GRAINS CRAWL BACK

Overview

Grains make a very impressive rally and bounce back from our lows. Initially it looked like were gonna get hammered again like we did yesterday with all grains trading down double digits, but we ultimately got a nice rally across the board aside from Minneapolis wheat.

As corn rallied 17 cents off its lows to end the day unchanged. Beans bounced nearly 30 cents off their lows. While Chicago ended 21 cents off it's low and KC 27 cents off it's low.

Minneapolis continued to see pressure due to the fast planting and overall good crop conditions for spring wheat. The US also bought some more wheat from Poland and Germant, which didn’t help the wheat market.

Initial pressure in the grains came from a few things. Demand has been pretty weak. Russia continues to hound the wheat market and sell cheap. Lastly, we have the China and covid situation which many people aren’t talking about. Basically, China is facing another covid break out which ultimately leads to them buying less and weakens their economics.

Overall, our markets were definitely oversold, especially considering the weather. We have seen nearly all of the rain across the corn belt continue to be removed from the forecasts. As the forecasts are getting hotter and more dry.

Mark Gold from Top Third said,

"This market reminds me of the 1983 market. Where despite a very hot and dry June, prices made their low on June 29th. The next day we had the crop report. It was hot and dry over the 4th of July weekend. Then the market exploded, and we rallied the beans $3 a bushel and the corn $1 a bushel."

In this morning's audio we said we thought grains had the chance to crawl back from those early lows. We also go over plenty of other factors as well as possible scenarios for our markets and more. If you missed it - Listen Here

The lows are getting very close to being made. Perhaps we make them tomorrow, or maybe it's not until next week. If we do get some follow through strength tomorrow, that would be a good indicator that the lows are in.

***

In case you missed it, Sunday's Weekly Newsletter

$3 or $12 Corn. Which Will Mother Nature Give Us? Read Here

Today's Main Takeaways

Corn

Corn manages to finish the day unchanged, after initially trading 17 cents lower at open.

Corn crop conditions came in at 69%, which was lower than the estimates of 71% and last year's 73%. We have been saying for the past few weeks that we think there is a solid chance that this is the highest number we see printed all year, that is if weather doesn't break and magically end the drought concerns.

For some years to compare, here are a few past years initial crop ratings. Keep in mind, not all of these come in at the same week every year.

Rated Good to Excellent %

2023 - 69%

2022 - 73%

2021 - 76%

2020 - 70%

2019 - 59%

2018 - 79%

2014 - 76%

2013 - 63%

2012 - 77%

We have compared this year to 2012 several times. But I again just wanted to take a look at the similarities between the two year's crop progress and conditions. If you notice, planting pace was fairly similar. Both were very fast planting years. In 2012 we saw an initial rating near 80% rated good to excellent, but that number was dropped to a little over 70%. Which means currently, our crops are in worse overall condition than that of 2012 at this same moment in time. After that, we saw small decreases until late June, then everything fell apart. Now I'm not saying this year is 2012. I am just pointing out the similarities, and if it does stay dry across the corn belt, we could ultimately be looking at a somewhat similar situation.

This April and May is one of the driest on record. The difference between this year and 2012 is that we are already much drier than we were at this same time. The biggest question is, do we continue to stay this dry throughout June?

