CORN & WHEAT POST MULTI-MONTH HIGHS

MARKET UPDATE

Video version is subscriber only.

Want full access? CLICK HERE

(Chart Breakdowns Start at 5:44 min)

Futures Prices Close

Overview

Corn & wheat both make multi-month highs.

As corn traded to it's highest levels since June 28th, and wheat was at it's highest levels since July 8th.

Soybeans lagged behind with some harvest pressure & profit taking. As well as rain in the forecasts for Brazil.

Wheat led the way higher following war escalation in the Middle East, as well as some areas of Russia declaring a state of emergency due to drought.

But the big news today was the war.

Iran had a missle attack on Israel and officially declared a state of war against Israel.

This of course led to a rally in crude oil and offered some additional support to the grain markets as well.

This is the largest escalation we have seen since this conflict began.

According to the odd makers at Polymarket, they think there is a 76% chance these tensions increase by the end of the week via Israel responding to the attacks.

The Israel Government also told CNN:

"We have plans, and we will operate at the place and time we decide. It will be significant.".

Now does this effect the grain markets?

Well, yes and no.

The Middle East is not a producer of grain. So it does not directly impact our supply & demand like it would if this was Russia & Ukraine, or a war in Brazil for instance.

But a war headline always spooks the markets. The funds are still holding short positions in the grains, so news like this can lead to the funds kind of saying "I want out" of their short positions due to the uncertainty it brings. And can give them a bigger appetite for commodities in general, as commodities such as oil are directly impacted.

