GRAINS & WHEAT RALLY

Overview

Grains are all higher for the second day in a row today. Yesterday was led by soybeans, today wheat is carrying the markets, seeing a double digit rally in the wheat market

With the holiday approaching we can expect lower trading volume and higher volatility in the markets.

Just a heads up, we will not have a Weekly Grain Newsletter this Sunday, as that is Christmas. We hope you enjoy your holidays.

Today's Main Takeaways

Corn

Corn higher today, following wheat higher with March up nearly a dime. Despite the gains, corn continues to chop around sideways for the most part. Corn has felt comfortable trading in the $6.35 and $6.60 range for the most part.

U.S. corn inspections for last week were the second highest volume of the marketing year. But did still trail that of last year and the 5-year average.

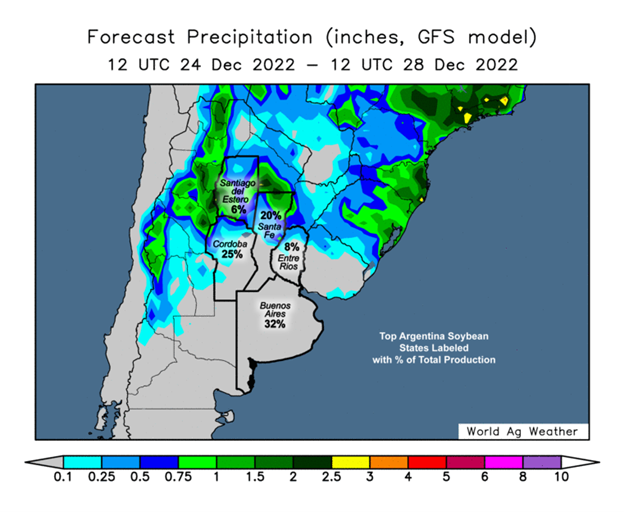

Two of the larger factors that everyone has their eyes on as we near the end of the year is Argentina weather and Chinese headlines. As there is some expected rain in Argentina this week which has the potential to pressure prices. If these rains do hit it will likely cause a little bit of selling in the markets especially corn and beans. However, there is a flip side to this. If the rains come in disappointing or just completely miss, this would further support prices.

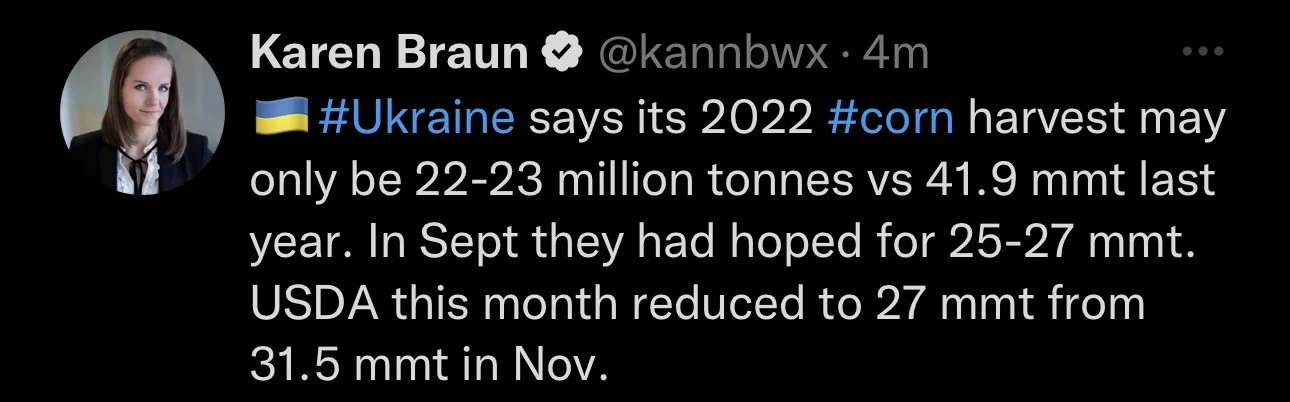

There is rumors that China is buying more corn from Ukraine and Brazil. As Chinese and overall demand is still a rather large uncertainty in the market.

