HEALTHY CORRECTION OR END OF RALLY?

Overview

Grains trade sharply lower across the board here today to close out the week as forecasts are showing a better chance for rain over the next week.

They have done a lot of damage the past two days without even actually seeing a drop of rain. As corn and beans both close down around 30 cents while the wheat market also closed down around double digits. Given the fact that we haven’t even seen any rain yet, and this pressure is simply going off the forecasts. I think this move to the downside was definitely over done.

Today was July options expiration. Typically, the Sunday and Monday following July options experation is known for some big, potentially limit moves. So we could be in for a major move Monday. Which side will it be? Well, that comes down to weather. If these rains hit, the markets likely take it on the chin again. If these rains miss, we likely bounce back and go screaming higher.

Taking a look to Monday, we will get another round of crop conditions. I can’t imagine a world where we don’t see these take another drop.

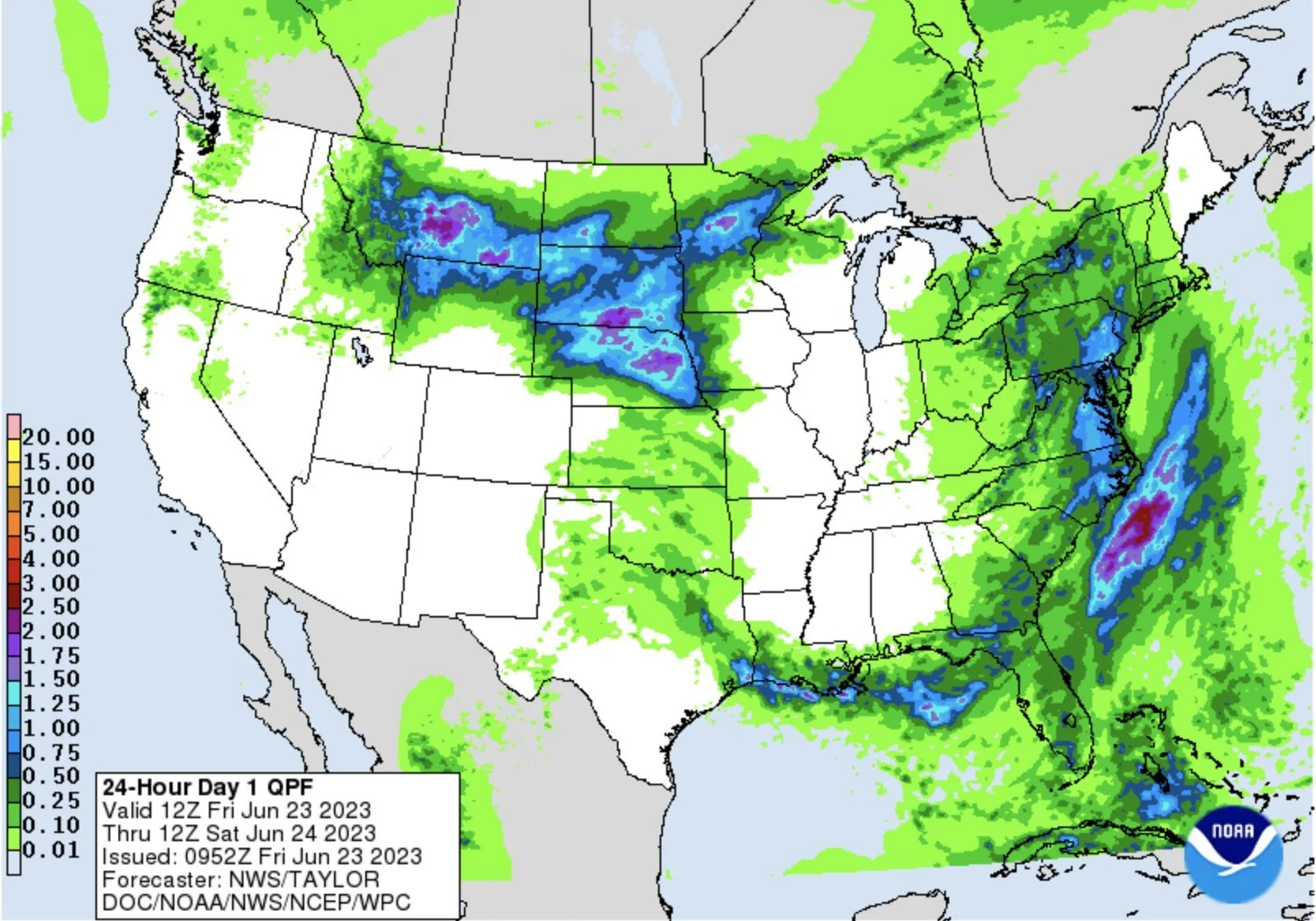

The problem with the forecasts that are pressuring the markets today is that the areas forecasted to get rain, aren’t even the areas that need it the most.

Here is the 24 hour forecast.

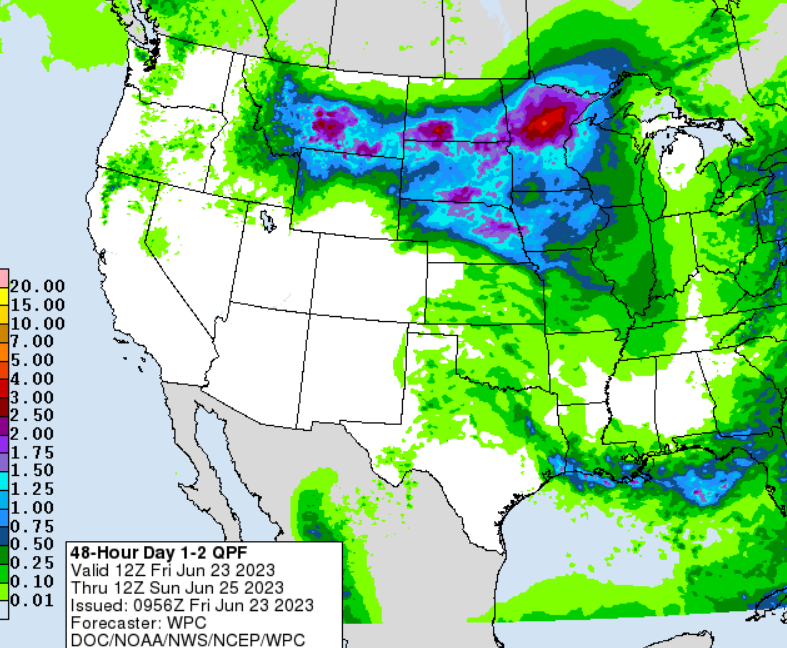

Here is the 48 hour forecast.

These forecasts have been anything but reliable, so we will have to wait and see what unfolds over the weekend. But there is a chance we don’t even get rain in the light green areas (Illinois, Indiana, etc.). Even if we do, these aren’t drought busting showers either given how far behind the rain already is, but the trade will still look to sell any sign of drought relief.

On the other hand, the market is currently pricing in probably somewhere in the range of at least two inches over the weekend. So if they do not come to fruiton, the lower we went today, the bigger disappointment and boomerang to the upside we could see.

The move we see Monday will all come down to how much of that rain actually hits the ground, as these rains are already priced in.

In case you missed this morning's audio where we went over risk vs reward amongst other things - LISTEN HERE

2 Days Left

Get every single one of our exclusive updates like this one sent via text & email for a massive discount. Scroll to the very end to check out past updates you would’ve received.

Unsure? Try a 30 day free trial HERE

OFFER: $299/yr or $29/mo

ORIGINALLY: $800 or $80

Become a Price Maker. Not a Price Taker.

Today's Main Takeaways

Corn

Corn futures take it on the chin, losing nearly 33 cents of their recent rally. However, we are still $1 off our late May lows and even with today’s losses we are still higher than where we opened up last Friday.

