ELECTION TOMORROW

MARKET UPDATE

Video Version is Subscriber Only*

For Full Access: CLICK HERE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

SNEAK PEAK OF TODAYS UPDATE

Below is 4 separate snippets from various sections of today’s update.

If you want access to the entire thing along with future updates, signals & 1 on 1 plans subscribe.

TRY 30 DAYS FREE: CLICK HERE

...Why did we get that early pop?

Hard to say exactly why, one reason in beans I'll touch on later is the weakness in the Brazil Real as it approaches multi-year resistance.

But personally today I think it was due to the election.

Let's take a look at the election betting odds & polls.

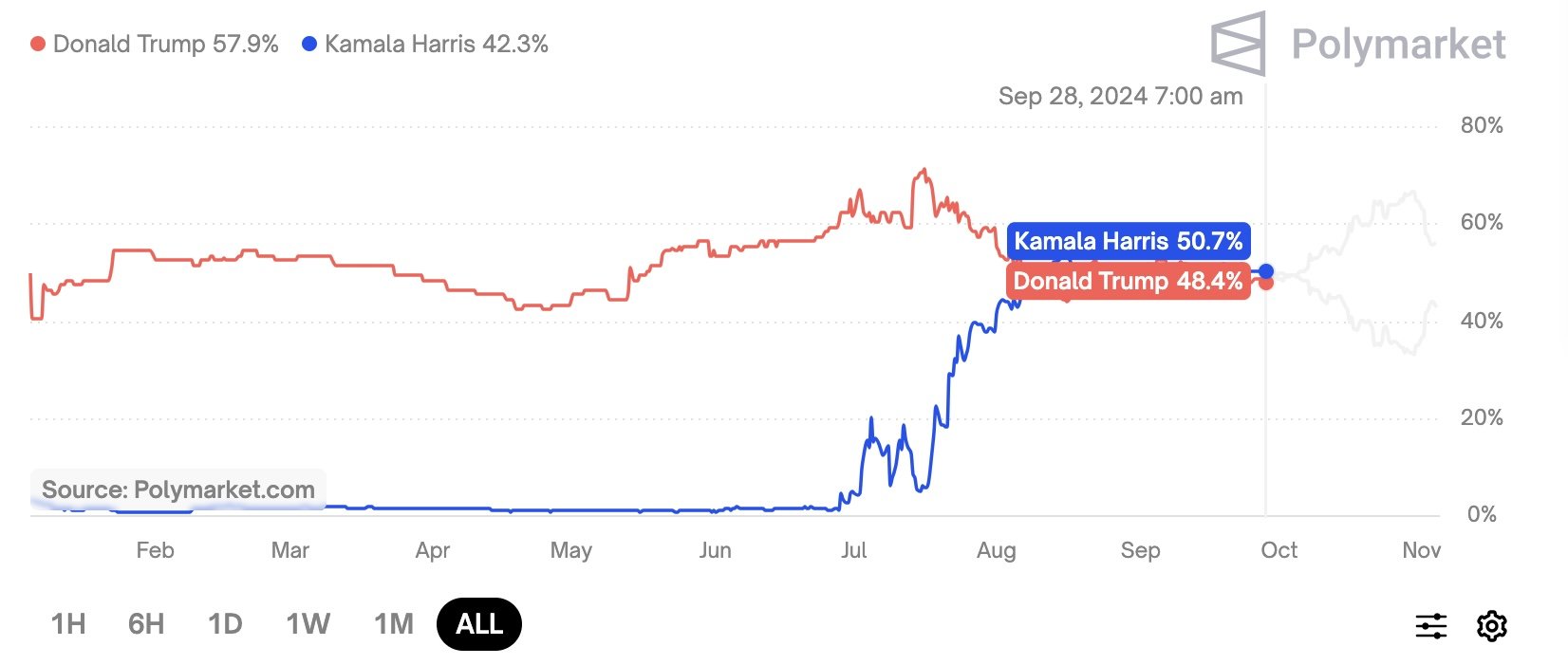

Here were the betting odds on September 27th when soybeans made their recent highs.

Trump: 48.4%

Harris: 50.7%

Shortly after, Trump took a sizeable lead and soybeans gave back that entire rally.

