GRAINS GREEN FOR FIRST TIME IN 10 DAYS

Hey guys we are looking for inputs on how planting is going in your areas. You can text us at (605) 295-3100

Overview

Grains finally finding some strength mid day, ending the day green for the first time in 10 days (8 trading days). Markets were under pressure overnight and it looked like we would see the down fall continue. But grains find support and worked their way well of their lows to end the week on a positive note. Leading the way higher today was soybeans following their heavy losses yesterday.

On yesterday’s sell off we saw corn and wheat make new lows while soybeans have held their March lows.

We had some deliveries of soy oil and wheat, but no corn, beans, or meal. Mark Gold from Top Third said "There is an old saying that goes, buy heavy deliveries on the first notice day, so I don't think I'd want to be short wheat down here. I think all the main markets are oversold here, and I think we are due for a rally"

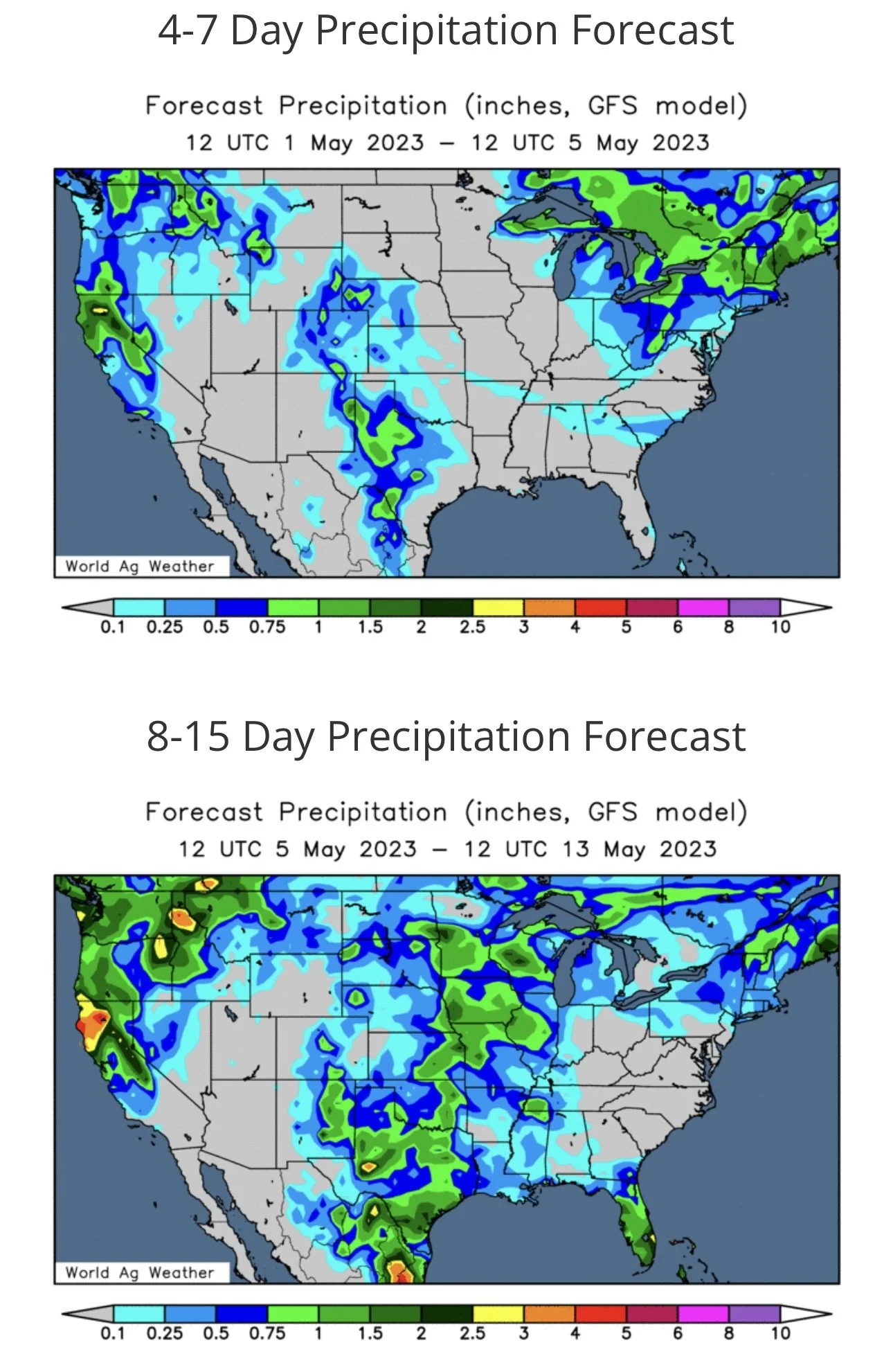

Markets have been pressured by China sale cancellations, a fast start to planting, cooperative weather in Brazil, rains in the southern plains, and some favorable forecasts here in the US.

Weather next week looks fairly cooperative with a warmer and drier forecast, so we could see planting ramp up and be a limiting factor in our markets. While some rainfall is expected in the northern corn belt which could restrict some planting.

Gong forward, we have a whole growing season ahead. Right now we do not have any premium built in for anything. So bottom line I think that leaves a lot of upside in our markets. Now could we see more pressure over the course of the next few weeks? Of course we possibly could. But our objective is to remain patient and wait for that bull rally to take us higher into summer.

***

In case you missed yesterday's audio you can listen to it here

Sunday's Weekly Grain Newsletter

Do You Have Enough Patience to Wait for All-Time Highs

Read Here

TRY OUR FREE TRIAL

Receive every single one of our updates, everything sent via text & email.

Today's Main Takeaways

Corn

July corn ends the day 3 1/2 cents higher, we started off lower but managed to finish 13 cents off our early session lows.

