GRAINS LOWER AHEAD OF ACRE ESTIMATES

50% OFF President's Day Sale

We extended our sale through the rest of the week. Last chances to get half off yearly or monthly.

Overview

Grains all trading lower, with lack of bullish news to influence the markets, while global political headlines also adding some pressure.

In 2010 the U.S. and Russia signed a treaty that limits the number of strategic nuclear warheads that the countries can deploy. Yesterday we saw Putin reaffirm his commitment to the war, and he announced he would suspend their participation in the current nuclear arms control pact with the US. Could things be heating up soon?

Short term, all eyes are on the end of this week's USDA Ag Outlook Forum where we get a look at early acre estimates.

Read Sunday's Weekly Grain Newsletter Here

Today's Main Takeaways

Corn

Corn lower here today, continues its choppy sideways trading action. As prices now move back to their 20-day moving average.

Early Argentina corn yields are reported to be coming in below expectations. Yes the frost over the weekend hurt their beans more than their corn, but it certainly didn’t help the already poor crop.

Tomorrow we will get the USDA Ag Forum and a look at early acre estimates. Most are suggesting we probably see corn acres a little higher and bean acres a little lower. So I wouldn’t be surprised to see corn under some pressure to end the week if that is the case.

On the flip side, bulls continue to look at the problems Argentina is facing, Brazil planting delays, and uncertainty surrounding the grain corridor deal. The deal expires in less than 30 days now. Ukraine is looking for a year extension.

Outside of the possible larger acres, bears also keep looking at demand, and seem to think we need to see the USDA again lower U.S. corn exports, ethanol, and feed demand.

Looking forward to the end of this week, its not looking like we will see a ton of super bullish headlines or demand stories outside of more planting delays in Brazil. As expectations for the Ag Outlook are slightly bearish.

In that report, the trade is looking for 91 million acres. Here are some acres from previous years as well for perspective;