Even though yes, this sell off was due to forecasts, I think this pullback was a necessary healthy correction.

Export sales this morning came in awful, but some are saying we don’t have good exports because we have don't any corn to sell.

Crop consultant Dr. Micheal Cordonnier cut his US corn yield projection again. His estimate is now at 177 bushels per acre. I think the trade is likely pricing in something around the 175 range.

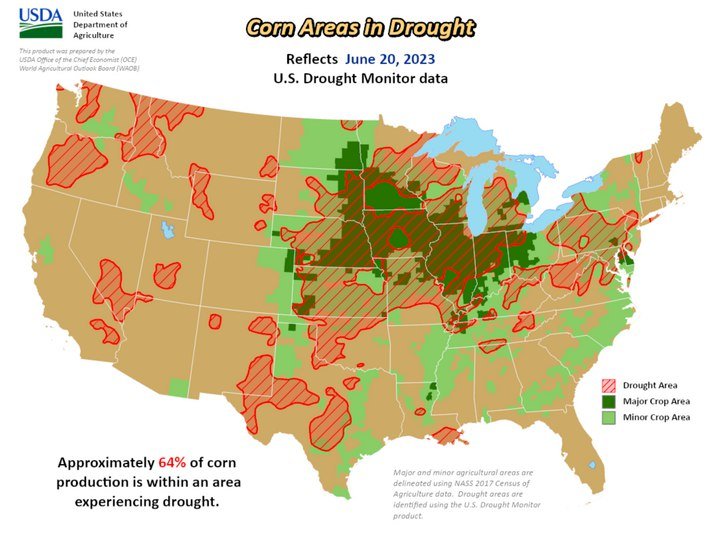

64% of US corn is in drought. This was an increase of 7% from last week and a whopping 38% increase over the last 4 weeks alone. I included this picture yesterday, but here it is again.

Today’s lower price action was all about the rain forecasts over the weekend as mentioned. But it was also just a result of profit taking and a healthy pullback before the weekend as the trade didn’t want to be as long with the chance of rain the next 48 hours.

How much of these rains actually hit will be the ultimate factor to start the week next week. There is a lot of faith being put into these forecasts considering just how inaccurate they have been all year long.

The biggest problem I have with the reason for today’s sell off was the fact that yes there is rain in the forecasts, but take a look at the areas expected to get rain. We have Minnesota, parts of Iowa, and the Dakotas. Rains in these areas won’t make the corn crop.

While the I-states are only expected to get a laughable amount. That light shade of green could quickly disappear. So while these rains could definitely cause some pressure in our markets, I don’t think these are drought saving showers even if they hit. It also appears that the forecasts may be shifting north rather than east. So I definitely have my doubts as to how much rain actually falls.

We are now only a couple of weeks before the key yield determining time period for corn. Which is early July. Mother Nature will decide, but if it stays dry or these rains simply miss, we could be going much higher. Personally I think that even if they do, one rain isn't going to save the yield. We still have a serious subsoil moisture problem, and sprinkling one shower on top isn't going to change much if anything. So the market definitely saw a little bit of an over reaction today.

I think today was a great opportunity to buy the dip and a potential bear trap. Of course, if we do see rain over the weekend we could expect some additional downside Monday. But after that, I think this break gets bought right back to go along with the expected poor crop conditions out after close on Monday.

