GRAINS HIGHER AGAIN AFTER USDA REPORT

Overview

Going into to yesterday's USDA report, most traders were preparing for a fairly bearish report. But that wasn’t the case, as the report yesterday was a pretty bullish one, with nearly everything falling below trade estimates resulting in higher prices across the board.

Today's write up is a little shorter than usual, but we will go into far more detail in this weekend's Weekly Grain Newsletter.

A reminder, markets will be closed Monday for Martin Luther King Jr. Day.

If you missed it, listen to yesterday’s audio commentary following the report.

How Bullish Was The USDA Report? Listen Here

Today's Main Takeaways

Corn

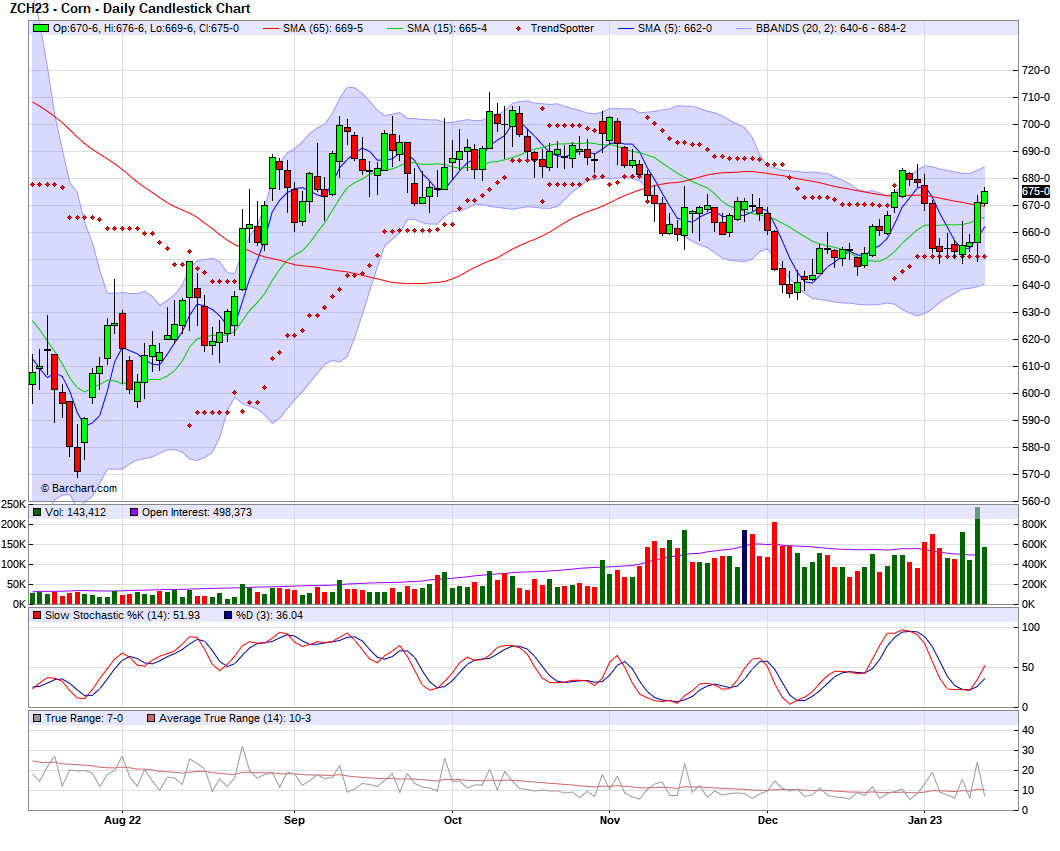

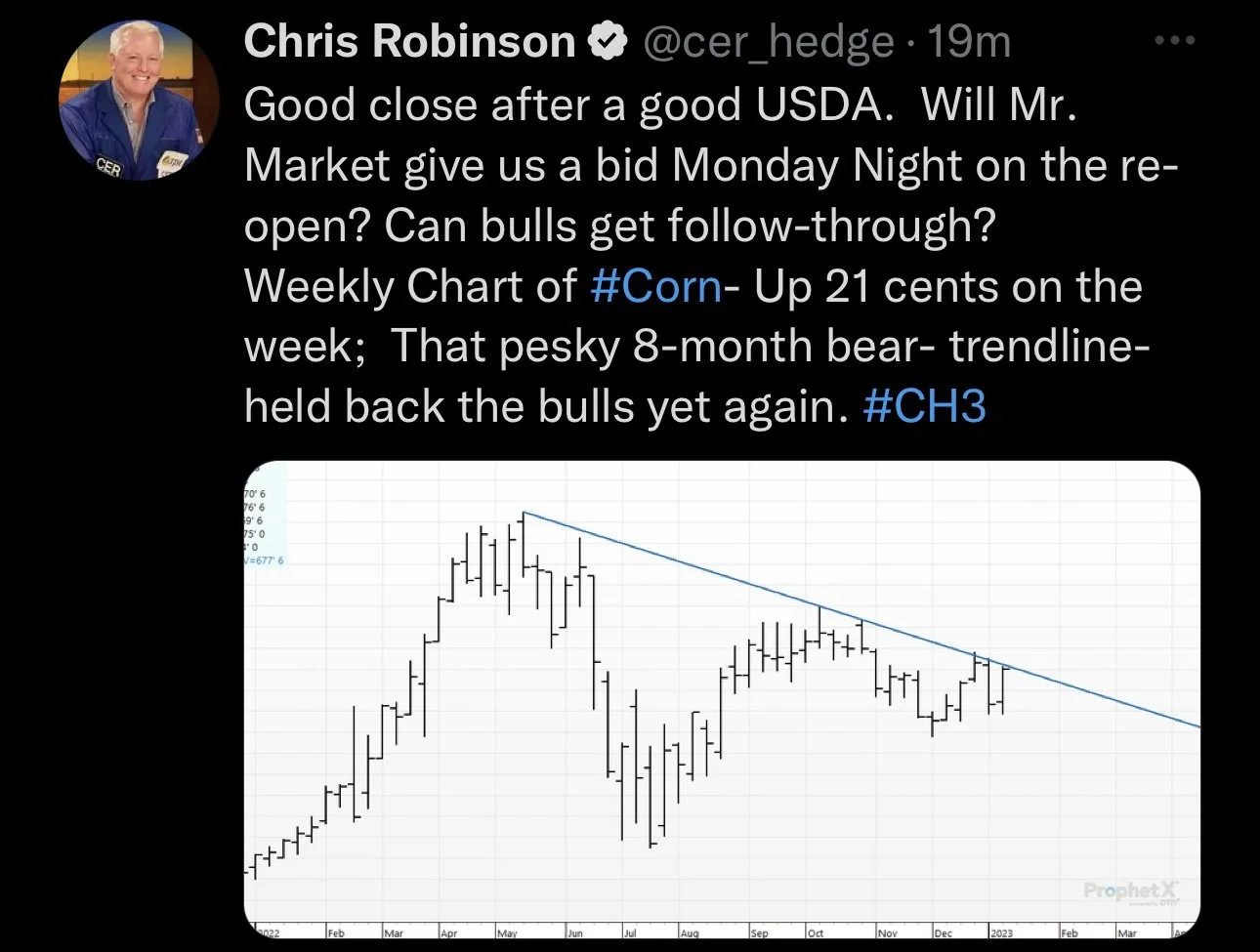

