GRAINS SLIDE WITH FAVORABLE FORECASTS

Overview

Grains all close out the week lower. The downside was led by 20 to 25 cent losses in both beans and KC wheat, while corn and the other classes of wheat also all closed down around double digits.

Taking a look at next week. We have the updates crop conditions Monday. I can imagine these will show improvements or at the very least be steady. I'm guessing we see improvements of a point or two. However, a lot of this is likely priced in already. As the trade is expecting improvements.

Something that isn’t priced in however is the carryout on the report Wednesday. As we get the USDA WASDE Supply & Demand report. The consensus going into the report is that we get a bearish report for corn, and an extremely bullish one for soybeans.

Mark Gold from Top Third had this to say,

"I can’t believe if the government is truthful to us, we won’t see bean carryout well under 160 million bushels. I think when it's all said and done, we are pretty tight out here. If bean ratings don’t improve, I don’t see us getting to 52 bushels an acre yield."

Looking at the weather, there is some good rains in the forecasts. We will have to see just how much of that is already factored in, but it definitely indicates improvements for the crops. Forecasts showing 1 to 2 inches of rain over most of the corn belt over the next week, with slightly cooler temps. So overall weather is still a bearish factor.

However, the downside may be limited by extremely tight soybean and wheat supply & demand outlooks. So weather is limiting the upside, while tight fundamental outlooks for beans and wheat limit the downside. Corn might try to pull beans lower, while beans try to pull corn higher.

The favorable weather outlook and optimism that conditions will improve next week was one of the biggest factors in today’s lower prices.

I can imagine any major breaks like we have just seen in the beans will be bought back fairly soon. Corn is heavily oversold, but the funds will still probably look to sell any rally, which is what happened today following yesterday's strength.

An interesting fact about this week's price action was that corn only 1/2 a cent this week, while soybeans lost 25 cents. I don’t think many people were expecting that with the results from he report last week.

Here are the forecasts. There is still a potential dry pocket over Iowa so that will be something to keep your eyes on.

Drought Change

The newest drought monitors came in. Here were the changes of areas experiencing drought.

🌽 Corn:

67% (-3%)

🌱 Beans:

60% (-3%)

🌾 Spring Wheat:

19% (+4%)

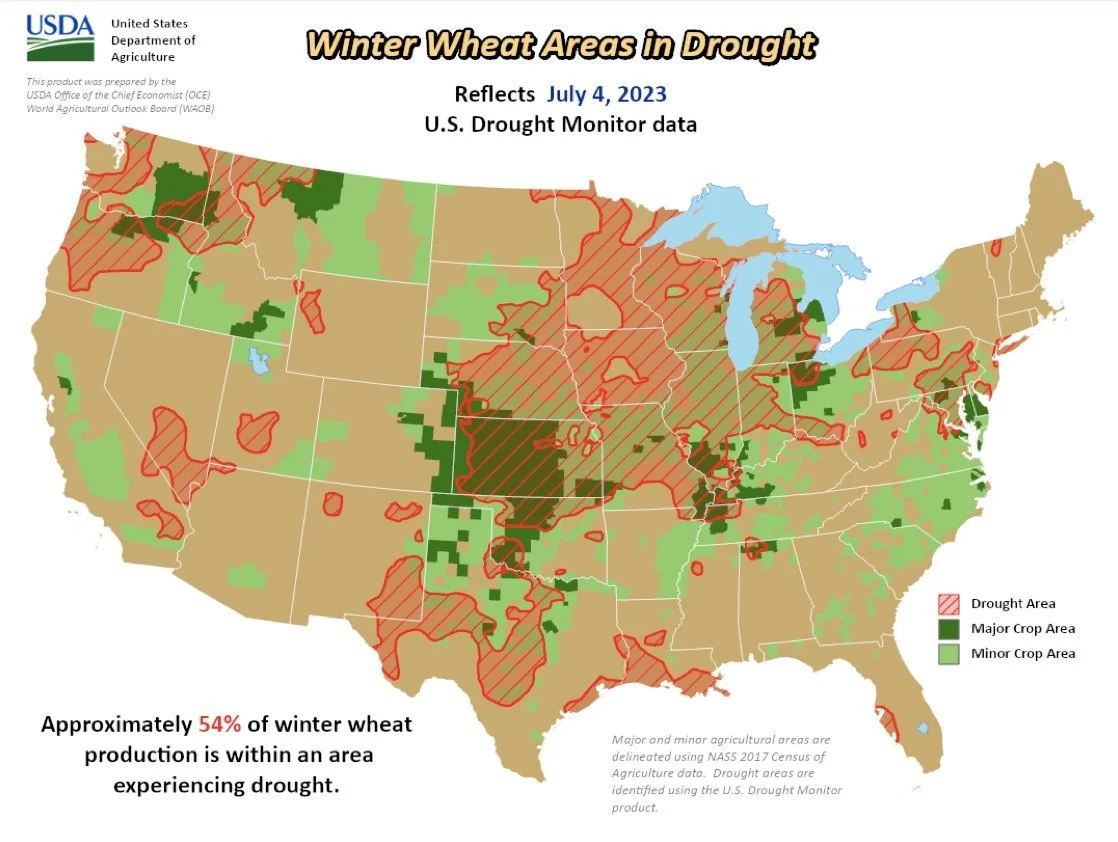

🌾 Winter Wheat:

54% (-1%)

***

In case you missed it, read Sunday's Weekly Newsletter

What's Next For Corn & Beans? - Read Here

Today's Main Takeaways

Corn

Corn gives up essentially all of yesterday's 13 cent rally on today's lower price action, as it struggles to find a bottom.

