GRAINS MIXED TO START HOLIDAY WEEK

MARKET UPDATE

Prefer to listen instead? Click here for audio version

Futures Prices Close

Overview

Grains start off the holiday week mixed. As it was a pretty quiet uneventful day in the headlines for grains.

The Russia & Ukraine grain export deal went through, which has added some additional pressure to the corn and wheat markets. The higher dollar and relatively weak crude also adding some pressure, even though crude had an impressive bounce from its lows.

We have a shortened week with markets closed Thursday for Thanksgiving. We will also see markets close early on Friday. Can expect some volatility this week with the holiday.

Today's Main Takeaways

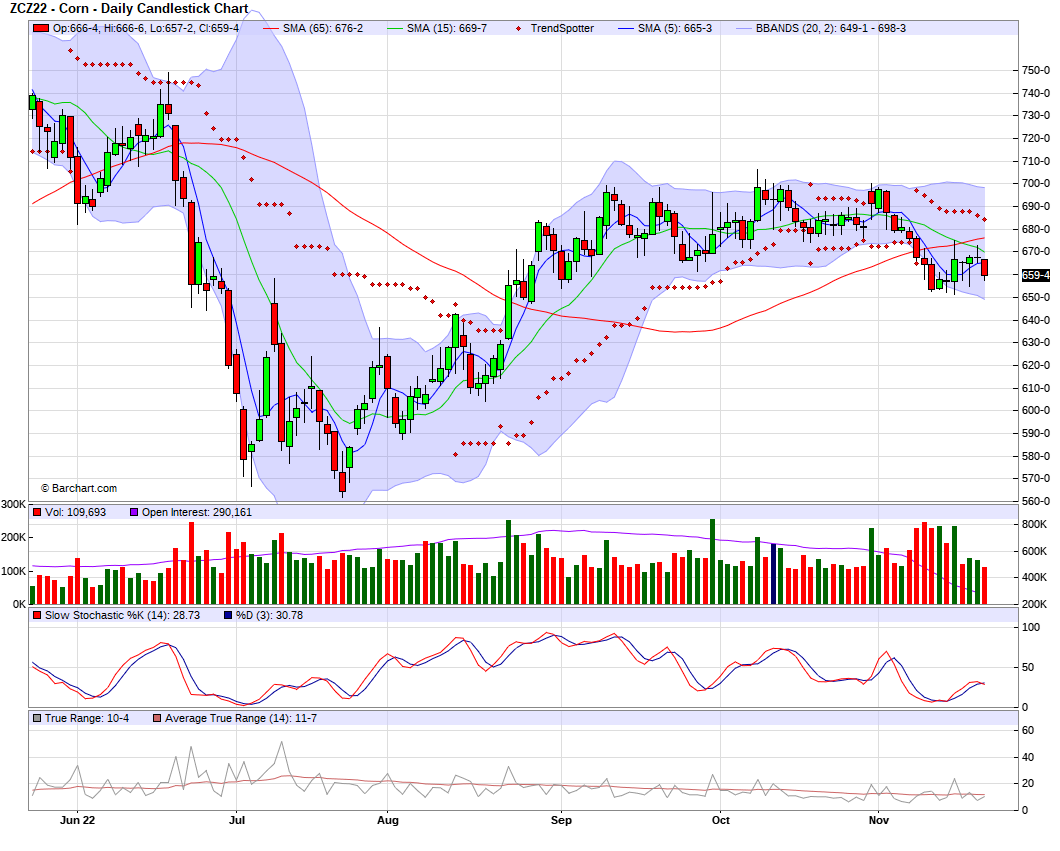

Corn

Corn starting off the holiday week lower. Struggling to gain any momentum after last weeks small rally. Dec-22 corn opened at $6.66 3/4 and never traded above that level after open. Ending the day -8 cents lower at $6.59 1/2.

Corn is being pressured by of course the Black Sea Agreement, but also the low Mississippi river levels, and a little bit of competition from South America. The recent weakness in crude oil isn't helping push corn higher.

One of the more impressive takeaways from last week, was how strong corn was relatively compared to crude oil being very week. As crude oil fell over $10 while corn gained nearly 10 cents on the week.

