LONG TERM CORN UPTREND? JANUARY DROP OFF IN BEANS? LONG TERM WHEAT FACTORS

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

You only get a small section of today’s update.

You miss the overview where go talk about Argentina and cattle along with the entire soybeans & wheat section.

Subscribe for every daily update & sell signal.

Don’t miss opportunities.

Try 30 Days Free: CLICK HERE

Want to talk? (605)295-3100

Today's Main Takeaways

Corn

Overall the outlook for corn still remains bullish from a technical and fundamental perspective.

For starters, look at the spreads.

This is the March to Dec spread. It was -31 back in July. It is now +13.

An inverse market basically means demand is currently outpacing supply.

The Funds

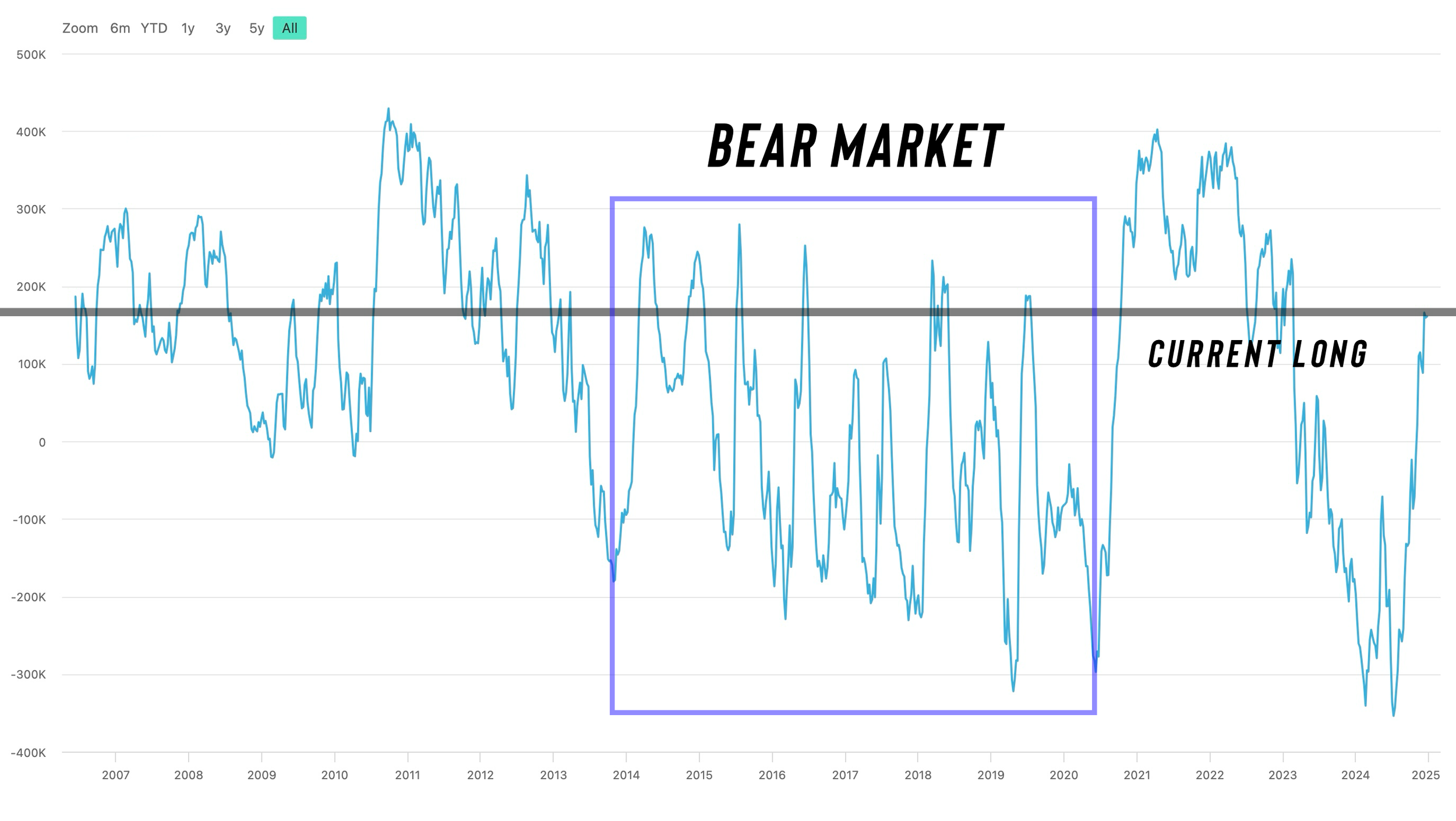

Looking at the funds, they are long around 160k contracts.

