GRAINS PRESSURED AHEAD OF REPORT

Overview

Grains lower here as the funds look to position themselves ahead of the big report tomorrow. Initially, it looked like the funds wanted to add onto their current positions, with beans trading a dime higher at one point while both corn and wheat traded lower. But beans eventually followed the rest of the grains lower with some profit-taking and positioning ahead of the report.

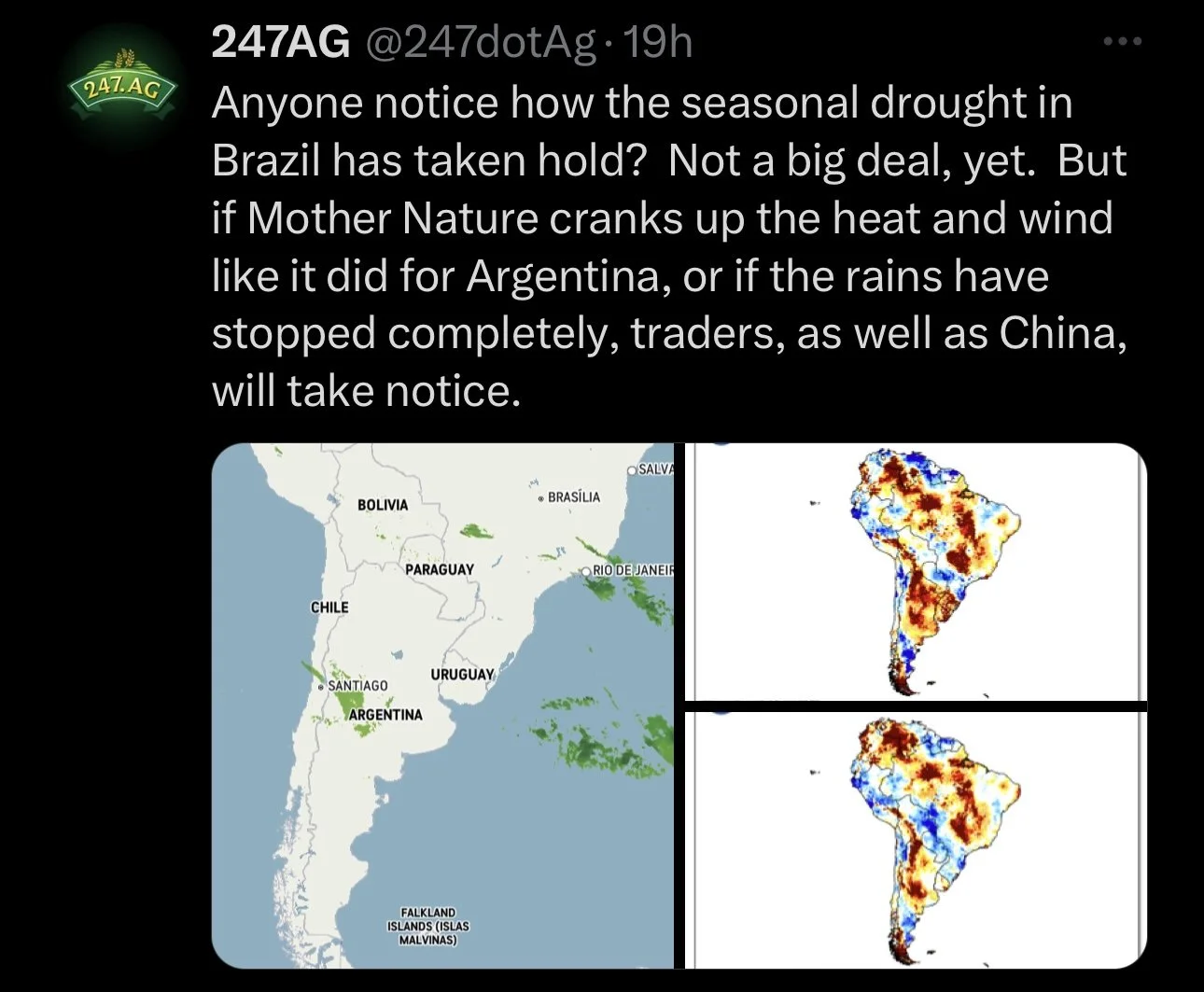

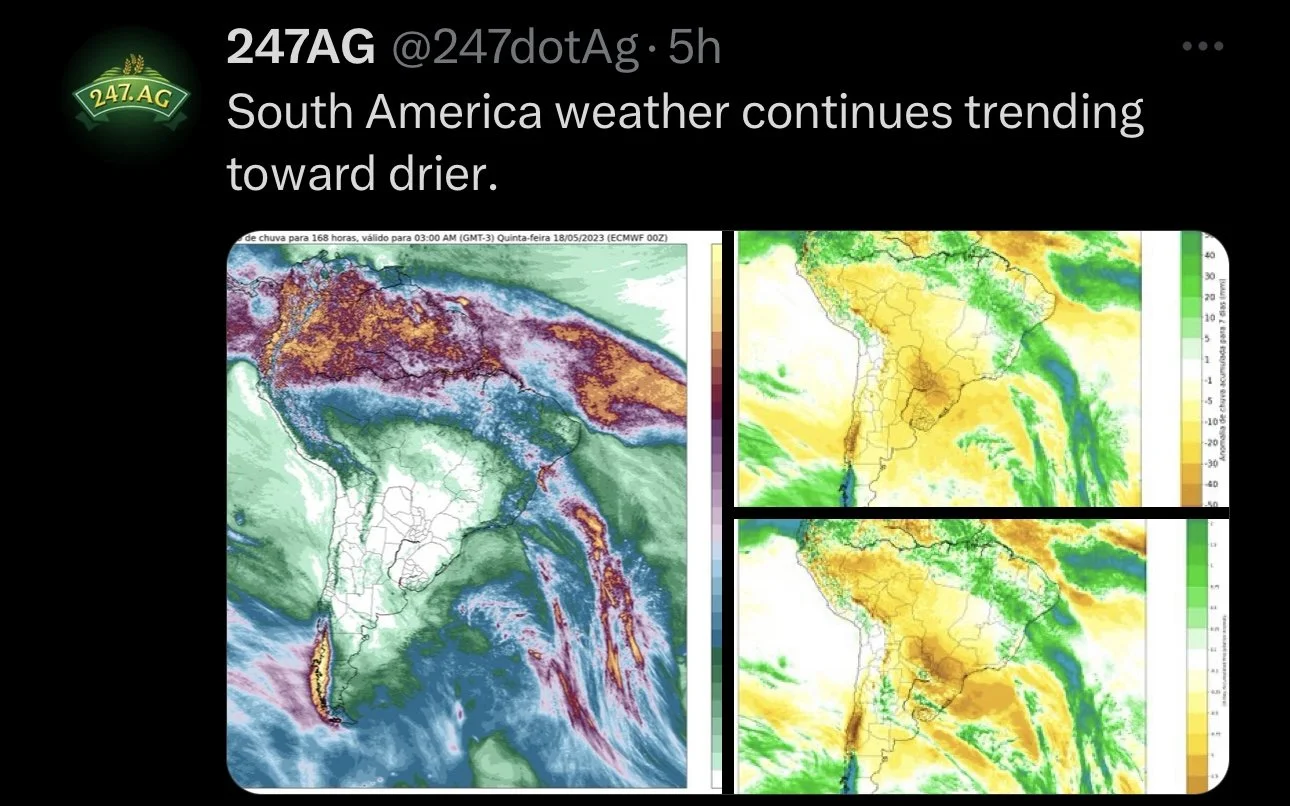

Corn and beans as of late have been pressured by the fast planting here in the US, to go along with decent weather and big crops out of Brazil. The trade is also predicting that the debut for new-crop ending stocks will come in firmly higher which has likely added some pressure here going into the report.

All eyes are on the report tomorrow. Remember that the report is both production as well as supply & demand, with our first looks at the new-crop balance sheet.