As mentioned, the favorable forecasts, optimism for improved crop conditions, and expectations that next week's report is a disaster for corn all weighed on the markets here today. To go along with some bearish fundamentals and the funds were also probably just looking to lighten up their position, as they are probably now sitting around even.

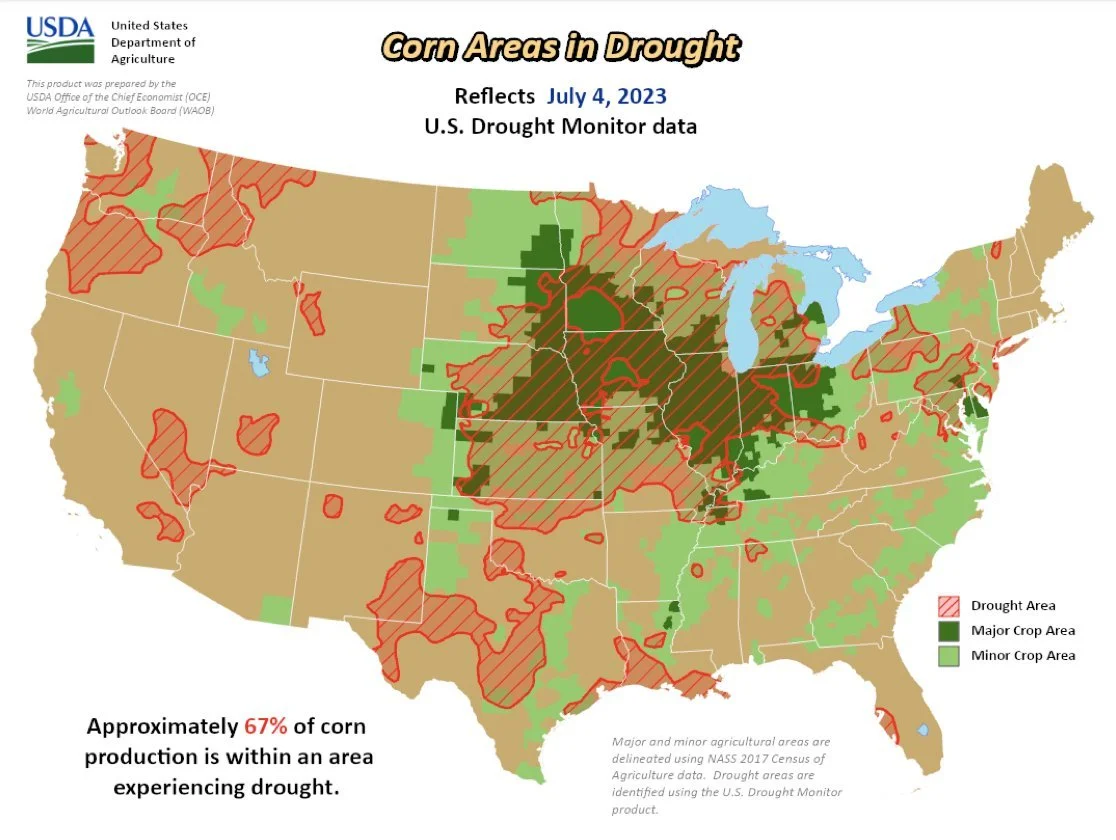

The newest drought monitors came out. They showed an improvement of -3% of corn areas experiencing drought. Bringing the new total to 67%. Below is the last few changes we have seen:

July 7th: 67% (-3%)

June 27th: 70% (+6%)

June 20th: 64% (+7%)

June 13th: 57% (+12%)

June 6th: 45% (+11%)

May 30th: 34% (+8%)

This was the first decrease we have seen since May 16th.

