GRAINS CLOSE WELL OFF LOWS

Overview

Grains closed mixed, with beans finding some support while wheat runs into some selling. All grains closed nicely off their early lows.

The banking crisis will continue to be a major headline surrounding the outside and macro markets this week. As we again saw another one go under, this time Credit Suisse, who was a 166 year old bank. Making that the fourth one this month, joining Silvergate, Silicon Valley, and Signature Bank.

We had Putin and Chinese President Xi meet today. We will likely have more info on this in the coming days when the meeting conclude.

Later this week we have the FOMC Rate Hike Meeting. Will we see a 0 BPS, 25 BPS, or 50 BPS? According to most reports, it’s looking like we will get a 25-point raise.

Read yesterday's Weekly Newsletter

Mother Nature & Black Swans - Read Here

Enjoy Our Stuff?

Try 30-days for $1 or get 50% OFF yearly & monthly. All updates and audio sent via text message & email.

Today's Main Takeaways

Corn

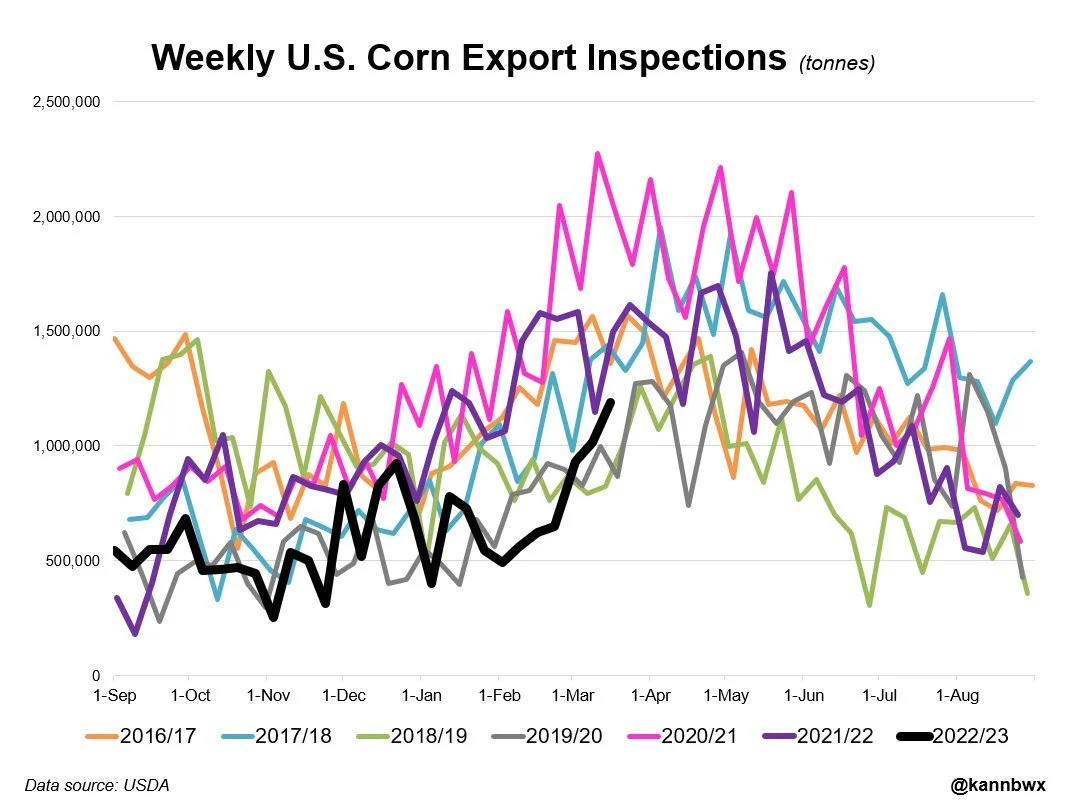

Last week we saw corn close +17 cents on the week, mostly due to the wave of buying we saw from China. Where we saw 4 straight days of export announcements totaling 2.22 metric tons of corn (83 million bushels). Which has led to corn exports making a comeback. Will we continue to see Chinese buying?