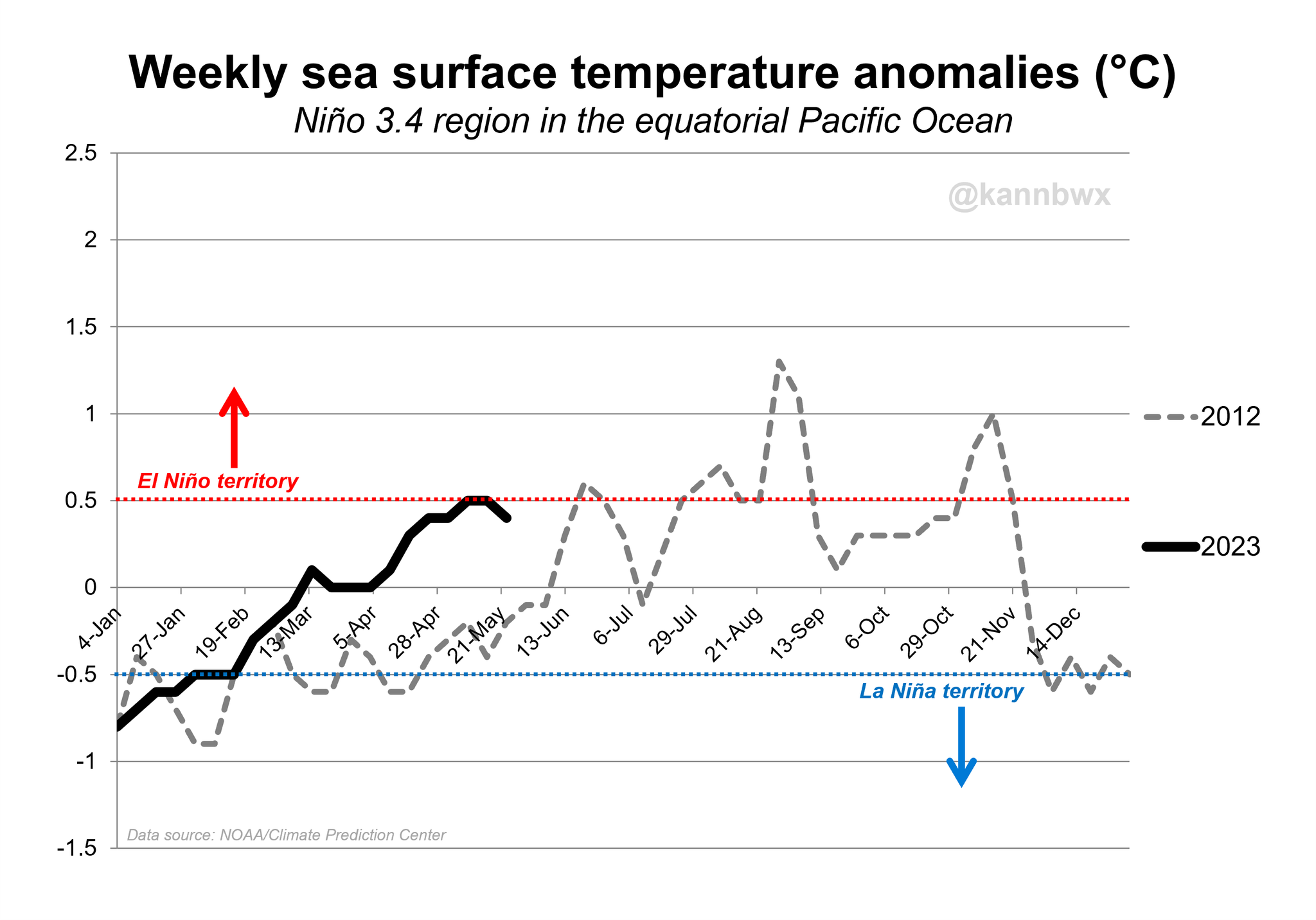

Here is a graph Karen Braun put together. It show cases the effects of El Nino and our sea surface temperatures. The current research suggests that El Nino is expected to strengthen well beyond that of 2012 levels. It also suggest that the trade winds won’t support that move until mid-June.

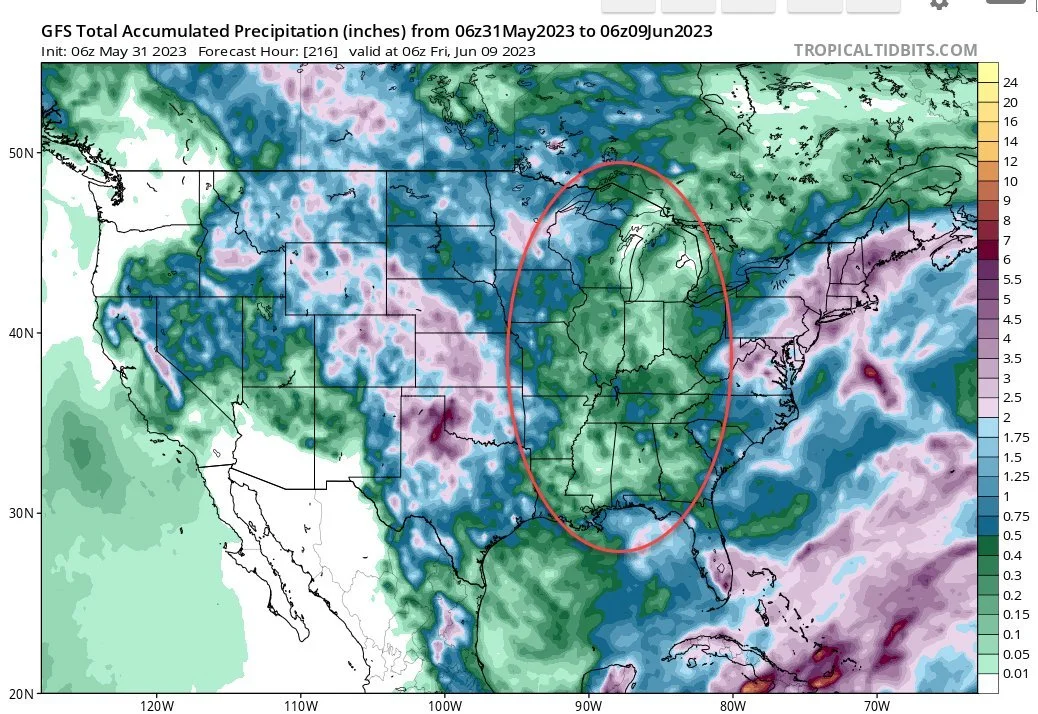

Taking a look at forecasts. It doesn’t look like we will be seeing any moisture relief in the next 10 days for the corn belt. This comes on the heels of the driest April and May in over 30 years.

