DROUGHT & AI YIELD PREDICTIONS

Today’s update will a little different than usual. Instead of breaking each of the grains down 1 by 1, we will be doing a vast overview and everything you need to know that is going on in the grains and perhaps what we can expect going forward.

As aside from weather, not a ton has changed. Weather continues to steal the show and will continue to be the make or break factor all summer long.

Grains finally found some support following our rough start to the week. As beans explode for nearly 30 cents, the wheat market closed up double digits in both Chicago and KC. Corn initially saw some strength, but ultimately faded 14 cents off its highs and ended the day lower a penny and a half, while new crop corn did finish 8 cents higher.

Overall, the markets are in a much better situation from where they were just yesterday morning. We rallied corn 30 cents off its lows from yesterday, the wheat 30 cents off its lows, and the beans well over 50 cents. So a great turn around from yesterday morning perhaps a sign of a reversal here in our markets.

We had two key things moving the markets today. Those being war and weather.

The were reports that Ukraine says Russia has blocked Black Sea grain export deal again. This has been a back and forth headline for a very long time now, but ultimately gave some support today. Russia also stated that their coast was being under attack, which led to them coming out with statements saying they might go ahead and cancel the grain deal. Is this just another ploy by Russia to sell wheat at higher prices? Who knows. But Russia has been making a lot of complaints ever since they extended it. So perhaps there is that chance they make that decision to not renew it when it comes time.

The second, and more impactful factor we saw was simply the weather. There has been some pop up rains but nothing note worthy. The long term forecasts still look very dry. We received the newest updated drought monitor.