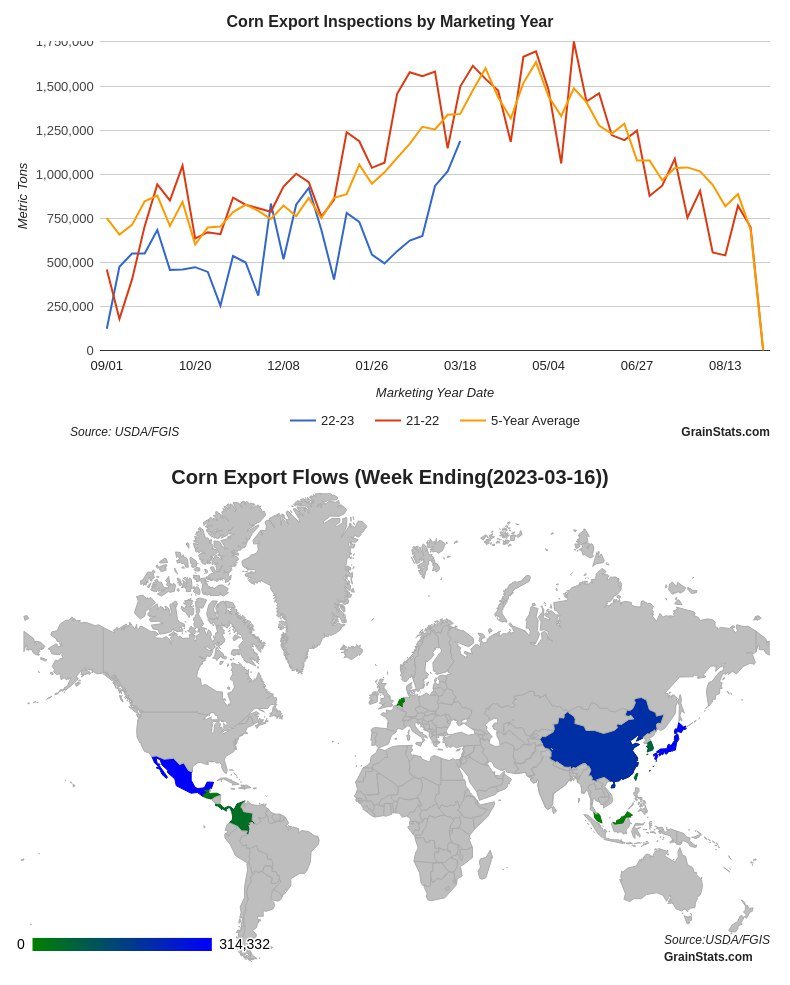

Corn posted another solid week of export inspections, coming in at the high end of the estimate range and above last week's numbers.

Chart Credit: GrainStats

To start the session corn saw some weakness, and at one point was down -8 cents. But we saw a nice rally into close, as corn closed down just over a penny at $6.33.

We don’t have the current CTTC data, as it was delayed again. But one could assume the funds are about even on corn. They were long 16k contracts through March 7th. They likely continued to sell through March 10th on our sell off. Then were probably buyers on the rally this week.

Going forward, there is still plenty of weather worries left that could impact the corn market. We have the planting delays in Brazil leading to their second corn corp being planted outside the ideal window, we have snow impacting the north west corn belt, and a possible wet early spring for the eastern corn belt.

If we get more weather worries in addition to a continuation of strength in Chinese appetite, I don’t see why we wouldn’t continue to see strength in the corn market.

Taking a look at the chart, our near term resistance is $6.37. Bulls would like a close above that level and our 20-day moving average to push us higher towards both our 100 and 200-day moving averages which both sit a tad over $6.60.

