GRAINS FAIL TO HOLD RALLY

Overview

Grains opened lower but actually showed some pretty good strength throughout the day before selling off from our highs, ending in a pretty disappointing close across the board.

Wheat saw the most pressure with Russia aggressively selling for cheap compared to the U.S. prices. Wetter Argentina forecasts added additional pressure to beans.

Looks like traders are preparing for some not so great news in Thursday's report. Which isn’t unreasonable. The trade is looking for acres of wheat acres to come in better relative to have they have been in the past few years, and bigger production numbers from row crops.

If you missed it, read Sunday's full version of our Weekly Grain Newsletter Here

Or check out yesterday’s audio update where we talk about what to expect going into the report. Listen Here

Today's Main Takeaways

Corn

Corn was the strongest of the grains today. At one point we were trading 12 cents higher at $6.64, but ultimately came down 9 cents off our highs and just closed over 2 cents higher on the day.

Looks like some fund rebalancing taking a look at how we closed this afternoon ahead of the USDA report in two days. Most inside the trade are looking for a slightly bigger U.S. crop and some small cuts to overall U.S. demand.

Strength in the corn may have came from news that the pacific coast was having trouble getting corn in. Foster farms, one of the biggest chicken processors on the west coast is claiming they cant get corn from the indian pacific railroad. As the railroad says the weather is terrible, and its causing some delays. As there has there has been some issues in California where some people were left without power for days.

Yesterday we saw some more disappointing export inspections which further solidify the argument that we will see a reduction in U.S. exports. Poor exports are another thing keeping a lid on the corn market, everyone just wants to sell these rallies. There is some rumors and stories of producers in Kansas switching from corn to wheat. Some are saying Nebraska is desperate for corn and it looks like they really don't have much to sell.

For the first five days of the year, Brazil exports came in at 1.9 MMT. In comparison, last years total exports for the month of January totaled 2.7 MMT. So this could lead to some serious competition in exports if they keep up this pace.

Taking a look at Argentina. They are still pretty hot and dry but might see some rain in the next week or so. Almost everyone agrees that we see the USDA lower its Argentina production estimates but this might already be priced in. There is also the potential for some Argentina acres to be switched over from beans to corn. Brazil's second corn crop will be a pretty big wild card after they harvest their beans. As Brazil has got a lot of rain and forecasts still look wet, so there is a chance we see corn planting delayed.

Corn March-23

Soybeans

Soybeans close slightly lower, but actually closed nearly 16 cents off our highs. At one point we rallied 23 cents off our lows and hit a high of $15 3/4 before coming back down and closing at $14.85. The funds are long corn and beans were probably looking to size down their position before the report.

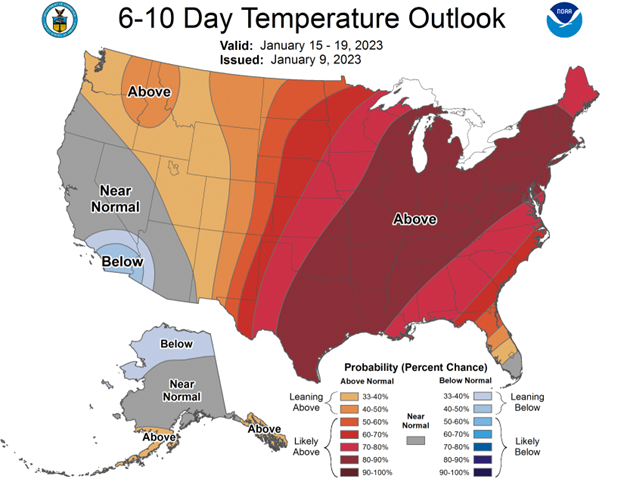

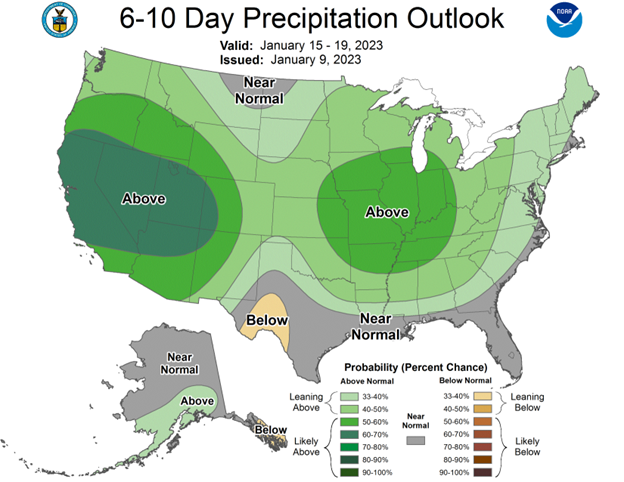

Beans seeing some pressure from a little wetter 8-14 day forecasts over in Argentina. Its gonna be cooler in Brazil and warmer in Argentina. So a little bit of a mixed bag there. Looks like Argentina might get some meaningful rain were they need it in a week or two. But the question is, will it be too little too late to make a big difference? Dr. Cordonnier again lowered his Argentina estimate by another 2 million metric tons, down to 41 million, but left his Brazilian 151 million estimates unchanged.

Probably one of the biggest concerns in the future of the soybean market still has to be the massive Brazilian crop. Yes we are going to probably have a very poor Argentina crop, but most seem to think Brazil’s massive crop in good conditions will more than offset the lack in Argentina's.

One thing we might see is the funds rebalancing, as they are still very long corn and beans. So there is definitely the possibility to see some more selling here which could ultimately further pressure prices. This was likely one of the reasons we saw grains break off from our highs on that mid day rally.

Something bulls are looking at is less soymeal being available in Argentina this year and optimism that we see China reopen and see their economy improve. But then again, there are a ton of uncertainties surrounding China and sometimes it seems like they don't want to do much business with the U.S. China still has a long ways to go in their battle with covid.

Looking at march beans, from a technical standpoint if we break lower we would look for some support around the $14.70 trend line range. If we do get an awful report or break below that trend line, we have the chance to see prices make a rather large correction to the downside, maybe even as low as the $14.20 or so range to make up for the lack of what the U.S. is going to export the next few months. That is IF we break support. Overall, soybeans seem comfortable trading in roughly a dollar range between $14.20 and $15.20, and each time we climb higher than $15 we run into resistance. As a producer there is nothing wrong with rewarding these rallies and taking some risk off the table especially when we climb in the upper end of our recent trade range.