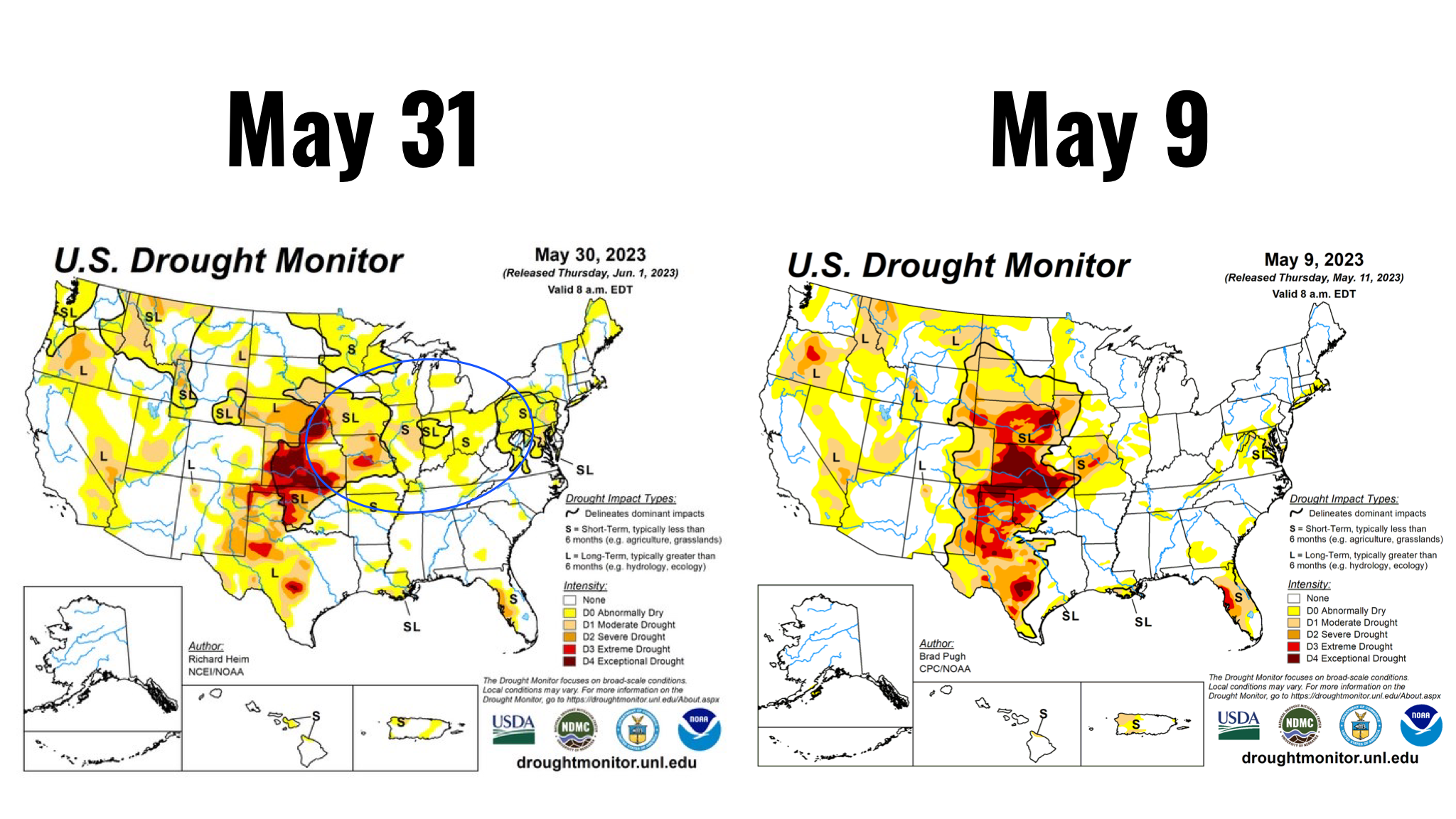

Below is a drought monitor comparing the most recent one, with one from 3 weeks ago. As you can see, we are seeing some slight improvements in areas such as Oklahoma, but the dryness is spreading east into the corn belt.

Just for comparison, 2012 was drier overall at this same point in time. But if we take a look at the corn belt, this year is actually far drier thus far.

Another 2012 comparison. There is 23% more drought in 2023 for the Midwest than we had in 2012. The question is, does this dryness continue? If so, we could see corn a lot higher from here.

