CORN CONTINUES LOWER & BRAZIL CONCERNS

MARKET UPDATE

Futures Prices Close

Overview

Grains mixed as beans close higher for the second day in a row supported by some talk surrounding China business. While corn continues to trickle lower, fighting to hold off those harvest lows. The wheat market manages to bounce following it's recent losses as KC wheat's fresh new low yesterday.

Insurance prices have been set for fall.

Corn

Spring Price: $5.91

Fall Price: $4.88

% Change: -17%

Beans

Spring Price: $13.76

Fall Price: $12.84

% Change: -7%

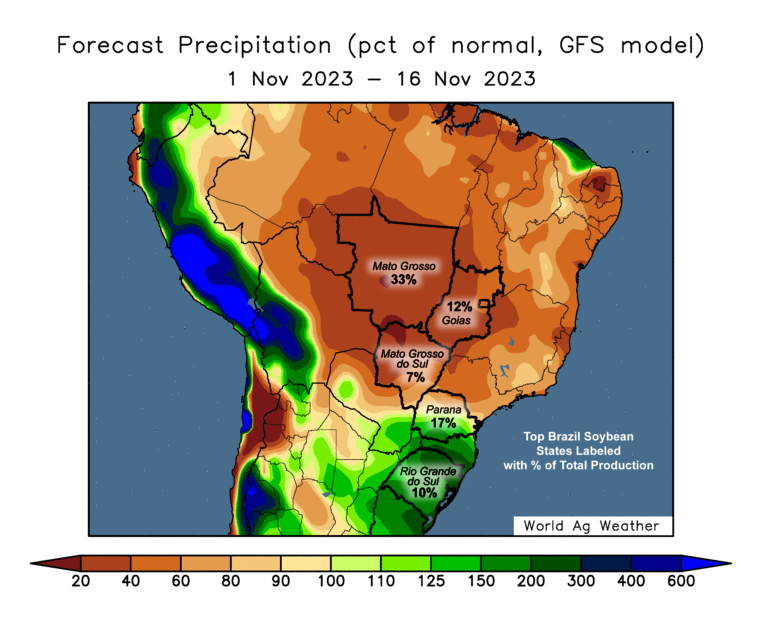

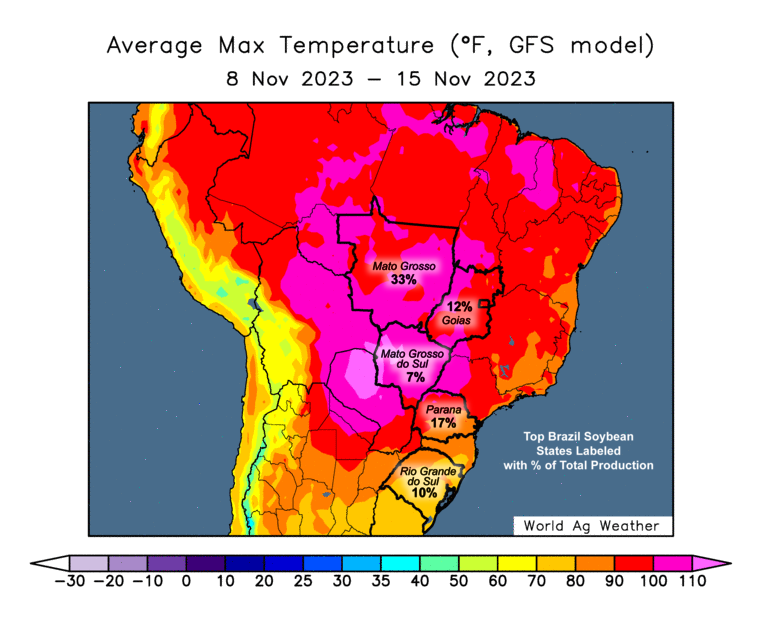

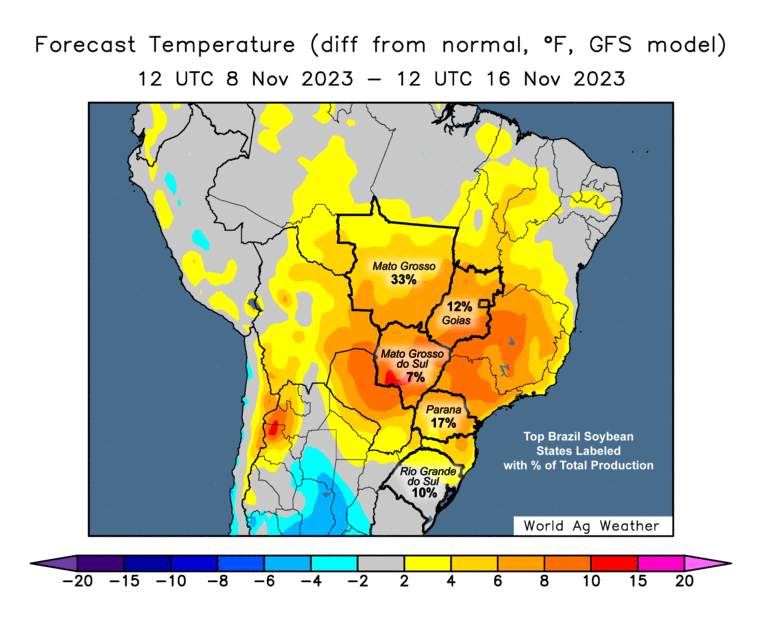