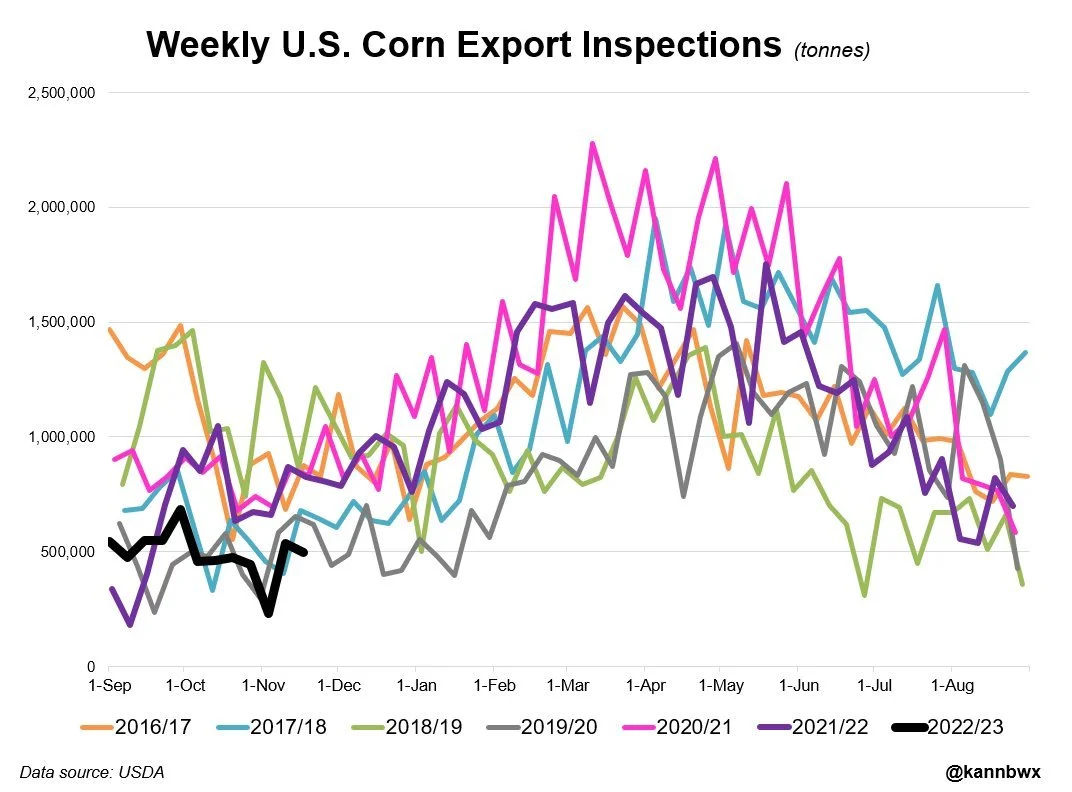

Exports this morning were pretty average, nothing special. Coming in right around the middle of estimates at 495,000 MT, and below last weeks 535,000.

China's corn imports fell -58% year to year. The Sep-Oct total of 2.1 MMT is over 50% off the 2021/22 pace.

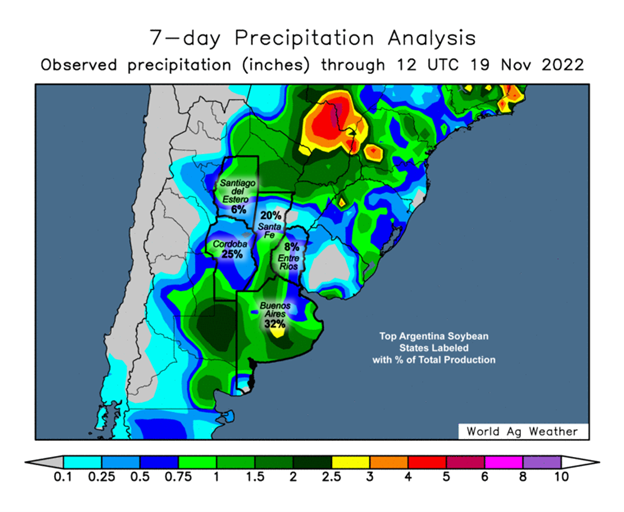

It’s looking like Brazil is expecting a large crop. But we can’t ignore the problems Argentina has been facing. The rain over the weekend in Argentina adding some pressure to prices today. As for the U.S. with harvest almost complete, there isn’t really any weather scare left for the U.S. crop.

The USDA currently has Brazil production at 126 MMT vs 116 MMT last year, and Argentina at 55 MMT vs 51 MMT last year. Going forward South America will likely be a wild card, as so far the weather has been pretty cooperative but as always that is subject to change.

Lastly we have the U.S. dollar and crude oil. Which both saw a pretty wild ranges lately. This morning we saw crude oil fall another -5% down to $75, before bouncing back here to $80. The last time crude traded significantly below that $75 mark was all the way back in January of 2021.

Overall we can likely expect a pretty volatile week of trading with the holiday. The $6.50 level remains a heavy support level for corn, so bulls would like to see corn stay above that price point this week.

Dec-22 (6 Month)

Cumulative Chart. Credit to Karen Braun @kannbwx on Twitter

Soybeans

Soybeans higher to start off the week continuing their higher prices from Friday following a sharply lower week last week. Soybeans had an impressive bounce back from their early lows of $14.17, closing the day at $14.36 3/4.

