CAN GRAINS SEPARATE THEMSELVES FROM THE STOCK MARKET?

Listen to today's audio below

Afternoon Market Update September 27th, 2022

Futures Prices Close

Overview

Intially we saw prices very strong this morning, as outside markets were helping push grains higher. However, as the outside markets turned around and the dollar picked up steam, we saw stock and equities lose their early gains, which helped pressure grains into giving up a majority of their early gains as well. Hopefully Friday's USDA report will help us separate the grain movement from the stock movement.

Today's Main Takeaways

Corn

Corn closed slightly higher this afternoon, up +1 1/4 cents. Closing 10 1/2 cents off its early highs we made this morning. Again the outside markets pressuring the grains. We were significantly higher across the board to start the morning, as it looked like a turnaround Tuesday following yesterday’s lower price action. As to start the morning we saw stocks and equities higher, with crude oil pushing higher as well, and a weakening dollar early on. But then we saw stocks start to fall, and the dollar creep higher, which ultimately led to the grains following suite.

Along with the outside markets continuing to add pressure to the grains, we have to look at another poor week of exports, as demand remains uncertain.

Corn crop condition ratings came in unchanged. However, harvest is a bit slower than expected, as corn harvest came in at 12% complete vs 14% average and compared to last years 17%. Some think this could push prices higher. However, the next few weeks for harvest are looking fairly promising for the most part, so most are expecting us to make some pretty good progress moving forward here. We only had three states running ahead of their harvest pace. Those being Texas, Nebraska, and Kansas.

From a technical standpoint, the $6.80 mark still acts as pretty strong resistance, as even with our strong early morning we struggled to push that point. With a high of $6.78 on the day. As mentioned earlier, we closed well off our highs.

Friday we will get a look at the USDA Quarterly Stocks Report. We could definitely see a curveball so all eyes will be on the report. We will have to see if the USDA thinks we need crop production lowered as some think this is a possibility.

Dec-22 (6 Month)

Soybeans

Soybeans closed the afternoon down 3 1/4 cents. However, this was well of their highs we saw earlier in the day. As soybeans finished 29 cents off their early highs. We are not almost exactly a dollar off our highs we made just a few short weeks ago on September 13th, where we saw soybeans peak at $15.08 3/4. Today we closed at $14.08.

Similar to corn, conditions also came in unchanged for soybeans. Soybean harvest came in at 8% complete vs 13% average compared to last years 15% completed.

Demand for soybeans still remains lackluster. If we want to see prices stabilize around this price level we will likely need to see Chinese demand pickup. Especiallypecially during this time period where the markets will start to shift there attention away from U.S. weather headlines and more towards South America planting headlines as planting starts. With the U.S. dollar surging as hot as it has, it just makes it tough to have a ton of optimism for demand. But its definitely possible to see demand increase especially if we see the dollar cool down a bit.

Other than demand issues, we don't have much of any weather concerns here in the U.S. to spark some rally. Especially since people will start to become more focused on weather in South America. We also have the outside markets continuing to pressure the grains.

From a technical standpoint, we would love to see soybeans hold the $14 psychological level, as nearby support support remains around the $13.80 to $14 range.

Soymeal & Soyoil

Soymeal down -3.9 to 413.6

Soyoil down -0.07 to 62.39

Soybeans Nov-22 (6 Month)

Wheat

Wheat all finished the day solidly higher leading the grains. However, just like corn and soybeans, wheat closed significantly lower off our early highs. With Chicago wheat closing -23 cents off our highs, KC -21, and MPLS just over -17 off its high.

The Russian and Ukraine news has died down for the most part, as we haven’t seen any major news or updates regarding the situation.

There is some demand for wheat around the world, but the question still remains whether the U.S. will get any of this business. With the dollar continuing to surge higher and higher it makes it tough for anyone to look to get wheat from us. Hopefully we can see this story turnaround.

