BRAZIL RAINS? LEAD TO GRAIN MARKET PRICES TRADING BOTH SIDES

CLOSING GRAIN MARKET COMMENTARY & GRAIN MARKETING ANALYSIS PLAN

Prefer to Listen? Audio Version

Grain Futures Prices Close

*Note: Due to the holidays we will not have a Weekly Wrap tomorrow, we will have an audio instead. Updates will resume as usual next week.

Overview - News Driving Grain Market Price Changes

Mixed choppy trade continues as corn and beans turn lower with some rains a week out for Brazil while wheat trades higher due to war headlines in the Black Sea.

The wheat news was that a Panama flagged ship was struck by a Russian mine.

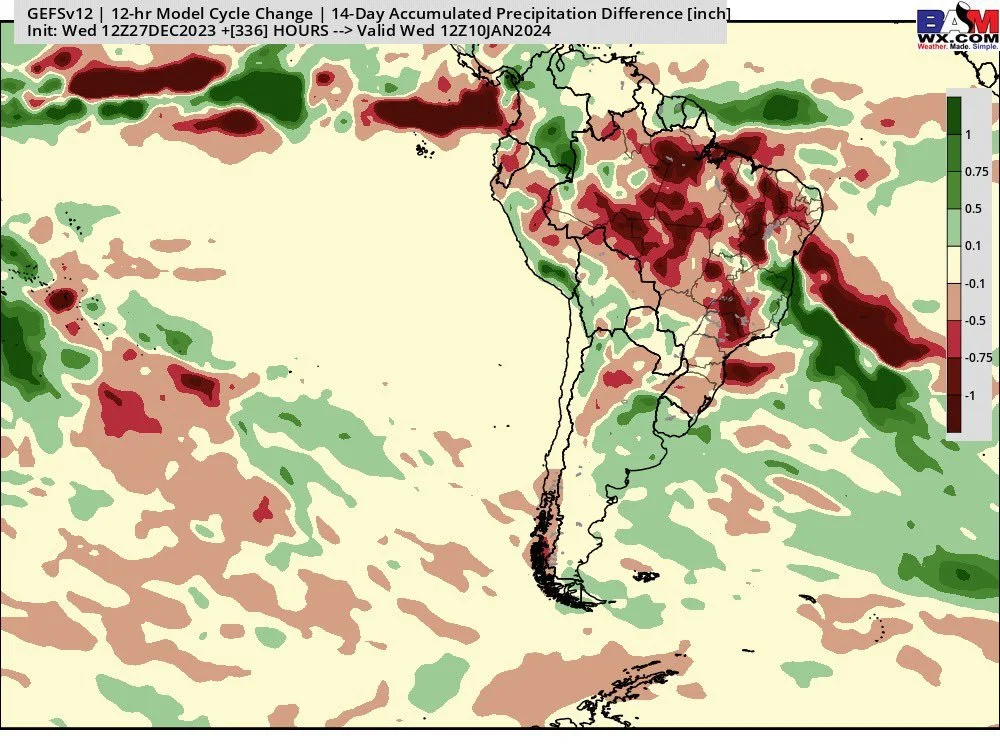

They added rains to the forecasts for Brazil next week. This time actually both the Euro as well as the GFS agree that rain is coming.

The dollar is trading at it's lowest levels since July.

Outside of those, there really isn’t a ton of fresh news. Expect more choppy two sided trade was we close out the new year.

With the lack of news, we also have thin trade with less traders taking place in the action. This will lead to moves in the market like today being over exaggerated.

Let's take a look at the Brazil situation.

Although rain is forecasted for Brazil, we have seen this story time and time again. As they will call for rains 1-2 weeks out only for them to disappear. More on this later..