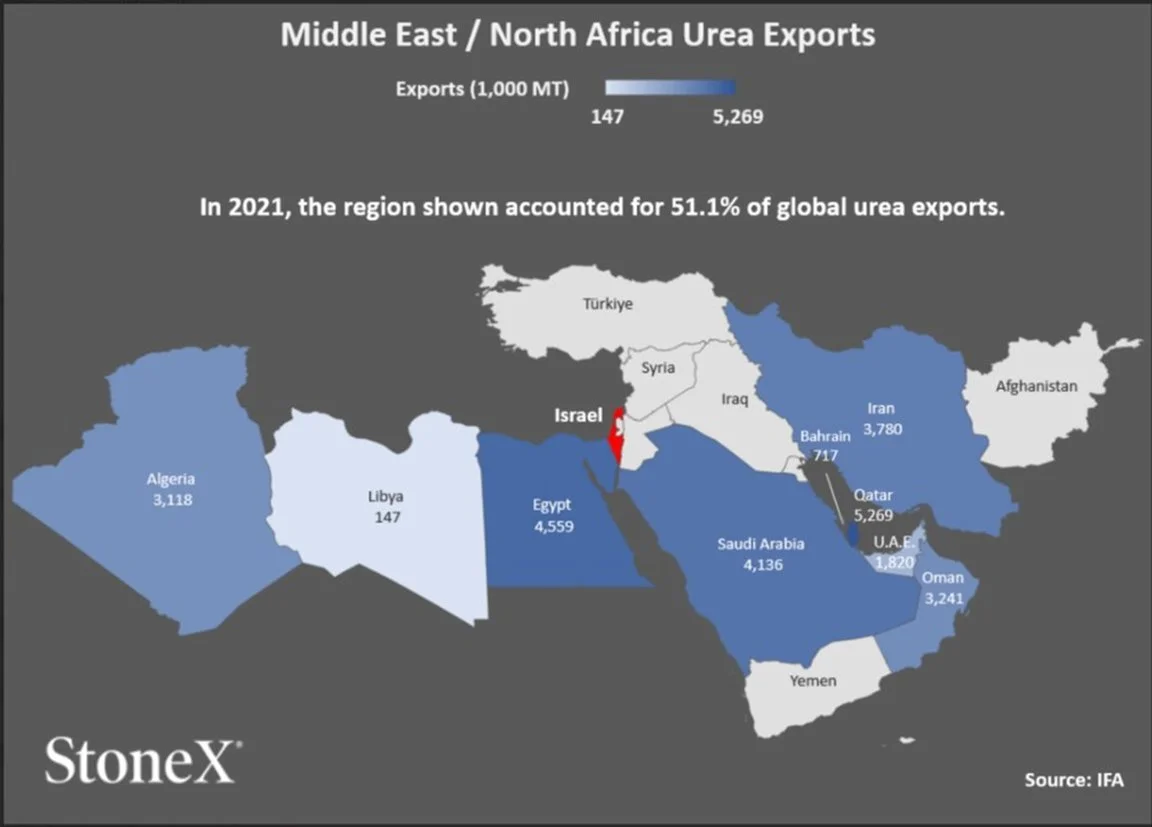

What this war can have an effect on is fertilizer.

1 out of every 2 tons of urea exported around the world comes from the Middle East.

If this escalates, it could potentially lead to higher fertilizer.

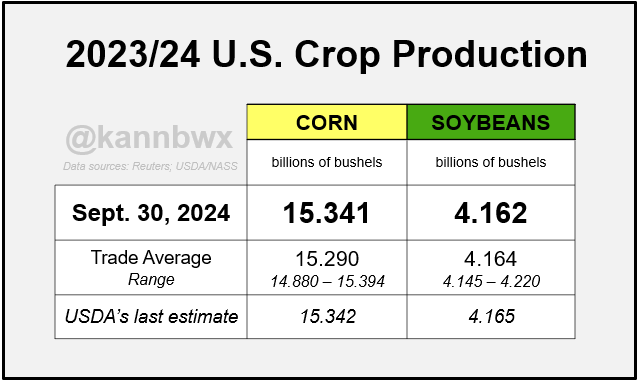

Yesterdays USDA Report

Outside of war headlines, corn also saw some follow through strength from the report.

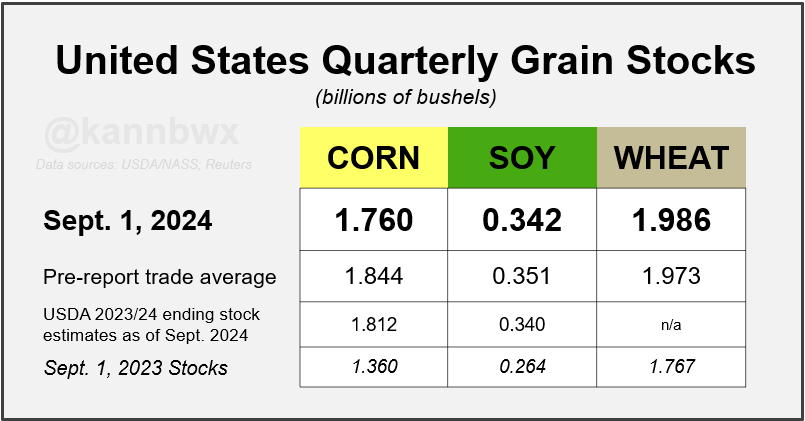

The USDA was bullish corn as Quarterly Stocks came in at 1.760 vs estimates of 1.844 billion bushels.

This change was due to an increase in feed & residual use as the USDA did leave the 2023 crop unchanged.

So the USDA was 50 million too light on feed & residual.. what if the USDA is too low on feed & residual this year? It would drop our carryout below 2 billion.

The numbers were not so bullish to the point where they alone can carry prices significantly higher. But they did show stronger demand than expected, so it could provide a base under corn if yield doesn’t wind up crawling higher.

For soybeans & wheat, the report was a non factor. As there were no surprises.

Charts from Karen Braun

Harvest & US Weather

Harvest is ahead of pace for both corn & soybeans.