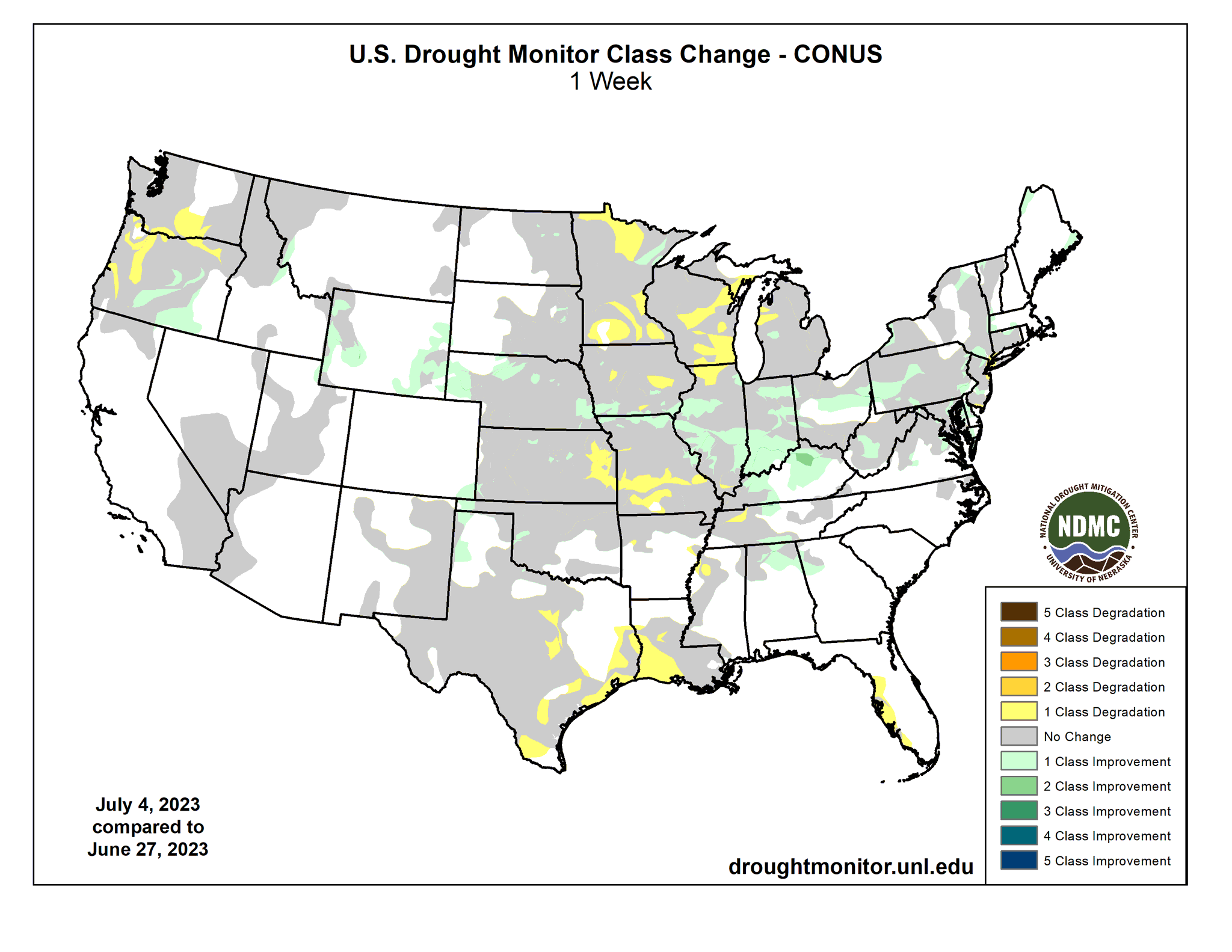

Here is the drought monitor change from the past week. As you can see, we did definitely see some improvements in the I-states, while states such as Minnesota, Wisconsin, and Missouri saw some additional drought.

Here is a comparison for this week to last, as well as this week to a month ago. Some slight improvements from last week. We are still a lot worse than a month ago however.