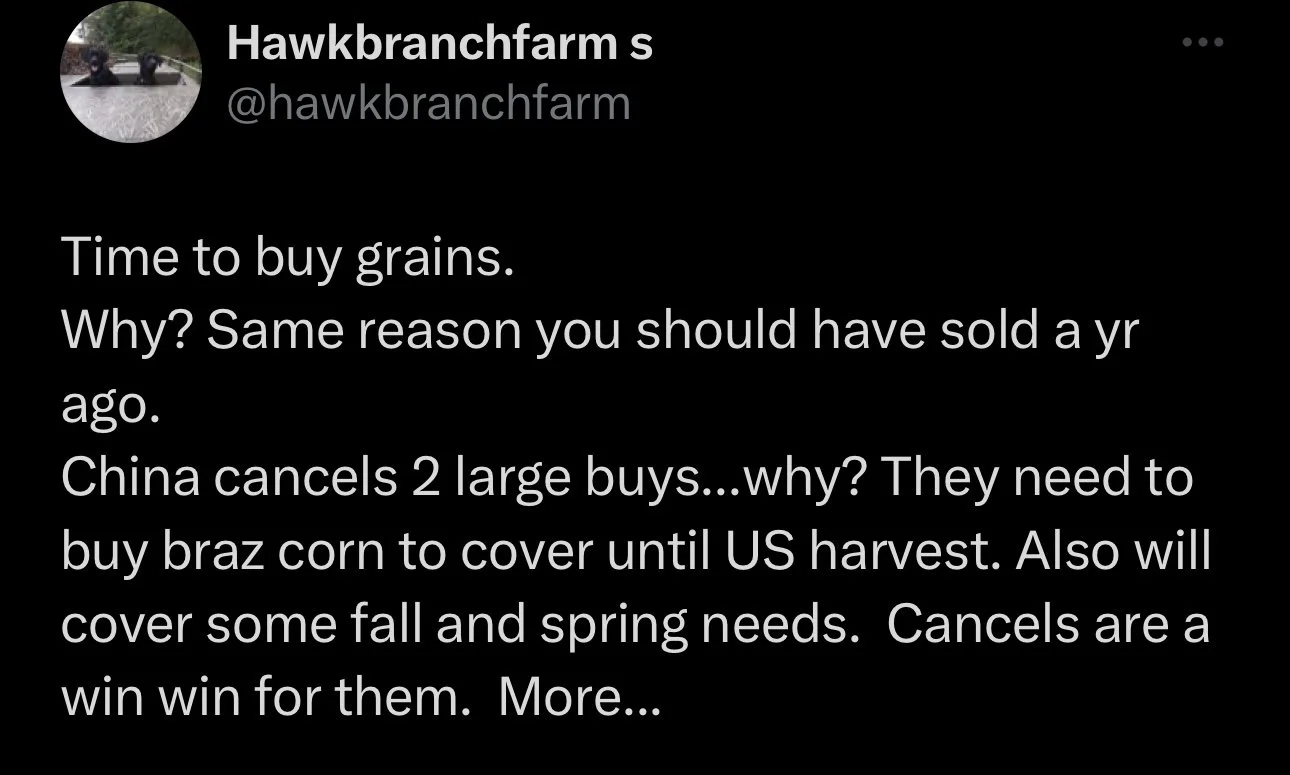

One of the biggest things that pressured corn the past few days is the cancellation of Chinese sales of corn. As we got our second cancellation of the week yesterday. The belief with these cancellations is that we see China look to buy cheaper corn from Brazil. Demand just hasn't been strong enough to keep the markets head above water on this sell off and period of transition where the markets focus shifts from South American weather to US weather. These cancellations make the demand uncertainties even more uncertain, as some argue the USDA's export forecast may need to be lowered.

With this transition period, most of the problems we have seen in Argentina are already factored in. To add on to the bearish tone we've seen, without any real US weather scares just yet, Brazil's weather has been cooperative and there is talk that their crop is getting bigger.

Generally cooperative weather across the corn belt has also added pressure to the markets. With our fast start to planting. But we need to remember that planting will start fast in years that have drought. For example, in 2012 we got off to a fast start which had our markets under pressure before finding a bottom the first week of June. Then the drought implications hit the markets and we rallied.

Even with the hot start to planting, bulls are looking at the weather problems the northern states are facing. Which makes them question just how preventive plant acres we wind up seeing.

BAGE had Argentina's corn harvest at 17.5%, up from 14.7% last week.

Taking a look at the May and July spread, it traded at its highest level yesterday. Which indicates there is indeed tightness out here in our markets.

Going forward, perhaps we are due for a big bounce given the heavy sell-off. But would I be surprised to see some more selling or choppy trade over the next few weeks? No I wouldn’t be. We look for us to make our lows sometime in May before we get that massive break to the upside.

