GRAINS FADE EARLY HIGHS

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Want the full update?

Get our full daily updates, sell signals & 1 on 1 market plans

Want to talk? (605)295-3100

Futures Prices Close

Overview

Very volatile day today. Grains opened up really strong, but quickly fell off the early gains then continued to fall, trading well in the red but bounced nicely into the close.

At one point today:

March Corn was up +5 to $4.58 1/2 (Closed at $4.52)

March Beans were up +15 to $10.04 1/2 (Closed at $9.92)

March Wheat was up +8 to $5.55 (Closed at $5.48)

Disappointing price action as we closed well off the highs, but grains all closed well off their mid-day lows as well.

Corn did post an outside down day. Taking out the previous days highs and closing right at the previous days lows.

This can often signal a reversal. But we did bounce nicely off the lows.

The main headline this morning was the dryness in Argentina.

This had both soybeans & bean meal rallying hard this morning despite fading off the early highs.

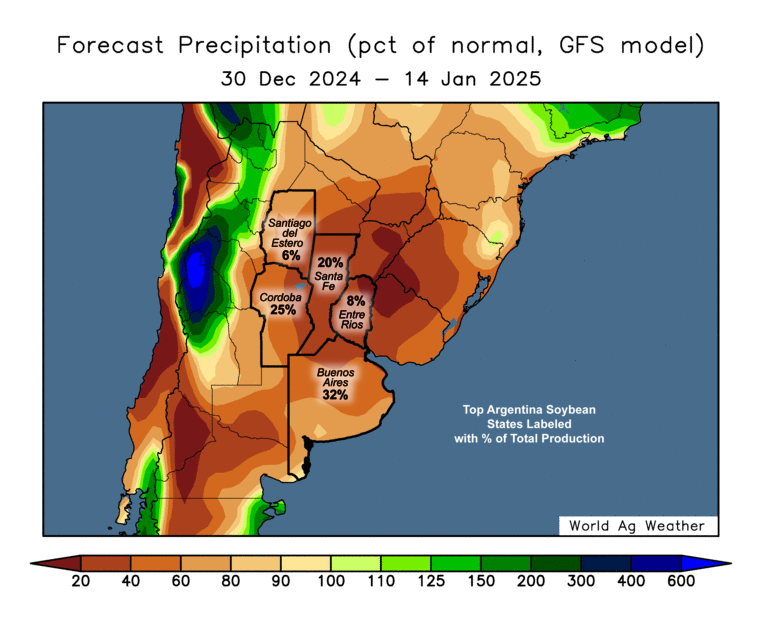

It appears that Argentina is going to lack rain for the next few weeks. As they are only expected to receive half the normal amount of rain the next 2 weeks.

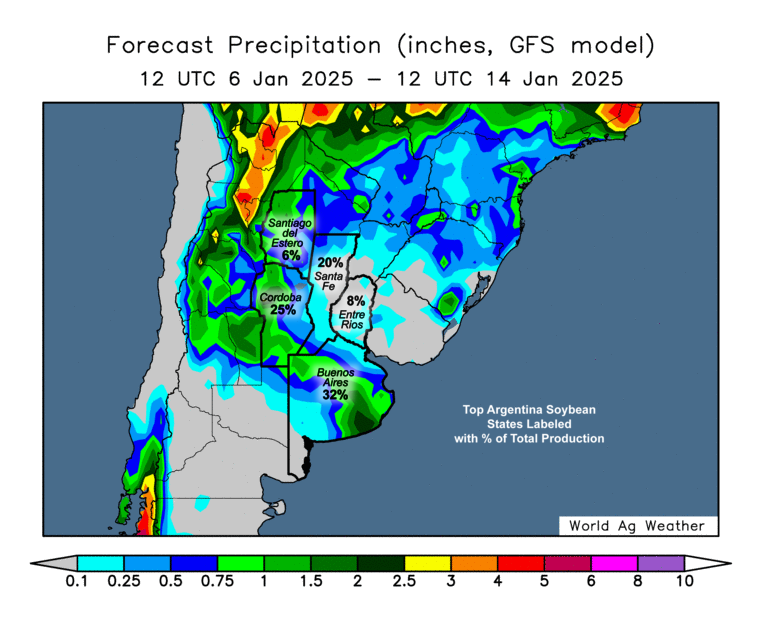

After New Years, they are only scheduled to get one rain until mid-January.