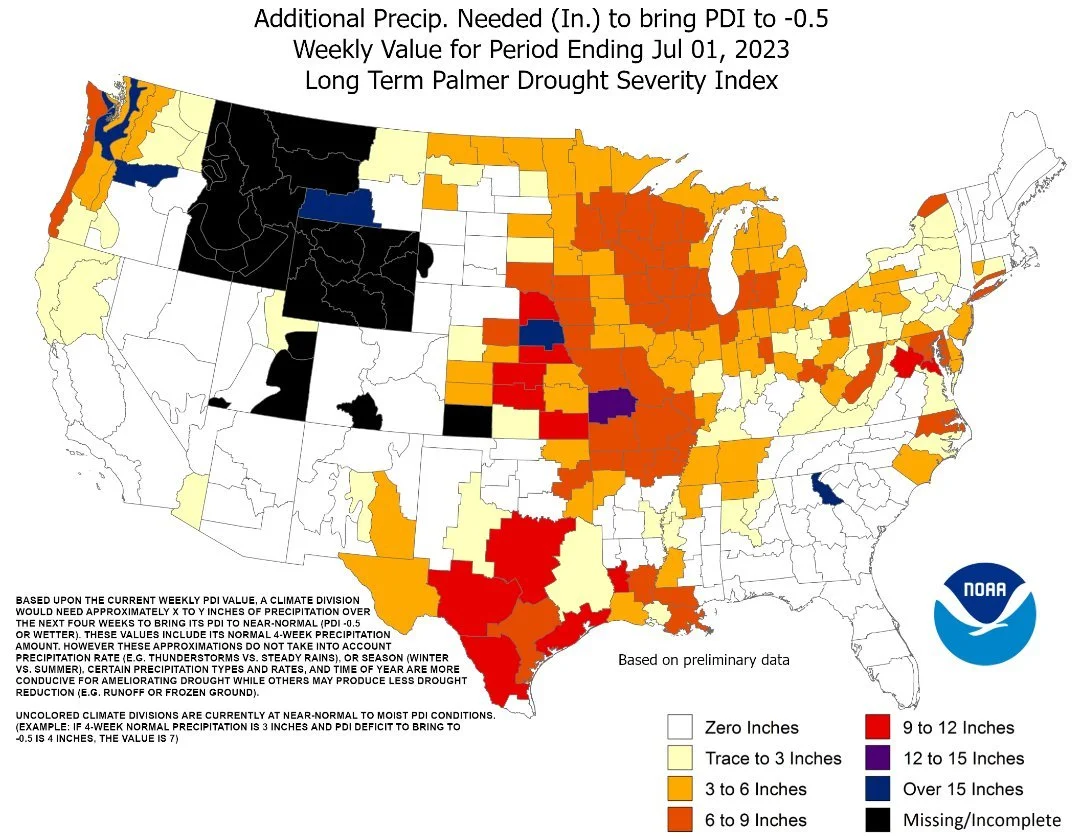

Here is a map showcasing how much precipitation every area needs. A large portion of the corn belt still needs anywhere from 3 to 9 inches.

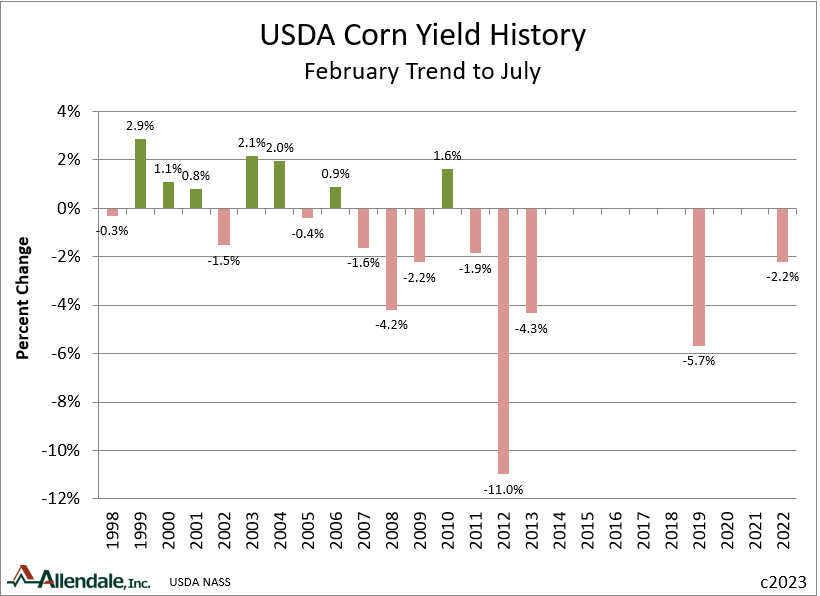

Everyone is expecting this horrible report for corn next week. Over the past 25 years here is what the USDA has done to yield in their July report.

11 times below trend line yield

7 times left it unchanged

7 times increased it

Ultimately I think it is almost certain we see yield dropped for corn. But by how much is the question, and what does the market currently have priced in already?

Currently the market is not trading a +180 crop. If we were trading that, we would be a lot lower by now. If I had to take a guess I'd say the market is probably pricing in something around the 174 to 175 range. Which is right around the USDA has their pre-report estimates. As the estimates I could find for the report are showing 175.8 bpa, a 5.7 drop. There is a lot of people who are thinking we could actually come in at the 172 to 173 range, which isn’t a surprise many people seem to be talking about. But it is a definite possibility. A number of 172.4 would be a 5% decrease from trend line.

How big of a cut in yield would we need to offset the extra acres? We would need about 4 bpa to make up for the acres. So the numbers would be a wash at 177.4 bpa. It's possible and even though I think they should, I don’t see the USDA dropping much below 175 if at all in this report just because it is early and they like to slow play things. But nonetheless we should see a cut of some sorts.

Here is the history of changes made from February trend line to the July report. Last year we saw a -2.2% decrease. However, I think we are far worse than last year. A -2.2% cut this year would bring us to 177.4 bpa, right where we need to be to make up for the added acres.

Ending stocks are projected to come in a lot higher, but if we get a cut to yield that would offset a good portion. The biggest question going into the report is just how much do they want to lower demand.

One thing adding support is that corn futures in China have rallied 12% from their May 12th lows. Trading at their highest levels since March.

I have seen some other advisors placing buy signals. I would have to agree this isn’t a bad spot. Are the definite lows in? It is tough to say. Personally, I could still see us making one more leg lower, especially if the report next week is as bad as everyone seems to think it will be. In yesterday's audio we did mention we liked the idea of potentially grabbing calls. Listen Here. If you would like any help or specific advise for your operation you can always feel free to give us a call ay (605)295-3100 and we would be more than happy to help.

Although I can’t say for certain the bottom is in, I think we are close. We finally got most of the bleeding to stop as prices have somewhat consolidated. There is still a lot of bearish factors, but then again a majority of these are already priced into our market. My current upside target for when we do find a bottom is the $5.25 and then the $5.40 range.

Taking a look at the chart, we closed near the very bottom of today's trade range which a very weak close. But we did manage to hold yesterday's lows. That potential double bottom is still in play.

