GRAINS GIVE BACK OVERNIGHT GAINS

MARKET UPDATE

Prefer to listen instead? Listen to the audio version below

Futures Prices Close

Overview

Grains lower here today following fairly strong price action from the overnight session, but those gains were diminished. Overall it was a pretty quiet day and we didn't get that turnaround Tuesday many were hoping for. Markets were pressured by optimism that the Black Sea agreement continues to hold, as well as another possibility of a rail strike. As there was no real bullish headlines to push prices higher today.

If we don't get any many headlines we could very possibly continue to see back and forth choppy trade through out the rest of the holiday week.

As mentioned yesterday, we have a shortened week with markets closed Thursday for Thanksgiving. We will also see markets close early on Friday. Can expect some volatility this week with the holiday.

Watch Today’s Market to Market Podcast Featuring Jeremey Frost

Helping farmers become price makers, not price takers

Today's Main Takeaways

Corn

Corn closed 4 cents lower this afternoon following slightly higher prices overnight. Closing this afternoon near the very bottom of its tight trading range. With March-23 corn closing at $6.59 1/4 cents. Corn is now down 10 cents in the last 5 trading days.

Crop progress for corn came in at 96% harvested vs 90% on average. So at home we are basically done. Now taking a look at Ukraine, reports are saying that Ukraine is 50% through corn harvest and a majority may have to be harvested later this winter or spring due to a scarcity in diesel.

Corn inspections were pretty bland, nothing impressive. Volume has continued to be pretty disappointing and is still seasonally low and far behind the USDA pace. On the bright side, this was the largest volume we have seen in a month and a half.

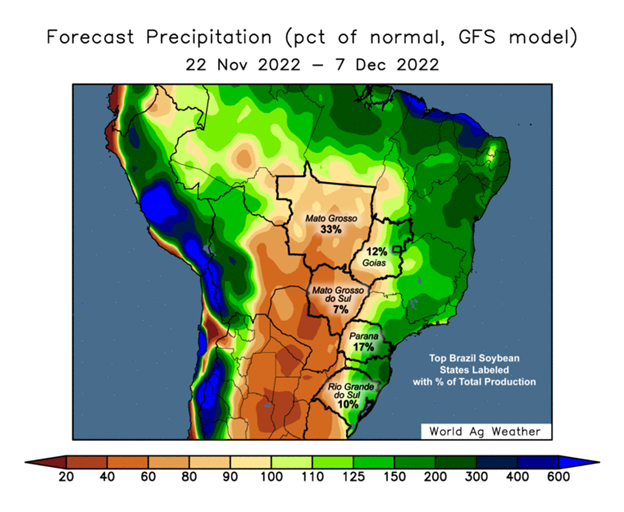

Corn has been pressured from some recent fund selling and the still low levels in the Mississippi river. Another main factor adding pressure is the expected large crop out of South America which is also a concern for soybeans, and currently they aren’t facing any real weather concerns. We also have the possibility of the USDA raising their yield estimates. Lastly we have the poor corn inspections which haven’t helped.

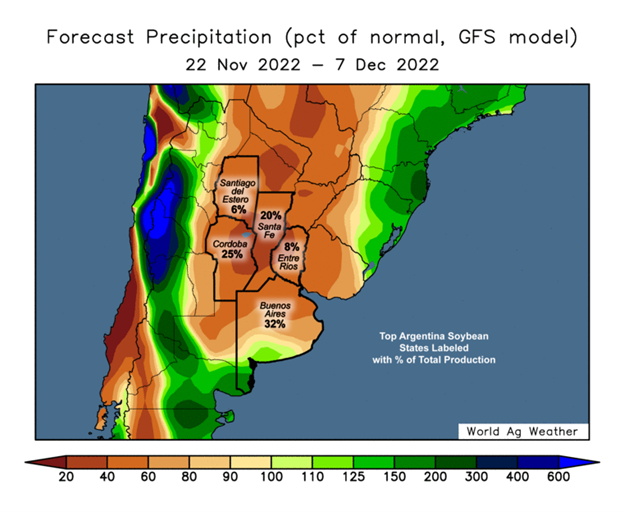

Despite the expected large crops from South America. Argentina weather continues to be a concern. This is despite the recent rain they have been receiving. However, their forecasts remain pretty dry for the most part of the next few weeks.