Taking a look at the chart, yesterday we broke that uptrend from August. But we found support right where we needed to on today’s lows at that $6.74 level and our lows from August, creating a possible double bottom.

Corn July-23

Soybeans

Beans finally find some relief amongst this sell-off. Leading the grains higher today, with July ending the day up 15 1/2 cents. Closing nearly 23 cents off it's lows.

BAGE left Argentina's bean crop estimates unchanged at 22.5 million metric tons. However, they did note that a reduction in the crop size is very possible moving forward. The crop conditions for the crop sit at 65% rated poor to very poor, a slight increase from last week's 64% and well above last year's 15%.

The poor crop and problems in Argentina are mostly factored in currently, but bulls argue that we could definitely see these problems arise and create more problems in the future. Possibly creating a larger demand-driven story down the road, and I would have to agree.

Brazil's massive record crop is getting close to being out of the field as they wrap up harvest. As the end of harvest nears, one of the biggest concerns in the bean market is still the fact that they have cheap exports in comparison to the US. As I've mentioned in the past, there is still an argument to be made about actually getting the crop out of the country due to the logistic issues they face.

Another thing bears have continued to look at a lack in Chinese demand and some question marks surrounding their economy as a whole.

Taking a look at the chart, we found support directly on that upward trend line from August.

Soybeans July-23

Wheat

Wheat futures all close out the week green on the day. With Minneapolis leading the way higher, up almost 19 cents. While Chicago was a dime off its lows closing 4 1/2 cents higher and KC ended 11 cents higher.

One of the biggest problems we have had with the wheat market is that we have struggled to remain competitive in the global market. However, the US wheat now looks to be the cheapest wheat in the world. So perhaps we see some demand come in here for our wheat.