2022 - 88.6 million

2021 - 93.3 million

2020 - 90.7 million

2012 - 97.3 million

Chart from GrainStats

GrainStats Chart

Corn May-23

Soybeans

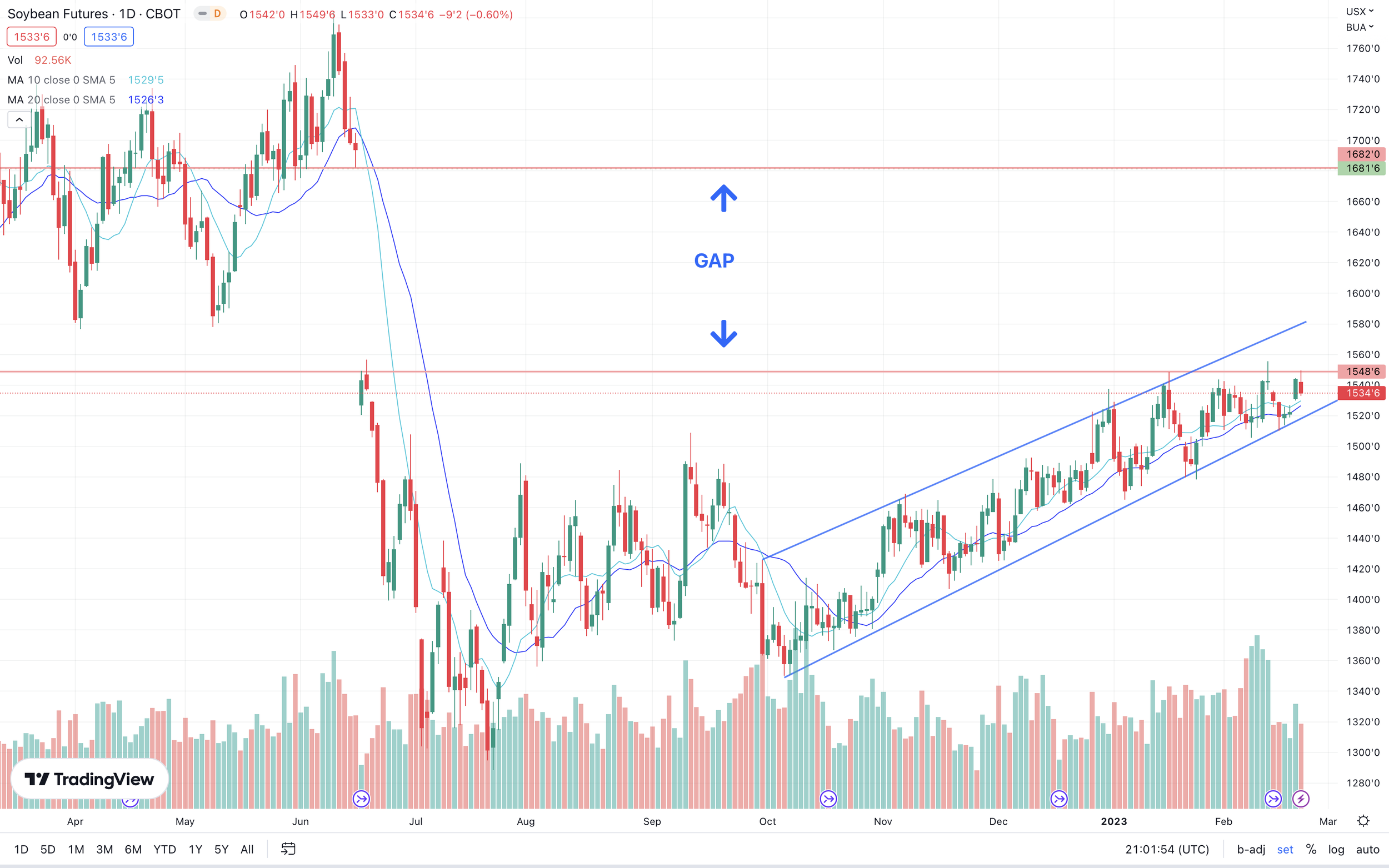

Yesterday we saw beans test our recent highs as they made a new high close, but weren't able to hold on to that strength here today following the rest of the markets lower.

Going forward, South America weather will continue to be the story surrounding beans. How bad was the frost damage? Will we continue to see harvest delays? But looking short term, we have a big USDA announcement coming up tomorrow and Friday. As the USDA will be releasing its early guesses for U.S. acres in their Ag Outlook Forum.

The trade is looking for bean acres to come in at 88.6 million. Here are a few past years for reference;

2022 - 87.45 million

2021 - 87.20 million

2020 - 83.35 million

2012 - 77.2 million

Here is what Van Trump had to say about the acres and the report this week;

"Keep in mind, back in 2012 when we planted a record 97.3 million corn acres, we only planted 77.2 million soybean acres. In 2013 when we planted 95.4 million, we only planted 76.82 million soybean acres. And in 2016 when we planted 94.0 million corn acres, we planted 83.45 million soybean acres. In other words, there are only so many acres in play and the soybean balance sheet can't afford much of a reduction in acres, so it's going to be very interesting to see how the combination of corn and soybean acres unfolds in 2023. For further reference, when you add planted wheat and cotton acres to the planted corn and soybean acres we typically (the past few years) see a total somewhere between 235 and 240 million total planted (corn, soybean, wheat, and cotton) acres. I suspect if the US planted soybean acreage number comes in below the trade guess of 88.6 million acres bulls are going to again add more risk-premium and prices are going to move even higher."