For the time being I'm not super bullish beans when we get into the $15+ range, as we just lack that major bullish catalyst to push us higher. Of course the situation in Argentina could always worsen but there is some risk there as they might get rain. However, one thing that could push prices higher in the future is if Brazil runs into some harvest issues down the line. Which could lead to crushers outbidding exporters. But that's something we just don't know yet. We also have the political issues in Brazil which could wind up supporting prices. But again, there are plenty of uncertainties.

Going forward, factors affecting the bean market are more of the same. Outside of the USDA report, we have South American weather and Chinese headlines. We will have to see what kind of tone the report sets and what happens in the Argentina forecasts.

Soybeans March-23

Wheat

Wheat markets see some red again here today, but in all it definitely could have been worse. Still pretty bad price action and not an ideal close. At one point we rallied 20 cents off our lows but gave back 9 of those come close. Ultimately losing a dime.

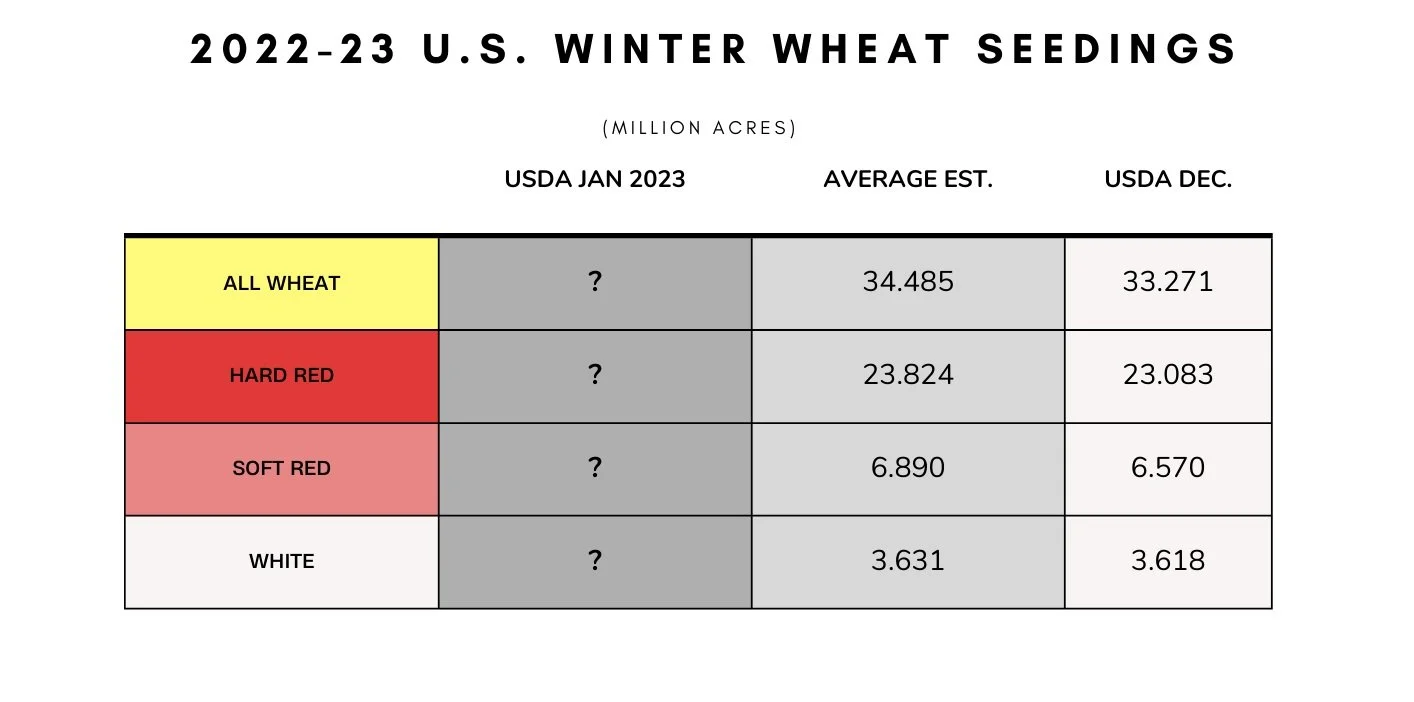

Traders are preparing for a poor report come Thursday. Which isn't unreasonable given that wheat acres are expected to come in bigger than they have in years past. Most also expect to see the U.S. balance sheet increase.

The sharply lower wheat prices over night were mostly due to Russia aggressively selling a bunch of wheat at cheap prices. As they sold quiet a bit to the Egyptians. Which was one of the main reasons for the sharply lower prices overnight.

Russia still has an awful lot of wheat they can move at decent values which is hurting our wheat market. On the other hand, the U.S. is also getting more in line with the global market. Eventually, there won't be an argument that U.S. is too far out of the market. We just aren't there quite yet.

As for the funds, we all know they are incredibly short wheat unlike corn and beans. I don’t necessarily see them adding on to this short position, but with prices sitting near 52-week lows, there just isn't a ton of pressure nor reasons to liquidate these positions yet.

Overall, short term there isn't really anything friendly for the wheat market. Today we did manage to hold support and close above our December low. To get wheat trading higher short term and prove the trade wrong we will likely need a bullish surprise in the report. Otherwise, if we get a bearish report we could break some support and trade even lower from these lows. If wheat does take another sizeable step back after the report, I think that gives us all the more power to get in at a good price for when higher prices hopefully come in the months following. As there is still a chance Russias exports are being slightly over exaggerated and Ukraines production and exports are also slightly overly optimistic. We also have the war that still remains a possible bullish wild card. Lastly we also have the chance to see Russia run into some winter kill. So short term, yes I think we definitely have the chance to see more downside, but I still hold a bullish tilt looking long term.