Things bulls are worried about is the potentially larger U.S. crop and overall demand. While bulls are hopeful we continue to see production cuts in South America and maybe get some more weather scares. Overall South America weather really just a wild card, and we also have the Russia/Ukraine war headlines still have the potential to shake things up.

With today’s 10 cent rally seeing corn break that $6.60 resistance level, I wouldn’t be surprised to see us climb another 10 cents here just looking short term, this is barring any bearish news such as Argentina rain.

March-22 (6 Month)

Soybeans

Soybeans slightly higher here today following their recovery rally yesterday. Every time the past few weeks soybeans have saw pretty stiff resistance around the $14.90 range, and prices slide each time we climb back up to those price levels.

I've said this in the past each time soybeans reach this higher end of their range, but it wouldn’t be a bad idea to price some soybeans in here and take some risk off the table. VanTrump said

"I currently have about 25% of next year's estimated production priced and am looking to price in a bit more if we breakout to the upside. Im just a bit nervous if SAM weather cooperates and the clock keeps ticking."

The two main factors remain the same as they have been. South American weather and how their crop comes out, and China headlines and demand.

The farmers in Argentina sold 240,000 metric tons of soybeans on Monday. Bringing the new total to 4.2 million tons since the exchange rate began. The exchange rate expires at the end of the year.

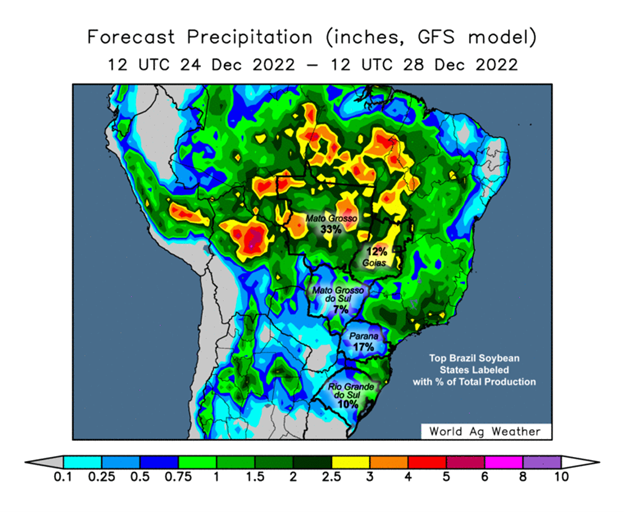

It looks like Argentina has some rain in their forecast which could pressure beans. But even with this rain we have already seen pretty big production estimate reductions and a lot of damage has already been done. The weather over in northern and central Brazil is still looking cooperative which still has Brazil potentially facing a record crop.

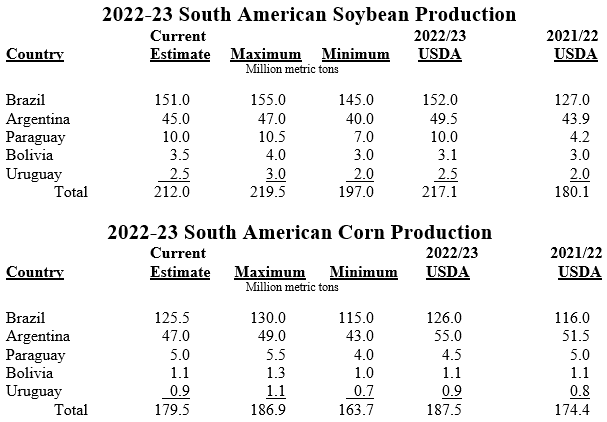

We saw Dr. Cordonnier lower its Argentina soybean production estimate to 45 million metric tons. The USDA's current estimate is 49.5 million. So we will very likely see the USDA lower theirs in the future from the looks of it. While he made reductions to his Argentina soybeans, he left Argentina corn, Brazil corn, and Brazil soybeans all unchanged.