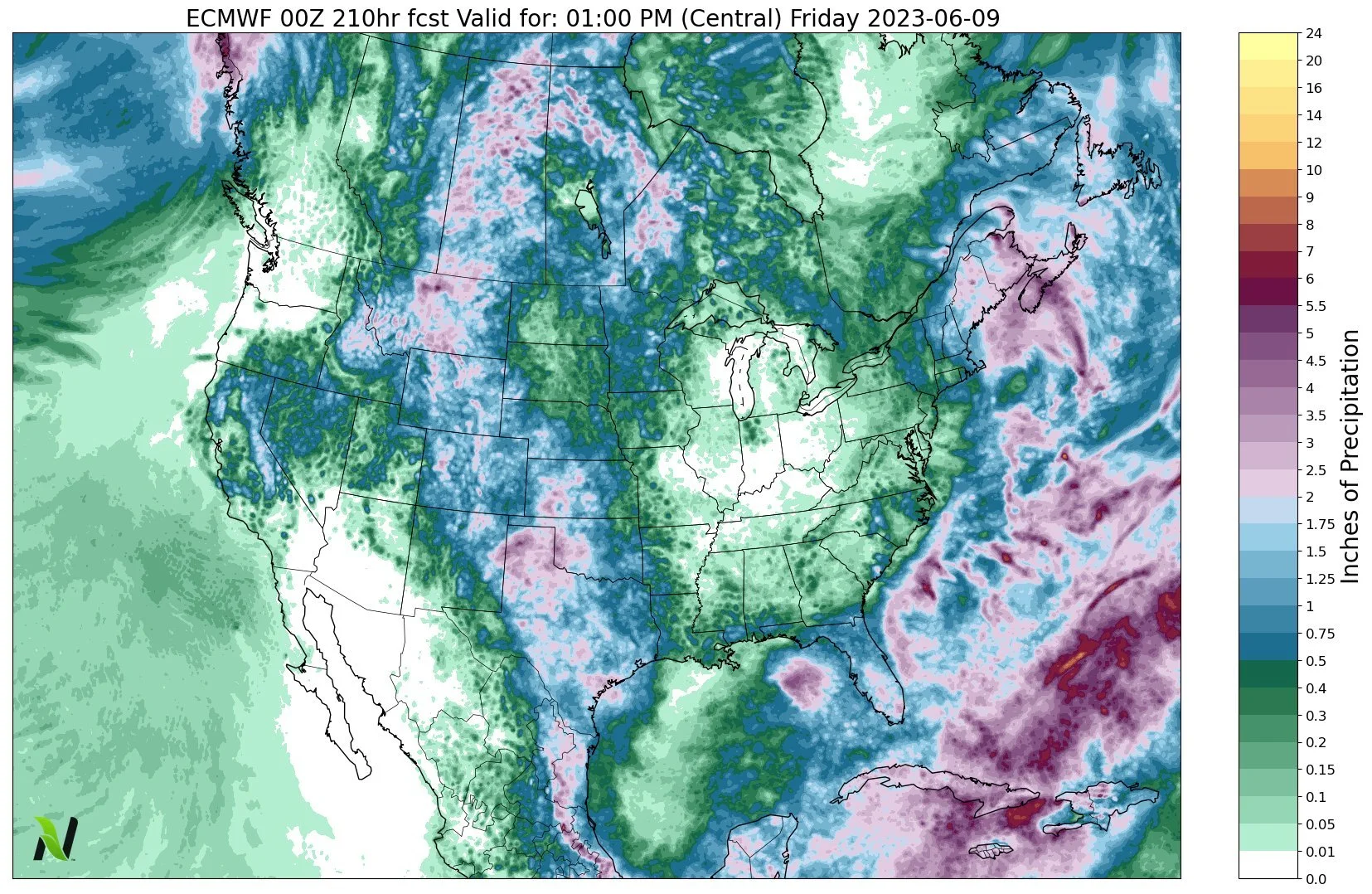

Forecasts are looking very dry for the first part of June. This is after coming off of a near record dry May. So even if rainfall is slightly below average, it doesn't make for a very ideal situation coming from such a dry May.

Short term, we essentially have no meaningful rain in the forecasts for the corn belt. Notice the only area expected to receive minimal if any rain.

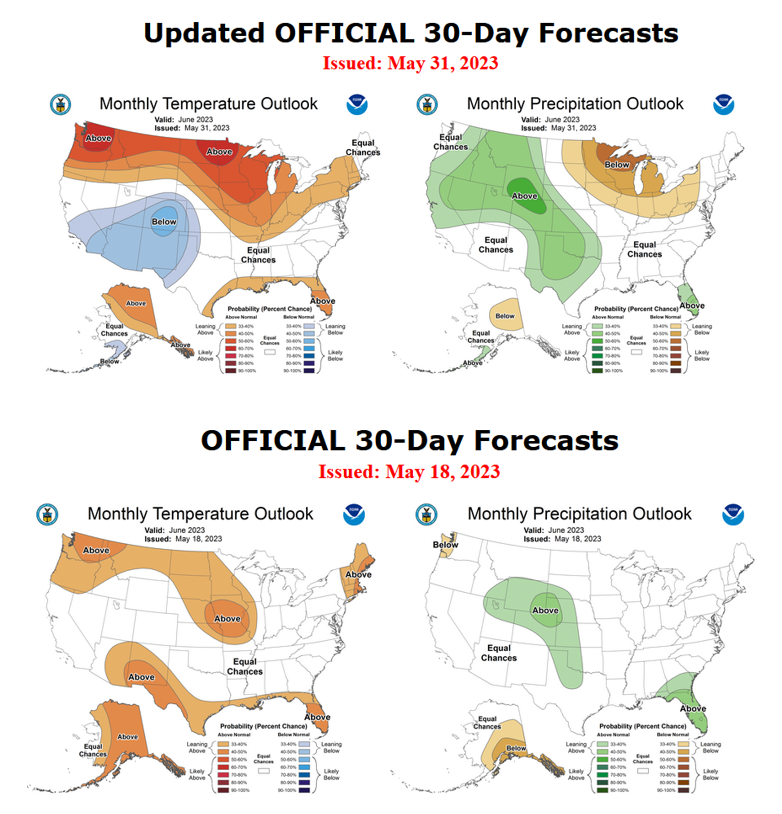

Here is a monthly outlook comparison for June. The top one is the current outlook which came out yesterday. The bottom one is from May 18th, just 2 weeks ago. That is a big difference. Again, the corn belt looks to be getting hotter and drier.