Chicago March-23

KC March-23

MPLS March-23

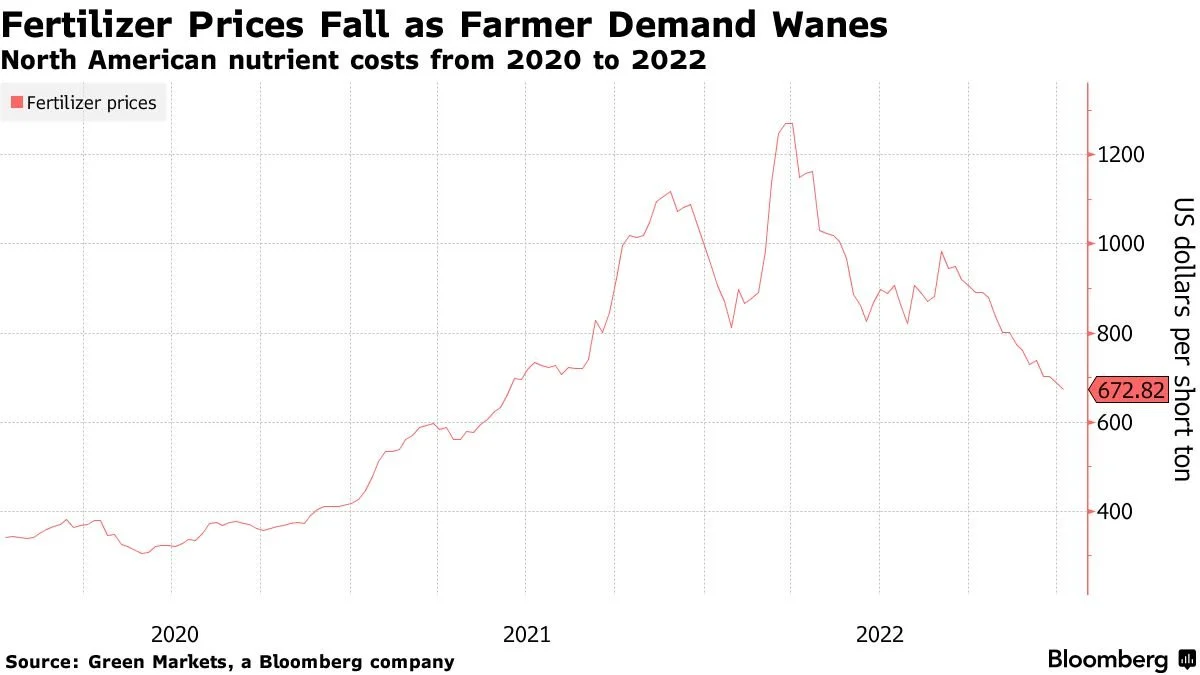

Fertilizer Prices Fall to 19-Month Lows

This information comes from Bloomberg.

Fertilizer prices are falling after hitting records in 2022 as gas costs and farmer demand both decline.

The Green Markets North American Fertilizer Index fell 4% Friday to $672.82 per short ton, the lowest since June 2021. The index surged to a record $1,270 per short ton after Russia’s invasion of. Ukraine threw the world’s crop-nutrient sector into disarray.

Tanking prices could bring relief to farmers, who have faced rising costs for everything that goes into growing food, from chemicals and fuel to equipment and labor. An easing of cost pressures could encourage farmers to plant more acres and apply more fertilizer, boosting production and helping to eventually bring down the cost of food for consumers experiencing historic inflation.

The fertilizer industry is globally bearish right now as farmers aren’t buying and the price of natural gas, the main input for most nitrogen fertilizer, declines, said Bloomberg Intelligence analyst Alexis Maxwell.

“We expect lower fertilizer prices in the first half of the year, yet the US market could bid regional prices higher in the first quarter as farmers scramble for tons,” she said.

Technical Analysis from GrainStats

Here are a few technicals from GrainStats. They put out new technicals every week and a ton of great info nearly every day. I highly recommend checking out their website Here

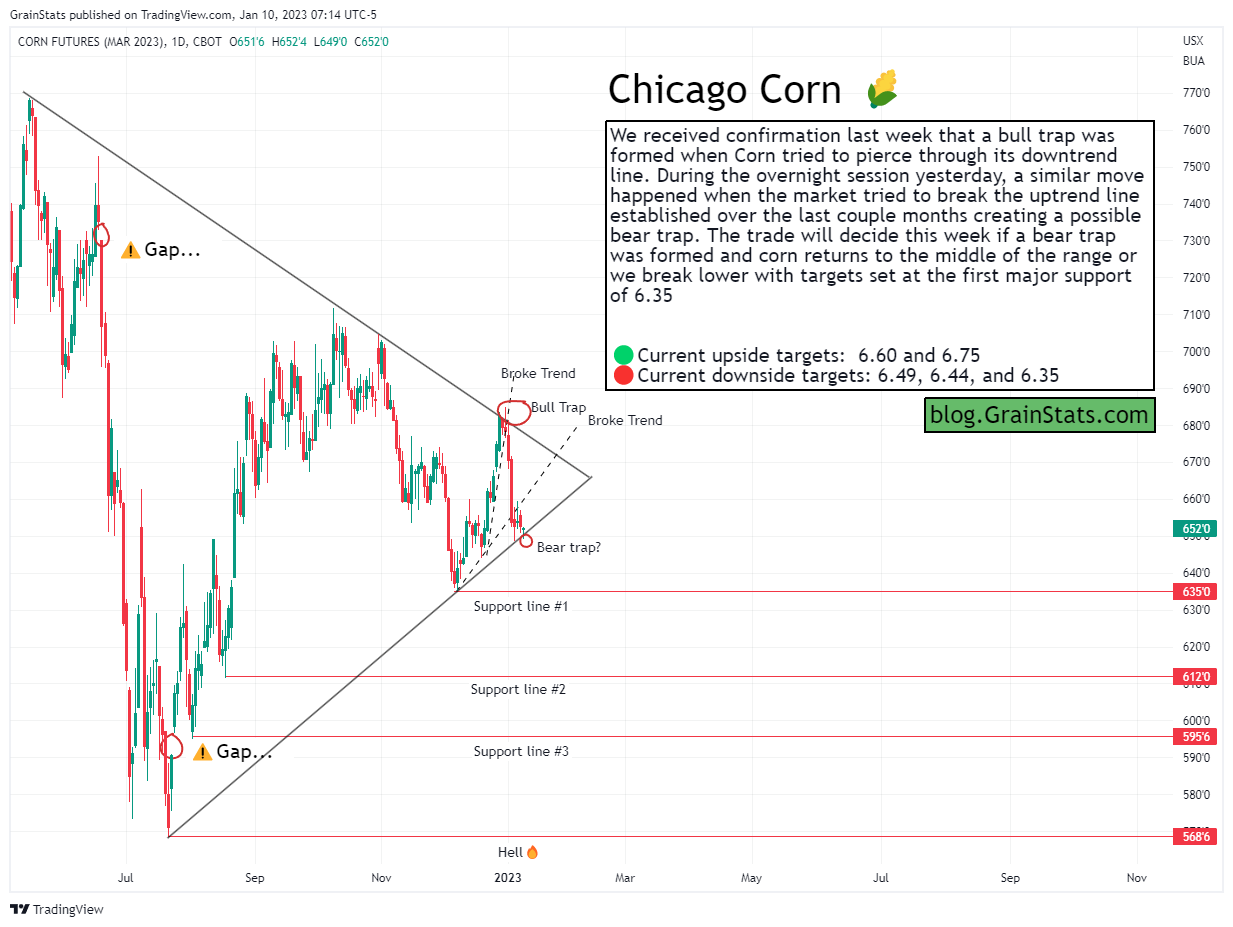

Corn 🌽

This is what they had to say about corn;