Out of all the grains, the one that benefited most was probably the corn market. Leading to higher prices yesterday and a little bit of follow through strength again today.

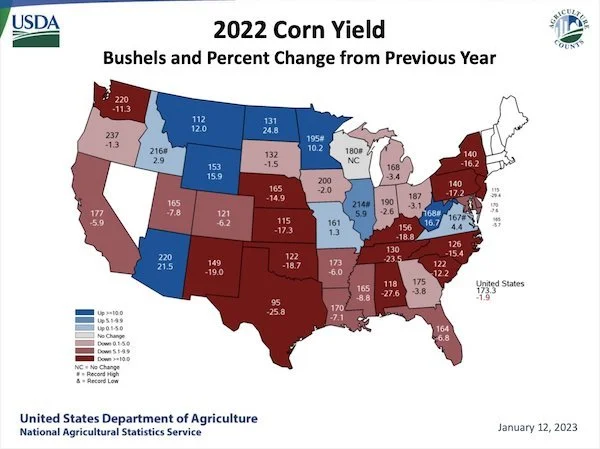

Ultimately the biggest surprise in yesterday’s report was that the USDA lower corn production by 200 million bushels as harvested corn acres came in down 1.6 million. This was despite a yield increase. The large acreage cut was a pretty bullish surprise that most weren’t expecting, as most were expecting a much smaller change. Traders were also expecting an increase in production.

Significant State Harvested Acres Change

South Dakota lowered by -240,000

Kansas lowered by -710,000

Nebraska lowered by -480,000

Colorado -120,000

The USDA also cut feed usage by 25 million bushels, while exports were lowered as expected.

