CLOSING MARKET UPDATE

Overview

Grains were mixed today, with some crazy volatility and still concerns over the forecast outlook. With forecasts still looking hot and dry for July for most of the midwest and corn belt areas. However, some of these concerns were offset by demand concerns and our economy as a whole, with the battle against inflation still raging through America.

The weather is still the main supporting factor for both corn and soybeans. However, spec fund selling and global recession keep attempting to push prices lower. Making matters worse was the higher than expected CPI numbers. Bulls and the bears fighting for which problem is larger (Weather and Recession).

Today's Main Takeaways

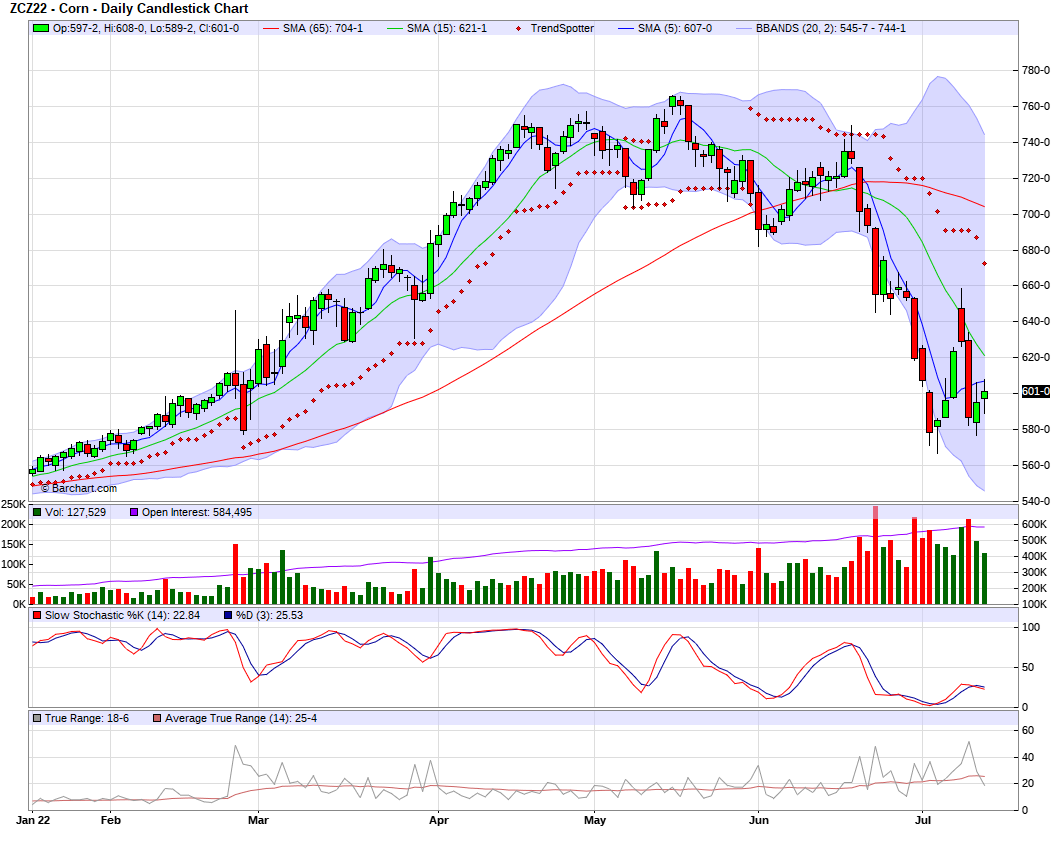

Corn

Corn finished higher this afternoon, with concerns over heat and dryness across the midwest and parts of the corn belt. For the next few days there is some potential for some spotty rain. But, the overall long term outlook is still very hot and dry for corn growing areas.

For the grains, especially corn. The number one thing that's going to hold back prices is the global demand and recession fears. Many bears also looking at the fact that U.S. gasoline demand fell a ton last week. We went from 9.413 million barrels per day, down to 8.062 million barrels. This brings our 4 week average to down nearly -8% compared to last year at this same time.

We've also seen a very sharp decline in ethanol production. The week ending July 8th, averaged around 1 million barrels per day. Which is a 3.7% decrease from the week prior. Ethanol stocks around 12% larger than last year. However, I don't see the ethanol stock numbers having all that drastic of effect on trade.

On the demand side, its pretty quiet for corn. With China still being out of the market for the time being. Although there has been some rumors they are looking to purchase. When China comes back into play, this will be great for demand.

With corn looking fairly strong, on the back of two consecutive green days, it still looks vulnerable from a technical standpoint. However, I think the scorching heat and dry weather should be enough to support prices going forward.

