CROP TOURS, BRUTAL HEAT, & NO RAIN

Overview

Grains rally across the board following yesterday’s disappointing price action, as all grains close double digits higher. More impressively in the bean market, started last night off down 14 cents but managed to climb back nearly 30 cents off our lows and end the day 14 1/2 cents higher.

Weather and war were the main driving factors today, as the concerns for bean yield loss and this hot and dry weather push beans higher, while war escalations push wheat higher.

We also saw a private jet in Russia carrying the head of the Wager Group crashed. The same group who recently lead the rebellion against Putin. Some are saying it was shot down. Adds more uncertainty to the entire war situation.

As for the war news, we saw Russia launch missile and drone attacks on both the port of Odesa as well as the Danube River. This was seen as a retaliation attack from when Ukraine attacked Russia.

The weather remains brutally hot for the next day or two but looks to cool off a bit as we head into the weekend.

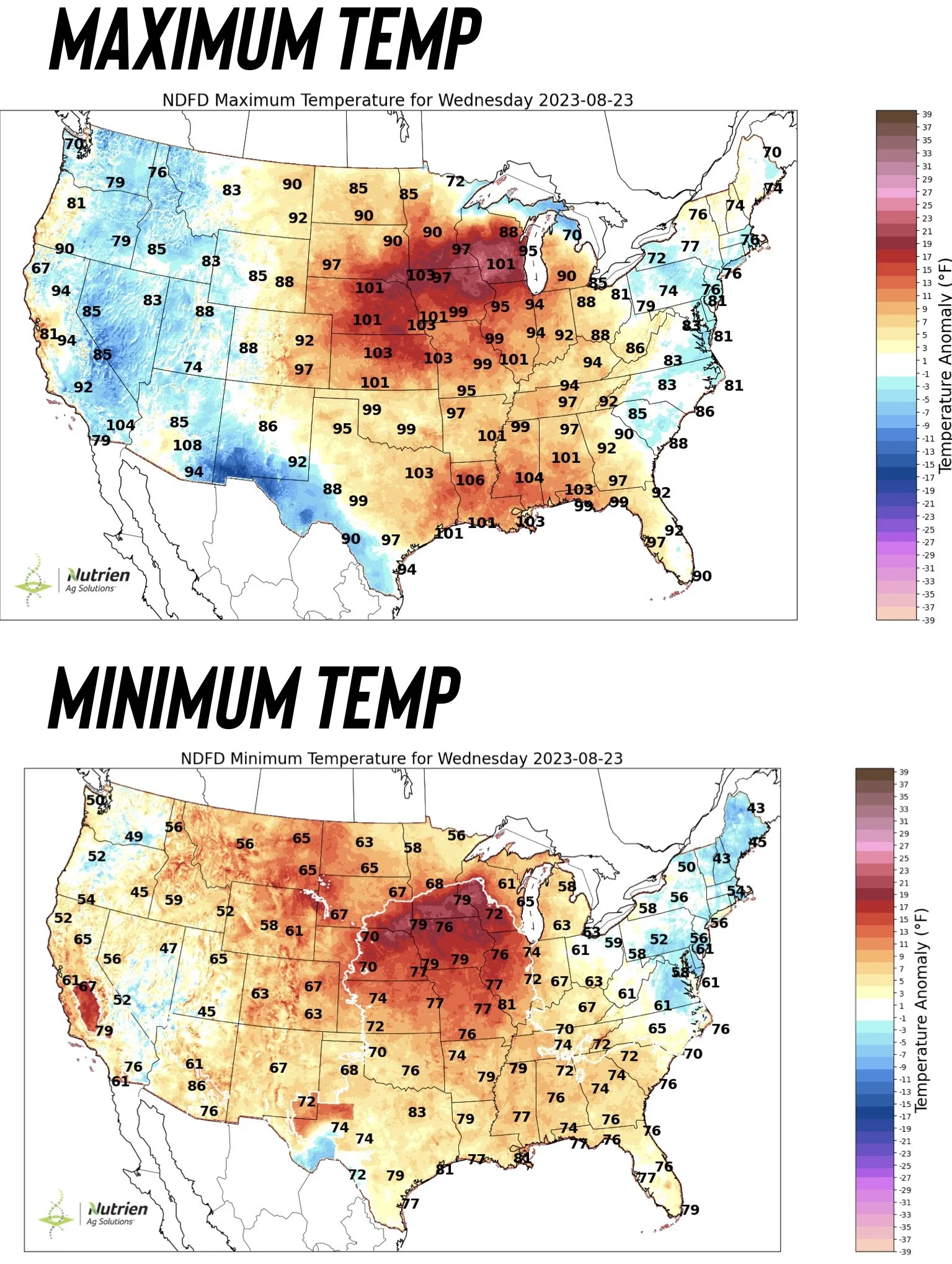

Here was the maximum and minimum temperatures for today. This certainly isn’t helping the crops. The night time temps, if too hot, can be critical.