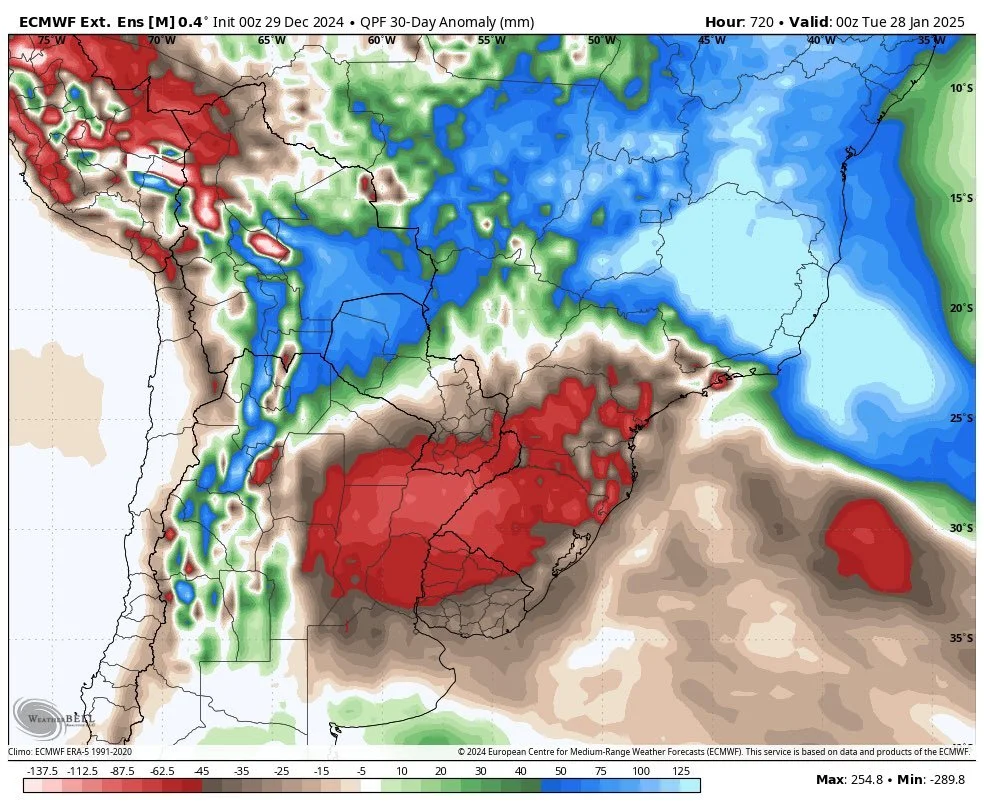

If the forecasts stay this dry after New Year's, maybe we get a rally in beans and meal.

Next 2 Weeks

Next 30 Days

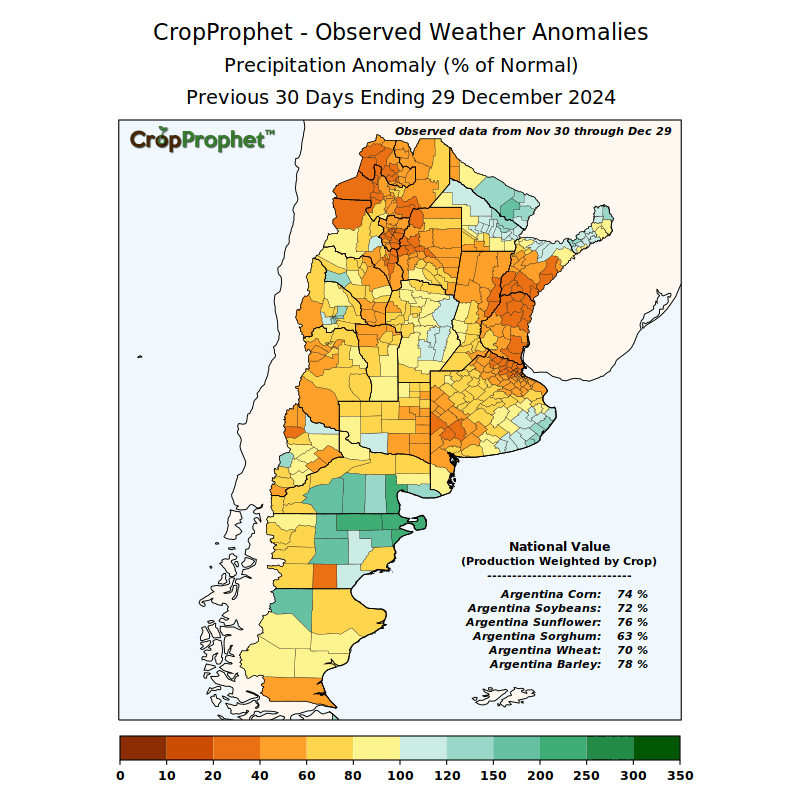

Argentina has been drier than usual as well.