Corn: 21% vs 18% avg

Bean: 26% vs 18% avg

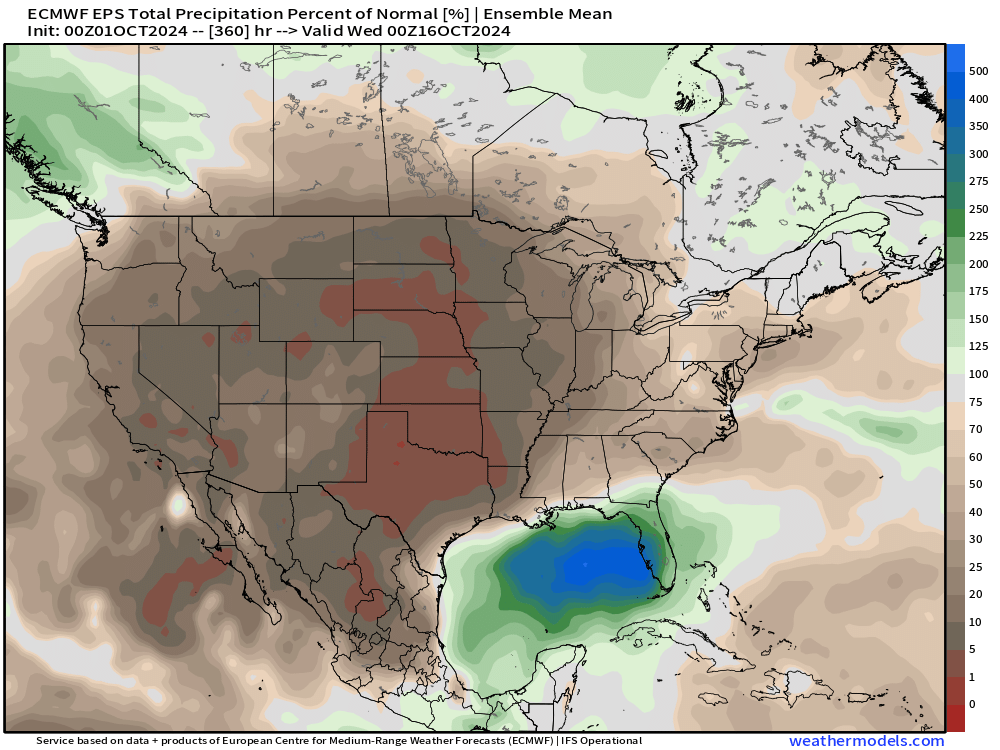

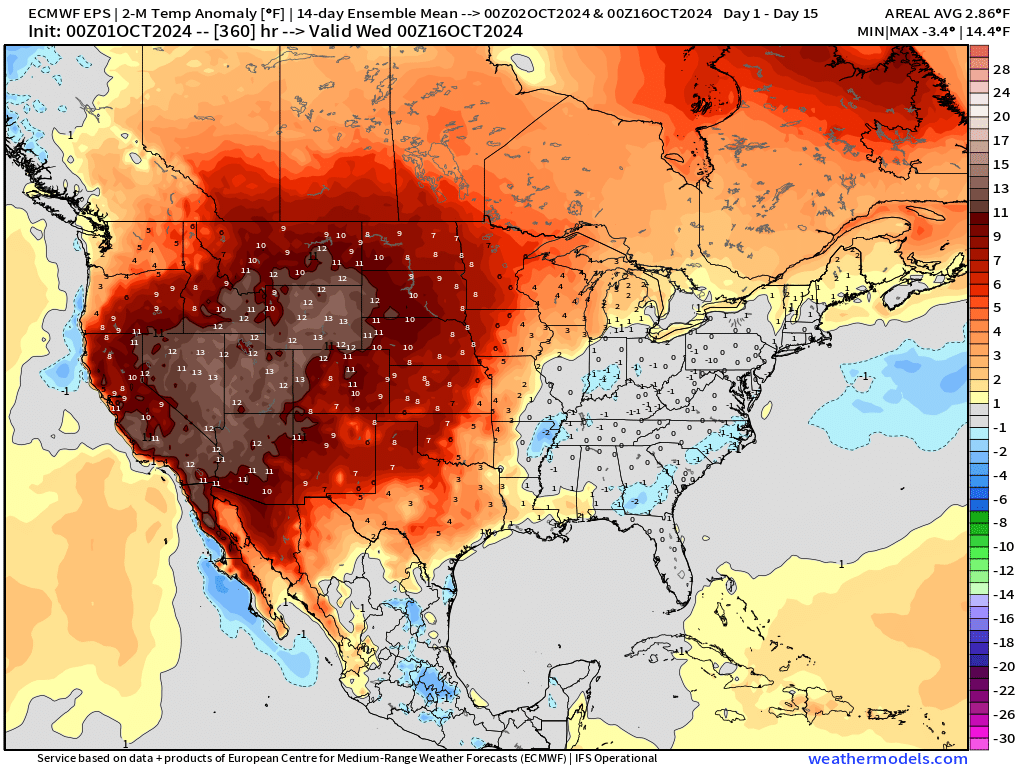

The corn belt looks like it will be about as dry as it can get for the next two weeks.

So harvest should continue to move along at a faster than average pace.

A fast harvest means a lot of supply is going to be hitting the markets at the same time, so this could potentially add some harvest pressure.

However, over the past 5 years our markets haven’t seen much "harvest pressure" during this time. Probably because it's mostly priced in. But this could put a damper on local basis.

Here is a very good quote from Angie Setzer as to why prices could potentially be poised to move higher after harvest.

She said:

”I think the most important thing to ask yourself when trying to evaluate whether prices are poised to move higher or lower is whether it is getting easier or harder for the world end user to source supplies?

At this point, with harvest getting rolling it should not be difficult to get whatever your needs are in the short term covered. However, as the farmer in the Northern Hemisphere puts crops away and we look at uncertainty both north and south of the equator, I would argue it is likely to get much harder for the end user to source supplies once the US wraps up harvest. What this means for price will be interesting to see as the narrative of too much supply and limited demand runs into air pockets in the pipeline.”

Today's Main Takeaways

Corn

Corn posts it's highest close in months at $4.29.

However we did close -3 1/2 cents off our highs.