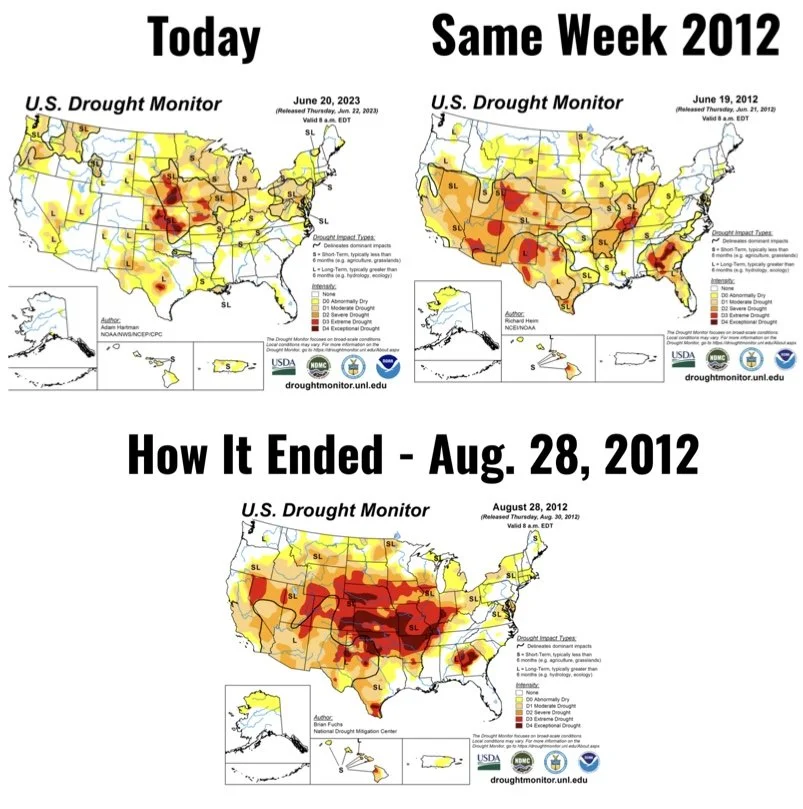

Here is the current drought monitor vs the same week in 2012 vs how we ended in 2012. If we don’t get meaningful rain it makes me question just how similar we can get to that of 2012 given that we are already drier than we were at this same time.

If we take a look at the charts, despite a 2 day correction, we are still in an uptrend and sitting above all of our moving averages. The $5.80 to $5.70 range on December corn looks like strong support and barring any crazy amount of rain, I think we see buyers step back in at or before those levels.

If you scroll the end of today’s update, I include a great write up from Wright on the Markets on where they see the future of corn. As well as ways to utilize different option strategies.

Corn Dec-23

Soybeans

Soybeans join corn on another day of losses, as beans take a hitting for the second day in a row. Beans did manage to close 20 cents off their lows, however still ending the day down 30 cents. Even with the +60 cent sell off over the past 2 days, July beans are still up over a $1 the past 9 days and November beans are still up 65 cents.

Essentially the same exact story as is going on in the corn market. We have rains forecasted over the weekend. Yes, we were over bought, so this correction isn’t necessarily a surprise. But it was a little overdone.

We can expect some heavy volatility going forward. On one side of the argument, bears are saying that it is still too early to see any major cuts to US yield. On the other hand, bulls say that the crops have seen enough early damage to justify doing so.

We also have the EPA situation which was the main reason for the sell off yesterday. The disappointing biodiesel mandate through 2025 put a damper on demand.

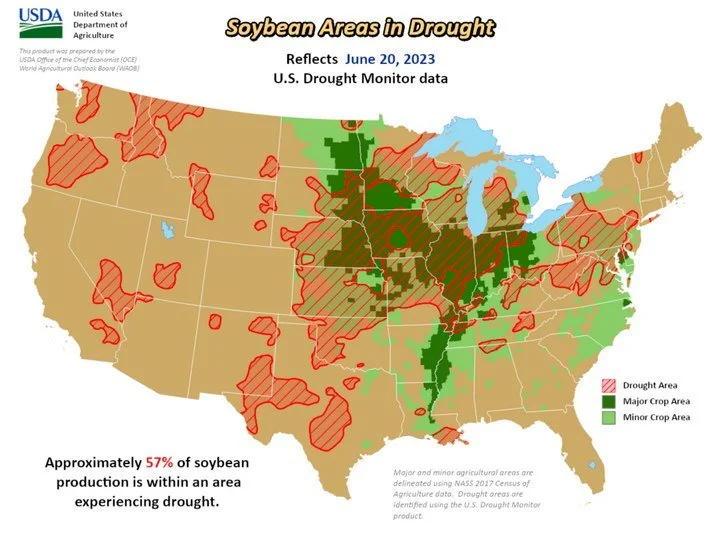

57% of US soybeans are in drought. A 6% increase from last week and a big 37% increase over the last 4 weeks.