Corn in Brazil is currently 82% planted compared to 91% last year. Argentina corn crop is 23.6% planted compared to the average of 35.8%. We saw a very small 1% increase here week over week. As its looking like producers were more focused on soybeans.

Overall this is a tough period of transition where focus shifts from the U.S. to South America headlines and weather. But looking into next year, I still have a slightly optimistic outlook.

Dec-22 (6 Month)

Soybeans

Soybeans also trading lower today following higher prices overnight. As we saw Jan-23 beans touch a high of $14.43 1/2. While closing near their low, ending the day at $14.29 3/4 cents. We continue to find the soybean market fairly comfortable trading in the $13.50 to $15 area. As that is the range we have traded in for the second half of the year now.

There is continuing concerns with China and their COVID situation. Its looking more likely that they will be shutting down their economy. As their cases have continued to spike. This isn’t great news for the grains as if this is the case, this could lead to weaker Chinese demand.

Taking a look at export inspections yesterday, they weren’t bad. Coming in on the stronger side. Coming in at 2.329 million metric tons. Which was on the upper end of the trade estimates and above last weeks. So overall it was good for soybeans, following an expected decline from last week. This week’s volume a little closer to being in line but still below last year's volume.

We also have Argentina Government again potentially changing their soybean currency ratio to allow farmers to get nearly 20% more for their soybeans.

Soybeans in Brazil came in at 80% planted, which is lower than year's 86% but still higher than the average of 73% planted. Mato Grosso is essentially complete, at 98.8% planted. Soybeans in Argentina came in at 12% planted, compared to 28.7% a year ago. So still falling behind pace there. There is rumors that farmers are planting extra soybeans in fields that were originally intended for corn, this could be partially due to the currency ratio we may see.

The South American sidelines are a mixed bag right now. On one hand we can't ignore all of the problems we have seen out of Argentina, which alone has some people pretty optimistic on prices. But on the other hand, Brazil is potentially looking at a record crop which is one of my larger concerns I've been talking about for some time now. The USDA has Brazil production estimates at 152 MMT vs 127 MMT we saw last, and there is rumors this number may continue to grow. Currently South America weather hasn’t looked all that threatening either which adds to concern.

So with the demand concerns in China due to their covid situation, I'm a tad worried about prices here unless we get some South American weather scares or some other major catalyst to shake prices.

Soymeal & Soyoil

Soymeal was down -3.0 to 405

Soyoil was up +0.71 to 71.44

Soybeans Jan-23 (6 Month)

Wheat

Wheat lower today along with the rest of the grains. Similar to corn and beans, we saw wheat give back its overnight gains. Dec-22 wheat saw a high of $8.07 before ultimately closing at $7.91 1/2.

Wheat continues to be pressured by the recession headlines, Black Sea agreement, and overall weak demand. This has led to wheat touching lows we haven’t seen since late August.

32% of the wheat came in good/excellent which was unchanged from last week. But its still a little too dry in the plains. That helped the strong action overnight.

We saw the USDA peg U.S. winter wheat at 87% emerged compared to the 86% average.

Argentina's Ag Ministry pegged their wheat crop at 13.4 million metric tons, compared to last year's 22.1 and the current USDA forecast of 15.5 million. So thoughts are that we continue to see the USDA lower their forecast. We also have some pointing at concerns in Australia.

But then on the other side of things, we are looking at fairly good conditions in most of the EU. We also have the potential that Russia could have a lot of export power here. We also have the strength of the U.S. dollar and recession scares still adding pressure to the markets.