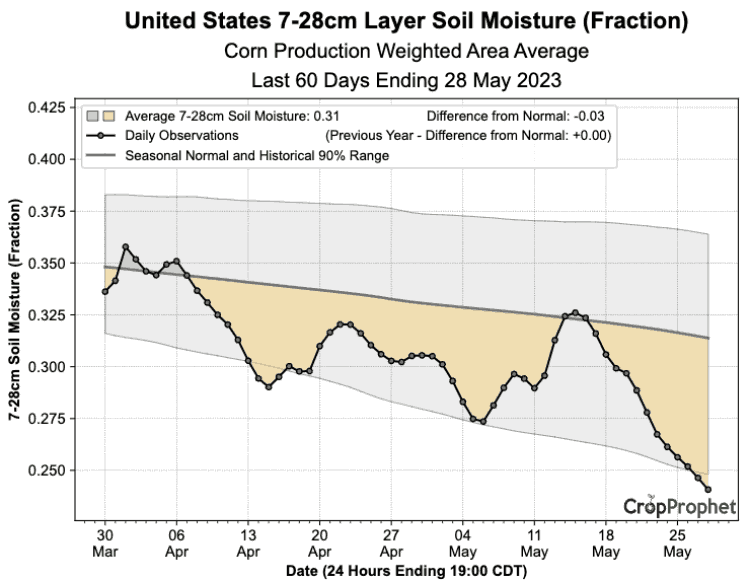

Just take a look at how rapid our soil moisture dropped over the course of May. If we don’t get some good rain, one could imagine we continue to see this drop at a fast decline.

Weather is really a wild card however. As one day they throw rains in the forecasts, the next day they take them out. Some weather gurus think we ultimately do get rain, some predict we won't. More often than not, it does seem like rains in the forecast start to disappear when we take a look at longer term forecasts. So personally I think weather is still bullish, and if it does indeed stay dry, this would push corn much higher. But we will have to wait and see just how dry it stays until mid-June.

With the initial crop conditions coming in worst than recent years, bears again question how well that 181.5 yield is going to hold up. If it stays dry with limited rain, 175 will become the new number of debate. I think the trade could already be anticipating a number closer to that range.

In the end it will all come down to weather. Does the corn belt receive or rain, or does it stay dry? That is too be determined, but it might already be drier than the trade realizes.

If we take a look at the continuous chart, the similarities between this year and 2012 tempt me to further debate the question.. Will history repeat?

Today’s price action wasn’t all that bad. Sure we closed unchanged. But that huge bounce from our lows was a good sign of strength. The funds are still incredibly short. A bigger weather scare could cause a rather large short covering. Are the lows in? It is tough to tell, but if i had to guess I'd predict a low within the next week or so if we haven’t already made them.

Corn July-23

Soybeans

Soybeans continue to bounce around near their recent lows. Initially beans were down 27 cents at open but managed to rally nearly 30 cents off their lows from last night and end the day 3 cents higher.

Bean planting also continues to keep it's hot start. Coming in at 83% planted vs last week's 66%. This is also well ahead of last year's 64% and the 5-year average of 65%.

China headlines have been pressuring beans, with uncertainty from the worlds largest soybean buyer. As there were rumors that China declined a meeting between the two nations defense chiefs at the annual security forum in Singapore. Additionally, as mentioned, China is now dealing with another covid break out which further creates demand uncertainty.

Brazil is still one of the biggest concerns for the bean market, as they still have that monster crop. But the biggest question there is how well can their logistics and labor handle exporting that record amount of beans. Which creates a potential wild card for down the road.

It appears that the trade and USDA are assuming ideal planting, a perfect growing season in the US, along with no logistical issues out of Brazil. Sure, these could all happen. But there is a ton of weather premium left to be built into the markets here, and an entire growing season ahead.

Is it really bearish that Brazilian soybeans are going to the US? Perhaps it means that the US simply doesn’t have enough supply……

The rest of this post is subscriber-only content.

Subscribe to continue reading and to receive every single one of our exclusive updates via text & email. Scroll to the end to check out some past updates.

LAST CHANCE OFFER

Last chance to lock in all of our stuff for a massive $500 discount. Take advantage before it’s gone.

$299/yr or $29/mo

Originally - $800/$80

Become a Price Maker, Not a Price Taker.

Check Out Past Updates

5/31/23 - Audio

Are Markets Overdone to Downside?

5/30/23 - Audio

Is There Opportunity In Today’s Sell Off?

5/28/23 - Weekly Grain Newsletter

$12 or $3 Corn? Which Will Mother Nature Give Us?

5/26/23 - Audio

Volatile Markets Ahead of Memorial Day

5/25/23 - Market Update

4th Day of Gains in Corn

5/24/23 - Audio

Are You Prepared If We Tank or Rally?

5/23/23 - Market Update