We received confirmation last week that a bull trap was formed when Corn tried to pierce through its downtrend line. During the overnight session yesterday, a similar move happened when the market tried to break the uptrend line established over the last couple months creating a possible bear trap. The trade will decide this week if a bear trap was formed and corn returns to the middle of the range or we break lower with targets set at the first major support of 6.35

🟢 Current upside targets: 6.60 and 6.75

🔴 Current downside targets: 6.49, 6.44, and 6.35

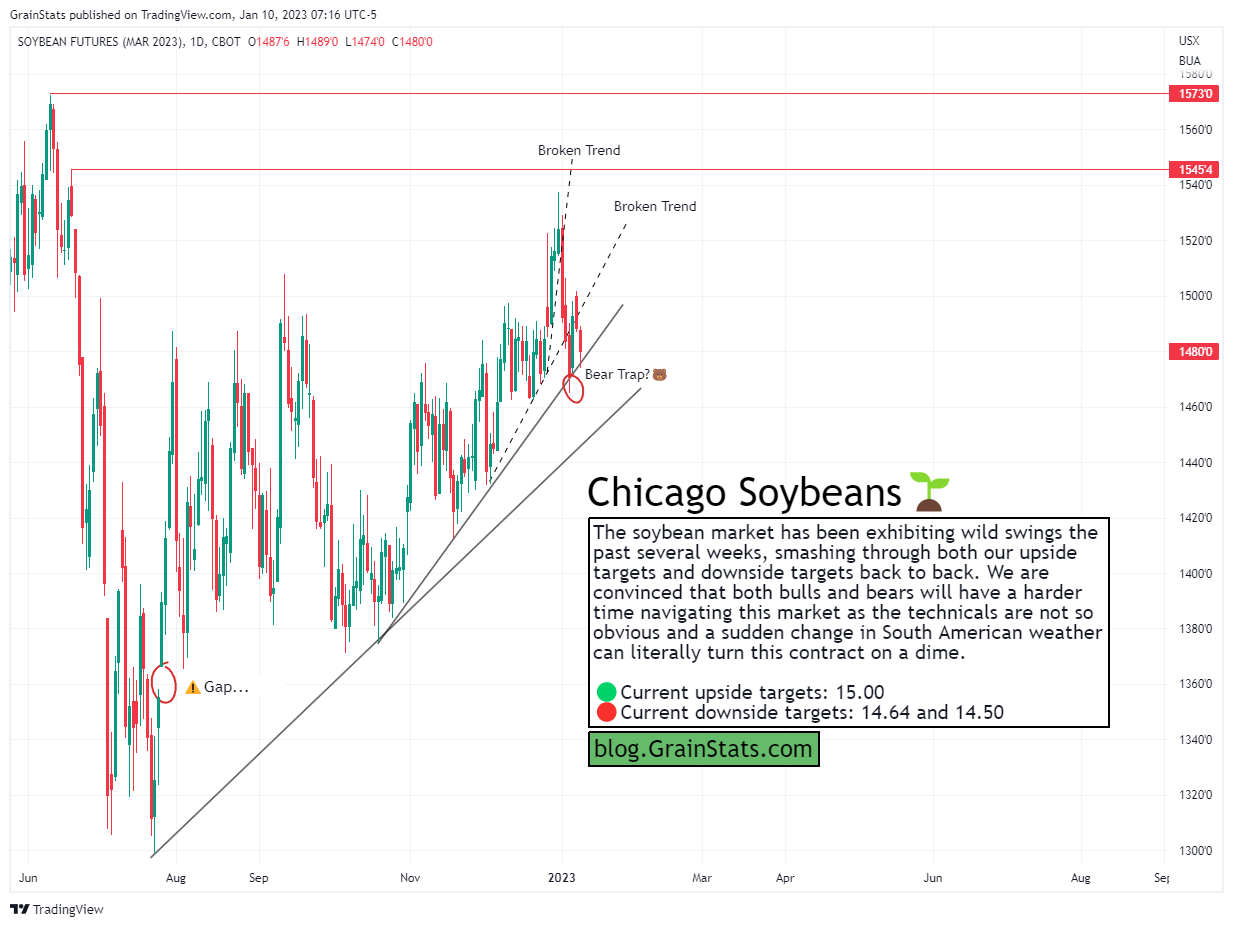

Soybeans 🌱

This is what they had to say about soybeans;

The soybean market has been exhibiting wild swings the past several weeks, smashing through both our upside targets and downside targets back to back. We are convinced that both bulls and bears will have a harder time navigating this market as the technicals are not so obvious and a sudden change in South American weather can literally turn this contract on a dime.