So in conclusion, there are plenty of factors pushing the markets around. But I wouldn’t be too surprised to see us climb back up in our high end of our range around $14.90 before seeing prices correct lower once again. But if we get a solid break above that range we could see prices continue to climb. We haven’t seen the March contract close above $14.90 since June.

Soymeal & Soyoil

Soymeal up +3.4 to 452.7

Soyoil down -0.22 to 64.59

Soybeans March-23 (6 Month)

Wheat

Wheat leading the markets higher today. With Chicago wheat trading roughly +15 cents higher today but is also 10 cents off its highs, with KC also trading up double digits and Minneapolis not too far behind also trading in the green.

The U.S. blizzards and storms this week could potentially put 30% of the U.S. wheat crop at risk. As brutally cold temps are expected in major growing regions. So this will look to add support to the markets.

We also have the war headlines looking to further add support to the markets, and Putin might be upping his war efforts. The war headlines will be something to closely monitor as severe escalation could be very beneficial to the wheat market.

India is looking to potentially sell 2 to 3 million metric tons of wheat from state reserves to cool the surging domestic prices. India is the worlds 2nd largest wheat producer behind only that of China. Here is what Wright on the Markets had to say about this situation;

"This news is not bearish wheat; it is bullish as wheat reserves will be further diminished. We say again, 2023 will be the fourth consecutive year the world consumes more wheat than it produces. How many more years can we do that?"

One concern with the wheat market is the expected record crops out of Australia and Russia. To go along with pretty poor U.S. export demand. But we still have problems globally and here in the U.S. as the winter wheat crop conditions are a concern that can't be ignored.

Prices are now nearly 50 cents off our lows we made back earlier in the month. Its still a little early for a lot of factors affecting the wheat market, but I'd still lean bullish if I had to pick a side, as I can’t think of many reasons to get super bearish here. As I've said in the past we might see prices just slosh around here. But looking long term I think we have tremendous potential to see some upside. Bulls would love to see a break above $8 again, which is still 30 cents away.

Chicago March-22 (6 month)

KC March-22 (6 month)

MPLS March-22 (6 month)

GrainStats Technical Analysis

I shared GrainStats technicals last week and it received good feedback. So here are some they shared yesterday. You can visit GrainStats here

Corn 🌽

They said;

"Corn is sending mixed signals to the market. After failing to break out last week and failing to establish a new trend, corn is officially too choppy to trade in the short run. It's best to avoid the chop and focus on the medium trend, either hitting the previous support level at 6.35 or breaking above 6.60 and trapping short sellers."

🟢 Current upside target is 6.60, opening the door to 6.74

🔴 Current downside target is 6.35

⚠️ Mind the gap below 5.95

Soybeans 🌱

They said;

"Soybeans continue to be stuck in between two trendlines. Down days are attributed to rains in South America. Up days are attributed to the lack of them. A big inflection point is coming up in the soybean market."