Corn May-23

Soybeans

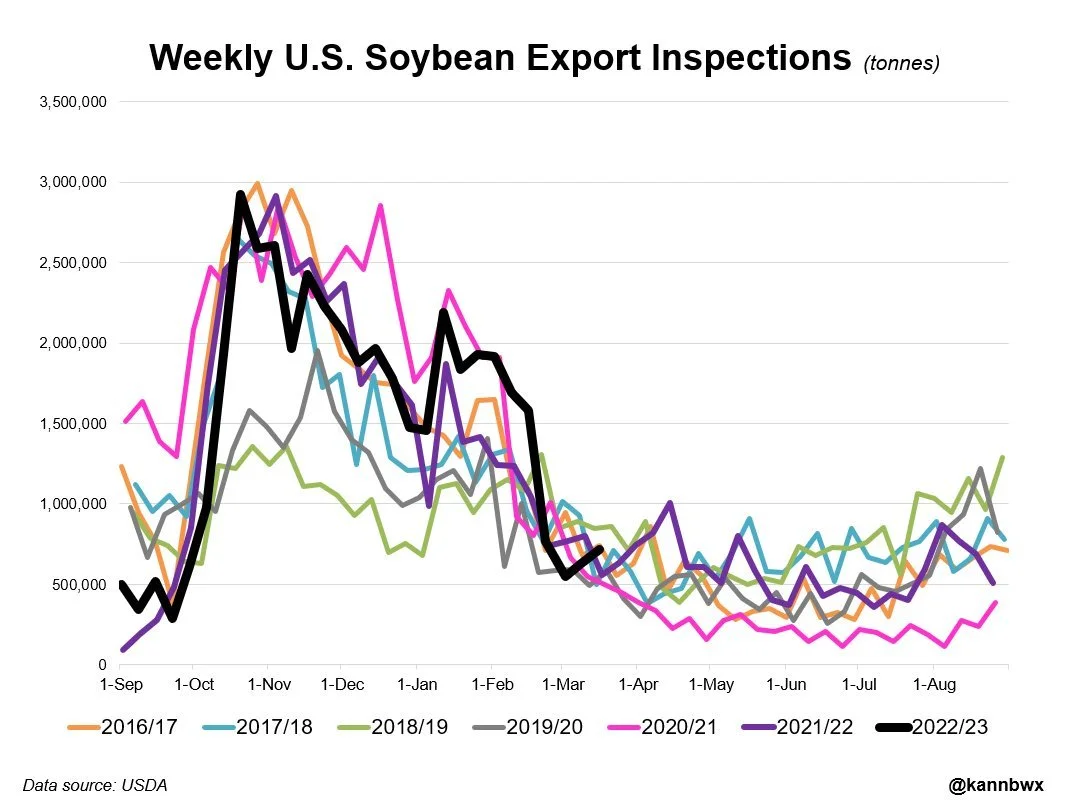

Beans start off the week strong following the poor performance last week. With May closing up +9 1/2 cents.

The funds are still very long both beans and meal, so there is some risk there that they possibly look to liquidate some of their position after rallies like today. As of March 7th they were long 155k contracts but are probably sitting on a slightly smaller position with the decline we saw last week.

Today’s rally was a little surprising given that we saw some fairly good rains in Argentina and weakness in meal.

Likely the biggest concern in the bean market is still with the large Brazilian crop, with soybean harvest rolling along. There are also reports of record yields in areas such as Parana and surrounding states. But then again, it is looking like Brazil's massive crop is getting smaller rather than larger.

On the other hand, bulls are starting to look at other areas of Brazil such as Rio Grande do Sul which could run into some production issues down the road. There are plenty of people saying that the USDA could be 5 million metric tons overly optimistic on their Brazil estimate. (USDA currently has 153).

Short term, perhaps we do see the funds look to sell some of these rallies. But looking forward, we still have the possibility to see a few more bullish catalysts out of Argentina.

Taking a look at the charts, we closed back above our 100-day moving average, as on today's lows we found support at the 200-day. Bulls would like a break out of this short term downtrend we have created.

Soybeans May-23

Wheat

Wheat futures run into selling with losses of 6 to 9 cents across the board.

I think today’s losses could have just been a healthy pullback following our pretty impressive rally last week.

Grain deal extension wasn’t a big surprise. The initial reports said the extension was 120-days, but Russia then came out and said no we want 60-days. So there was some questions as to just how long the deal was actually extended by, which could be part of the reason for the weakness in wheat today. From what I've seen nothing is official yet, but it is looking like it will be the 60-day Russia wanted. The 60-day extension brings the new deadline to May 18th.

With the funds as short as they are on wheat, one might expect them to buy on these breaks lower such as today. Bulls would like to see the funds continue to liquidate their shorts this week.

To put things into perspective, last week we saw the funds close out roughly 15k of their short positions since our lows the week prior. In the meantime, we saw a rally of over +40 cents.

One has to imagine what could happen if the funds decided to continue to liquidate their massive position of -100k or so. Again, the funds being this short might be a great opportunity in the wheat market, as we could be one unforeseen war or weather headline away from things escalating quickly.

From a technical standpoint, I would like to see a close above the $7.13 level and our 20-day moving average to open the door to higher prices.

Chicago March-23

KC March-23

MPLS March-23

Crude Oil

Crude finally found some strength today, closing up nearly +2%. Did crude find a bottom or was this just a relief bounce?

As stated in my updates last week, I still wouldn’t be too entirely surprised to see another leg lower before finding major support.

First level of support to the downside I have is at $62 with additional support towards the $57 level.