For the past 30 days Argentina corn & bean areas have only received 72-74% of normal precipitation.

The market quickly sold this news this morning, but it is still something to keep an eye on.

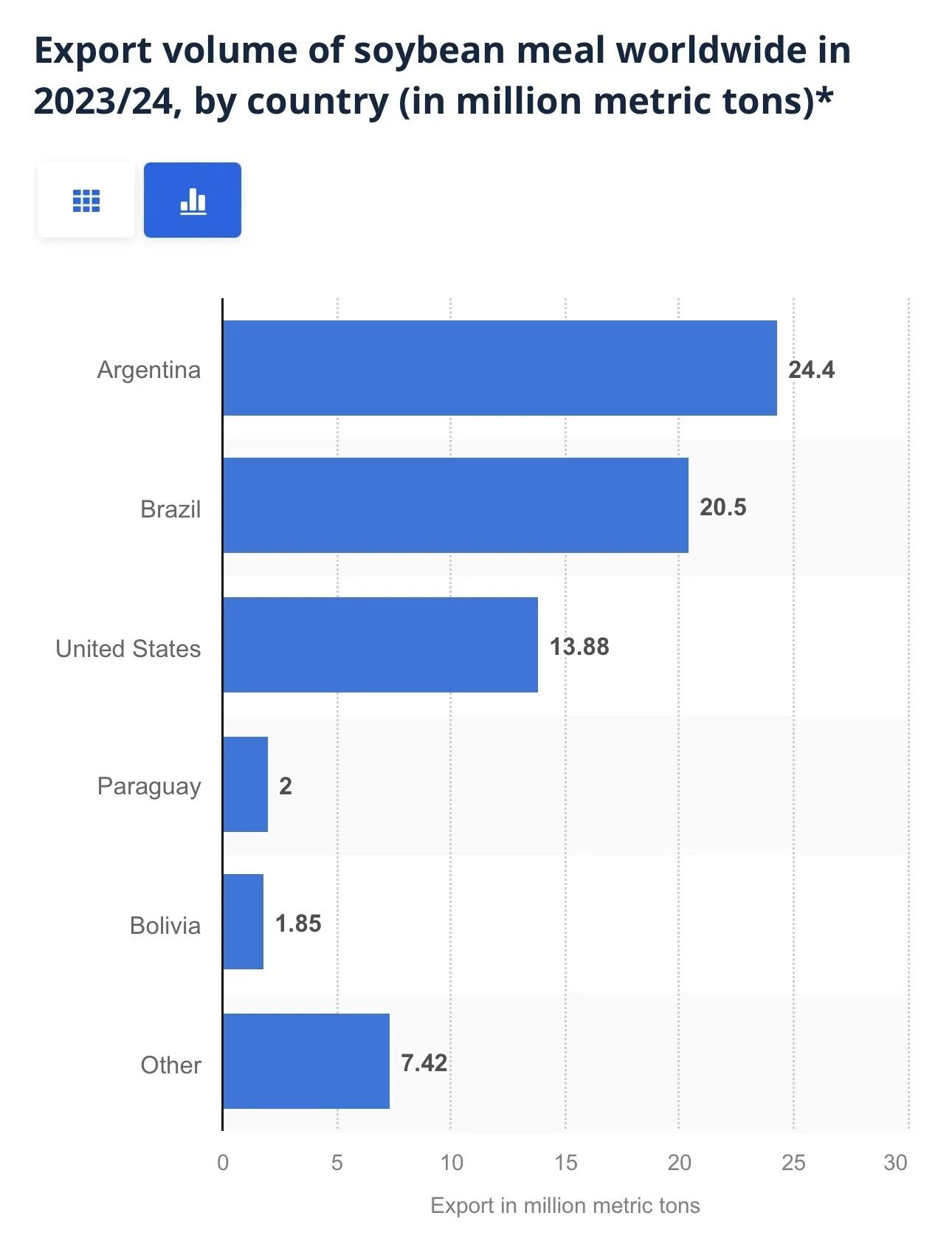

Argentina is the worlds leading meal exporter.

So if this dryness continues, it could spark a little weather scare in mainly the meal and bean market.

Have a Marketing Plan

With harvest over, this is the time where you need to be proactive and have a marketing plan.

So if you'd like to talk through your operation, please feel free to reach out to us. It doesn’t cost you anything. We'd be happy to help.