The USDA lowered their Argentina corn crop by 3 million metric tons, and their Brazil estimate by 1 million.

U.S. carry outs also came in below expectations across the board for all grains, corn, beans, and wheat which was a nice surprise given most were anticipating a slight increase.

A paragraph from Wright on the Markets this morning said,

"Take this to the bank also: By the end of this corn marketing year, corn for feed use will be 300+ million bushels higher than the USDA stated. There is no way we feed +425 million fewer bushels of corn this marketing year."

Focus for corn will know shift back to Argentina weather, China, Demand, Funds, and other macro headlines. With the bullish USDA report, bulls have their eyes set on $7, as we are 25 cents off our new year lows.

Weekly Change:

March-23: +20 1/4 cents

Corn March-23

Soybeans

Similar to corn, soybeans also had a pretty friendly report. Which has soybeans trading to +9 cents higher today, we are now 60 cents off our lows posted right after the new year.

One of the biggest headlines from the report was that U.S. soybean production was lowered by 70 million bushels. As the USDA lowered U.S. soybean harvested acreage by 300,000 acres. Unlike corn, soybeans did see a drop yield of 0.7 bpa, bringing it to 49.5 bpa.

U.S. soybean exports were lowered by 55 million bushels, but crush was left unchanged.

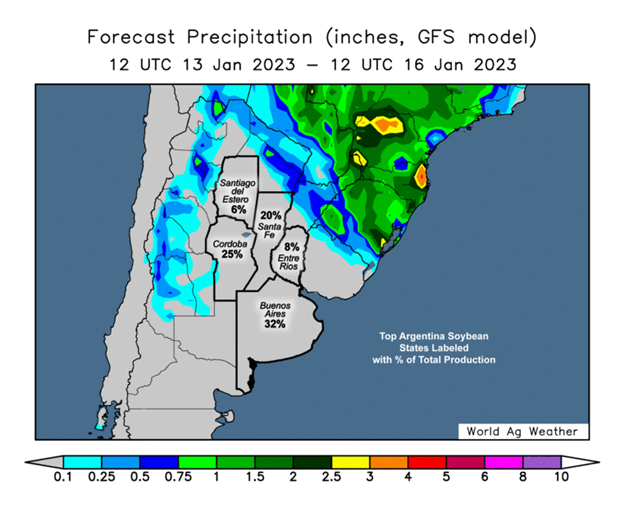

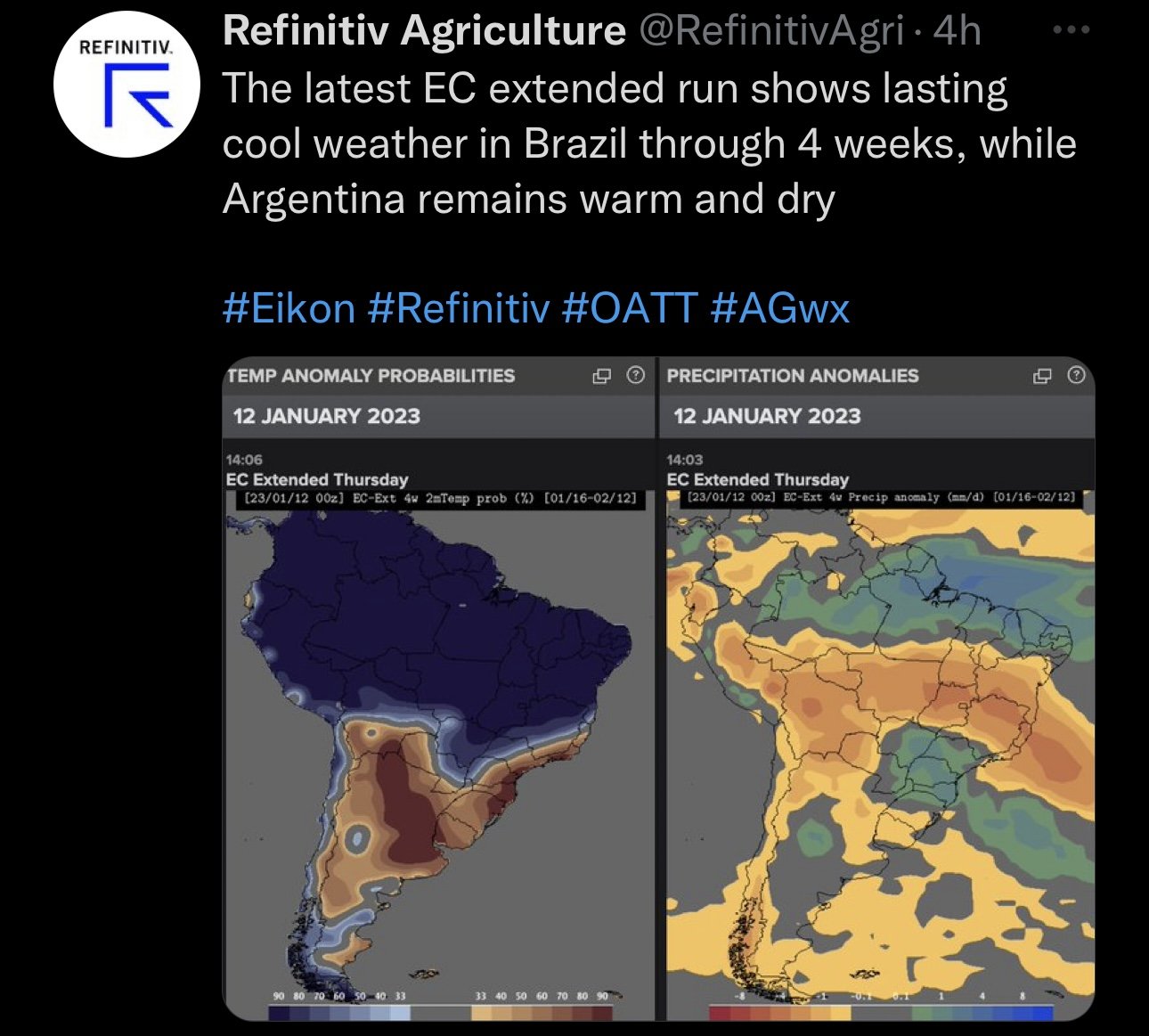

For South America, we did see them lower their Argentina estimate which was a given. But some are saying we might see them even further lower this number in the future. Nonetheless, the USDA lowered their estimate to 45.5 million. Keep in mind, this is still far more than many other grain exchanges. Buenos Aires (BAGE) for example has theirs set at 41 million. While Rosario Grain Exchange has theirs as a dismal 37 million. So the USDA will likely continue to lower these estimates. Brazil on the other hand did see a small increase of 1 million tons to their estimate.