The Argentina goverment is again changing their soybean currency ratio to allow farmers to get roughly 22% more for their soybeans. This could likely make us see a large boost in soybeans sales as we near the end of November.

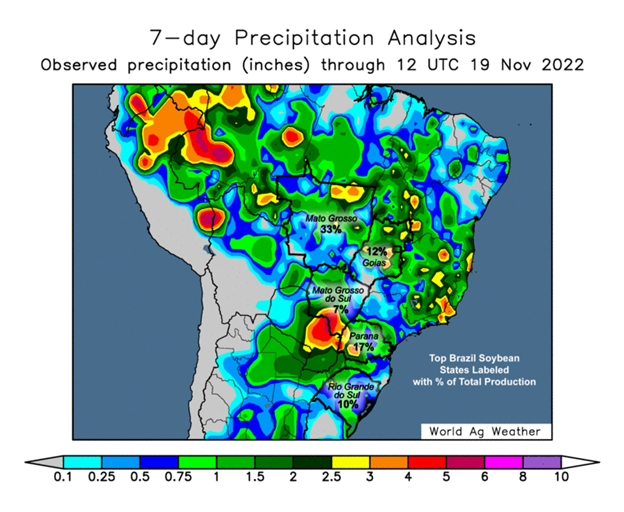

Taking a look at Brazil, their forecast is calling for more rain this week and early next week. So with this rain and overall not very threatening forecasts, we could see this put some pressure on soybean prices later this week going into next week.

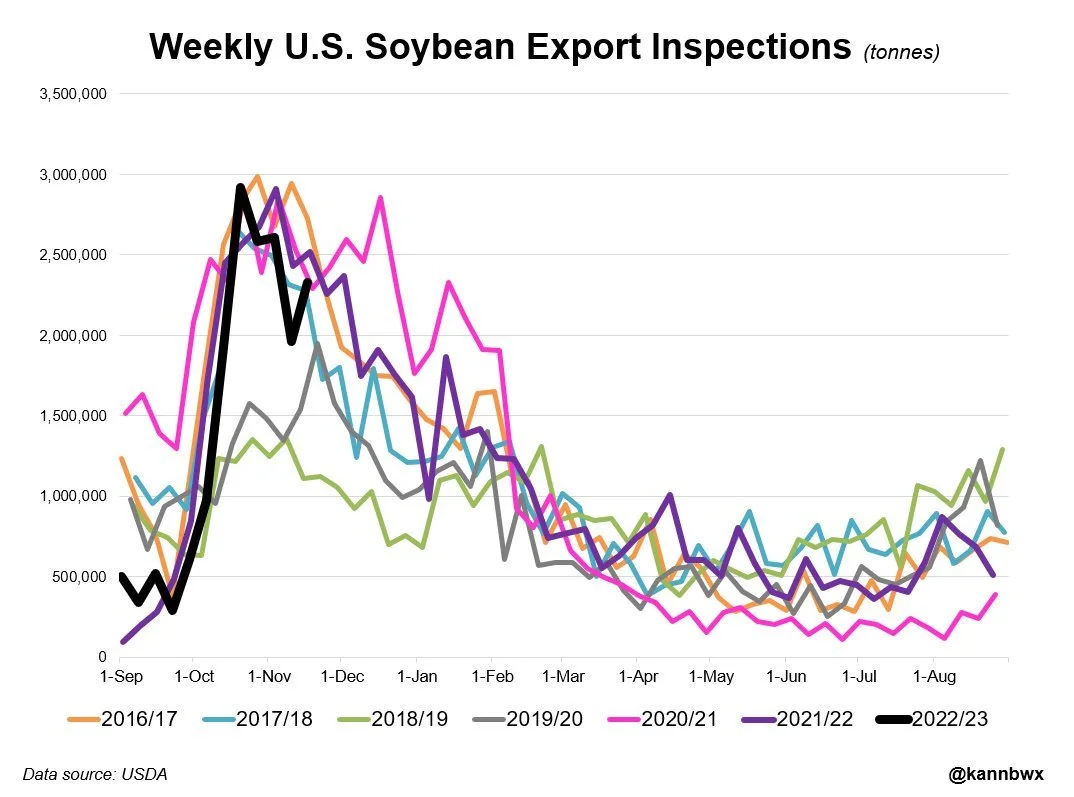

Overall Chinese demand has been fairly quiet. But we did see pretty decent exports. They were "good" but not necessarily "great". As soybeans came in at 2.329 MMT, which was near the upper range of the trade estimates and above last weeks 1.964 MMT.

