HOW MUCH DAMAGE WAS DONE FROM RECENT HEAT?

WEEKLY GRAIN NEWSLETTER

Weekly Recap

First off let's start with a weekly recap from last week and the biggest things to watch for this upcoming week.

It was a volatile filled week. Monday we were off the races with the war headlines. Corn took back over half of it's recent sell off. November beans nearly traded contract highs while August beans actually did at one point. And wheat futures traded at their highest levels all year long.

However, the rally didn’t last as the trade got bored after not seeing anymore crazy war headlines. To add on to that, weather forecasts started to shift a bit cooler with some rain being added in. Both of these factors led to us coming far off our highs. Despite the total sell off from the highs, Chicago and Minneapolis still managed to close higher on the week. While corn only lost 6 cents. The biggest loser of the week were beans as they took it on the chin Friday.

Here is the price recap with our highs, lows, and closes.

Corn 🌽

Dec: -6

High: $5.72

Low: $5.25 1/2

Close: $5.30 1/4

Beans 🌱

Nov: -19 1/4

High: $14.35

Low: $13.79

Close: $13.82 1/2

Chicago Wheat 🌾

Sep: +6 3/4

High: $7.77 1/4

Low: $6.88 3/4

Close: $7.04 1/4

KC Wheat 🌾

Sep: -4

High: $9.29 3/4

Low: $8.42 1/2

Close: $8.56 1/4

MPLS Wheat 🌾

Sep: +9

High: $9.47 3/4

Low: $8.81 1/2

Close: $8.96

Biggest Things to Watch This Week

Weather

For soybeans this will be the biggest thing. Mother Nature will decide if we go to $15 or right back down to $12. All week the forecasts were super hot, but then Thursday and Friday we saw the forecasts start to add some cooler wetter temps in the 8-14 day outlook.

Here is what the forecasts were showing as of Friday afternoon. A big reason for the weakness in corn and beans, as the funds simply started to remove weather premium.

To close out the week we heard all of the weather guys saying it would cool down. Well when it’s over 100 degrees, one would assume so.

Bottom line, unless we see some wildy drastic improvement, nobody thinks the USDA's corn yield of 177.5 and bean yield of 52 is remotely close.

However, it does look like the forecasts as of Sunday have turned fairly bearish as well.

From Friday*

Past Weather & Crop Conditions Monday

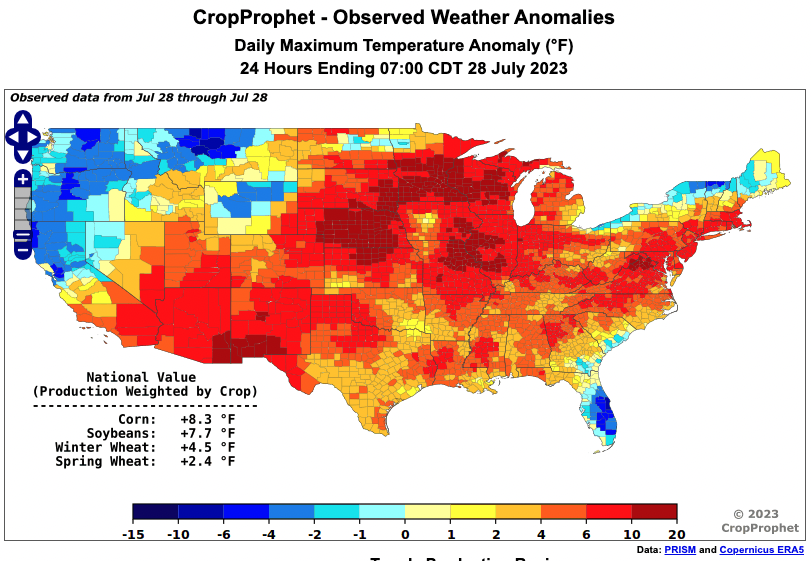

To close out the week, temperatures in major growing regions were +8 degrees hotter than normal. The key word there is normal. I think the trade is undervaluing the damage this heat has brought this far.

Yes, beans are made in August. So it is a tad early for beans that are setting pods. But we can’t discount this.

53% of our bean crop is experiencing drought. Up from 50% last week and 26% last year. This number could very well be closer to 57% next week.

Taking a look Monday, I wouldn’t be at at surprised to see these numbers shock the trade and come in far worse than expected. The question is how much of that will be discounted if forecasts stay cooler and wet.