The Russia and Ukraine situation has remained fairly quiet since we saw the renewal of the grain export deal. But many are saying the situation is still far from being stable.

Many other advisors currently have buy signals in place for both Chicago & KC wheat. I am also optimistic that we find a floor here in the coming weeks. With Chicago Dec-22 trading below $8, if we do happen to continue slightly lower we could hopefully see some major support come in at the $7.80 level.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil had an impressive rebound from Monday's lows. Trading nearly $7 off its lows made. Currently trading around $81 following the Monday lows of around $75.30

Dow Jones strong today, up nearly 350 points or 1%

Dollar Index down about 0.50%

Cotton up strong here today. Trading 2.64 higher following its limit down trading session we saw Monday

Jan-23 Crude Oil WTI (6 month)

News

Ukraine exports are down almost 32% compared to last year.

The U.S. is sending another $4.5 billion to Ukraine.

The largest railroad union voted against the wage proposal by the White House. If no agreements are made, there could potentially be strikes in the next few weeks.

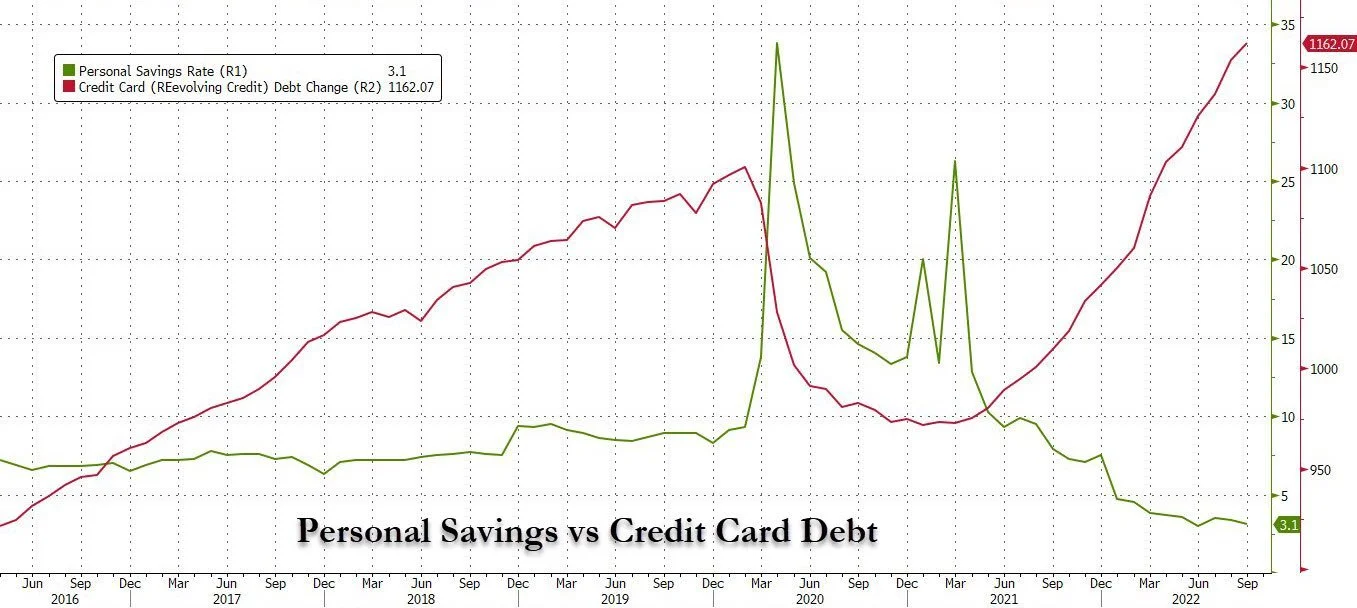

U.S. credit card debt hit an all-time high of $930 billion. With personal savings also hitting nearly an all time low.