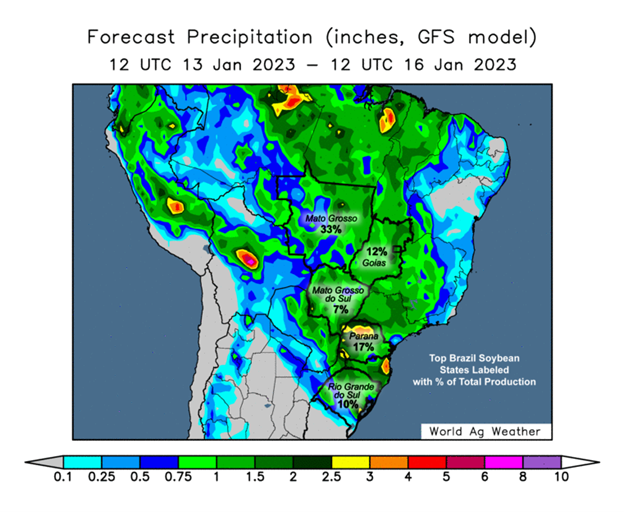

Now that the USDA report is over. The markets will shift focus back to the basics. Which for the soybean market, most of what it comes down to is Argentina here looking short term. Will they get rain, will they not. The markets are eventually going to have to make the decision and ask themselves is it too little too late. As when we reach a certain point, the damage done by the drought might be irreversible. We then of course have the record Brazil crop which will continue to be a dominant factor, as there is still some belief that the major crop will more than offset Argentina's losses.

The other thing we will be keeping an eye out on going forward is China. Will their covid situation improve or worsen, and what’s next for their economy.

With this recent rally, we want to advise you to be comfortable with where you are at in your operation. If you need to make some sales then do whatever you feel comfortable doing as prices are still relatively high with this rally. If you ever have any questions or want to talk about your operation and what might make the most sense for you, don’t hesitate to give Jeremey a call at (605)295-3100.

Weekly Change

March-23: +34 1/2 cents

Chart from Jeff Peterson @jeffpeterson01 on Twitter

Soybeans March-23

Wheat

Wheat had the least friendly report. Now I wouldn’t say the report was terrible as it could have been much worse. But it wasn’t necessarily bearish either, especially given the fact most were anticipating a pretty rough report for wheat.

One thing that was surprising and gives bulls some hope was the fact we were trading sharply lower before the report and managed to bounce back and close in the green despite what most were considering a "bearish" report. The price action suggests the opposite.

