GRAINS SHARPLY LOWER AS RUSSIA RESUMES GRAIN EXPORT DEAL

MARKET UPDATE

By Sebastian Frost

Futures Prices 11:45am CT

Overview

Following the recent 2-day rally we had to start the week off due to Russia suspending the grain export deal with Ukraine in the Black Sea which caused prices especially wheat to rally much higher. But, the same situation that led us higher is now taking back those gains. As Russia agreed to resume the grain export deal. Leading to sharply lower prices across the board today.

Today's Main Takeaways

Corn

Corn following the rest of the markets lower today after the Russia and Ukraine export news broke out. Corn now back below its 20-day moving average and is looking like it might continue its choppy sideways trading that we have seen as of recently. Corn is currently down -11 1/2 cents (from $6.96 1/2 open) and near the bottom of its trade range.

Tomorrow we will see the weekly export data. And its looking like most are expecting another round of disappointing numbers. If we want to see prices higher, we will almost certainly need to see better export demand. Demand currently remains fairly disappointing. Along with the recession fears effecting ethanol demand.

Yesterday we saw Dec-22 corn close at $6.97 3/4, getting so close to that $7 mark all the bulls would love to see. We haven’t seen a close above $7 since June.

Obviously the big news today that pushing around the markets is the Russia situation. But looking forward, everyone is excited for the highly anticipated USDA Supply & Demand report scheduled for November 9th, which is next Wednesday.

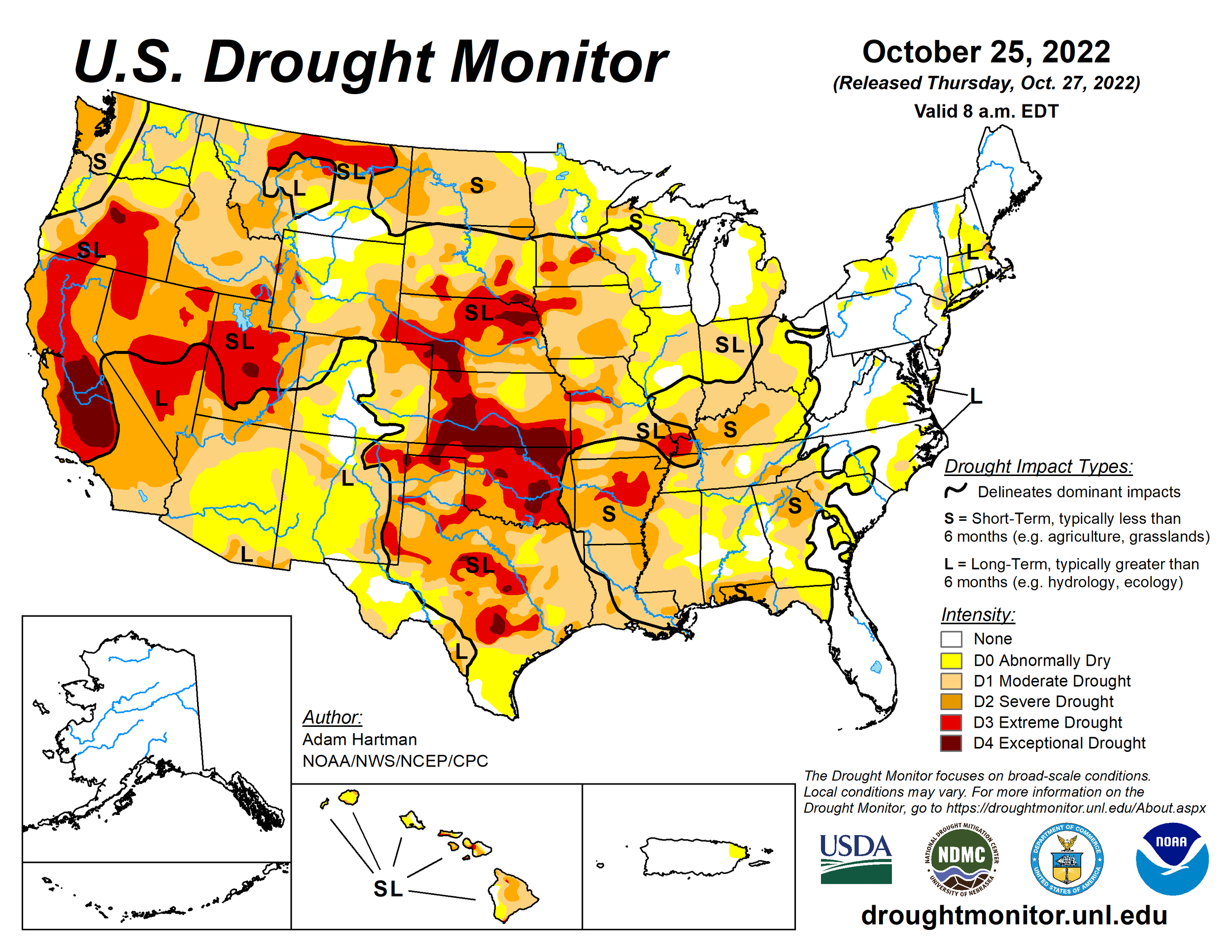

Weather wise, we aren’t seeing much worries from Brazil and Argentina just yet. Yes, they are seeing some small problems here and there with Argentina's drought and some parts of Brazil being too wet. But overall this hasn’t made a large impact yet, and currently the outlook is good for the crops down there. Here in the U.S. harvest is moving along faster than normal. Coming in at 76% harvested, compared to the 5-year average of 64%.