Corn Dec-23

JULY 4TH SALE ENDS TOMORROW

Get every single one of our daily exclusive updates sent via text & email for a massive discount. (Scroll to end to see past updates you would’ve received).

OFFER: $350/yr or $35/mo

USUALLY: $800/$80

Not sure? Try Free Trial HERE

Become a Price Maker. Not a Price Taker

Soybeans

Soybeans take another knock on the chin, with their 3rd straight day of losses. As Monday was the last day soybeans closed higher. Despite the absolutely bullish report and crop conditions for beans, they actually lost 25 cents on the week and sit 60 cents off Wednesday's highs. So there is some concern there for bulls when we get this super bullish reaction Friday, but yet we find a way to end the week lower.

Pressure came from additional rain being added to the forecasts with overall outlook turning more favorable.

Some think the past few days price action may be a mistake given that the majority of everyone is expecting a pretty bullish report next week and just how tight our supply and demand situation is.

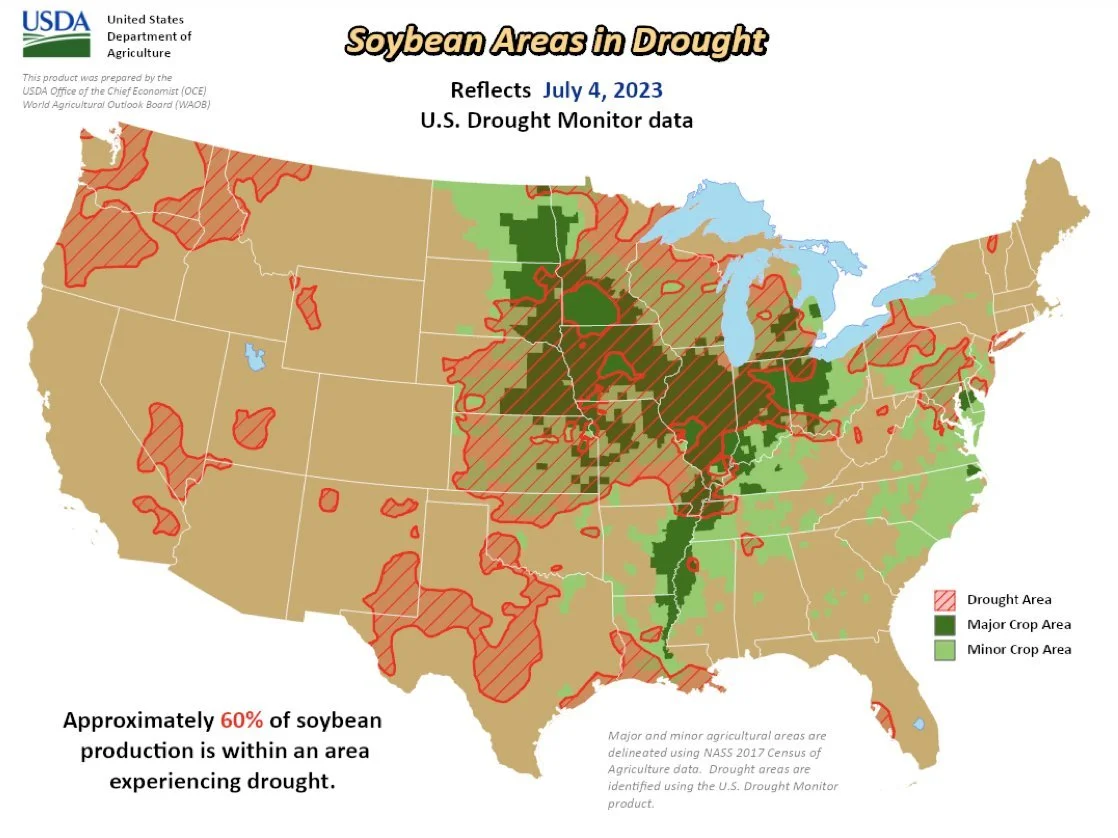

Just like corn, soybean areas experiencing drought also decreased by 3% to 60%. Here are the last few changes we've seen:

July 7th: 60% (-3%)

June 27th: 63% (+6%)

June 20th: 57% (+6%)

June 13th: 51% (+12%)

June 6th: 39% (+11%)

May 30th: 28% (+8%)

So definitely some weather selling weighing on the markets as everyone always does say "rain makes grain".

But the biggest thing going forward that bulls continue to look at is the tightness in soybeans. They argue this very tight carry out will need to be corrected with higher prices.

