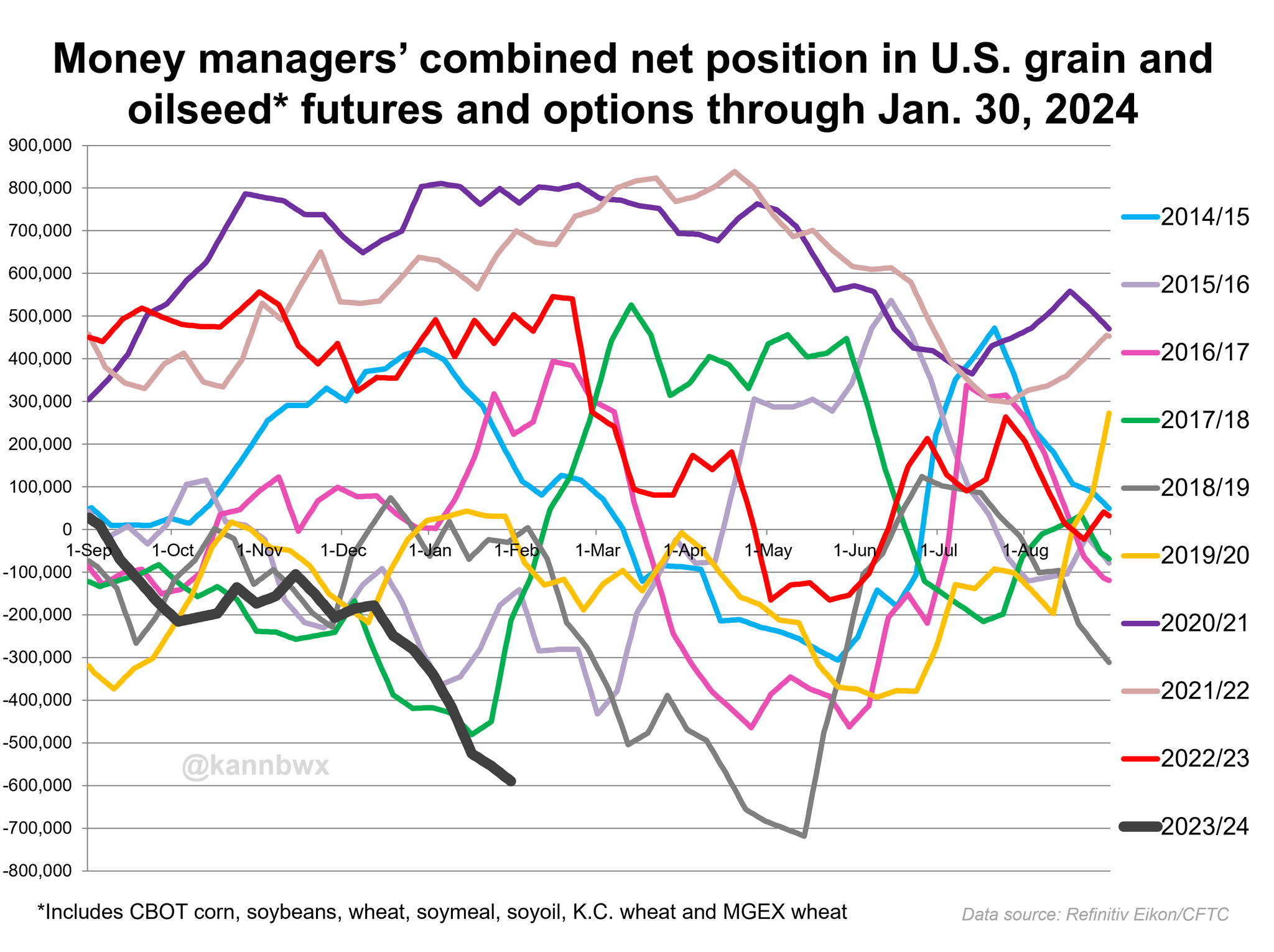

The Funds

The funds are now the shortest they have been across the grains and oilseeds since May of 2019.

Chart Credit: Karen Braun

What happened in May 2019?

In corn, we rallied over $1.00

Here is the chart:

Now yes, the rally in 2019 was largely due to the flooding and delayed planting and I'm not saying corn will rally $1. But the point is that we tend to find both the tops and the bottoms of the market when they hold their largest positions.

The funds will cover eventually.. but when, and how fast?

From DTN:

"Overbought-oversold indicators such as stochastics and RSI's are showing bullish divergence in both March corn and March soybeans. This indicates a market whose downside momentum is waning."

From Mark Gold of Top Third:

"If I were the funds, I would look for a spot to cover shorts. If not today, then Monday."

Now let’s jump into the rest of today’s update…

Today's Main Takeaways

Corn

Corn lower today as we took out the past two days lows but still manage to hold the January 30th lows of $4.37.

As mentioned, we had an outside down day which is negative on the charts.

I am still in the camp that Brazil corn acres and yields will be smaller when it is all said and done, but it doesn’t have to shake out that way. Then we have Argentina, who could possibly wind up being another bullish wild card as well. Time will tell.

How low can corn go?

Well if we take a look at……..

The rest of this is subscriber-only. Please subscribe to keep reading & get every exclusive update.

A few things we go over today:

How low can corn go?

Will old resistance turn to new support?

What to expect short term vs long term

Biggest risks & factors

Where is the next support for beans?

Protecting downside & managing risk

KEEP READING FOR FREE

Try our daily updates completely free for a month.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

2/1/24

NO CONFIRMATION OF HIGHER OR LOWER PRICES IN GRAINS

1/31/24

HOW SHOULD YOU BE SETTING YOUR TARGETS?

1/30/24

OUTSIDE UP DAY IN ALL THE GRAINS

1/29/24

GEO POLITICS, CHINESE, BRAZIL, ALGOS, & BIG MONEY

1/26/24

SOLD RALLIES & HISTORICAL HIGHS

1/25/24

DEVELOPING A GRAIN MARKETING PLAN WITH TECHNICALS

1/24/24

5TH GREEN DAY IN A ROW: WAYS TO OUTPERFORM THE MARKET

1/23/24

GRAINS CONTINUE TO BOUNCE

1/22/24

HAVE MARKETS FOUND A BOTTOM?

1/19/24

FAILED REVERSALS & ELECTION YEAR RALLIES?

1/18/24

UTILIZING TRENDS & TECHNICALS IN YOUR GRAIN MARKETING PLANS

Read More

1/17/24

FUNDS & CHINA

1/16/24

BEANS TRY TO BOUNCE FOLLOWING BEARISH USDA

1/12/24

FULL USDA REPORT BREAKDOWN

1/11/24

USDA REPORT TOMORROW. ARE YOU PREPARED?

1/10/24

PREPARING FOR THE USDA

1/9/24

TURNAROUND TUESDAY & USDA PREVIEW

1/8/24

HOW TO GET COMFORTABLE AHEAD OF USDA REPORT

1/5/24

FIRST WEEK OF NEW YEAR FLOPS

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23