(605)295-3100

Today's Main Takeaways

Corn

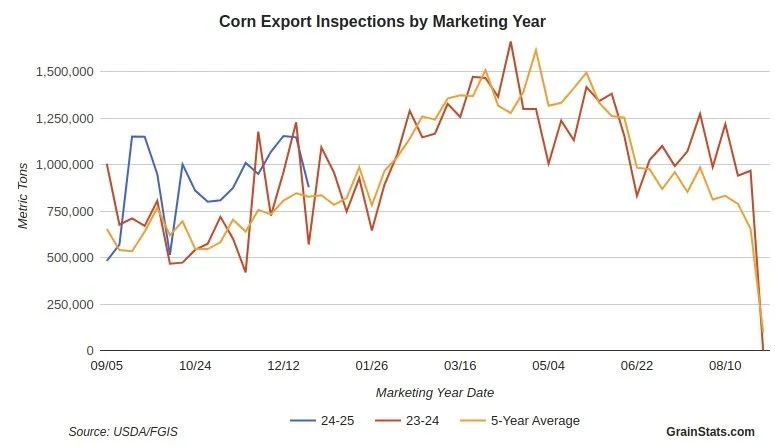

Demand remains very strong for corn.

Exports are still up +30% compared to last year.

Some are still saying: "Oh this demand is front ran in anticipation for Trump"

It is becoming more and more clear that this is likely not the case.

Exports have continued to be strong.

The USDA raised it's export estimates recently when they historically do not so at this time frame.

The USDA is convinced this export demand is here to stay.

Chart from GrainStats

Ethanol also continues to impress.

We are currently +4% ahead of last years pace.

The USDA projects us to only be +0.4% higher vs last year.

Even if we can’t completely sustain this big +4% edge, it is still a very friendly factor with the potential for the USDA to bump ethanol once again.

Chart from GrainStats

Overall, demand continues to be the story as I've stated for months it would be.

Long term I do still think we have potential. I am talking spring/summer time frame.

Short term, I mentioned on Friday we were very likely going to see a local top soon.

It appears we could’ve very well put in that local top today.

How did I identify this as a potential local top?

Two simple indicators. The stochastics and the RSI.

First the stochastics, they were overextended and begun to cross bearish (blue crosses below orange)

The stochastics have marked pretty much every local top in corn as of recent. (highlighted by the purple vertical lines)

On Friday we posted bearish divergence on the RSI (relative strength indicator)

This happens when prices make a higher high, but the RSI does not.

This signals that a market is losing it's upward momentum.

Moving forward, I personally think we find a bottom somewhere in this green box.

Likely between $4.47 to $4.44 (Our 50% to 61.8% retracments of the recent rally).

We do not have to go that low, for all we know today could’ve been the bottom as we did bounce right off the 200-day MA and the 38.2% retracement level from the recent rally. (Technically low enough for a correction).

However, the stochastics still have room to come down and we did post a potential bearish reversal.

If you did not take advantage of our Dec 11th sell signal, get caught up if you have something to move in the next several months.

Keep in mind, we are sitting at 6-month highs. That is something to reward.

If you did take advantage of the sell signal, or have plenty of time on your hands, my next target to take risk off the table is $4.67 (161.8% golden fib extension of the $4.25 to $4.51 rally)

(If you missed Dec 11th's signal: Click Here)