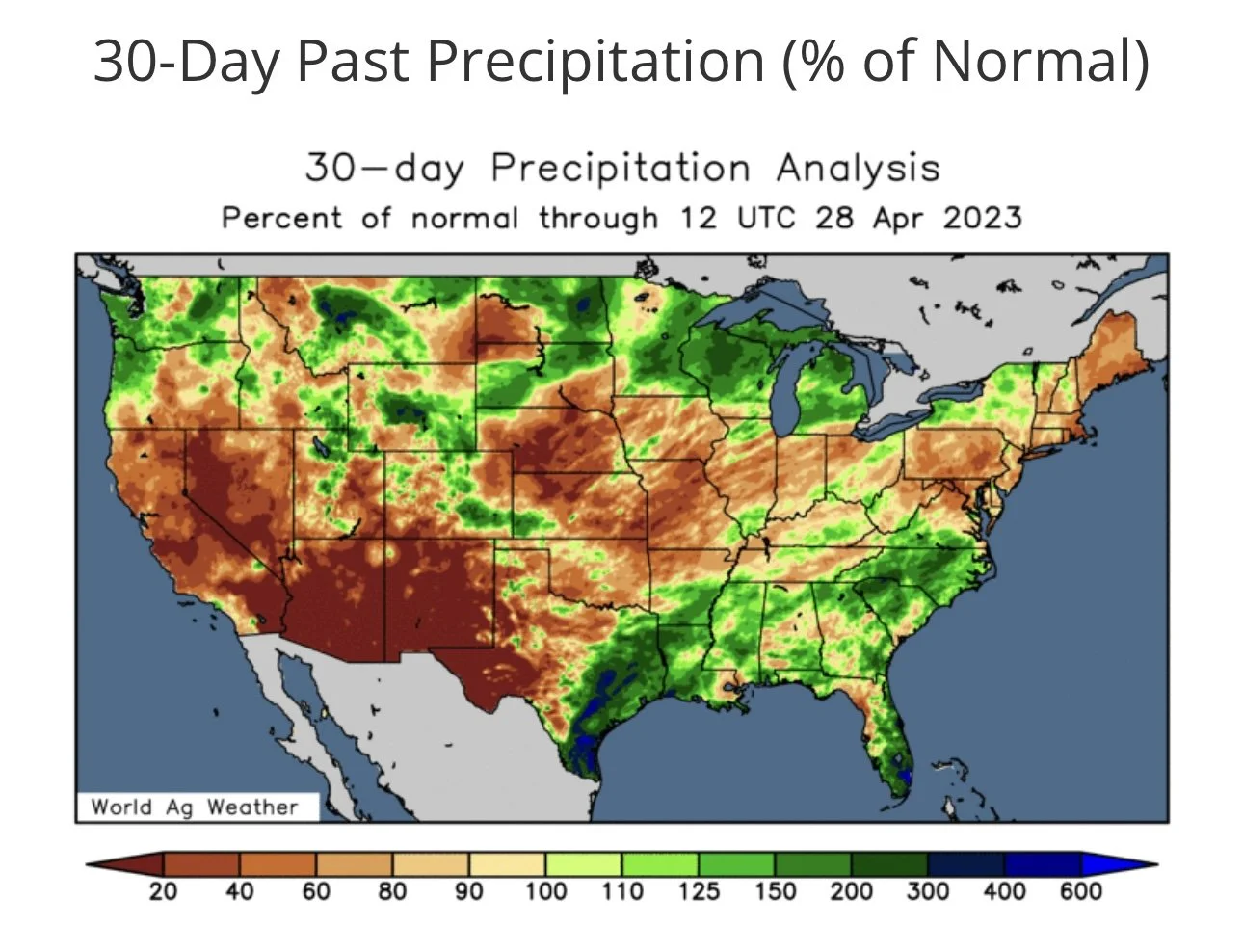

Some improved forecasts and rain have also been one of the things pressuring the wheat market on this sell off. But we need to keep in mind just how poor this winter wheat crop is. As just a few days ago the crop conditions came in at some of the worst we have ever seen. With 26% of the crop being rated good to excellent which is tied for the lowest number on record, while 41% of the crop is sitting poor to very poor, the second worst on record only behind that of 1996. I don’t think these recent rains are actually going to make as big of a difference as the trade seems to think. The market is acting like we just got some crop-saving rain and that just isn't the case. We will see a lot of acres get abandoned and left unplanted when it's all said and done.