🟢 Current upside target is 14.92

🔴 Current downside target is 14.58, 14.54, and 14.25

⚠️ Mind the gap above 15.36

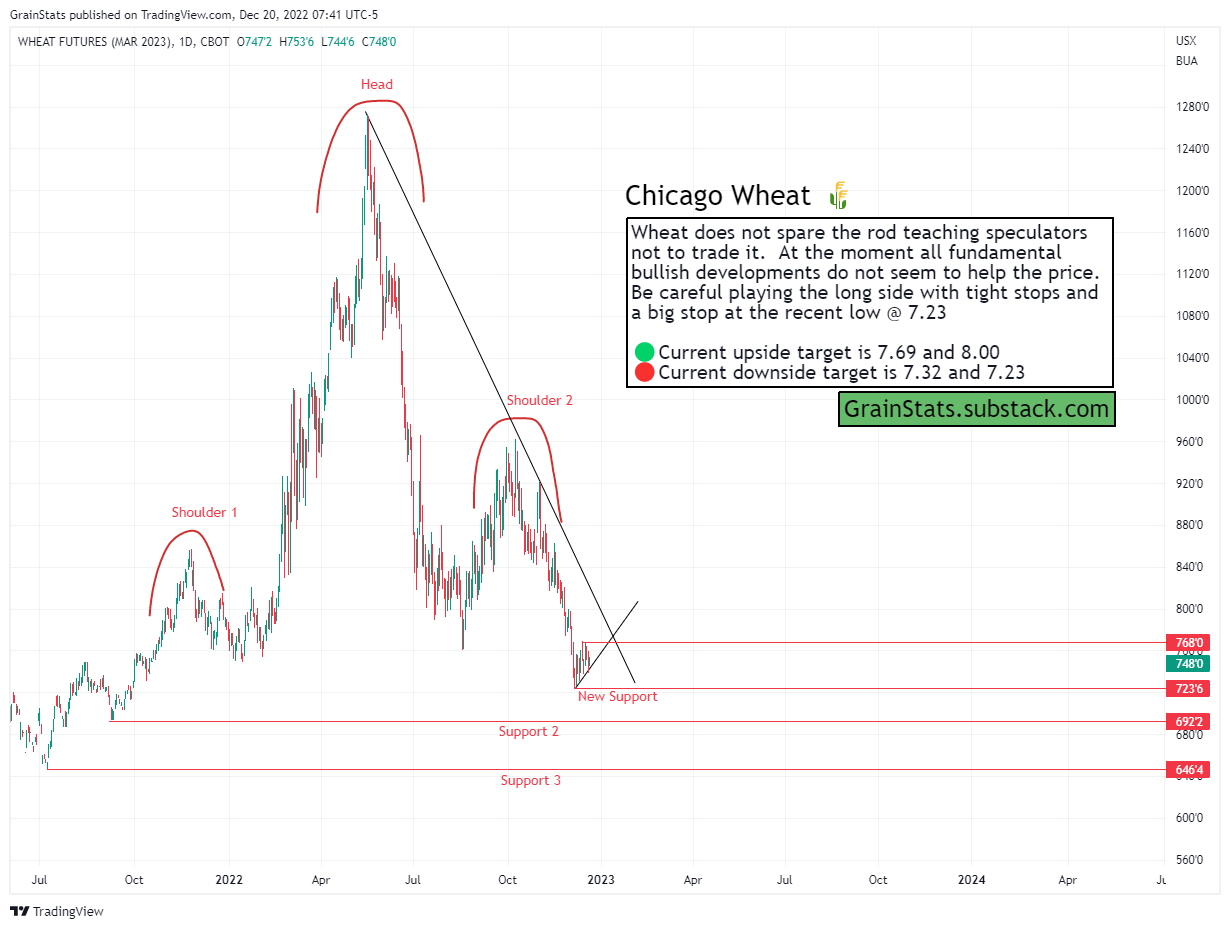

Wheat 🌾

They said;

"Wheat does not spare the rod teaching speculators not to trade it. At the moment all fundamental bullish developments do not seem to help the price. Be careful playing the long side with tight stops and a big stop at the recent low @ 7.23"