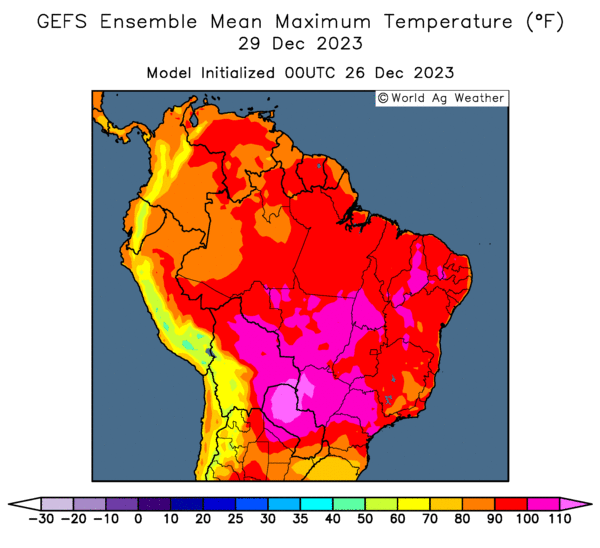

The crops are still deteriorating and they are starting to harvest some areas in Mato Grosso. Which is the earliest ever. Most are looking for the lowest yields in 40 years.

This rain, if it hits could certainly stop some of the damage, but we can’t ignore the fact that significant damage has been done.

Dr. Cordonnier dropped his Brazil bean estimate to 153 million metric tons. Far lower than the USDA's current 161. It is safe to say more cuts to production estimates are coming, but by how much and what is currently priced into the market is the main question.

From Brazil Producer Diego Meurer:

"18 soybean producing towns in Brazil have declared a state of emergency due to severe drought and high temps. The rains that fell over the holiday hit the capital the most which is not a grain producer."

Over the past 2 months most weather forecasters have far over promised the rain for Brazil a week out and been wrong. However, there has been one company who has been consistently accurate and that is BAM weather.

BAM weather had this to say:

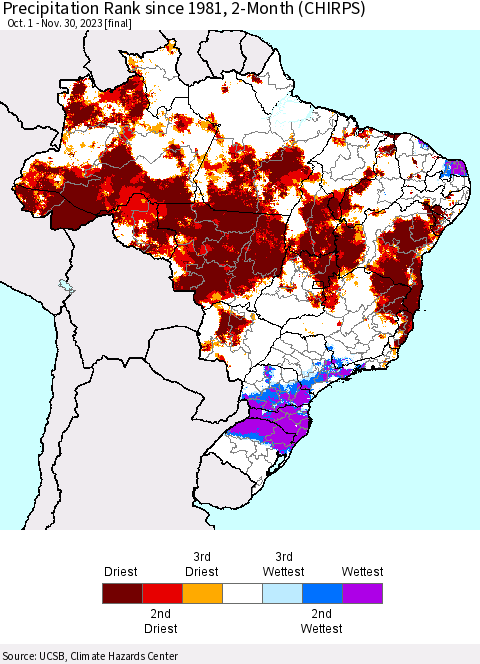

Drought concerns are on going in central Brazil, which is one of the highest producing areas in the entire world. This image shows the least amount of over the past two months compared to the last 40 years.

"What is more concerning is if we look back at history, it tells us this concern will linger for potentially many months ahead."

Keep in mind, the current time frame for Brazil currently compares to that of August in the United States. What would our crop have looked like if it was the driest on record for June and July and we didn’t get any rain in August either? Something to consider when debating how these crops have been impacted.

BAM went on to say:

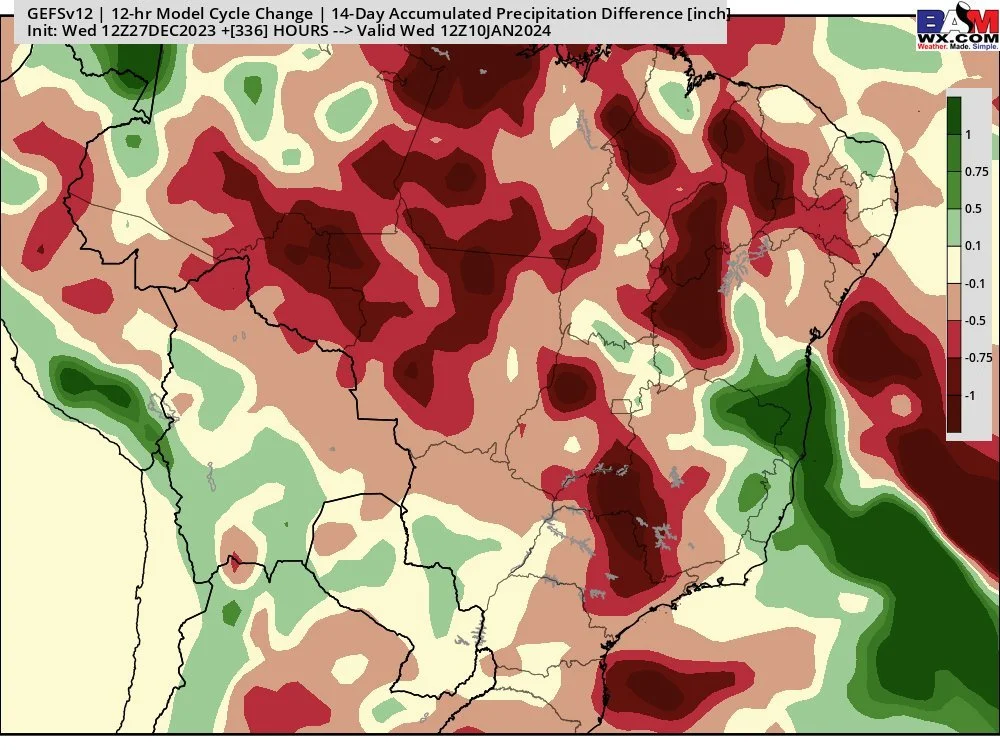

"Latest GFS Ensemble 12z, 12 hour precip change over the next 2 weeks, significantly drier across major central #Brazil #soybean areas.

Why such a change?

It's readjusting its MJO forecast more correctly, which we talked about in our latest SA ag weather update at @bamwxcom!

As the MJO heads into the drier phases of 3-4-5-6 into January, expect the data to be too wet and to roll forward drier (just like it did for December)."

Essentially they are saying to expect the forecasts to show moisture but to disappoint.

SLE Farms from Brazil had this to say:

"The drop will be significant and pointing out percentages at this moment is a guessometer and total disrespect for other peoples intelligence."

"The drop will be historic in this region, which represents one of the largest production centers in Brail and has a yield standard that is among the best in the world. Algorithms and satellite images do not calculate plant height, much less production load."

Here is what the Euro and the GFS are predicting. They are both in agreement that Brazil will see wide heavy rainfall next week. This was the main reason for soybeans falling -20 cents off their highs today.

Will they actually fall is the question..

From Darren Frye:

"If January is anything like December, it might exceed 30 million metric tons (losses to Brazil's bean crop) Below is the 2 week change from the previous model run. Very consistent with the past 90 days. Promise me rain in week 2, and then lose the moisture as week 2 rolls into week 1."

From 247 Ag:

"Still cooking in Brazil, not good. Weekend rains were a flop. Oh but rains are coming next week!" (Sarcasm)

Today's Main Takeaways - Driving Price Factors impacting today’s futures price changes

Corn

The corn futures market was slightly lower as we continue to chop around in this recent range.

We opened up higher but eventually gave back the early gains along with soybeans and crude oil.

No real fresh news. The losses today were due to the rain in the Brazil forecasts along with thin holiday markets that allow the algo's to push markets where they want.

The funds remain heavily short. Some think they will rebalance after the first of the year, however they might wait until they see how much the American farmer sells after the first of the year. So perhaps we don’t see any major movement from the funds until a week or so into the new year.

Remember there is an old saying, the market won’t go up until…..

The rest of this is subscriber only. Please subscribe to continue reading and receive every update.

In the rest of today’s update we go over the Brazil corn situation, why there is risks in the corn market, what to do if you need to make sales, cheap options, floors, the ceiling for beans, what to do if you are nervous about the downside, getting comfortable & more.

SALE ENDS IN 3 DAYS

Our biggest sale of the year ends on New Years. Don’t miss it. Become a price maker and learn all of the tools to take back that power from Big Ag.

EVERYTHING: $399 vs $800

NOT SURE? TRY 30 DAYS FREE

Try completely free for a month. Scroll to check out past updates you would have received.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

Read More

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23

THIN HOLIDAY TRADE & BECOMING COMFORTABLE

12/15/23

NEXT WEEK WILL BE KEY

12/14/23

WHY WE DON’T SELL FEAR

12/13/23