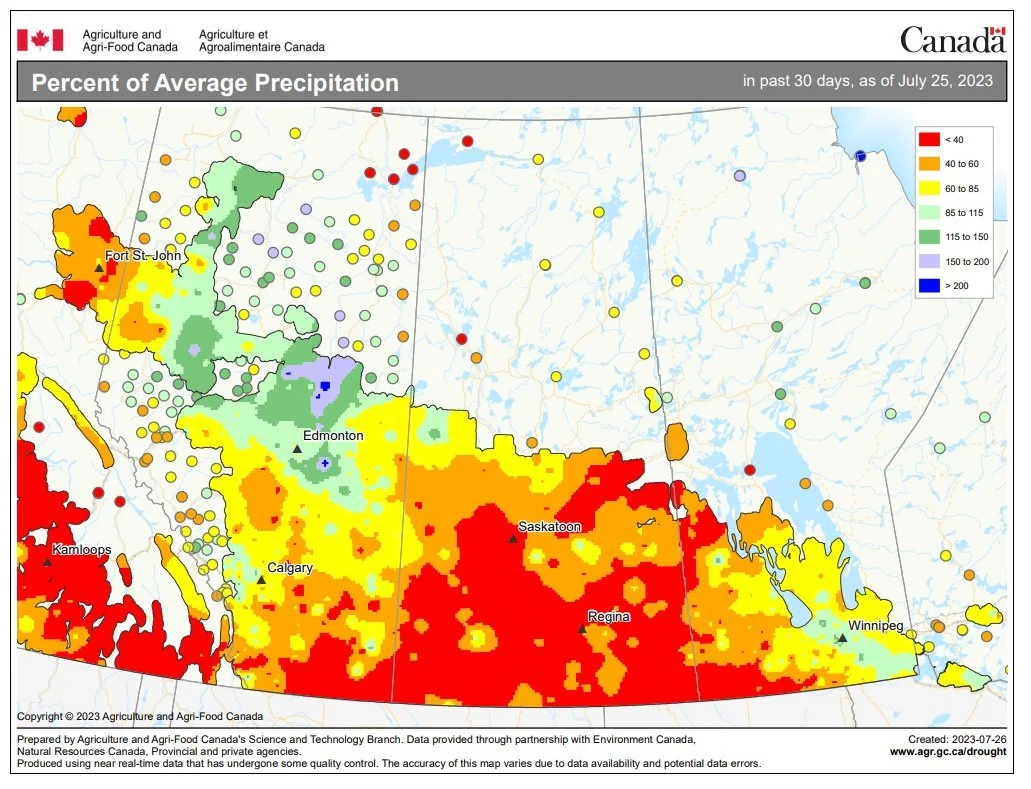

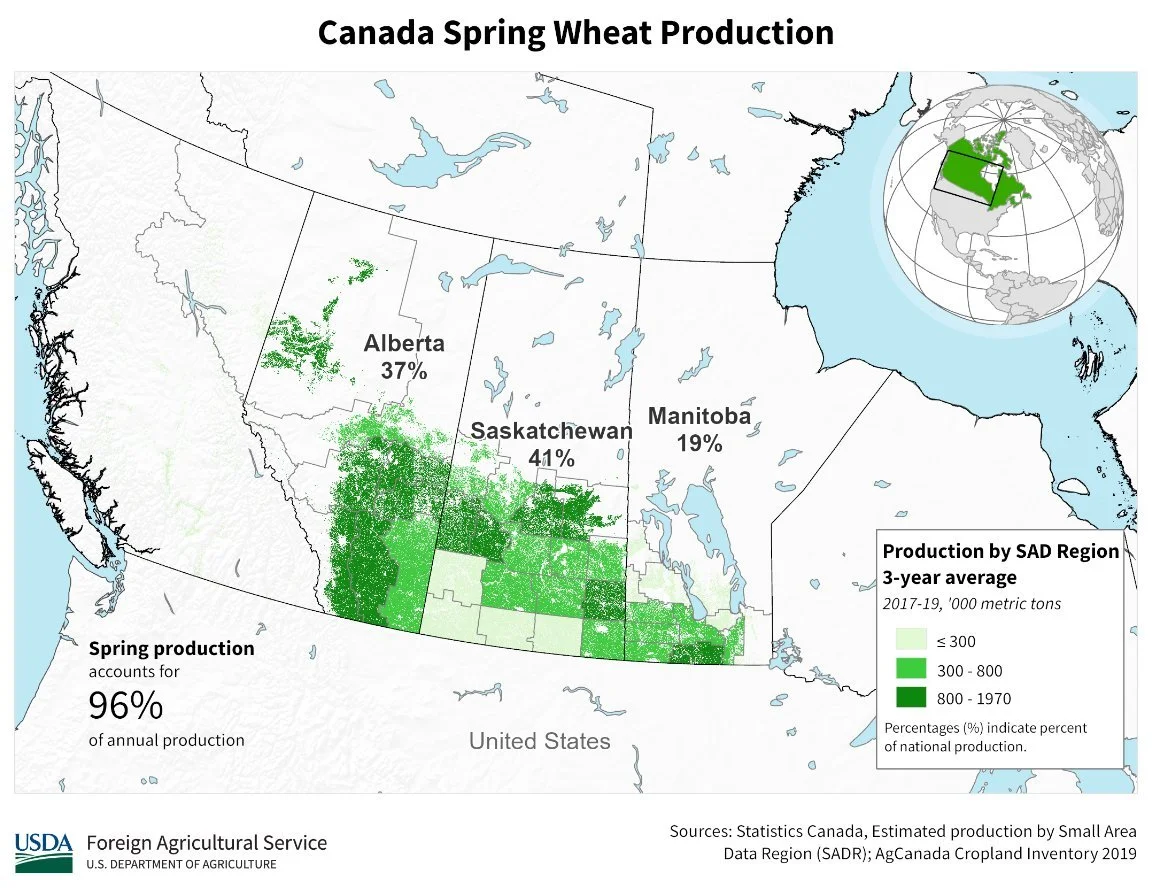

Canadian Drought

Take a look at just how dry this is and take a look at the areas that produce the most spring wheat there. Not a whole lot else to say.

Chinese Appetite

China stepped in after the big rally and bought nearly 2 million metric tons. This could potentially be an indication that they are try to manage the tight soybean situation.

Will we continue to see Chinese demand?

War

This thing has been going on well over a year now. Does it look like it is stopping anytime soon? Nope.

We just saw that massive rally Monday from war headlines. Then all of the sudden we get this news that Ukraine is going to starting exporting their grain via truck and rail and the market gives the entire rally back. Doesn’t make much sense.

The amount of grain you can export on a barge or vessel isn't even remotely the same to truck or rail and that doesn’t fix the problems.

Just imagine what would happen if Ukraine somehow attacked Russia and disturbed THEIR exports. Not saying this will happen because nobody knows.

Things escalate, we go higher.

If they don’t, well wheat will probably struggle to hold on to any sort of rally here and corn could follow lower as well.

Will be interesting to see if the market has any reaction to the attacks we saw yesterday. If those attacks happened today, we probably would be trading limit up again. But since it wasn’t, we will just have to wait and see.

Now let's dive into our weekly grain newsletter…

Here are some not so fearless comments for www.dailymarketminute.com