🟢 Current upside target is 7.69 and 8.00

🔴 Current downside target is 7.32 and 7.23

Again you can visit GrainStats website here

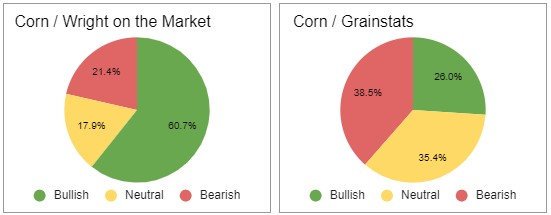

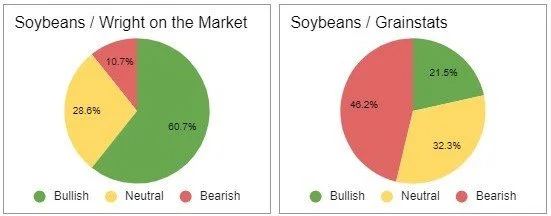

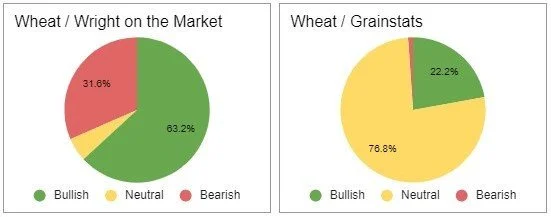

Wright on the Markets & GrainStats

Bullish/Bearish Consensus

These charts are voted on by their audience

You can visit Wright on the Markets Here

South America

Overall Brazil is still been favorable and Argentina has continued to see problems although they are expected to perhaps see some rain.

Brazil soybeans were roughly 97% planted

Argentina soybeans are still half way unplanted. Sitting at 50.6% planted. This is nearly 20% behind the average pace.

Soybeans in Argentina sit at 19% rated good/excellent

Corn in Argentina is 42.6% planted which isn't terribly far behind the average of 57.5%

23% of Argentina corn was rated good/excellent

I mentioned this earlier but Dr. Cordonnier cut his Argentina soybean estimate by 2 million metric tons down to 45 million. The USDA has their estimate at 49.5 million.

via Soybean & Corn Advisor Inc.