🟢 Current upside targets: 15.00

🔴 Current downside targets: 14.64 and 14.50

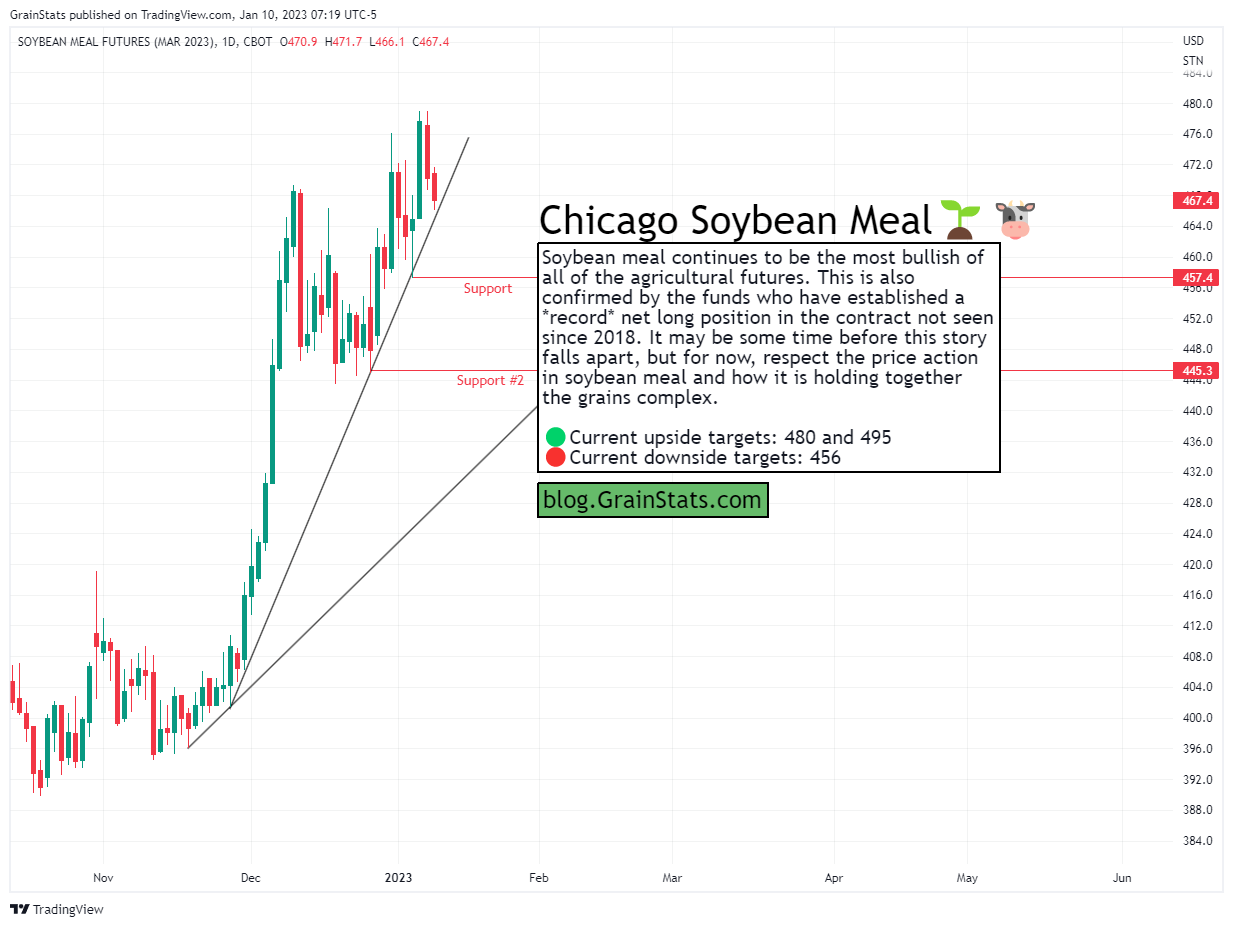

Soymeal 🌱 🐮

They said this on soymeal futures;

Soybean meal continues to be the most bullish of all of the agricultural futures. This is also confirmed by the funds who have established a *record* net long position in the contract not seen since 2018. It may be some time before this story falls apart, but for now, respect the price action in soybean meal and how it is holding together the grains complex.

🟢 Current upside target is 480 and 495

🔴 Current downside target is 456

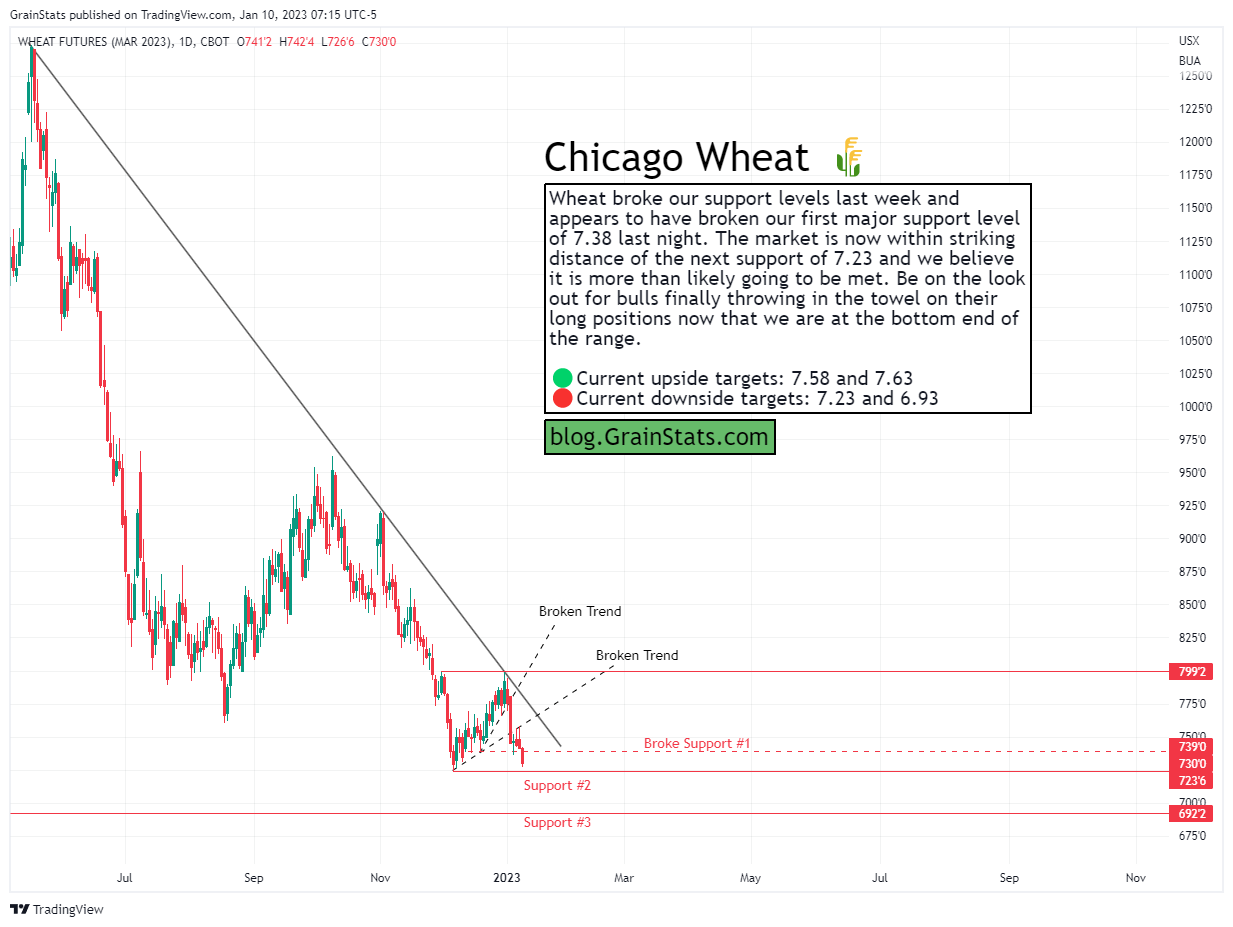

Wheat 🌾

This is what they said about wheat;

Wheat broke our support levels last week and appears to have broken our first major support level of 7.38 last night. The market is now within striking distance of the next support of 7.23 and we believe it is more than likely going to be met. Be on the look out for bulls finally throwing in the towel on their long positions now that we are at the bottom end of the range.