Pre-USDA Breakdown

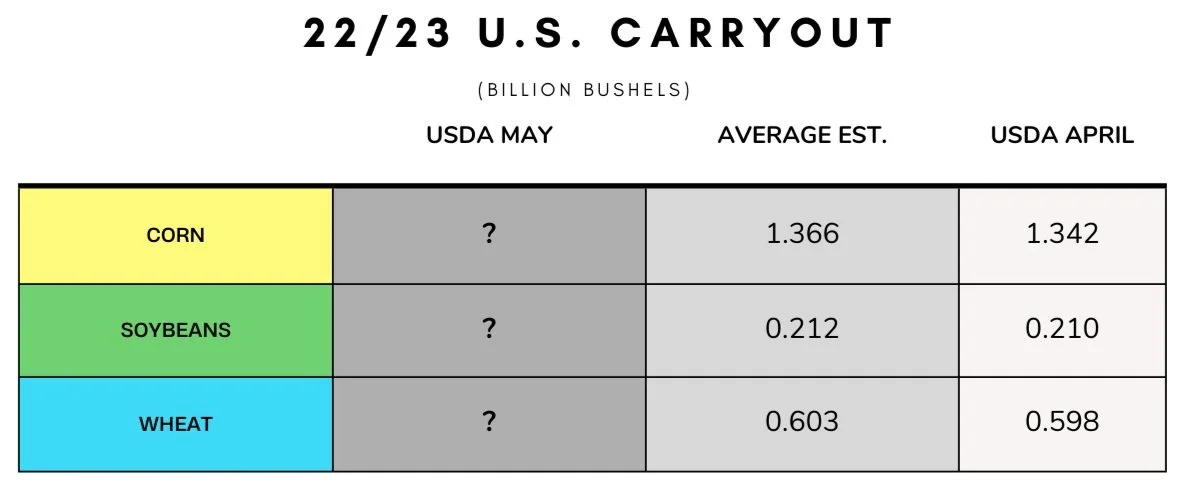

This report will debut the 23/24 new crop balance sheets. The pre-report estimates see new crop US corn ending stocks at a 5-year high and up 53% from previous year, while soybeans are projected at a 4-year high and up 38%, with wheat stocks projected to be unchanged from last year which was a 9-year lows.

Old crop ending stocks are forecasted to come in higher across the board. With slight increases to both wheat and beans, while corns trade range is fairly wide but still projected to come in higher.

We will likely see more cuts to the already disastrous Argentina crop. With the estimates showing the bean crop to be down 45% from last year, while the corn crop is forecasted down 29%. Rosario Grain Exchange just cut their Argentina bean crop estimate from 23 down to 21.5 million metric tons. This is very far below the USDA's current 27 million.

On the other side of things, Brazil is expecting small increases to both of their crops. These estimates would put them at a record crops for both.