We closed above a huge resistance level. This is what you need to watch now…….

The rest of this is SUBSCRIBER-ONLY content.

Subscribe to get full access to all of our updates, signals, & 1 on 1 market plans.

In today’s update we go over..

Full chart breakdowns

Targets for all grains

Detailed thoughts

Levels you need to watch

Brazil weather

Did the funds appetite change?

Can prices keep going higher?

TRY 30 DAYS FREE

Get full access to everything we have to offer completely free

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

9/30/24

BULLISH USDA FOR CORN: RECOMMENDATION

9/27/24

UP-TOBER? SELL SIGNAL, TARGETS, & FACTORS

9/27/24

BEAN SELL SIGNAL

9/26/24

NEW HIGHS BUT CONCERNING CLOSE

9/25/24

HIGHEST CLOSES SINCE JULY. UPSIDE & SALES CONSIDERATION

9/24/24

GREAT START TO THE DAY, AWFUL FINISH

9/23/24

MASSIVE DAY FOR THE GRAINS

9/22/24

EARLY YIELD TALK, DROUGHT, BRAZIL, SEASONAL LOWS & MORE

9/19/24

GRAINS SEE TECHNICAL SELLING

9/18/24

FED DROPS RATES, BRAZIL STORY, 2025 SALES?

9/17/24

TARGETS & WHAT TO DO IF YOU BOUGHT PROTECTION

9/16/24

WAS TODAY HEALTHY CORRECTION BEFORE GRAIN RALLY RESUMES?

9/13/24

CORN & WHEAT BREAK OUT: EVERYTHING YOU NEED TO KNOW

9/12/24

USDA RAISES YIELD BUT REPORT WASN’T ALL THAT BEARISH

9/11/24

USDA TOMORROW. MAKE OR BREAK SPOT ON CHARTS

9/10/24

USDA THURSDAY

9/9/24

LOWS ARE IN UNLESS SOMETHING FUNDAMENTALLY CHANGES?

9/6/24

GRAINS WEAK. OUTSIDE DOWN DAY ON CHARTS

9/5/24

GRAINS GET HEALTHY CORRECTION. GETTING READY TO PROTECT DOWNSIDE

9/4/24

GRAINS CONTINUE RUN. WAYS TO PLAY THE MARKET. WHAT’S YOUR SITUATION?

9/3/24