WHEAT LEADS WITH RUSSIA TARIFF RUMORS

MARKET UPDATE

Prefer to Listen? Audio Version

Futures Prices Close

Overview

Decent day for the grains as wheat leads the way higher for the 2nd day in a row while soybeans are lower for the 2nd day in a row as well.

Wheat has seen a nice 2 day bounce, as the wheat market is +25 cents off it's lows from yesterday.

Some of the strength has come from farmers protesting in the EU as they are upset with cheap imports from the Black Sea. To deal with this, the EU is considering putting tariffs on Russian wheat of $103 a metric ton.

This could certainly help level the playing field with the Russians if it happens, but the EU doesn’t import a lot of grain from Russia.

Both corn and soybeans have seen a little pressure from the rains in Brazil. As they are expected to get rain for the next 10 to 14 days.

These rains aren’t bearish for soybeans. They are negative for the soybean crop as it could delay harvest. If Brazil can’t get beans out, this could lead to other countries looking to get business from the US. On the other hand, these rains bearish for corn as they are good for their second corn crop with the drought concerns they’ve been having.

Safras Mercado of Brazil came out with their new estimates. They have Brazil beans at 148.6 MMT vs the USDA's 155. Brazil bean harvest is now 62% complete.

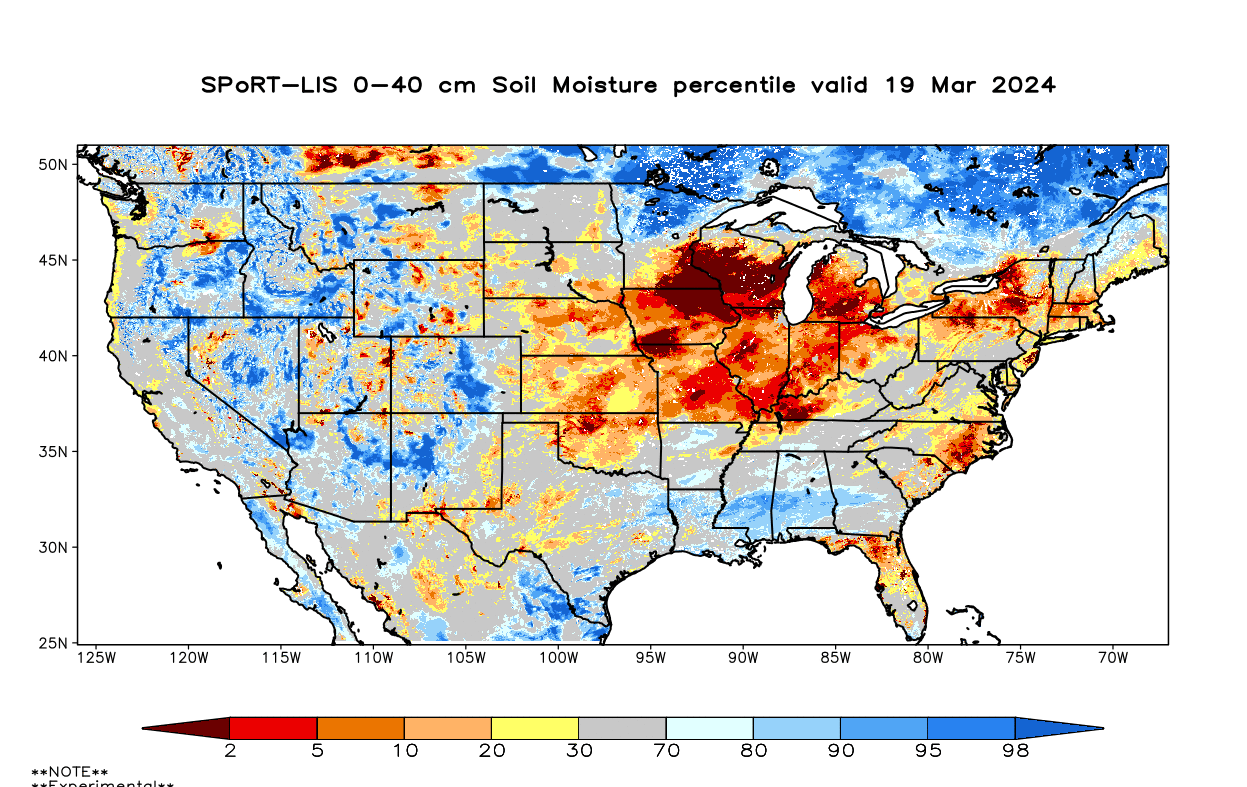

Precipitation is finally expected for the US, and a lot of it in areas such as Iowa who have suffered from a lack of precipitation all winter thus far.