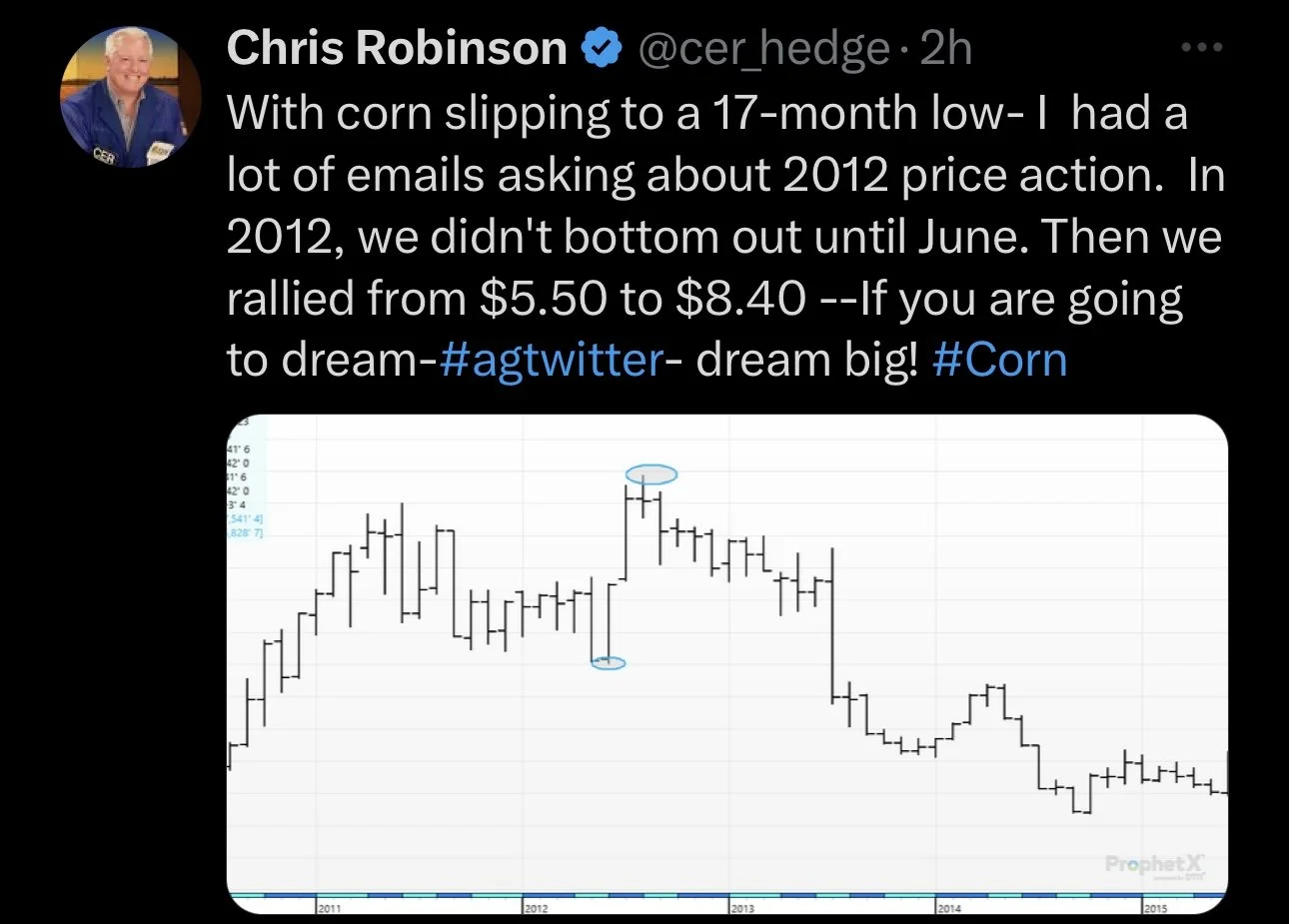

Overall, I of course wouldn’t be too surprised to see some somewhat bearish numbers printed. But if we do, it shouldn’t be a time to panic. With the funds still heavily short corn and wheat, I could see them buying back the break fairly soon. Following the report, the focus will again shift back to the fundamentals, weather, and demand. I think weather will start adding some premium back into these markets by the end of the month, or possibly not even until June. But when they do, I think it gives us all the more power to go higher.