Dec-22 Corn

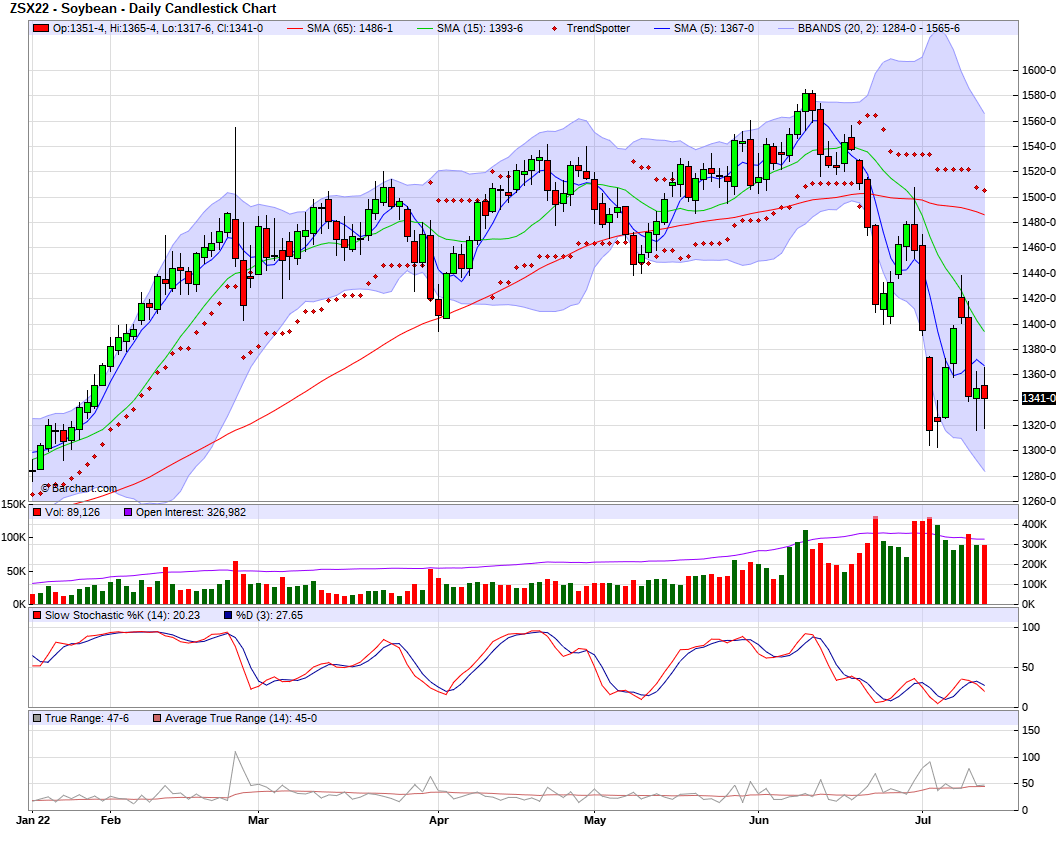

Soybeans

Soybeans finished slightly lower this afternoon. Weather concerns showing support, but not enough and certainly not as beneficial as it is for corn prices. Chinese demand concerns really putting a lid on soybean prices as well, to go along with the recession, keeping funds uninterested.

Technically soybeans remain somewhat on the weak side. After failing to find any buying on the overnight highs. However, we did remain above nearly all support levels. Weather will continue to be a driving factor to push prices higher if forecasts remain dry. Whenever China re-joins the world, it will spark some demand and help support prices as well.

Nearby resistance for Nov. beans is around that $13.70 range. It would be a great outlook if we could get a close over that range, or its 200-day moving average. If we could get over that hurdle, could very easily see prices climb back up into the longer-term resistance of around $14.75. Looking to the downside, our major support has to be the lows we made last week. The low being $13.02.

Nov-22 Beans

Wheat

Wheat down again today, with talks about Ukraine ports opening up escalating. Putting a ton of pressure on wheat prices. This news outweighing the strongest weekly U.S. wheat export sales in more than three years. Looking from a bull's perspective, some think the dry weather should be helping spring wheat prices. As the U.S. still looks dry, so do parts of Canada.

Still ta ton of news surrounding talks about Russia and Ukraine nearing a deal, with is still very negatively affecting prices. However, I don't think anyone, including myself, foresee them coming to an agreement anytime soon. A lot of these headlines are likely just for politics. But as long as there are these headlines, wheat will continue to be in a vulnerable situation.

Export Sales

Export sales outside of wheat were terrible, with the cancellations from China in the soybean market. Corn was probably the biggest disappointment.

Corn - Slightly up from the previous two weeks. But still very disappointing.

Soybeans - U.S. bean exports came in at 16.2 million bushels. Lowest we've seen in 6 weeks.

Wheat - U.S. exports for wheat came in at 38.5 million bushels. By far surpassing expectations that were roughly 7.5 to 18.5 million. This is the largest weekly total since February of 2019.

Other Markets / News

Crude up +$0.53 to $93.61

French wheat exports hit a 3-year high

Last week we saw the most jobless claims in the U.S. since November of last year. The total came in at 244,000.

Weather

Source: National Weather Service