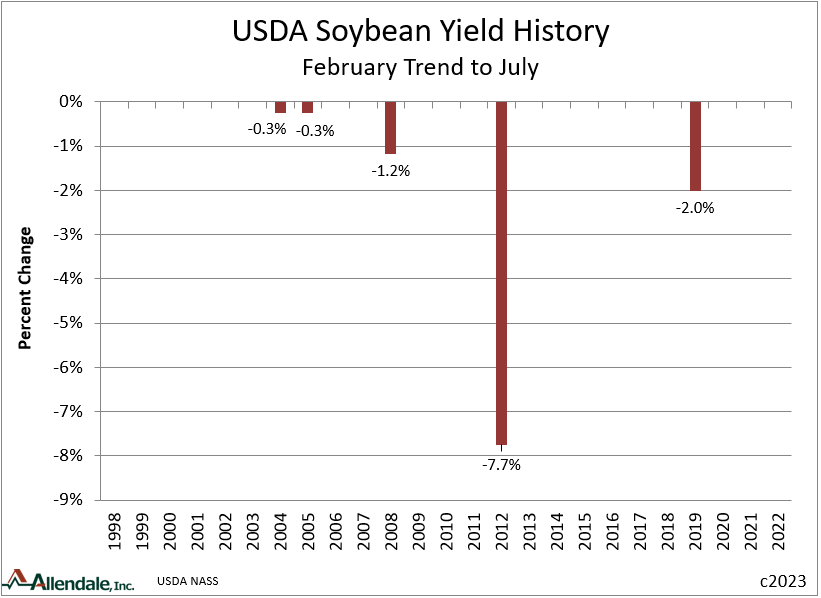

I would have to agree. Taking a look at next week's report, the estimates have yield at 51.4 bushels per acre, a 0.6 decrease from the original 52 we saw. I wouldn’t be surprised at all to see a some cut but I also wouldn’t be surprised to see the USDA simply leave it unchanged at 52 bpa.

Here is a little history of changes from February to this report. As you can see, we typically don’t see many major changes. So if any change is made, it will be a small decrease.

However, the bigger takeaway from the report that everyone will be watching is the carryout numbers. The estimates are showing 206. Some people are arguing that is far too high, and think we are actually closer to 150 than we are 200.

There is some concern about how many double crop acres we will have. But the problem there is that we can’t get the wheat our due to the over abundance of rain and wet weather we've seen. But the trade seems to be bettering we get some more added acres when they do the survey again later in the year.

The funds still remain long just shy of 100k contracts, so perhaps they look to continue to off load some of those ahead of the report. From a technical side of things, I could see another day of downside before the next move higher as we look to test that trend line. Bulls really want that $13.10 level to hold.

Fundamentally, I do think we will find support very soon due to the tight supply and demand. The very tight carry out will need to be corrected with higher prices. Going forward the soybean market has a ton of potential, and the $14 range isn’t that unreasonable of a target. If the cards play out right, there is a possibility to push upwards of $15 later this year. Now I'm not saying that will happen, but it's a real possibility.

As for recommendations, Tuesday I said it wouldn’t be a terrible place to take some risk off the table if that is what makes you comfortable. That was 40 cents ago. Even though I think we will be going higher, we need to keep in mind we are still nearly $2.00 off our lows from May 31st. If you want specific advice or help just shoot us a call.

Soybeans Nov-23

Wheat

Wheats rally from Wednesday was cut short on today's pressure across all of the grains.

Earlier this week spring wheat surprised many people with the lower crop conditions. Spring wheat areas experiencing drought were the only of the grains to see an increase this week, as the areas increased form 15% to 19%.

Winter wheat on the other hand saw a slight decrease of areas experiencing drought. Dropping by 1% to 54%. The first decrease since early May.

There are plenty of talks surrounding Russia and Ukraine, and now it looks like Turkey is involved. The market is acting like something but might get done, but so far all signs have pointed at Russia exiting the Black Sea agreement when it expires on July 17th unless sanctions against it are lifted. But I'm not too sure I buy this, as we have heard this exact same story in the past multiple times. Ultimately I think the deal will be extended again.

There are a few things bulls are looking at, that further solidifies our stance that wheat has the potential to be a sleeper in our markets.

Of course we have the spring wheat situation and surprise earlier this week. We have the over abundance of rains potentially damaging crops. As areas like Kansas that hadn’t seen good rain in a very long time, now can’t get away from it.

But the more important factors may be the global ones. El Niño is typically very poor for Australian wheat production, so it looks like their crop is getting smaller rather than larger.