We saw intial crop conditions come in at 69% rated good to excellent, which is already lower than that of last year's. If it stays dry, I can’t imagine we see this number improve. As we had been mentioning for the past few week's before the initial ratings came out, we still think that this number could very well be the highest number we print all year long.

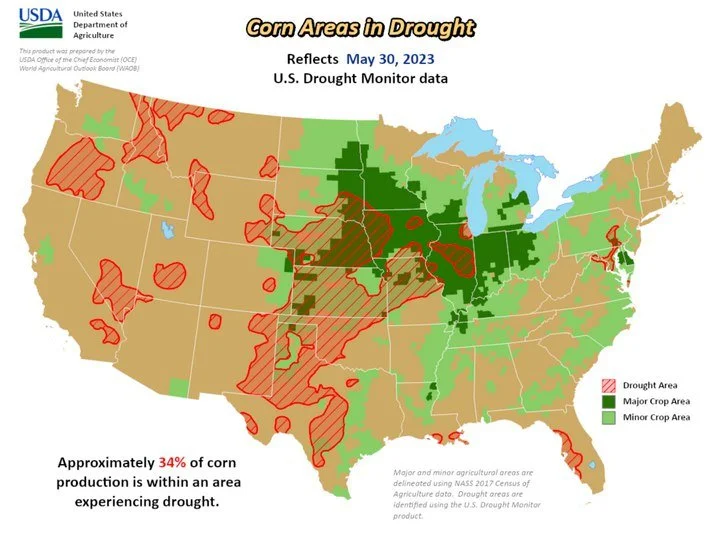

Currently, 34% of the corn here in the US is experiencing drought. This was a pretty big 8% increase from last week's 26%. As mentioned, the forecasts don’t indicate this is going to change within the next 7 to 10 days at minimum.