****

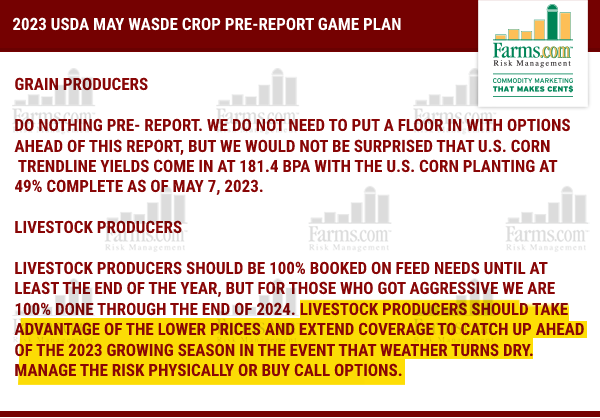

Farms.com Risk Management said,

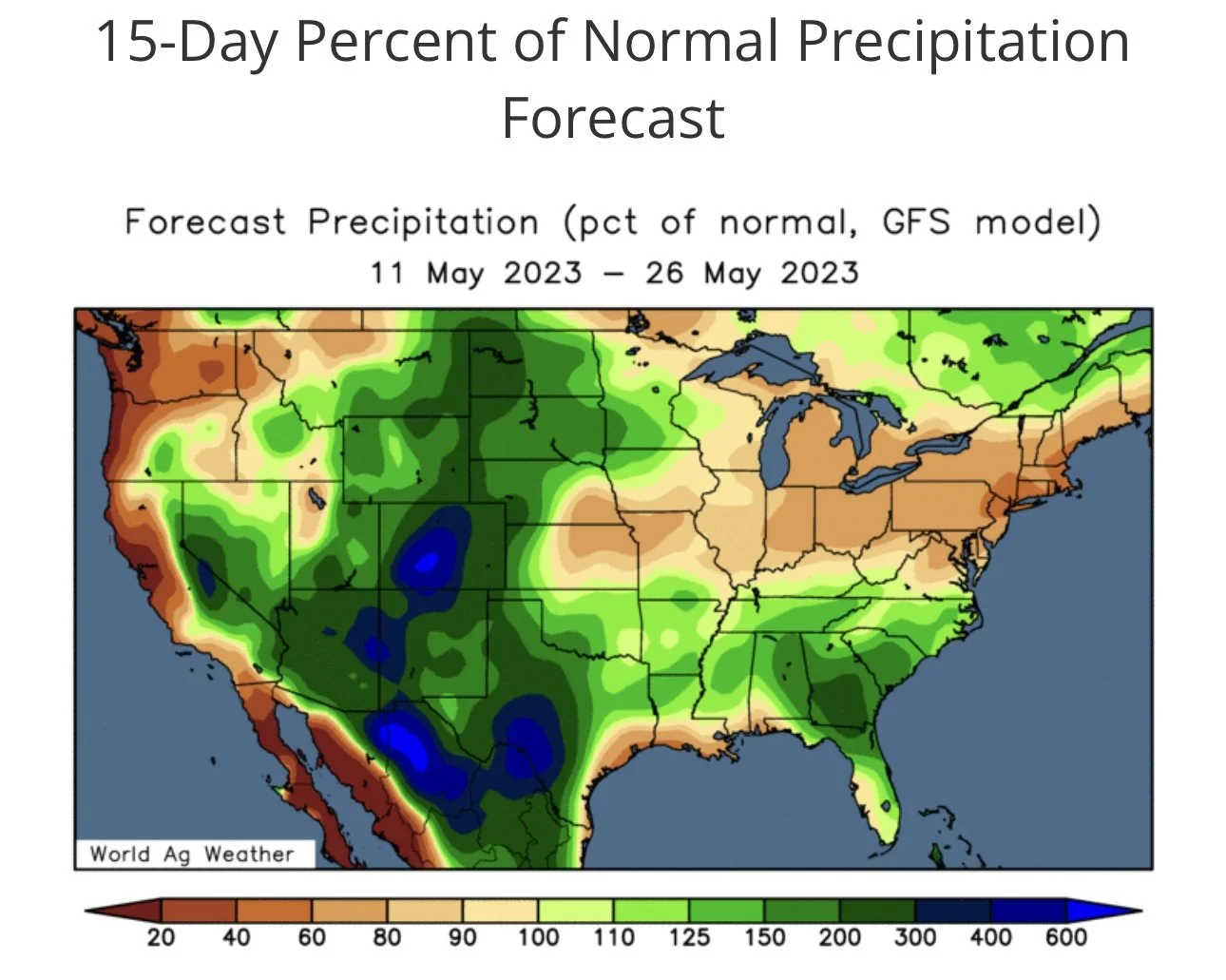

"With the US planting at 49% by May 7th, the USDA has no reason to print a trendline yield of 181.4 bpa. BUT its a guess, and with the Western corn belt dryness that is slowly moving east, we could see the final yield on average come down by as much as 6 bpa in 9 out of 10 years."

If you scroll to the end of today’s write-up, I included a great snippet of their stuff where they go over the bottom line ahead of the report and some things we could see.

****

Jason Britt, the President of Central States Commodities said,

"The thing that stands out to me going over the trade estimates for the report is how little we actually grow the soybean carryout while plugging in a new record yield. And if the actual yield is 2 bushels less (but still higher than last year), you don't even have pipeline supplies."

The Estimates

Our Biggest Sale Ever Ends Tomorrow

For the USDA report we are offering our biggest discount ever. Make sure you lock in our stuff before its gone or try 30-days free. Get every exclusive update sent via text & email

Today's Main Takeaways

Corn

Corn ended the day nearly 12 cents lower here following yesterday's higher price action. As we essentially gave up yesterday's gains with today's losses.

The lower action here today wasn’t all that surprising. Sure one could argue that maybe we would've expected to see the funds trim that heavy position ahead of the report, but they didn’t. As the funds may be expecting some slightly negative news come the report.

The trade is anticipating a higher carry-out for both old and new crop corn. But taking a look at the old crop trade range, we do have a very wide range. With this wide range comes a less likely chance for a surprise there.

As mentioned, we will almost certainly see Argentina estimates lowered, but most think this will more than be offset by the increases we might see in Brazil. As CONAB increased their Brazil estimates today. But taking a look past the report, the forecasts and weather show that it might be a little too hot and dry for their second corn crop.