Dec-22 (6 Month)

Soybeans

Soybeans currently holding up the best among the grains but still trading lower following a big rally of nearly +30 cents yesterday. Soybeans currently down -1 3/4 cents. Good news is soybeans remain above that $14 level which had acted as a very strong resistance level for a long time. Soybeans are up nearly +50 cents in the last 5 trading days.

StoneX raised their 2022-23 Brazil production estimate from 153.8 to 154.35 million metric tons. Last season was 127.2 million metric tons.

According to the USDA, U.S. crush for soybeans in September came in at 167.6 million bushels. Which was right around estimates. However, this is down from August’s report of 175 million bushel crush, and higher than the 164.1 million bushel we saw last year.

Hopes are that we continue to see the Chinese have an appetite for U.S. soybeans. With the most recent export numbers coming in pretty strong again. It would be very beneficial to prices if we kept seeing demand increase. There is rumors that China may start to ease off of its recent zero covid policy where they have seen lockdowns. If they remove the lockdowns fully one would think this would at the least help Chinese demand.

Soymeal has remained relatively strong up until today. As earlier this week we almost saw a new high on the year. Soy oil is also very strong. Make sure you call Jeremey at (605)295-3100 or Wade at (605)870-0091 over at Banghart Properties for any sunflower offers.

Similar to corn, U.S. harvest is moving along faster than traditionally. Coming in at 88% harvested, compared to the average of 78%.

People will soon begin to shift their focus to South American weather than U.S. weather. So weather will continue to be a major factor and whether or not we see any scares in South America.

Soymeal & Soyoil

Soymeal -2.9 to 421.9

Soyoil up +2.14 to 75.51

Soybeans Nov-22 (6 Month)

Wheat

Wheat sharply lower today as new broke out that Russia would resume the grain export deal. The same news that originally sent wheat sky rocketing is now the news pushing prices lower, which shouldn’t come as a major surprise as everyone knew we would see prices lower if the export deal renewed. But I don't think many were expecting it to happen this soon, just a few days after the original headlines.

Wheat is down anywhere from -40 to -60 cents. With Chicago getting hit the hardest. Even with today’s sharp losses, we are still higher than where we closed at Friday, but still well below where we opened up Monday following the news. Wheat may now look to resume its choppy back and forth trade action until the next piece of fresh news hits the headlines.

Full breakdown of the headlines: Today Russia said it would resume its participation in the grakn export deal to free up grain exports from Ukraine. This news came after originally suspending the deal over the weekend. The Russian defense ministry said they had written guarantees from Kyiv that they won't use the Black Sea for military operations against Russia. Russia initially suspended the deal because they said they couldn't guarantee safety for civilian ships in the Black Sea.The head of Russian Sovecon said this was an unexpected turnaround. But also noted that the deal still remains "shaky". As they are unsure if the deal will receive an extension or not. There is still two weeks until the extension deadline (Nov. 19). So there could definitely be more headlines surrounding this situation that pop up.

Outside the whole Russia and Ukraine situation which has consumed the markets, crop conditions for wheat came in very poor. Coming in at their worst for this time of year. Along side U.S. weather, eyes will be on Argentina weather as well. If it wasn’t for Russia turning back and agreeing the deal, wheat prices would’ve likely continued to trend higher especially given we have one of the worst crops here in the U.S. we've seen in recent memory. But now we will just have to be patient and see how this situation plays out. Keep in mind, there is also the possibility they don't renew the deal come Nov. 19. But from what everyone is saying, most think they will.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil up +1.76 to 90.13

Dow Jones down -120

Dollar Index up +0.066

Cotton up +4.00 to 79.00

News

Record volume of grain shipped from Ukraine Monday under grain deal

Russia resumes grain deal after guarantee that the corridor won't be used for military actions

North Korea fired 23 missiles including one landing off the coast of South Korea.

Feds will release their interest rate decision today, expecting a 75 bps increase.

Livestock

Live Cattle down -0.600 to 151.350

Feeder Cattle up +1.825 to 180.025

Live Cattle (6 Month)

Feeder Cattle (6 month)

Sunday's Weekly Newsletter

In case you missed it. Read Sunday's weekly newsletter

Social Media

All credit to respectful owners

Precipitation Forecast 2-Day

Weather

Source: National Weather Service