Russia and Putin continue to make threats that they will exit the Black Sea agreement. But the markets have been mostly ignoring these threats. As they have been calling his bluff and seem to think that Russia will return to negotiate when the deal expires. Where will this whole situation go? Nobody really knows. But bulls still think we have the chance for a few bullish wild cards.

Going forward, wheat will continue to play the weather and war, while the funds have built one of the largest short positions in history. Bulls are just waiting for that one bullish catalyst to scare the funds and end the bleeding, pushing us higher.

Chicago July-23

KC July-23

MPLS July-23

Comparing History

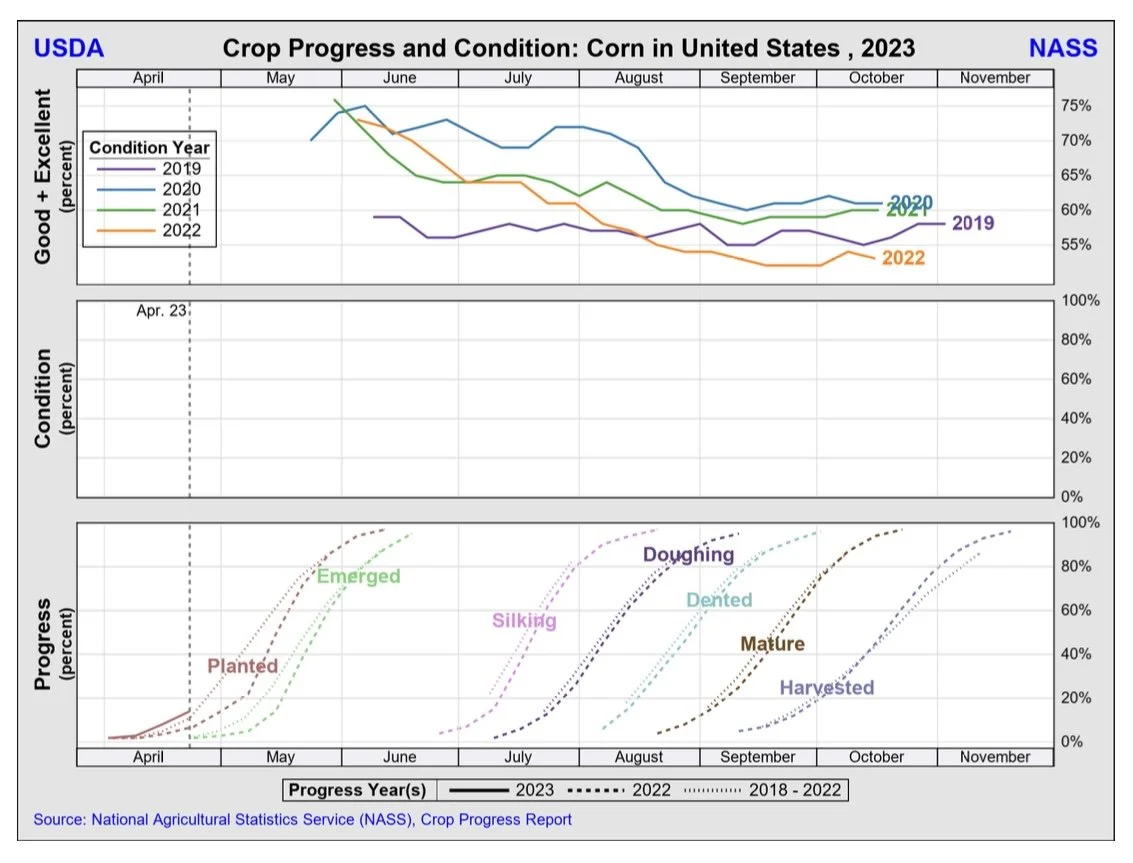

As you can see, similar to this year. In 2012 we got off to a very fast start to planting.

We are going to be keeping our eye on the crop progress, if we start accelerating at a fast pace that could mean that its dry. A lot of guys we have been talking to in the "I" states have said that they don't have a lot of subsoil moisture.

So again, we again ask the question. Will history repeat itself?

We had these next two charts in our past few updates, but I thought I would again include them.