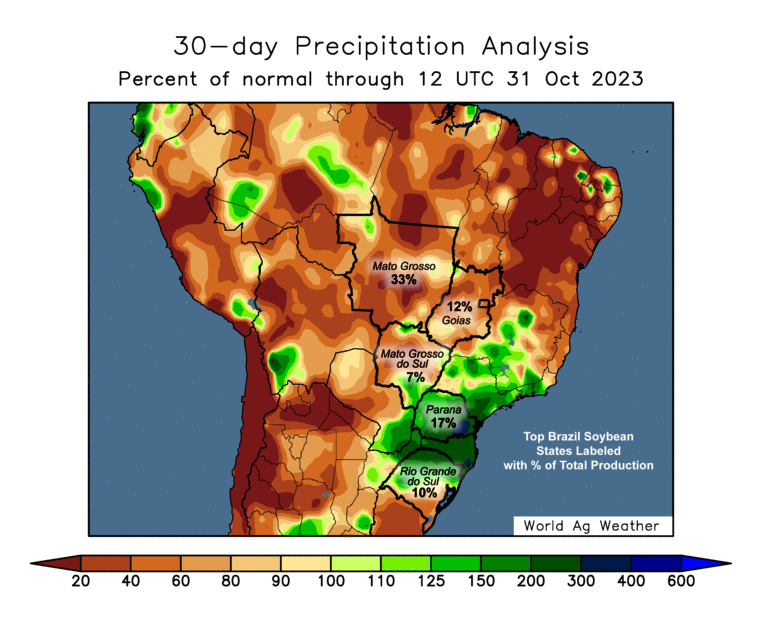

South America is going to be the most influential factor in these markets as we near the end of the year. Bears are arguing that the dry areas in Brazil received good rains, which they did. But take a look at these maps. It still looks pretty dry to me.

Another thing to keep in mind, there is zero weather premium built into these markets. Can’t imagine what would happen when the trade starts to take this into consideration if this were to continue.

So the dryness to the north in Brazil is not good for their production. But what about the south?

They have received far too much and have seen flooding, which is also not good for production and causes delays.