Short term it will come down to weather. But taking a look long term. The situation and fundamentals for beans are looking very bullish, and I think we might have a greater demand story still building up.

From Wright on the Markets,

The market does not realize that Argentina has become the world's number two soybean importer after their drought reduced production by 30 million mts. Sure, Brazil had a huge crop, but 20 to 30 million mts of it are going to Argentina. Total soybean production in South America in 2023 is actually less than what was expected when the crop was planted.

Soybeans Nov-23

Wheat

Wheat futures join in on the lower price action. As wheat closes down 6 to 10 cents, holding up the best amongst the grains and 15 cents off their early lows.

Yesterday July chicago settled at a 4-month high. The market is finally starting to believe that Russia is actually going to cancel the grain deal.

Ukraine said that they are 99.9% certain Russia will quit the Black Sea grain deal in July.

Outside of the Black Sea talk, we have quiet a few global issues looking to support the wheat market.

First we have some pretty heavy hail and wind storms hitting winter wheat areas here int he US. The crop in India is getting smaller everyday it seems like. Argentina's wheat planting estimates were reduced by nearly half a million acres. We have the flooding issues and weather problems in China. Lastly, we have some scorching temps in parts of Europe and Asia.

So going forward, the wheat market might be the sleeper of the grains. Im not expecting this massive explosion in prices like I am in corn if it doesn't rain soon. But the potential is definitely there will an accumulation of everything going on in the world.

Of course, if Russia does back out of the grain deal, we could see wheat futures heavily supported. But there is still some time before we get any confirmation on that.

Cheap Russian prices are still a concern, but if we can start to see export prices in Russia climg higher we be able to get some more bullish demand stories.