This will likely replenish some of that lack of soil moisture and might lead to a little less talk about early planting.

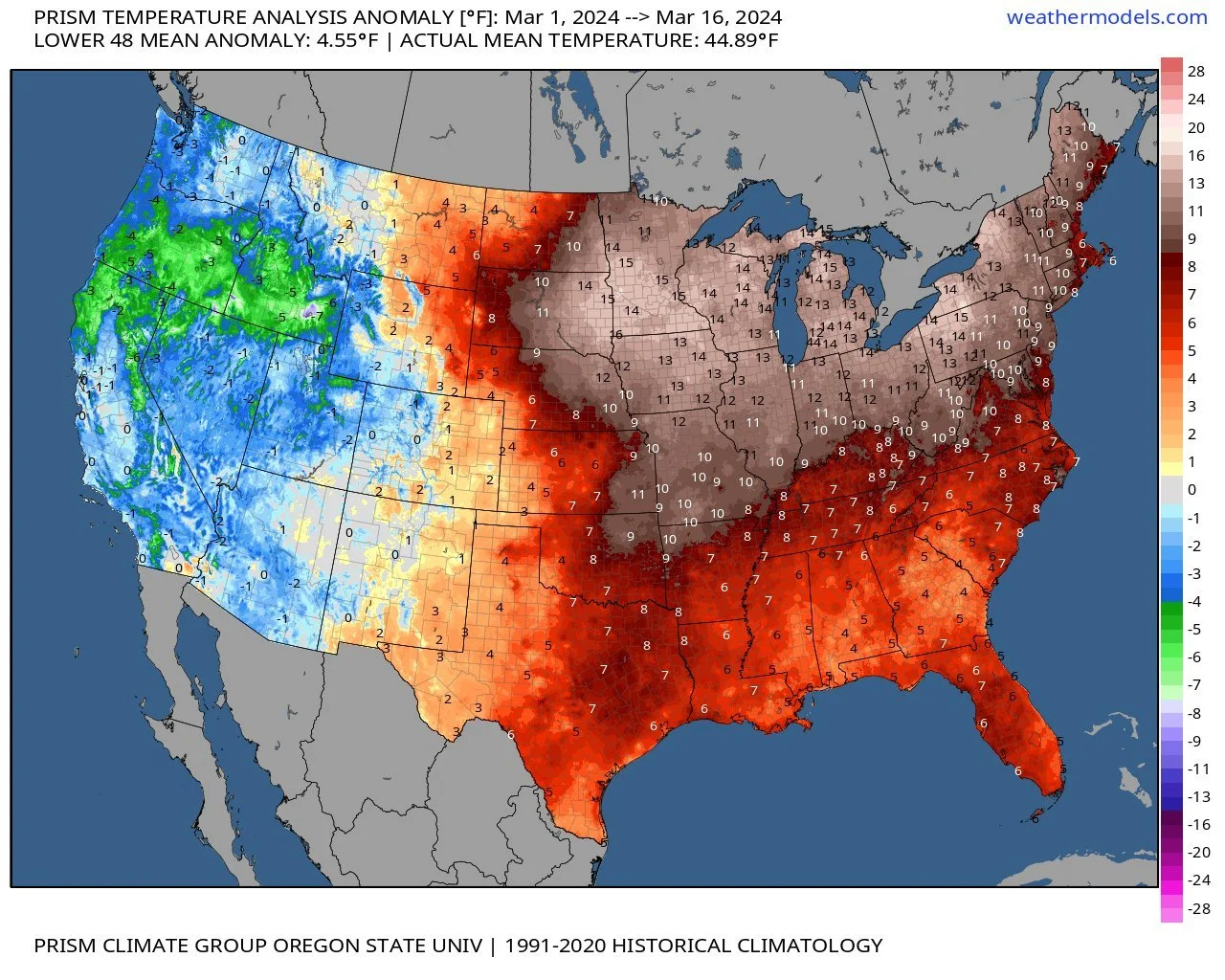

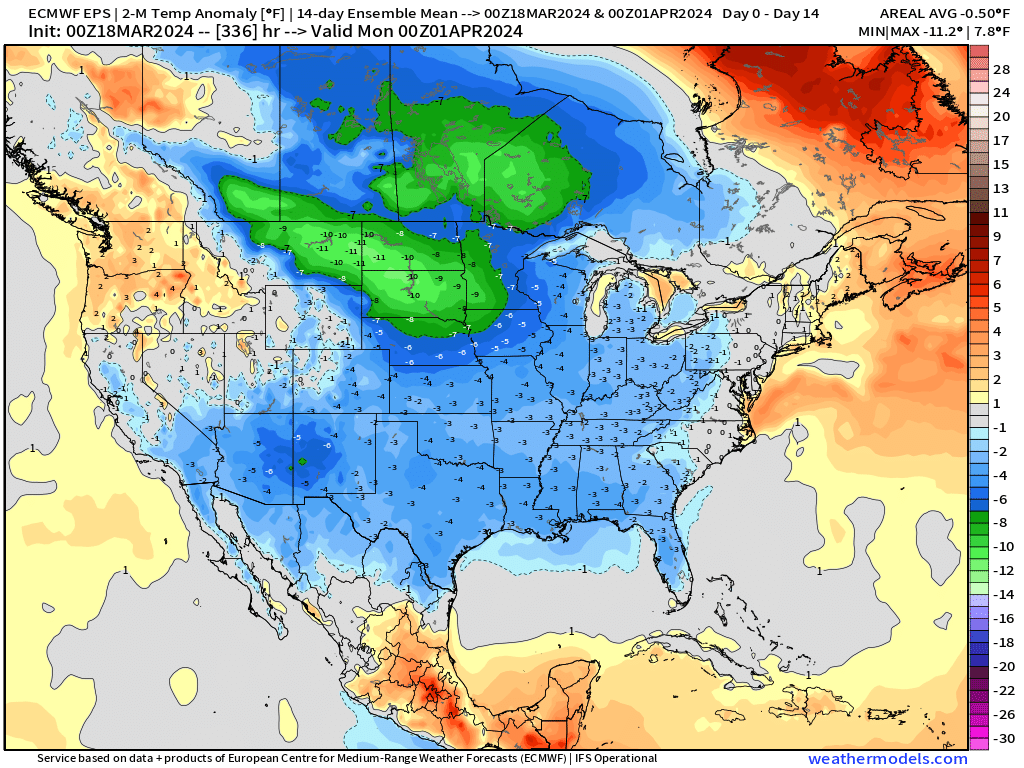

There will also be a huge difference in temperatures.

The 1st map is the temp anonomly for the first 2 weeks of March. Far warmer than normal.

The 2nd map is the temp anomaly forecast for the next 2 weeks. Colder than normal.

We have the USDA stocks and acres report in 9 days on March 28th. There is a lot of talk about higher acres. Personally I think we will see short covering heading up into that report. That report is expected to be a major market mover as always.

The estimates for this report are all over the board. The USDA currently has 91 million corn and 87.5 million for beans but most estimates I've seen have corn around 93 million and beans around 86 million.

These numbers would still have corn down from last year's 94.6 and have beans up from last year's 83.6. Most spring wheat estimates are in line with last year, but I don’t think spring wheat is gaining any acres over cotton.