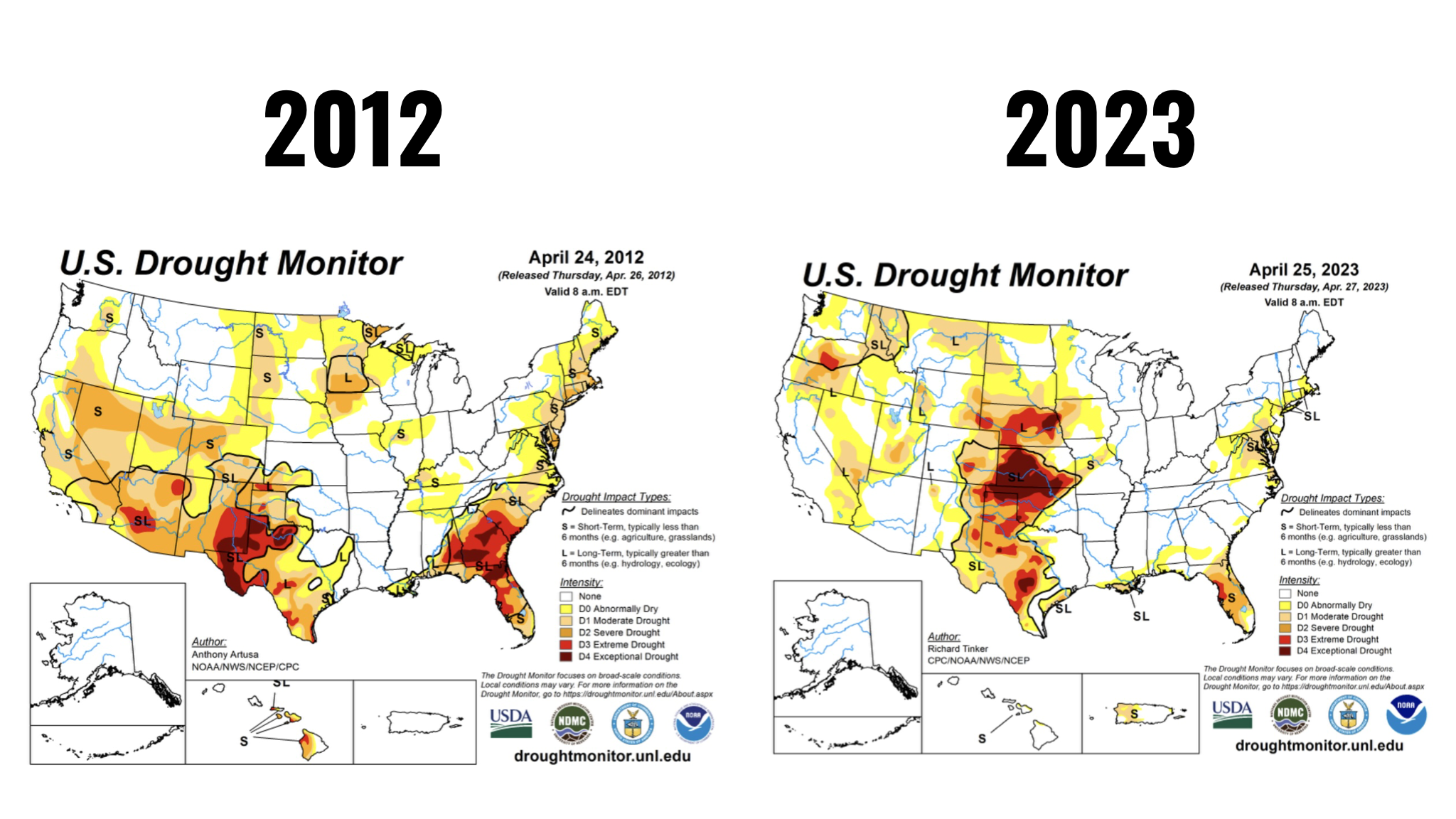

We saw the 2012 rally due to drought. But taking a look at the drought monitors, we might have more similarities between the two years than some think.