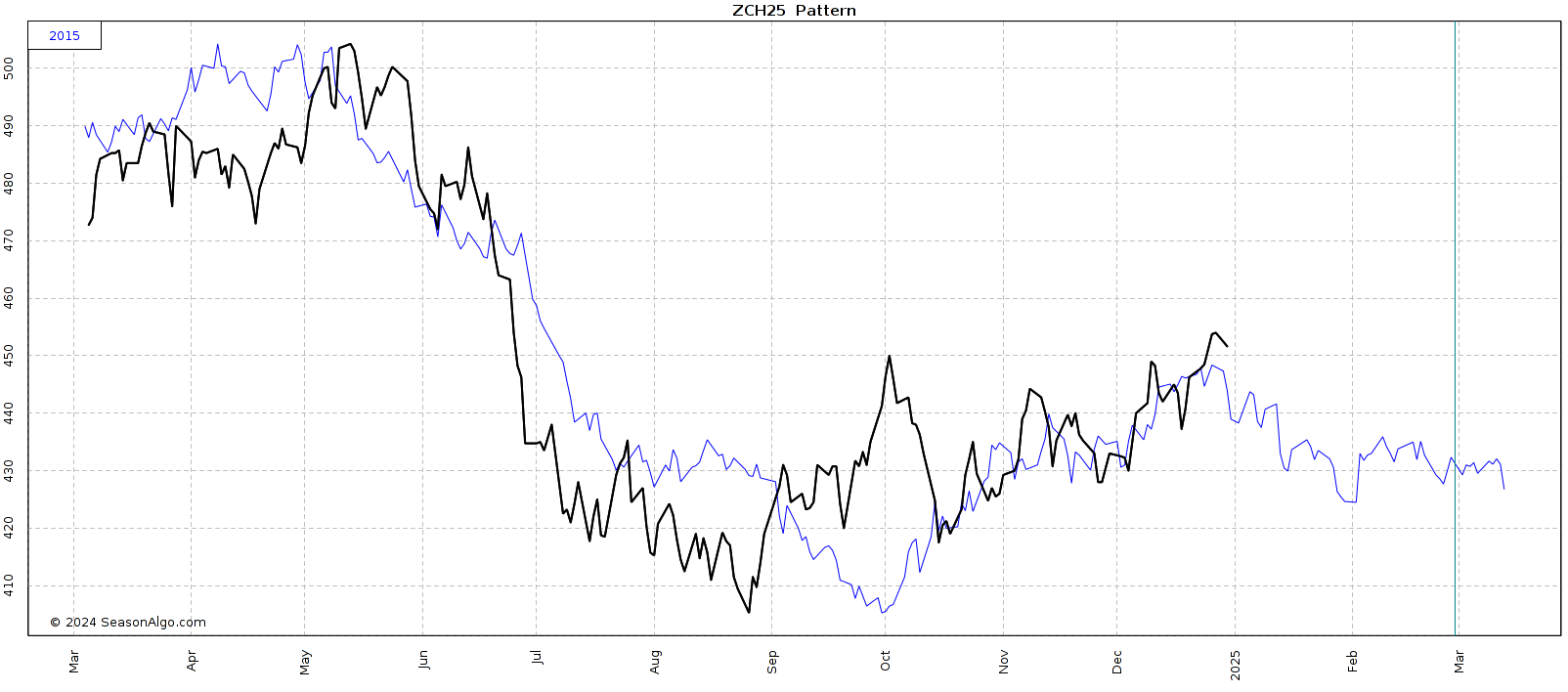

Corn 2015 Comparison

I do not think this happens, but it is just a reason why you want to take risk off the table when we get opportunities.

What if this was the highest prices we will see a for while? I do not think that is the case, but it is a question you have to ask yourself when marketing.

Here is a comparison for March 2015 corn vs March 2025 corn.

They are awfully similar. March 2015 corn we put in it's highs on Dec 29th and continued lower for a few months.

Soybeans

Soybeans continue to struggle, trying to bust above that downward trend we have respected since May.

This is the……………

The rest of this update is subscriber-only.. please subscribe to keep reading.

Get every full daily update, sell signal & access to 1 on 1 tailored market plans.

TRY 30 DAYS FREE

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

12/27/24

STILL LONG TERM UPSIDE POTENTIAL, BUT TAKE ADVANTAGE OF 6 MONTH CORN HIGH

12/26/24

CORN ABOVE 200-DAY MA. ARGY DRY. BEANS +44 CENTS OFF LOWS

12/23/24

CORN & BEANS TALE OF 2 STORIES. BEANS REJECT OLD SUPPORT

12/20/24

PERFECT BOUNCE IN CORN. SIMPLE BEAN BACKTEST BEFORE LOWER?

12/19/24

THE SOYBEAN PROBLEM. NEW WHEAT LOWS. CORN UPTREND

12/18/24

BEANS BREAK SUPPORT & OPEN FLOOD GATES

12/17/24

SINK OR SWIM TIME FOR SOYBEANS

12/16/24

SOYBEANS & WHEAT FIGHTING LOWS. WILL CORN DEMAND CONTINUE

12/13/24

POST USDA COOL OFF

12/12/24

CORN CORRECTION. WHY WE ALERTED SELL SIGNAL YESTERDAY

12/11/24

USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

12/11/24

CORN SELL SIGNAL

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24

TARIFF TALK PRESSURE

11/25/24

HOLIDAY TRADE, SEASONALS, TARGETS & DOWNSIDE RISKS

11/22/24

CORN TARGETS & CHINA CONCERNS

11/21/24

BEANS NEAR LOWS. CORN NEAR HIGHS. 2025 SALE THOUGHTS

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24