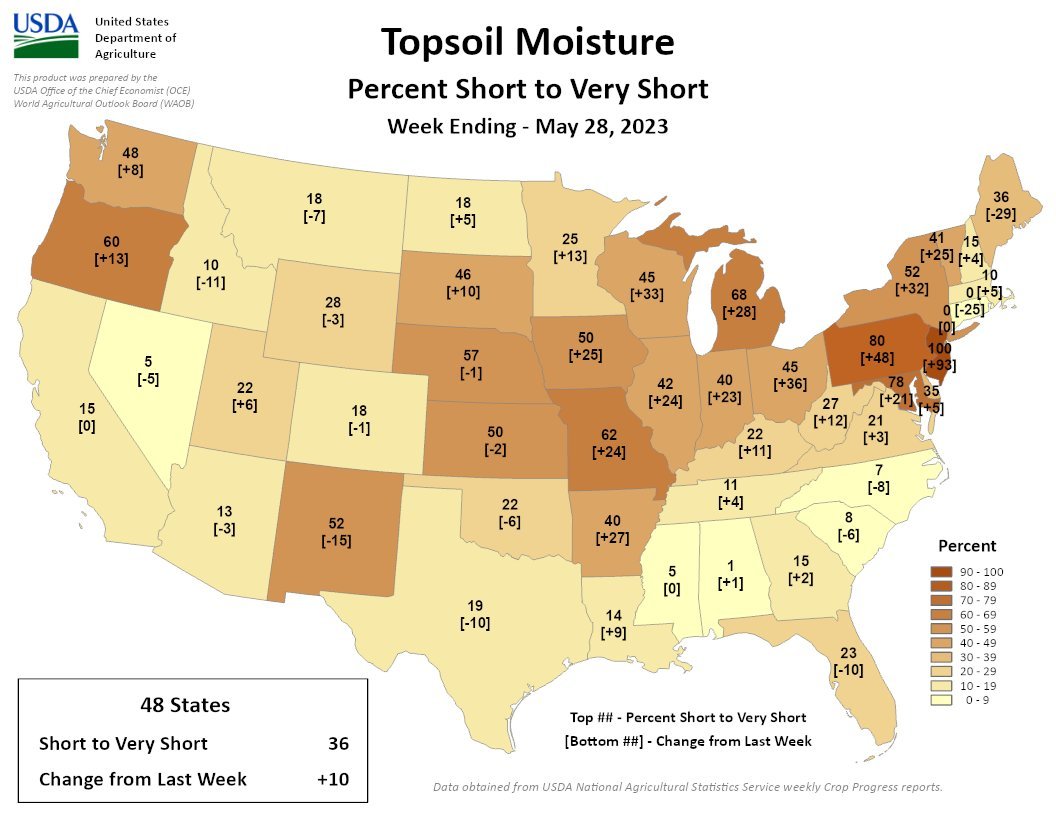

US soil moisture rated short to vey short also jumped 10% to 36% nationwide this week. As soil moisture drops rapidly in the midwest and north east.

So all in all, it is clear the drought situation is getting worse not better.

For those of you that have been following us since last year, have been preaching about this potential drought since fall.

The market is finally beginning to realize that problems we could face, and we are starting to build that weather premium in.

In the end, it will all come down to weather. Does it stay dry, and we get a similar type drought to that of 2012 that ultimately rallies us much higher? Or do we get rains that bust the drought and send us lower?

Personally, I think the market is still undervaluing weather premium here. Especially in the corn belt. The trade and USDA are expecting us to have this perfect growing season, and currently, that just doesn’t look like it is going to be the case. What happens if we fall short on yield by a wide margin?

What is AI's current outlook and yield predictions?

Below is another interaction with the popular AI tool "ChatGPT" that has taken the internet by storm the past few months. We asked it for the current outlook on the corn belt, it’s predictions for the July & August yields, as well as what it would do if it worked for the USDA.

Me:

What is the current weather and growing conditions outlook for the month of June in the corn belt?

ChatGPT:

The current weather and growing conditions outlook for the month of June in the Corn Belt are not ideal. There has been an unusual amount of dryness in the region, with the final week of May being the driest in over 30 years. Dry conditions have increased in various regions, including abnormally dry to drought conditions in parts of Iowa, Illinois, and Indiana.

As June begins, the heat is expected to shift farther east and south into the core of the Corn Belt. The start of June is forecasted to be the third hottest in over 30 years, according to data from WeatherTrends360. The dry weather is set to continue as temperatures rise, which is raising concerns for soil moisture, especially as evapotranspiration rates increase in the heat

Me:

What do you think is the probability of US corn yield dropping below 160 bushels per acre?

ChatGPT:

The previous yield was 181.5 bushels per acre. The impact of the 2012 drought, which was severe, resulted in a yield decrease of about 48 bushels per acre (from 171.9 to 123). If this year's drought has a similar impact, we would expect a significant yield decrease.

Given that the current drought conditions are even more severe than they were in 2012, and the fact that we're already seeing an early drop in corn good/excellent ratings (from 73% to 69%), the probability of a yield below 160 bushels per acre is…….

The rest of this post is subscriber-only content. Please subscribe to continue reading and receive every one of our exclusive daily updates via text & email.

INCLUDED TODAY

AI’s yield predictions for July & August

What percentage of chance do we see yield drop below 160 bpa?

If AI worked for the USDA..

A replication of 2012?

How long until the fireworks start?

GET 50% OFF YEARLY

Use code “DROUGHT” to get 50% off ($400 value). Get every single one of our updates sent via text & email. Scroll to the bottom to check out past stuff similar to what you’d receive.

UNSURE? TRY FREE TRIAL

Check Out Past Updates

6/1/23 - Audio

Weather Markets In Full Swing

5/31/23 - Market Update

Grains Crawl Back

5/31/23 - Audio

Are Markets Overdone to Downside?

5/30/23 - Audio

Is There Opportunity In Today’s Sell Off?

5/28/23 - Weekly Grain Newsletter

$12 or $3 Corn? Which Will Mother Nature Give Us?

5/26/23 - Audio

Volatile Markets Ahead of Memorial Day

5/25/23 - Market Update

4th Day of Gains in Corn

5/24/23 - Audio

Are You Prepared If We Tank or Rally?

5/23/23 - Market Update