🟢 Current upside targets: 7.58 and 7.63

🔴 Current downside targets: 7.23 and 6.93

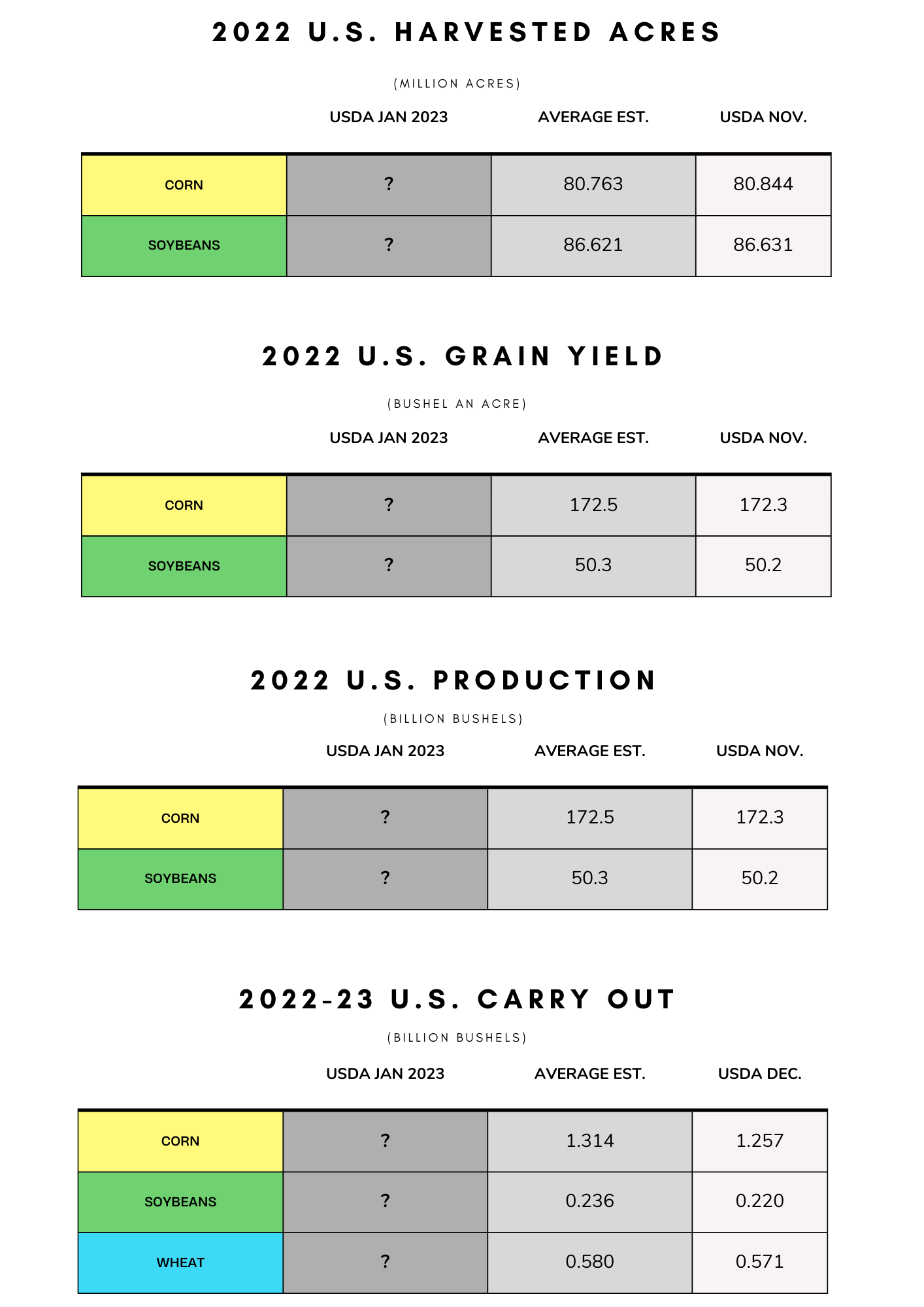

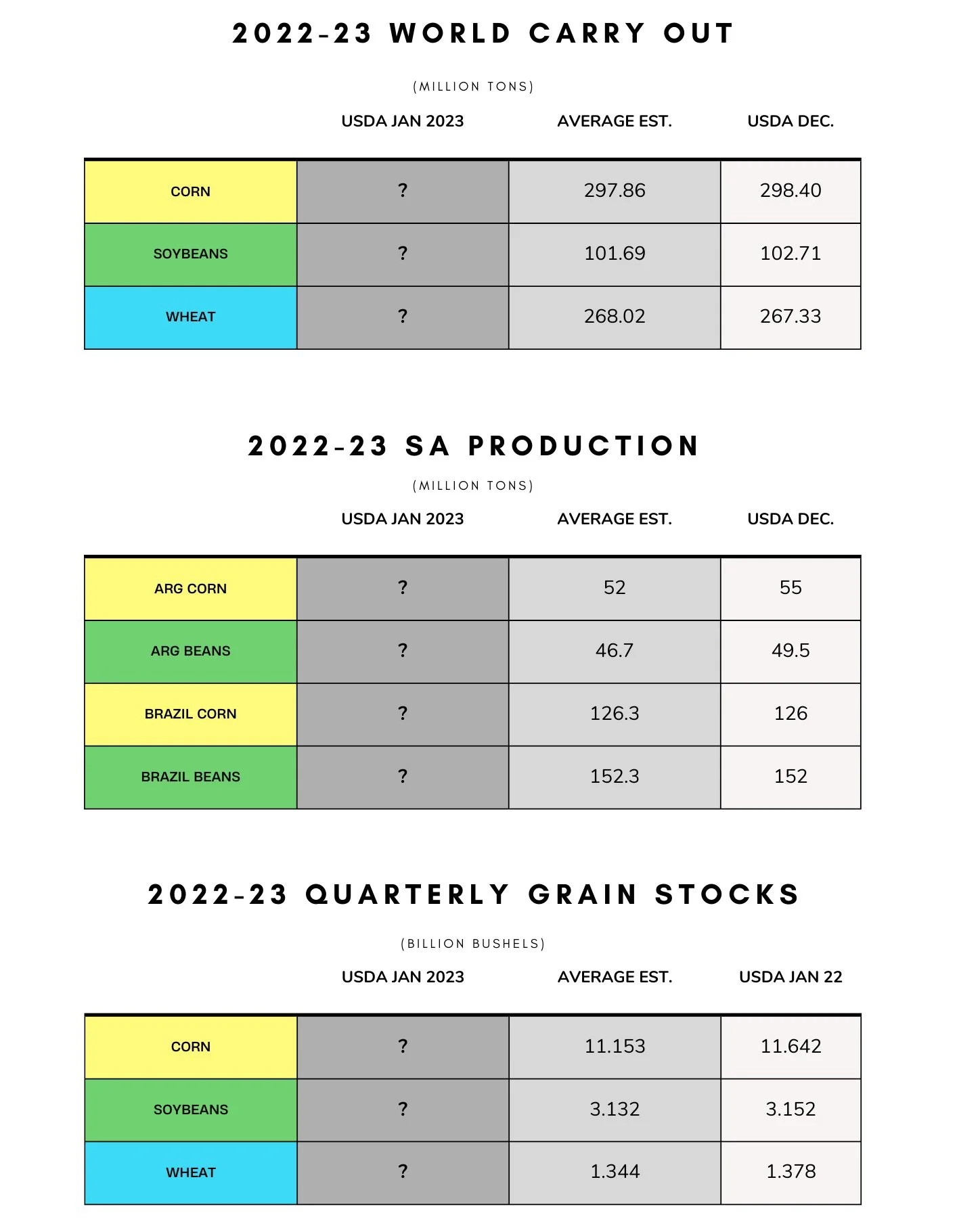

USDA Report Estimates

Analysts are expecting a snoozer for 2022 U.S. corn and soybeans in the USDA report Thursday. As they are expecting historically small changes in harvested acres, yield, and production. But with these projected small changes, leaves the window open for some curveballs.

As for ending stocks, corn is expected to see the largest rise due to smaller demand. Their current estimate is still lower than that of 2021-22.

Most are expecting growth in Brazil's corn and bean crop, but a very big decline is expected for Argentina crops.

South America Update

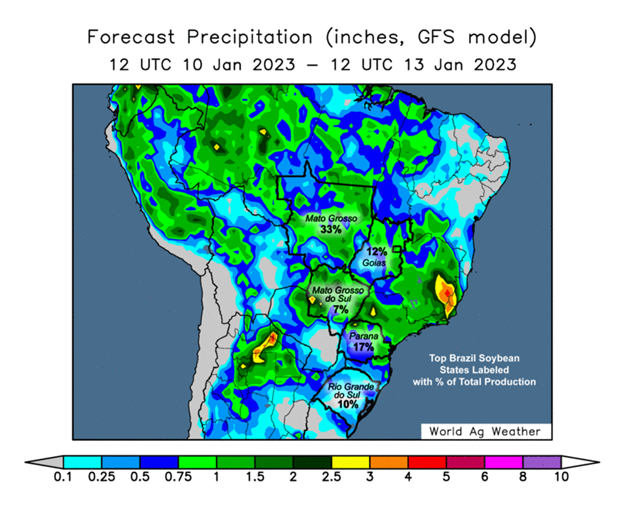

Brazil

Soybean harvest is underway, but less than 1% has been harvested thus far.

