4 STRAIGHT DAYS OF LOSSES IN GRAINS

Overview

Awful performance yet again for the grains. Initially all the grains started off higher overnight to give back all of the gains and end the day lower.

This now marks 4 straight red days in a row, every single day of this week.

For the week (July Contracts):

Corn: -18 1/4

Beans: -43

Chicago Wheat: -18 3/4

KC Wheat: -12 1/4

For the month of May (July Contracts):

Corn: -1/2

Beans: +42 1/4

Chicago Wheat: +75 1/2

KC Wheat: +74

Why do grains continue to go lower?

The simple answer is a lack of a bullish catalyst. When we lack a reason to go higher, often times the path of least resistance is lower.

On the charts, we failed to break out Tuesday. This led to technical selling.

Corn planting is going to be done in a week or two. The wheat market has paused because the Russia and Urkraine issues are priced in for now. So we no longer have wheat supporting corn and beans.

The funds had been big buyers recently, but have now again switched to sellers. Which does give them more power to cover in the future, but right now they see less upside risk than they did previously when the market wasn’t sure how planting would turn out. Right now there is no risk in these markets for another few weeks.

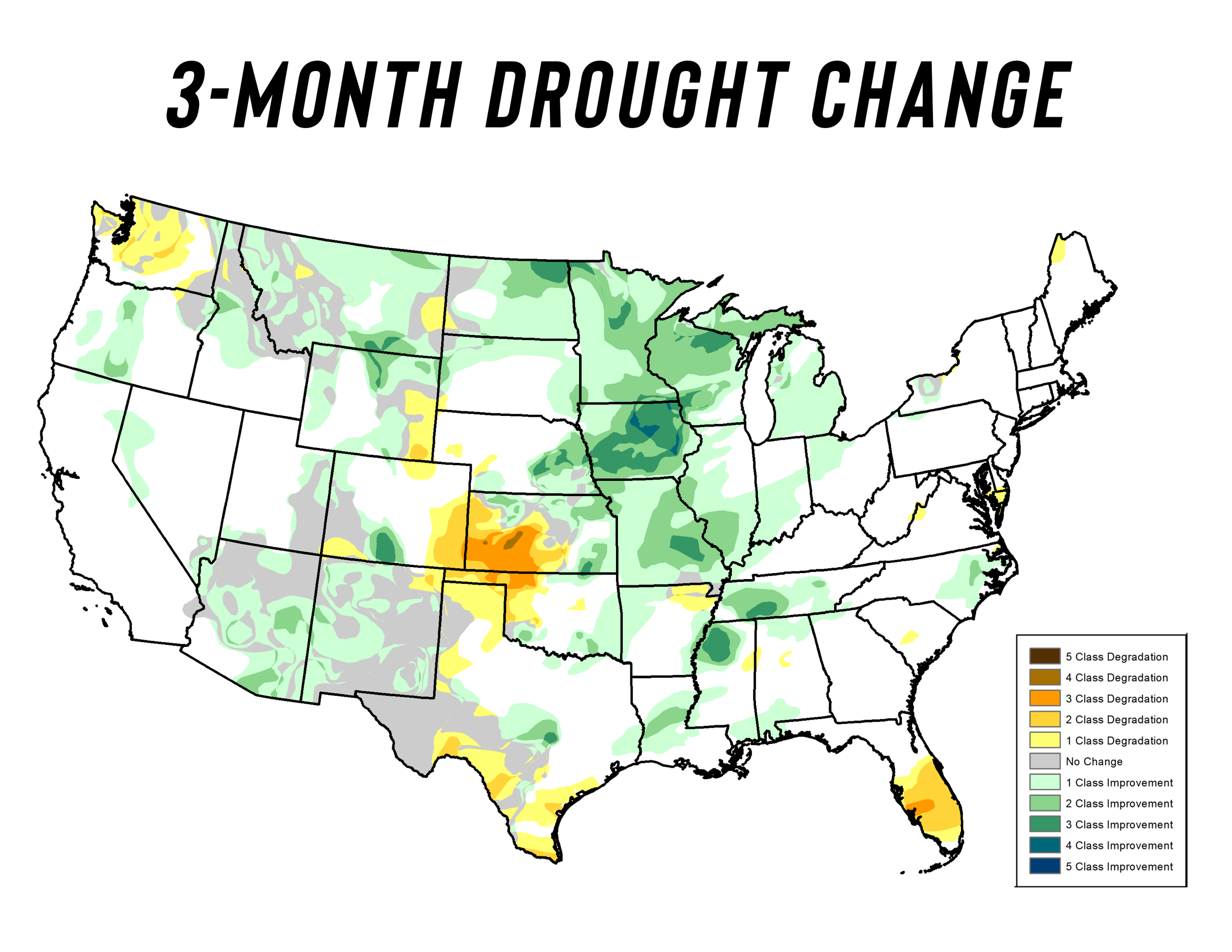

There are no more planting delays. The current US weather outlook looks favorable. This market has completely removed 100% of that weather premium we had in corn and beans. (But gives us the opportunity to add more later).

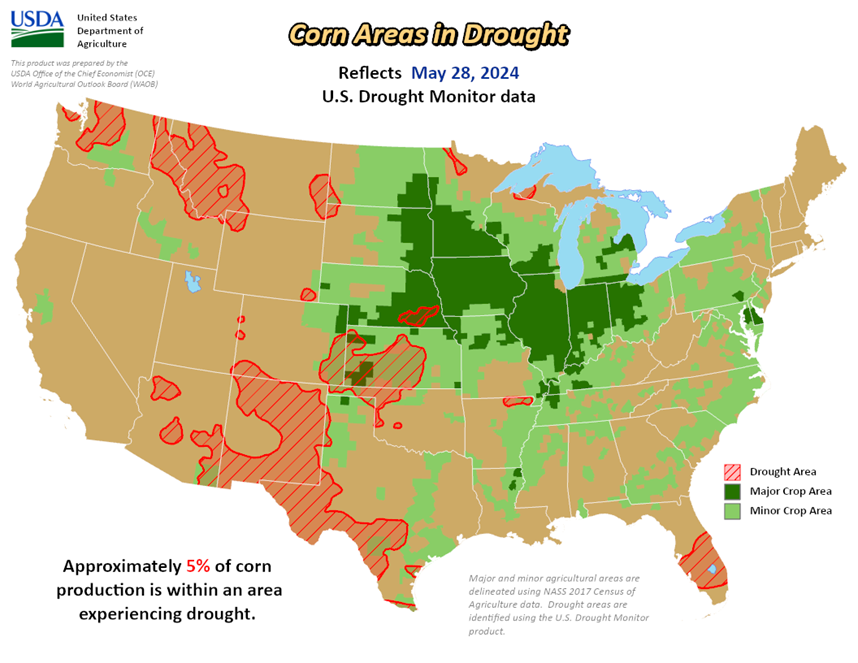

The corn belt drought is now gone.

Areas experiencing drought:

Corn: 5%

Beans: 3%

Winter wheat: 25%

Spring wheat: 3%

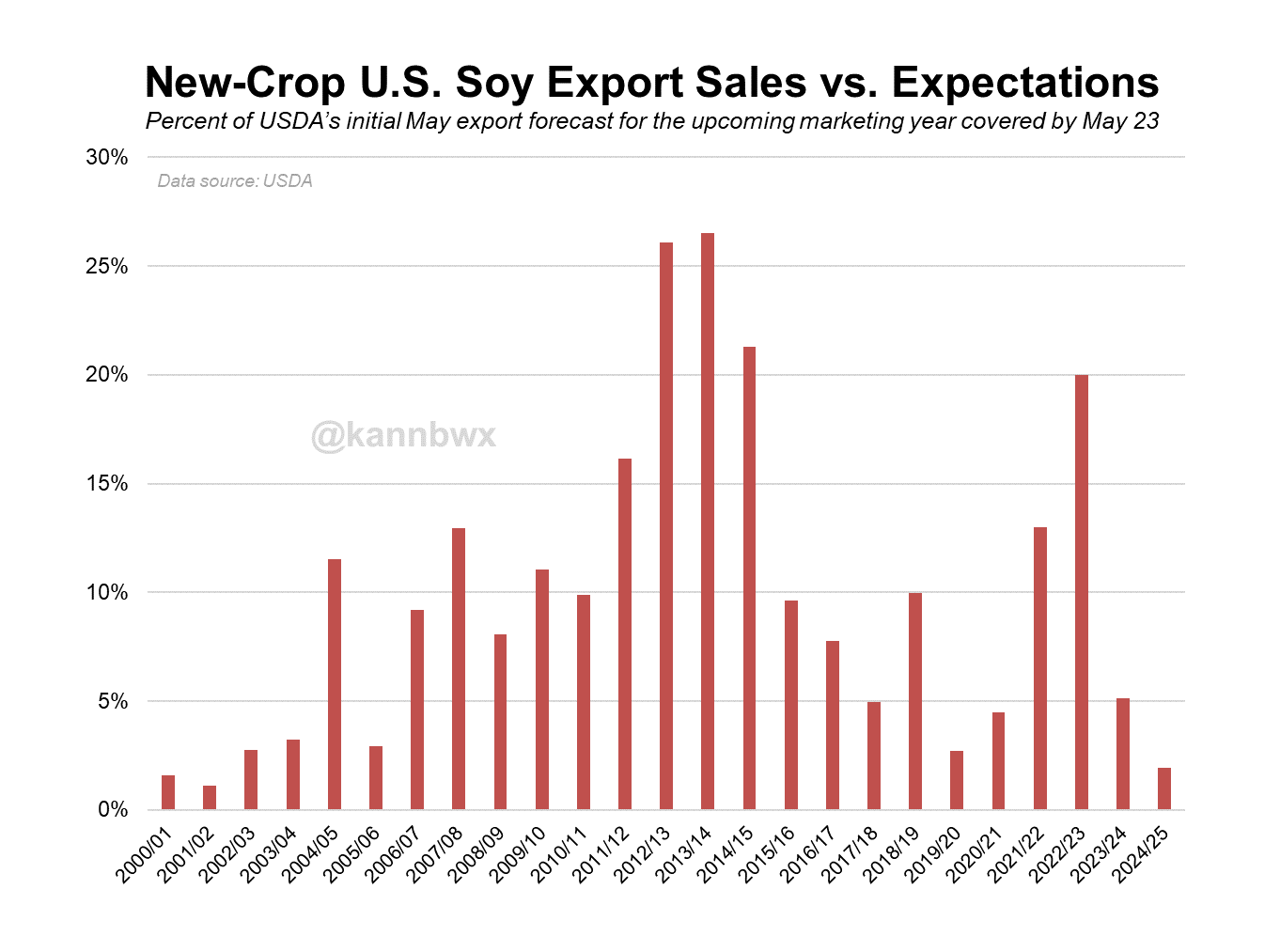

This morning's weekly export sales didn’t provide any support either. As new crop sales for soybeans are the worst in 23 years relative to expectations.

Chart Credit: Karen Braun

We will get our first crop ratings of the year on Monday, most expect some pretty strong initial ratings.

After that, next big piece of data the market is going to get to chew on is the WASDE report in 2 weeks and the USDA acres report a month from now. So this does put bulls in a tough place, with lack of reason to go roaring higher short term until we get into that "real growing season".

However, although we lack a reason to go screaming higher here. We also don’t have a reason to just continue to fall and fall. This downside move was overdone. I don’t see how they would want to break the entire market before the release of the upcoming USDA and acre reports. Plenty of uncertainty still left in these markets...

Today's Main Takeaways

Corn

Corn lower for 4 straight days. It took us 3 months to build up this rally and 3 days to give back half of it.

The funds are now selling again as we lack that catalyst to maintain a rally.

This market has……

The rest of this is subscriber-only. Subscribe to get access to every full updates & 1 on 1 market plans.

IN TODAYS UPDATE

The bigger issue with wet spring

Forecasts shifting hotter in summer

Why USDA probably won’t lower yield in June

Zero weather premium

Russias growing season

Global wheat situation changing?

TRY OUR UPDATES FREE 30 DAYS

Get our daily updates completely free. Create a 1 on 1 plan. Get comfortable.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24