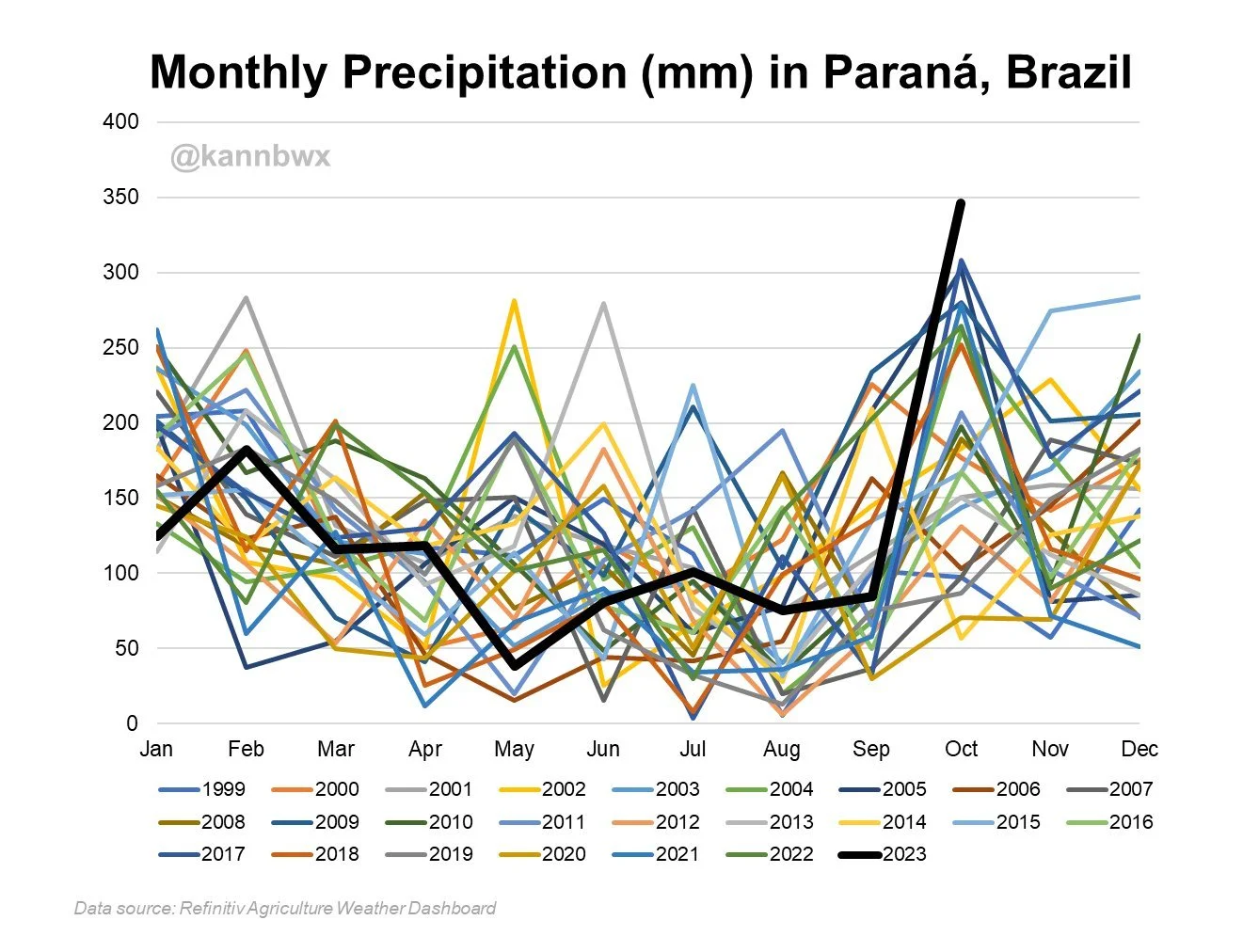

Here is a chart from Karen Braun that showcases the rain in Parana Brazil (southern state). This October they have seen more rain than any other month dating back to 1999.

Make sure to scroll to the very end of today’s update where we include AI’s perspective on the grain markets.