It appears crops around the world are looking a little better than expected which is also adding some pressure. To go along with a record crop out of Russia. However, we do have some production estimates being trimmed in Argentina.

The USDA showed spring wheat harvest at 96% complete vs 97% average. With winter wheat planting at 31% vs 30% average.

Chicago Dec-22 (6 month)

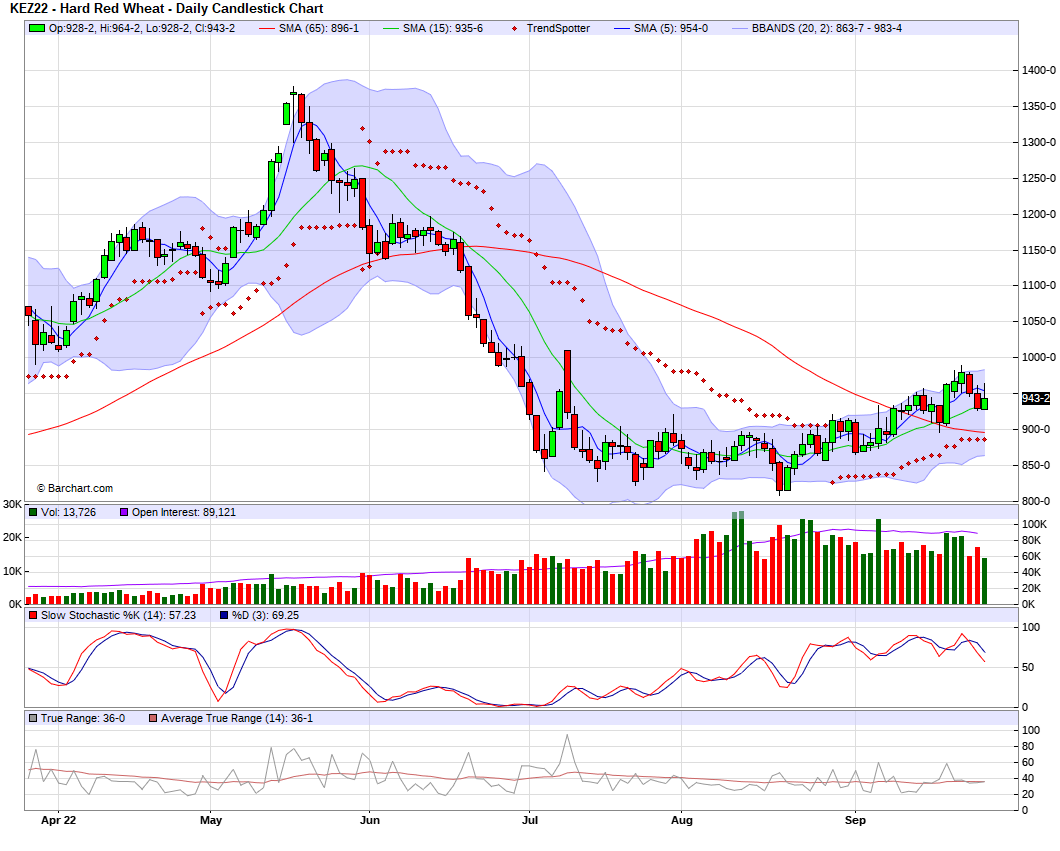

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil up +2.12 (+2.8%) to 78.40

Dow Jones down -123.3 (-0.40%)

Dollar Index up +0.095 (+0.09%)

S&P 500 down -7.47 (-0.20%)

News

China is looking to reduce soybean meal used in animal feed

Brazils soybean planting is running ahead of pace

Russia may plant less WW if they continue to get rainfall

Category 4 Hurricane is looking to hit Florida’s west coast as soon as tomorrow. Will be first time in 100 years they are hit by a major hurricane