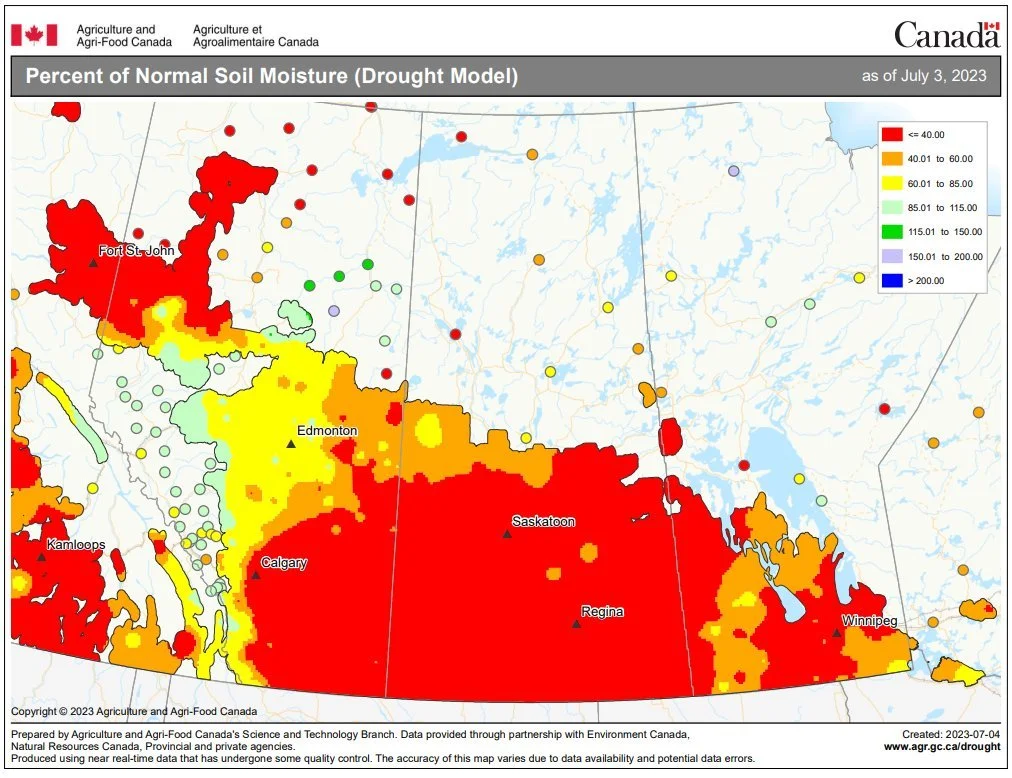

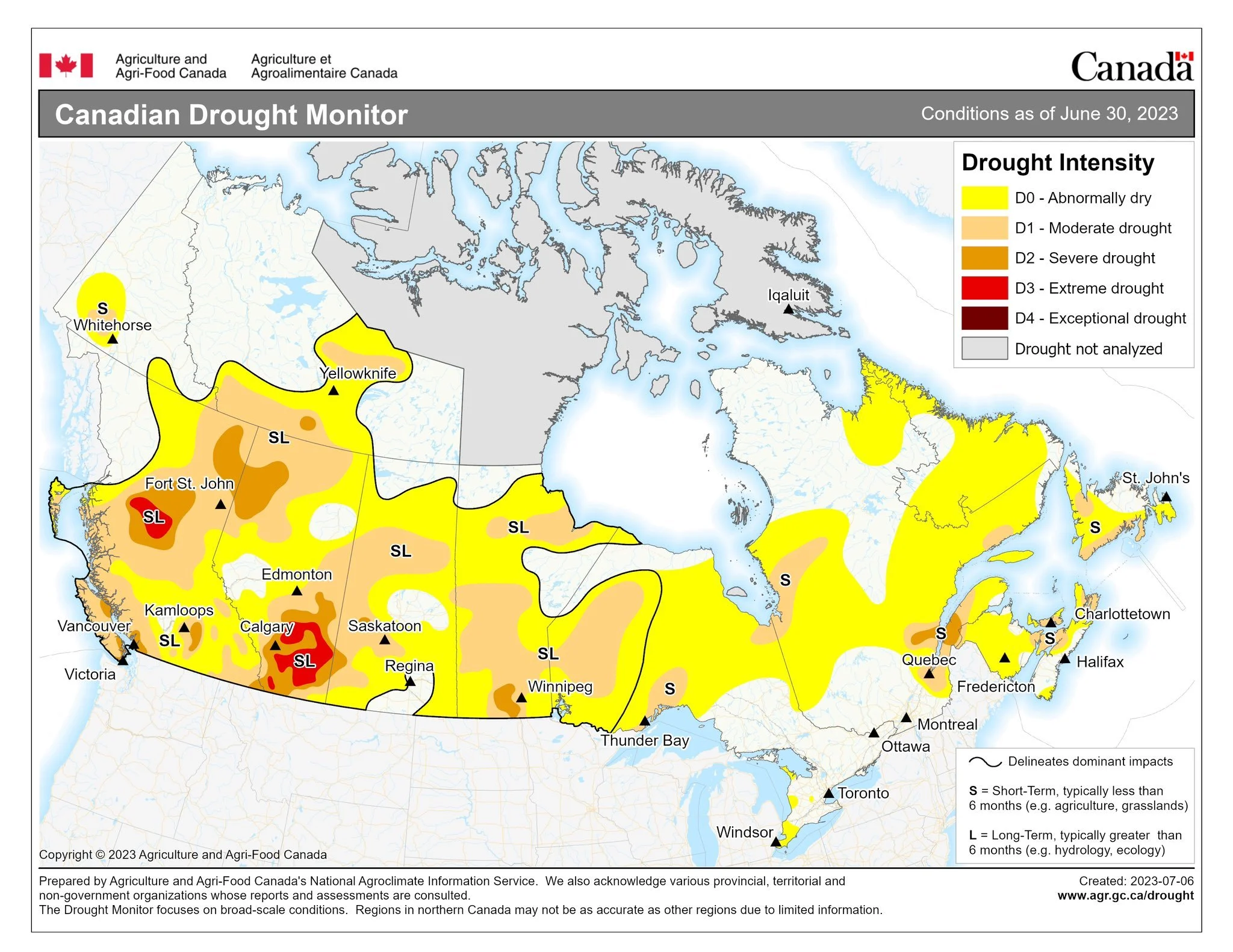

We have the droughts in Canada. This is why oats were so strong.