Some say it is actually now closer to 200k contracts.

In other bear market years (2014-2019) the funds long position often peaked around 200k contracts.

Just something we need to be aware of is that they are decently long compared to other bear market years.

Some years like 2015 they went almost 300k long, where as in years like 2017 the longest they got was just 100k.

Eventually corn will likely reach overbought status on the charts.

Unless we see more fundamental changes, we could see the funds start to take some profit on their new long position.

Corn is above the 200-day MA

If you remember, I talked about for a few months how the 200-day MA had acted as resistance for corn futures since 2022.

We are now above the 200-day MA.

What does this mean?

For starters it means that this could potentially be our new base of support. It was previously incredible resistance, a case of old resistance turned to new support.

When a market is above the 200-day it also signals that the long term trend is shifting from bearish to bullish.

Bottom line, my next target is $4.67-$4.68

Reason #1 (Chart 1)

It is the 161.8% golden fib extension fo the $4.25-$4.51 rally.

Reason #2 (Chart 2)

Is is the 61.8% retracement to our May highs.

We are already above the 50% May retracement, next logical target is the 61.8%.

Something to be aware of is the stochastics. They are getting toppy which could suggest a short term correction soon.

If we get a correction, I am looking for a bounce in that green box.

Ideally, we hold the 200-day MA.

I could see us just getting a simple re-test of this assending triangle before going higher. Back testing the point of where we broke out ($4.50)

If you have yet to take risk off, not the worst idea to do so here. If you took advantage of our $4.51 signal, the next target is $4.67

(If you missed Dec 11th's signal: Click Here)

Soybeans

Still very little reasons to get wildly bullish on soybeans.

(Unless we get a weather scare in Argentina, but that will likely be a short-lived rally if it happens. Not something that carries on for a month or longer like we have seen in the demand rally for corn).

But the funds are still short, and we have a technical breakout on the charts which could cause a little more short covering.

If we look here………….

The rest of this is subscriber only..

HOLIDAY SALE

Last chance for the offer

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

12/31/24

MASSIVE DAY FOR GRAINS. FLOORS? 2025 SALES? GAME PLAN? CHART BREAKDOWNS

12/30/24

GRAINS FADE EARLY HIGHS

12/27/24

STILL LONG TERM UPSIDE POTENTIAL, BUT TAKE ADVANTAGE OF 6 MONTH CORN HIGH

12/26/24

CORN ABOVE 200-DAY MA. ARGY DRY. BEANS +44 CENTS OFF LOWS

12/23/24

CORN & BEANS TALE OF 2 STORIES. BEANS REJECT OLD SUPPORT

12/20/24

PERFECT BOUNCE IN CORN. SIMPLE BEAN BACKTEST BEFORE LOWER?

12/19/24

THE SOYBEAN PROBLEM. NEW WHEAT LOWS. CORN UPTREND

12/18/24

BEANS BREAK SUPPORT & OPEN FLOOD GATES

12/17/24

SINK OR SWIM TIME FOR SOYBEANS

12/16/24

SOYBEANS & WHEAT FIGHTING LOWS. WILL CORN DEMAND CONTINUE

12/13/24

POST USDA COOL OFF

12/12/24

CORN CORRECTION. WHY WE ALERTED SELL SIGNAL YESTERDAY

12/11/24

USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

12/11/24

CORN SELL SIGNAL

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24

TARIFF TALK PRESSURE

11/25/24

HOLIDAY TRADE, SEASONALS, TARGETS & DOWNSIDE RISKS

11/22/24

CORN TARGETS & CHINA CONCERNS

11/21/24

BEANS NEAR LOWS. CORN NEAR HIGHS. 2025 SALE THOUGHTS

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24