Other Markets

Crude oil up +2 to 78.20

Dow Jones up over +450

Dollar Index up +0.35 to 103.95

Cotton up +0.18 to 88.02

News

The USDA is investing $9.5 million to develop bio products

The world's billionaires are nearly $2 Trillion poorer this year than last

U.S. hop production down -12% compared to last year

U.S. lands $4 billion windfall on oil-reserve sales

Livestock

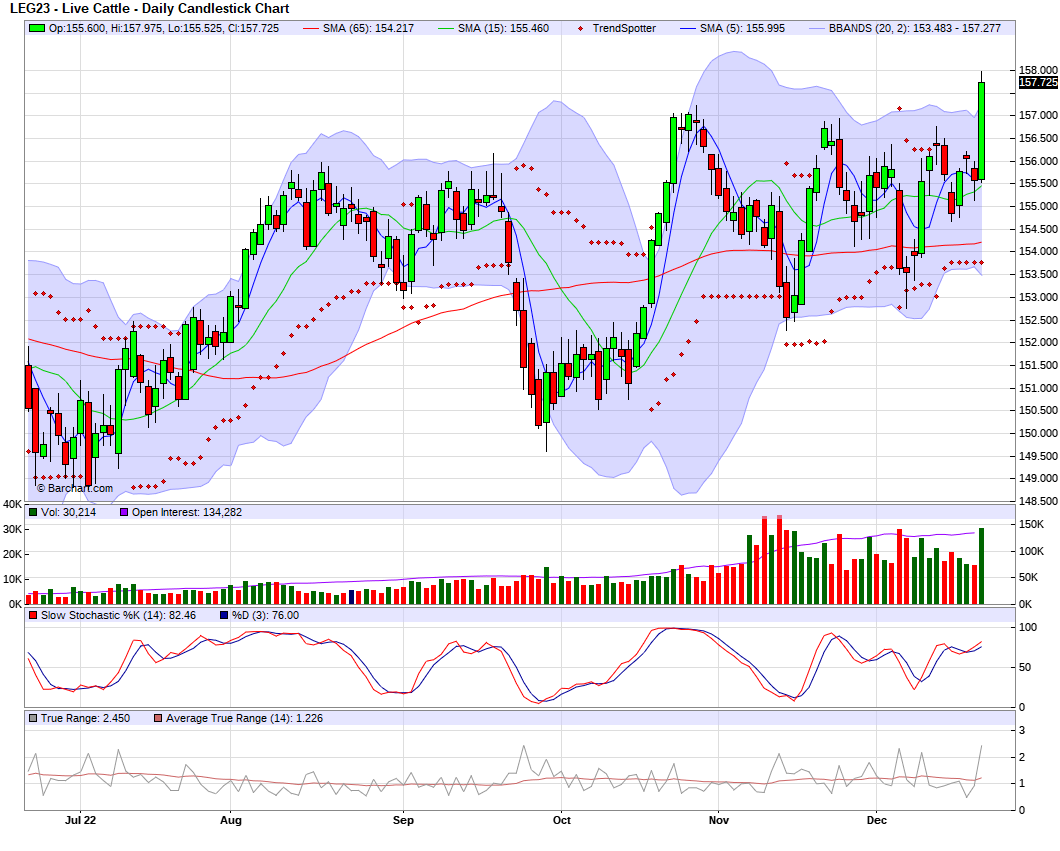

Live Cattle up +2.375 to 157.925

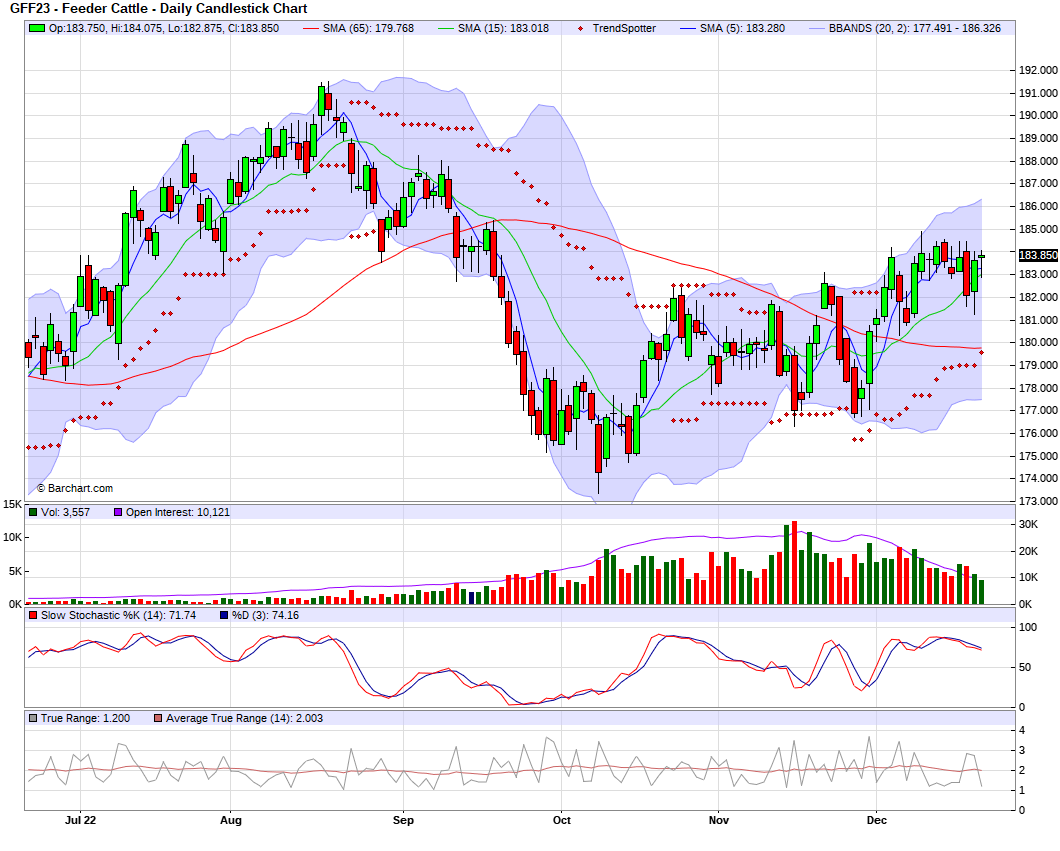

Feeder Cattle up +0.700 to 185.725

Live Cattle (6 Month)

Feeder Cattle (6 month)

In Case You Missed It..

Sunday's Weekly Newsletter - Full Version

Yesterday's Audio - What if farmers didn’t pre-harvest market?

South America Weather

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service