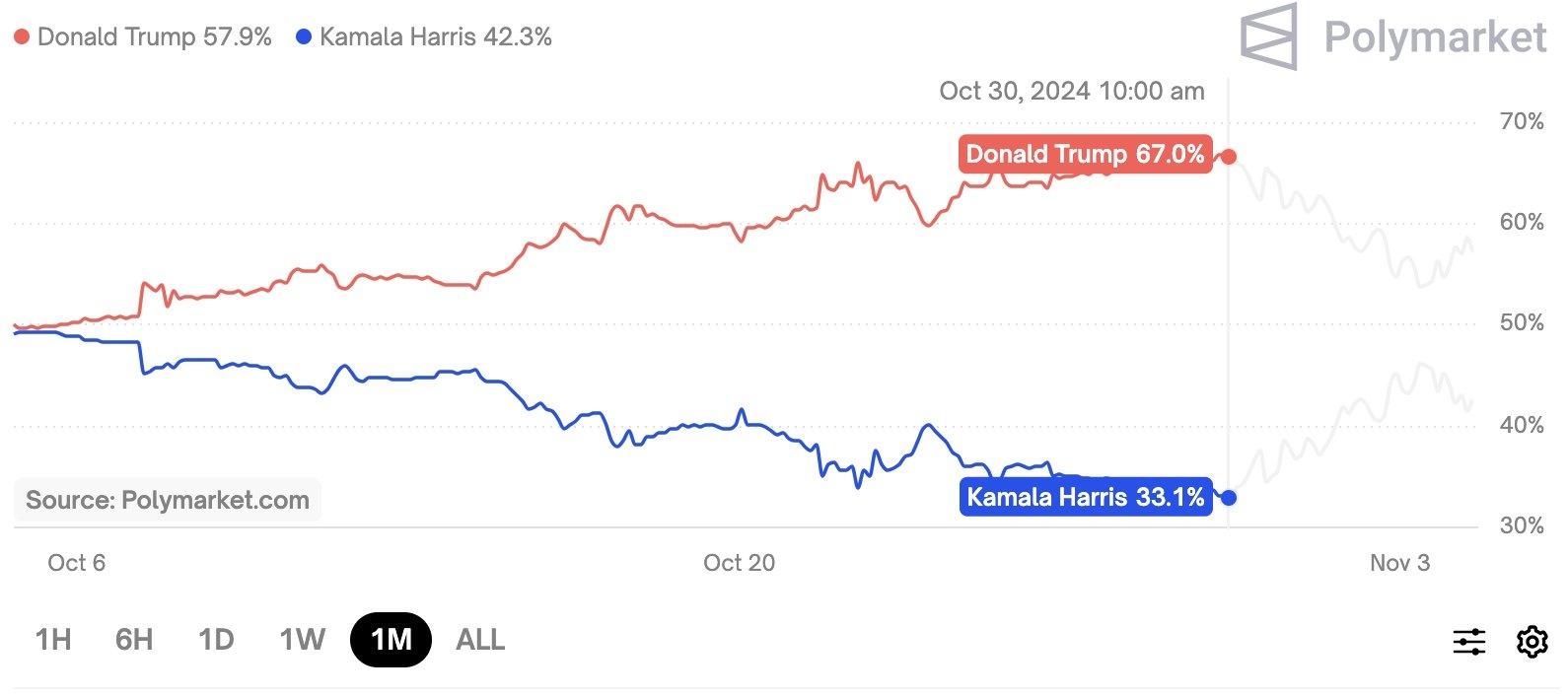

Here is the betting odds on October 30th.

Trump: 67%

Harris: 33%

This was the day Trump had his largest leads on the betting market.

It is also coincidentally the day soybeans made their recent lows last week.

Now here is the………..

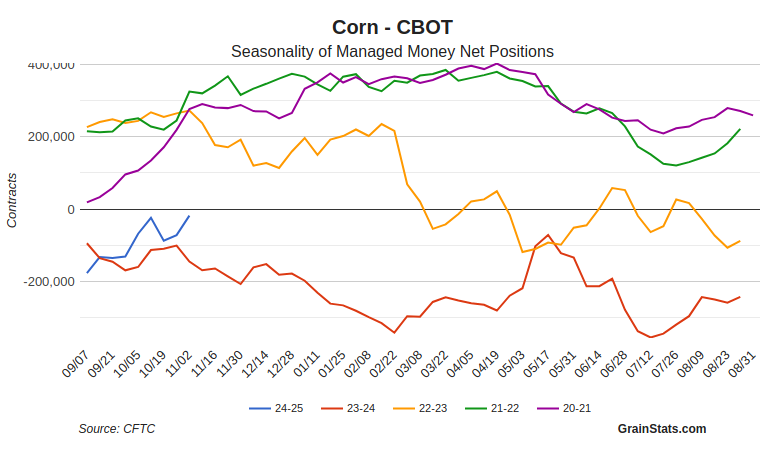

…The funds at one point this year were short over a record -350k contracts of corn.

Now they are short just -17.7k contracts.

The smallest short position since August 2023.

You can look at this two ways:

There is no longer the potential for a massive short covering event.

But it also means that the funds are no longer betting that corn is heading lower.

Chart from GrainStats

Long term, I still believe corn has plenty of upside. (I am talking +3-6 months looking towards next year)

The USDA could very well…………..

Soybeans

Outside from the changing election odds, one reason for the recent mini bounce in soybeans might be the weakness in the Brazil real today.

As you can see, they are highly correlate sometimes.

If the Brazil real goes up, beans often go down. And vice versa.

This is one "potentially" friendly factor I see.

As the Brazil real is sitting at multi-year resistance levels.

Of course it could keep going higher and bust through, but if it was gonna cool off this would be the spot to do so.

Short term, if we look at the chart we also have some potentially friendly signs.

Yes the past 2 sessions we closed well off the highs, which is not a good sign.

However, we have a daily MACD bullish cross. The last time saw one was that late August rally.

We also have some bullish divergence on the RSI.

This is also a friendly sign and sometimes signals "possible" reversals.

(It happens when the RSI forms an uptrend, while prices form a downtrend)

I am not saying this HAS to happen. But they are potentially friendly signs short term.

For example: we had bullish divergence at the end of August, yet we still went lower.

If we were to get a rally, and you wanted to look at a spot to take some risk off the table. I would be looking at the $— range………

…Short term, beans don’t have that first notice day selling pressure.

With harvest complete, it looks like we won't see farmers pulling beans out of storage at levels $1.50 below breakeven.

But if we do get a short term pricing opportunity, be ready to take advantage.

As the long term outlook for soybeans is still very unclear and bearish if nothing changes.

A major rally is going to be tough unless we see a story out of Brazil.

But right now, Brazil doesn’t look like a problem. Their planting is entirely caught up and they are forecasted to have great rains for now.

"Well what if the USDA drops yield this week?"

It would be friendly, but wouldn’t……………….

Subscribe for Full Access

30 DAYS FREE: CLICK HERE

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24