April-23 Crude Oil WTI

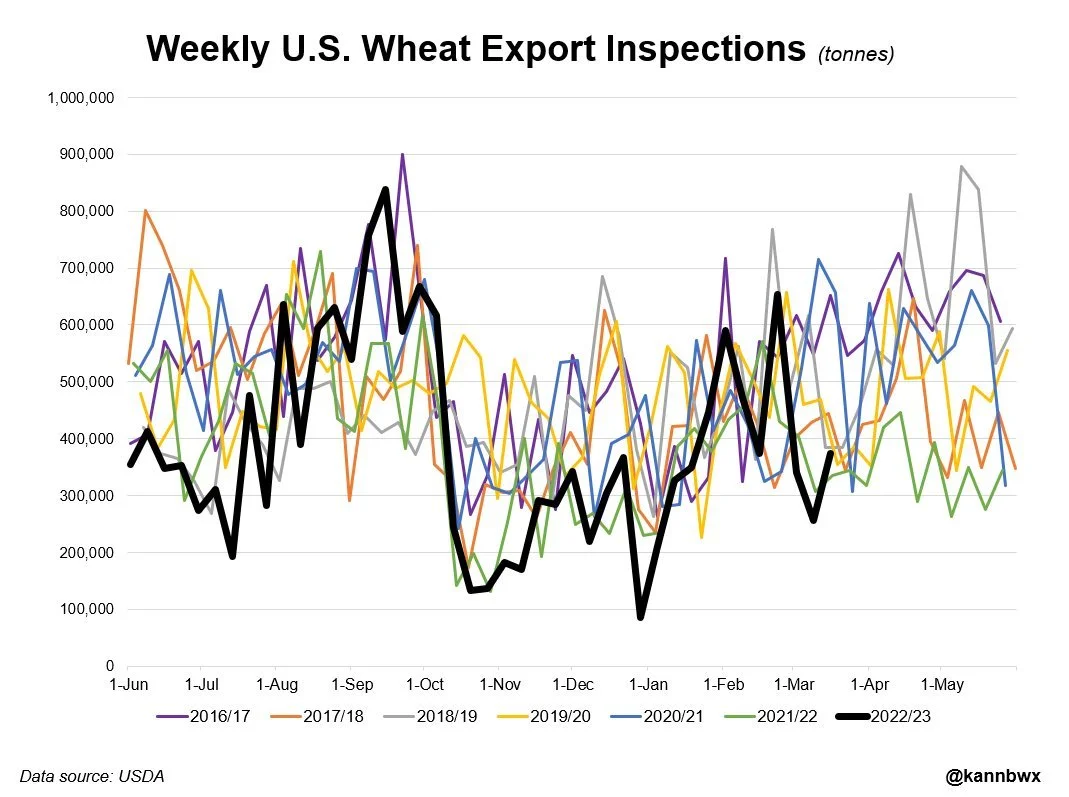

Export Inspections

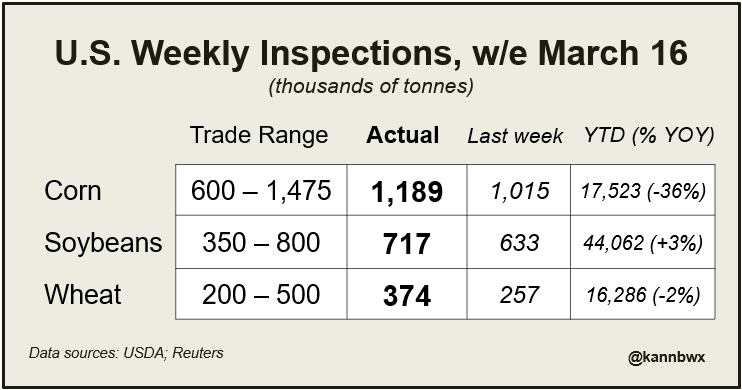

Export inspections this morning came in strong across the board but nothing too crazy or noteworthy. With all three grains coming in above last week's numbers. Corn however is finally getting the pop in volume they’ve needed.