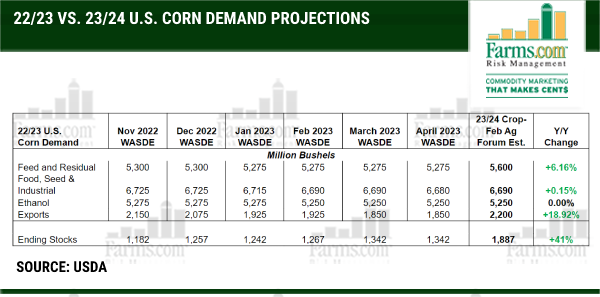

This report will be a pretty big one as it will be our first look at the new-crop balance sheet and data. This report will include production as well as supply and demand. Now it is still a little early to get any major changes to the production side of things, so the trade will likely focus on the changes make to the demand side of the table.

So with the trade focusing on demand, demand really isn’t totally there to carry the markets right now. So we could of course see a slightly bearish report and that is something we need to be aware of.

One thing I do think bulls could benefit from is our yield. The USDA initially came in with a massive 181 yield. If we got a number closer to 178 I think that could really excite the bulls, but we will have to see.

Going forward and following the report, the markets focus will again shift back to the basics. Where we will again trade the fundamentals and factors. With weather being the biggest one. I still think the funds are slightly underestimating our weather premium right now. As we don't have much if any currently built in. When the funds do realize that the corn belt is dry and start to take a deeper look, I think this could send us higher come this summer, as we have an entire growing season ahead.

Drought Monitor

Saw a comparison of these on Twitter today. Which has more risk to production. 2008, 2012, or 2023?

Corn July-23

Soybeans

I thought the funds would maybe want to unload part of their long bean position here ahead of the report and at first that didn’t look like the case. As beans were trading a dime higher at one point. But mid-day they fell under pressure following the rest of the grains lower.

We had a flash sale of beans this morning, 132k metric tons of new-crop beans sold to unknown. Which added some support to our initially higher prices this morning.

We also saw estimates from Argentina's Rosario Grain lower their bean production estimate by 6.5%. As they lowered it from 23 million metric tons down to 21.5 million. Bulls liked to see this but it was partially offset by the expected increases from the Brazil crop.As the CONAB increased also increased their Brazil soybean production by another 1 million metric tons.

Taking a look at the report, bears argue that we need to see old-crop exports cut by 10 to 25 million bushels with the possibility for more down the road.

The trade is expecting domestic crush to come in unchanged. But bulls do make the argument that we eventually see this higher in the future.

The USDA has US harvest acres around 86 million or so, while they intially threw out a 52 bpa yield as the early estimate. Some argue that is far too optimistic.

From the Van Trump Report,

"The bottom line the USDA could bump its old-crop ending stock estiamte a hair higher. As for new-crop, there are just a ton of uknowns. Remember the trade will be digesting the USDA's first new-crop balance sheet."

If we do get a bearish report tomorrow, the new-crop markets are getting a tad oversold, so perhaps we do see the funds buy the break. But we will first have to see how the report shakes out.

Technical Analysis Audio

Here is an analysis from Vince, where he talks about July beans hitting a strong support line. RSI indicates the downside momentum is waning.