Today's Main Takeaways

Corn

The rest of this is subscriber-only. Sign up for our free trial to continue reading and receive every daily update along with 1 on 1 completely tailored marketing planning.

START 30 DAY FREE TRIAL

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

3/18/24

ARE YOU PREPARED FOR 160 OR 190 BU CORN?

3/15/24

BULLISH & BEARISH FACTORS DRIVING GRAINS

3/14/24

ARE YOU COMFORTABLE WITH THIS VOLATILITY?

3/13/24

RALLY TAKES A PAUSE

3/12/24

CONAB A LOT SMARTER & SMALLER THAN USDA

3/11/24

CORN 4TH DAY HIGHER & KEY REVERSAL IN WHEAT

3/8/24

USDA RECAP: POOR REPORT, GREAT REACTION

3/7/24

CORN TECHNICALS TURNING BULLISH. PREPARING FOR USDA REPORT

3/6/24

CHINA CANCELS WHEAT? RUSSIA SELLING WHEAT TO FUND WAR

3/5/24

NEW LOWS IN WHEAT & USDA BRAZIL ESTIMATES

3/4/24

IS CHINA HUNGRY FOR CHEAP GRAIN?

3/1/24

FIRST HIGHER WEEK IN MONTHS

2/29/24

HOW TO USE TARGETS VS TRIGGERS

2/28/24

BIGGEST 3 DAYS IN CORN SINCE AUGUST

2/27/24

DID CHINA BUY CORN YESTERDAY?

2/26/24