PREPARING FOR USDA REPORT & TAKING A LOOK AT HISTORY

Overview

Grains end the day mixed as the trade prepares for the USDA Quarterly Stocks Report tomorrow. The choppy trade continues, as traders don’t want to push prices too far in either direction ahead of the report.

Today we had corn higher, as it continues to look to put in it's harvest lows, now +21 cents off it's lows from last week. Soybeans continue to chop in their recent range around $13, but did manage to close +13 cents off of it's lows today, so fairly good close there. The wheat market lower here today, as Chicago was just slightly lower and continues to hold it's lows from the last USDA report, but KC wheat did make yet another new move lower today and it was down -9 1/2 cents on the day.

Overall, not a ton that’s new. As expected. All that matters to close out the week here is the USDA report. After the report we will go back to trading yield results and demand.

One thing to note, we still have the looming potential government shut down over the weekend. Which would mean tomorrow’s report will be the last one for a while. As when the government shuts down, so do the reports and data collection. According to Goldman Sachs, there is a 90% chance that the government shuts down.

The trade is expecting slightly smaller stocks for beans and wheat compared to last year. As for corn, they are expecting a little over 50 million bushels increase from last year, but slight decrease from the last report.

This report, has a long history of providing surprises either which way.

Here is the estimates for tomorrow.

Chart Credit: Karen Braun

History of September Report for Corn

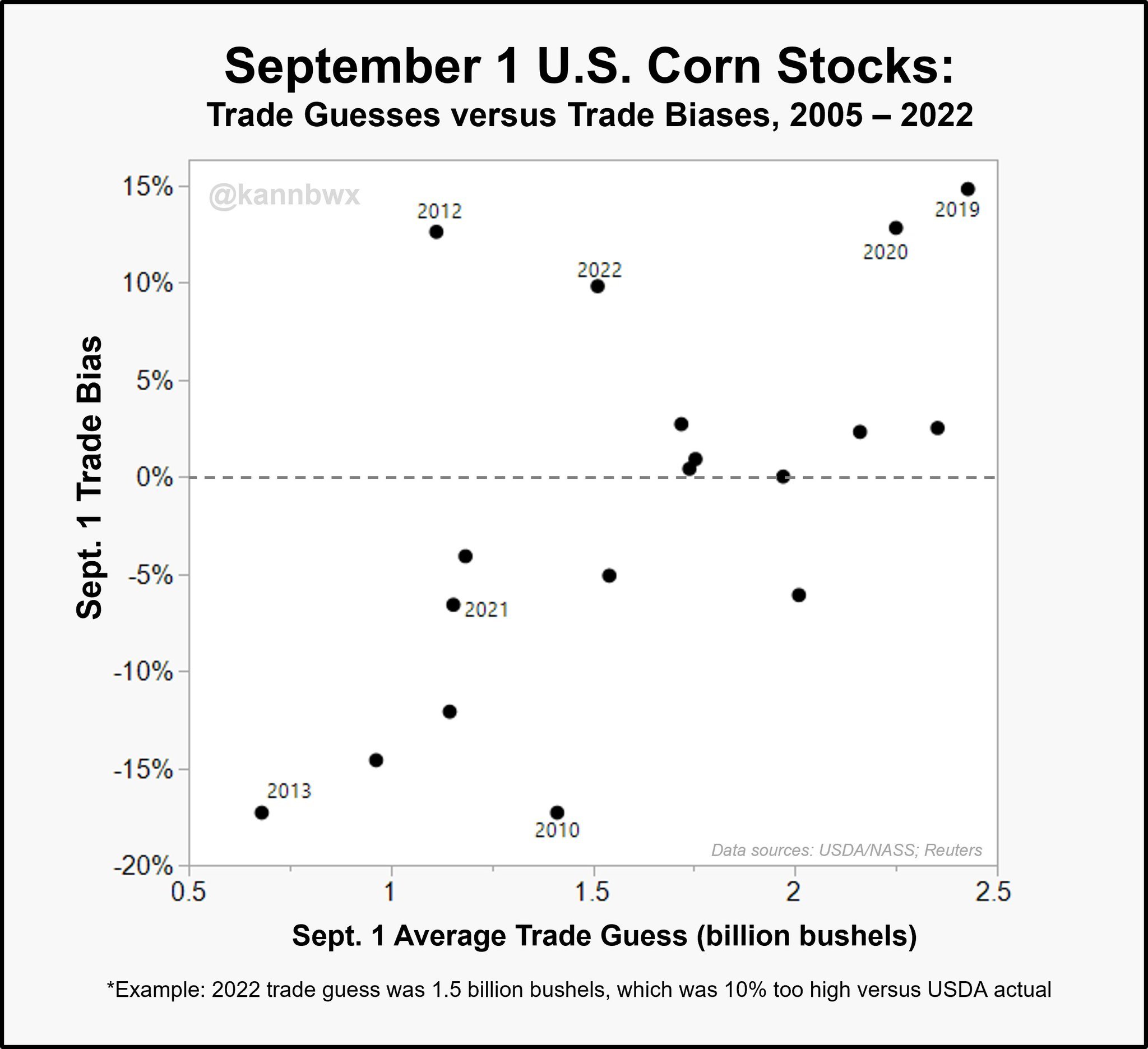

Below is a great graph from Karen Braun. It showcases how this report has played out in the past.

The left axis shows the % that the trade estimate was off by.

The bottom axis shows the average trade guess number in billions of bushels.

As you can see from the chart, historically when the trade is expecting larger numbers in this report, they tend to surprise under (bullish surprise). When the trade is expecting a smaller number, the report tend to have a surprise over (bearish surprise).

The trade's guess for tomorrow is somewhat in the middle of the road. Sitting at 1.429 billion bushels, which is similar to last year's 1.5 billion. Last year we had a bullish surprise, as the trade was 10% too high with their numbers.

Now should we be expecting a bullish surprise? Not necessarily. This year's estimates are right in that middle ground. So we could be in for a surprise either which way. We could have a report like last year, or like 2010. It is anyone's guess.

One thing to note is that sometimes stocks will come in higher due to a fast harvest.

What happens if we do get a report similar to 2010 where the USDA comes in with a bearish whopping 15 to 20% above estimates?

Let's take a look back. In 2010, on the day of this report on Thursday, September 30th………

The rest of this is subscriber-only. Please subscribe to continue reading and get exclusive access to every daily update.

In the rest of today’s update we go over the history of this report. What happened last time we got a super bearish report? We also take a look at previous harvest lows. Why did we make lows later in the year on certain years but not others? Find out in today’s update.

HARVEST SALE ENDS THIS WEEKEND

For a limited time lock in our stuff for a huge discount. Don’t miss all our future updates. Offer ends this weekend.

Scroll to check out updates you would’ve received.

OFFER: $299/YR $800/YR

Become a Price Maker. Not a Price Taker.

NOT SURE? TRY 30 DAYS FREE

Check Out Past Updates

9/27/23

PROTECTING YOUR INSURANCE GUARANTEE

9/26/23

GOVERNMENT CONCERNS & PREPARING FOR USDA REPORT

9/25/23

HAVING A PLAN OF ATTACK

9/22/23

WEEKLY WRAP

9/21/23

HARVEST BASIS THOUGHTS

9/20/23

BUYING OPPORTUNITIES

9/19/23

CAN WE FIND DEMAND?

9/18/23

HARVEST PRESSURE

9/15/23

BECOMING COMFORTABLE IN THE MARKETS

9/14/23