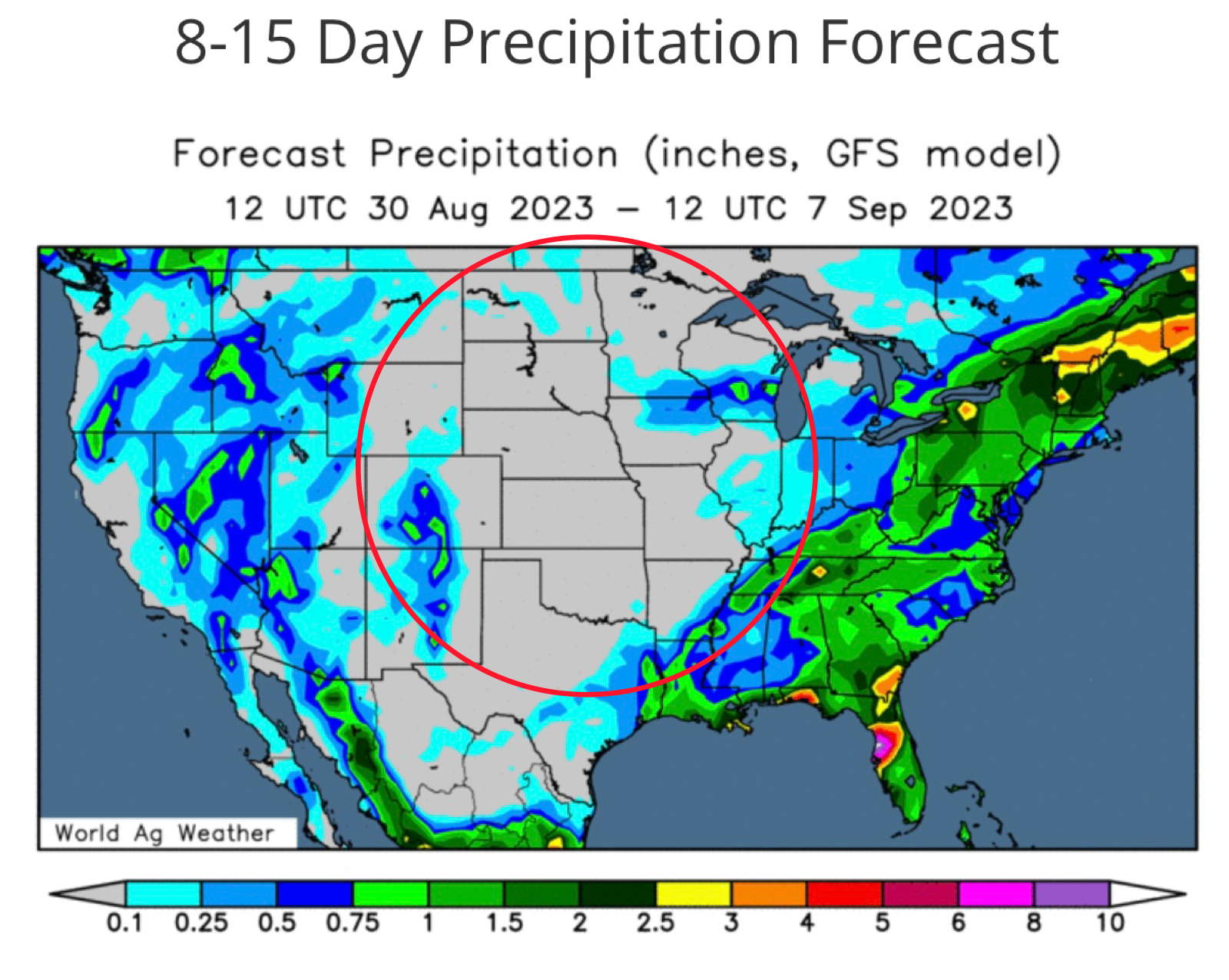

But just as importantly along with this heat, the corn belt is expected to see nearly zero precipitation over the course of the next 2 weeks.