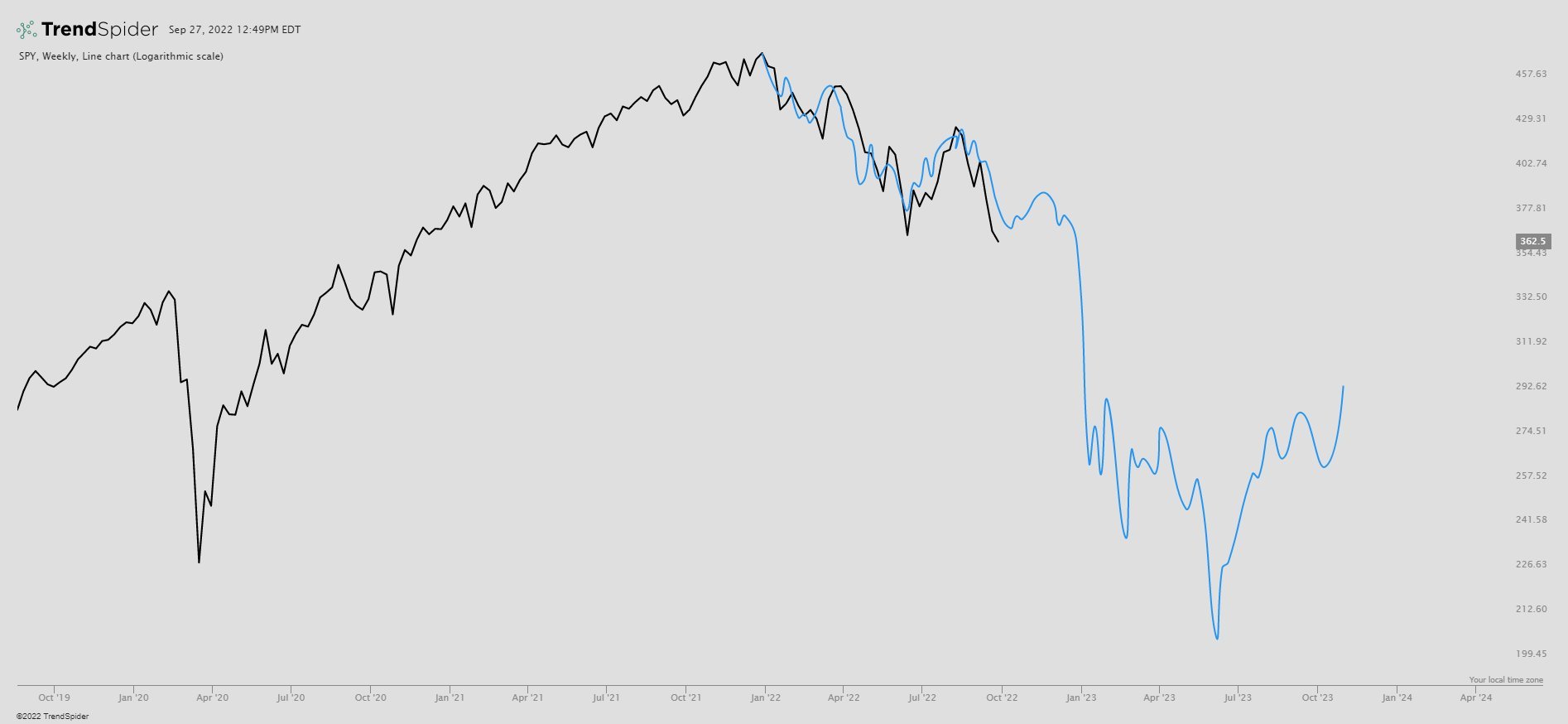

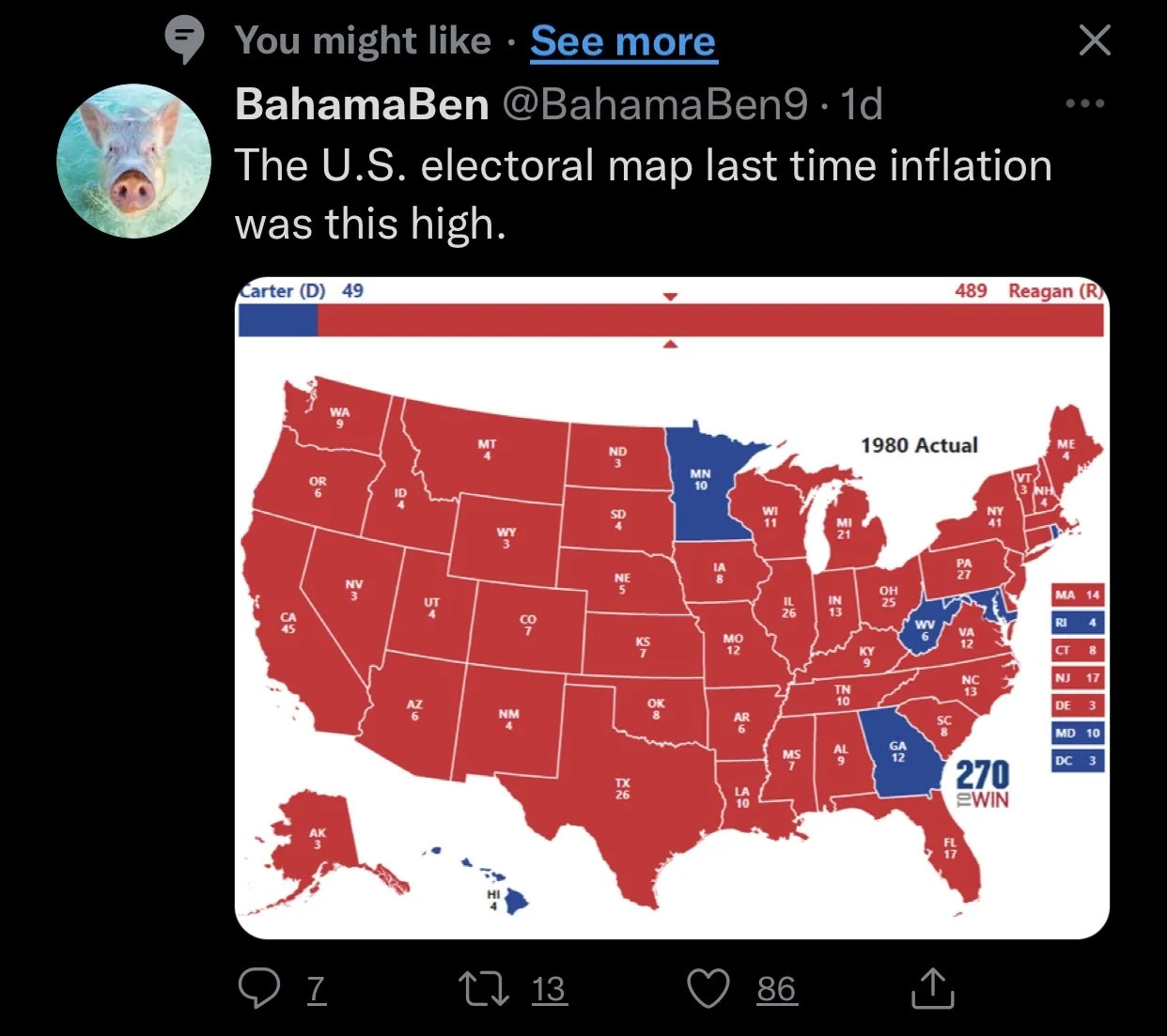

Here is a chart comparing 2008 vs 2022 for $SPY (S&P 500 ETF TRUST)

Chart credit to @Braczyy Twitter

Previous Newsletters

Check out a few of our other posts in case you missed them. Would love any feedback or things you would like to see.

Sundays Weekly Newsletter

Does it matter how high the dollar gets?

Social Media

Credit: All credit to users of posts

Precipitation Forecast 2-Day

Weather

Source: National Weather Service