The first crop corn harvest in Brazil is just ahead of bean harvest, sitting at 2.3% complete. This is slightly behind last years 3.1%.

Yields of the first corn crop will likely be poor due to the dry conditions in southern Brazil which has the largest first crop corn acerage.

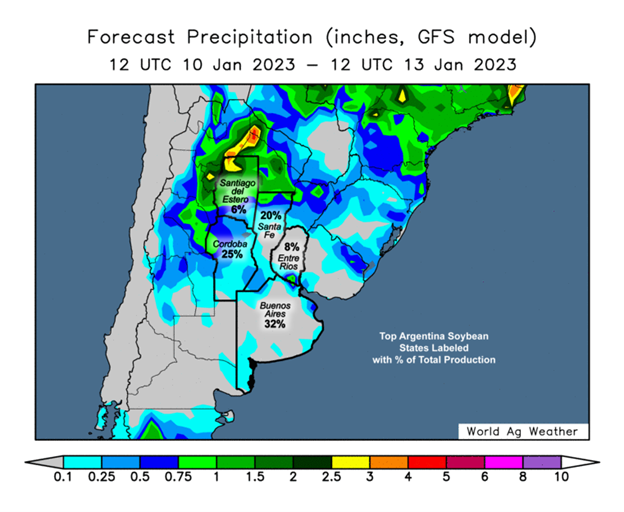

Argentina

Soybeans are nearly 82% planted vs 93.5% last year, and an average of 92.8%.

The end of the Argentina planting window for soybeans is typically around the second week of January.

Soybeans in Argentina were rated;

38% poor/very poor

54% fair

8% good/excellent

Corn in Argentina was was 70% planted compared to 77.3% last year and an average of 84.5% The early planted corn has been hurt the most by the dry weather.

Corn in Argentina was rated;

32% poor/very poor

55% fair

13% good/excellent

Dr. Cordonnier again trimmed his estimates

Lowering Argentina beans by 2 million tons.

Lowering Argentina corn by 1 million tons.