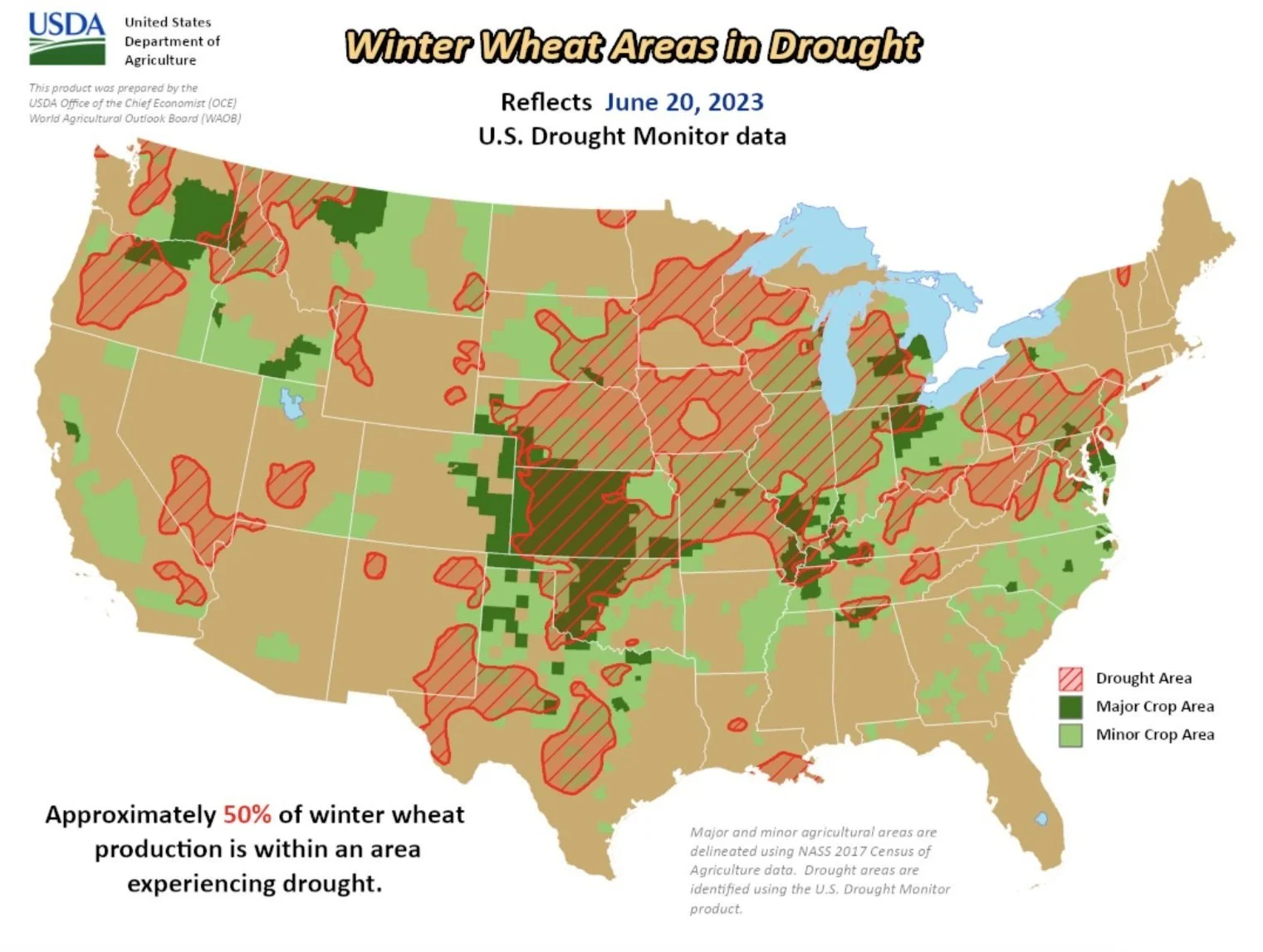

Below is a drought map. It shows that 79% of Kansas is still in a drought. Keep in mind, Kansas typically accounts for 25% of total winter wheat production in the US.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

Corn Options

From Wright on the Market,

Joe wrote on 21 June 2023:

"Good morning Roger, I have read your recommendations and see where you recommend a HTA on new crop corn in the next couple weeks.

Here is my situation: I grow some white corn. I locked-in an exceptionally strong basis of $1.10. What should I do now? Price the grain at 7.00-7.40 and be happy with 8.10+ price?"

Good Morning, Joe, early AM 22 June 2023

Given the current crop conditions, soil moisture, and weather forecast, yes, be prepared to price corn futures in the $7.00 to $7.40 range.

However, that price range is 75¢ away on the December corn and a lot of things can happen by the time corn gets to the $7 area. One possibility is rain could come clear across the Corn Belt any day now and we will not get to $7 in the coming weeks. None-the-less, I am confident we will later in the year.

The high in corn for the summer will probably be made no later than the middle of July and more likely a few days before or after the 4th of July if weather stays the way it has been so far this month as predicted. Corn can move 45¢ a day, so be ready. Note also, by the time we see corn near the $7.00 to $7.40 range, it may be obvious we are going a lot higher, in which case we will revise the recommendation.

Please read this carefully:

The day you price the corn need not be the end of the opportunity to capture more profit.

There is no need for any farmer to look at pricing corn (or any other commodity) as a one-shot opportunity. Likewise, there is no reason to not grab a profitable price even if a higher price is expected.

Sell the corn at some price, any price that has a reasonable risk/reward balance for you.

If prices go higher, buy put options and make money on the way down you did not make on the way up.