Below is a map showcasing the percent of average precipitation for the past 30 days.

Here is the updated drought monitor for Canada.

When we combine all of these factors, I think we could be looking to put in a bottom sometime soon and the wheat market might surprise some people.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

USDA Outlook

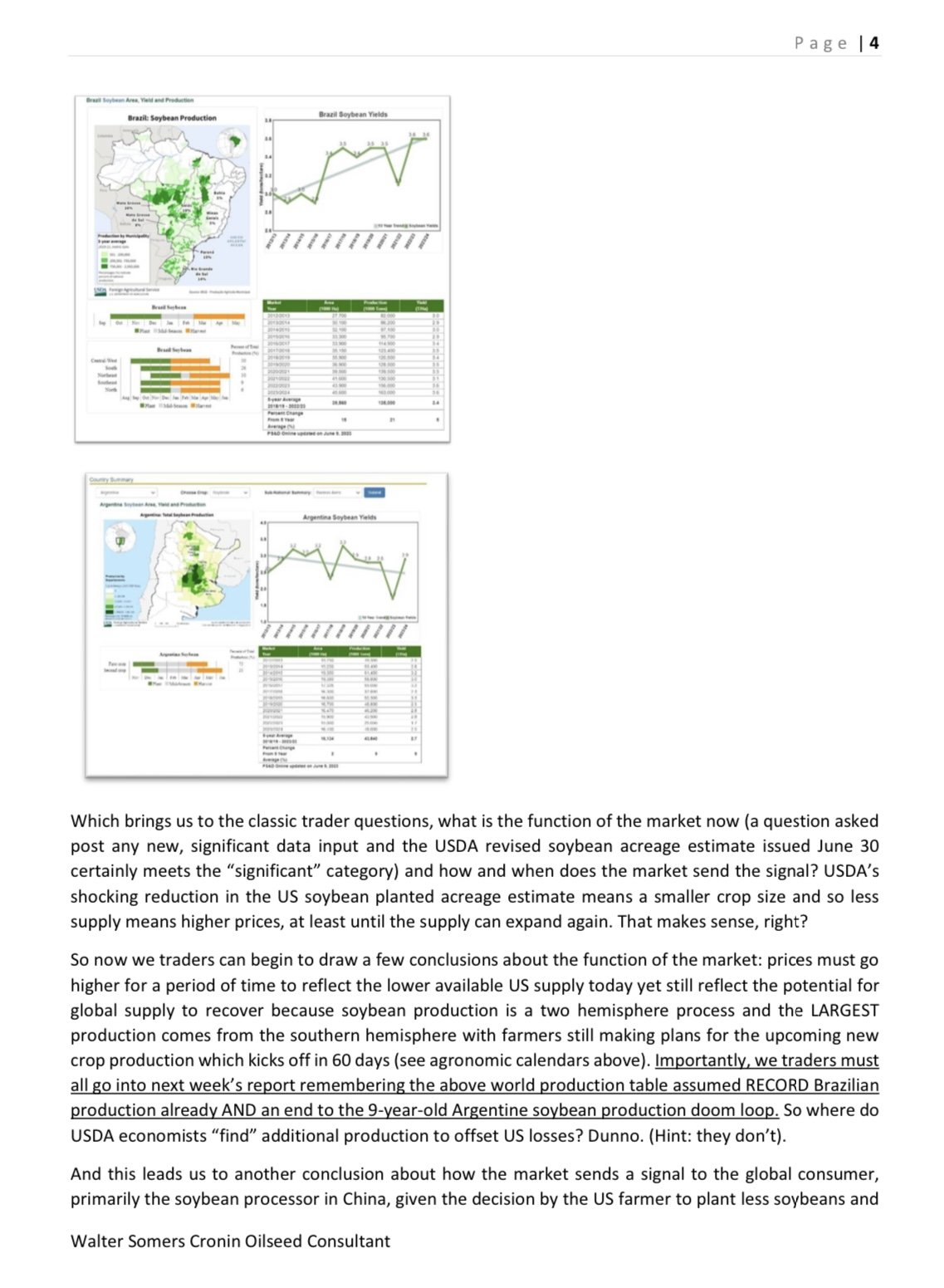

From Walter Cronin,

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

7/6/23 - Audio

OPPORTUNITIES IN THE MARKETS

7/5/23 - Market Update

WHEAT SURGES WHILE CORN & BEANS DISAPPOINT

7/5/23 - Audio

THE HEAVY VOLATILITY CONTINUES

7/3/23 - Audio

ARE THE MARKETS GOING TO BLOW UP OR FIZZLE

7/2/23 - Weekly Grain Newsletter

WEATHERING THE STORM: WHAT’S NEXT FOR CORN & BEANS?

6/30/23 - Audio & Report Recap

WHAT THE USDA REPORT MEANS

6/29/23 - Market Update

MORE DROUGHT & USDA REPORT TOMORROW

6/29/23 - Audio