Chart Credit: Karen Braun

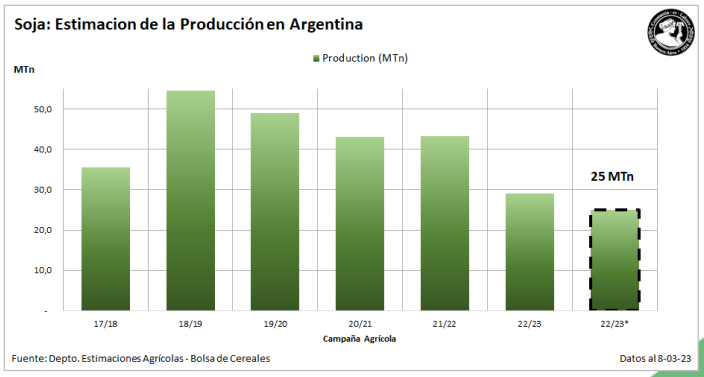

Argentina Cuts

Beans

We once again saw Argentina bean production estimate cuts. As we Buenos Aires cut their estimate down to 25 million metric tons, which is over a 40% decrease from last year. This number implies roughly an 11 bushel per acre yield which is a pretty crazy number.

Corn

We also saw Buenos Aires lower their corn number down to 36 million metric tons. At the same time Rosario Grain Exchange has their number at 35 MMT, with Dr. Cordonnier's number sitting at 37 MMT with a continued bias downwards. Now the USDA on the other hand is at 40 MMT. So we have to wonder, is a sub-30 crop a real possibility?

The chart below shows yield at 39 bushels per acres which equates to 53.8qq/Ha. This number is 25% below the average.

Market Commentary

From Jon Sheve at Wright on the Market

May corn finished the week up 17 cents, largely due to China providing export announcements four days in a row. Each day with an export announcement, old crop corn futures also increased. There has not been a four day rally on the May contract since early January.

Also last week, it was announced that the funds have been liquidating a significant amount of their long positions since late February. It now seems end users and likely China were buying old crop corn during the pullback.

If the funds move to a holding pattern while farmers are planting, a floor price might have been established. And if more exports are announced in the next few weeks, higher prices are a possibility.

Ukraine Uncertainty Continues

Currently, it is unclear how many days the Ukraine grain corridor will be extended. Ukraine said it was renewed for the normal 4 months, while the Russians have said it was only for 2 months. Fewer days makes it more difficult logistically for buyers to line up freight in and out of the region. Either way, the continued uncertainty in Ukraine will not likely go away anytime soon.

South American Weather

The Mato Grosso region in Brazil has had significant rainfall recently, and some are concerned there could be nitrogen loss in the soil which could lead to yield reductions longer term. Conversely, Argentina continues to miss out on rainfall, and the dry weather may reduce yields even further.

Wheat Weather Impact

Continued dry weather in the US southern plains may help Kansas City wheat futures prices and minimize it being used as a corn replacement in feed rations this spring.

African Swine Fever (ASF)

There were reports this week that the disease is again present in China. Some market participants suggest that the disease has only affected about 10% of the herd and is not a big concern at this point. It seems that every winter now the disease is making a return, but producers there are getting better at dealing with the outbreaks too. This issue will be monitored closely by the markets moving forward.

Banking Concerns

All the banking issues in the news this week has spooked the financial markets. To combat this, the Fed and their European counterparts seem determined to keep the faith in the banking systems strong by moving quickly to keep depositors at these shaky institutions whole. Long term this should be positive for the financial markets, and in turn corn prices.

Moving Forward

As the trade awaits the acreage and old crop stocks report on March 31st, the focus before the report will be on export announcements out of the US.

- Jon Scheve, Superior Feed Ingredients, LLC

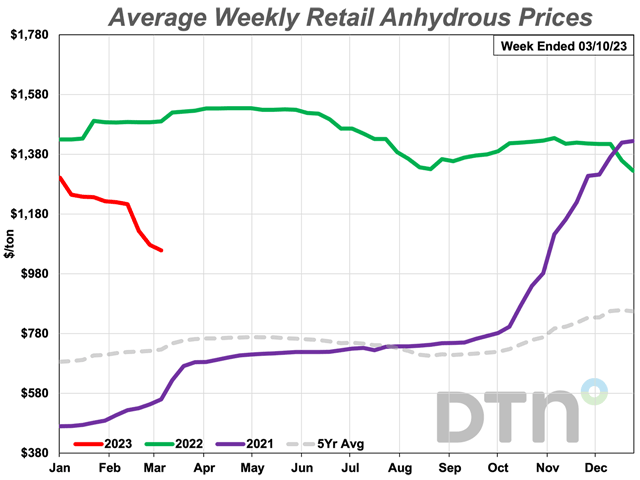

Fertilizer Update

From Fertilizer Week,

Some fertilizer prices increased last week for the first time in months, as we have recently seen months of price declines.

Urea benchmarks gained at NOLA, the Middle East, and SE Asia

Fertilizer prices surged last year after the shock of Russia's invasion of Ukraine, as natural gas prices jumped in Europe.