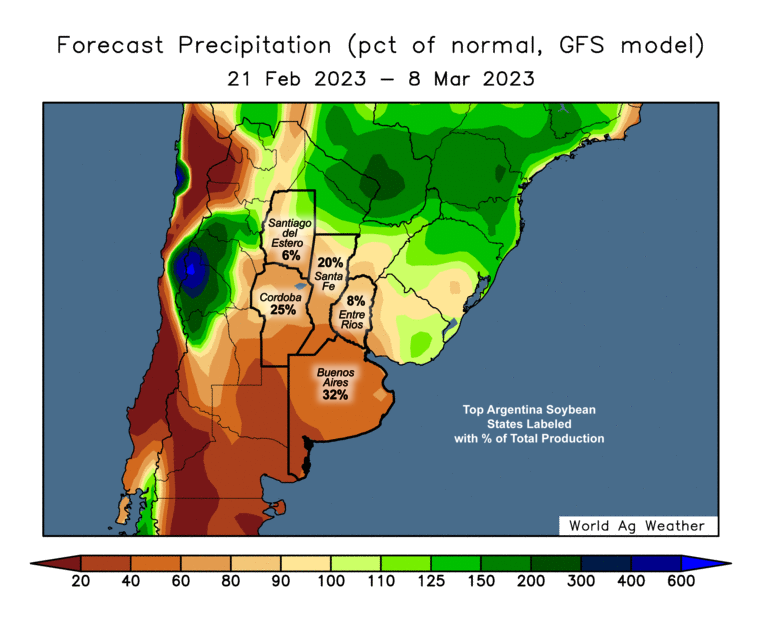

As for South America, bulls keep looking at all the problems they've been facing. I mean first off, we have a severe drought with extreme heat, then the crops are thrown into freezing temps, then shortly after again put into extreme heat. We already knew the crop was very poor, but this recent frost just adds on to that. Bears on the other hand are making the argument that South America weather headlines will soon be in the rearview mirror and most of this is already priced in. They also think that big crops in other countries such as Brazil will more than make up for the losses in Argentina.

While Brazil is facing harvest delays, Mato Grosso is now 60% harvested, which is faster than their average of 58%. There were some unexpected rains in Argentina last night which was likely the reason for the break lower here. But current outlook is still pretty dry for Argentina.

Taking a look at the chart, we again retraced lower after testing our recent highs. Will we work our way to the bottom of the trendline or can we get a break to the upside. Again, there is a huge gap to the upside if we do happen to get that break.