Highlights & News

U.S. voters support Ethanol and RFS, and oppose EV mandates

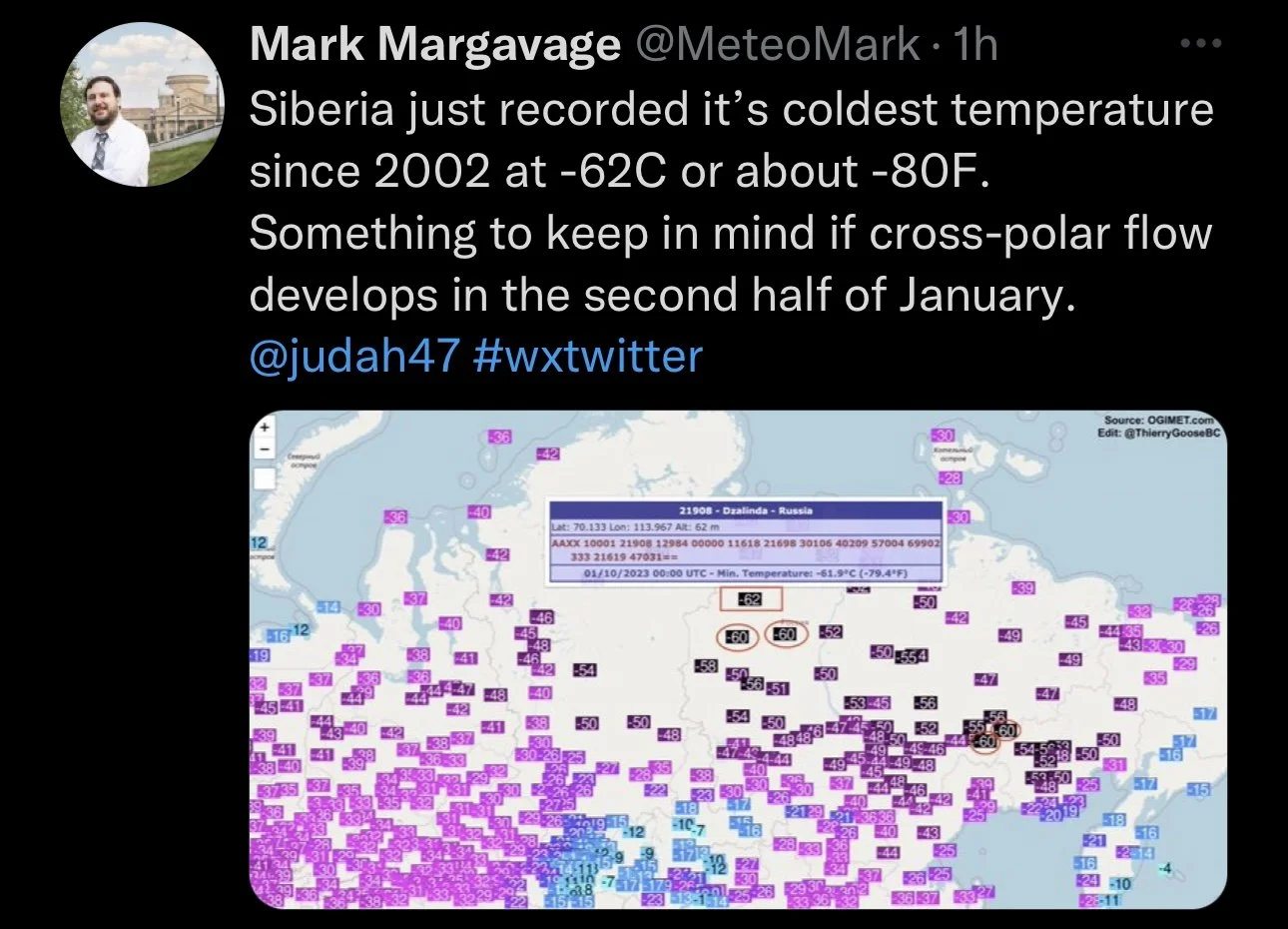

Ukraine winter grain crops are at risk from the warm weather.

Consumer reports say that EV cars are less reliable than gas powered ones.

2022 was the 5th hottest year on record.

World Bank warns of a global recession in 2023.

Other Markets

Crude oil down -0.20 to 74.45

Dow Jones up +180

Dollar Index up +0.267 to 103.01

Cotton down -1.46 to 84.76

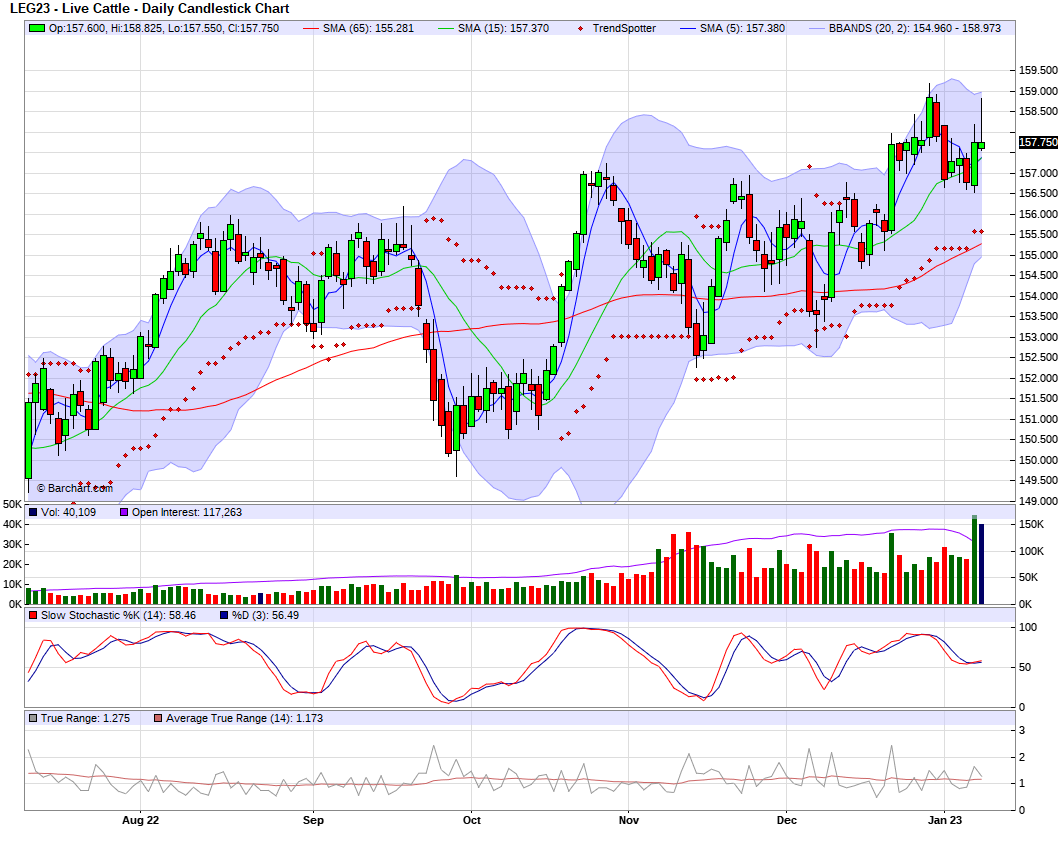

Livestock

Live Cattle unchanged at 157.750

Feeder Cattle up +0.200 to 186.500

Live Cattle

Feeder Cattle

South America Weather

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service