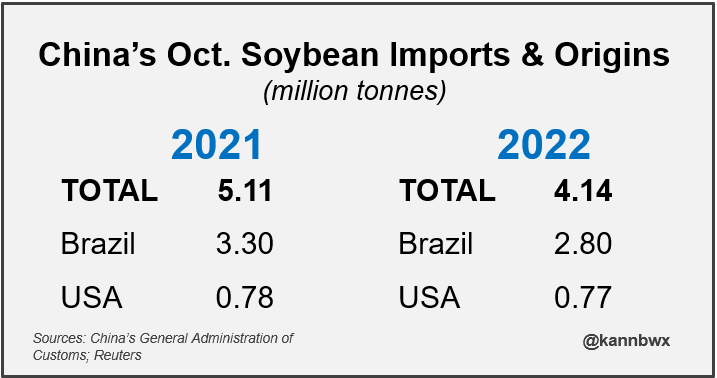

China's soybean imports from Brazil have fell -15% in Oct. comparatively to last year. Imports from the U.S. were flat from a year earlier. And overall soybean imports fell -19% in Oct. (from a year ago) to 4.14 million tons. The lowest for any month since 2014.

China covid lockdowns also continue. As they reported their first covid death in over 6 months. This and South American weather will be large roles going forward. Some sources are saying that China will likely continue to battle with covid until Spring when the winter weather dies down.

We have continued to see analysts raise their Brazil soybean production estimates. With most recently Agribusiness consultant Patria Agronegocios raising their estimates from 146 million to 148.90 million tons.

The USDA currently has Brazil production estimates at 152 MMT vs 127 MMT last year. Argentina's forecast is 49.5 MMT vs 43.9 MMT last year. If weather continues to be cooperative people are going to start to talk more and more about the large crops expected out of South America.

Soymeal & Soyoil

Soymeal up +1.9 to 408

Soyoil up +0.12 to 70.73

Soybeans Jan-23 (6 Month)

Cumulative Chart. Credit to Karen Braun @kannbwx on Twitter

China's Oct. Soybean Imports. Credit to Karen Braun @kannbwx on Twitter

Wheat

Wheat lower to start the week after the news last week that Russia would go ahead and extend the grain export agreement for 120 days. Not a great start the week as Chicago Dec-22 wheat closed a hair under $8. If wheat does continues lower we look at $7.80 for some major support.

Exports this morning weren’t terrible for wheat. Coming in near the higher end of trade estimates at 280,000 metric tons. Compared to last weeks 170,000.

Wheat being pressured by some timely rain in Argentina, as they saw a good amount of rain over the weekend. This has wheat under pressure here today. But we have to keep in mind all of the problems their wheat crop is facing even with this rain.

According to the Rosario Board of Trade, Argentina will export 6.5 MMT of wheat in the 2022-23 season. A -7% decrease from previous estimate.

Taking a look at the U.S., the winter wheat crop still ahs a ton of question marks. We have seen some small increases to crop conditions as of late but the crop is still in a historically bad condition. As the USDA recently bumped the crop from 30% rated good/excellent to 32% good/excellent, but this is still far lower than last years 46%. We will have to see if we continue to see conditions raised or if they think the crop is worsening.

We also still have the Russia/Ukraine and war headlines that will continue to be a contributing factor. Any hiccups or bullish news could send prices higher but the situation still remains an unknown factor.

Many, including myself, think that we see wheat rebound here from these low prices. As we'd like to think we see U.S. exports increase. But we also have plenty of global issues, especially in Argentina and Australia. Which are currently looking like supportive factors for the wheat market. As has been for however long, weather and war will continue to be the main factors to look out for.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Russia Oil Cap

The G7 will put a cap on the price of Russian crude oil, and will be effective as of December 5th. The EU will also ban Russian crude oil imports. This said, the EU will lose roughly 2.5 million barrels of Russian crude oil per day.

Other Markets

Crude oil down a quarter at $79.90, after trading as low as $75.30

Dow Jones unchanged

Dollar Index higher, up 0.80%

Cotton down -4 to 79.78

Jan-23 Crude Oil WTI (6 month)

News

Russia for the first time has become the biggest fertilizer supplier to India.

Ukraine Ag Ministry reports that their grain harvest in 2022 will be roughly 50 MMT, down from 86 MMT last year.

Median national rent falls below $2,000 for the first time in 6 months.

Feds Daly: "Its way to early to say inflation has peaked."

Livestock

Live Cattle up +0.875 to 156.725

Feeder Cattle up +1.850 to 182.625

Cattle strength continues. Following the release Friday of NASS's Cattle on Feed data.

Live Cattle (6 Month)

Feeder Cattle (6 month)

In Case You Missed It..

Click here to listen to Yesterday’s Weekly Grain Newsletter

Social Media

All credit to respectful owners

South America Weather

Chart Source: Roach Ag

Precipitation Forecast 2-Day

U.S. Weather

Source: National Weather Service