Soybeans May-23

Soymeal

Soymeal May-23

Wheat

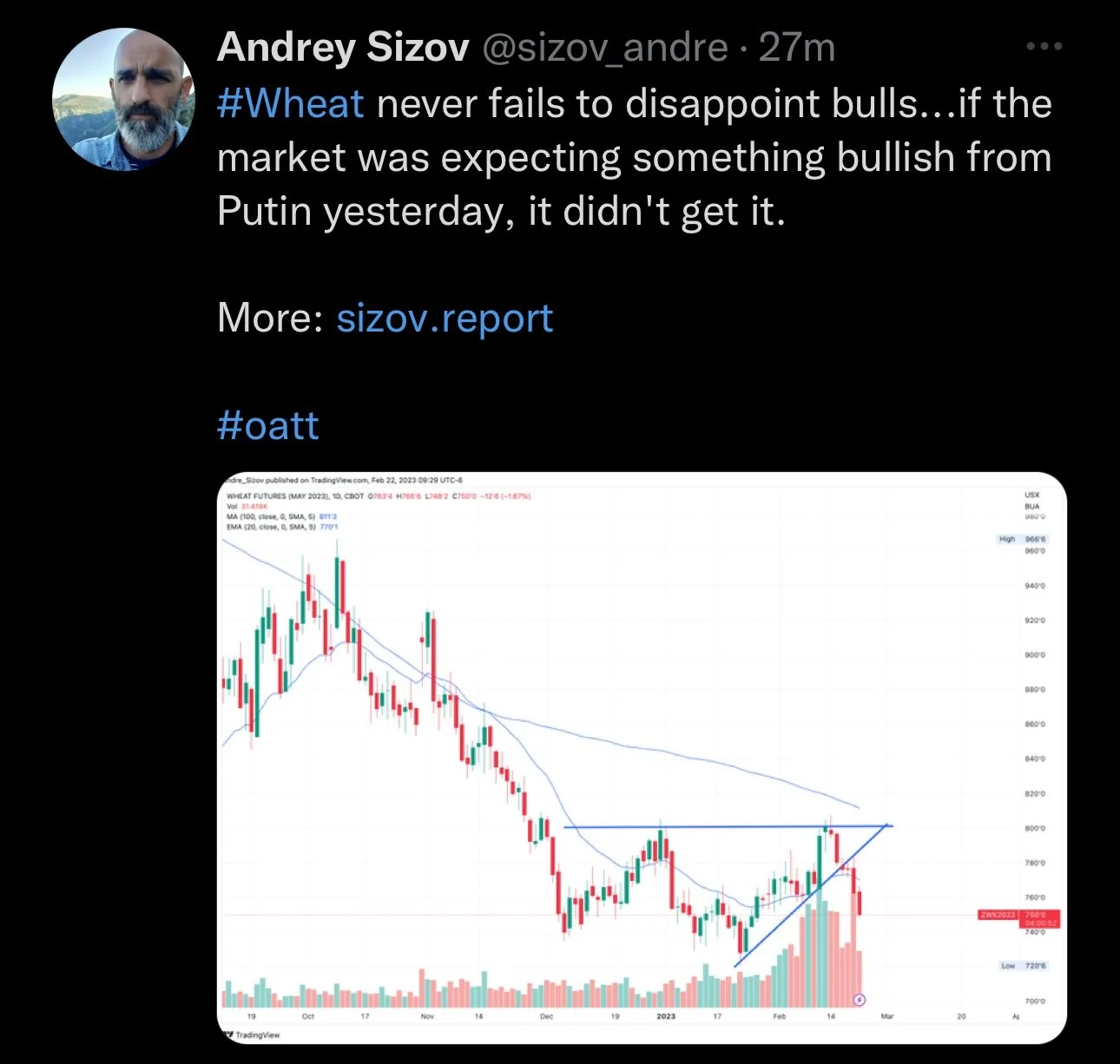

Wheat futures lower again here today, as bulls are trying their best to not wave the white flag. Following our recent rally, the March contract is 60 cents off its highs and the May is 50 cents off its highs.

One thing bulls are looking at is the snowstorms and brutally cold temps across the plains. As parts of Kansas and the plains are going to be going from fairly warm weather to very cold in a short amount of time.

We also have some slight weather concerns over in the EU, as weather may be harming some of Russia's new crop. Some are forecasting that we see estimates dropped by 5 to 10 million metric tons.

India's government said they will offer a further 2 million tons of wheat in the open market to cool down prices. So far their government has unloaded a total of 5 million tons of wheat this year. India is the world's biggest consumer of grain and second largest producer.

I mentioned this earlier, but Putin said yesterday that he is doubling down on the war and they would be suspending their participation in the treaty that limits the number or nuclear weapons countries can use. So bulls are assuming its a matter of time before we see things escalate.

We also have China supplying Russia with non lethal military supplies. The U.S. is worried that they will start supplying weapons. Now even if they do, we shouldn’t necessarily expect this to harm the relationship between the U.S. and China. No matter how much support China gives to Russia's military, its highly unlikely the U.S. would end business connections.

Why it won’t affect the relationship, from Wright on the Market: During the Vietnam War, the U.S. "allies", England, and France, were selling war goods to North Vietnam all through out the war. The North Vietnam military was killing an average of 86 Americans every week for 13 years.

So overall, yes I still think there is plenty of bullish headwinds ahead of us. Now this might not happen as soon as one would like. But with time we will likely eventually see a few bullish wild cards push us higher towards spring. The recent weakness very well may have just been a great buying opportunity, as there is still a good chance we see a rally come March and spring.

Ag Outlook Forum Estimates

2023 Estimate - 48.5 million

2022 - 45.7 million

2021 - 46.7 million

2020 - 44.5 million

Taking a look at the charts, they really don't look at all from a technical standpoint, as the past two losing sessions resulted in us breaking our recent uptrend.

Chicago March-23

KC March-23

MPLS March-23

War Outlook

This is a good write up from Farms.com Risk Management where they talk about war outlook and impact.

Here are some highlights;

The 1-year anniversary of the war is this Friday February 24th, 2023, and nothing has changed expect more of the same in 2023. The Black Sea Grain Initiative is expected to be renewed on March 17th and negotiations start this Friday.

Sanctions and an oil cap and embargo have done very little thus far as the Russian economy has done better than most expected including the currency the Ruble.

Crop production in the Black Sea region will get cut by 50% in 2023 vs. last year and if the war rages on as we are forecasting a year from now expect production to be cut again by 50%.