Despite the report being fairly neutral, wheat managed to close in the green yesterday and is seeing some strength here again today.

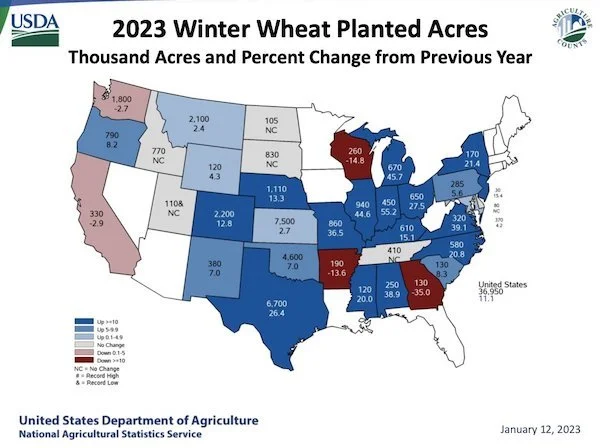

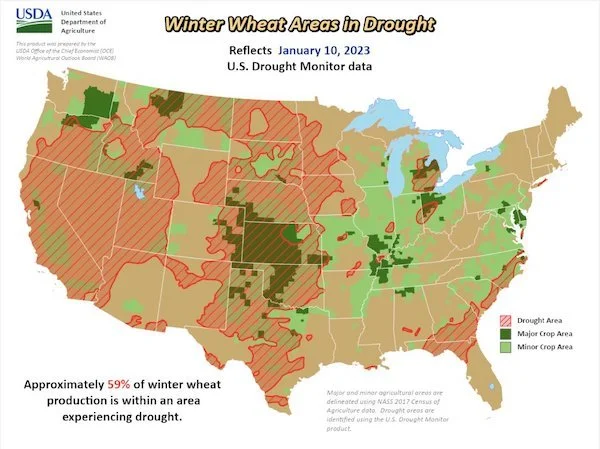

One of the biggest ones was that winter wheat seedings came in almost 2.5 million acres over the trade estimates. As U.S. winter wheat seedings for 2022-23 came in at 36.95 million acres. Which is almost 3.7 million more than last year.

Russian wheat was also forecasted at a record 91 million MMT which wasn’t much of a surprise given everyone already knew they were expecting a record crop. This 91 MMT is 21% higher than that of last year and 7% higher than their previous record crop from 2020.

On the bright side, bulls were happy to see U.S. ending stocks lowered rather than increased.

Wright on the Markets wrote this about wheat this morning,

"Wheat has been a sick bull market for a couple months despite a lot of bullish fundamentals and a technical long-term uptrend. The fact that March CBOT wheat could trade 17 cents lower 15 minutes before the USDA reports were released, but shot higher on the day is impressive. Any time a market rallies on somewhat bearish news (planted acres in this case), is really bullish. There was some friendly wheat news with the US wheat carryout 13 million bushels less than expected and 5 million less than last month. The inventory of wheat on hand as of Dec. 1st was 64 million bushels less than expected, which means the wheat carry over will probably be getting smaller in later S&D reports."

Things to watch out for in the wheat market going forward will be, the funds and what they decide to do as they are still have a pretty sizable short position. U.S. weather will also be a factor to watch out for, with the warm temps as well as possible winter kill. Another thing is global competition such as Russia who recently started selling a lot of wheat at a discount. Lastly, we have the war, which yes is beginning to be a story of the past. But, the war with Ukraine and Russia doesn't look like its near an end, so there is always the chance for that to make some headlines and move the markets.

So with nothing too amazing to get wheat prices moving higher in the report, I wouldn’t be too shocked if we see prices slightly lower here short term, as there just isn't a ton of major factors currently in the market that give us that bullish catalyst we need. However, bulls still have their eyes set on $8 and I think we have tremendous upside looking long term in the next few months.

Weekly Change:

Chicago March-23: +1 cent

KC March-23: +11 1/2 cents

MPLS March-23: +11 cents

Chicago March-23

KC March-23

MPLS March-23

Highlights & News

International Grains Council forecasts record world wheat and soy production

NOAA says 2022 tied for 5th warmest year on record

Argentina is set to produce 45% less wheat, which doesn't bode well for global supplies already impacted by the war.

U.S. Dollar dropped to new lows overnight

Indonesia, the top palm oil exporter is set to restrict shipments and boost domestic biodiesel consumption which will squeexe global veg oil supplies already undercut by lower output.

South America Weather

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service