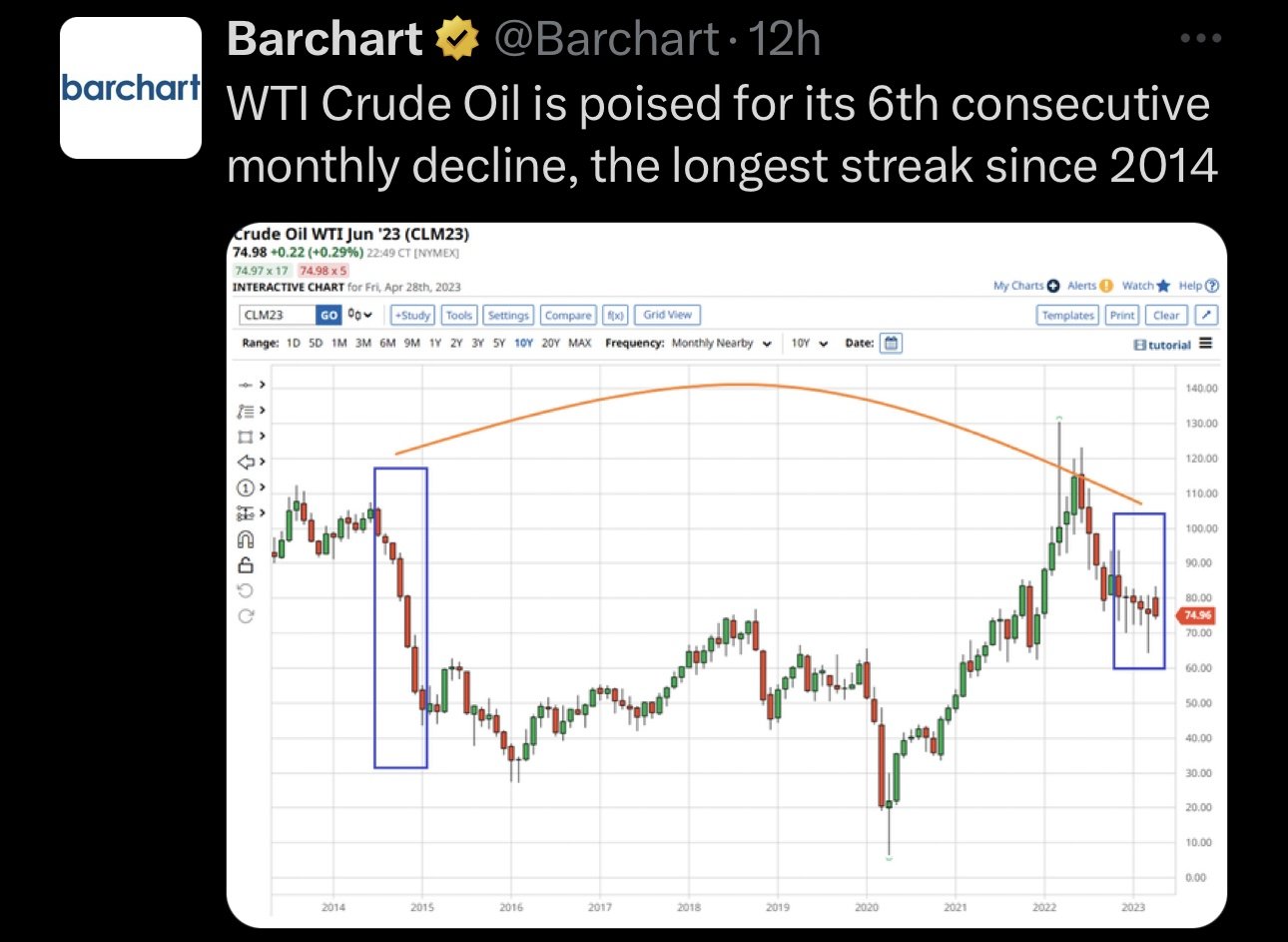

Lastly we have the continuous corn chart. Now these two patterns look very similar. In 2011 and 2022 we get a great rally. The following year we go a lot lower and everyone thinks its game over. In 2012 we make our bottom the first week in June before getting a rally that surpasses the previous year. Will 2023 follow suite? Now we aren’t saying all of these scenarios are going to happen. Just some food for thought, as there are similarities that we can’t ignore.