The chances of a ceasefire or a peace deal is very small and to renew the Black Sea Grain Export Initiative on March 17th, 2023 is 50/50. The tensions have risen since the deal was renewed in Nov. of 2022 so we are forecasting that unless Western sanctions are reduced or removed wheat and corn futures will need to add back a ‘war’ premium to ration demand as other countries will need to fill the production gap. Remain patient we could add $2.00/bu in the next 2 months like soybeans futures have since July of 2022. The 3-year long bull market remains alive and well!

Russia is stepping-up their offensive in Ukraine and pulled out of a nuclear weapons treaty with the U.S. Despite rising budget deficits, the Kremlin will be able to continue funding its war machine for several more years to come.

A short and unstable ceasefire is not in the cards as Putin has made it clear he will not stop, and Ukraine has made it clear it is still fighting for its life.

The winter will be difficult, as Russian attacks on Ukrainian infrastructure will try to break the morale and endurance of an already shattered population. But Ukrainian resilience has proved to be remarkable. They will stand firm. The war will drag on and on.

The prospect for a peaceful negotiation is bleak with rumors that Hungary will broker a deal but the core demands of at least one side need to change. There is no evidence that this has happened, or that it will happen soon.

The costs of the war, both material and human, might break the level of commitment of the Russian political elite. The key will be inside Russia with elections coming up in 2024. This may only happen, however, if the West stands firm in its support for Ukraine, (Biden’s surprise trip to Ukraine yesterday) in the face of increased domestic pressures linked to the costs of the war. Sadly, this will continue to be a long-protracted political, economic and military battle of resolve and will continue in 2024. History suggests that the war will be a test of will and a test of logistics. Expect more of the same in 2023 and a year from now as Putin wants one thing VICTORY! He is in for the long haul.

There’s is a 50/50 chance the Black Sea Grain Initiative will be renewed as Putin has threatened before and yet the deal got renewed but tensions are much higher now than in November of 2022. The biggest risk could be the lethal aid from China to Russia? (Beijing is ready to join forces with Moscow to decisively defend the national interest of the 2 countries). We are forecasting a no deal by March 17th and wheat/corn futures will need to add back the ‘war” risk premium to ration demand as other countries will need to fill in the gap with the lack of competition from the Breadbasket of the world as production falls by 50% in 2023 vs. last year and yet again by an additional 50% by 2024! Remain patient we could add $2.00/bu by the end of April of 2023!

This was just a few paragraphs of their write up.

Read Full Article Here

Time to Buy Wheat?

I saw this post on Twitter from GrainStats. The post said;

Ever heard of the Voice From The Tomb?

"This is the legend of a wise grain trader that made a fortune trading "seasonals" in the pits of the Chicago Board of Trade. 🌽 🌾

After his wife died, a millionaire grain trader dedicated his life to raising their children. The children were lazy and thought they'd inherit all of their father's money.

He felt that his children were wasteful and believed they took him for granted. When he died, all the money went to charity. All he left them in his will were the following dates of when to buy and sell. The will said that if they strictly followed his advice, they'd have the fortunes they always thought were going to drop in their laps."

The trading instructions read:

Wheat 🌾

🔴 Sell March Wheat on January 10

🟢 Buy May and/or July Wheat on February 22

🔴 Sell July Wheat on May 10

🟢 Buy December Wheat on July 1

🔴 Sell December Wheat on September 10

🟢 Buy March Wheat on November 28

Corn 🌽

🟢 Buy July Corn on March 1

🔴 Sell July Corn on May 20

🟢 Buy December Corn on June 25

🔴 Sell December and March Corn on August 10

Today is February 22, so it must be time to buy Wheat futures? 🌾 👀

Check Out Past Updates & Audio

Here are a few of our past updates in case you missed them

2/21/23

Argy Frost Pulls Beans Higher

2/20/23

Was Bean Freeze Bullish Headline We've Been Waiting For

2/16/23

Will Grains Have Nuclear Price Action

2/14/23

Why We Think We'll Go Higher

Livestock

Live Cattle down -0.025 to 165.075

Feeder Cattle up +1.100 to 187.975

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service