Take a look at the 8 to 15 day precipitation forecast.

I touch on this later, but beans need moisture towards the end of their maturation cycle to prevent yield loss.

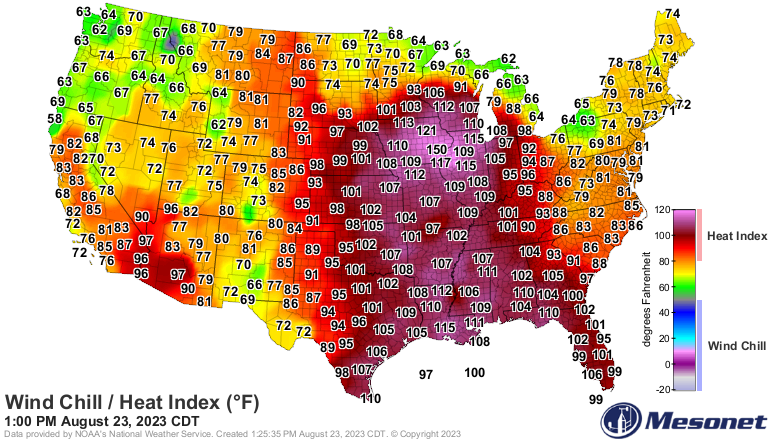

Here was the heat index today. This isn’t actual temperatures. This is just how "hot it feels". Was that 150 degrees a typo? Absolutely brutal heat for those on the crop tours.

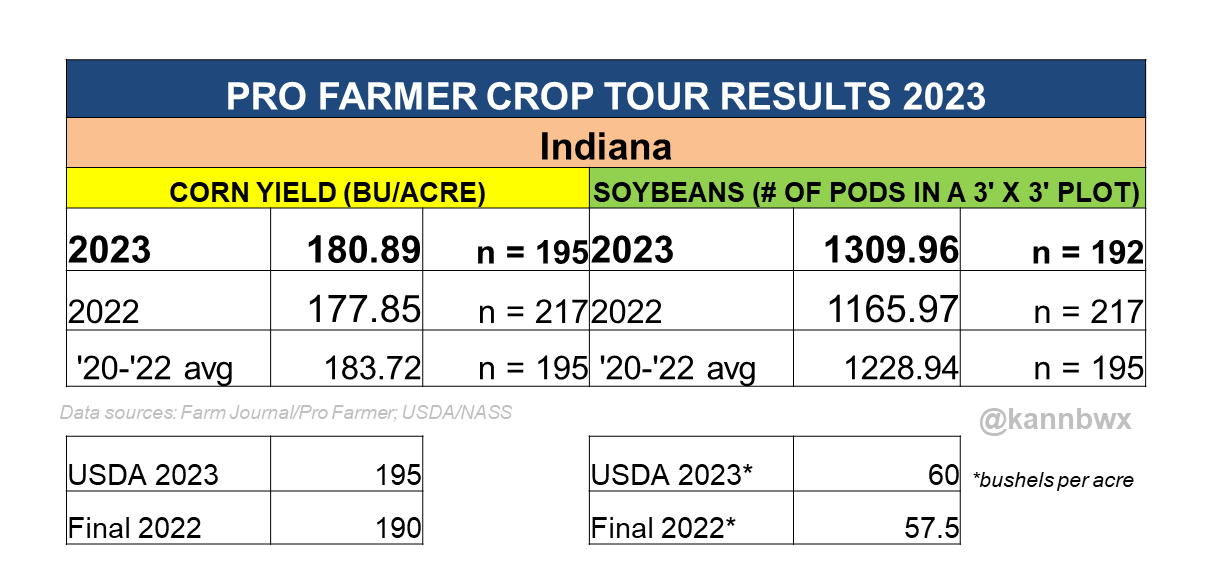

As mentioned yesterday, day 2 of the crop tours weren’t as great as day 1 was, but they weren’t bad. They came in better than last year. Making the first 2 days of the crop tours both coming in better than last year.

Nebraska corn yield came in at it's 2nd lowest for the tour since 2017, but still better than last year. Their bean pods were below last year and the 3 year average.

Indiana corn yield came in below average but also above last year's. However, their beans were solid, showing well above average pods.

So overall, day 2 was mixed. But how does the crop tours line up with final yield historically?

Below is a "cheat sheet" that tells us how far off the tours are usually from the USDA's final number.