Do not price your corn and then buy call options.

We would much rather you pay 25¢ for the right to sell corn at $7.00 (with put options) than pay 25¢ for the right to buy corn at $7.00 (call options). After all, what is the probability corn will be substantially less than $7 in the coming months versus above $7 in the coming months?

You could price the corn right now in the $6.25 range and place orders to buy a:

Dec $6.00 corn put for 25¢

Dec $6.30 corn put for 25¢

Dec $6.60 corn put for 25¢

Dec $6.90 corn put for 25¢

If December corn goes to $7.66 like it did last year, each of those puts will be bought for 25¢.

Last year, ten weeks after Dec corn traded at $7.66, it was down to $5.52. In which case, the:

Dec $6.00 put would be worth 48¢

Dec $6.30 put would be worth 78¢

Dec $6.60 put would be worth $1.08

Dec $6.90 put would be worth $1.38

Sell the four puts for a total income of $3.72; deduct the $1 cost of the four puts (25¢ each), leaving a put profit of $2.72 to add to the HTA price. If the HTA price is $6.25, the $2.72 put profit brings it to $8.97, more than a dollar above the contract high after pricing the HTA more than a dollar below the contract high! All the while, the downside risk was completely eliminated with the HTA at $6.25 or whatever price has the best risk/reward ratio for you. Right now, I see that ratio being in the $7.00 to $7.40 range, but weather and politicians could change that in a heartbeat.

Talk to your merchandisers to see if they will buy the puts for you and attach to the HTA. If not, get the cash to buy the puts in your own futures/option account.

~ Roger

How Long Have We Been Predicting This Drought?

We have been predicting for the summer of 2023 to bring one of the worst droughts on record since last September.

Here is a few of our past updates where we predicted this if you want to go back and read/listen to any of them.

December 18th Weekly Grain Newsletter

If you scroll towards the bottom of this update, we go over why 2023 will bring one of the worst droughts and how history may repeat itself. We mentioned how we think the drought from last year will simply move North East. That is exactly what has happened. Check it out below

READ

April 16th Weekly Grain Newsletter

In this write up we go over the possibilities of us seeing new-all time highs in 2023.

Some snippets,

"If you knew today that we would have the worst drought in 60 years int eh corn belt in 2023 how much corn would you have sold, can you imagine how high the price will go?"

"I don’t think the industry is prepared at all for anything more than a 10% below trend line yield"

"I know most of you reading this don’t think that is a possibility"

READ

April 27th Audio

In this audio titled "Will Markets Reverse Second You Throw In The Towel?" we go over why the cheaper we got then, the higher we will go now. We also go over why this year's seasonal rally was going to be late, and why this year is similar to 2012.

LISTEN

May 14th Weekly Grain Newsletter

In this write up we go over the "USDA's Garbage Assumptions". We go over history, the report, and why it was garbage. We also went over why this year was worse than 2012. Keep in mind, this was a month and a half ago when the markets were getting beat up.

READ

Check Out Past Updates

6/23/23 - Audio

EXTREME VOLATILITY & WEATHER MARKETS

6/22/23 - Market Update

BEANS PULLBACK & DROUGHT CONTINUES

6/22/23 - Audio

DON’T FEAR THIS VOLATILITY

6/20/23 - Audio

VOLATILE MARKETS

6/19/23 - Audio

CORN SUPPLY RALLY

6/16/23 - Audio

ARE THE GRAINS ABOUT TO GO PARABOLIC

6/15/23 - Audio

2023 IS WORSE THAN 2012

6/15/23 - Audio

CAN CORN BREAK MAGIC LINES?

6/13/23 - Audio

2012 REPEAT OR WORSE

6/12/23 - Market Update

CROP CONDITIONS CONTINUE TO FALL

6/12/23 - Audio

WHY THIS YEAR ISN’T 2013

6/11/23 - Weekly Grain Newsletter

NAVIGATING THE USDA REPORT & DROUGHT