Personal Savings vs Credit Card Debt

Livestock

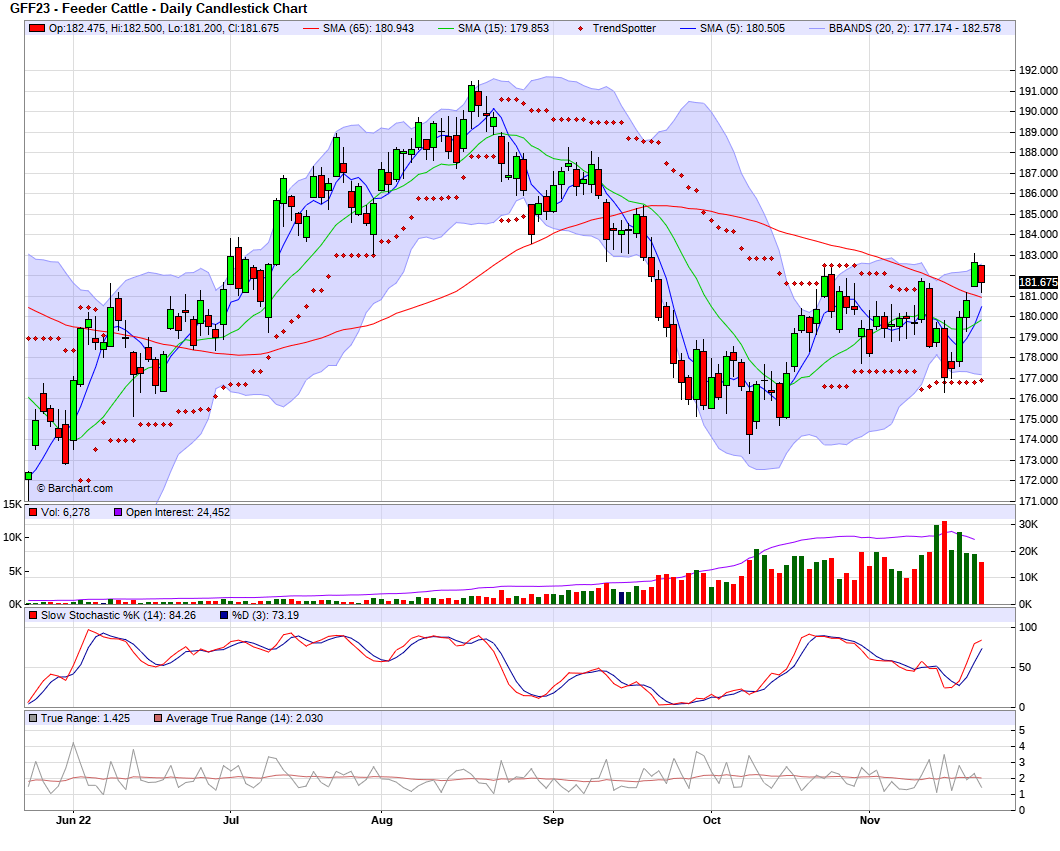

Live Cattle down -0.300 to 156.425

Feeder Cattle down -0.950 to 181.675

The cattle market is still up over +2% in the last five trading days. Friday's Cattle on Feed report report is long term pretty bullish, and points to tight cattle supplies down the road which should ultimately help support prices.

Live Cattle (6 Month)

Feeder Cattle (6 month)

In Case You Missed It..

Click here to listen to Yesterday’s Weekly Grain Newsletter

South America Weather

Current forecast for Brazil is pretty wet, and looking pretty dry for Argentina. Northern Brazil is expecting roughly 1 to 5 inches of rain over the next week. While Southern Brazil and Argentina appear to moving into a more dry pattern.

Chart Source: Roach Ag

Social Media

All credit to respectful owners

Precipitation Forecast 2-Day

U.S. Weather

Source: National Weather Service