Since mid-2022, prices have declined as Europe's mild winter eased gas supply concerns and the continent pulled in LNG. Costs for producers have also fallen. Sulphur, sulphuric acid, and ammonia are much cheaper than a year ago, as is potash, but the uncertainty remains high.

-

From DTN (March 15th)

Despite the increase last week, all major fertilizer's are still cheaper than a month ago as they continue their downward trend.

Anhydrous was 13% cheaper than last month. With an average price of $1,059 a ton.

UAN28 was also 13% cheaper, with an average price of $436 a ton.

UAN32 was 10% cheaper, with an average price of $522.

Urea was 7% cheaper, with an average price of $643.

Potash was 5% cheaper, with an average price of $657.

DAP, MAP, and 10-34-0 were all just slightly lower compared to last month. The average prices are as follows:

DAP was $825

MAP was $823

10-34-0 was $740

Highlights & News

FOMC meeting Wednesday, looking for a 25-point increase.

Chinese President Xi said that China is prepared to defend world alongside Russia in accordance with international law.

UBS is acquiring Credit Suisse for $3.25 billion.

Goldman Saches lost $200 million in the market turmoil after Silicon Valley Bank's collapse.

Gold is on track for its largest one week rally since March of 2020.

The Pentagon announced another $350 million in military aid to Ukraine.

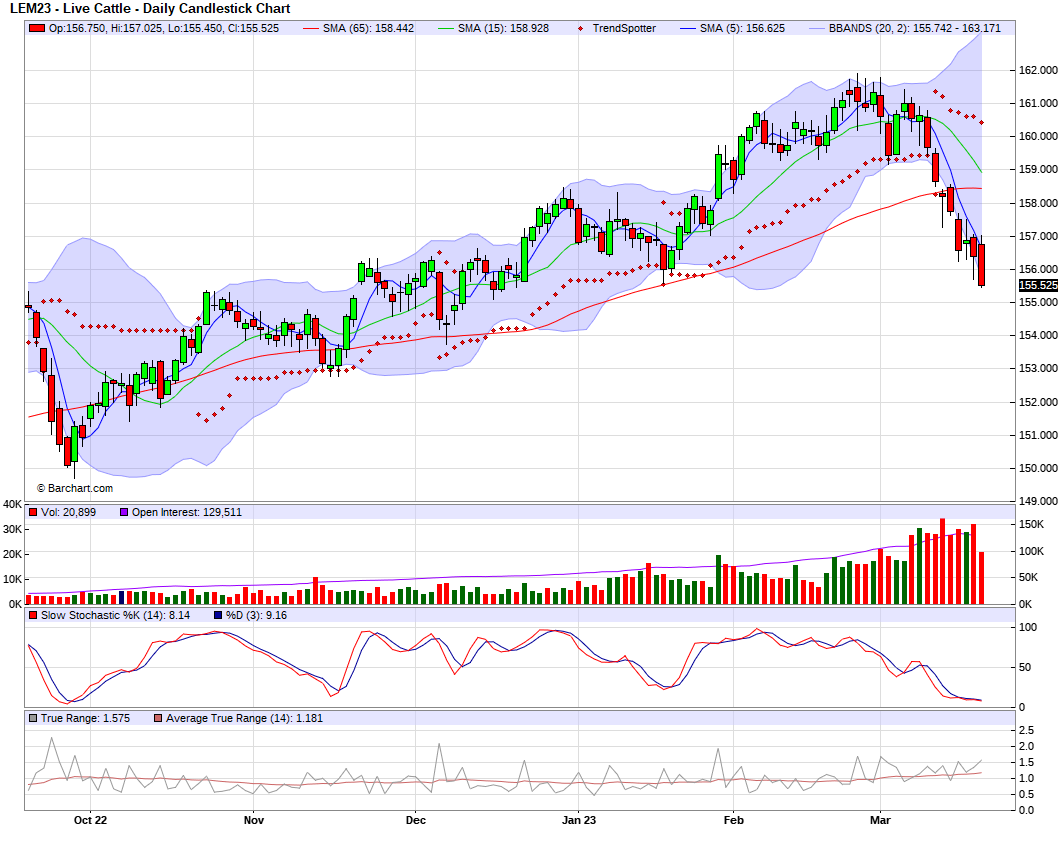

Livestock

Live Cattle down -0.875 to 155.525

Feeder Cattle down -0.800 to 199.150

Feeder Cattle

Live Cattle

Social Media

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

U.S. Weather

Source: National Weather Service