Today's Main Takeaways

Corn

Corn continues to chop around and trend slightly lower. We have traded in a 35 cent range since July.

There isn’t a ton of fresh news or headlines to chew on from bulls nor bears. Which often leads to risk off approaches.

What are bears saying? For starters, they are arguing that South America has seen some needed rain. Which they have. But you can’t tell me the outlook is all that favorable. We are already seeing some lower adjustments made to the Brazil crop. Dr. Cordonnier lowered his Brazil corn number by 2 million metric tons due to his belief that there will be less acres due to the late soybean planting. He had a neutral to lower bias moving forward.

Bears also argue that it's going to be hard to manage a rally with this massive US carryout. Which is a valid argument that I somewhat agree with. A major rally here will not be easy. As I have mentioned several times in the past, the path for higher corn will be a marathon and a dog fight. Because yes, 2 billion bushels is a lot of corn.

However, this is what bulls are looking at. They think we could still see the US crops lower as well as our ending stocks tighten up down the road. Possible, but I wouldn’t bet the house on it.

Bulls are also looking at the potential weather worries in South America. Now this is what I think could be that catalyst bulls are searching for. I’m not a weather man, but there is already talk that the USDA is too high on their Brazil estimates solely based off of fewer acres. A weather worry for their second crop would be a major deal for corn.

I noticed a few other advisors still had buy signals in place for corn. If you have made sales, I think this is a decent spot to look to re own. Need to make sales or will be making sales? I think it makes the most sense to lock in a floor vs selling at these levels.

Bottom line, we broke some recent support on the charts. We now sit just 7 cents away from those September harvest lows. There is a chance we look to test those or even break those lows. I also wouldn’t be surprised to see the algos and funds to push us to new lows then we get a reversal, similar to what they did when they pushed us past $5 and reversed us back down.

November is often a difficult month for corn futures. We can’t out predict the markets, but we can manage our risk as best as possible.

The biggest thing right now would be, with us in the bottom of this 3 month range, the best way to manage risk would be……

The rest of this is subscriber-only. Subscribe to keep reading and receive every update via text & email.

KEEP READING FOR FREE

Try our stuff completely free for 30 days. Scroll to check out past updates you would have received.

INCLUDED IN TODAY’S UPDATE

Best way to manage risk in the corn market

Why soybeans have the ppotential to reach $14 to $15+

Staying in the game after sales

Zero weather premium yet

Levels bulls need to hold

AI’s perspective on wheat

Check Out Past Updates

10/30/23

HOW TO BEAT BIG AG AT THEIR OWN GAME

10/27/23

WEEKLY WRAP

10/26/23

SEPARATING THE FUTURES & BASIS COMPONENT TO BECOME A PRICE MAKER

10/25/23

LONG TERM UPSIDE & BEING PATIENT

10/24/23

TECHNICAL SELLING, SA WEATHER, & MANAGING RISK

10/23/23

IS THIS CORRECTION A HEAD FAKE?

Read More

10/20/23

BIG WEEKEND CORRECTION

10/19/23

CORN BREAKS $5. IS WHEAT NEXT? - SOYBEAN RECCOMENDATION

10/18/23

BEANS BREAK $13. IS CORN NEXT?

10/17/23

DID BEANS CONFIRM REVERSAL?

10/16/23

CHOPPY BORING TRADE

10/13/23

POST USDA REPORT CORRECTION

10/12/23

BULLISH REACTION TO USDA REPORT

10/11/23

CAN THE USDA GIVE US A BULLISH SURPRISE?

10/10/23

BEANS BREAK THEN BOUNCE - USDA PREVIEW

10/9/23

WILL YOU BE FORCED TO SELL ANYTHING AT HARVEST?

10/6/23

CORN & WHEAT HOLD LAST WEEK’S LOWS

10/5/23

UPSIDE BREAKOUT IN CORN

10/4/23

ARE YOU A PRICE MAKER OR PRICE TAKER THIS HARVEST?