We had another rather violent and volatile week the last 7 days. It started with a bang both literally and physically as grain ports on the Danube River got attacked which led to a wheat market that closed up the limit at the end of the day Monday. But by the end of the week most of the markets had given up most if not all of the gains that we had on Monday.

Why did the markets break hard to close out the week? Why did we quickly take the premium out for weather and war? We had one of the hottest weeks we have seen in a long time. July globally was the hottest month ever.

The reason we broke so hard was……

The rest of this post is subscriber-only content. Please subscribe to continue reading to receive every one of our exclusive daily updates via text & email

WANT TO KEEP READING?

Get all of our exclusive stuff for 50% off yearly or monthly.

Not sure? Try 30 days for just $1 - HERE

Scroll to check out some past updates you would’ve received.

INCLUDED IN TODAY’S UPDATE

Why prices broke so hard after rally

How much damage did the recent heat do?

Why can’t wheat keep war premium

Why hasn’t wheat rallied more with short covering that has happened

Is there still possibility for a 2022 type rally in wheat

What the war means fundamentally

What should you do in the wheat market. Re-own? ? Sell? Options?

Can soybeans make new all-time highs?

Not panic selling the weather forecasts

Focusing on being a price maker. Not a price taker.

Check Out Past Updates

7/28/23 - Audio

DO CURRENT PRICES HAVE ENOUGH WEATHER & WAR PREMIUM BUILT IN?

Read More

7/27/23 - Audio & Market Update

GRAINS FADE OFF EARLY HIGHS

7/26/23 - Audio

WHAT HOLDS MORE GRAIN? A TRUCK, RAIL, BARGE, OR VESSEL?

7/25/23 - Market Update

GRAINS MIXED BUT WELL OF LOWS

7/24/23 - Market Update & Audio

WAR, WEATHER, & WHEAT LIMIT UP

Read More

7/24/23 - Audio

WAR & WEATHER SURGE GRAINS

7/23/23 - Weekly Grain Newsletter