Soybeans July-23

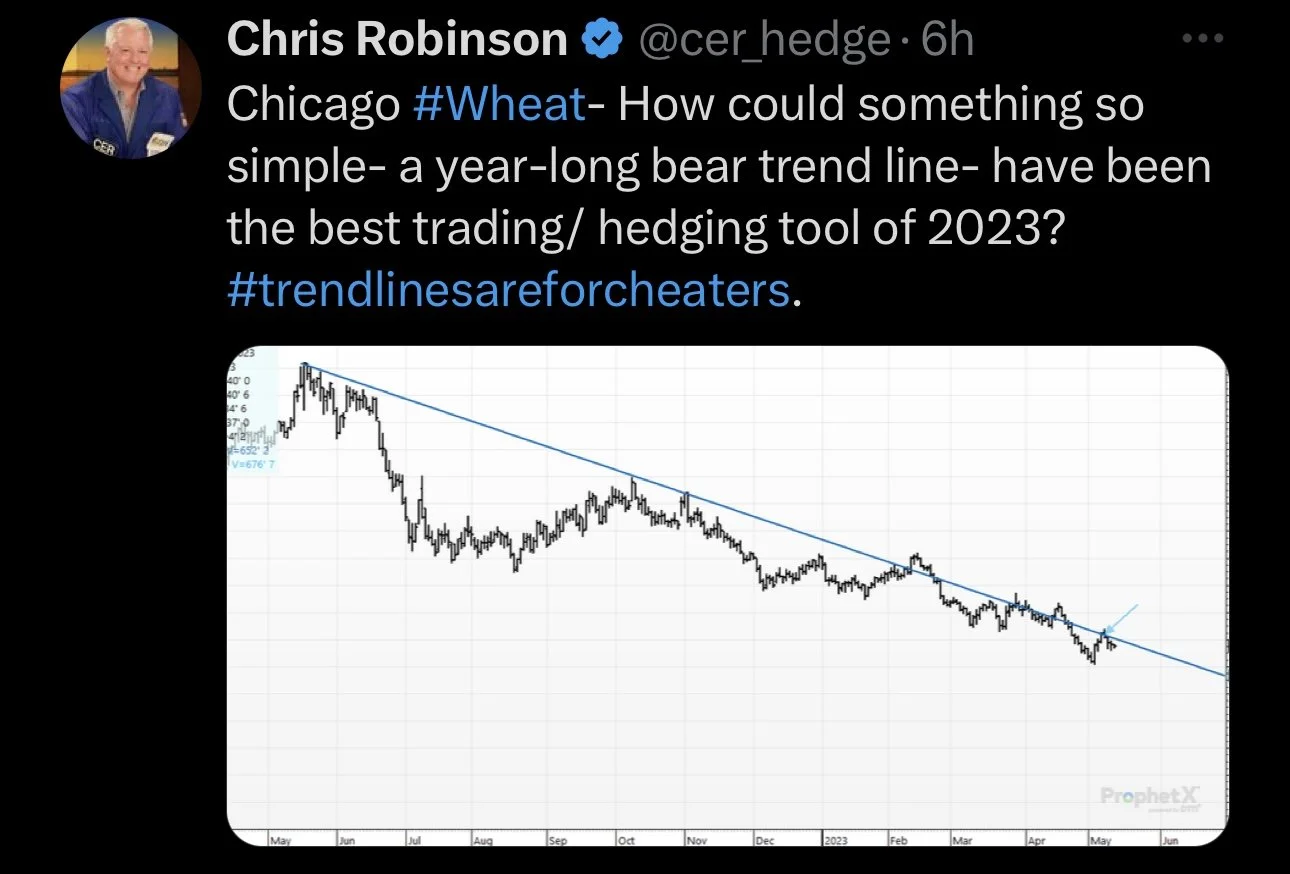

Wheat

Wheat futures all end the day sharply lower following KC wheat's massive rally. Was likely a lot of profit taking from KC and pre-positioning ahead of the report.

Russia, Ukraine, and the Black Sea deal remain a hot topic for wheat. But we haven’t seen much for updates recently. There is some rumors that Russia may agree to extend it but that’s just a rumor. The deal expires a week from now. But it is interesting that after 2-days of discussions to get a renewal, the only thing we got back from was a week delay with zero progress.

Spain is expected to produce less wheat due to the persistent drought they’re experiencing.

Taking a look at the report, wheat could potentially be a sleeper. As there is that potential for the numbers to be under the average estimates by quiet a bit especially for winter wheat. But who knows how it shakes out.

This report could be a volitle one for the wheat market as there are plenty of unknowns surrounding US new-crop. The old-crop numbers aren’t expecting much of a change but that could wind up being a different story for the new-crop side of things.

The numbers tomorrow will be the first numbers we get from the fields when taking look at winter wheat. Obviously we already have a ton of arguments surrounding how many acres will be abandoned and how many actually wind up being harvested.

Many argue that this winter wheat crop might be the worst we've seen in the past 50 years, and I would have to agree. While some argue that, there is others who argue that our spring wheat crop could be one of the better we have seen in a long time.

Tomorrow’s numbers will give us a better idea, but I still think it is going to be tough to completely analyze new-crop wheat production. As we will continue to see plenty of debates surrounding yield and harvest acres.

Following the report tomorrow, the two main factors remain the same. War and weather. Both with the possibility to cause a spark and push us higher.

I still think we see the Kansas crop tours make the trade realize just how bad the crop is and everything they've been through with the drought. Funds are still heavily short Chicago, so bulls suggest it is just a matter of time before things flip.