What keeps this year from repeating 2013?

From Wright on the Market,

2012 was the sixth Corn Belt wide drought since 1900. The other five were in 1934, 1936, 1980, 1983, and 1988. Corn and bean futures made their all-time high trade in 2012.

December 2012 corn traded to $8.49 on August 10th and then December 2013 corn traded to $4.10 in October 2013.

November 2012 beans traded to $17.89 on September 4th. By the fall of 2013, November 2013 beans were down to $11.75 in August 2013.

KC wheat made its high at $9.57 on July 19th, 2012 and spot December 2013 KC wheat was down to $6.93 in November 2013.

Yesterday, someone asked: "What keeps this year from repeating 2013?"

War in the bread basket of the world that will only get worse.

Ukraine, the fourth leading corn exporter, will plant half as many acres of corn this year as they did last year, when acreage was down about 20%.

Argentina, the world’s #3 corn and bean exporter, suffered the worst drought in at least 26 years and is importing soybeans and corn.

The Horn of Africa, a huge land area, is suffering its worst drought in 70+ years.

The US hard red winter wheat crop last month was rated worse than it has ever been rated for this time of year.

Spring wheat is going to be planted late.

El Niño is bringing drier than normal weather where 85% of Brazil’s corn and beans are grown. Brazil is the #1 bean exporter and #2 corn exporter. It will reduce Australia’s wheat crop by 20 to 25%.

During and shortly after the drought of 2012, many people, including many respected market analysts, predicted corn would never trade below $6 and beans below $12 again. The rush to buy corn and beans in 2012 was astounding. Users bought 4, 6, 8 even 10 months of inventory during the summer and fall of 2012. That is what put in the all-time highs. At the time, no one remembered that the highest prices of all time would remove a lot of demand.

Last year, no one said that corn and beans prices would never drop below breakeven again. In 2012, “everyone” was confident prices would stay strong. In 2022 and 2023, “everyone” is scared silly prices will crash and burn and they have crashed, building demand.

The 2023 demand is remarkably strong and corn, beans, and wheat prices have been well below the 2012 highs (way below if corrected for inflation) for the most part. In 2021, the US exported a record shattering $177 billion in agriculture products. In February 2023, we learned that US grain exports (just grain, not all ag products) were valued at $196 billion in 2022.

NOPA crush in March was the second highest all-time for any month.

The livestock numbers point to no more than a 2% decline in corn for feed use this year. USDA is using 7.7% less corn and soybean meal for feed use in their S&D.

These low prices now are building demand that no one expected.

Many countries are restricting agriculture exports to keep domestic prices down. No one did that in 2012 or 2013.

Sustainable Aviation Fuel (SAF), biodiesel, ethanol and ethanol for SAF (9 gallons ethanol will make 5 gallons of SAF). ADM and Gevo are going to make SAF out of half of ADM’s ethanol.

Canada, Belgium, France, Holland are restricting nitrogen fertilizer use in 2023.

Russia, China and Belarus are three of the top four fertilizer exporters. They are not happy with Europe nor the USA. Even so, economic sanctions and cargo insurance problems greatly complicate world fertilizer trade.

The world population in 2013 was 7.229 billion people. Now it is 8.045 billion.

Alan Bonifas predicts prices will rally after a low in May. So does Cargill's upper management.

Other Highlights & News

Dr. Cordonnier forecasts US corn planted area at 91.5 million acres, which is lower than the USDA's March intentions of 92 million. He also noted that wet soils, flooding, and below normal temps in the north west corn belt are delaying planting and could reduce acres down the road.

Buenos Aires Grain Exchange left their corn and bean estimates for Argentina left unchanged, but they did warn that beans could further see reductions if yields continue to disappoint.

Brazil's Mato Grosso faces a 64 million metric ton grain storage deficit.

Check Out Past Updates

4/27/23 - Audio Commentary

Will Markets Reverse the Second You Throw in the Towel?

4/26/23 - Market Update

6th Straight Day of Losses

4/25/23 - Audio Commentary

Can You Get $1.50 Better Than Best Price?

4/24/23 - Market Update

Funds Continue to Sell

4/23/23 - Weekly Grain Newsletter