For Indiana, they are typically 3.5 bpa too low compared to final yield. Yesterday they came in with 181 bpa. If we add that 3.5 we get 184.5. Which is still FAR below the USDA's current 195 estimate. But is about on par with the states 3 year average.

For Nebraska, the crop tour is usually 14 bpa too low. If we take the 167 bpa we got yesterday and add 14, we get 181. Which is still slightly below the USDA's 184.

Here were the results.

From Wright on the Market,

"These much better than expected Pro Farmer yields will make it very difficult for the harvest reports to be 'better than expected'. That means we can be confident that the fall low will be made before harvest begins"

Today the crop tours are touring Illinois and Iowa. Our two largest growers. The numbers out of these fields will be a big deal.

I don’t think the rest of the crop tours will show as good as numbers as day 1 and 2. So I expect us to start getting more spotty results, which should ultimately support prices.

From Karen Braun,

Karen Braun who is on the tours said that on her 9 stops in West Central Iowa, corn yield was 159 bpa. Last year on her exact same route, the yield was 188 bpa, and was 200 bpa in 2021. We could in for a surprise come 8pm tonight when the numbers are released.

From Darren Frye of Water Street Ag,

"Wow. No way we will stay above 170 as a nation the way Illinois and Iowa are coming in. The crop is on it's way to the grave and limping in at that!"

Tomorrow the tours will finish up, hitting the rest of Iowa and then southern Minnesota.

Taking a look to next week, we get crop conditions on Monday. I have a feeling these are going to be hit pretty hard.

Heartland Farm Partners is predicting a 3% to 5% decline Monday due to this week's weather.

Here is another bold prediction from Jason Britt, the President of Central State Commodities. He is predicting that corn ratings drop by at least 7% and that beans will drop anywhere from 8% to 10%.

I actually don’t disagree with these predictions. We are definitely going to a rather big drop. I think it will shock some people the amount of damage this week's weather has done. We are hearing a lot of talk about just how quickly the crop is deteriorating in the midwest, especially with these type of high overnight temps.

Overall, we saw a great close on the charts across the board. We got some good follow-through strength from yesterday's lows. As we mentioned yesterday, we expect a strong closeout to the week barring any bearish surprises from the crop tours.

Bottom line, this past week has been hot and dry. Future outlook remains dry. We will have to see how these crop tours pan out, but expect a drop in ratings come Monday.

Today's Main Takeaways

Corn

Corn rallies off the back of war and weather headlines. Closing up over a dime and taking out yesterday's highs, which is a good sign. Corn is only down roughly 2 cents on the week.

Lately, corn has struggled to keep any momentum to the upside as we still sit below $5 and haven’t had a close above in 3 weeks as of today.

Demand is still the biggest concern and thing keeping a lid on corn futures.

From what I’ve seen on social media, I think we will see these Pro Farmer crop tours support us to close out the week. Today we have Iowa and Illinois, then tomorrow we have the rest of Iowa and Minnesota. We all know the issues Minnesota has faced with their weather.

I fully expect……

The rest of this is subscriber-only content. Please subscribe to keep reading and get every exclusive update sent via text & email.

KEEP READING WITH A FREE TRIAL

Get every single exclusive update sent via text & email. Scroll to check out past updates you missed. Try a 30 day free trial or get 50% OFF yearly or monthly HERE

Become a Price Maker. Not a Price Taker.

Updates You Might’ve Missed

8/22/23 - Audio

DON’T PANIC. TODAY REINFORCED HIGHER PRICE OUTLOOK

8/21/23 - Audio & Market Update

MARKETS PLAYING LEAP FROG

8/20/23 - Weekly Grain Newsletter

WHY THIS IS MORE THAN A DEAD CAT BOUNCE..

Read More

8/18/23 - Market Update

GRAINS BOUNCE. WEATHER REMAINS BULLISH

8/18/23 - Audio

WEATHER,WAR, & MANAGING RISK

Read More

8/16/23 - Audio

CAN DEMAND & WEATHER LEAD TO A BOUNCE?

8/15/23 - Audio

GRAINS LOWER WITH IMPROVEMENT TO CROPS

8/14/23 - Audio

BEANS RALLY BUT CONDITIONS IMPROVE & WHEAT DISAPPOINTS

8/13/23 - Weekly Grain Newsletter

WHAT’S NEXT FOLLOWING DISAPPOINTING USDA REPORT?

8/11/23 - Audio & Report Recap

USDA REPORT BREAKDOWN

Read More

8/10/23 - Audio