Chicago July-23

KC July-23

MPLS July-23

Bottom Line Ahead of the Report

From Farms.com Risk Management,

The demand side of the crop equation has been lagging lately. Since mid-April, the Chinese have cancelled 832,000 MT of U.S. origin corn. It can be debated whether there is a political edge to it, but there is a legitimate business reason: Brazil origin is cheaper. Taiwan bought a cargo of Brazil origin overnight, too!

One of the funds’ focus in Friday’s USDA report will be on the 23/24 global soybean ending stocks number which could be record large. But what stands out is the 23/24 U.S. soybean ending stocks number that is not much bigger from last season when you plug in a record soybean yield. A 2 bpa lower yield (but still higher than last year) results in below pipeline supplies. But this number could grow if the U.S. Northern Plains plants more soybean acres.

23/24 U.S. corn ending stocks number above 2 billion will be the largest number printed as acres and yields come down. The real concern is demand with China. (Please see chart below)

Finally, look for a higher % of abandonment in HRW wheat acres in this report in Oklahoma and Kansas that could provide a bullish surprise to KC wheat futures.

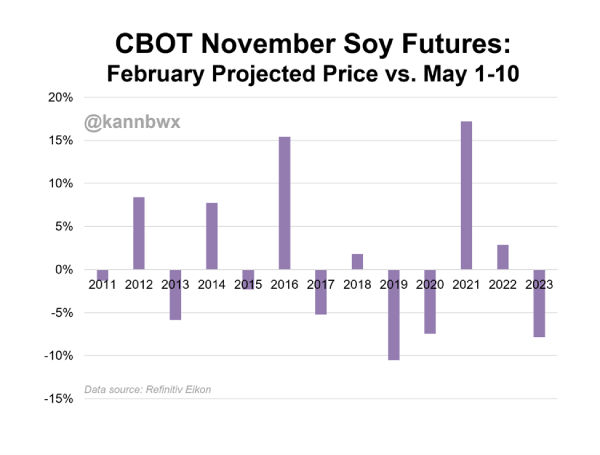

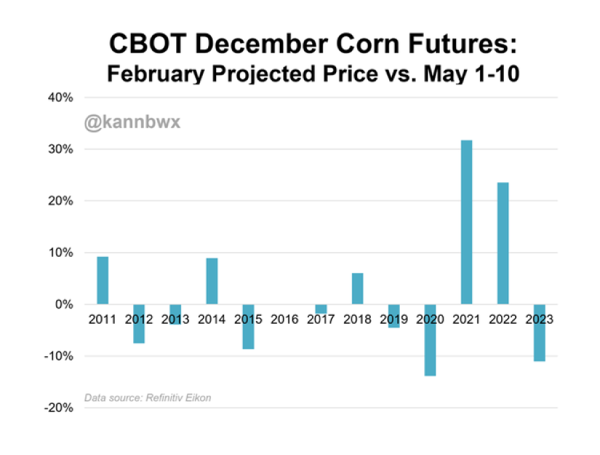

A strong start to the US row crop planting season, pre-USDA positioning, and fund flows continuing to lean to the short side continue to weigh near-term. Through the first 10 days of May, December corn is down about 11% from the February average price, the biggest losses in 3 years and totally the opposite of the huge gains seen in 2021 and 2022. November soybeans have lost around 8% since February, more than the 7% in 2020 but less than the 11% in 2019. Corn is down about 65 cents/bu & soybeans down $1.08, both the largest outright losses between Feb and early May of any other year recently. This makes the market susceptible to a bullish USDA surprise on Friday. (Please see chart below)

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. We have a USDA report tomorrow, with that comes uncertainty. If you want help managing your risk you can give us a call anytime at (605)295-3100 or set up a hedge account below.

Check Out Past Updates

5/10/23 - Audio

Are Funds Undervaluing Weather Premium?

5/9/23 - Market Update

Another Chinese Cancellation Pressures Grains

5/8/23 - Market Update

KC Wheat Continues Its Rally

Read More

5/7/23 - Weekly Grain Newsletter

AI Thinks We Are Going Higher. Do You?

5/5/23 - Audio Commentary

If This Was Short Covering, Why Didn’t Chicago Lead Us Higher?

5/4/23 - Market Update

Grains Rally Off Lows

5/3/23 - Audio Commentary